Legal Arizona Transfer-on-Death Deed Document

A thoughtful estate planning strategy includes considering how to transfer assets to beneficiaries with the least amount of hassle and expense. In Arizona, one valuable tool available for this purpose is the Transfer-on-Death (TOD) Deed form. This legal document allows property owners to pass real estate directly to a designated beneficiary upon their death, bypassing the often lengthy and costly probate process. The TOD Deed effectively facilitates a seamless transition of property ownership without bogging down the asset in legal formalities, making it an attractive option for many. Its simplicity lies in the ability to designate a beneficiary with a document that is both straightforward to create and to revoke if circumstances change, providing a flexible approach to estate planning. Importally, it is paramount for those interested in utilizing this form to understand the specific requirements and implications in Arizona to ensure the transfer aligns with their overall estate planning goals.

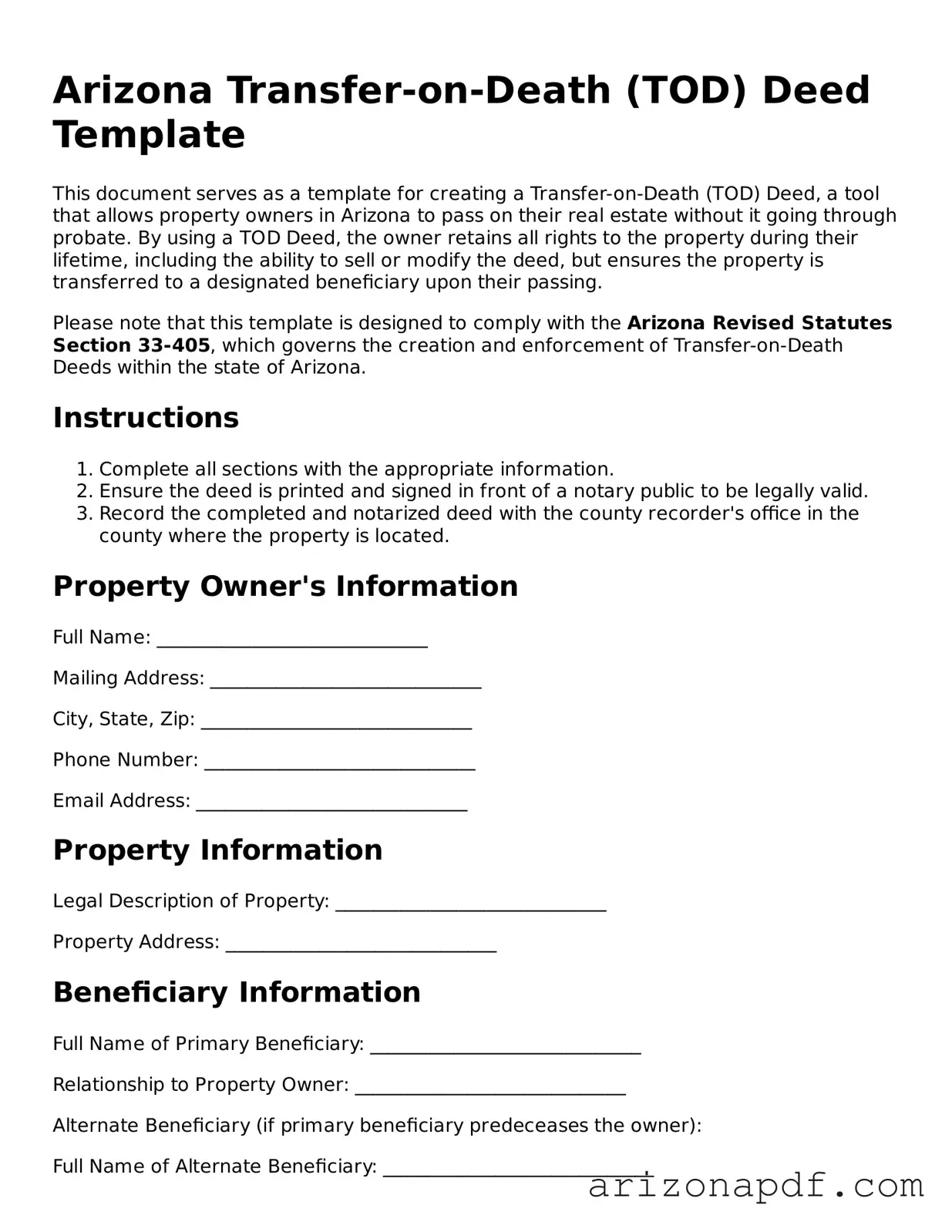

Arizona Transfer-on-Death Deed Preview

Arizona Transfer-on-Death (TOD) Deed Template

This document serves as a template for creating a Transfer-on-Death (TOD) Deed, a tool that allows property owners in Arizona to pass on their real estate without it going through probate. By using a TOD Deed, the owner retains all rights to the property during their lifetime, including the ability to sell or modify the deed, but ensures the property is transferred to a designated beneficiary upon their passing.

Please note that this template is designed to comply with the Arizona Revised Statutes Section 33-405, which governs the creation and enforcement of Transfer-on-Death Deeds within the state of Arizona.

Instructions

- Complete all sections with the appropriate information.

- Ensure the deed is printed and signed in front of a notary public to be legally valid.

- Record the completed and notarized deed with the county recorder's office in the county where the property is located.

Property Owner's Information

Full Name: _____________________________

Mailing Address: _____________________________

City, State, Zip: _____________________________

Phone Number: _____________________________

Email Address: _____________________________

Property Information

Legal Description of Property: _____________________________

Property Address: _____________________________

Beneficiary Information

Full Name of Primary Beneficiary: _____________________________

Relationship to Property Owner: _____________________________

Alternate Beneficiary (if primary beneficiary predeceases the owner):

Full Name of Alternate Beneficiary: _____________________________

Relationship to Property Owner: _____________________________

Signatures

This document must be signed in the presence of a Notary Public to be legally binding.

_____________________________

Property Owner's Signature

_____________________________

Date

Notary Public

State of Arizona )

County of ____________ )

On this _____ day of ____________, 20__, before me personally appeared ________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_____________________________

Notary Public Signature

My Commission Expires: ____________

Document Details

| Fact | Detail |

|---|---|

| Legislation Enabling Transfer-on-Death Deed | Arizona Revised Statutes Section 33-405. |

| Purpose | Allows property owners to pass real estate directly to a beneficiary upon death without probate. |

| Form Requirement | Must be in writing, contain legal description of the property, and the beneficiary must be clearly identified. |

| Signing Requirement | Needs to be notarized and signed by the property owner. |

| Witness Requirement | Not required under Arizona law for the deed to be valid. |

| Recording Requirement | Must be recorded before the owner's death in the county where the property is located to be effective. |

| Revocability | The deed can be revoked by the owner at any time before death without the beneficiary’s consent. |

| Effect on Beneficiary’s Rights Prior to Death | Beneficiary does not have any right or interest in the property until the owner's death. |

Instructions on Utilizing Arizona Transfer-on-Death Deed

After acquiring a piece of property, you might consider how best to pass this asset on to your beneficiaries in a manner that is efficient and avoids the complexities of probate. In Arizona, one avenue to consider is the use of a Transfer-on-Death (TOD) deed. This legal document permits the direct transfer of the property to a named beneficiary upon the death of the property owner, without the necessity of probate proceedings. While the effectiveness of a TOD deed is not in operation until the owner's death, completing this form correctly is crucial to ensure that your wishes are honored, and the property transitions smoothly to your designated beneficiary.

To properly fill out the Arizona Transfer-on-Death Deed form, follow the steps outlined below:

- Identify the Current Property Owner(s): Start by listing the name(s) of the current owner(s) as they are listed on the property's current deed. This ensures clarity and continuity in property records.

- Designate the Beneficiary(ies): Clearly indicate the person or persons who will inherit the property. Include full legal names and, if possible, contact information to prevent any ambiguity regarding the identity of the beneficiaries.

- Provide a Legal Description of the Property: This is not simply the address. Instead, you must use the legal description as it appears on the current deed or property records. This description typically includes lot numbers, subdivision names, and other details that uniquely identify the property.

- Sign the Deed in the Presence of a Notary Public: For the TOD deed to be valid, it must be signed by the property owner(s) in the presence of a notary public. This official acknowledgment is crucial for the deed's validity.

- Record the Deed with the County Recorder’s Office: After notarization, the deed must be submitted to the county recorder’s office in the county where the property is located. A fee will typically be required for recording the deed. It is only upon recording that the deed becomes effective.

By following these steps carefully, you create a legal instrument that clearly communicates your intentions regarding the property after your passing. This process, while straightforward, requires attention to detail to ensure that the TOD deed is correctly executed and thus serves its intended purpose without unintended consequences or disputes among potential beneficiaries.

Listed Questions and Answers

What is a Transfer-on-Death Deed in Arizona?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Arizona to transfer their real estate to a beneficiary upon their death without the need for probate court proceedings. This tool enables an individual to name one or more beneficiaries who will receive their property, but it does not take effect until the death of the property owner, allowing them to retain full control over the property during their lifetime, including the right to change or revoke the deed.

How can I create a Transfer-on-Death Deed in Arizona?

To create a valid Transfer-on-Death Deed in Arizona, the document must include a legal description of the property, the name of the beneficiary, and it must be signed by the property owner in the presence of a notary public. After it is signed and notarized, the deed must be recorded with the county recorder in the county where the property is located. It's important to ensure the deed compliles with Arizona law to be considered valid.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the death of the property owner. Revocation can be accomplished in several ways, including executing a new deed that expressly revokes the previous one or sells the property to someone else. It is crucial that any revocation is handled correctly and is similarly recorded with the county recorder to effectively nullify the previous deed.

Are there any restrictions on who can be named as a beneficiary on a Transfer-on-Death Deed in Arizona?

Arizona law allows property owners to name almost any individual, trust, or organization as a beneficiary on a Transfer-on-Death Deed. However, the owner must ensure the beneficiary is clearly identifiable to avoid any confusion after their passing. Minors can be named as beneficiaries, but considerations should be made regarding the management of the property until they reach legal age.

What happens to the property if the beneficiary predeceases the property owner?

If a beneficiary named on a Transfer-on-Death Deed predeceases the property owner, the property will not transfer to that beneficiary's heirs or devisees. Instead, the property becomes part of the estate of the deceased property owner and will pass according to their will or, if there is no will, according to Arizona's laws of intestate succession. To avoid complications, property owners may consider naming alternate beneficiaries on the TODD.

Common mistakes

-

Not specifying a beneficiary clearly is a common pitfall. Individuals often write a name without sufficient detail, making it unclear who the intended beneficiary is. They should provide full names and, if possible, a second identifier like an address or a relationship to avoid any confusion.

-

Another mistake is neglecting to describe the property with enough precision. A complete legal description is required, not just the address. This ensures the property can be correctly identified and transferred without legal complications.

-

Failing to sign the deed in front of a notary public is a critical error. For the deed to be legally binding, it must be signed by the property owner in the presence of a notary who then certifies the signature. Skipping this step invalidates the document.

-

Forgetting to file the deed with the county recorder's office is a common oversight. After the document is notarized, it doesn't automatically take effect. It must be filed with the appropriate office in the county where the property is located to be effective.

-

Assuming that the deed overrides other legal documents is a misunderstanding some people have. If there are any conflicts with previous documents, like a will, those need to be resolved. The Transfer-on-Death Deed does not automatically have precedence over other estate planning documents.

-

Not considering the implications for beneficiaries is the final pitfall to avoid. Owners should understand how this deed affects the beneficiary's taxation, eligibility for government benefits, and responsibilities. Proper legal advice can help in navigating these issues.

Documents used along the form

When planning for the future, it's crucial to be thorough, ensuring that all your bases are covered. The Arizona Transfer-on-Death (TOD) Deed is a valuable tool in estate planning, allowing property owners to designate beneficiaries to receive their property upon death without the property having to go through probate. However, to ensure a comprehensive estate plan, there are several other documents that you should consider including alongside your TOD Deed. Each of these forms plays a vital role in safeguarding your assets and wishes:

- Will: This fundamental document allows you to specify how you want your possessions, other than those covered by the TOD deed, to be distributed after you pass away. It can also be used to name an executor for your estate and guardians for any minor children.

- Durable Power of Attorney: This form gives someone you trust the authority to manage your financial affairs if you become incapacitated. It’s crucial for making sure your bills are paid and your financial matters are handled if you're unable to do so yourself.

- Medical Power of Attorney: Also known as a healthcare proxy, this document allows you to appoint someone to make medical decisions on your behalf if you're unable to communicate your wishes directly.

- Living Will: A living will, or advance healthcare directive, outlines your preferences for medical treatment if you become unable to make decisions for yourself. It often includes your wishes regarding life support and end-of-life care.

- Beneficiary Designations: While not a form per se, ensuring that your beneficiary designations on accounts such as retirement plans, life insurance policies, and bank accounts are up-to-date is critical. These designations can override your will for those specific assets.

Integrating these documents with your Arizona Transfer-on-Death Deed forms a strong foundation for your estate plan. Each element complements the others, providing you with peace of mind and ensuring that your wishes are honored. Remember, while the process might seem daunting, the effort you put into organizing your estate now can save your loved ones time, money, and stress in the future. It's always advisable to consult with legal and financial advisors to tailor your estate plan to your specific needs.

Similar forms

The Arizona Transfer-on-Death (TOD) Deed is similar to a Last Will and Testament in that it allows an individual to specify how they want their property to be distributed after their death. The key distinction lies in the process and effectiveness of the transfer. While a Last Will and Testimony becomes effective only after it has been verified through a probate process, a TOD Deed bypasses this process entirely, allowing for a more immediate transfer of property rights to the beneficiary upon the owner's death.

Comparable to a Living Trust, the Arizona Transfer-on-Death Deed offers a way to plan for the future disposition of one’s assets outside of probate. Both a Living Trust and a TOD Deed enable the direct transfer of assets to beneficiaries upon death. However, a Living Trust covers a broader scope of property management and allows for more complex directives. Unlike a TOD Deed, which is specifically designed for real estate, a Living Trust can include various types of assets and provides for management of the assets in the event of the grantor's incapacity.

The Beneficiary Deed, which is another term for a Transfer-on-Death Deed in Arizona, is inherently similar to a Payable-on-Death (POD) account. A POD account is a banking or investment account that names a beneficiary who can claim the account's assets upon the account holder's death. Like a TOD Deed, a POD account avoids probate and directly transfers assets to the beneficiary. The difference primarily lies in the types of assets they control; a TOD Deed applies exclusively to real estate, whereas POD accounts are used for cash and other financial assets.

Finally, the Arizona Transfer-on-Death Deed shares similarities with a Joint Tenancy deed, particularly regarding the right of survivorship. Both mechanisms allow property to pass to the surviving owner(s) upon the death of an owner. In a Joint Tenancy, this transfer is automatic and does not require probate. However, unlike a TOD Deed, which allows the property owner to designate a beneficiary while retaining full control of the property during their lifetime, Joint Tenancy involves shared ownership of the property, with all joint tenants having equal rights to use the property during their lives.

Dos and Don'ts

Filling out an Arizona Transfer-on-Death (TOD) Deed form is a significant step in managing your estate planning. This deed allows property owners to name beneficiaries who will inherit the property upon the owner's death without going through probate. When completing this form, it's vital to follow certain guidelines to ensure the transfer goes smoothly and according to your wishes. Here are some important dos and don'ts to keep in mind:

Do:- Review the entire form before filling it out. Make sure you understand each part to avoid any mistakes that could affect the validity of the deed.

- Clearly identify all beneficiaries. Include their full names and relationship to you, ensuring there's no confusion about your intentions.

- Consult with a legal professional. This ensures that the deed aligns with your estate plan and complies with Arizona law.

- Use precise legal descriptions for the property. This information can usually be found on your property deed or at the county recorder's office.

- Sign the deed in front of a notary public. This step is essential for the document to be legally binding.

- Delay recording the deed with the county recorder's office. Once completed and notarized, the deed must be recorded before it becomes effective.

- Forget to consider all potential outcomes. Think about how changes in relationships or beneficiary circumstances might affect your estate plan.

- Omit reviewing and updating the deed as necessary. Life changes, such as marriages, divorces, or the death of a beneficiary, can necessitate adjustments to your TOD deed.

Properly completing and managing your Arizona TOD Deed can significantly simplify the transfer of your real estate to your chosen beneficiaries. Always take the time to ensure every detail is correctly addressed and seek legal guidance when needed. Remember, this deed is an important part of your overall estate planning strategy, and its accuracy and validity are crucial for your peace of mind and the well-being of your beneficiaries.

Misconceptions

When people in Arizona consider how to manage their assets after they're gone, many have heard about the Transfer-on-Death (TOD) deed. This form allows homeowners to pass on their property directly to a beneficiary when they die, bypassing the often lengthy and costly probate process. However, several misconceptions about this tool can lead to confusion. Let's clear up some of these misunderstandings.

- Misconception 1: A TOD deed overrides a will. One common mistake is thinking that a Transfer-on-Death deed can override what's stated in a will regarding the property. In reality, the TOD deed takes precedence over a will. This means the property will pass to the beneficiary named in the TOD deed, even if the will says otherwise. Understanding this is crucial for ensuring your property is transferred according to your wishes.

- Misconception 2: You cannot change your mind after recording a TOD deed. Another misunderstanding is that once a TOD deed is recorded with the county, the decision is permanent. In fact, property owners have the flexibility to revoke or change a TOD deed at any time before their death, as long as they are mentally competent. This change can be made without the consent or notification of the named beneficiary.

- Misconception 3: TOD deeds allow the beneficiary to own the property immediately. Some people mistakenly believe that once a TOD deed is filed, the beneficiary becomes an immediate co-owner of the property. The truth is, the beneficiary has no legal right to the property until the owner's death. Until then, the owner retains complete control and can use or sell the property as they see fit.

- Misconception 4: A TOD deed avoids all taxes and debts. Lastly, there's a false assumption that transferring property through a TOD deed means the beneficiary will receive it free of any taxes or debts. However, the transferred property may still be subject to estate recovery claims or federal estate taxes, depending on the value of the estate. Also, if the property has a mortgage or lien against it, the beneficiary will be responsible for those debts.

Understanding the specifics of a Transfer-on-Death deed in Arizona ensures that individuals can make informed decisions about their estate planning. It's an effective tool for avoiding probate for real estate but requires a clear comprehension of its features and limitations.

Key takeaways

Filling out and using the Arizona Transfer-on-Death (TOD) Deed form is a significant step for property owners who wish to ensure the smooth transfer of their real estate upon their death, without the need for probate. Here are key takeaways regarding this legal instrument:

- The Arizona TOD Deed allows property owners to designate beneficiaries to whom the property will transfer upon the owner’s death, automatically bypassing the often lengthy and costly probate process. This facilitates a smoother and faster transfer of real estate assets to the intended heirs.

- To create a valid TOD Deed in Arizona, the deed must be properly completed, signed, and notarized. Importantly, the form must include the legal description of the property, the name of the designated beneficiary(ies), and the owner's clear intention to transfer the property upon death. This ensures both the legality and the enforceability of the deed.

- Another critical aspect is that the TOD Deed must be recorded with the county recorder’s office in the county where the property is located, before the owner’s death, to be effective. Recording the deed makes it a part of the public record, which is crucial for the transfer process after the owner's death.

- The TOD Deed offers flexibility to the property owner, who retains full control of the property during their lifetime. This means the owner can sell, lease, or mortgage the property and even revoke or change the beneficiary designation at any time before death without the beneficiary’s consent. This flexibility ensures that the owner’s current and future circumstances and wishes are accommodated.

- It is important to understand that filing a TOD Deed has tax implications for the beneficiary. While the deed allows for the avoidance of probate, beneficiaries may still be responsible for federal estate taxes if the estate exceeds the federal exemption limit. Additionally, there may be other tax considerations regarding inheritance or capital gains taxes that should be carefully reviewed.

Adopting a TOD Deed in Arizona is a strategy that requires careful consideration, detailed legal knowledge, and precise execution. Property owners are encouraged to seek legal advice to ensure that all requirements are met, and that the TOD Deed aligns with their overall estate planning goals. By taking these steps, property owners can provide for a seamless transition of their real estate to their chosen beneficiaries, safeguarding their legacy and providing peace of mind for themselves and their loved ones.

Create Popular Templates for Arizona

Home Rental Application Template - The inclusion of consent clauses in the Rental Application form is crucial for legal compliance in obtaining credit and background reports.

Report of Sale - It acts as a receipt for the transaction, detailing the agreement's specific terms.

Arizona Prenup - This agreement can detail the responsibility for any financial liabilities incurred during the marriage, offering clarity and fairness.