Legal Arizona Small Estate Affidavit Document

When someone passes away in Arizona, their estate—consisting of assets like real estate, bank accounts, and personal property—needs to be legally distributed to their heirs or beneficiaries. This process often seems daunting, particularly during a time of grief. However, for smaller estates that fall under a certain value, Arizona provides a more straightforward option: the Small Estate Affidavit form. Designed to simplify the transfer of assets without the need for a lengthy probate process, this form offers a semblance of ease during challenging times. It is pivotal for those involved to understand the form’s criteria, such as the valuation limits for personal and real property and the necessary documentation to accompany the affidavit. Moreover, knowing when and how to submit this form not only ensures compliance with Arizona law but also facilitates a smoother transition of assets, potentially sparing families additional distress and financial burden.

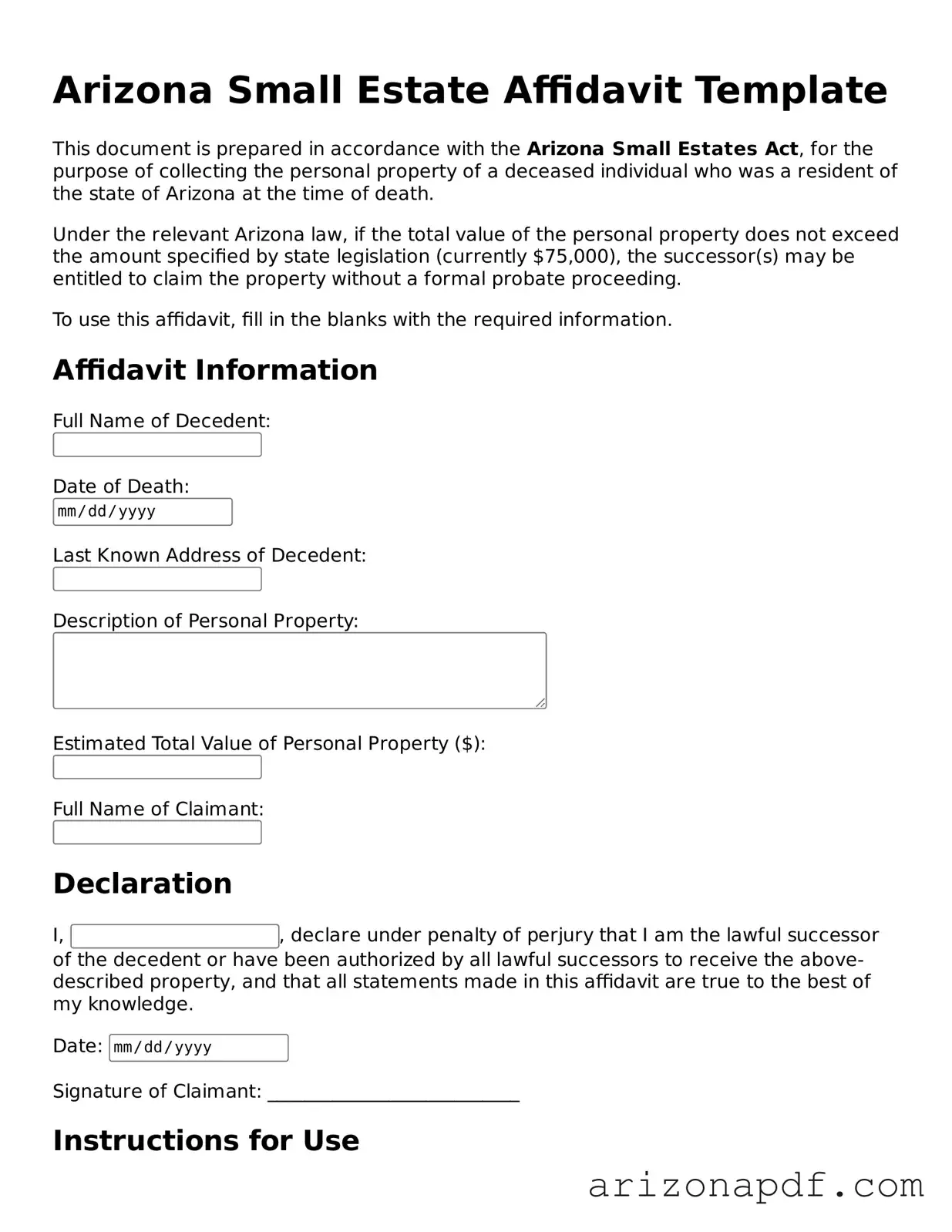

Arizona Small Estate Affidavit Preview

Arizona Small Estate Affidavit Template

This document is prepared in accordance with the Arizona Small Estates Act, for the purpose of collecting the personal property of a deceased individual who was a resident of the state of Arizona at the time of death.

Under the relevant Arizona law, if the total value of the personal property does not exceed the amount specified by state legislation (currently $75,000), the successor(s) may be entitled to claim the property without a formal probate proceeding.

To use this affidavit, fill in the blanks with the required information.

Affidavit Information

Declaration

I, , declare under penalty of perjury that I am the lawful successor of the decedent or have been authorized by all lawful successors to receive the above-described property, and that all statements made in this affidavit are true to the best of my knowledge.

Date:

Signature of Claimant: ___________________________

Instructions for Use

- Complete all sections of the affidavit with accurate information.

- Ensure the total value of the described personal property does not exceed the current threshold under Arizona law.

- Sign the affidavit before a notary public.

- Present the completed affidavit, along with a certified copy of the death certificate, to the entity holding the decedent's property.

Document Details

| Fact | Description |

|---|---|

| 1. Purpose | The Arizona Small Estate Affidavit form simplifies the process of estate distribution for estates that fall below a certain value threshold. |

| 2. Applicable Law | Governed by Arizona Revised Statutes (ARS) § 14-3971 for personal property and § 14-3971.01 for real property. |

| 3. Eligibility Thresholds | As of the latest update, personal property estates valued at or below $75,000 and real property estates valued at or below $100,000 qualify. |

| 4. Waiting Period | Affidavits for personal property can be filed 30 days after the death, while for real property, the waiting period is 6 months. |

| 5. Mandatory Information | Includes decedent's information, a description of the property, the value of the estate, and the legal heir(s) or beneficiary(ies). |

| 6. Benefit | Allows for a more efficient and less costly transfer of assets than going through probate court. |

| 7. Notarization Requirement | The form must be notarized to be considered valid and legally binding. |

| 8. Public Record | Once filed with the appropriate county recorder's office, the affidavit becomes a public document. |

Instructions on Utilizing Arizona Small Estate Affidavit

Filling out the Arizona Small Estate Affidavit form is an essential process for those looking to manage the small estate of a deceased person without going through the lengthy and complicated probate process. This form allows you to legally claim property of the deceased if you are entitled to it under Arizona law. Below, you'll find a simplified guide to complete this important document. First, gather all necessary information about the deceased's estate, including asset values and any debts owed. With this information at hand, you're ready to fill out the form following these steps.

- Start by entering the full legal name of the deceased, also known as the decedent, in the designated space at the top of the form.

- Fill in the date of death of the decedent, making sure it matches the certified death certificate.

- Provide your own full legal name and address, indicating your relationship to the decedent and why you are entitled to claim the estate.

- List all known assets belonging to the decedent. Be specific and include any bank accounts, vehicles, stock, real estate within Arizona, and personal belongings with significant value.

- Detail any debts the decedent owed at the time of death, including funeral expenses, medical bills, credit card debts, or any other outstanding liabilities.

- Sign the affidavit in front of a notary public to validate your claim. Ensure the notary also signs and seals the form, making it legally binding.

After completing the form, you must wait the required 30 days following the decedent's death before you can submit the document to the institution holding the decedent's asset, such as a bank or the Bureau of Motor Vehicles. This waiting period allows for all parties to present any potential claims against the estate. Handing in the affidavit effectively transfers the ownership of the assets from the decedent to you, bypassing the need for a formal probate process. It's crucial to ensure that all information provided in the affidavit is accurate and truthful to avoid legal penalties.

Listed Questions and Answers

What is the purpose of the Arizona Small Estate Affidavit form?

In Arizona, the Small Estate Affidavit form serves as a simplified way for heirs or designated beneficiaries to collect the property of a deceased person without going through a formal probate process. This option is available for estates that meet specific criteria, making it easier and faster to transfer assets to the rightful heirs.

Who is eligible to use the Arizona Small Estate Affidavit?

To be eligible to use the Arizona Small Estate Affidavit, the total value of the personal property left by the deceased must not exceed $75,000, and the value of real estate must not exceed $100,000. Additionally, at least 30 days must have passed since the death of the property owner. The affidavit can be used by heirs or beneficiaries named in the will, assuming the estate qualifies under these terms.

What documents are required to complete the Arizona Small Estate Affidavit?

Completing the Arizona Small Estate Affidavit requires a certified copy of the death certificate of the deceased, the Small Estate Affidavit form filled out completely, and any additional documents proving the filer’s right to the property. If real estate is involved, a legal description of the property must also be provided. It's advisable to consult the County Recorder's office to ensure all required documents are in order for the transfer of real property.

What steps should be taken after filling out the Arizona Small Estate Affidavit?

After accurately completing the Arizona Small Estate Affidavit, the next steps involve getting the affidavit notarized and then presenting it to the entity holding the property (such as a bank or brokerage). For real estate, the affidavit along with a death certificate and any other required documents must be filed with the County Recorder's office in the county where the property is located. This process legally transfers the property to the heirs or designated beneficiaries.

Are there any costs associated with using the Arizona Small Estate Affidavit?

While the Arizona Small Estate Affidavit process is designed to be less costly than a formal probate, there are still some fees involved. These can include notary fees, fees for obtaining a certified copy of the death certificate, and any recording fees required by the County Recorder's office for the transfer of real property. The specific costs can vary depending on the county and the specific needs of the estate.

Common mistakes

When settling a small estate in Arizona, many individuals opt to use the Small Estate Affidaid form. This approach often simplifies the probate process for estates under a certain value. However, accuracy and adherence to specific requirements are paramount. The following outlines common mistakes to avoid:

-

Not waiting the required 30 days after death to file the affidavit. Arizona law mandates this waiting period before the affidavit can be submitted, ensuring all claims against the estate can be properly addressed.

-

Failing to accurately calculate the value of the estate. The total value must fall below a specific threshold for the small estate process to be applicable, and incorrect calculations can lead to legal complications.

-

Misunderstanding which assets can be included. Certain assets, such as those held in joint tenancy or designated to pass to a survivor, should not be included in the affidavit’s estate value.

-

Omitting required documentation, such as death certificates, or failing to provide necessary information about the deceased’s assets and debts.

-

Incorrectly assuming that the affidavit transfers title or ownership of assets. While the affidavit can facilitate the transfer, additional steps may be needed for certain assets.

-

Misidentifying the rightful heirs or beneficiaries. Arizona law dictates a specific order of succession that must be followed unless a valid will states otherwise.

-

Not properly serving notice to creditors or failing to address outstanding debts, which can result in legal challenges against the estate.

-

Attempting the process without consulting legal guidance when the estate’s circumstances are complex. While the Small Estate Affidavit form is designed for simplicity, professional advice can prevent costly errors.

Avoiding these pitfalls is crucial for a smooth transition of assets and ensuring the decedent’s wishes are honored. Each step must be approached with diligence and respect for the legal process, safeguarding against undue delays or disputes.

Documents used along the form

When handling the affairs of a loved one who has passed away in Arizona, the Small Estate Affidavit is a critical document, especially for estates that fall under a certain value threshold, allowing for a simpler, court-free process of asset distribution. However, this form doesn’t stand alone. Several other documents and forms often accompany it, each serving its own unique purpose in the estate settlement process. Here's a rundown of six such forms and documents:

- Death Certificate: This is an official document issued by the state that certifies the date, location, and cause of death. It’s essential for many steps in settling an estate, including the use of the Small Estate Affidavit, as it proves the passing of the individual in question.

- Will: If the deceased left a will, it specifies their wishes regarding the distribution of their assets and the care of any dependents. While the Small Estate Affidavit can be used without a will, the presence of one may guide the distribution of assets mentioned in the affidavit.

- Vehicle Title Transfer Forms: For estates that include vehicles, these forms legally transfer ownership. If the Small Estate Affidavit includes vehicles, the appropriate state Department of Motor Vehicles (DMV) form is necessary.

- Real Estate Deed Transfer Forms: When a small estate includes real property, a deed transfer form is essential for changing the title of the property to the new owner’s name following the process set forth by Arizona law.

- Bank Account Closure Forms: To access or close the deceased’s bank accounts, one might need to fill out specific forms provided by the bank, proving entitlement to the funds under the Small Estate Affidavit.

- Asset Inventory Sheets: Though not an official form, maintaining a detailed list of the deceased’s assets, including personal property, bank accounts, securities, and real estate, can be invaluable. This inventory assists in filling out the Small Estate Affidavit accurately and ensures all assets are accounted for.

Completing the estate settlement process in Arizona, especially for smaller estates, can be streamlined with the right documentation in hand. Each document plays a crucial role in validating the estate’s details, transferring ownership of assets, and ultimately honoring the decedent’s legacy while complying with state laws. It's imperative for individuals to gather and prepare these documents carefully alongside the Small Estate Affidavit to ensure a smooth transition of assets.

Similar forms

The Transfer on Death Deed (TODD) shares similarities with the Arizona Small Estate Affidavit in that both documents facilitate the transfer of assets upon the death of the owner without the need for probate court proceedings. While the Small Estate Affidavit is used to claim assets by the heirs, the TODD enables property owners to name beneficiaries to real estate, ensuring a smooth transition upon their death.

Joint Tenancy with Right of Survivorship (JTWROS) agreements are akin to the Arizona Small Estate Affidavit as they both serve to bypass the probate process. A JTWROS allows co-owners of property to automatically inherit the other's share upon their death, mirroring the simplified transfer method that the Small Estate Affidavit provides for asset distribution without court intervention.

A Payable on Death (POD) account is similar to the Arizona Small Estate Affidavit because both offer a streamlined process for transferring assets at death. POD accounts allow the account holder to designate a beneficiary who will receive the funds directly upon the holder's death, akin to how the Small Estate Affidavit enables heirs to directly claim assets from a deceased's estate without probate.

Life Insurance Policies directly relate to the functionality of the Arizona Small Estate Affidavit by providing beneficiaries with a means to obtain assets outside of probate. Much like the Small Estate Affidavit, beneficiaries of life insurance policies receive proceeds directly, allowing for the bypassing of the prolonged probate process.

The Revocable Living Trust holds similarity with the Arizona Small Estate Affidavit in its purpose to avoid probate. Property and assets held in a Revocable Living Trust can be directly transferred to named beneficiaries upon the trustor's death, paralleling the swift asset transfer aimed by the Small Estate Affidavit without court involvement.

A beneficiary deed in Arizona serves a purpose similar to the Small Estate Affidavit, specifically designed to transfer real property upon the death of the property owner. Much like the Small Estate Affidavit, a beneficiary deed avoids the need for probate, streamlining the process for transferring property directly to the named beneficiary.

Gift Deeds are related to the Arizona Small Estate Affidavit process in that both involve the transfer of ownership without financial consideration. While a Gift Deed is used to transfer property ownership while the giver is alive, the Small Estate Affidavit facilitates the transfer of assets from a deceased's estate to their rightful heirs, both aiming to simplify the transfer process.

The Durable Financial Power of Attorney (POA) shares its core objective with the Arizona Small Estate Affidavit by allowing an individual to manage another’s assets in specific situations. Unlike the after-death asset transfer via the Small Estate Affidavit, a Durable Financial POA enables financial management and asset handling during the principal's lifetime, particularly in instances of incapacity, highlighting a proactive approach to asset management and transfer.

Dos and Don'ts

When dealing with the process of settling a small estate in Arizona, it's important to carefully fill out a Small Estate Affidavit form. This document facilitates the transfer of assets from a deceased person's estate to their rightful heirs without the need for formal probate proceedings. Here are key dos and don'ts that will guide you through completing the form correctly and efficiently.

Things You Should Do:

- Gather all necessary documents: Before filling out the form, make sure you have all relevant documents such as the death certificate, property documents, and any outstanding debts listed and organized.

- Verify eligibility: Ensure the estate qualifies under Arizona’s small estate threshold. As of the latest regulations, personal property estates valued at $75,000 or less and real property estates valued at $100,000 or less may qualify.

- Accurately describe the assets: Be precise and thorough in describing the deceased's assets. Include account numbers, property descriptions, and other identifiers as needed.

- Ensure accuracy of information: Double-check all entered information for accuracy. Mistakes can delay the process or lead to legal complications.

- Sign in front of a notary public: Arizona law requires the Small Estate Affidavit to be notarized. Ensure this is done correctly to validate the document.

- File the affidavit with the appropriate court: Depending on the assets' location, you may need to file the affidavit with a specific Arizona county court. Confirm where to file the document based on the estate’s assets.

- Understand the waiting period: Be aware that Arizona law mandates a waiting period after the decedent's death before the Small Estate Affidavit can be filed. This period allows creditors to make claims against the estate.

Things You Shouldn't Do:

- Avoid guessing on asset values: Do not estimate or guess when it comes to the value of the estate's assets. Use appraisals or factual data to determine accurate valuations.

- Don’t overlook debts and creditors: Failing to address the deceased's outstanding debts can lead to legal issues. Ensure all debts are accounted for before distributing assets.

- Refrain from dishonesty: Don't attempt to conceal assets or information. Honesty is crucial in legal proceedings, and discrepancies can result in severe penalties.

- Don’t file prematurely: Respect the waiting period required by Arizona law. Filing too early can invalidate the process.

- Avoid using the form when not eligible: If the estate exceeds Arizona’s small estate thresholds, proceeding with a Small Estate Affidavit is not appropriate. Consult with a legal professional about other probate alternatives.

- Don’t forget to distribute assets according to the will or state law: After you’ve properly completed and filed the affidavit, ensure assets are distributed in accordance with the decedent’s will or, in the absence of a will, Arizona’s intestacy laws.

- Do not ignore tax considerations: Be mindful of any tax implications related to the transfer of assets. It may be beneficial to consult with a tax professional.

Misconceptions

When handling the transfer of assets in Arizona for estates that are considered small under state law, a Small Estate Affidavit form is often utilized. This document simplifies the process, but misunderstandings surrounding its use are not uncommon. Below are eight misconceptions about the Arizona Small Estate Affidavit form and clarifications that aim to provide a clearer understanding.

Any estate can use the Small Estate Affidavit form. In truth, only estates that fall under certain value thresholds, specifically $75,000 for personal property and $100,000 for real property, can utilize this expedited process. Estates larger than these amounts require formal probate proceedings.

Real estate can always be transferred using the form. While the form can facilitate the transfer of real estate under the $100,000 threshold, specific criteria must be met. Importantly, the title must not be contested, and certain time frames post-death must be observed.

The form immediately transfers ownership of assets. Although the form can simplify asset transfer, it does not act instantaneously. Proper filing and approval, particularly from financial institutions or entities holding the asset, are prerequisites before any transfer is effected.

It eliminates the need for a will. The Small Estate Affidavit is designed to streamline asset transfer for qualifying estates and does not negate the necessity for a will. A will provides comprehensive directives beyond the scope of asset transfer, including guardianship considerations and specific bequests.

Filling out the form is all that’s required. The process involves more than just completing the form. Legal requirements, such as obtaining death certificates and possibly securing signatures from all heirs or beneficiaries, are vital steps in this process.

It can be used immediately after a person dies. Arizona law stipulates a waiting period before the form can be used—30 days after the death. This grace period allows for the emergence of wills, debts, and claims against the estate.

Only family members can file the form. While family members commonly complete the form, legally recognized representatives or designated beneficiaries can also file, provided they meet Arizona’s eligibility criteria.

A lawyer’s assistance is not necessary. Although it's possible to navigate the affidavit process without legal guidance, consulting with a knowledgeable professional can prevent costly errors. Legal nuances and potential estate complications make professional advice invaluable.

Understanding these nuances ensures that the use of the Arizona Small Estate Affidavit is both appropriate and effective, streamlining the process of asset transfer for small estates while adhering to state statutes.

Key takeaways

When dealing with the Arizona Small Estate Affidavit form, individuals can navigate through the process of asset transfer from a deceased person's estate to their rightful heirs or beneficiaries in a more streamlined and cost-effective manner, provided certain conditions are met. Here are some key takeaways to help understand its use and importance:

- Eligibility Requirements: To use the Arizona Small Estate Affidavit, the total value of the personal property left by the deceased must not exceed $75,000, and real estate properties must have a cumulative value of less than $100,000. These amounts are subject to change, so it's important to confirm current thresholds.

- No Probate Necessary: One of the significant advantages of this form is that it allows the legal heirs to claim assets without going through a lengthy and often costly probate process. This makes it faster and easier for assets to be distributed.

- Waiting Period: In Arizona, a Small Estate Affidavit for personal property can be filed 30 days after the decedent has passed away, while for real estate, the waiting period extends to six months. This waiting period is crucial to ensure that all debts and claims against the estate have been accounted for.

- Filing and Documentation: When filling out the Small Estate Affidavit, it's essential to accurately describe the assets and provide proof of the deceased's death, usually through a death certificate. Additionally, the claimant must swear under oath that they are entitled to the assets described in the affidavit. Depending on the asset type, the completed affidavit is filed with the appropriate entity, such as a bank for personal property or the county recorder's office for real estate.

Understanding and following the guidelines for the Arizona Small Estate Affidiff can make managing a loved one's final affairs more bearable, avoiding unnecessary legal complexities and expenses.

Create Popular Templates for Arizona

Home Rental Application Template - Fees associated with processing the Rental Application are usually detailed within the form, including any non-refundable application fees.

Arizona Homeschool Funding - Assists in creating an official record of homeschooling, which may be required for future educational or legal purposes.