Legal Arizona Real Estate Purchase Agreement Document

Embarking on the journey of purchasing or selling real estate in Arizona demands a comprehensive understanding of the legal framework that underpins these transactions. Central to this process is the Arizona Real Estate Purchase Agreement form, a critical document that outlines the terms and conditions agreed upon by both parties involved. This form serves as a legally binding contract, detailing the specifics of the property sale, including the purchase price, property description, financing terms, closing and possession dates, contingencies, and any additional requirements specific to the Arizona market. Its significance cannot be overstated, as it not only ensures a mutual understanding between buyer and seller but also safeguards their interests throughout the transaction. By meticulously outlining each aspect of the sale, this agreement form helps to prevent potential disputes and fosters a transparent, efficient pathway to transferring property ownership.

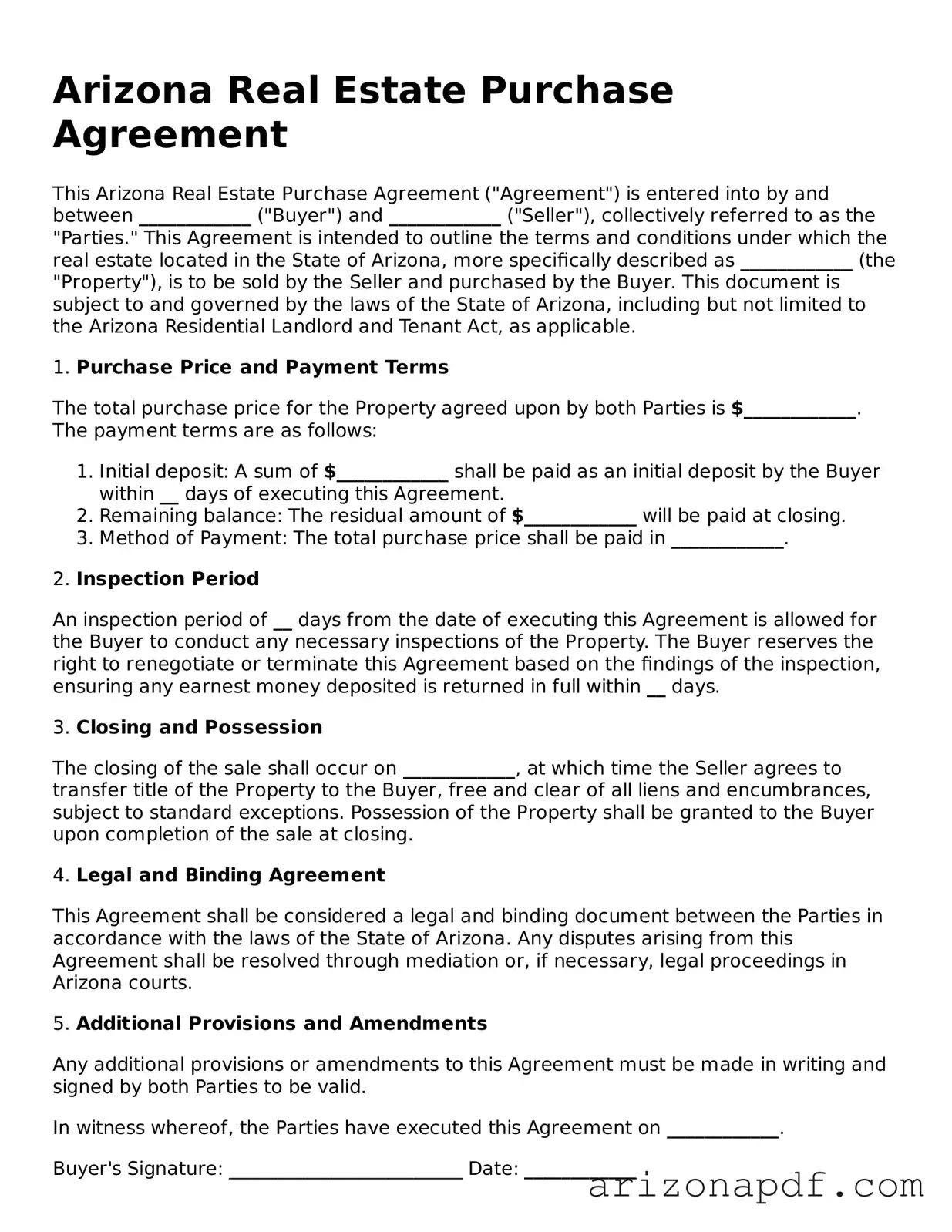

Arizona Real Estate Purchase Agreement Preview

Arizona Real Estate Purchase Agreement

This Arizona Real Estate Purchase Agreement ("Agreement") is entered into by and between ____________ ("Buyer") and ____________ ("Seller"), collectively referred to as the "Parties." This Agreement is intended to outline the terms and conditions under which the real estate located in the State of Arizona, more specifically described as ____________ (the "Property"), is to be sold by the Seller and purchased by the Buyer. This document is subject to and governed by the laws of the State of Arizona, including but not limited to the Arizona Residential Landlord and Tenant Act, as applicable.

1. Purchase Price and Payment Terms

The total purchase price for the Property agreed upon by both Parties is $____________. The payment terms are as follows:

- Initial deposit: A sum of $____________ shall be paid as an initial deposit by the Buyer within __ days of executing this Agreement.

- Remaining balance: The residual amount of $____________ will be paid at closing.

- Method of Payment: The total purchase price shall be paid in ____________.

2. Inspection Period

An inspection period of __ days from the date of executing this Agreement is allowed for the Buyer to conduct any necessary inspections of the Property. The Buyer reserves the right to renegotiate or terminate this Agreement based on the findings of the inspection, ensuring any earnest money deposited is returned in full within __ days.

3. Closing and Possession

The closing of the sale shall occur on ____________, at which time the Seller agrees to transfer title of the Property to the Buyer, free and clear of all liens and encumbrances, subject to standard exceptions. Possession of the Property shall be granted to the Buyer upon completion of the sale at closing.

4. Legal and Binding Agreement

This Agreement shall be considered a legal and binding document between the Parties in accordance with the laws of the State of Arizona. Any disputes arising from this Agreement shall be resolved through mediation or, if necessary, legal proceedings in Arizona courts.

5. Additional Provisions and Amendments

Any additional provisions or amendments to this Agreement must be made in writing and signed by both Parties to be valid.

In witness whereof, the Parties have executed this Agreement on ____________.

Buyer's Signature: _________________________ Date: ____________

Seller's Signature: _________________________ Date: ____________

Document Details

| Fact | Detail |

|---|---|

| 1. Purpose | Used to outline the terms and conditions of the sale and purchase of real estate in Arizona. |

| 2. Parties Involved | Identifies the buyer(s) and seller(s) involved in the real estate transaction. |

| 3. Governing Law | Governed by Arizona state laws, specifically Title 33 (Property) of the Arizona Revised Statutes. |

| 4. Property Description | Includes a detailed description of the property being sold, including its address and legal description. |

| 5. Purchase Price and Terms | Details the agreed-upon purchase price and the terms of payment between the buyer and seller. |

| 6. Contingencies | May include various contingencies such as financing, inspection, and the sale of another property. |

| 7. Closing and Possession | Specifies the closing date and the terms of possession for the buyer. | 1958/tr>

| 8. Disclosures | Requires certain disclosures to be made, such as the presence of lead-based paint or any material defects in the property. |

Instructions on Utilizing Arizona Real Estate Purchase Agreement

Completing the Arizona Real Estate Purchase Agreement form is a critical step in the process of buying or selling property in Arizona. This document officially records the terms and conditions under which the sale will occur. It's essential for both the buyer and seller to thoroughly understand and accurately complete this agreement to ensure the transaction proceeds smoothly. The following steps have been outlined to guide you through each section of the form, ensuring every detail is correctly addressed.

- Enter the date of the agreement at the top of the form.

- Fill in the full names and contact information of both the buyer and seller in the designated areas.

- Describe the property being sold, including its legal description and address. This section may also require additional details about the property, such as parcel number and legal identifiers.

- Specify the purchase price agreed upon by both parties in the corresponding section.

- Detail the terms of payment. This includes stating whether the purchase is being made with cash, through financing, or a combination of both. If financing is involved, provide the specifics of the loan terms.

- Outline any earnest money deposit made by the buyer, including the amount and the holding party.

- Itemize any personal property that will be included in the sale. This could encompass appliances, furniture, or other items not permanently affixed to the property.

- Discuss any inspections that will be required and who is responsible for arranging and paying for these inspections.

- Specify the closing date and location. This section determines when the final sale will occur and where the closing documents will be signed.

- Address possession details, including when the buyer will officially take possession of the property.

- List any additional agreements or contingencies that are part of the sale, such as necessary repairs, seller concessions, or conditions that must be met before the sale can be completed.

- The buyer and seller must both sign and date the agreement at the bottom of the form to indicate their understanding and acceptance of the terms.

- Ensure that a witness or notary public signs the form, validating the signatures of both parties.

Once the Arizona Real Estate Purchase Agreement form is fully completed and signed by all parties, it becomes a legally binding contract that outlines the responsibilities and obligations of both the buyer and seller. Ensuring that all information is accurate and clearly stated is crucial for a successful real estate transaction.

Listed Questions and Answers

What is an Arizona Real Estate Purchase Agreement?

An Arizona Real Estate Purchase Agreement is a binding document between a seller and buyer for the purchase of real estate in Arizona. It outlines the terms and conditions of the sale, including the purchase price, property description, closing details, and any contingencies that must be met prior to closing.

Who needs to sign the Arizona Real Estate Purchase Agreement?

Both the buyer and seller must sign the agreement for it to be legally binding. In some cases, real estate agents representing each party might also sign the document, although their signatures are not a legal requirement for the validity of the agreement.

Are there any contingencies that can be included in the agreement?

Yes, contingencies are common in real estate purchase agreements. They might include financing contingencies, inspection contingencies, the sale of the buyer's current home, and any other conditions that must be met for the transaction to proceed.

What happens if either party wants to back out of the agreement?

If a party wishes to back out of the agreement, they can do so without penalty if it's done within the confines of any contingency outlined in the agreement. If there are no contingencies, or they have already been met, backing out could result in the forfeit of the earnest money deposit or possibly lead to legal action for breach of contract.

How is the purchase price determined?

The purchase price is determined through negotiation between the buyer and seller. Once both parties agree on a price, it is documented in the Arizona Real Estate Purchase Agreement.

Is an earnest money deposit required?

Yes, an earnest money deposit is commonly required as part of the Arizona Real Estate Purchase Agreement. It acts as a security deposit to show the buyer's good faith in proceeding with the purchase. The amount is negotiable and is often held in escrow until closing.

Can either party make changes to the agreement after it has been signed?

Yes, but any changes to the agreement must be made in writing and signed by both the buyer and seller. Amendments can be attached to the original agreement to reflect any changes made.

What is the role of escrow in the real estate transaction?

Escrow serves as a neutral third party that holds the earnest money deposit and manages the exchange of documents and funds between the buyer and seller. The escrow ensures that all conditions of the sale are met before the transaction is finalized.

How does the closing process work?

The closing process involves the finalization of the sale, where the deed is transferred from the seller to the buyer, and the buyer pays the purchase price agreed upon in the Arizona Real Estate Purchase Agreement. This process typically occurs at a title company with both parties present or represented and concludes with the buyer obtaining the keys to the property.

Common mistakes

Filling out the Arizona Real Estate Purchase Agreement is a critical step in the home buying or selling process. Mistakes on this form can lead to delays, financial losses, or even the nullification of the deal. Here are nine common mistakes to avoid:

-

Not double-checking personal information: It's easy to misspell names or input incorrect contact information. This can cause significant confusion and delays further down the line.

-

Omitting essential details about the property: Every aspect of the property should be disclosed, including the accurate address, legal description, and any inclusions or exclusions in the sale.

-

Skipping over financial terms: The purchase price, down payment, and financing details must be clearly stated and agreed upon by both parties to prevent misunderstandings.

-

Ignoring contingency clauses: Contingencies such as financing, inspection, and appraisal are safeguards for both buyers and sellers. Overlooking these can lead to complications if any issues arise.

-

Misunderstanding the closing date and possession terms: Failing to agree on a specific closing date and when the buyer takes possession can create conflicts.

-

Incorrectly handling disclosures: Sellers are required to disclose certain information about the property's condition. Failure to properly complete these sections can result in legal repercussions.

-

Not specifying who pays for what: The agreement should detail who is responsible for closing costs, inspections, repairs, and other expenses. Leaving these details vague can lead to disputes.

-

Forgoing a final walk-through: Not including a provision for a final walk-through before closing can prevent buyers from verifying the property's condition one last time.

-

Forgetting to keep a copy: Both parties should keep a copy of the signed agreement. Not doing so can be problematic if any issues need to be reviewed or resolved later.

Avoiding these mistakes can help ensure a smoother real estate transaction for everyone involved. It's always recommended to review the agreement thoroughly and possibly consult with a legal professional before signing.

Documents used along the form

In the process of buying or selling real estate in Arizona, the Real Estate Purchase Agreement is a crucial document that outlines the terms of the sale, including the purchase price and any conditions that must be met before the sale can be finalized. However, this agreement does not stand alone. Several other forms and documents are often used alongside it to ensure a thorough and legally sound transaction. Each serves a specific purpose, working together to provide clarity, meet legal requirements, and protect all parties involved in the transaction.}

- Title Insurance Commitment: This document outlines the details of the title insurance policy that will be issued to the buyer upon closing. It includes any existing liens, loans, or encumbrances on the property and any conditions that must be satisfied to issue a clear title insurance policy.

- Loan Estimate and Closing Disclosure: For transactions involving a mortgage, the buyer receives these documents from their lender. The Loan Estimate provides an overview of the loan terms, projected payments, and closing costs early in the process. The Closing Disclosure offers detailed financial details and is received closer to the closing date, ensuring the buyer understands all fees and charges.

- Home Inspection Report: This report, generated by a professional home inspector, details the condition of the property, including any existing issues or potential repairs needed. It helps the buyer make an informed decision about proceeding with the purchase.

- Appraisal Report: An appraisal report assesses the market value of the property. It’s typically required by lenders to ensure the property's value meets or exceeds the purchase price and loan amount. This report protects the lender's interests by verifying the collateral value of the property.

- Home Warranty Agreement: This agreement provides the buyer with a warranty covering certain home systems and appliances for a specific period after the purchase. It offers peace of mind by reducing the risk of unexpected repair costs.

- Seller's Property Disclosure Statement (SPDS): The SPDS is completed by the seller and provides detailed information about the property’s condition and history, including any known defects or problems. This disclosure helps protect the buyer from unseen issues and informs them about the property they are committing to purchase.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is required by federal law. It informs the buyer about the presence of any known lead-based paint on the property, which is important for health and safety reasons.

Together, these documents provide a framework for a transparent and legally compliant real estate transaction in Arizona. By accurately completing and carefully reviewing each form, all parties can navigate the complexities of buying or selling property with greater confidence and security.

Similar forms

The Arizona Real Estate Purchase Agreement shares similarities with a Residential Lease Agreement. Both documents outline terms between two parties—the homeowner and the buyer in the purchase agreement, and the landlord and tenant in the lease agreement. Each agreement details the responsibilities each party has regarding property usage, payment schedules, and maintenance obligations. However, while the purchase agreement culminates in ownership transfer, a lease agreement grants occupancy rights for a specified period.

Similar to a Bill of Sale, the Arizona Real Estate Purchase Agreement is a transactional document detailing the sale of property from one individual to another. Both serve as legal proofs of agreement on the transfer of ownership of assets—real estate in the former and typically personal property in the latter. Key elements, such as the identification of parties involved, the sale price, and date of transaction, are integral to both documents to ensure their enforceability and legitimacy.

The Land Contract is another document bearing resemblance to the Arizona Real Estate Purchase Agreement, predominantly in their facilitation of property transactions. In both, payment terms, property particulars, and obligations of both buyer and seller are outlined. However, land contracts often differ by allowing the buyer to pay the seller directly over time for the property, transferring full ownership only after all payments have concluded, unlike a traditional purchase agreement that often involves immediate full payment and quick transfer of ownership.

An Escrow Agreement also mirrors aspects of the Arizona Real Estate Purchase Agreement, especially in the security and safeguarding it provides to the transaction. Both documents involve a neutral third party to oversee the deal—ensuring that all conditions are met before finalizing the property transfer. While the purchase agreement outlines the terms of the sale, an escrow agreement deals more with holding the buyer's payment and other necessary documents until the sale's conditions are fully satisfied.

Property Deeds are closely related to the Arizona Real Estate Purchase Agreement, as they are essential in the actual transfer of property ownership. The purchase agreement signifies the intention and terms under which the property will change hands, while the deed is the legal tool that completes the transfer. It's the document that formally and legally affirms the buyer as the new owner of the property.

Finally, the Earnest Money Receipt is akin to parts of the Arizona Real Estate Purchase Agreement through its role in the initial financial transaction of the sale process. This receipt acts as proof of the buyer's deposit—earnest money—to demonstrate their serious commitment to the transaction. Similarly, initial deposits and financial terms, including earnest money, are usually detailed within the purchase agreement, emphasizing the buyer's intention to follow through with the purchase.

Dos and Don'ts

Filling out the Arizona Real Estate Purchase Agreement form requires careful attention to detail. Below, find a helpful list of things you should and shouldn't do to ensure the process is completed accurately and effectively.

Things You Should Do:

- Read the entire form carefully before filling it out, to understand all the requirements and provisions.

- Use black ink or type when filling out the form to ensure legibility and prevent any issues with readability.

- Include all relevant details such as the full names of the buyer and seller, property address, and legal description of the property to avoid any misunderstandings.

- Check for any specific Arizona state requirements or addenda that need to be attached to or included with the purchase agreement.

- Have the document reviewed by a legal professional or real estate expert to ensure that all information is accurate and that you understand the terms.

Things You Shouldn't Do:

- Don't leave any sections blank. If a section does not apply, write “N/A” (not applicable) to indicate this.

- Don't use informal language or abbreviations that might not be understood by all parties or could lead to confusion.

- Don't forget to obtain signatures from all parties involved, including any witnesses or a notary public, as required.

- Don't neglect to make and distribute copies of the signed agreement to all relevant parties, ensuring everyone has a record of the transaction.

- Don't fail to adhere to the deadlines and schedules specified within the agreement, as missing these can result in breaches of contract or other legal complications.

Misconceptions

Navigating the complexities of buying or selling property in Arizona often involves dealing with the Real Estate Purchase Agreement. This document is crucial in outlining the terms and conditions of the real estate transaction. However, there are common misconceptions about what this agreement entails, which can lead to confusion or even legal complications. Here are seven of the most prevalent misunderstandings:

- "Signing the agreement means you've bought the house." While signing the Real Estate Purchase Agreement is a significant step in the process of buying a property, it does not, in itself, transfer ownership. The transfer happens once all the conditions outlined in the agreement are met and the transaction is finalized at closing.

- "The terms of the agreement are non-negotiable." This is far from the truth. Prior to signing, both the buyer and the seller have the opportunity to negotiate the terms of the Real Estate Purchase Agreement. This includes the purchase price, closing date, contingencies, and any other conditions both parties want to include.

- "The agreement is the same regardless of location within Arizona." Despite Arizona state laws governing real estate transactions, local jurisdictions may have specific regulations that affect the agreement. Therefore, components of the agreement might vary based on location, making it important to understand local real estate laws.

- "An attorney isn't necessary for the real estate transaction process." Although it's not mandatory to hire an attorney, having a legal professional review the Real Estate Purchase Agreement can prevent potential legal issues. Attorneys can help clarify terms, ensure the agreement complies with all applicable laws, and protect your interests throughout the transaction.

- "All real estate agents can draw up the Real Estate Purchase Agreement." While real estate agents play a crucial role in the process, not all of them are qualified or legally allowed to draft legal documents, depending on state laws. In Arizona, a real estate agent typically uses a standard form, but complex transactions might require legal assistance for document preparation.

- "If something is missed in the agreement, it can easily be added later." Making changes to a Real Estate Purchase Agreement after it has been signed by both parties can be difficult and, in some cases, impossible without mutual consent. It is critical to thoroughly review and include all necessary terms before signing.

- "A verbal agreement is as binding as the written agreement." Verbal agreements related to real estate transactions are not enforceable in Arizona. The statute of frauds requires that agreements for the purchase of real estate must be in writing to be legally binding.

Understanding these misconceptions can help parties involved in a real estate transaction navigate the process more smoothly. It's always advisable to consult with professionals, including real estate agents and attorneys, to ensure that your interests are adequately protected and that the Real Estate Purchase Agreement reflects the terms you've agreed upon.

Key takeaways

When entering into a real estate transaction in Arizona, the Arizona Real Estate Purchase Agreement form is essential. This document, binding once signed by all parties, outlines the terms and conditions of the sale and purchase of property. Below are key takeaways to consider:

- Accuracy is vital: Ensure all information is accurate, including names of the buyer and seller, property address, and legal description of the property.

- Understand all terms: It's crucial to read and understand every term and condition laid out in the agreement. This includes the sale price, closing costs, and any contingencies such as financing or property inspections.

- Financial details: The agreement must clearly state the purchase price, the deposit amount, and details regarding financing. Ensure these figures are thoroughly reviewed and understood.

- Contingency clauses: Pay close attention to contingency clauses. These can offer ways for either party to back out of the sale under specific circumstances without financial penalty.

- Legal requirements: The form must comply with Arizona law. This includes statutes related to real estate transactions, escrow accounts, and property disclosures.

- Deadlines: Be aware of all deadlines. The agreement will specify dates by which certain actions must be completed, such as property inspections, loan approvals, and the final closing.

- Signatures are binding: Once all parties sign the agreement, it becomes legally binding. Ensure you are fully committed before signing.

- Disclosure obligations: Sellers are often required to disclose certain information about the property’s condition and history. Failure to disclose can lead to legal consequences.

- Seek professional advice: Given the legal and financial implications, consider consulting with a real estate professional or attorney. They can provide valuable guidance throughout the process.

Create Popular Templates for Arizona

Arizona Title Transfer Bill of Sale - For registration and titling purposes, this form is often a necessary document proving the buyer’s right to change the ownership records with state agencies.

Free Printable Simple Bill of Sale for Dog - This document serves as a formal agreement for the sale of a dog, detailing the transaction between seller and buyer.