Legal Arizona Promissory Note Document

The Arizona Promissory Note form stands as a critical document for individuals engaging in loans within the state. This binding financial instrument not only delineates the terms under which money is borrowed and repaid but also ensures clarity and legal enforceability between the borrower and the lender. Pacing through its importance, the form encapsulates various facets including the amount loaned, interest rates, repayment schedule, and potential consequences of non-payment. By laying out these terms explicitly, it plays a pivotal role in minimizing misunderstandings and disputes. Moreover, in an environment where financial agreements require precision, the form adheres to Arizona's legal requirements, making the arrangement not just a matter of trust, but also a matter of law. This secure footing provided by the Arizona Promissory Note form is invaluable, ensuring that both parties are protected and fully aware of their commitments.

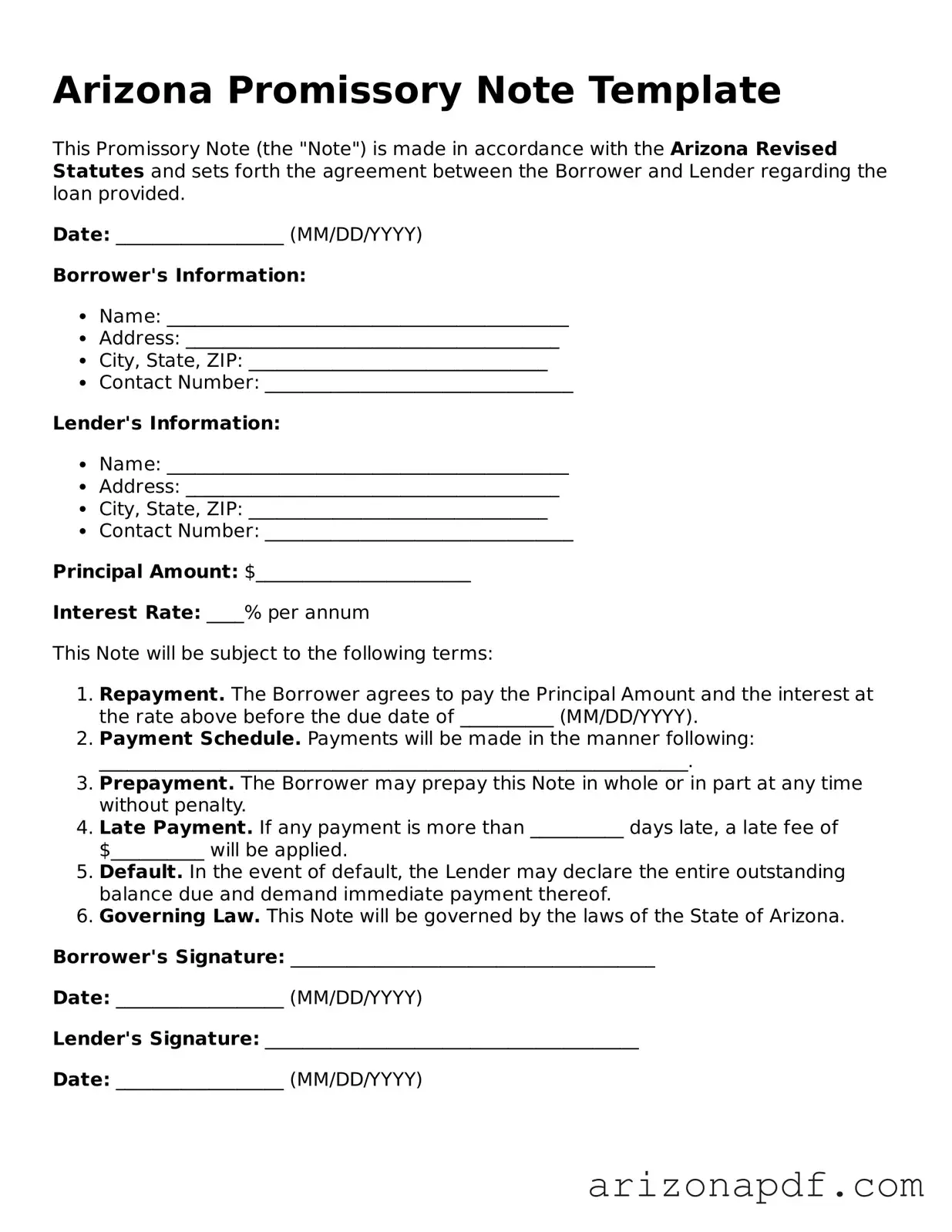

Arizona Promissory Note Preview

Arizona Promissory Note Template

This Promissory Note (the "Note") is made in accordance with the Arizona Revised Statutes and sets forth the agreement between the Borrower and Lender regarding the loan provided.

Date: __________________ (MM/DD/YYYY)

Borrower's Information:

- Name: ___________________________________________

- Address: ________________________________________

- City, State, ZIP: ________________________________

- Contact Number: _________________________________

Lender's Information:

- Name: ___________________________________________

- Address: ________________________________________

- City, State, ZIP: ________________________________

- Contact Number: _________________________________

Principal Amount: $_______________________

Interest Rate: ____% per annum

This Note will be subject to the following terms:

- Repayment. The Borrower agrees to pay the Principal Amount and the interest at the rate above before the due date of __________ (MM/DD/YYYY).

- Payment Schedule. Payments will be made in the manner following: _______________________________________________________________.

- Prepayment. The Borrower may prepay this Note in whole or in part at any time without penalty.

- Late Payment. If any payment is more than __________ days late, a late fee of $__________ will be applied.

- Default. In the event of default, the Lender may declare the entire outstanding balance due and demand immediate payment thereof.

- Governing Law. This Note will be governed by the laws of the State of Arizona.

Borrower's Signature: _______________________________________

Date: __________________ (MM/DD/YYYY)

Lender's Signature: ________________________________________

Date: __________________ (MM/DD/YYYY)

Document Details

| # | Fact | Description |

|---|---|---|

| 1 | Governing Law | Arizona promissory notes are governed by the statutes and codes of the state of Arizona. |

| 2 | Type | There are two main types: secured and unsecured. Secured means collateral backs the loan; unsecured does not. |

| 3 | Interest Rate Maximum | The maximum interest rate allowed by Arizona law is 10% per annum unless a different rate is contractually agreed upon. |

| 4 | Usury Limit | If a loan charge exceeds the legal interest rate, it's considered usurious unless specific exceptions apply. |

| 5 | Signatures | The note must be signed by the borrower and, in some cases, a co-signer to be legally binding. |

Instructions on Utilizing Arizona Promissory Note

Once the Arizona Promissory Note form is correctly filled out, it serves as a binding agreement between the borrower and lender for the repayment of a loan. This document is crucial for both parties as it clearly outlines the loan's amount, interest rate, repayment schedule, and other terms that have been agreed upon. Accurately completing this form not only ensures legal protection but also helps in maintaining a good relationship between the two parties involved. It is essential to follow the provided steps carefully to fill out the form correctly.

Steps for Filling Out the Arizona Promissory Note Form:

- Start by entering the date on which the promissory note is being created.

- Write the full name and address of the borrower.

- Include the full name and address of the lender.

- Specify the principal amount of the loan in US dollars.

- Detail the interest rate per annum. Ensure this rate complies with Arizona's legal maximum; if unsure, consult a legal expert.

- Define the loan repayment structure (e.g., installments, lump sum, due on demand) and provide the specific terms, including any installment amounts and due dates.

- If installments are chosen, indicate whether interest will be compounded and, if so, at what intervals.

- Clarify the terms regarding late fees, stating the grace period for late payments and any applicable late fee amounts.

- Outline the conditions under which the loan must be repaid in full before the scheduled due dates (if applicable).

- Include any additional agreements or clauses relevant to the loan or required by Arizona law.

- Both borrower and lender must sign and date the form to acknowledge their understanding and acceptance of its terms.

- For added legal protection, consider having the signatures witnessed by a notary public or two non-participating witnesses.

Once the form is completely filled out and signed, both parties should keep a copy for their records. This document will serve as a reference and proof of the agreed-upon terms and conditions for the loan. Remember, it’s important to review all the information carefully before signing to ensure that every detail is correct and understood by both the lender and the borrower.

Listed Questions and Answers

What is a Promissory Note?

A Promissory Note is a financial document in which one party (the promisor) promises in writing to pay a determinate sum of money to the other (the promisee), either at a fixed or determinable future time or on demand of the promisee, under specific terms.

Is a Promissory Note legally binding in Arizona?

Yes, a Promissory Note is legally binding in Arizona if it contains the signature of the promisor and clearly mentions the amount to be paid, the terms of repayment, and the interest rate, if applicable. It needs to comply with Arizona's legal statutes to be enforceable.

Do I need a lawyer to create a Promissory Note in Arizona?

While it's not a requirement to have a lawyer to create a Promissory Note in Arizona, consulting with a legal professional can help ensure that the document complies with all state laws and adequately protects the rights of all parties involved.

What information should be included in a Promissory Note?

A Promissory Note should include the names and addresses of the promisor and promisee, the amount of money being borrowed, the interest rate, repayment schedule, late fees (if any), and the date and place of issuing. It should also outline the consequences of defaulting on the loan.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both the lender and borrower agree to the changes. The modifications should be documented in writing and signed by both parties, preferably with a witness or notary public present to validate the changes.

What happens if the borrower fails to repay the Promissory Note?

If the borrower fails to repay the loan as agreed in the Promissory Note, the lender has the right to take legal action to recover the debt. This may include filing a lawsuit to obtain a judgment against the borrower or pursuing other collection efforts in accordance with Arizona law.

Common mistakes

When it comes to filling out an Arizona promissory note form, ensuring accuracy and completeness is critical. This document is a legally binding agreement in which one party promises to pay a sum of money to another. Mistakes can lead to misunderstandings, delays, and even legal disagreements. Here are four common mistakes people often make:

Failing to Clearly Identify the Parties Involved - It's essential to provide the full names and addresses of both the borrower and the lender. This might seem straightforward, but omitting details or using nicknames instead of legal names can lead to confusion and could potentially impact the enforceability of the note.

Not Specifying the Loan Amount and Terms Clearly - The principal amount should be stated clearly in figures and words to prevent any disputes over the amount borrowed. Furthermore, terms including interest rate, repayment schedule, and maturity date need to be explicitly outlined. A vague or incomplete description of these terms can cause problems down the line.

Omitting Details About the Interest Rate - The interest rate must be clearly stated and comply with Arizona's usury laws. Failing to specify the interest rate, or specifying one that is illegally high, can render the promissory note void or subject to legal penalties.

Ignoring State-Specific Requirements - Each state has its own laws regarding promissory notes. In Arizona, for example, there might be specific signing requirements or clauses that need to be included for the note to be valid. Overlooking these requirements can lead to a document that does not fulfill its intended legal function.

By paying close attention to these areas, individuals can prevent common mistakes and ensure their promissory notes serve as intended, providing clear, enforceable agreements between lenders and borrowers.

Documents used along the form

When handling the financing or lending process, the Arizona Promissory Note form is often just a part of the larger collection of documents required. Each document plays its unique role, and together, they provide a comprehensive framework that protects the interests of all parties involved. Here's a list of documents that are commonly used alongside the Arizona Promissory Note to ensure a smooth and secure transaction.

- Loan Agreement: Outlines the broader terms and conditions of the loan, including the responsibilities of both borrower and lender beyond the repayment schedule.

- Security Agreement: Secures the loan by identifying specific assets the borrower offers as collateral, explaining the rights the lender has if the borrower defaults.

- Mortgage or Deed of Trust: For real estate transactions, this document puts a lien on the property as collateral for the loan.

- Amortization Schedule: Provides a detailed payment plan over the loan’s life, showing how each payment is split between principal and interest.

- Guaranty: Involves a third party who agrees to be responsible for the debt if the original borrower cannot pay.

- UCC-1 Financing Statement: Used for loans involving personal property as collateral, it is filed to publicly declare the lender's interest in the borrower's assets.

- Promissory Note Release: Issued by the lender once the loan is fully repaid, releasing the borrower from any further obligations.

- Late Payment Notice: A formal notice sent to borrowers detailing any late payments, including the amount and any applicable late fees.

- Disclosure Statements: Required by federal law, these documents provide the borrower with information about the cost of their credit, APR, and other loan details.

- Modification Agreement: Used if the terms of the original promissory note or loan agreement need to be altered or renegotiated.

Together, these documents complement the Arizona Promissory Note to offer a full picture of the financial transaction, responsibilities, and safeguards for both lenders and borrowers. It's crucial for all parties to review and understand each document thoroughly to ensure a fair and transparent agreement is established.

Similar forms

A Mortgage Agreement shares similarities with the Arizona Promissory Note form as both are legal documents that pertain to borrowing money. The Mortgage Agreement, however, is secured against a property, which means if the borrower fails to repay the loan, the lender can take ownership of the property used as collateral. The Promissory Note, in contrast, might not necessarily be secured, indicating a potentially different level of risk for the lender.

Loan Agreements, much like the Arizona Promissory Note, outline the terms under which money has been lent. However, Loan Agreements are typically more comprehensive, detailing the responsibilities of both parties in greater depth including interest rates, repayment schedules, and consequences of default. This document often serves as a more formal and detailed contract between the lender and borrower.

A Bill of Sale is another document related to the Arizona Promissory Note, particularly in transactions where goods are sold on credit. The Bill of Sale proves ownership of an item has transferred from a seller to a buyer and may be accompanied by a Promissory Note when the buyer needs to make payments over time. Both documents work together to ensure the terms of payment and ownership transfer are clear.

A Line of Credit Agreement also bears similarity to the Promissory Note as it involves a lender allowing a borrower to use funds up to a specified limit. The borrower can withdraw funds as needed, making it a flexible financial tool. The Promissory Note can be seen as a subset of such agreements, usually pertaining to a single loan amount rather than an ongoing borrowing arrangement.

An IOU (I Owe You) is a simpler cousin of the Arizona Promissory Note. It acknowledges that a debt exists but typically lacks the detailed terms found in a Promissory Note, such as repayment schedules and interest rates. While an IOU may suffice for informal loans among acquaintances, a Promissory Note is favored for more formal agreements to ensure clarity and enforceability.

A Debt Settlement Agreement is related to the Promissory Note in the context of resolving an outstanding debt. This agreement comes into play when the original terms of the Promissory Note cannot be met, and the parties negotiate a settlement. It outlines the new terms under which a debt will be considered settled, often involving a reduced payoff amount.

Last, a Credit Agreement shares the foundational principle of lending with the Promissory Note but is typically used in more complex financial transactions. It involves detailed terms about the extension of credit from a lender to a borrower. The agreement covers various loans, credit limits, terms of repayment, and covenants that the borrower must adhere to, making it a comprehensive lending document.

Dos and Don'ts

When drafting or filling out the Arizona Promissory Note form, it is crucial to ensure that everything is done correctly to avoid future misunderstandings or legal issues. Below, you'll find a handy list of do's and don'ts that will guide you through the process.

Do's:

Do make sure all the information is accurate. Double-check the names, addresses, and all the numbers related to the loan amount, interest rate, and repayment schedule.

Do clearly specify the interest rate, ensuring it adheres to Arizona's legal maximums, to prevent your note from being flagged as usurious.

Do outline a clear repayment schedule. Whether payments are expected monthly, quarterly, or on another basis, specify the dates or conditions under which payments are due.

Do include clauses about late fees and what happens in case of a default. This can protect both parties by setting expectations upfront.

Do use language that is clear and easy to understand. Avoid legal jargon as much as possible to ensure that all parties involved have a clear understanding of the terms.

Do review the final document with all parties involved before signing. This can often catch errors and clarify any misunderstandings before they become problematic.

Don'ts:

Don't forget to check the laws pertaining to promissory notes and lending within Arizona. Ignoring state laws can invalidate your note or get you into legal trouble.

Don't leave any fields incomplete. If a section does not apply, mark it as 'N/A' (not applicable) instead of leaving it blank to avoid potential tampering or misunderstandings.

Don't skip having a co-signer section if the loan is risky. This can provide an additional layer of security for the lender.

Don't avoid detailing what the loan is for if it's a significant amount. Having the purpose documented can help legally enforce the terms if there's ever a dispute about the intent of the loan.

Don't use a generic template without customizing it to your specific situation. Each lending agreement can differ, and it's important to tailor the document to the particulars of your deal.

Don't forget to have all parties sign and date the document and keep a copy for each party involved. This is crucial for the enforceability of the promissory note.

Misconceptions

The Arizona Promissory Note form is a critical document for many individuals entering into lending agreements. However, several misconceptions surround its use and legal standing. Let's clarify some of these common misunderstandings to ensure that individuals are fully informed when engaging in financial agreements.

A promissory note is just like any other informal loan document. This is not true. In Arizona, a promissory note is a legally binding document that outlines the specifics of a loan's repayment. It is more formal and detailed than a simple verbal agreement or handshake deal, providing crucial legal protections for both the lender and the borrower.

There is only one standard form for all promissory notes in Arizona. Actually, several types of promissory notes exist, such as secured, unsecured, demand, and installment notes. Each type serves a different purpose and offers varying terms, demonstrating the necessity for individuals to select the form that best fits their specific situation.

Completing a promissory note without a lawyer is risky. While it's advisable to consult with a lawyer to avoid potential pitfalls, especially for large or complex loans, many promissory notes, especially straightforward ones, can be completed accurately without legal assistance, provided that the parties involved understand the terms and comply with Arizona law.

A promissory note is only about paying back the principal amount. This is a misconception. In addition to the principal amount, a promissory note typically includes terms regarding interest rates, repayment schedule, late fees, and the consequences of defaulting on the loan, making it a comprehensive repayment agreement.

Signing a promissory note means you'll automatically be taken to court if you can't make payments. Not necessarily. Many lenders prefer to work out a modified payment plan rather than taking legal action, which can be costly and time-consuming. Communication is key when facing financial difficulties.

If the borrower defaults, the lender can immediately claim the collateral. In situations involving secured promissory notes, the lender must typically follow a specific process, including providing notice to the borrower, before taking possession of any collateral. This ensures that the rights of both parties are protected under Arizona law.

All promissory notes require a notary to be legally valid. While having a promissory note notarized can add an extra layer of validity, especially in proving the signatures' authenticity, not all promissory notes in Arizona must be notarized to be considered legally binding. The essential factor is that the note is signed by both parties and meets the state's legal requirements.

Understanding these nuances is crucial for anyone involved in drafting, signing, or enforcing a promissory note in Arizona. Clearing up these common misconceptions can ensure that all parties enter into financial agreements with eyes wide open, setting the stage for more secure and amicable lending relationships.

Key takeaways

When handling the Arizona Promissory Note form, understanding its key takeaways ensures it serves its purpose effectively, safeguarding both the lender and the borrower throughout the lending process. Below are crucial points to keep in mind:

Complete Accuracy is Crucial: Every piece of information entered into the promissory note needs to be accurate. This includes the names, addresses of the parties involved, the loan amount, and the repayment terms.

Clarity in Repayment Terms: The note should clearly outline how the repayment is structured, including payment amounts, due dates, and the final due date for the full repayment of the loan.

Interest Rates Must Comply with State Laws: The interest rate stated in the promissory note must be within the limits set by Arizona state laws to avoid being considered usurious.

Secured or Unsecured: Identifying whether the note is secured or unsecured is essential. A secured note ties the loan to a piece of property as collateral, whereas an unsecured note does not.

Signatures Are Mandatory: For the promissory note to be legally binding, it must be signed by all parties involved in the transaction.

Witnesses or Notarization: While not always required, having the note witnessed or notarized can add an extra layer of legal protection and authenticity.

Understand the Default Terms: The note should specify what constitutes a default and the subsequent actions that could be taken, ensuring both parties understand the consequences.

Keep Records: Maintain a copy of the promissory note for your records. This is crucial for both the lender and the borrower should any disputes arise.

Legal Advice is Beneficial: Consulting with a legal professional can provide clarity and ensure that the promissory note complies with all applicable laws and regulations.

By paying attention to these key takeaways when filling out the Arizona Promissory Note form, individuals can navigate the lending process with a better understanding and protection of their rights and responsibilities.

Create Popular Templates for Arizona

Warranty Deed Form Arizona - Types of Deeds vary, such as Warranty Deeds, which offer the highest level of protection for buyers.

Affidavit of Death Form Pdf - An Affidavit of Death helps in updating records with various entities, ensuring that assets and liabilities are correctly addressed posthumously.