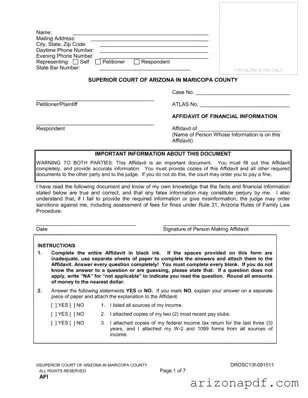

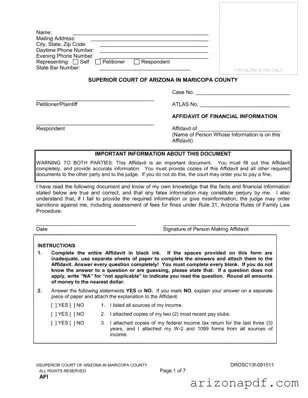

The Arizona Financial form, also known as the Affidavit of Financial Information, is a critical document used in family law matters within Maricopa County, Arizona. It requires individuals to provide detailed and accurate financial information, which includes income, expenses, and...

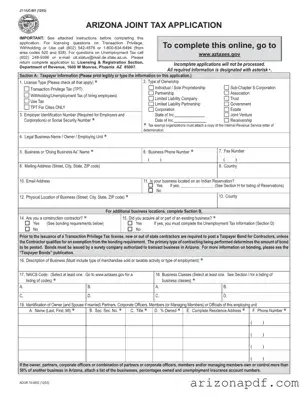

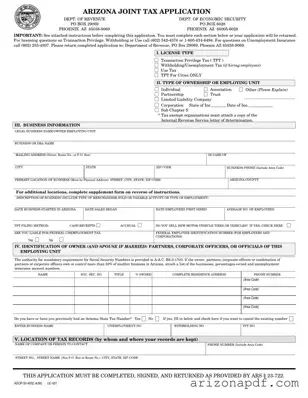

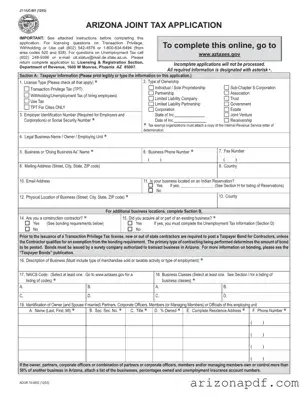

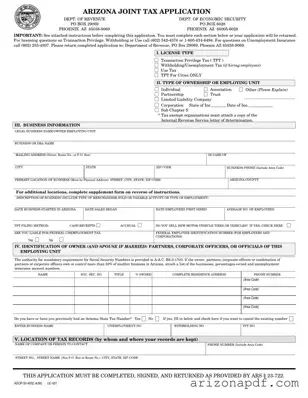

The Arizona JT-1/UC-001 form serves as a critical document for businesses within Arizona, acting as a joint tax application. It’s essential for entities engaging in taxable activities as per state laws, which includes applying for Transaction Privilege Tax (TPT), Withholding/Unemployment...

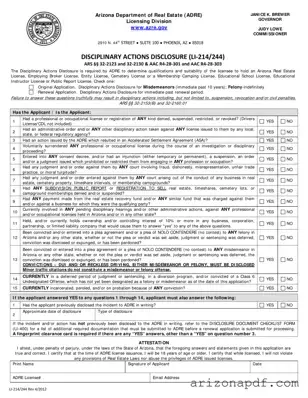

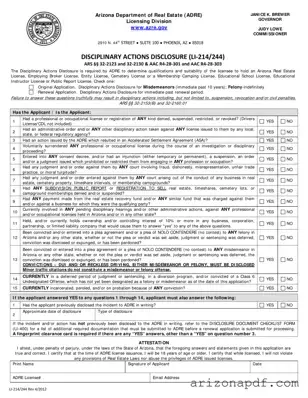

The Arizona Li 214 244 form, also known as the Disciplinary Actions Disclosure, plays a critical role in the licensing process for real estate professionals within the state. Mandated by the Arizona Department of Real Estate (ADRE), it ensures that...

The Arizona Joint Tax Application is a comprehensive document that facilitates the process for businesses to apply for various tax-related licenses, including the Transaction Privilege Tax, Withholding/Unemployment Tax, and Use Tax. Managed jointly by the Department of Revenue and the...

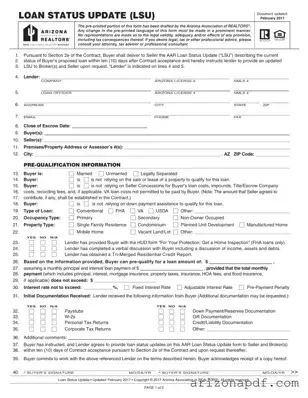

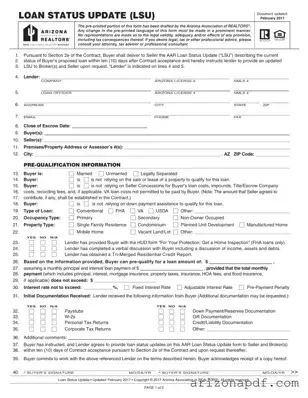

The Arizona Loan Status Update (LSU) form serves as a critical communication tool in real estate transactions within Arizona, detailing the current status of a buyer's proposed loan pursuant to Section 2e of the Contract. It mandates the provision of...

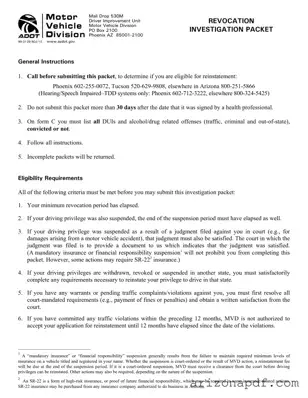

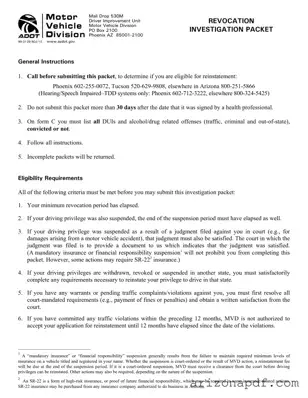

The Arizona Motor Vehicle Division Packet form is a comprehensive document designed for individuals seeking to reinstate their driving privileges after revocation due to DUIs, alcohol or drug-related offenses, or other violations. It outlines a step-by-step process, including eligibility criteria,...

The Arizona Religious Beliefs form is a crucial document facilitated by the Arizona Department of Health Services (ADHS), designed specifically for parents who, due to their religious beliefs, choose to exempt their children from mandatory vaccinations required for attendance in...

The Arizona Subpoena form is a legal document used to order a person or entity not part of an ongoing case to testify, produce documents, or allow inspection of premises. It is a powerful tool that facilitates the collection of...

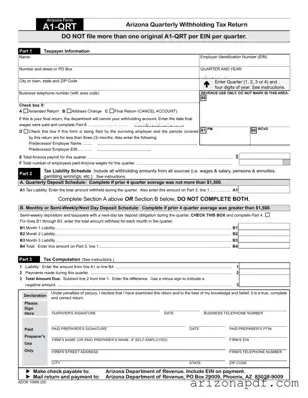

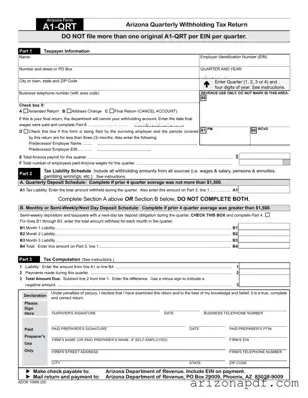

The Arizona Tax Return form, specifically known as Form A1-QRT, is a required quarterly filing for employers who withhold Arizona income tax from their employees' wages for services performed within Arizona. Employers use this form to report and reconcile the...

The Arizona Temporary Orders form is a critical document designed to address immediate legal decisions and arrangements while a case is pending. Such orders can cover a range of temporary solutions, including child support, spousal maintenance, and decisions regarding the...

The Arizona Form 290, also known as the Request for Penalty Abatement, provides a pathway for taxpayers to apply for a reduction or removal of certain penalties imposed by the Arizona Department of Revenue. This form is applicable when the...

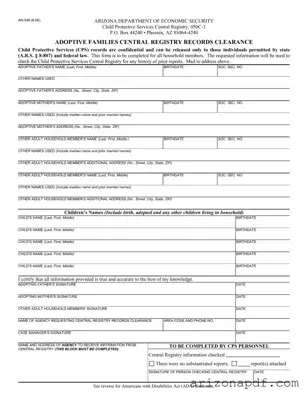

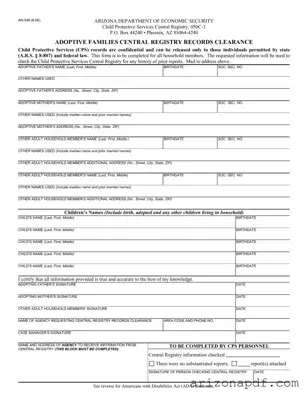

The An 048 Arizona form, designated by the Arizona Department of Economic Security, serves as a critical tool in the Adoptive Families Central Registry Records Clearance process. It is meticulously designed to screen all household members' backgrounds by checking them...