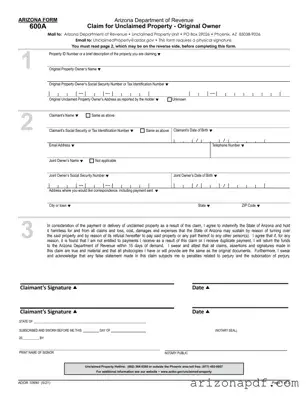

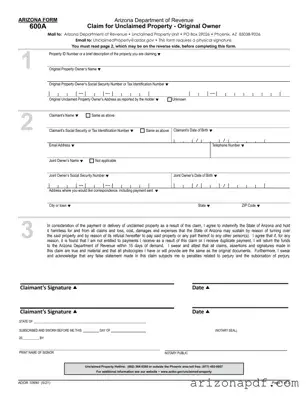

The Arizona 600A form is a document used by individuals to claim unclaimed property in Arizona as the original owner. This form, which must be submitted to the Arizona Department of Revenue, requires detailed information about the claimant and the...

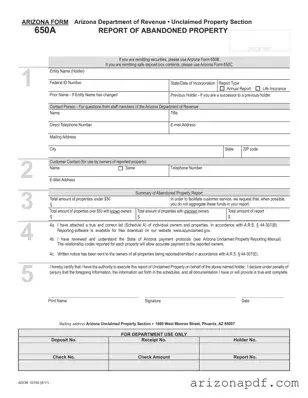

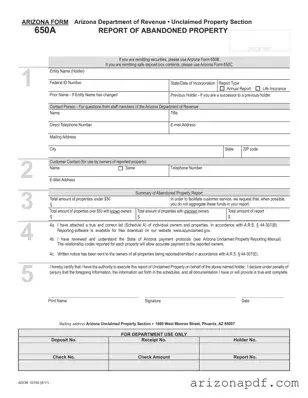

The Arizona 650A form serves a crucial role for businesses and organizations, acting as a report for abandoned or unclaimed property to the Arizona Department of Revenue. It's a detailed document that businesses use annually to report personal property that...

The Arizona 652 form, issued by the Arizona Department of Revenue's Unclaimed Property Section, is a detailed document used for reporting abandoned property. This form helps in the systematic declaration of unclaimed assets, from cash to securities, ensuring they can...

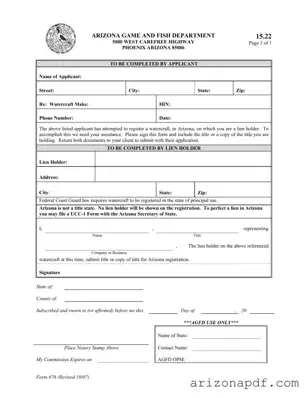

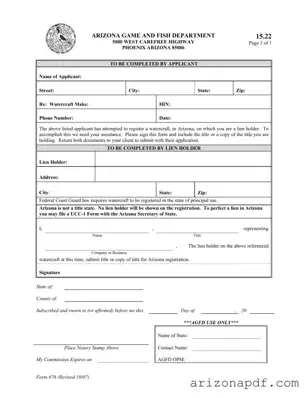

The Arizona 676 form is a crucial document for those attempting to register a watercraft in Arizona when there is a lien on it. It serves as a bridge between the applicant and the lien holder, ensuring that the registration...

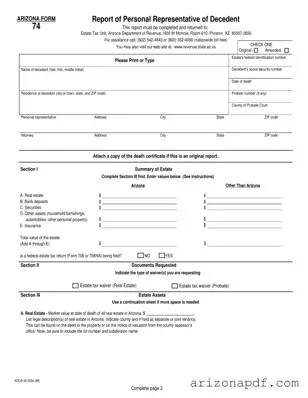

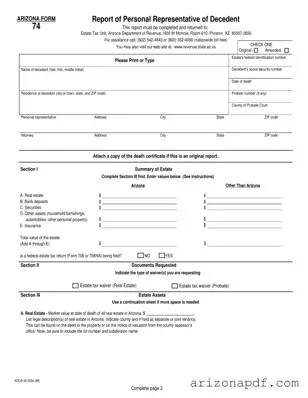

The Arizona 74 form, officially titled "Report of Personal Representative of Decedent," is a crucial document for personal representatives handling the estate of a deceased person in Arizona. It is designed to be submitted to the Estate Tax Unit of...

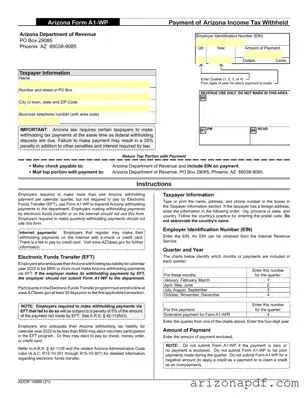

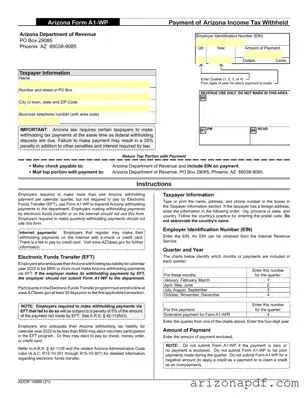

The Arizona Form A1-WP is designed for the payment of Arizona income tax withheld by employers, as dictated by the Arizona Department of Revenue. This document outlines the necessary details for making these payments accurately, including the Employer Identification Number...

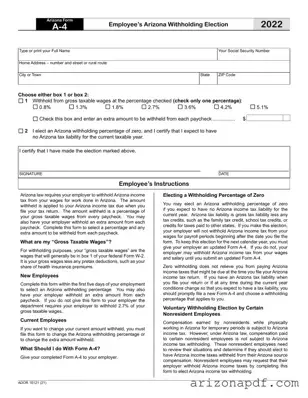

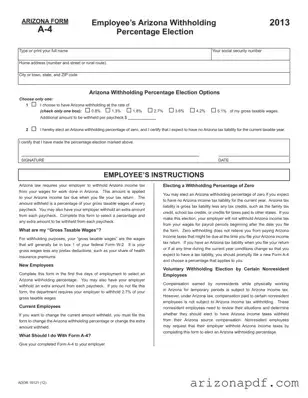

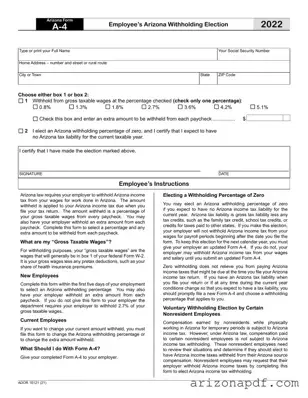

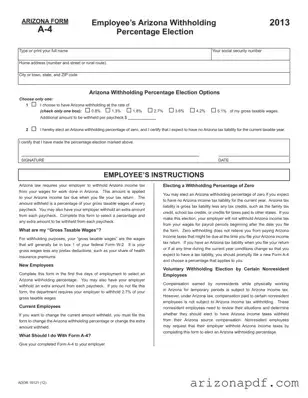

The Arizona A4 form, officially known as the Arizona Form A-4 Employee’s Arizona Withholding Election, is a critical document that enables employees to specify the percentage of their gross taxable wages that should be withheld for Arizona state income tax....

The Arizona A-4 form, officially titled "Employee’s Arizona Withholding Percentage Election," is a document where employees working in Arizona can specify the percentage of their gross taxable wages that should be withheld by their employer for state income taxes. It...

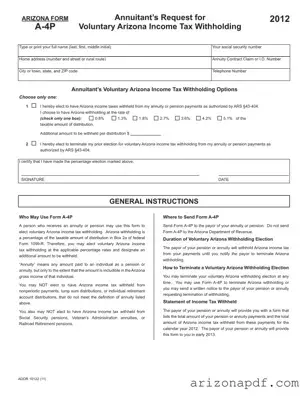

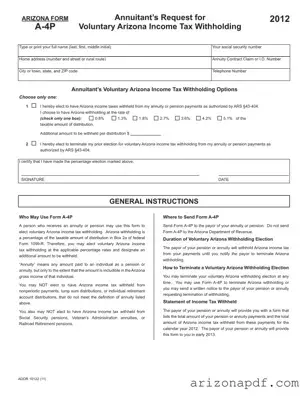

The Arizona A-4P form, officially known as the "Annuitant’s Request for Voluntary Arizona Income Tax Withholding," is a document that allows individuals receiving an annuity or pension to elect voluntary income tax withholding in Arizona. Designed for ease of use,...

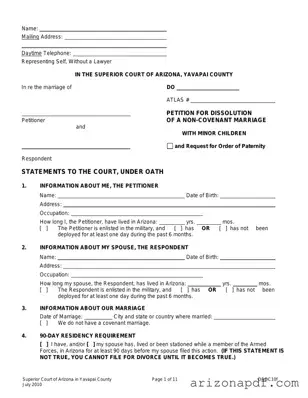

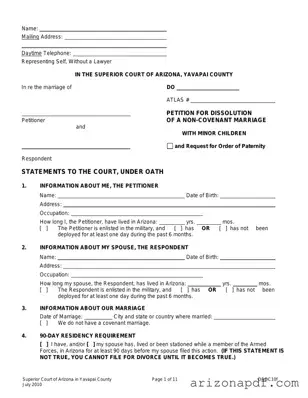

The Arizona Drdc10F form is a comprehensive document used in Yavapai County for individuals seeking to dissolve a non-covenant marriage, where minor children are involved, and it sometimes includes a request for an order of paternity. It lays out detailed...

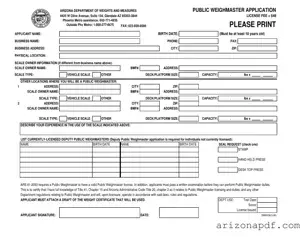

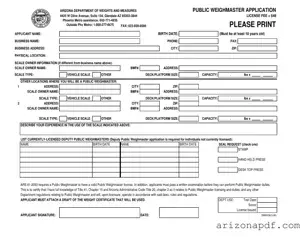

The Arizona DWM156 form is an official document from the Arizona Department of Weights and Measures for those applying to become a Public Weighmaster. It requires detailed information about the applicant, including their experience with scales, and mandates a license...

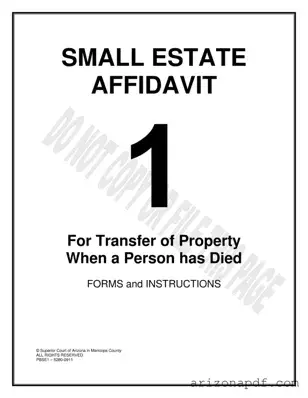

The Arizona Estate form is a legal document used to manage and distribute a person's assets after their death. It ensures that their wishes regarding the inheritance of their estate are honored. For those looking to safeguard their assets for...