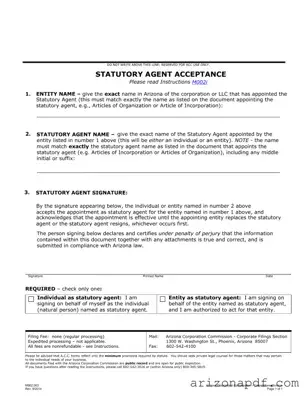

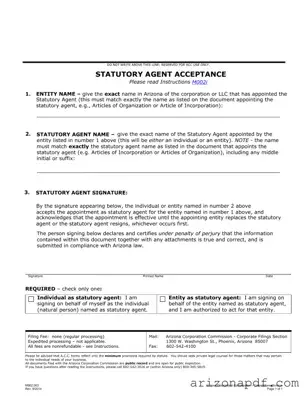

The Arizona Agent form, officially known as the Statutory Agent Acceptance form, is a crucial document for corporations and LLCs in Arizona. It serves as a formal acceptance by the individual or entity named as the statutory agent, acknowledging their...

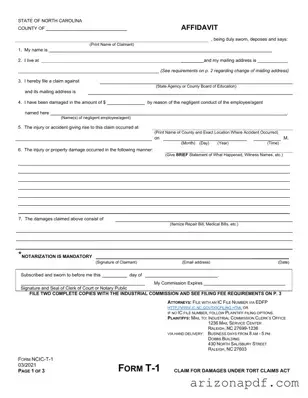

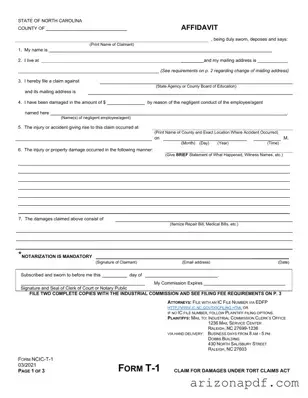

The Arizona Tort Claim Form is a crucial document for individuals intending to file a claim against a state agency or county board of education in Arizona due to alleged negligence. It outlines the necessary information and steps required to...

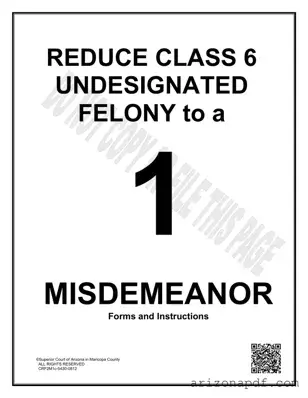

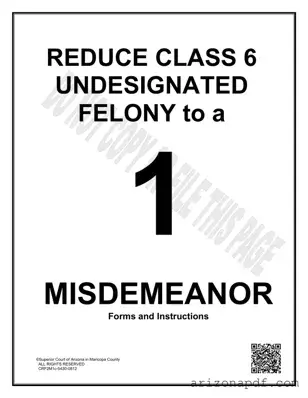

The Arizona Class 6 Undesignated Felony form is a crucial resource for individuals seeking to have their Class 6 undesignated felony conviction reclassified as a misdemeanor. This transition can significantly impact one’s ability to find employment, among other benefits. By...

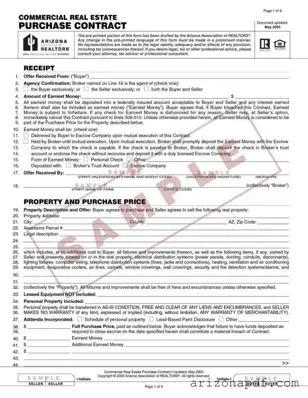

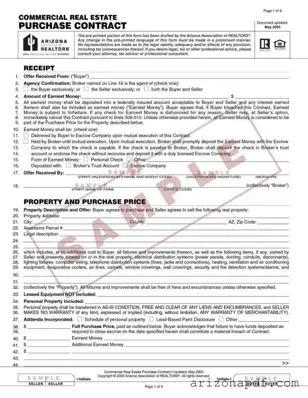

The Arizona Commercial Real Estate Contract form is a legally binding document used to outline the terms and conditions of a commercial real estate transaction in the state of Arizona. It ensures all parties are clear about their obligations, rights,...

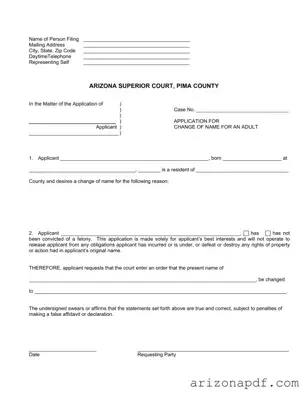

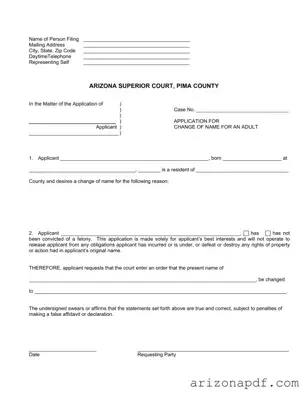

The Arizona Court Change Name form serves as a legal document intended for individuals seeking to alter their name through the court system, specifically within Pima County. This form details the necessary steps and requirements for petitioning a name change,...

The Arizona Divorce Petition form serves as a formal request to the court for dissolving a marriage, especially when children are involved. It outlines the necessary steps and qualifications for filing, and highlights the importance of considering legal advice due...

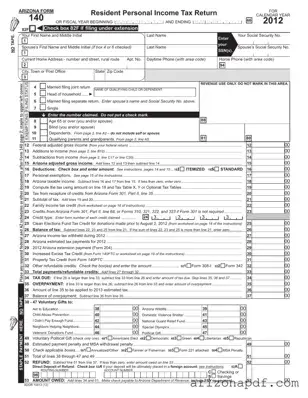

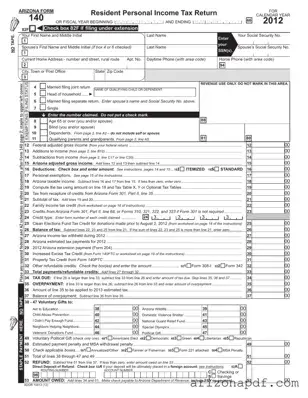

The Arizona 140 form is an essential document for residents of Arizona, serving as the Resident Personal Income Tax Return for those filing within the state. It meticulously details taxpayers' income, deductions, and credits to establish their state tax liability...

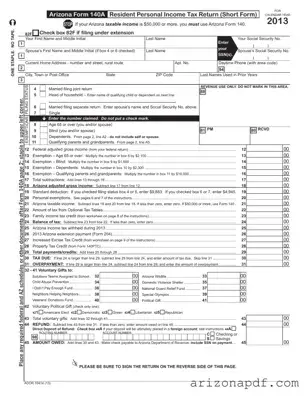

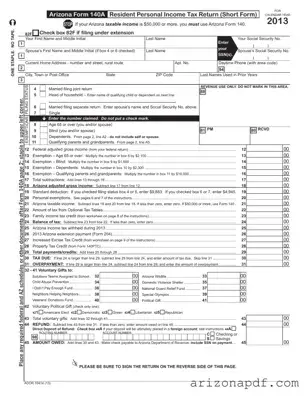

The Arizona Form 140A, also known as the Resident Personal Income Tax Return (Short Form), is designed for individuals whose Arizona taxable income is less than $50,000. This form allows residents to report their income, calculate taxes owed, and claim...

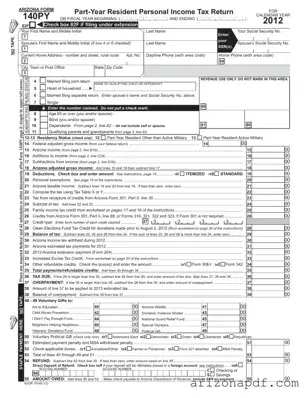

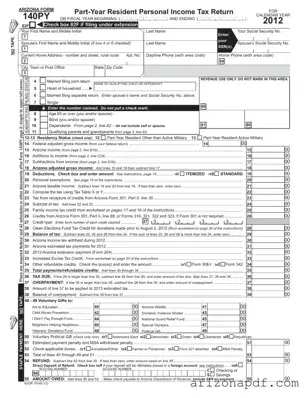

The Arizona 140PY form is designated for part-year residents who need to file their personal income tax return. It facilitates the correct calculation and reporting of income earned during the portion of the year a taxpayer lived within the state,...

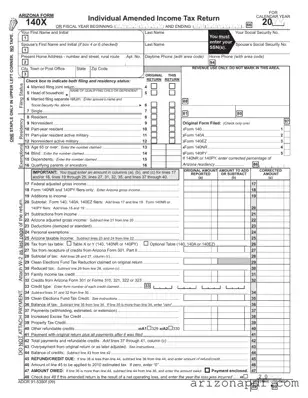

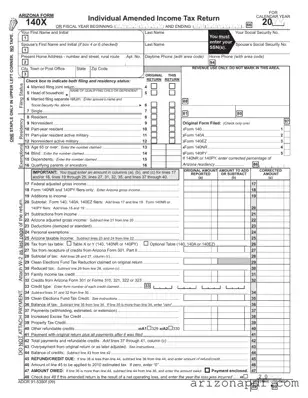

The Arizona 140X form is designed for individuals who need to amend their previously filed state income tax return. This could be due to corrections, updates, or any changes to income, deductions, or personal information that impacts their tax liability....

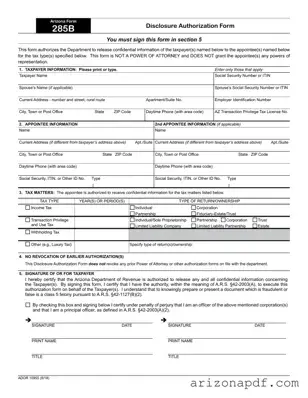

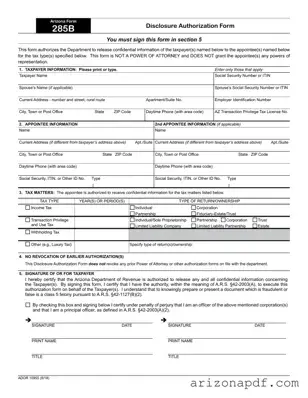

The Arizona Form 285B, also known as the Disclosure Authorization Form, is a critical document for individuals and businesses seeking to authorize the release of their confidential tax information to specified appointees. This form does not serve as a power...

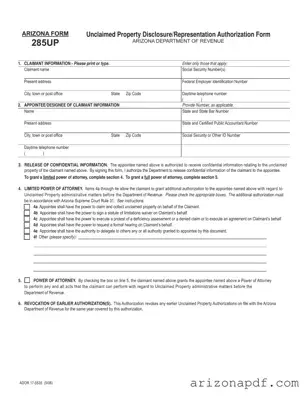

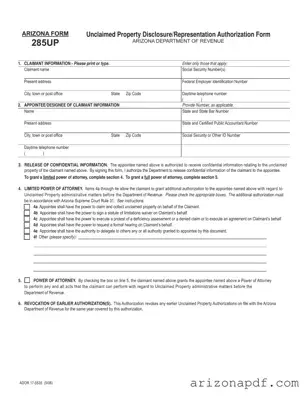

The Arizona 285Up form, officially known as the Unclaimed Property Disclosure/Representation Authorization Form, serves as a critical document for individuals or entities claiming unclaimed property in Arizona. It not only gathers claimant information but also details on the appointee or...