Legal Arizona Operating Agreement Document

In the world of business, especially when it comes to managing and operating a limited liability company (LLC) in Arizona, the importance of having a comprehensive Operating Agreement cannot be overstated. This document serves as a foundational piece, outlining the rules, policies, and procedures under which the LLC will operate. It covers a wide array of topics including the division of profits and losses, the rights and responsibilities of members, management structures, and procedures for handling the addition or removal of members. Furthermore, the Arizona Operating Agreement is tailored to meet the specific legal requirements of the state, ensuring that the LLC is not only well-organized but also in compliance with local laws. By doing so, it provides a critical framework for dispute resolution and decision-making, preventing misunderstandings among LLC members and offering a clear path forward for the growth and success of the business. Though the content of the Arizona Operating Agreement form itself cannot be displayed, its significance in establishing a strong and legal foundation for an LLC in Arizona is clear, guiding members through the complexities of business operations and legal compliance.

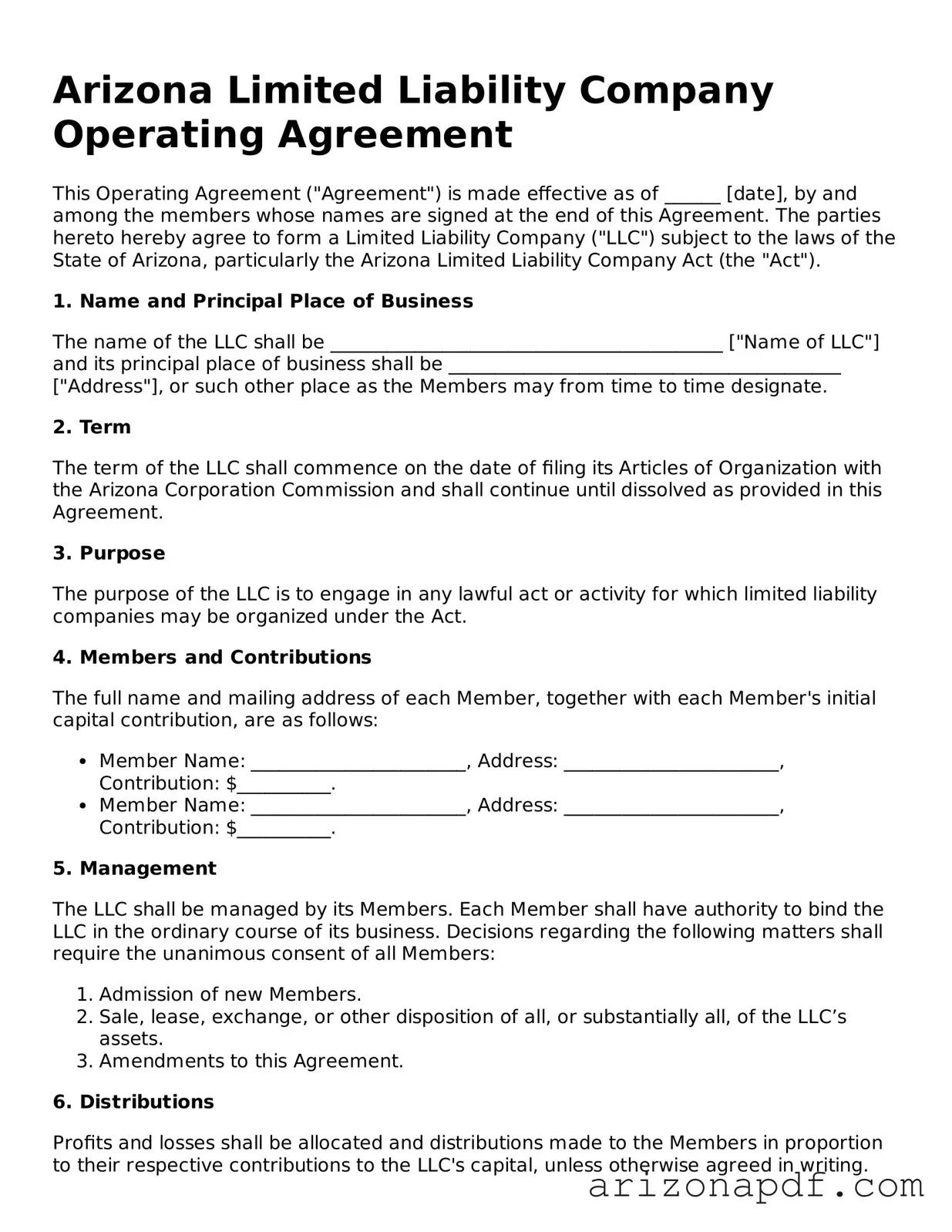

Arizona Operating Agreement Preview

Arizona Limited Liability Company Operating Agreement

This Operating Agreement ("Agreement") is made effective as of ______ [date], by and among the members whose names are signed at the end of this Agreement. The parties hereto hereby agree to form a Limited Liability Company ("LLC") subject to the laws of the State of Arizona, particularly the Arizona Limited Liability Company Act (the "Act").

1. Name and Principal Place of Business

The name of the LLC shall be __________________________________________ ["Name of LLC"] and its principal place of business shall be __________________________________________ ["Address"], or such other place as the Members may from time to time designate.

2. Term

The term of the LLC shall commence on the date of filing its Articles of Organization with the Arizona Corporation Commission and shall continue until dissolved as provided in this Agreement.

3. Purpose

The purpose of the LLC is to engage in any lawful act or activity for which limited liability companies may be organized under the Act.

4. Members and Contributions

The full name and mailing address of each Member, together with each Member's initial capital contribution, are as follows:

- Member Name: _______________________, Address: _______________________, Contribution: $__________.

- Member Name: _______________________, Address: _______________________, Contribution: $__________.

5. Management

The LLC shall be managed by its Members. Each Member shall have authority to bind the LLC in the ordinary course of its business. Decisions regarding the following matters shall require the unanimous consent of all Members:

- Admission of new Members.

- Sale, lease, exchange, or other disposition of all, or substantially all, of the LLC’s assets.

- Amendments to this Agreement.

6. Distributions

Profits and losses shall be allocated and distributions made to the Members in proportion to their respective contributions to the LLC's capital, unless otherwise agreed in writing.

7. Transfers of Membership Interest

Except as otherwise provided herein, no Member may transfer all or part of their interest in the LLC without the written consent of all other Members.

8. Dissolution

The LLC may be dissolved upon the written consent of all Members or upon other events as specified in the Act. Upon dissolution, the assets of the LLC shall be distributed in accordance with the provisions of the Act.

9. Governing Law

This Agreement and the rights of the Members hereunder shall be governed by and construed in accordance with the laws of the State of Arizona.

10. Amendments

This Agreement may be amended only by written agreement signed by all Members.

11. Signatures

In witness whereof, the undersigned have executed this Operating Agreement as of the date first above written.

- Member Signature: _______________________ Date: ______

- Member Signature: _______________________ Date: ______

Document Details

| Fact | Description |

|---|---|

| Purpose | The Arizona Operating Agreement form is used to outline the operating procedures and financial and functional decisions of a Limited Liability Company (LLC) within the state of Arizona. |

| Governing Law | This form is governed by the Arizona Limited Liability Company Act, which sets the legal framework for forming and operating an LLC in Arizona. |

| Flexibility | It allows members to establish their own guidelines for the operation of their LLC, as long as they do not conflict with Arizona laws. |

| Not Mandatory, but Recommended | While not required by law in Arizona, having an Operating Agreement is highly recommended as it provides clarity and protects the LLC's operations from default state rules. |

| Scope | It covers various aspects such as the allocation of profits and losses, the process for adding or removing members, the duties of members and managers, and procedures for dissolving the LLC. |

Instructions on Utilizing Arizona Operating Agreement

An operating agreement is a fundamental document for any LLC in Arizona, outlining the structure of the organization and the rules by which it operates. This document isn't filed with the state but is kept by the members of the LLC. Proper completion of an Arizona Operating Agreement ensures clear communication and agreement among members on the business's operational aspects. As there is no official form provided by the state for creating an operating agreement, entities are advised to follow a comprehensive approach to ensure all necessary details are covered. The process involves a few critical steps to be thoroughly completed to tailor the document to the specific needs of your LLC.

- Gather all necessary information about your LLC, including the business name, principal place of business, names of members, and the percentage of ownership each member holds.

- Decide on the management structure of your LLC, whether it will be member-managed or manager-managed, and document the names and roles of the managers or managing members.

- Outline the allocation of profits and losses among members and specify any specific conditions or procedures for distribution.

- Detail the processes for adding or removing members, including any buyout or sell-out rules that apply.

- Define the meeting requirements for members, including how many meetings will be held per year, the notice period required for meetings, and the voting rules.

- Document any requirements or processes for amending the operating agreement should the need arise in the future.

- Include clauses about the dissolution of the LLC, detailing the conditions under which the LLC may be dissolved and the process for doing so.

- Consider adding any other terms that are important to the operations of your LLC, such as non-compete or confidentiality agreements among members.

- Review the agreement with all members present to ensure clarity and consensus on all points. It might be advisable to have a legal professional review the document to ensure its completeness and accuracy.

- Finally, have each member sign the operating agreement. While not required, notarizing the document can add an extra layer of legitimacy.

Once the operating agreement is fully executed, it is important to store it in a safe and accessible place. Each member should receive a copy for their records. The operating agreement is a living document and should be revisited regularly or whenever significant changes to the LLC's operation or structure occur. Although this document is internal and not filed with the Arizona Corporation Commission, it is crucial for the smooth functioning and legal protection of your LLC.

Listed Questions and Answers

What is an Arizona Operating Agreement?

An Arizona Operating Agreement is a legal document that outlines the ownership structure and operating procedures of a Limited Liability Company (LLC) within the state of Arizona. It is designed to guide the LLC's operations and establish the rights and responsibilities of its members. While not mandated by state law, it is highly recommended for establishing clear rules and agreements among members.

Is an Operating Agreement required for LLCs in Arizona?

No, the state of Arizona does not legally require LLCs to have an Operating Agreement. However, having one is beneficial as it provides a clear framework for the business's operations and can help avoid future disputes among members by setting clear rules and expectations.

Can I write my own Operating Agreement in Arizona?

Yes, you can write your own Operating Agreement in Arizona. While it's possible to draft this document yourself, it's often wise to consult with a legal professional or use a professionally designed template to ensure that the agreement complies with state laws and covers all necessary aspects of your business's operations.

What should be included in an Arizona Operating Agreement?

An Arizona Operating Agreement should include details such as the LLC's name and address, names of its members, how profits and losses will be divided, management structure, voting rights and procedures, guidelines for adding or removing members, procedures for amending the agreement, and how the LLC will be dissolved, if necessary.

Can an Operating Agreement be changed?

Yes, an Operating Agreement can be changed. It typically requires a vote among the LLC's members according to the procedures outlined in the agreement itself. It's crucial to document any amendments made to the agreement and ensure all members have access to the updated version.

How does an Operating Agreement protect the members of an LLC?

An Operating Agreement protects the members of an LLC by outlining each member's rights and responsibilities, detailing the operational procedures of the LLC, and establishing guidelines for resolving conflicts. This can help prevent legal disputes between members and provides legal support if disputes occur.

Do single-member LLCs need an Operating Agreement in Arizona?

Even though it is not legally required, single-member LLCs can benefit from having an Operating Agreement in place. It helps to establish the legitimacy of your business, separates your personal assets from your business, and provides detailed rules for the operation of your LLC, which can be particularly important in the absence of multiple members to make decisions.

Where should I keep my LLC's Operating Agreement?

Your LLC's Operating Agreement should be kept in a secure yet accessible place. It does not need to be filed with any state agency in Arizona but should be kept on file within your business records, with copies provided to all members of the LLC. Some choose to keep it alongside other important documents like the Articles of Organization.

Does the Operating Agreement need to be notarized in Arizona?

No, the Operating Agreement for an LLC in Arizona does not need to be notarized. However, ensuring that all members sign the document is important for it to be effective and enforceable. Having a notarized signature is not a requirement but can add a level of authenticity to the document.

How do I file an Operating Agreement with the state of Arizona?

An Operating Agreement does not need to be filed with the state of Arizona. It is an internal document that outlines the operating procedures and guidelines of your LLC. You should keep it for your records and provide copies to all LLC members. Although it's not required, maintaining an updated copy is important for the governance of your LLC.

Common mistakes

When filling out the Arizona Operating Agreement form, individuals often aim to detail the specifics of their business arrangements within a Limited Liability Company (LLC). This document is crucial as it outlines the management structure and the financial relationship among members. However, common mistakes can undermine its effectiveness, leading to potential legal issues or misunderstandings among members. Here are some of the critical errors to avoid:

Not customizing the form to fit the specific needs of the LLC. A generic form may not address unique aspects of the business, leading to gaps in the agreement.

Omitting details about the distribution of profits and losses. It's essential to clearly define how profits and losses are divided among members to prevent conflicts.

Failing to specify the process for admitting new members. Without a clear process, it can be difficult to manage the introduction of new members smoothly.

Leaving out the roles and responsibilities of members. This can lead to confusion and inefficiency if members are unclear about their duties.

Ignoring the procedures for member exits. The agreement should outline how a member can exit the LLC and what happens to their share.

Not defining the management structure. Whether member-managed or manager-managed, this detail sets the foundation for operational decisions.

Overlooking dispute resolution methods. It's beneficial to have a predetermined approach to resolving disputes among members.

Forgetting to detail the voting rights and procedures. Understanding how decisions are made is crucial for the LLC's operation.

Lacking an amendment process. The business environment and relationships can change, necessitating updates to the agreement.

Furthermore, in ensuring the effectiveness of the Operating Agreement, attention to detail and foresight are paramount. Here are some additional considerations:

Ensure all members review and agree on the terms before finalizing the document.

Consult with a legal professional to confirm that all relevant legal requirements are met and that the document is enforceable under Arizona law.

Update the agreement as the business evolves or as members' relationships change to reflect the current state of the LLC.

In summary, while the Operating Agreement is an internal document, its significance in delineating the framework within which the LLC operates cannot be overstated. Avoiding these common mistakes can help ensure smooth operations, prevent internal conflicts, and protect the interests of all members involved.

Documents used along the form

When forming a limited liability company (LLC) in Arizona, the Operating Agreement is a crucial document that outlines the operational and financial decisions of the business. It's a roadmap for how the company is run and provides a clear guide for resolving any disputes that may arise. However, it doesn't stand alone. To fully establish and operate an LLC in Arizona effectively, several other documents and forms are often needed alongside the Operating Agreement. These documents serve various purposes, from affirming the company's legal formation to ensuring compliance with state and federal regulations.

- Articles of Organization: This is the primary document required to formally establish an LLC in Arizona. It is filed with the Arizona Corporation Commission and officially registers the company as a legal entity in the state.

- Employer Identification Number (EIN) Application: Immediately after forming the LLC, obtaining an EIN from the IRS is essential. This number is like a social security number for the company, necessary for tax purposes and opening a business bank account.

- Operating Agreement Amendment: As businesses evolve, so do their operational needs and structures. This document is used when members of the LLC need to make changes or updates to the original Operating Agreement.

- Annual Report: While not all states require LLCs to submit an annual report, it's good practice. In Arizona, this report keeps the state updated on vital information, such as the company's address and current member list.

- Statement of Organizer: After filing the Articles of Organization, this document is used to officially appoint the initial members or managers of the LLC, transferring the authority from the organizer to the named individuals.

- Trademark Application: If your LLC plans to use a unique name, logo, or slogan, filing a trademark application will protect those assets from being used without permission. While not mandatory, it's a wise step for brand protection.

Together with the Operating Agreement, these documents and forms create a comprehensive foundation for your LLC, ensuring that it's not only legally formed but also well-positioned for business operations and compliance. Proper documentation is the backbone of any successful business, and by ensuring all these pieces are in place, you're setting your LLC up for long-term success.

Similar forms

The Arizona Operating Agreement form is notably similar to a Partnership Agreement, primarily because both establish the workings of the internal structure of the business. A Partnership Agreement, much like the Operating Agreement, outlines the responsibilities, profit distribution, and operational protocols among partners. This ensures that everyone involved has a clear understanding of their roles and expectations, fostering a harmonious business relationship.

Similarly, a Shareholder Agreement shares resemblances with the Arizona Operating Agreement as both documents define the rights and obligations of the parties involved in a business entity. The Shareholder Agreement, relevant for corporations, details the shareholders' rights, share transfer provisions, and procedures for resolving disputes, mirroring the way an Operating Agreement organizes the management and financial arrangements of an LLC.

Another document that parallels the Arizona Operating Agreement is the Buy-Sell Agreement. This document comes into play in scenarios involving the buying and selling of an owner's interest in the business. It outlines how an owner's share will be reassigned if they depart, pass away, or sell. The Operating Agreement often contains similar clauses, providing a roadmap for the continuity of the business in various eventualities.

The Bylaws of a corporation bear a resemblance to an Operating Agreement as well. Bylaws set forth the internal rules governing the management of a corporation, covering topics such as meetings, elections of a board of directors, and the roles and duties of the directors. Similarly, an Operating Agreement lays down the rules for the operation and management of an LLC, though it is tailored to the unique structure of an LLC rather than a corporation.

An Employment Agreement is another document similar to the Arizona Operating Agreement in that it delineates the roles, responsibilities, and compensation of employees within a company. While an Employment Agreement is specific to an employee-employer relationship, the Operating Agreement can specify the operational roles and financial benefits for its members, serving a somewhat analogous function within an LLC.

Finally, a Non-Disclosure Agreement (NDA) shares some common ground with the Arizona Operating Agreement, as both can include clauses related to confidentiality and the protection of trade secrets. While an NDA is specifically designed to prevent the sharing of protected information, Operating Agreements often contain confidentiality clauses that bind members to secrecy regarding sensitive business information, ensuring internal matters remain private.

Dos and Don'ts

When filling out the Arizona Operating Agreement form, it's crucial to navigate the process with a clear understanding of what to do and what to avoid. This ensures compliance with state laws and helps in establishing a solid legal foundation for your Limited Liability Company (LLC). Below are key dos and don'ts to consider.

Do:

- Review state requirements: Before you start filling out the form, make sure you understand Arizona's specific requirements for an Operating Agreement. This ensures that your agreement complies with local laws.

- Provide accurate information: Double-check to ensure all information is accurate and current. Mistakes can lead to misunderstandings or legal issues down the line.

- Be detailed in your descriptions: Clearly outline the roles, responsibilities, and rights of each member. This clarity can prevent conflicts in the future.

- Seek legal advice if necessary: If you're unsure about any part of the agreement, consulting with a legal professional can provide clarity and prevent potential issues.

Don't:

- Use ambiguous language: Avoid using vague terms that can be open to interpretation. Be as clear and specific as possible in your descriptions and provisions.

- Skip sections: Do not leave any sections incomplete. Even if you think a section may not currently apply, it's important to address every part of the form.

- Forget to update the document: An Operating Agreement should evolve with your LLC. Failing to update it as circumstances change can lead to operational and legal complications.

- Overlook the importance of signatures: Ensure that all members review the final document and sign it. Unsigned agreements may not be legally binding.

Misconceptions

When it comes to forming a Limited Liability Company (LLC) in Arizona, the Operating Agreement plays an essential role. However, several misconceptions surround this document, leading to confusion and potential missteps for business owners. Here’s a clear look at nine common misunderstandings:

- It’s required by law to have an Operating Agreement. While highly recommended for the clear definition of business operations and the protection of members, Arizona law does not require LLCs to have an Operating Agreement. However, not having one can expose members to default state rules that may not be in their best interest.

- An Operating Agreement is only necessary for multi-member LLCs. Even if you're a single-member LLC, it's wise to have an Operating Agreement. It enhances your liability protection by clearly separating your personal and business assets and outlines your business operations.

- The Operating Agreement doesn't need to be in writing. While Arizona law allows for oral or implied agreements, it’s best to have a written Operating Agreement. Written agreements provide a clear reference in case of disputes or misunderstandings among members.

- Operating Agreements are the same for every LLC. Many assume that all Operating Agreements are generic. However, this isn’t the case. Each LLC’s Operating Agreement should be tailored to fit its specific business operations, member responsibilities, and management structure.

- You can’t change the Operating Agreement once it's made. Operating Agreements are meant to be flexible documents that can evolve as the business grows and changes. Members can usually amend the Operating Agreement as long as they follow the process outlined within it.

- There’s no need to follow the Operating Agreement once it’s written. An Operating Agreement is more than a formality. It’s a legally binding document that outlines how the LLC should be operated. Failing to follow the terms can result in legal disputes among members.

- Only larger LLCs need an Operating Agreement. Size doesn’t determine the need for an Operating Agreement. Small operations can benefit just as much, and sometimes more, from having one. It’s about defining business processes and member relationships rather than the size of the operation.

- An Operating Agreement will look the same across all states. While there are similarities, Operating Agreements should comply with state-specific laws. An Operating Agreement tailored for an LLC in another state may not address specific requirements or default rules in Arizona, potentially leading to legal issues.

- Any template will work for your Operating Agreement. Many online templates provide a good starting point, but they may not cover all specifics of your business or include all necessary legal provisions. It’s often beneficial to consult with a legal professional to ensure that your Operating Agreement meets all legal requirements and fully protects the interests of all members.

Understanding these misconceptions about Arizona’s Operating Agreement can help owners and members of LLCs navigate their business formation and operations more smoothly, ensuring legal compliance and protection along the way.

Key takeaways

When setting up a Limited Liability Company (LLC) in Arizona, crafting a comprehensive Operating Agreement is a pivotal step. It doesn't just lay out the operational ground rules for your business, but also solidifies the structure of your company’s financial and functional decisions. Here are several key takeaways to consider when filling out and using the Arizona Operating Agreement form:

- It's Not Mandatory, But It's Wise: Even though Arizona law doesn't require LLCs to have an Operating Agreement, having one is beneficial. It helps safeguard your limited liability status, outlines the management structure, and ensures that your own rules govern your business, not default state laws.

- Customization is Key: The Operating Agreement should be tailored to fit your business's specific needs. It should detail the members' ownership percentages, their rights and responsibilities, the profit sharing, and procedures for making business decisions and handling changes or disputes.

- Choose Your Management Structure: Decide whether your LLC will be member-managed or manager-managed and document this in your Operating Agreement. This decision impacts daily operations and the authority levels of members and managers.

- Detail the Financial Arrangements: Clearly state how profits and losses will be distributed among members. This should reflect the members' contributions and the agreement among them. Ensure this section aligns with your tax preparation plans and practices.

- Ratify to Make it Official: For the Operating Agreement to take effect, all members need to agree on its contents and sign it. While notarization isn’t a must in Arizona, it’s a step that can lend additional legal credibility to your document.

- It's a Living Document: Your Operating Agreement should evolve with your business. Review and amend it as necessary to reflect significant changes, such as new members joining, changes in capital contributions, or adjustments in management structure.

- Safe Storage and Accessibility: Keep a copy of the Operating Agreement where it can be easily accessed by all members. While not filed with the state, it’s a crucial internal document that guides your business operations and resolves internal disputes.

An effectively drafted Operating Agreement sets a solid foundation for your Arizona LLC. It clarifies each member's expectations, responsibilities, and the framework for your business operations, helping to prevent misunderstandings and protect your interests. Remember, while templates and forms can provide a starting point, consider consulting with a legal professional to ensure that your agreement fully aligns with Arizona laws and your business goals.

Create Popular Templates for Arizona

Arizona Quit Claim Deed Form - People often use Quitclaim Deeds to gift property to family members or loved ones.

Contract to Purchase Real Estate - Amendments or waivers to the agreement must be in writing, ensuring any changes are mutually agreed upon and enforceable.