Legal Arizona Last Will and Testament Document

Creating a comprehensive plan for the future involves considering a variety of legal documents, one of the most important being a Last Will and Testament. Particularly in Arizona, this form serves as a crucial tool for individuals looking to ensure that their assets and possessions are distributed according to their wishes after passing away. Not only does it provide a clear roadmap for the distribution of one’s estate, but it also offers an opportunity to appoint a trusted executor who will oversee the process. Furthermore, for those with minor children, it presents a vital means of appointing guardianship, thereby securing their well-being. The Arizona Last Will and Testament form must adhere to specific state laws to be deemed valid, encompassing requirements such as the presence of witnesses during the signing process. Though the prospect of drafting such a document may seem daunting, understanding its significance and the peace of mind it brings can make the process far more approachable. This document represents not just a legal obligation, but a deeply personal statement of one's final wishes, ensuring that personal values and priorities are respected even in absence.

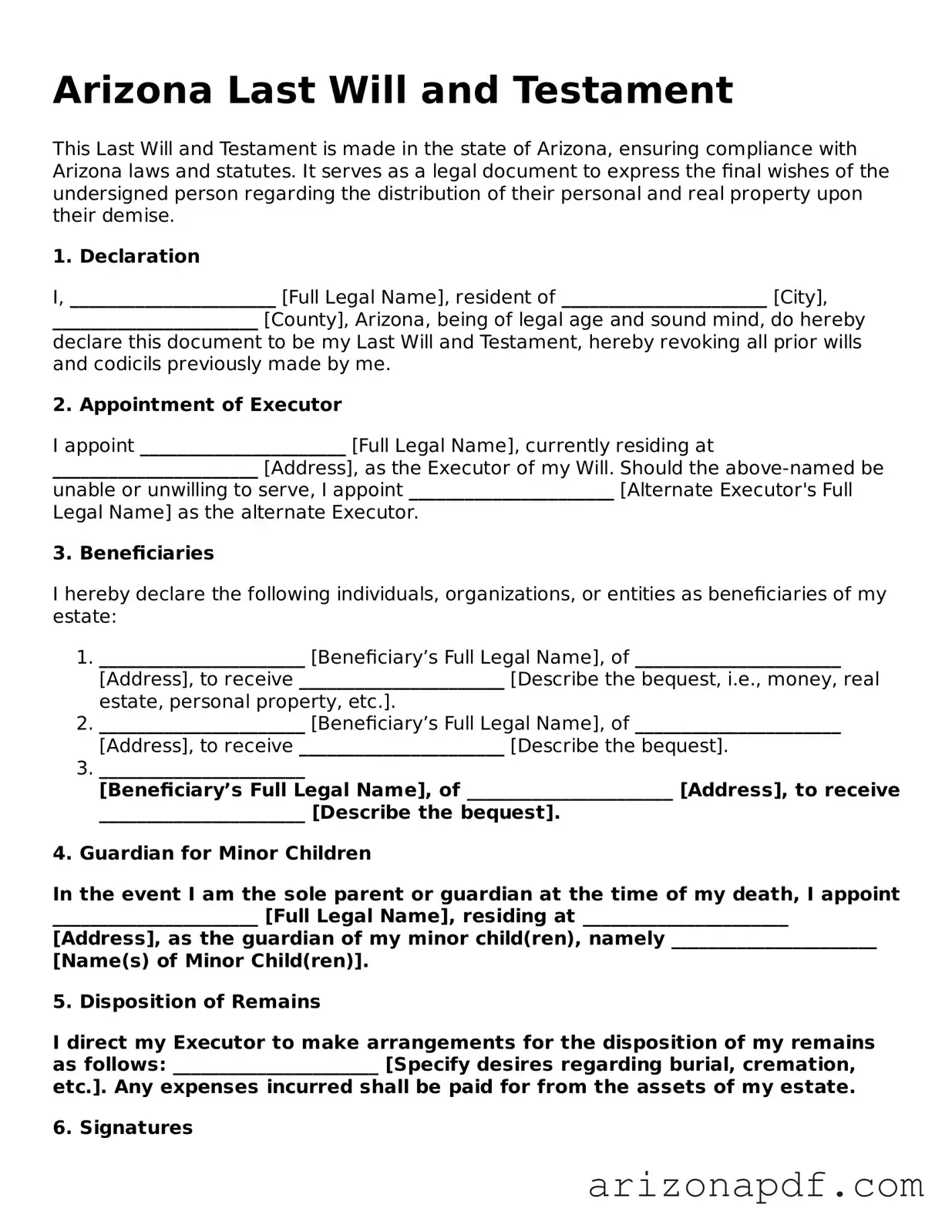

Arizona Last Will and Testament Preview

Arizona Last Will and Testament

This Last Will and Testament is made in the state of Arizona, ensuring compliance with Arizona laws and statutes. It serves as a legal document to express the final wishes of the undersigned person regarding the distribution of their personal and real property upon their demise.

1. Declaration

I, ______________________ [Full Legal Name], resident of ______________________ [City], ______________________ [County], Arizona, being of legal age and sound mind, do hereby declare this document to be my Last Will and Testament, hereby revoking all prior wills and codicils previously made by me.

2. Appointment of Executor

I appoint ______________________ [Full Legal Name], currently residing at ______________________ [Address], as the Executor of my Will. Should the above-named be unable or unwilling to serve, I appoint ______________________ [Alternate Executor's Full Legal Name] as the alternate Executor.

3. Beneficiaries

I hereby declare the following individuals, organizations, or entities as beneficiaries of my estate:

- ______________________ [Beneficiary’s Full Legal Name], of ______________________ [Address], to receive ______________________ [Describe the bequest, i.e., money, real estate, personal property, etc.].

- ______________________ [Beneficiary’s Full Legal Name], of ______________________ [Address], to receive ______________________ [Describe the bequest].

- ______________________ [Beneficiary’s Full Legal Name], of ______________________ [Address], to receive ______________________ [Describe the bequest].

4. Guardian for Minor Children

In the event I am the sole parent or guardian at the time of my death, I appoint ______________________ [Full Legal Name], residing at ______________________ [Address], as the guardian of my minor child(ren), namely ______________________ [Name(s) of Minor Child(ren)].

5. Disposition of Remains

I direct my Executor to make arrangements for the disposition of my remains as follows: ______________________ [Specify desires regarding burial, cremation, etc.]. Any expenses incurred shall be paid for from the assets of my estate.

6. Signatures

This Last Will and Testament will not be valid unless it is signed in the presence of two disinterested witnesses, who cannot be beneficiaries of this Will. Under Arizona law, this document must also be notarized to be legally effective.

Signed this ______ day of _____________, 20____.

_______________________________

Signature of Testator/Testatrix

Witnesses:

- _______________________________ [Name]

_______________________________ [Address]

_______________________________ [Signature]

Date: ______/______/______ - _______________________________ [Name]

_______________________________ [Address]

_______________________________ [Signature]

Date: ______/______/______

Notarization (if applicable):

This document was acknowledged before me on ______/______/______ by ______________________ [Full Legal Name of Testator/Testatrix].

_______________________________

Notary Public

My Commission Expires: ______

Document Details

| Fact | Detail |

|---|---|

| Legal Purpose | Outlines how a person's estate will be distributed upon their death. |

| Governing Law | Arizona Revised Statutes, Title 14 - Trusts, Estates and Protective Proceedings. |

| Age Requirement | The testator must be at least 18 years old. |

| Sound Mind Requirement | The testator must be of sound mind at the time of drafting. |

| Signature Requirement | The will must be signed by the testator or in the testator's name by some other individual in the testator's conscious presence and by the testator's direction. |

| Witness Requirement | Requires at least two witnesses who are present during the will's signing. |

| Writing Requirement | Must be in writing to be considered valid. |

| Notarization | Not required for the will to be valid but recommended for a self-proving affidavit. |

| Self-Proving Affidavit | A notarized statement by the witnesses that can expedite the probate process. |

| Nuncupative (Oral) and Holographic Wills | Oral wills are not recognized. Holographic (handwritten) wills are valid if the material provisions and the signature are in the handwriting of the testator. |

Instructions on Utilizing Arizona Last Will and Testament

When preparing an Arizona Last Will and Testament, it's essential to undertake each step with care to ensure your final wishes are accurately recorded and legally enforceable. This legal document allows you to specify how you would like your estate to be distributed upon your death, who will manage your affairs, and can also provide directions regarding the care of any minor children. The process does not have to be daunting. By following these clear steps, you can confidently create a Last Will that reflects your intentions and meets all legal requirements in Arizona.

- Start by gathering all necessary information: Compile a list of your assets, including real estate, bank accounts, investments, and personal property you wish to be distributed. Also, think about who you want to inherit these assets, and who will be the executor of your Will, responsible for managing the distribution of your estate.

- Choose an Arizona Last Will and Testament form: Ensure it meets Arizona’s legal requirements. It’s wise to use a form specifically designed for Arizona to avoid any legal complications.

- Fill in your full legal name and address: This identifies you as the testator—the person making the Will. Make sure to provide accurate details to avoid any confusion.

- Appoint your executor: Decide who will fulfill this crucial role. Include their full name and address. It’s advisable to name an alternate executor in case the primary one is unable to serve.

- Designate your beneficiaries: Clearly list the names of the individuals or organizations you wish to inherit your assets. Specify which assets each beneficiary will receive, ensuring there is no ambiguity.

- Assign guardians for any minor children: If applicable, state your choice of guardian to ensure the well-being of your children. Provide the guardian’s full name and address. Consider appointing an alternate guardian as well.

- Include any specific wishes or instructions: If you have particular directions regarding how your assets should be managed or distributed, or any other specific desires, clearly detail these in the Will.

- Review your Will carefully: Go over each section of your Will to ensure all the information is correct and reflects your wishes accurately. It’s crucial that your Will contains no errors or unclear instructions that could lead to disputes or complications.

- Sign and date the Will in front of witnesses: Arizona law requires your Will to be signed in the presence of at least two witnesses, who must also sign the document. These witnesses should be people not named as beneficiaries in the Will to avoid any conflict of interest.

- Store the Will in a safe place: Once completed, keep your Will in a secure location. Inform your executor and a trusted family member or friend of where it can be found, to ensure it is easily accessible when needed.

Creating a Last Will and Testament is a proactive step towards ensuring your estate is managed according to your wishes. By following these steps, you can produce a complete and legally sound document that clearly communicates your intentions and provides peace of mind for both you and your loved ones..

Listed Questions and Answers

What is a Last Will and Testament?

A Last Will and Testament is a legally binding document that outlines how a person’s assets and property should be distributed after their death. It designates an executor who will manage the estate and ensure the deceased’s wishes are carried out as specified in the document.

Why is it important to have a Last Will and Testament in Arizona?

In Arizona, having a Last Will and Testament is crucial because it provides clear instructions on how your assets should be handled and distributed among your heirs and beneficiaries. Without a will, the state laws of intestacy will determine how your assets are distributed, which might not align with your actual wishes. Furthermore, a will can help minimize any potential conflicts among surviving family members and expedite the probate process.

What requirements must be met for a Last Will and Testament to be valid in Arizona?

In Arizona, the person creating the will (testator) must be at least 18 years old and of sound mind. The will must be in writing, signed by the testator or by another person in the testator’s presence and at their direction. It also requires the signatures of at least two witnesses who observed the testator signing the will. These witnesses must also be at least 18 years of age and not beneficiaries of the will.

Can I make changes to my Last Will and Testament after creating it?

Yes, changes can be made to your Last Will and Testament at any time as long as you are of sound mind. These changes can be made through a codicil, which is a supplement to your will that explains, modifies, or revokes a will or part of one. Like the original will, the codicil must be signed in accordance with Arizona state laws regarding wills.

What happens if I die without a Last Will and Testament in Arizona?

If you die without a will in Arizona, your assets will be distributed according to the state’s intestacy laws. This means the court will decide how your estate is divided and who your beneficiaries are, which may not match your wishes. Typically, assets are distributed to the closest surviving relatives, such as a spouse, children, or parents.

Can a Last Will and Testament be contested in Arizona?

Yes, a Last Will and Testament can be contested in Arizona on several grounds, including if someone believes the testator was not of sound mind at the time of signing, if there was undue influence or coercion involved, or if the will was not executed properly according to state laws. Contesting a will requires proceeding in probate court and can be a complex and lengthy process.

Does a Last Will and Testament cover all types of property?

No, a Last Will and Testament does not cover all types of property. Certain assets that have designated beneficiaries, such as life insurance policies, retirement accounts, and some types of jointly held property, pass outside of the will. It’s important to review these designations as part of your estate planning process.

Is a handwritten Last Will and Testament legal in Arizona?

In Arizona, a handwritten will, also known as a holographic will, is legal as long as it is written entirely in the testator’s handwriting and signed by the testator. However, it’s advisable to have a will that meets all formal requirements and is witnessed, to avoid any potential challenges during the probate process.

How does one revoke or change a Last Will and Testament in Arizona?

A Last Will and Testament can be revoked or changed by creating a new will that states it revokes all previous wills and codicils, by physically destroying the original will (burning, tearing, or otherwise destroying it with the intent to revoke), or by executing a subsequent will or codicil that specifically revokes the previous one. It’s essential to follow these steps properly to ensure your current wishes are accurately reflected.

Where should I keep my Last Will and Testament?

It’s important to keep your Last Will and Testament in a safe, secure place where your executor or personal representative can easily access it after your death. Many choose to keep it in a fireproof safe at home, in a safe deposit box, or with their estate planning attorney. Ensure that someone you trust knows the location and how to access it when the time comes.

Common mistakes

Preparing a Last Will and Testament is a significant step in managing one’s affairs, ensuring that one's wishes are honored and assets are distributed according to those wishes upon their passing. Many individuals take on this task with the utmost seriousness, recognizing its importance. However, in the process of completing the Arizona Last Will and Testament form, some common mistakes can be made. These mistakes can complicate the execution of the will, potentially leading to disputes among beneficiaries or even causing the will to be contested in court. To assist in this vital task, here is a detailed guide to avoiding common errors:

- Not adhering to Arizona state laws. Every state has specific requirements for what constitutes a valid will. In Arizona, failing to comply with these laws, such as the need for the will to be witnessed by two individuals, can invalidate the document.

- Overlooking the designation of an executor. An executor plays a critical role in managing and distributing your estate. Neglecting to appoint one or choosing someone without the capability or willingness to serve can create significant issues.

- Using vague or unclear language. Clarity is crucial in any legal document. Ambiguous language can lead to misunderstandings and disputes among the beneficiaries.

- Forgetting to update the will. Life changes such as marriages, divorces, births, and deaths can affect your final wishes. Not updating your will to reflect these changes can result in unintended distributions.

- Failing to include all assets. Some individuals might omit certain assets, either unintentionally or because they don't recognize their value. This oversight can lead to complications in estate distribution.

- Incorrectly executing the will. Beyond fulfilling state-specific requirements, the act of signing the will must also follow a particular procedure. Errors in the execution process can lead to challenges of its validity.

- Not specifying guardians for minors. If you have children under the age of 18, not appointing a guardian can have serious implications. The court will decide on their guardianship, which might not align with your wishes.

- Assuming joint ownership negates the need for a will. Joint ownership can sometimes simplify the transfer of assets upon death, but it doesn’t cover all situations or assets. A well-crafted will is necessary to ensure comprehensive coverage of your estate.

- Choosing witnesses who are beneficiaries. This can raise questions about the validity of the will, as these witnesses may stand to gain from its execution.

- Failing to consider the potential for disputes. While it’s not pleasant to think about, disputes among beneficiaries can and do occur. Provisions to handle disputes can help avoid lengthy and costly legal battles.

In conclusion, when preparing your Last Will and Testament, paying attention to detail and understanding the legal requirements are key. A well-prepared will can safeguard your final wishes and ensure your estate is managed and distributed in the manner you specify. Avoiding the above mistakes can help simplify the process for your loved ones during a difficult time. If uncertain, seeking the advice of a legal professional is always a wise decision to confirm that your will fully complies with Arizona law and accurately reflects your intentions.

Documents used along the form

Completing a Last Will and Testament in Arizona is a significant step in managing one's affairs, ensuring that personal wishes regarding the distribution of assets and care for dependents are clear and legally recognized. However, this critical document is often just one component of a comprehensive estate plan. To fully address the broad scope of planning for the future, several other documents are commonly utilized alongside a Last Will and Testament. The following list encompasses essential legal forms that complement and enhance the directives laid out in a Last Will, ensuring thorough preparation for various circumstances.

- Durable Power of Attorney – This legal document grants an individual of your choice the authority to manage your financial affairs if you become incapacitated and are unable to do so yourself. It can cover a broad range of financial decisions and remains in effect until your death unless you decide to revoke it.

- Health Care Power of Attorney – Similar to the Durable Power of Attorney, but specifically focused on healthcare decisions, this form allows you to appoint someone to make medical decisions on your behalf if you're unable to communicate your wishes directly.

- Living Will – Often used in conjunction with a Health Care Power of Attorney, a Living Will outlines your preferences regarding life-sustaining treatment if you're in a terminal condition or permanently unconscious. This document speaks for you when you're not able to verbalize your desires regarding medical intervention.

- Beneficiary Designations – While a Last Will and Testament controls many aspects of your estate, some assets, like retirement accounts and life insurance policies, are governed by beneficiary designations. Ensuring these are up-to-date is crucial, as they override what's stated in your will.

- Revocable Living Trust – This tool allows you to maintain control over your assets while you're alive but ensures they are transferred to your designated beneficiaries without the need for probate court proceedings after your death. It can be altered or revoked at any time during your lifetime.

- Letter of Intent – This document provides additional instructions or wishes not covered by other legal forms. Though not legally binding, it serves as a guideline for your executors and beneficiaries, often covering personal property distribution or funeral arrangements.

- Financial Inventory – A comprehensive list of your assets, debts, accounts, and other financial information. This inventory is invaluable for your executor and attorney in efficiently managing your estate and ensuring nothing is overlooked.

- Digital Asset Inventory – As digital assets become increasingly significant, detailing accounts, passwords, and instructions for managing online presences (social media accounts, digital wallets, etc.) is crucial for modern estate planning.

In conclusion, while an Arizona Last Will and Capacity Testament is foundational in estate planning, it's the integration with these additional documents that creates a robust plan, addressing all facets of one's personal and financial affairs. With these complementary documents in place, individuals can have peace of mind knowing they have prepared comprehensively for the future, safeguarding their legacy and ensuring their wishes are respected.

Similar forms

The Arizona Last Will and Testament form shares similarities with the Living Trust in that both are used to manage and distribute an individual's property after their death. Just like a Last Will, a Living Trust specifies who will inherit the assets, but it also offers the added benefit of avoiding probate—a legal process that can be time-consuming and costly. A Living Trust allows for a more streamlined distribution of assets, providing a seamless transfer of wealth to the designated beneficiaries without the need for court involvement.

Similar to the Powers of Attorney documents, the Arizona Last Will and Testament form allows individuals to appoint someone to act on their behalf. While Powers of Attorney cover decisions related to financial matters or healthcare decisions while the individual is alive, the Last Will and Testament appoints an executor to manage and distribute assets according to the deceased's wishes after their death. This ensures that the individual's estate is handled according to their preferences, providing peace of mind to the person making the will and their loved ones.

The Advance Health Care Directive is another document that, like the Last Will and Testament, focuses on preparing for the future. However, instead of dealing with the distribution of assets, an Advance Health Care Directive outlines a person's wishes regarding medical treatment and end-of-life care if they become unable to communicate those decisions themselves. The Last Will and Testament complements an Advance Directive by covering aspects not related to healthcare, ensuring a comprehensive approach to future planning.

The Beneficiary Designation, commonly found in retirement accounts and life insurance policies, also shares a core purpose with the Arizona Last Will and Testament. Both allow individuals to specify who will receive their assets upon their death. While Beneficiary Designations directly transfer specific assets like retirement funds and life insurance proceeds to named beneficiaries outside of the probate process, a Last Will provides broader instructions for distributing all remaining assets. This broad scope makes the Last Will an essential part of estate planning, complementing direct beneficiary designations by covering assets not included in those arrangements.

Dos and Don'ts

Filling out an Arizona Last Will and Testament form is an important task that requires careful attention to detail and adherence to state laws. To ensure that your will is legally valid and accurately reflects your wishes, consider the following dos and don'ts:

- Do:

- Thoroughly read all instructions provided with the form to ensure you understand the requirements and the process.

- Use blue or black ink to ensure the document is legible and photocopies clearly.

- Clearly state your name, address, and the fact that the document is your Last Will and Testament at the beginning.

- Be specific when designating beneficiaries and what assets they are to receive to avoid any potential confusion.

- Assign a trusted executor who will manage your estate and ensure your wishes are carried out as you intended.

- Have two witnesses present who are not beneficiaries of the will to sign the document, as required by Arizona law.

- Consider having the will notarized, even if not required by Arizona law, to add an extra layer of verification.

- Don't:

- Attempt to fill out the form without first consulting with relevant law or a legal advisor if you have complex assets or concerns.

- Use ambiguous language that could lead to misinterpretation or disputes among your heirs and beneficiaries.

- Forget to date and sign the will at the end after all other sections are completed, as this is crucial for its validity.

By following these guidelines, you can ensure that your Last Will and Testament accurately reflects your wishes and complies with Arizona law. Remember, the clarity and legal validity of your will can significantly impact how smoothly your estate is distributed among your heirs.

Misconceptions

When it comes to the Arizona Last Will and Testament, misconceptions abound. These misunderstandings can cause significant confusion and might even lead to the mismanagement of an individual's final wishes. Here are nine common misconceptions explained:

- It must be notarized to be valid. In Arizona, a Last Will and Testament does not need to be notarized to be considered valid. However, it must be signed by the testator and by at least two witnesses who observed the testator sign the document or heard them acknowledge the signature.

- Only wealthy people need a Last Will and Testament. Regardless of the size of the estate, a Last Will and Testament is essential for directing the disposition of assets, nominating guardians for minor children, and can even direct the type of funeral arrangements a person desires.

- Oral wills are just as valid as written ones. In Arizona, oral wills (nuncupative wills) are not considered valid. A Last Will and Testament must be in writing to be legally recognized.

- All assets can be distributed through a Last Will and Testament. Certain assets, such as those held in joint tenancy, retirement accounts, and life insurance policies with designated beneficiaries, typically pass outside of the Last Will and Testament.

- A Last Will and Testament can eliminate all debts. Debts and outstanding obligations are handled by the estate before any distribution to heirs. A Last Will and Testament does not erase debts.

- If you die without a Last Will and Testament, the state takes everything. If someone dies intestate (without a will), state laws of succession determine the distribution of assets, not the "state" in terms of government ownership. This can still result in unintended beneficiaries receiving assets.

- Once executed, it cannot be changed. A Last Will and Testament can be altered at any time before death through a codicil or by drafting a completely new will, as long as the individual making the changes is mentally competent.

- A Last Will and Testament can completely disinherit a spouse. Under Arizona law, a spouse is entitled to a portion of the estate through elective share rights, regardless of what the will says, unless there is a prenuptial agreement stating otherwise.

- Creating a Last Will and Testament is a one-time task. It's advisable to review and possibly update your Last Will and Testament regularly, especially after major life events like marriage, divorce, the birth of a child, or significant changes in financial status.

Understanding these misconceptions is crucial for properly planning an estate and ensuring that one's final wishes are respected. When in doubt, seeking guidance from a legal professional experienced in estate planning can provide clarity and peace of mind.

Key takeaways

The Arizona Last Will and Testament form is an essential document for residents of Arizona looking to legally declare their wishes regarding the distribution of their assets upon their death. Providing clear instructions and being mindful of specific state requirements can ensure that the will is both valid and effective. Here are key takeaways to consider when filling out and using the Arizona Last Will and Testament form:

- Eligibility to create a will in Arizona requires the individual (testator) to be at least 18 years old and of sound mind.

- The document must be in writing. Arizona does not recognize oral wills made in-state.

- For the will to be valid, it must be signed by the testator, or by another individual in the testator's presence and at their direction.

- The signing of the will must be witnessed by at least two individuals, who are both present at the same time and observe the testator signing the will.

- Witnesses should be adults and should not stand to benefit from the will to avoid potential conflicts of interest.

- Although not a requirement in Arizona, notarizing the will can add an extra layer of authenticity and may help in the probate process.

- A Self-Proving Affidavit, while not mandatory, is recommended. This notarized statement by witnesses can speed up probate since it confirms the validity of the will without contacting the witnesses.

- Be specific about asset distribution to help prevent misunderstandings and legal challenges among potential heirs.

- Designate a reliable and competent executor to manage the estate and ensure the will's terms are executed as intended.

- Keep the will in a safe but accessible place, and inform the executor or a trusted individual of its location.

- Regularly review and update the will to reflect changes in assets, beneficiaries, or personal circumstances.

Being informed and cautious during the creation and maintenance of the Last Will and Testament ensures that a person's wishes are respected and efficiently executed after their passing. It's also advisable to consult with a legal professional to navigate the complexities of estate planning and ensure compliance with Arizona law.

Create Popular Templates for Arizona

Residential Lease Agreement Arizona - It underscores the significance of tenant screening, ensuring only qualified individuals enter a leasing contract.

Warranty Deed Form Arizona - Each party’s responsibilities and rights, as outlined in the Deed, are enforceable by law.

Divorce Settlement Template - Formalizes agreements on asset division, debt responsibility, and arrangements for children, making them legally binding post-divorce.