Fill in a Valid Jt 1 Arizona Tax Template

Navigating the intricacies of tax obligations in Arizona necessitates a comprehensive understanding of the JT-1/UC-001 form, a critical document for businesses operating within the state. This form serves as a cornerstone for both the Arizona Department of Revenue and the Department of Economic Security, guiding entities through the process of registering for Transaction Privilege Tax, Use Tax, and Employer Withholding and Unemployment Insurance. Its importance cannot be overstated, as it is foundational for ensuring tax compliance and facilitating smooth operations for new and existing businesses. The JT-1 form, also known as the Arizona Joint Tax Application, is a detailed document that requests information ranging from Federal Employer Identification Numbers or Social Security Numbers, if applicable, to descriptions of the business activities, NAICS codes, and details about the ownership type, thereby encompassing a broad spectrum of business particulars necessary for tax administration. Moreover, it alerts applicants to the necessity of bonding requirements for contractors, signifying its role not just as a form but as a guide through Arizona's tax landscape. By integrating a meticulous approach to its completion, businesses can avoid the pitfalls of incomplete submissions, which the Arizona Department of Revenue explicitly warns will not be processed. Furthermore, the form facilitates changes in business ownership or structure, emphasizing its utility in maintaining accurate state records. With its comprehensive design, the JT-1/UC-001 form stands as a beacon for businesses navigating the complexities of tax registration and compliance in Arizona.

Jt 1 Arizona Tax Preview

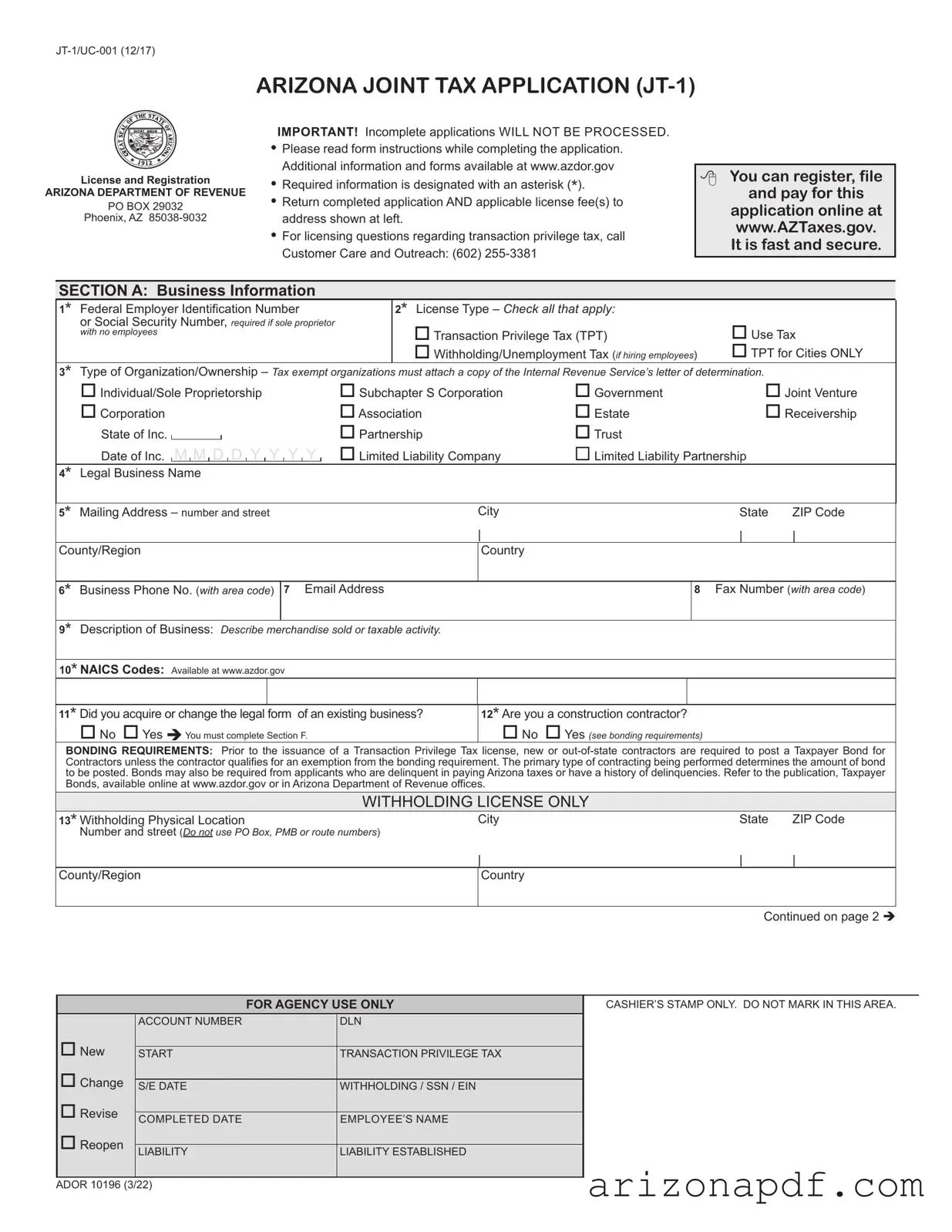

ARIZONA JOINT TAX APPLICATION

License and Registration

ARIZONA DEPARTMENT OF REVENUE

PO BOX 29032

Phoenix, AZ

IMPORTANT! Incomplete applications WILL NOT BE PROCESSED.

•Please read form instructions while completing the application. Additional information and forms available at www.azdor.gov

•Required information is designated with an asterisk (*).

•Return completed application AND applicable license fee(s) to address shown at left.

•For licensing questions regarding transaction privilege tax, call Customer Care and Outreach: (602)

You can register, file

and pay for this

application online at www.AZTaxes.gov. It is fast and secure.

SECTION A: Business Information

1* Federal Employer Identification Number

or Social Security Number, required if sole proprietor with no employees

2* License Type – Check all that apply: |

|

Transaction Privilege Tax (TPT) |

Use Tax |

Withholding/Unemployment Tax (if hiring employees) |

TPT for Cities ONLY |

3* Type of Organization/Ownership – Tax exempt organizations must attach a copy of the Internal Revenue Service’s letter of determination.

Individual/Sole Proprietorship |

Subchapter S Corporation |

Government |

Joint Venture |

||

Corporation |

Association |

Estate |

Receivership |

||

State of Inc. |

|

|

Partnership |

Trust |

|

Date of Inc. M M D D Y Y Y Y |

Limited Liability Company |

Limited Liability Partnership |

|

||

|

|

|

|

|

|

4* Legal Business Name

5* Mailing Address – number and street |

City |

State |

ZIP Code |

||||

|

|

|

| |

|

|

| |

| |

County/Region |

Country |

|

|

||||

|

|

|

|

|

|

|

|

6* Business Phone No. (with area code) |

7 Email Address |

|

|

8 |

Fax Number (with area code) |

||

|

|

|

|

|

|

|

|

9* Description of Business: Describe merchandise sold or taxable activity. |

|

|

|

|

|

||

|

|

|

|

|

|

||

10* NAICS Codes: Available at www.azdor.gov |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

11* Did you acquire or change the legal form of an existing business? |

12* Are you a construction contractor? |

|

|

||||

No Yes You must complete Section F. |

No Yes (see bonding requirements) |

|

|

||||

BONDING REQUIREMENTS: Prior to the issuance of a Transaction Privilege Tax license, new or

WITHHOLDING LICENSE ONLY

13* Withholding Physical Location |

City |

State |

ZIP Code |

Number and street (Do not use PO Box, PMB or route numbers) |

|

|

|

|

| |

| |

| |

County/Region |

Country |

|

|

|

|

|

|

Continued on page 2

FOR AGENCY USE ONLY

CASHIER’S STAMP ONLY. DO NOT MARK IN THIS AREA.

New

Change

Revise

Reopen

ACCOUNT NUMBER |

DLN |

|

|

START |

TRANSACTION PRIVILEGE TAX |

|

|

S/E DATE |

WITHHOLDING / SSN / EIN |

|

|

COMPLETED DATE |

EMPLOYEE’S NAME |

|

|

LIABILITY |

LIABILITY ESTABLISHED |

|

|

ADOR 10196 (3/22)

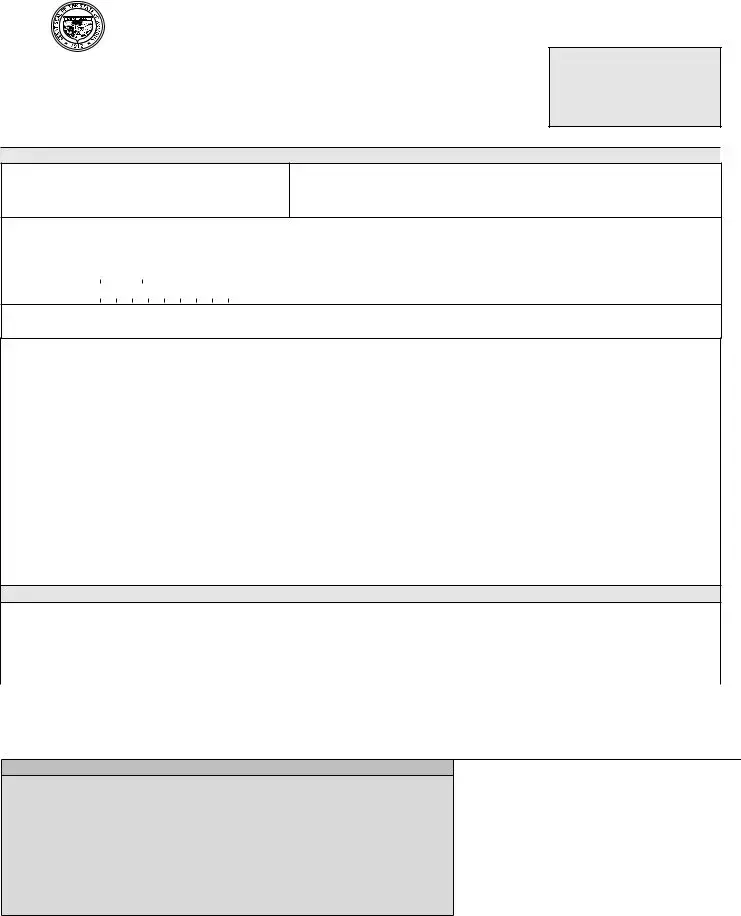

Name (as shown on page 1)

FEIN or SSN (as shown on page 1)

SECTION B: Identification of Owners, Partners, Corporate Officers Members/Managing Members or Officials of this Employing Unit

If you need more space, attach Additional Owner, Partner, Corporate Officer(s) form available at www.azdor.gov. If the owner, partners, corporate officers or combination of partners or corporate officers, members and/or managing members own more than 50% of or control another business in Arizona, attach a list of the businesses, percentages owned and unemployment insurance account numbers or provide a Power of Attorney (Form 285) which must be filled out and signed by an authorized corporate officer.

|

*Social Security No. |

|

*Title |

1 |

|

|

|

Owner |

*Street Address |

|

|

*ZIP Code |

|

*County |

|

|

|||

|

|

||

|

*Social Security No. |

|

*Title |

|

|

||

|

|

||

2 |

|

|

|

Owner |

*Street Address |

|

|

*ZIP Code |

|

*County |

|

|

|||

|

|

||

|

*Social Security No. |

|

*Title |

|

|

||

|

|

||

3 |

|

|

|

Owner |

*Street Address |

|

|

*ZIP Code |

|

*County |

|

|

|||

|

|

||

|

|

|

|

*Last Name |

First Name |

Middle Intl. |

||

| |

|

|

|

| |

*City |

|

|

*State |

* % Owned |

|

|

|

|

|

*Phone Number (with area code) |

|

*Country |

|

|

|

|

|

|

|

*Last Name |

First Name |

Middle Intl. |

||

| |

|

|

|

| |

*City |

|

|

*State |

* % Owned |

|

|

|

|

|

*Phone Number (with area code) |

|

*Country |

|

|

|

|

|

|

|

*Last Name |

First Name |

Middle Intl. |

||

| |

|

|

|

| |

*City |

|

|

*State |

* % Owned |

|

|

|

|

|

*Phone Number (with area code) |

|

*Country |

|

|

|

|

|

|

|

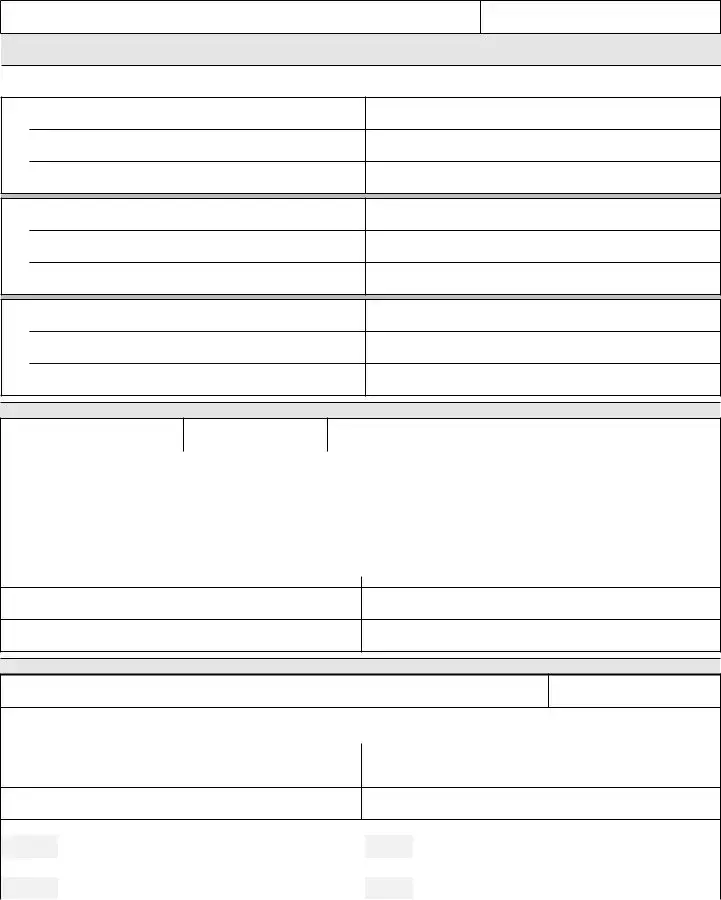

SECTION C: Transaction Privilege Tax (TPT)

1* Date Business Started in Arizona 2* Date Sales Began |

3 What is your Estimated Tax Liability for your first twelve months of business? |

|

M |

|

M |

|

D |

|

D |

|

Y |

|

Y |

|

Y |

|

Y |

M |

|

M |

|

D |

|

D |

|

Y |

|

Y |

|

Y |

|

Y |

|

|

|

||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

4 |

Filing Frequency Monthly |

Quarterly |

|

Seasonal Annual |

If seasonal filer, check the months for which you intend to do business: |

||||||||||||||||||||||||||||||

|

JAN FEB MAR |

APR MAY |

JUN JUL |

AUG |

SEP OCT NOV DEC |

||||||||||||||||||||||||||||||

5 |

Does your business sell tobacco products? |

|

6 |

TPT Filing Method |

|

7 |

Does your business sell new motor vehicle tires or vehicles? |

||||||||||||||||||||||||||||

|

Yes Retailer OR Distributor |

|

|

|

|

|

|

|

Cash Receipts |

|

|

Yes You will have to file Motor Vehicle Tire Fee form |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrual |

|

|

available at www.azdor.gov |

||||||

8* Tax Records Physical Location – number and street |

|

|

|

|

|

|

City |

State ZIP Code |

|||||||||||||||||||||||||||

|

(Do not use PO Box, PMB or route numbers) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

County

9* Name of Contact

| |

| |

Country |

|

* Phone Number (with area code) |

Extension |

|

| |

SECTION D: Transaction Privilege Tax (TPT) Physical Location

1* Business Name, “Doing Business As” or Trade Name at this Physical Location

2* Phone Number (with area code)

3* Physical Location of Business or Commercial/Residential Rental |

City |

State |

ZIP Code |

Number and street (Do not use PO Box, PMB or route numbers) |

|

|

|

|

|

| |

| |

County/Region |

Country |

|

|

Residential Rental Only – Number of Units

Reporting City (if different than the physical location city)

4* Additional County/Region Indian Reservation/City: County/Region Indian Reservation and City Codes available at www.azdor.gov

County/ |

|

|

|

|

|

|

|

|

|

|

Region |

|

|

|

|

|

City |

|

|

|

|

Business Codes (Include all codes that apply): |

See instructions. Complete list available at www.azdor.gov |

|||||||||

State/ |

|

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

City |

|

|

|

|

If you have more locations, attach Additional Business Locations form available at www.azdor.gov

ADOR 10196 (3/22) |

ARIZONA JOINT TAX APPLICATION |

Page 2 of 4 |

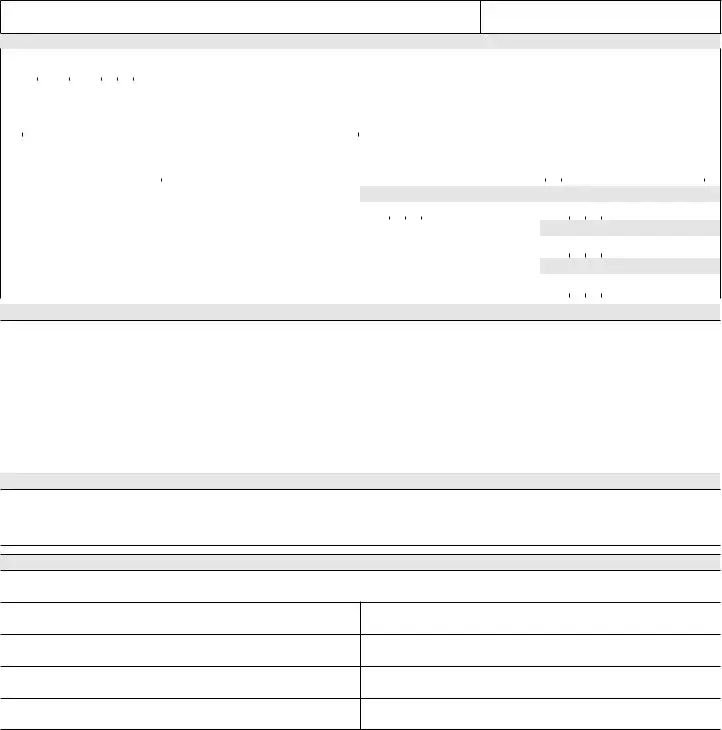

Name (as shown on page 1)

FEIN or SSN (as shown on page 1)

SECTION E: Withholding & Unemployment Tax Applicants

1* Regarding THIS application, Date Employees First Hired in Arizona |

2 |

Are you liable for Federal Unemployment Tax? |

||||||||||||

|

M M |

|

D D |

|

Y Y Y Y |

|

Yes First year of liability: Y |

|

Y |

|

Y |

|

Y |

|

|

|

|

||||||||||||

3 Are individuals performing services that are excluded from withholding |

4 |

Do you have an IRS ruling that grants an exclusion from |

||||||||||||

or unemployment tax? |

|

Federal Unemployment Tax? |

||||||||||||

Yes Describe services: |

|

Yes Attach a copy of the Ruling Letter. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5Do you have, or have you previously had, an Arizona unemployment tax number?

|

No |

|

|

|

Unemployment Tax Number: |

||||

|

Yes Business Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

First calendar quarter Arizona employees were/will be hired and paid |

Hired Year |

Hired Quarter |

|

|

Paid Year |

Paid Quarter |

||

|

(indicate quarter as 1, 2, 3, 4): |

Y Y Y Y |

Q |

|

Y Y Y Y |

Q |

|||

|

|

|

|

||||||

7 |

When did/will you first pay a total of $1,500 or more gross wages in a calendar quarter? |

|

|

|

Year |

Quarter |

|||

|

(indicate quarter as 1, 2, 3, 4) |

|

|

|

|

|

|

|

|

|

|

|

|

Y Y Y Y |

Q |

||||

|

Exceptions: $20,000 gross cash wages Agricultural; $1,000 gross cash wages Domestic/Household; not applicable to 501(c)(3) |

|

|||||||

8 |

When did/will you first reach the 20th week of employing 1 or more individuals for some portion of a day in |

|

|

Year |

Quarter |

||||

|

each of 20 different weeks in the same calendar year? (indicate quarter as 1, 2, 3, 4) |

|

|

Y Y Y Y |

Q |

||||

|

Exceptions: 10 or more individuals Agricultural; 4 or more individuals 501(c)(3) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

SECTION F: Acquired Business Information

If you answered “Yes” to Section A, question 11, you must complete Section F.

1* Did you acquire or change all or part of an existing business? |

2* |

|

Date of Acquisition |

3* EIN of Business Under Previous Owner |

||||||||||||||||||||||||||||

All |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part |

|

|

M |

|

M |

|

D |

|

D |

|

|

Y |

|

|

Y |

|

|

Y |

|

|

Y |

|

||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||||||

4* Previous Owner’s Telephone Number |

5* Name of Business Under Previous Owner |

6* Name of Previous Owner |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7* Did you change the legal form of all or part of the Arizona operations of |

|

8* |

|

|

|

Date of Change |

9* EIN of Previous Legal Form |

|||||||||||||||||||||||||

your existing business? (e.g., change from sole proprietor to corporation or etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part |

|

|

M |

|

M |

|

D |

|

D |

|

Y |

|

Y |

|

Y |

|

Y |

|

||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION G: AZTaxes.gov Security Administrator

Visit www.AZTaxes.gov (the Arizona Department of Revenue’s online customer service center) to register for online services. The authorized individual will have full online access to transaction privilege, use, withholding and corporate tax account information and services. The authorized individual will be able to add or delete users and grant user privileges. Online services include viewing tax account information, filing tax returns, signing returns electronically with a

SECTION H: Required Signatures

This application must be signed by either a sole owner, at least two partners, managing member or corporate officer legally responsible for the business, trustee or receiver or representative of an estate that has been listed in Section B.

1 Print or Type Name

2 Print or Type Name

Title

Title

Date

Date

Signature

Signature

This application must be completed, signed, and returned as provided by A.R.S. §

Equal Opportunity Employer/Program

This application is available in alternative formats at Unemployment Insurance Tax Office.

PLEASE COMPLETE SECTION I: STATE/COUNTY & CITY LICENSE FEE WORKSHEET

TO CALCULATE AND REMIT TOTAL AMOUNT DUE WITH THIS APPLICATION.

ADOR 10196 (3/22) |

ARIZONA JOINT TAX APPLICATION |

Page 3 of 4 |

Name (as shown on page 1)

FEIN or SSN (as shown on page 1)

SECTION I: State/County & City License Fee Worksheet

ALL FEES ARE SUBJECT TO CHANGE. Check for updates at www.azdor.gov.

To calculate CITY FEE: Multiply No. of Locations by the License Fee and enter sum in License Subtotal.

|

|

|

No. of |

License |

License |

|

|

|

|

|

|

No. of |

License |

|

License |

|

|

No. of |

License |

License |

City/Town |

Code |

Loc’s |

Fee |

Subtotal |

City/Town |

|

Code |

Loc’s |

Fee |

|

Subtotal |

City/Town |

Code |

Loc’s |

Fee |

Subtotal |

||||

Apache Junction |

AJ |

|

$2.00 |

|

Goodyear |

|

|

|

GY |

|

$5.00 |

|

|

Sahuarita |

SA |

|

$5.00 |

|

||

Avondale |

AV |

|

$0.00 |

|

Guadalupe |

|

|

|

GU |

|

$2.00 |

|

|

San Luis |

SU |

|

$2.00 |

|

||

Benson |

BS |

|

$5.00 |

|

Hayden |

|

|

|

HY |

|

$5.00 |

|

|

Scottsdale |

SC |

|

$50.00 |

|

||

Bisbee |

BB |

|

$1.00 |

|

Holbrook |

|

|

|

HB |

|

$1.00 |

|

|

Sedona |

SE |

|

$2.00 |

|

||

Buckeye |

BE |

|

$2.00 |

|

Huachuca City |

|

HC |

|

$2.00 |

|

|

Show Low |

SL |

|

$2.00 |

|

||||

Bullhead City |

BH |

|

$2.00 |

|

Jerome |

|

|

|

JO |

|

$2.00 |

|

|

Sierra Vista |

SR |

|

$1.00 |

|

||

Camp Verde |

CE |

|

$2.00 |

|

Kearny |

|

|

|

KN |

|

$2.00 |

|

|

Snowflake |

SN |

|

$2.00 |

|

||

Carefree |

CA |

|

$10.00 |

|

Kingman |

|

|

|

KM |

|

$2.00 |

|

|

Somerton |

SO |

|

$2.00 |

|

||

Casa Grande |

CG |

|

$2.00 |

|

Lake Havasu |

|

|

LH |

|

$5.00 |

|

|

South Tucson |

ST |

|

$2.00 |

|

|||

Cave Creek |

CK |

|

$20.00 |

|

Litchfield Park |

|

LP |

|

$2.00 |

|

|

Springerville |

SV |

|

$5.00 |

|

||||

Chandler |

CH |

|

$2.00 |

|

Mammoth |

|

|

|

MH |

|

$2.00 |

|

|

St. Johns |

SJ |

|

$2.00 |

|

||

Chino Valley |

CV |

|

$2.00 |

|

Marana |

|

|

|

MA |

|

$5.00 |

|

|

Star Valley |

SY |

|

$2.00 |

|

||

Clarkdale |

CD |

|

$2.00 |

|

Maricopa |

|

|

|

MP |

|

$2.00 |

|

|

Superior |

SI |

|

$2.00 |

|

||

Clifton |

CF |

|

$2.00 |

|

Mesa |

|

|

|

ME |

|

$20.00 |

|

|

Surprise |

SP |

|

$10.00 |

|

||

Colorado City |

CC |

|

$2.00 |

|

Miami |

|

|

|

MM |

|

$2.00 |

|

|

Taylor |

TL |

|

$2.00 |

|

||

Coolidge |

CL |

|

$2.00 |

|

Nogales |

|

|

|

NO |

|

$0.00 |

|

|

Tempe |

TE |

|

$50.00 |

|

||

Cottonwood |

CW |

|

$2.00 |

|

Oro Valley |

|

|

|

OR |

|

$12.00 |

|

|

Thatcher |

TC |

|

$2.00 |

|

||

Dewey/Humboldt |

DH |

|

$2.00 |

|

Page |

|

|

|

PG |

|

$2.00 |

|

|

Tolleson |

TN |

|

$2.00 |

|

||

Douglas |

DL |

|

$5.00 |

|

Paradise Valley |

PV |

|

$2.00 |

|

|

Tombstone |

TS |

|

$1.00 |

|

|||||

Duncan |

DC |

|

$2.00 |

|

Parker |

|

|

|

PK |

|

$2.00 |

|

|

Tucson |

TU |

|

$20.00 |

|

||

Eagar |

EG |

|

$10.00 |

|

Patagonia |

|

|

|

PA |

|

$0.00 |

|

|

Tusayan |

TY |

|

$2.00 |

|

||

El Mirage |

EM |

|

$15.00 |

|

Payson |

|

|

|

PS |

|

$2.00 |

|

|

Wellton |

WT |

|

$2.00 |

|

||

Eloy |

EL |

|

$10.00 |

|

Peoria |

|

|

|

PE |

|

$50.00 |

|

|

Wickenburg |

WB |

|

$2.00 |

|

||

Flagstaff |

FS |

|

$20.00 |

|

Phoenix** |

|

|

|

PX |

|

$50.00 |

|

|

Willcox |

WC |

|

$1.00 |

|

||

Florence |

FL |

|

$2.00 |

|

Pima |

|

|

|

PM |

|

$2.00 |

|

|

Williams |

WL |

|

$2.00 |

|

||

Fountain Hills |

FH |

|

$2.00 |

|

Pinetop/Lakeside |

PP |

|

$2.00 |

|

|

Winkelman |

WM |

|

$2.00 |

|

|||||

Fredonia |

FD |

|

$10.00 |

|

Prescott |

|

|

|

PR |

|

$5.00 |

|

|

Winslow |

WS |

|

$10.00 |

|

||

Gila Bend |

GI |

|

$2.00 |

|

Prescott Valley |

PL |

|

$2.00 |

|

|

Youngtown |

YT |

|

$10.00 |

|

|||||

Gilbert |

GB |

|

$2.00 |

|

Quartzsite |

|

|

|

QZ |

|

$2.00 |

|

|

Yuma |

YM |

|

$2.00 |

|

||

Glendale |

GE |

|

$35.00 |

|

Queen Creek |

|

|

QC |

|

$2.00 |

|

|

|

|

|

|

|

|||

Globe |

GL |

|

$2.00 |

|

Safford |

|

|

|

SF |

|

$2.00 |

|

|

|

|

|

|

|

||

Subtotal City License Fees |

|

|

Subtotal City License Fees |

|

|

|

Subtotal City License Fees |

|

|

|||||||||||

|

|

(column 1) |

$ |

|

|

|

|

|

|

(column 2) |

$ |

|

|

|

(column 3) |

$ |

|

|||

AA TOTAL City License Fee(s) (column 1 + 2 + 3) |

|

|

|

|

|

|

|

|

|

|

$ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fee per |

TOTAL |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. of Loc’s |

Location |

|||

BB TOTAL State License Fee(s): Calculate by multiplying number of business locations by $12.00 |

|

$12.00 |

$ |

|

||||||||||||||||

|

Residential Rental License Fees - Only Chandler, Phoenix, and Scottsdale |

|

|

|

|

|

||||||||||||||

|

Multiply the number of units per locations by $2.00 ($50.00 Annual Cap per license). |

|

No. of Units |

No. of Loc’s |

City Fee |

|||||||||||||||

|

|

|

|

|

|

|

|

|

Residential Rental |

|

|

|

$ |

|

||||||

|

ONLY CHANDLER, PHOENIX, and SCOTTSDALE |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

should use this section. |

|

|

|

|

Residential Rental |

|

|

|

$ |

|

||||||||

|

DO NOT use the fee chart above to calculate license fees. |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

The amount for each city CANNOT EXCEED $50.00 |

|

Residential Rental |

|

|

|

$ |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

CC TOTAL City Residential Rental License Fees (Add Chandler, Phoenix, & Scottsdale) |

............................................................. |

|

|

|

$ |

|

||||||||||||||

DD TOTAL DUE (Add lines AA + BB + CC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|||||

•Make check payable to Arizona Department of Revenue.

•Include FEIN or SSN on payment.

•Do not send cash.

•License will not be issued without full payment of fee(s).

**If your only business is under Class 213, Commercial Lease, there is no license fee due.

ADOR 10196 (3/22) |

ARIZONA JOINT TAX APPLICATION |

Page 4 of 4 |

ARIZONA DEPARTMENT OF REVENUE

GENERAL INSTRUCTIONS FOR ARIZONA JOINT TAX APPLICATION

Online Application

Go to www.AZTaxes.gov

Notice for Construction Contractors: Due to bonding requirements, construction contractors are not permitted to license for transaction privilege tax online. For more information, please contact us.

Mailing Address

Arizona Department of Revenue

PO Box 29032

Phoenix, AZ

Customer Service

Center Locations

8:00 a.m. - 5:00 p.m.

Monday through Friday

(except Arizona holidays)

Phoenix Office

1600 W Monroe

Phoenix, AZ 85007

Tucson Office

400 W Congress

Tucson, AZ 85701

7:00 a.m. - 6:00 p.m.

Monday through Thursday

8:00 a.m. - 12:00 p.m.

Friday

(except Arizona holidays)

Mesa Office

55 N Center

Mesa, AZ 85201

(This office does not handle billing or account disputes.)

Customer Service

Telephone Numbers

Licensing for TPT, Withholding or Use Tax

(Arizona Department of Revenue)

(602)

Unemployment Tax

(Arizona Department of

Economic Security)

(602)

The Arizona Joint Tax Application

USE THIS APPLICATION TO:

License New Business: If you are selling a product or engaging in a service subject to transaction privilege tax, you will most likely need to obtain the state transaction privilege tax license (TPT) license.

Change Ownership: If acquiring or succeeding to all or part of an existing business or changing the legal form of your business (sole proprietorship to corporation, etc.).

IMPORTANT: To avoid delays in processing of your application, we recommend you read these instructions and refer to them as needed to ensure you have accurately entered all the required information. This application must be completed, signed, and returned as provided by A.R.S. §

Please read form instructions while completing the application. Additional information and forms are available at www.azdor.gov.

Required information is designated with an asterisk (*).

Please complete Section I: State/County & City License Fee Worksheet to calculate and remit Total Amount Due with this application.

Whencompletingthisform,pleaseprintortypeinblackink. Legible applications are required for accurate processing. The following numbered instructions correspond to the numbers on the Form

If you need to update a license, add a business location, get a copy of your license, or make other changes: Complete a Business Account Update form and include a State fee of $12 per location and any applicable fees related to locations within the City/Town jurisdictions. Additional information and forms are available at www.azdor.gov.

ADOR 10196 (3/22) |

Instructions Page 1 |

ARIZONA JOINT TAX APPLICATION |

INSTRUCTIONS |

Section A: BUSINESS INFORMATION

1.Provide your Federal Employer Identification No. (FEIN) or Social Security No. (SSN) if you are a sole proprietor without employees. Taxpayers are required to provide their taxpayer identification number (TIN) on all returns and documents. A TIN is defined as the federal employer identification number (EIN) or SSN, depending upon how income tax is reported. The EIN is required for all employers. A penalty of $5 will be assessed by the Department of Revenue for each document filed without a TIN.

2.License Type (Check all that apply):

Transaction Privilege Tax (TPT): Anyone engaged in a business taxable under the TPT statutes must apply for a TPT License before engaging in business. For TPT, you are required to obtain and display a separate license certificate for each business or rental location. This may be accomplished in one of the following ways:

Each location may be licensed as a separate business with a separate license number for purposes of reporting transaction privilege and use taxes individually. Therefore, a separate application is needed for each location.

Multiple locations may be licensed under a consolidated license number, provided the ownership is the same, to allow filing of a single tax return. If applying for a new license, list the various business locations as instructed below. If already licensed and you are adding locations, do not use this application to consolidate an existing license. Please submit a Business Account Update form, available at www.azdor.gov.

Withholding & Unemployment Taxes: Employers paying wages or salaries to employees for services performed in the State must apply for a Withholding number & Unemployment number.

Use Tax:

TPT for cities only: This type of license is needed if your business activity is subject to city TPT which is collected by the state, but the activity is not taxed at the state level.

3.Type of Organization/Ownership: Check as applicable. A corporation must provide the state and date of incorporation.

4.Provide the Legal Business Name or owner or corporation as listed in its articles of incorporation, or individual and spouse, or partners, or organization owning or controlling the business.

5.Provide the MailingAddress (number and street) where all correspondence is to be sent. You may use your

home address, corporate headquarters, or accounting firm’s address, etc. If mailing address differs for licenses (for instance withholding and unemployment insurance), please send a cover letter with completed application to explain.

6.Provide the Business Phone Number including the area code.

7.Provide the Email Address for the business or contact person.

8.Provide the Business Fax Number including the area code.

9.Provide the Description of Business by describing the major taxable business activity, principle product you manufacture, commodity sold, or services performed. Your description of business is very important and MUST link to the appropriate NAICS Code and Business Code.

10.Provide all North American Industries Classification System (NAICS) Code(s) that apply. The NAICS is identified for your business, based on your major business activity, principle product you manufacture, commodity sold, or services performed. You must indicate at least one NAICS code. A current listing is available at www.azdor.gov.

11.If you acquired or changed the legal name of an existing business, you must complete Section F of this application. If you check NO, proceed to number 12.

12.If you are a construction contractor, read bonding requirements and submit the appropriate bonding paperwork with this application. If you check NO, proceed to number 13.

13.Provide the Withholding Physical Location of the business. This address cannot be a PO Box or Route Number.

Section B: IDENTIFICATION OF OWNERS, PARTNERS, CORPORATE OFFICERS,

MEMBERS/ MANAGING MEMBERS OR

OFFICIALS OF THIS EMPLOYING UNIT

Provide the full name, social security number and title of all Owners, Partners, Corporate Officers, Members/ Managing Members or Officials of the Employing Unit. If you need additional space, attach Additional Owners, Partners, Corporate Officer(s) Addendum available at www.azdor.gov. If the owner, partners, corporate officers or combination of partners or corporate officers, members and/ or managing members own more than 50% of, or control another business in Arizona, attach a list of the businesses, percentages owned and unemployment insurance account numbers or provide a General Disclosure/ Power of Attorney (Form 285) which must be filled out and signed by an authorized corporate officer.

ADOR 10196 (3/22) |

Instructions Page 2 |

ARIZONA JOINT TAX APPLICATION |

INSTRUCTIONS |

Section C: TRANSACTION PRIVILEGE TAX (TPT)

1.Provide the Date Business Started in Arizona.

2.Provide the Date Sales Began in Arizona or estimate when you plan to begin selling in Arizona.

3.Tax Liability: Provide the amount of gross income you can reasonably expect to generate in your first twelve months of business. You will be set up for monthly filing unless your Estimated Tax Liability will result in a tax liability of less than $8,000, which will require you to file quarterly.

4.Based on your tax liability, provide your filing frequency. If your total estimated annual combined Arizona, county and municipal TPT liability is:

•Less than $2,000, you may file and pay annually.

•Between $2,000 and $8,000, you may file and pay quarterly.

•Otherwise, your transaction privilege taxes are due

monthly.

If your business is Seasonal or you are a transient vendor, indicate the months in which you intend to do business in Arizona.

5.Indicate whether your business sells tobacco products. If you checked yes, check the box to indicate if you are a retailer or distributor of tobacco products.

6.TPT Filing Method: Check which filing method your business uses for determining tax liability. Cash basis requires the payment of tax based on sales receipts actually received during the period covered on the tax return. When filing under the accrual basis the tax is calculated on the sales billed rather than actual receipts.

7.If you sell new Motor Vehicle Tires or Vehicles, you must file the Motor Vehicle Waste Tire Fee form

8.through 9. Tax Records Physical Location indicate the physical address where your tax records are located. Include the contact person’s name and phone number.

Section D: TRANSACTION PRIVILEGE TAX (TPT)

PHYSICAL LOCATION

1.Provide the Business Name, “Doing Business As” (DBA). DBA is the name of a business other than the owner’s name or, in the case of a corporation, a name that is different from the legal or true corporate name. If it is the same as the Legal Business Name enter “same”.

2.Provide the Business Phone Number including the area code.

3.Provide the Physical Location of the business. This address cannot be a PO Box or Route Number. Provide:

County/Region

Residential Rentals ONLY - Number of Units

Reporting City, if different from the Physical Location city. For example, if the location for the listed address

is listed in an adjacent city, such as Scottsdale, but the location of the business is actually within the city of Phoenix. See “TPT Rate Look Up” on www.AZTaxes.gov .

4.Provide if your business is located on an Indian Reservation; provide the Additional County/Region Indian Reservation Code(s). A current listing is available at www.azdor.gov.

Provide the Business Code(s) including all State and City Business Code(s) that apply; based on your major business activity, principle product you manufacture, commodity sold, or services performed. You must indicate at least one business code. A current listing is available at www.azdor.gov.

If you have more locations, attach Additional Business Locations form available at www.azdor.gov.

Section E: WITHHOLDING & UNEMPLOYMENT TAX

APPLICANTS

1.Provide the Date Employees First Hired in Arizona.

2.If you are liable for Federal Unemployment Tax, check YES and enter the first year of liability.

3.If individuals in your business are performing services that are excluded from withholding or unemployment tax, check YES and describe the services these individuals are performing.

4.If your business has an IRS ruling that grants an exclusion from Federal Unemployment Tax, check YES and you must attach a copy of the Ruling Letter to this application.

5.If you have, or previously had an Arizona unemployment tax number, check YES and provider the business name you used and the unemployment number.

6.Provide the first calendar quarter Arizona employees were or will be hired and paid.

7.When do you anticipate or did you first pay a total of $1,500 or more in gross wages in a calendar quarter? Indicate the year and quarter in which this occurred or will occur.

8.When do you anticipate or did you first reach the 20th week of employing 1 or more individuals for a full or partial day within the same calendar year? Indicate the year and quarter in which this occurred or will occur.

Section F: ACQUIRED BUSINESS INFORMATION

1.Did you acquire or change all or part of an existing business? If part, to obtain an unemployment tax rate based on the business’s previous account, you must request it no later than 180 days after the date of acquisition or legal form of business change; contact the Unemployment Tax Office Experience Rating Unit for an Application & Agreement for Severable Portion Experience Rating Transfer (form

ADOR 10196 (3/22) |

Instructions Page 3 |

ARIZONA JOINT TAX APPLICATION |

INSTRUCTIONS |

2.Provide the date you acquired the previous owner’s business or changed the legal form of your existing business (sole proprietor to corporate, etc.).

3.through 6. Complete as indicated if you know the previous owner’s information.

7.through 9. If you merely changed the legal form of your existing business, indicate whether or not you changed all or part of the business, the date of change and EIN of previous Legal Form of Business.

SectionG:AZTAXES.GOVSECURITYADMINISTRATOR

Visit www.AZTaxes.gov (the Arizona Department of Revenue’s online customer service center) to register for online services. The authorized individual will have full online access to transaction privilege, use, withholding and corporate tax account information and services. The authorized individual will be able to add or delete users and grant user privileges. Online services include viewing tax account information, filing tax returns, signing returns electronically with a

Section H: REQUIRED SIGNATURES

This application must be signed only by either a sole owner, at least two partners, managing member or corporate officer legally responsible for the business. This application CANNOT be signed by agents or representatives.

Section I: STATE/COUNTY & CITY LICENSE FEE

WORKSHEET

There are no fees for Withholding/Unemployment Insurance, or Use Tax registrations. State license fees are calculated per business location. To calculate the city license fees, use the listing of cities on page 4, Section I of this application. City fees are subject to change. Check for updates at www.azdor.gov.

AA: TOTAL City License Fees – To calculate the city fees, multiply No. of Locations in the city by the license fee and enter sum in Subtotal City License Fees. Then calculate and enter the sum of columns 1 + 2 + 3. If you have a location in Phoenix and the business is only under Class 213, Commercial Lease, there is no license fee due.

BB: TOTAL State License Fees – To calculate the state fees, multiply the No. of locations in the state by $12.

CC: TOTAL City Residential Rental License Fee –

USE THIS SECTION FOR CHANDLER, PHOENIX AND SCOTTSDALE ONLY. These cities WILL NOT use the larger fee chart. To calculate Residential Rental license fee, multiple the No. of units by the No. of locations by $2.00 ($50.00 Annual Cap per license). The amount for each city CANNOT EXCEED $50.00.

DD: TOTAL DUE – Add lines AA + BB + CC.

Please send your payment for this amount. Failure to include your payment with this application will result in a delay in processing your license. Licenses are not issued until all fees have been paid.

Make checks payable to the Arizona Department of Revenue. Be sure to return all pages of the application with your payment. Retain a copy of the application for your records.

DO NOT SEND CASH

Include your EIN or SSN on payment

ADOR 10196 (3/22) |

Instructions Page 4 |

ARIZONA JOINT TAX APPLICATION

State/County Business Codes

Codes |

Taxable Activities |

Codes |

Taxable Activities |

Codes |

Taxable Activities |

002 |

Mining - Nonmetal |

014 |

Personal Property Rental |

051 |

Jet Fuel Use Tax |

004 |

Utilities |

015 |

Contracting - Prime |

053/055 |

Rental Car Surcharge |

005 |

Communications |

017 |

Retail |

129 |

Use Tax Direct Payments |

006 |

Transporting |

019 |

Severance |

153 |

Rental Car Surcharge - Stadium |

007 |

Private (Rail) Car |

023 |

Recreational Vehicle Surcharge |

315 |

MRRA Amount |

008 |

Pipeline |

025 |

Transient Lodging |

911 |

911 Telecommunications |

009 |

Publication |

029 |

Use Tax Purchases |

912 |

E911 Prepaid Wireless |

010 |

Job Printing |

030 |

Use Tax from Inventory |

|

|

011 |

Restaurants and Bars |

033 |

Telecommunications Devices |

|

|

012 |

Amusement |

041 |

Municipal Water |

|

|

013 |

Commercial Lease |

049 |

Jet Fuel Tax |

|

|

City Business Codes

Codes |

Taxable Activities |

Codes |

Taxable Activities |

Codes |

Taxable Activities |

004 |

Utilities |

020 |

Timbering & Other Extraction |

116 |

Feed Wholesale |

005 |

Communications |

027 |

Manufactured Buildings |

144 |

Hotel/Motel (additional tax) |

|

|

|

|

|

Commercial Rental, Licensing |

006 |

Transporting |

029 |

Use Tax |

213 |

for Use |

|

|

|

|

|

Rental, Leasing and Licensing for |

009 |

Publication |

030 |

Use Tax from Inventory |

214 |

Use of Tangible Personal Property |

010 |

Job Printing |

037 |

Contracting - Owner Builder |

244 |

|

|

|

|

|

|

Commercial Lease (additional |

011 |

Restaurants and Bars |

040 |

Rental Occupancy |

313 |

tax) |

012 |

Amusement |

044 |

Hotels |

315 |

MRRA Amount |

015 |

Contracting - Prime |

045 |

Rental Residential |

|

|

016 |

Contracting Spec Builder |

049 |

Jet Fuel Tax |

|

|

017 |

Retail |

051 |

Jet Fuel Use |

|

|

|

|

|

Retail Sales Food for Home |

|

|

018 |

Advertising |

062 |

Consumption |

|

|

|

Severance - Metalliferous |

|

|

|

|

019 |

Mining |

111 |

Additional Restaurants & Bars |

|

|

ADOR 10196 (3/22)

File Properties

| Fact | Description |

|---|---|

| Form Number | JT-1/UC-001 |

| Purpose | Application for Transaction Privilege Tax, Use Tax, and Employer Withholding and Unemployment Insurance. |

| Application Revision Date | 1/18 |

| Governing Body | Arizona Department of Revenue |

| Online Registration | Available at www.AZTaxes.gov |

| Key Requirements | Incomplete applications will not be processed. Required information is designated with an asterisk (*). |

| Sections | Business Information, Identification of Owners, Transaction Privilege Tax, Withholding & Unemployment Tax Applicants, Acquired Business Information, AZTaxes.gov Security Administrator, Required Signatures and State/County & City License Fee Worksheet. |

| Bonding Requirements | New or out-of-state contractors must post a Taxpayer Bond for Contractors unless exempt. |

| Payment | Must return completed application and applicable license fee(s). |

Instructions on Utilizing Jt 1 Arizona Tax

To apply for Transaction Privilege Tax, Use Tax, and Employer Withholding and Unemployment Insurance in Arizona, the JT-1 Arizona Tax Application must be accurately filled out and submitted to the Arizona Department of Revenue. Ensuring all required fields are properly completed helps avoid processing delays. Here are detailed steps to guide you through filling out the JT-1 form.

- Enter your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) if you're a sole proprietor with no employees in Section A, number 1.

- In Section A, number 2, check the appropriate boxes for the license type(s) you are applying for: Transaction Privilege Tax (TPT), Use Tax, Withholding/Unemployment Tax, or TPT for Cities ONLY.

- Choose your Type of Organization/Ownership in Section A, number 3. If you are a tax-exempt organization, attach the IRS's letter of determination.

- Provide your legal business name in Section A, number 4.

- Fill in your mailing address in Section A, number 5.

- Enter your business phone number, email address, and fax number in Section A, numbers 6 through 8.

- Describe your business and provide the NAICS Codes that apply to your business in Section A, numbers 9 and 10.

- Answer questions about acquiring or changing the legal form of an existing business, and if you are a construction contractor in Section A, numbers 11 and 12.

- Provide withholding and unemployment tax information in Section E, including the date employees were first hired in Arizona, and answer related questions in numbers 2 through 8.

- If applicable, complete Section F regarding acquired business information.

- Visit www.AZTaxes.gov to register as a security administrator for online services (Section G).

- Ensure the form is signed in Section H by the appropriate business representative(s).

- Complete Section I: State/County & City License Fee Worksheet to determine the total amount due with your application.

- Review your completed application for accuracy, make a check payable to the Arizona Department of Revenue, and include your FEIN or SSN on the payment. Do not send cash. Mail the completed application and payment to the address provided: Arizona Department of Revenue, PO Box 29032, Phoenix, AZ 85038-9032.

Remember, this application is a crucial step in legally conducting business within Arizona. It's important to accurately complete each section to ensure compliance with state regulations.

Listed Questions and Answers

What is the JT-1 Arizona Tax Form used for?

The JT-1 Arizona Tax Form, officially known as the Arizona Joint Tax Application, serves multiple purposes. It's primarily used to apply for different tax-related requirements for businesses operating within the state, including the Transaction Privilege Tax (TPT), Use Tax, and Employer Withholding and Unemployment Insurance. Additionally, this form facilitates changes in business ownership or the legal structure of the business.

Can I submit the JT-1 Form online?

Yes, the JT-1 Form can be submitted online, which is the recommended approach for faster processing. The Arizona Department of Revenue’s website, www.AZTaxes.gov, provides an online application process. However, it's worth noting that construction contractors, due to bonding requirements, cannot apply for the TPT license online. For such cases or further information, contacting the department directly is advised.

Is there a fee associated with the JT-1 form?

Yes, there are various fees associated with the JT-1 form, including state, county, and possibly city license fees, which are dependent on the number of business locations and the specific tax licenses required. A breakdown of fees, including city-specific fees and exemptions, is detailed in the State/County & City License Fee Worksheet section of the JT-1 form documentation. It's important to calculate the total amount due accurately and include payment with the submission of your application.

What information is required on the JT-1 Form?

The JT-1 Form requires detailed business information including: Federal Employer Identification Number (FEIN) or Social Security Number (SSN) if a sole proprietor, license types needed, type of organization/ownership, business name and contact details, business description, NAICS codes, and information about bonding requirements for contractors. Also, for those hiring employees, details regarding withholding and unemployment tax must be provided. Mark sections requiring your attention with an asterisk (*).

What is the Transaction Privilege Tax (TPT)?

The Transaction Privilege Tax (TPT) is a tax on the privilege of conducting business in the state of Arizona. It is a tax that the business owner is responsible for paying, but it is common for the business to pass the tax on to the customer. Various business activities require a TPT license, such as retail sales, leasing, and renting tangible personal property.

How do I determine the filing frequency for my taxes?

When completing the JT-1 form, you'll decide on your tax filing frequency—monthly, quarterly, seasonally, or annually—based on your estimated tax liability and business operations. Your choice affects when you are required to submit your tax returns and payments to the state.

Does my business need to pay for licenses for each city it operates in?

Yes, if your business operates in multiple cities, you may need to pay additional license fees specific to each city in addition to the state license fee. The exact fees and any associated requirements vary by city. The JT-1 form’s State/County & City License Fee Worksheet helps in calculating these fees.

What are the bonding requirements mentioned in the JT-1 form?

Bonding requirements apply primarily to construction contractors. Before the issuance of a Transaction Privilege Tax license, new or out-of-state contractors must post a Taxpayer Bond unless they qualify for an exemption. The bond amount varies depending on the primary type of contracting performed. Further details and exemption criteria can be found in the Taxpayer Bonds publication on the Arizona Department of Revenue website.

Can I use the JT-1 form if I'm changing the ownership or legal form of my existing business?

Yes, if you're acquiring, succeeding to a portion of, or entirely changing the ownership or legal form of an existing business, you can use the JT-1 form to notify the state of these changes. It's crucial to complete this process to ensure your business remains in compliance with state tax laws.

Who needs to sign the JT-1 form?

The JT-1 form must be signed by an individual authorized to act on behalf of the business. This includes a sole owner, at least two partners in the case of a partnership, a managing member, a corporate officer, a trustee, a receiver, or a representative of an estate. This ensures that the form has been reviewed and approved by someone with legal responsibility for the business.

Common mistakes

Not providing required information marked with an asterisk (*). Every field on the JT-1 Arizona Tax form that is marked with an asterisk is required. Failure to complete these sections can result in the application not being processed.

Incorrectly filling in the Federal Employer Identification Number or Social Security Number if a sole proprietor with no employees. This key identifier is crucial for the accurate processing of the application.

Selecting the wrong license type or not checking all that apply. It's essential to accurately indicate whether the application is for Transaction Privilege Tax, Use Tax, Withholding/Unemployment Tax, or TPT for Cities ONLY.

Failing to attach a copy of the Internal Revenue Service’s letter of determination for tax exempt organizations. This documentation is necessary to verify the organization's tax-exempt status.

Inaccurate description of the business or failing to describe the merchandise sold or taxable activity in sufficient detail. This information helps determine the correct tax classifications and applicable rates.

Not completing Section F for construction contractors or when acquiring or changing the legal form of an existing business. These sections are critical for understanding the specific conditions and requirements applicable to the applicant’s business activities.

Omitting contact information or providing an incorrect email address and business phone number. Accurate contact information is crucial for any follow-up required by the Department of Revenue.

For any questions regarding the application process or if further clarification is needed, the Arizona Department of Revenue encourages applicants to consult the detailed instructions provided on their website or to contact the Customer Care and Outreach at (602) 255-3381. It is also recommended to check the Arizona Department of Revenue’s website for any updates or changes in the licensing requirements and to verify the accuracy of the licensing fee schedule.

Documents used along the form

When filling out the Arizona Joint Tax Application (JT-1), several other forms and documents can be required or useful depending on specific business circumstances. These additional forms support various aspects of tax and business regulation compliance, including employee management, industry-specific taxation, and changes in business status or ownership. Understanding these documents can simplify the application process and ensure compliance with Arizona's Department of Revenue and Department of Economic Security requirements.

- Form 285, Power of Attorney: Needed if another person will handle tax matters for the business. It authorizes them to receive and inspect confidential tax information.

- Taxpayer Bond for Contractors: Essential for contractors to guarantee tax payment. The bond amount depends on the contracting work type.

- Additional Owner, Partner, Corporate Officer(s) Form: Used if the JT-1 form does not have enough space to list all individuals with significant control over the business.

- Business Account Update Form: Required for updating information about your license, adding new business locations, or making other significant changes after your JT-1 has been processed.

- Motor Vehicle Tire Fee Form: Necessary for businesses dealing with the sale of new motor vehicle tires, addressing an environmentally focused fee.

- UI Tax Application (UC-001): For employers to register for Unemployment Insurance Tax, detailing employer and employee information for state records.

- Withholding Tax Application: Separate application for businesses that intend to withhold taxes from employees' wages.

- License Fee Worksheet (Section I of JT-1): Although part of the JT-1, it's crucial for calculating state, county, and city license fees accurately, impacting the total amount due.

Each of these forms complements the JT-1 application by covering specific regulatory requirements, helping businesses ensure comprehensive compliance. Whether it's by providing detailed information about the owners and officers, managing industry-specific fees, or updating business information, these documents play a crucial role in the broader context of business operations and tax compliance within Arizona.

Similar forms

The Form SS-4, Application for Employer Identification Number (EIN), shares similarities with the JT-1/UC-001 Arizona Joint Tax Application because both are essential for new business entities that need to report taxes. Like the JT-1 form, the SS-4 is a prerequisite for companies needing to establish their tax identity with the Internal Revenue Service (IRS). Businesses must provide detailed information about their type, purpose, and ownership structure on both forms, making them crucial steps in formalizing a business's tax reporting obligations at both the federal and state levels.

The Form W-4, Employee's Withholding Certificate, although designed for a different purpose, shares the commonality of tax obligations with the JT-1 form. The W-4 is used by employees to determine the amount of federal income tax that should be withheld from their paychecks, while the JT-1 registers a business for state tax obligations in Arizona. Both documents play significant roles in ensuring the proper calculation and collection of taxes, fulfilling each entity's responsibility in the tax reporting process. However, the W-4 applies to employee-employer relationships, highlighting the diverse applications of tax-related documentation.

Form TPT-EZ, the Short Form for Reporting Transaction Privilege Tax in Arizona, also closely relates to the JT-1 form as it is part of the state's tax reporting and collection framework. The JT-1 form is used by businesses to apply for a Transaction Privilege Tax license among other tax registrations, while TPT-EZ is a subsequent monthly or quarterly filing requirement for reporting tax collected from sales. Both forms are integral to the compliance with Arizona’s sales tax regulations, albeit at different stages of the tax collection process.

The Unemployment Tax Registration form, used for registering a business with the state’s Unemployment Insurance Program, parallels the JT-1 form in the context of employer obligations. Similar to sections within the JT-1 that register a business for unemployment insurance tax, this form ensures that businesses contribute to the state’s unemployment insurance pool, a requirement for entities with employees. The focus on employer responsibilities towards state-regulated insurance programs underscores the importance of both forms in maintaining the economic safety nets for workers.

Lastly, the Business Account Update form, while not a registration form per se, aligns with the updating aspect of the JT-1 form. This form is used for updating a business’s tax account information with the Arizona Department of Revenue, including changes in business locations or ownership, similar to updates that may be filed using the JT-1 form. Both documents underscore the need for current information in the state's tax administration system, ensuring that businesses remain compliant with state tax laws and regulations.

Dos and Don'ts

Filling out the Arizona Joint Tax Application (JT-1) can be straightforward if you know what you should and shouldn't do. Here’s a helpful guide:

Things You Should Do:

- Read the instructions carefully before you start filling out the form. These instructions are designed to help you understand the requirements and prevent common mistakes.

- Double-check all the information you enter, especially your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) if you're a sole proprietor. Accuracy is crucial to avoid processing delays.

- Include all required documents, especially if you’re a tax-exempt organization. Attach a copy of your Internal Revenue Service’s letter of determination to prove your status.

- Calculate and remit the total amount due for State/County & City license fees. Use the fee worksheet provided in the form to ensure you pay the correct amount and avoid underpayment issues.

Things You Shouldn't Do:

- Leave required fields blank. Fields marked with an asterisk (*) are mandatory. Failing to provide these details can result in your application being incomplete and not processed.

- Forget to sign the application. Ensure that the application is signed by the appropriate party or parties as required. An unsigned application is considered incomplete.

- Use PO Boxes for certain addresses. For some sections, like the business physical location or withholding physical location, PO Box addresses are not acceptable. Make sure to provide a physical address.

- Ignore the special requirements for certain licenses, such as bonding requirements for Construction Contractors. Make sure you meet all special conditions for the licenses you are applying for.

Misconceptions

When it comes to handling the JT-1 Arizona Tax Form, there are several misconceptions that can lead to confusion for new and experienced business owners alike. Here are six common misunderstandings and clarifications to help navigate the filing process effectively.

- Only physical businesses need to file a JT-1. This is a misconception. Online businesses with presence or nexus in Arizona are also required to file the JT-1 form for Transaction Privilege Tax (TPT) and other applicable taxes.

- Filing the JT-1 automatically registers a business for all taxes. While the JT-1 is a comprehensive application for several tax responsibilities including TPT, Use Tax, Withholding, and Unemployment taxes, specific scenarios may require additional registrations or forms.

- There is a flat rate for city license fees. In reality, city license fees vary. The JT-1 form's Section I helps calculate these fees based on the number of locations and the specific city codes, which can significantly impact the cost for multi-location businesses.

- Non-profits are exempt from filing. This is incorrect. Tax-exempt organizations must still complete the JT-1 application but must attach a copy of the IRS’s letter of determination to confirm their status. Even though they might be exempt from certain taxes, registration is still required.

- Construction contractors can complete the process entirely online. Due to bonding requirements, construction contractors must follow a specific procedure that includes potentially submitting additional information offline, even though many steps can be initiated online.

- Payment of fees guarantees immediate license issuance. While completing the JT-1 form and paying the appropriate fees are essential steps, licenses are issued upon approval, not payment. The application must be complete and accurate, and all requirements met, including any necessary bonding for construction contractors.

Understandably, navigating tax responsibilities can be daunting. However, recognizing and addressing these misconceptions about the JT-1 Arizona Tax Form can make the process more manageable. Remember, when in doubt, consulting the form instructions, reaching out to the Arizona Department of Revenue, or seeking expert advice can provide clarity and prevent potential issues down the line.

Key takeaways

Filling out the JT-1 Arizona Joint Tax Application is an essential first step for businesses operating within the state to comply with tax obligations. Here are five key takeaways for effectively completing and utilizing the form:

- Ensure Completeness: The Arizona Department of Revenue emphasizes that incomplete JT-1 forms will not be processed. It's imperative to review the application thoroughly, filling out all sections that apply to your business and ensuring required fields, marked with an asterisk (*), are completed.

- Understand Licensing Requirements: This application is necessary for business engaging in activities subject to transaction privilege tax (TPT), use tax, and for those employing workers in Arizona, necessitating withholding and unemployment insurance. It's crucial to check the appropriate boxes for the licenses your business requires and comply with any additional requirements for your specific situation.

- Online Registration is Encouraged: The Arizona Department of Revenue advocates for the use of their online platform, www.AZTaxes.gov, for the registration, filing, and payment processes associated with the JT-1 form. The online system is not only faster but also more secure, offering an array of online services, including account management and electronic tax return filings.

- Pay Attention to Section I: The form requires applicants to complete Section I meticulously, calculating and remitting the total amount due for state, county, and city license fees. This step is crucial for ensuring that the licensing process progresses without delays, and it involves checking the latest fee requirements on the department's website since fees are subject to change.

- Signatures are Mandatory: The completion and submission of the JT-1 form must be finalized with the required signatures. Depending on the business structure, this may include a signature from the sole owner, partnerships, managing members, corporate officers, trustees, receivers, or estate representatives listed in Section B. This endorsement certifies the accuracy and completeness of the information provided.

Accurately and thoroughly completing the JT-1 Arizona Joint Tax Application is critical for ensuring compliance with the state's tax obligations and securing the necessary licenses to legally operate your business. It's recommended to seek additional details and clarify any ambiguities by consulting the Arizona Department of Revenue's website or contacting their Customer Care and Outreach department for assistance.

More PDF Forms

Arizona Corporation Commision - Requires telecommunications companies to detail their customer base and revenue streams, offering a clear picture of their market position and financial contributions to the state.

Does Arizona Have State Income Tax - Designed to enhance clarity and prevent confusion around the process of electing withholding amounts for state taxes.

Arizona Dmv Forms - Key documents and instructions for Arizona individuals to navigate the driver license reinstatement process after revocation.