Legal Arizona Independent Contractor Agreement Document

An Arizona Independent Contractor Agreement form serves as a crucial document that outlines the relationship between a contractor and the entity or person hiring their services. It is designed to clearly distinguish the contractor as not being an employee of the company, which significantly impacts tax obligations, liability, and employment benefits. This form includes vital details such as the duration of the contractor's services, payment rates and methods, confidentiality agreements, and the specific nature of the work to be performed. Additionally, it often contains clauses relating to the ownership of any work product produced during the contract period, as well as termination procedures and dispute resolution mechanisms. By establishing a mutual understanding of each party's rights and responsibilities through this agreement, both parties can protect their interests, ensuring that the contractor can perform their duties effectively while the hiring entity receives the desired services. As these agreements are legally binding, it's essential for both parties to carefully review and understand the terms before finalizing the document, possibly with the assistance of legal counsel to navigate any complex aspects that might arise.

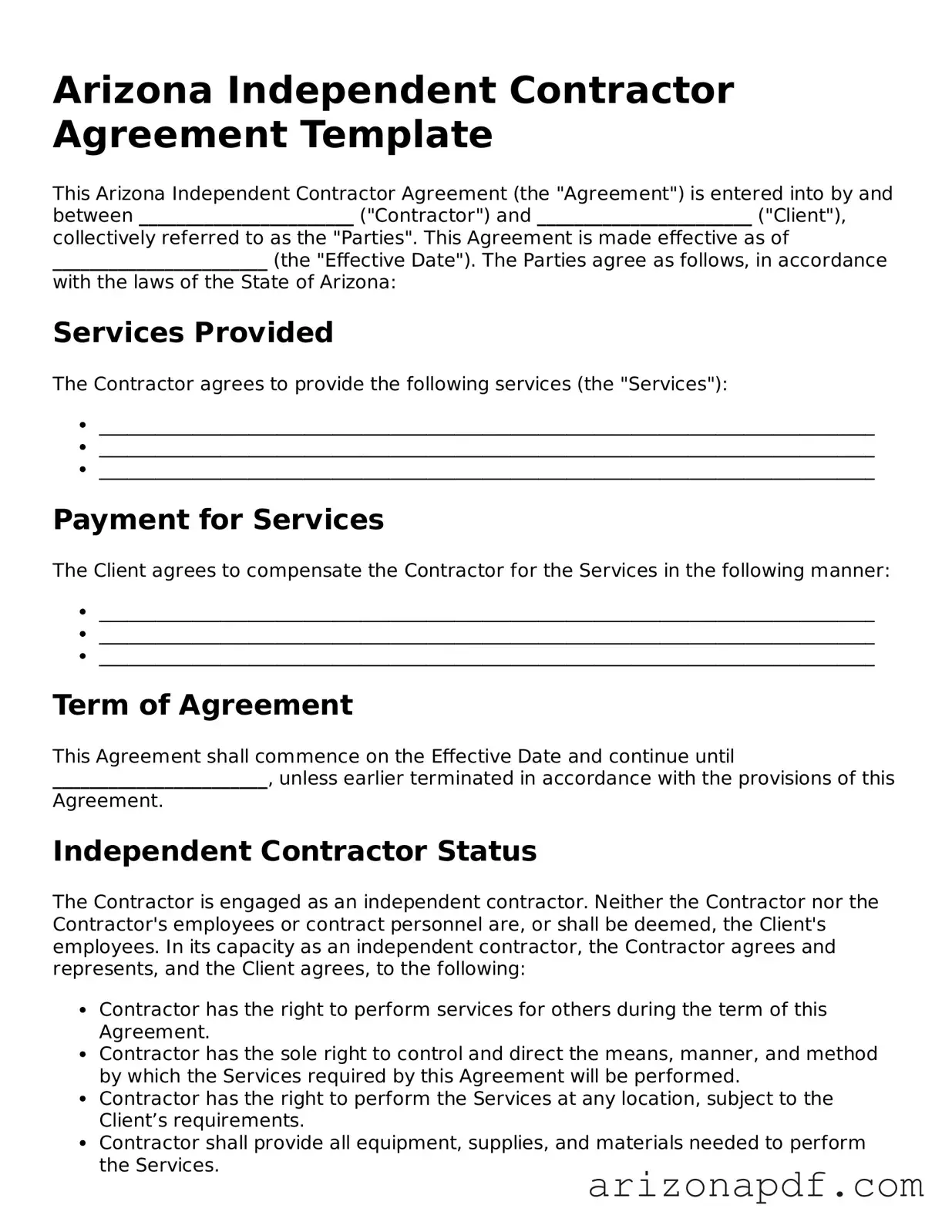

Arizona Independent Contractor Agreement Preview

Arizona Independent Contractor Agreement Template

This Arizona Independent Contractor Agreement (the "Agreement") is entered into by and between _______________________ ("Contractor") and _______________________ ("Client"), collectively referred to as the "Parties". This Agreement is made effective as of _______________________ (the "Effective Date"). The Parties agree as follows, in accordance with the laws of the State of Arizona:

Services Provided

The Contractor agrees to provide the following services (the "Services"):

- ___________________________________________________________________________________

- ___________________________________________________________________________________

- ___________________________________________________________________________________

Payment for Services

The Client agrees to compensate the Contractor for the Services in the following manner:

- ___________________________________________________________________________________

- ___________________________________________________________________________________

- ___________________________________________________________________________________

Term of Agreement

This Agreement shall commence on the Effective Date and continue until _______________________, unless earlier terminated in accordance with the provisions of this Agreement.

Independent Contractor Status

The Contractor is engaged as an independent contractor. Neither the Contractor nor the Contractor's employees or contract personnel are, or shall be deemed, the Client's employees. In its capacity as an independent contractor, the Contractor agrees and represents, and the Client agrees, to the following:

- Contractor has the right to perform services for others during the term of this Agreement.

- Contractor has the sole right to control and direct the means, manner, and method by which the Services required by this Agreement will be performed.

- Contractor has the right to perform the Services at any location, subject to the Client’s requirements.

- Contractor shall provide all equipment, supplies, and materials needed to perform the Services.

- Contractor is responsible for paying all taxes, social security, unemployment insurance, and other charges as may be required by law for the Contractor's employees or contract personnel.

Confidentiality

In the course of performing the Services, the Contractor may have access to the Client's confidential information. The Contractor agrees not to disclose any of the Client's confidential information to any third party without the prior written consent of the Client.

Termination

Either Party may terminate this Agreement at any time by providing ________ days written notice to the other Party. Upon termination, the Contractor shall be compensated for any Services completed to the satisfaction of the Client but not yet paid for.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Arizona, without regard to its conflict of law principles.

Signatures

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date:

Contractor's Signature: _____________________________________ Date: _________________________

Client's Signature: _________________________________________ Date: _________________________

Document Details

| Fact | Detail |

|---|---|

| Definition of Independent Contractor in Arizona | An independent contractor is typically a person or entity engaged in a work agreement to perform services for another entity as a non-employee. |

| Governing Laws | The agreement is governed by the laws of the State of Arizona, including but not limited to the Arizona Revised Statutes. |

| Tax Implications | Independent contractors are responsible for their own federal and state taxes, including Arizona income tax. |

| Liability and Risk | Independent contractors in Arizona assume the risk for profit or loss in their business, distinguishing them from employees. |

| Work Relationship | The form clarifies that the relationship between the party hiring and the contractor is not that of an employer/employee, creating no entitlements to employment benefits. |

| Customizable Nature of the Agreement | The Arizona Independent Contractor Agreement can be tailored to fit the specific terms agreed upon by the hiring party and the contractor, including payment, duration, and services to be provided. |

Instructions on Utilizing Arizona Independent Contractor Agreement

Filling out the Arizona Independent Contractor Agreement form is crucial for establishing the rights and responsibilities of both the independent contractor and the hiring party. This document serves as a legal agreement that outlines the nature of the work, payment details, confidentiality clauses, and termination conditions among other essential terms. Completing this form accurately is vital to ensure that both parties are protected and have a clear understanding of the contractual relationship. The following steps are designed to guide you through this process efficiently.

- Begin by providing the full legal names and addresses of the parties involved; this includes the entity or individual hiring the independent contractor and the independent contractor themselves.

- Describe in clear detail the services that the independent contractor is being hired to perform. Be specific to avoid ambiguity and potential disputes.

- Specify the duration of the agreement. Indicate the start date and, if applicable, the end date of the contract. If the duration is project-based, describe the conditions under which the contract will be considered complete.

- Outline the compensation terms. State how much and how often the independent contractor will be paid. Include any conditions related to expenses, bonuses, or other compensation elements.

- Detail the terms related to confidentiality, non-disclosure, and non-compete clauses, if applicable. Clearly specify what information is considered confidential and the responsibilities of the independent contractor to protect it.

- Include a clause about the ownership of work product. This section should define who owns the intellectual property created by the independent contractor during the course of the agreement.

- Address termination conditions. Clearly state how either party can terminate the agreement and any notice period required.

- Discuss any applicable legal requirements or conditions, such as insurance, licenses, or permits needed to perform the contracted work.

- Ensure both parties have space to sign and date the agreement, validating its terms. Digital or electronic signatures may also be acceptable, depending on state laws.

- Finally, consider having the agreement reviewed by legal counsel to ensure it complies with Arizona laws and adequately protects your interests.

Once the form is filled out, both parties should keep a copy for their records. Remember, this agreement serves as a binding legal document that can be referenced in case of any disputes or discrepancies relating to the contracted services. Should changes to the agreement be necessary, ensure they are made in writing and signed by both parties. Prompt attention to the accurate completion and review of this form will help establish a successful and legally sound working relationship.

Listed Questions and Answers

What is an Arizona Independent Contractor Agreement?

An Arizona Independent Contractor Agreement is a legal document that outlines the working arrangement between an independent contractor and their client. This type of agreement specifies the services to be provided, compensation, duration of the contract, and other terms that govern the professional relationship. Signing this agreement helps both parties by clearly defining their roles, expectations, and responsibilities.

Who needs an Arizona Independent Contractor Agreement?

Any individual or business entity in Arizona that intends to hire an independent contractor to complete a specific project or task should use an Independent Contractor Agreement. Similarly, any self-employed person or entity providing services to a client in Arizona will benefit from having this agreement in place to ensure clarity and legal protection.

What information should be included in the agreement?

An effective Arizona Independent Contractor Agreement should include details such as the names and contact information of the parties involved, a comprehensive description of the services to be provided, payment terms and conditions, the contract's duration, confidentiality clauses, and terms for termination. It's also important to outline any specific legal or regulatory compliance requirements related to the work being performed.

Is an Independent Contractor Agreement legally binding?

Yes, once signed by both the independent contractor and the client, the Arizona Independent Contractor Agreement becomes a legally binding document. Both parties are then obligated to adhere to its terms and conditions, making it an essential tool for avoiding misunderstandings and potential disputes.

Can you modify an Independent Contractor Agreement after it’s been signed?

Modifications to an Arizona Independent Contractor Agreement can be made after it has been signed, but any changes require the agreement and signature of both parties. It's typically best to document these amendments clearly and attach them to the original agreement.

How do you terminate an Independent Contractor Agreement in Arizona?

The process for terminating an Arizona Independent Contractor Agreement should be outlined in the agreement itself. This often includes conditions under which the agreement can be terminated, required notice periods, and any responsibilities or liabilities upon termination. Following these provisions is crucial for a smooth separation.

Does an Independent Contractor Agreement need to be notarized in Arizona?

While notarization is not a requirement for an Independent Contractor Agreement in Arizona to be legally binding, doing so can add an extra layer of validity and help protect against disputes regarding the authenticity of the signatures.

Are verbal agreements considered legal in Arizona for independent contracting?

Verbal agreements can be legally binding in Arizona; however, proving the existence and terms of a verbal agreement can be extremely difficult. For clarity, security, and ease of enforcement, a written Independent Contractor Agreement is highly recommended.

How can one ensure that an Independent Contractor Agreement is enforceable in Arizona?

To ensure the enforceability of an Independent Contractor Agreement in Arizona, make sure the document is clear, detailed, and signed by both parties. It should comply with all relevant laws and regulations, including those related to labor, taxation, and confidentiality. Consulting with a legal professional to review the agreement can also help ensure it meets all legal criteria.

What are the tax implications of hiring an independent contractor under such an agreement in Arizona?

When hiring an independent contractor in Arizona, the client is not responsible for withholding income taxes or paying Social Security, Medicare, and unemployment taxes as they would for an employee. Instead, independent contractors are considered self-employed and are responsible for managing and paying their taxes, including federal and state income taxes and self-employment taxes. Clients may need to file certain forms with the IRS, like the Form 1099-MISC, to report payments made to independent contractors.

Common mistakes

In drafting an Arizona Independent Contractor Agreement, individuals often navigate a complex field of stipulations and legal requirements. This document, critical in defining the relationship between a contractor and a client, must be meticulously completed to avoid future disputes and legal complications. Here, we explore nine common mistakes people make when filling out this form:

-

Not specifying the scope of work - A clear description of the services to be provided is essential. Vague or incomplete descriptions can lead to misunderstandings about the responsibilities of the contractor.

-

Failing to detail the payment terms - This includes the amount, method, and schedule of payments. It is crucial to outline these terms explicitly to prevent disputes over financial matters.

-

Omitting the duration of the agreement - The start and end dates set the timeframe for the contractual relationship. Without this, it's challenging to enforce the terms of the contract.

-

Ignoring state-specific legal requirements - Arizona may have unique laws affecting independent contractor agreements. Overlooking these can result in a non-compliant agreement.

-

Forgetting to include a termination clause - This outlines how either party can end the contract before the completion of the work. Without it, terminating the agreement can become legally complicated.

-

Skipping over indemnification clauses - Such clauses protect against losses and damages caused by the contractor's services. Their absence can leave a client vulnerably exposed.

-

Not defining the relationship - Clearly stating that the contractor is not an employee is fundamental. This distinction affects tax obligations and legal responsibilities.

-

Lack of a confidentiality clause - Protecting sensitive information is crucial in many professional agreements. Without this clause, there's no legal recourse for the unauthorized sharing of proprietary data.

-

Forgetting to include dispute resolution methods - Specifying how disputes will be handled can save both parties time and resources. Without this, resolving disagreements can be more complicated and expensive.

Successfully navigating these pitfalls requires attention to detail and a good understanding of both parties' needs. By carefully reviewing and accurately completing the Arizona Independent Contractor Agreement form, individuals ensure that the groundwork for a clear and professional working relationship is laid, thereby minimizing potential legal issues down the line.

Documents used along the form

When engaging with an independent contractor in Arizona, creating a comprehensive contractual agreement is just the first step. To ensure a smooth collaboration and adherence to legal and financial guidelines, several additional documents often accompany the Arizona Independent Contractor Agreement form. These documents help to clarify the roles, responsibilities, and expectations of all parties involved. They contribute to a structured and legally sound working relationship.

- W-9 Form: This IRS form is used by the hiring company to collect tax identification numbers from contractors, which is necessary for tax reporting purposes. It verifies the contractor's legal name and Taxpayer Identification Number (TIN).

- Non-Disclosure Agreement (NDA): An NDA protects confidential information. It ensures that sensitive business details shared with the contractor during the course of their work won’t be disclosed to unauthorized parties.

- Scope of Work (SoW) Documentation: This document provides a detailed description of the services the contractor will perform, including tasks, deliverables, timelines, and any specific standards or requirements. It helps manage expectations and reduce disputes.

- Independent Contractor Policy Acknowledgment: This form acknowledges that the contractor has received, understood, and agreed to comply with the company's policies for contractors. It often covers topics such as data privacy, security practices, and professional conduct.

- 1099-MISC Form: At the end of the tax year, companies must issue this form to any contractor they have paid $600 or more. It reports the income paid to the contractor to the IRS.

- Business Licenses and Permits: Depending on the contractor’s profession and the nature of the work being performed, local, state, or federal licenses or permits may be required to legally carry out the work.

- Contract Amendment Form: If changes to the original independent contractor agreement are needed, a contract amendment form should be used. This document outlines any modifications agreed upon by both parties, ensuring the agreement remains accurate and current.

In conclusion, assembling the right set of documents along with the Arizona Independent Contractor Agreement form can significantly impact the efficiency and legality of working relationships with independent contractors. It not only provides a clear framework for the project but also safeguards the interests of both parties involved. Ensuring these documents are in order adds an extra layer of professionalism and compliance to any independent contracting arrangement.

Similar forms

The Arizona Independent Contractor Agreement form shares similarities with an Employment Agreement, primarily in how it defines the relationship between the parties involved. Both documents outline the responsibilities, duties, and compensation for work performed. The key difference lies in the nature of the relationship: an Employment Agreement establishes an employer-employee relationship, including benefits and tax withholdings, whereas an Independent Contractor Agreement sets the stage for a service provider to operate more autonomously, without the typical employer-provided benefits and with the contractor responsible for their own taxes.

Similarly, a Non-Disclosure Agreement (NDA) bears resemblance to aspects of the Arizona Independent Contractor Agreement, especially in terms of confidentiality clauses. Both documents often include provisions to protect sensitive information, trade secrets, and other proprietary data from being disclosed to third parties. The inclusion of these clauses ensures that any confidential information accessed during the course of the work remains secure, although the NDA focuses more exclusively on the aspect of non-disclosure, regardless of the working relationship.

A Services Agreement is another document that bears a resemblance to the Independent Contractor Agreement, with both serving to outline the terms of service provision, including scope of work, duration, payment terms, and conditions for termination. The main distinction often lies in their applicability; Services Agreements can be used for both individual contractors and companies providing services, offering a broader scope of application compared to the specific contractor-client relationship established in an Independent Contractor Agreement.

Consulting Agreements are closely related to the Independent Contractor Agreement as well, with both types of documents commonly used by professionals who offer specialized expertise. These agreements outline the nature of the consulting services to be provided, compensation, duration, and confidentiality obligations, among other terms. The emphasis in Consulting Agreements on the provision of expert advice align for the most part with Independent Contractor Agreements, especially when the contractor's role involves consulting services.

Lastly, the Master Service Agreement (MSA) shares features with the Independent Contractor Agreement, as it sets forth a contractual foundation for ongoing services between a service provider and a client. MSAs detail the general terms and conditions under which the services will be provided, often leaving specific work orders to define individual projects or tasks. While an MSA establishes the framework for a long-term relationship covering multiple projects, the Independent Contractor Agreement typically focuses on the terms for a single project or a defined series of tasks.

Dos and Don'ts

When it comes to filling out the Arizona Independent Contractor Agreement form, making sure everything is done correctly is key to setting a clear, legally binding agreement between the contractor and the client. Here's a straightforward guide to ensure you're on the right track:

Do's:

- Provide complete and accurate information about both the contractor and the client, including full legal names, addresses, and contact details.

- Clearly outline the scope of work to be performed, including any specific projects, deadlines, and deliverables. This clarity helps prevent misunderstandings down the line.

- Specify payment details such as amount, payment schedule, and method. This is crucial for a smooth financial relationship between the parties.

- Include signatures from both parties with the date. This validates the agreement, making it legally binding and enforceable.

Don'ts:

- Leave any sections incomplete. Missing information can lead to disputes and may affect the enforceability of the agreement.

- Forget to specify whether the relationship is ongoing or for a fixed term. This detail affects responsibilities and expectations.

- Ignore state-specific laws and provisions. Arizona law may have unique requirements for independent contractors that need to be reflected in the agreement.

- Use overly complex or legalistic language unnecessarily. Keeping the agreement clear and understandable ensures both parties fully comprehend their obligations and rights.

Misconceptions

When discussing the Arizona Independent Contractor Agreement form, it's important to address common misconceptions that can lead to confusion. This document, crucial for defining the relationship between a contractor and their client, often suffers from misunderstandings regarding its nature, contents, and legal implications. Below are six misconceptions that merit clarification:

- One-size-fits-all: Many believe that an Independent Contractor Agreement form in Arizona is standardized, usable in any situation without modifications. Each agreement should be customized to reflect the specifics of the individual working relationship, including terms around scope of work, payment, and confidentiality, to avoid legal issues down the line.

- Legal jargon is a must: It's a common misconception that these agreements must be filled with legal jargon to be valid. Clarity is key in any legal document. The agreement should be written in plain language to ensure that both parties fully understand their rights and obligations.

- Not necessary for short-term projects: Some assume that an Independent Contractor Agreement is unnecessary for short-term projects. Regardless of the project's duration, this formal agreement helps prevent misunderstandings by clearly delineating the scope of work, compensation, and other critical terms.

- It provides employment rights: There's a misconception that entering into an Independent Contractor Agreement grants the contractor the same rights and benefits as an employee. Independent contractors typically do not receive employee benefits and are responsible for their own taxes and insurance.

- Only benefits the client: Another misconception is that the agreement solely benefits the client. In reality, a well-drafted agreement offers protection to both parties, outlining expectations clearly and providing a legal framework to address disputes should they arise.

- Signing is enough: Simply signing an Independent Contractor Agreement does not automatically ensure compliance with all relevant laws. Both parties must adhere to the terms of the agreement and all applicable state and federal regulations, including those regarding independent contractor classification.

Understanding these misconceptions is crucial for both parties entering an Independent Contractor Agreement in Arizona. By addressing these misunderstandings, both contractors and their clients can create a more effective and legally sound working relationship.

Key takeaways

When handling the Arizona Independent Contractor Agreement form, it's crucial to pay attention to several key aspects that ensure the contract is legally binding and protects both parties involved. Here are eight essential takeaways:

- Clearly define the relationship: The document should explicitly state that the individual is being hired as an independent contractor, not an employee. This distinction affects taxes, benefits, and legal liabilities.

- Detail the scope of work: Clearly outline what services the contractor is expected to perform. This clarity helps prevent misunderstandings and sets clear expectations.

- Compensation and payment terms: Specify how much and when the contractor will be paid. Whether it's a flat fee, hourly rate, or contingent upon certain deliverables, being precise helps avoid disputes.

- Duration of the agreement: State the starting date and whether the contract is for a specific project or ongoing. If it's project-based, mention the expected completion date or conditions that signify the end of the contract.

- Confidentiality and non-disclosure: If the contractor will have access to sensitive information, include a clause to protect your business secrets and data.

- Materials and equipment: Clarify who is responsible for supplying the tools and materials required for the job. For an independent contractor, typically, they use their own resources.

- Liability and insurance: It's important to state who bears the risk for job-related accidents or errors. Often, independent contractors carry their own insurance.

- Termination of agreement: Define how either party can end the contract before the work is completed. Include notice periods and any conditions for early termination.

By taking these points into account, the Arizona Independent Contractor Agreement form will serve as a robust framework that guides the working relationship, ensuring clarity and legal compliance for both parties.

Create Popular Templates for Arizona

Divorce Settlement Template - It’s a written agreement that details how divorcing couples have decided to manage their assets, liabilities, and child support.

Hold Harmless Indemnity Agreement - In construction projects, Hold Harmless Agreements can protect contractors from liabilities related to workplace accidents and injuries.