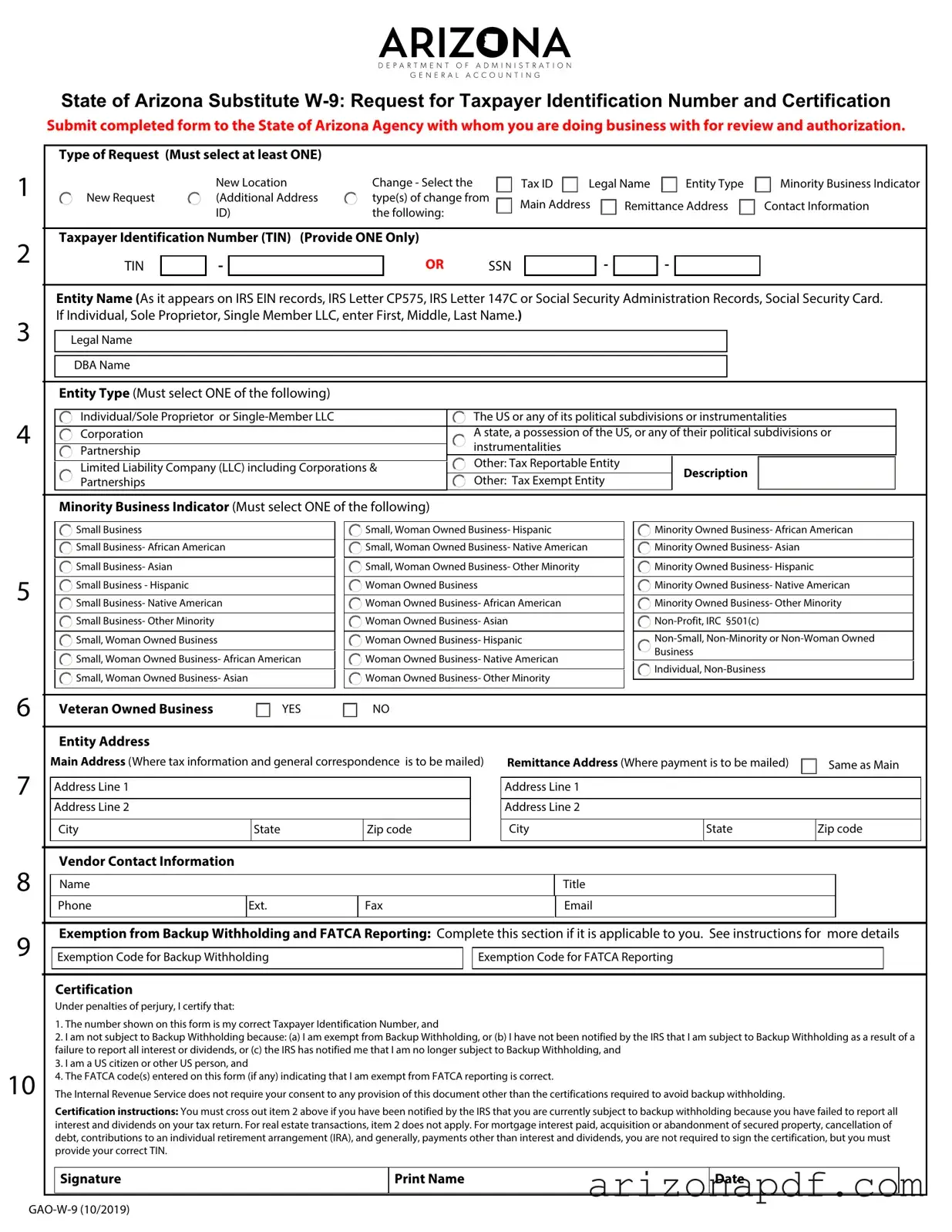

Fill in a Valid Gao W 9 Arizona Template

In today’s digital age, navigating paperwork required for financial and tax purposes remains a critical task for individuals and businesses alike. A prime example of this is the State of Arizona Substitute W-9: Request for Taxpayer Identification Number and Certification. This essential document plays a pivotal role in the business dealings within Arizona, ensuring that the correct taxpayer identification number (TIN) is on file to prevent backup withholding on payments. This form is utilized across a range of circumstances, from establishing a new location to changing a remittance address, and it requires careful attention to detail when selecting the appropriate type of request, whether it's a new submission or updating existing information. Businesses, including minority, woman-owned, and veteran-owned entities, must accurately provide their legal name, type of entity, and taxpayer identification number, which could either be a Social Security Number (SSN) or an Employer Identification Number (EIN). Additionally, the form includes provisions for indicating special statuses such as small business classification and various exemptions from backup withholding and FATCA reporting. The significance of the form is underscored by the need for certification under penalties of perjury that the information provided is correct and that the entity is in compliance with relevant IRS regulations. Failure to correctly complete the form can result in mandatory withholding of 28% of all payments, underlining the importance of this document in ensuring smooth financial operations with the State of Arizona.

Gao W 9 Arizona Preview

1

2

3

4

State of Arizona Substitute

Submit completed form to the State of Arizona Agency with whom you are doing business with for review and authorization.

Type of Request (Must select at least ONE)

|

|

New Location |

Change - Select the |

|

|

Tax ID |

|

Legal Name |

|

Entity Type |

|

|

Minority Business Indicator |

|||||||||

New Request |

|

(Additional Address |

type(s) of change from |

|

Main Address |

|

|

Remittance Address |

|

|

Contact Information |

|||||||||||

|

|

|

|

|

||||||||||||||||||

|

|

ID) |

the following: |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer Identification Number (TIN) (Provide ONE Only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

TIN |

|

|

|

OR |

SSN |

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

||

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Entity Name (As it appears on IRS EIN records, IRS Letter CP575, IRS Letter 147C or Social Security Administration Records, Social Security Card. If Individual, Sole Proprietor, Single Member LLC, enter First, Middle, Last Name.)

Legal Name

DBA Name

Entity Type (Must select ONE of the following)

|

Individual/Sole Proprietor or |

The US or any of its political subdivisions or instrumentalities |

|

|

|

|

|

|

Corporation |

A state, a possession of the US, or any of their political subdivisions or |

|

|

|

instrumentalities |

|

|

Partnership |

|

|

|

|

Other: Tax Reportable Entity |

|

|

Limited Liability Company (LLC) including Corporations & |

Description |

|

|

|||

|

|

||

|

Partnerships |

Other: Tax Exempt Entity |

|

|

|

||

Minority Business Indicator (Must select ONE of the following)

5

Small Business

Small Business

Small Business- African American

Small Business- African American

Small Business- Asian

Small Business- Asian

Small Business - Hispanic

Small Business - Hispanic

Small Business- Native American

Small Business- Native American

Small Business- Other Minority

Small Business- Other Minority

Small, Woman Owned Business

Small, Woman Owned Business

Small, Woman Owned Business- African American

Small, Woman Owned Business- African American

Small, Woman Owned Business- Asian

Small, Woman Owned Business- Asian

Small, Woman Owned Business- Hispanic

Small, Woman Owned Business- Hispanic

Small, Woman Owned Business- Native American

Small, Woman Owned Business- Native American

Small, Woman Owned Business- Other Minority

Small, Woman Owned Business- Other Minority

Woman Owned Business

Woman Owned Business

Woman Owned Business- African American

Woman Owned Business- African American

Woman Owned Business- Asian

Woman Owned Business- Asian

Woman Owned Business- Hispanic

Woman Owned Business- Hispanic

Woman Owned Business- Native American

Woman Owned Business- Native American

Woman Owned Business- Other Minority

Woman Owned Business- Other Minority

Minority Owned Business- African American

Minority Owned Business- African American

Minority Owned Business- Asian

Minority Owned Business- Asian

Minority Owned Business- Hispanic

Minority Owned Business- Hispanic

Minority Owned Business- Native American

Minority Owned Business- Native American

Minority Owned Business- Other Minority

Minority Owned Business- Other Minority

Non-Profit,

Non-Profit,

Individual,

Individual,

6

7

8

9

10

|

Veteran Owned Business |

|

|

|

YES |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entity Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Main Address (Where tax information and general correspondence is to be mailed) |

Remittance Address (Where payment is to be mailed) |

|

Same as Main |

||||||||||||

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Line 1 |

|

|

|

|

|

|

|

|

Address Line 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Line 2 |

|

|

|

|

|

|

|

|

Address Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City |

|

State |

|

|

Zip code |

|

City |

State |

|

Zip code |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vendor Contact Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Phone |

Ext. |

|

|

Fax |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exemption from Backup Withholding and FATCA Reporting: Complete this section if it is applicable to you. See instructions for more details

Exemption Code for Backup Withholding |

|

Exemption Code for FATCA Reporting |

|

|

|

Certification

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct Taxpayer Identification Number, and

2.I am not subject to Backup Withholding because: (a) I am exempt from Backup Withholding, or (b) I have not been notified by the IRS that I am subject to Backup Withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to Backup Withholding, and

3.I am a US citizen or other US person, and

4.The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

Certification instructions: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN.

Signature |

Print Name |

Date |

|

|

|

The State of Arizona Substitute

The State of Arizona (State), like all organizations that file an information return with the IRS, must obtain your correct Taxpayer Identification Number (TIN) to report income paid to you or your organization. The State uses the Substitute

Part 1 - Type of Request: Select only one.

Part 2 - Taxpayer Identification Number (TIN): Enter your

Part 3 - Entity Name: Enter the legal name as it appears on IRS EIN records, IRS Letter CP575, IRS Letter 147C or Social Security Administration Records, Social Security Card. If Individual, Sole Proprietor, Single Member LLC, enter First, Middle, Last Name. Enter your DBA in the designated line if applicable.

Part 4 - Entity Type: Select only one for TIN given.

Part 5 - Minority Business Indicator: Select only one for TIN given.

Part 6 - Veteran Owned Business: Select only one for TIN given.

Part 7 - Entity Address: List the locations for tax reporting purposes and where payments should be mailed.

Part 8 - Entity Contact Information: List the contact information.

Part 9 - Backup Withholding and FATCA Exemptions: If you are exempt from Backup Withholding and/or FATCA reporting, enter in the Exemptions box, any code(s) that may apply to you.

Backup Withholding Exemption Codes: Generally, Individuals (including Sole Proprietors) are not exempt from Backup Withholding. Additionally, Corporations are not exempt from Backup Withholding when supplying legal or medical services. If you do not fall under the categories below, leave this field blank. The following codes identify payees that are exempt from Backup Withholding:

Code 1: An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b) (7) if the account satisfies the requirements of section 401(f) (2)

Code 2: The United States or any of its agencies or instrumentalities

Code 3: A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or Instrumentalities

Code 4: A foreign government or any of its political subdivisions, agencies, or instrumentalities

Code 5: A corporation

Code 6: A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States Code 7: A futures commission merchant registered with the Commodity Futures Trading Commission

Code 8: A real estate investment trust

Code 9: An entity registered at all times during the tax year under the Investment Company Act of 1940

Code 10: A common trust fund operated by a bank under section 584(a)

Code 11: A financial institution

Code 12: A middleman known in the investment community as a nominee or custodian

Code 13: A trust exempt from tax under section 664 or described in section 4947

FATCA Exemption Codes: The following codes identify payees that are exempt from reporting under FATCA. These codes apply to persons submitting this form for accounts maintained outside of the United States by certain foreign financial institutions. If you are only submitting this form for an account you hold in the United States, leave this field blank. The following codes identify payees that are exempt from FATCA Reporting:

Code A: An organization exempt from tax under section 501(a) or any individual retirement plan as defined in section 7701(a) (37)

Code B: The United States or any of its agencies or instrumentalities

Code C: A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or instrumentalities

Code D: A corporation the stock of which is regularly traded on one or more established securities markets, as described in Reg. section

Code E: A corporation that is a member of the same expanded affiliated group as a corporation described in Reg. section

Code F: A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any state

Code G: A real estate investment trust

Code H: A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940

Code I: A common trust fund as defined in section 584(a)

Code J: A bank as defined in section 581 Code K: A broker

Code L: A trust exempt from tax under section 664 or described in section 4947(a) (1)

Code M: A

Part 10 - Certification: Please sign, date and provide preparer's name in appropriate space.

File Properties

| Fact | Detail |

|---|---|

| Purpose | The State of Arizona uses the Substitute W-9 Form to request a taxpayer's identification number and certification for accurate payee/vendor information and to avoid IRS mandated Backup Withholding. |

| Type of Request Options | Options include a new request, location change, or additional address types. At least one option must be selected. |

| Required Information | Taxpayer needs to provide either a Social Security Number (SSN) or an Employer Identification Number (EIN) along with the legal name, DBA name if applicable, and the entity type. |

| Entity Types | Includes Individuals, Corporations, Partnerships, Limited Liability Companies, and multiple tax-exempt or minority business indicators. |

| Exemption from Backup Withholding and FATCA Reporting | Individuals must complete this section if applicable, entering any codes that exempt them from Backup Withholding and FATCA Reporting. |

| Governing Laws | The form is governed by IRS regulations requiring a 28% withholding of all payments if a certified TIN is not provided by the vendor/payee. Specific exemptions and certifications are outlined to comply with these regulations. |

Instructions on Utilizing Gao W 9 Arizona

Filling out the GAO W-9 Arizona form is an important process for individuals and organizations needing to provide their Taxpayer Identification Number (TIN) to the State of Arizona. This form is necessary for ensuring that all financial transactions, payments, and reporting duties are accurately executed to comply with tax laws. Whether you're starting a new collaboration with the State or updating your current information, the steps below guide you through completing the form correctly.

- Under "Type of Request," select the box that best describes the nature of your submission (e.g., New Request, Location Change).

- For the "Taxpayer Identification Number (TIN)," input either your Social Security Number (SSN) or Employer Identification Number (EIN) in the space provided.

- In the "Entity Name" section, write your legal name exactly as it appears on your IRS records or Social Security card. If applicable, also provide your Doing Business As (DBA) name.

- Choose the correct "Entity Type" that applies to you from the options given (e.g., Individual/Sole Proprietor, Corporation).

- Select the appropriate "Minority Business Indicator" that represents your business status, if applicable.

- For "Veteran Owned Business," indicate Yes or No.

- Under "Entity Address," provide your main address for tax information and correspondence. If your remittance address is different, fill it in as well; otherwise, select "Same as Main Address."

- Enter the "Vendor Contact Information," including name, title, phone number, extension (if any), fax, and email address.

- If applicable, enter any "Exemption Code" for Backup Withholding and FATCA Reporting. Review the list of exemption codes and their qualifications carefully before entering your applicable code(s).

- Sign and date the form under "Certification." If you've been notified by the IRS that you're subject to backup withholding but this no longer applies, cross out the second item in the certification statement before signing.

After completing the form with accurate information, submit it to the State of Arizona agency you are conducting business with. They will review the form for authorization and ensure that your financial transactions are processed in alignment with state and federal requirements.

Listed Questions and Answers

What is the purpose of the GAO W-9 Arizona form?

The GAO W-9 Arizona form, known as the State of Arizona Substitute W-9: Request for Taxpayer Identification Number and Certification, is utilized to certify a vendor or payee's Taxpayer Identification Number (TIN) to the State of Arizona. This certification helps ensure the accuracy of information in the state's payee/vendor system and to avoid Backup Withholding as mandated by the IRS. Any vendor or payee who wishes to conduct business with the State of Arizona must complete this form.

What Taxpayer Identification Number (TIN) should be provided on the form?

On the form, you should enter your nine-digit Taxpayer Identification Number (TIN), which can be either your Social Security Number (SSN) assigned by the Social Security Administration (SSA) or your Employer Identification Number (EIN) assigned by the Internal Revenue Service (IRS).

Can an individual or sole proprietor use this form?

Yes, individuals or sole proprietors, including single-member LLCs, can use this form. When doing so, they must enter their first name, middle name, and last name as it appears on IRS or Social Security Administration records.

What should I do if my business is a minority-owned or woman-owned entity?

If your business is a minority-owned or woman-owned entity, you should select the appropriate Minority Business Indicator on the form. There are multiple categories available, including small business, veteran-owned, and various minority and woman-owned designations. Choose the one that accurately reflects your business status.

What is the significance of selecting an entity type on the GAO W-9 Arizona form?

Selecting an entity type on the form is critical because it informs the State of Arizona about the nature of your business or organization for tax and reporting purposes. The options include individual/sole proprietor, corporation, partnership, limited liability company, and more. Your selection should match the entity classification used in your tax filings with the IRS.

What happens if I don't provide a correct TIN on the form?

Failing to provide a correct TIN on the form may result in the State of Arizona withholding 28% of all payments due to you or your organization. This withholding is in compliance with IRS regulations to ensure accurate tax reporting and to prevent tax evasion.

How do I claim exemption from backup withholding and FATCA reporting?

If you are exempt from backup withholding and/or the Foreign Account Tax Compliance Act (FATCA) reporting, you must complete the exemptions section on the form. This includes entering any applicable exemption code(s) for your specific situation based on the guidelines provided in the form's instructions.

What address should I use for the remittance address section?

For the remittance address section, you should provide the address where you wish to receive payment. This can be the same as your main business address or a different address designated for receiving payments.

What entity contact information is required on the form?

The form requires you to list contact information for your business or organization, including the name and title of the contact person, phone number, fax number, and email address. This information is used by the State of Arizona for communication purposes related to your vendor/payee account.

How do I complete the certification portion of the GAO W-9 Arizona form?

The certification portion of the form must be signed and dated by the person completing the form. By signing, you are certifying under penalties of perjury that the TIN provided is correct, that you are not subject to backup withholding, and that you are a U.S. citizen or other U.S. person. If you are subject to backup withholding due to IRS notification, you are required to cross out the relevant section before signing.

Common mistakes

When filling out the State of Arizona Substitute W-9 form, providing accurate and complete information is crucial for ensuring compliance with tax reporting and withholding requirements. Unfortunately, mistakes can occur, leading to delays or issues with payment processing. Here are seven common mistakes people make:

- Not selecting the correct type of request: The form requires the identification of the request type, such as a new request or a change to existing information. Failure to select at least one option can result in processing delays.

- Incorrect Taxpayer Identification Number (TIN) or Social Security Number (SSN): Providing an incorrect nine-digit TIN or SSN is a significant error. This number must match the individual or entity's records exactly as they appear in IRS or Social Security Administration documentation.

- Misidentifying the entity type: The form requires the entity type to be specified clearly, whether an individual/sole proprietor, corporation, partnership, etc. Selecting the wrong entity type can lead to tax reporting and withholding issues.

- Leaving the minority business indicator blank or selecting incorrectly: This indicator helps in identifying the business category for state reporting purposes. Incorrect selection or omission can affect eligibility for certain programs or initiatives.

- Using informal or DBA names instead of legal names: It's important to use the legal name as it appears on IRS or Social Security Administration records. Using a 'Doing Business As' (DBA) name without including the legal name can create discrepancies in records.

- Incorrect address for tax reporting or payment mailing: Providing an inaccurate main or remittance address can lead to misdirected tax documents or payments, causing unnecessary complications.

- Not applying exemption codes properly: If exempt from backup withholding or FATCA reporting, the appropriate exemption codes must be applied correctly. Not doing so, or incorrectly applying these codes, can lead to unnecessary withholding or reporting.

Here is a summary of additional tips to avoid these mistakes:

- Before submitting, double-check the form for accuracy and completeness.

- Ensure the TIN or SSN provided matches the IRS or Social Security Administration documentation exactly.

- Review the entity type options carefully and select the one that accurately describes your situation.

- Use the legal name associated with your TIN or SSN, not just your DBA name.

- Provide accurate and current addresses for both tax reporting and payments to avoid delays.

- Understand the implications of your minority business indicator selection and choose accordingly.

- Consult the instructions provided with the form for clarity on exemption codes and other details if in doubt.

By avoiding these common mistakes and following the tips provided, individuals and entities can ensure smoother interactions with the State of Arizona, preventing delays and issues with tax reporting and payments.

Documents used along the form

When engaging in business affairs, particularly with the State of Arizona, providing the correct documentation is crucial for legal and financial accuracy. The State of Arizona Substitute W-9 form is just one example of important documentation used to certify a business or individual's Taxpayer Identification Number (TIN) for tax reporting purposes. However, this document does not stand alone. Various other forms and documents are often needed alongside it, each serving a distinct function in the broader context of legal, financial, and organizational operations.

- IRS Form W-8BEN: Used by foreign individuals to certify their non-U.S. status and claim any applicable treaty benefits for tax withholding purposes.

- IRS Form 1099-MISC: Issued by businesses to report payments made in the course of a trade or business to others who are not employees.

- IRS Form 941: Employers use this form to report income taxes, social security tax, or Medicare tax withheld from income payments to employees.

- Direct Deposit Authorization Form: Used to allow businesses to deposit funds directly into a bank account, often required for vendor setup alongside the W-9.

- Business License: A legal document provided by local governments that allows a business to operate within a specific jurisdiction.

- Articles of Incorporation: Filed with a governmental body to legally document the creation of a corporation, often needed alongside the W-9 for tax identification purposes.

- Operating Agreement for LLCs: A document used by LLCs to outline the business' financial and functional decisions including rules, regulations, and provisions. It is important when establishing entity type for tax purposes.

- Contract or Purchase Order: Documents detailing agreements between parties for the supply of goods or services, often necessitating the submission of a W-9 for tax reporting.

- IRS Form 8821 or 2848: Authorizes an individual or organization to represent the taxpayer before the IRS, allowing actions like obtaining and inspecting confidential tax information.

- Proof of Insurance: Documentation verifying that a business or individual holds a valid insurance policy, often required in contractual agreements to mitigate risk.

Together, these documents support the nuances of business operations, compliance, and financial integrity. From establishing a business’s legal entity and ensuring its authorization to operate, to managing tax obligations and enabling financial transactions, each document plays a vital role. Whether you are a contractor, supplier, or engaging in any form of business with the State of Arizona or elsewhere, having these documents in order can simplify processes, ensure compliance, and facilitate smoother business relationships.

Similar forms

The IRS Form W-9 is directly related to the State of Arizona Substitute W-9 Form in its primary function: both forms request a Taxpayer Identification Number (TIN) and certification from the individual or entity providing it. While the IRS Form W-9 is used across the United States for various purposes such as freelance work, bank account openings, or other instances where tax reporting on payments is required, the State of Arizona Substitute W-9 specifically caters to individuals or entities engaging in business with a state agency within Arizona. Thus, both serve the purpose of ensuring accurate tax identification and reporting, albeit at different governmental levels.

Another similar document is the IRS Form W-8BEN, which is used by foreign individuals to certify theirnon-U.S. status and claim any applicable benefits under a tax treaty. Similar to the Substitute W-9, the Form W-8BEN gathers information to ensure correct tax withholding and reporting. However, it's distinct in that it applies to nonresident aliens and foreign entities participating in U.S. financial transactions, highlighting the global dimension of tax reporting versus the state-specific substitute W-9 requirements in Arizona.

The Form 1099-MISC is an informational tax form used by businesses to report payments made in the course of a trade or business to non-employees. Like the Substitute W-9, it plays a crucial role in accurate tax reporting, ensuring the IRS receives information on miscellaneous income. However, while the Substitute W-9 is used to collect data from contractors or entities for future reporting, the Form 1099-MISC is the mechanism through which income is actually reported to the IRS and to the payee.

Form 1099-NEC, reintroduced by the IRS in the 2020 tax year, replaces the Form 1099-MISC for reporting nonemployee compensation. It bears similarity to the Substitute W-9 as both are integral to the process of reporting payments to individuals and entities that are not employees. The Substitute W-9 collects taxpayer information upfront, which is then used by an entity to fill out a Form 1099-NEC for actual income reporting purposes, streamlining compliance with IRS regulations.

The IRS Form 8822, Change of Address, parallels the Substitute W-9 in its role of ensuring up-to-date information within government systems. While the Substitute W-9 may include address information as part of its taxpayer identification process, Form 8822 is specifically designed for individuals or businesses to report a change of address. Accurate address information is pivotal for both forms to ensure timely communication and compliance with tax obligations.

The SS-4 Form, Application for Employer Identification Number (EIN), shares its objective with the Substitute W-9 of correctly identifying entities for tax purposes. Business entities use Form SS-4 to apply for an EIN, a number that they might later provide on a Substitute W-9 when doing business with the State of Arizona or other parties that require identification for tax-reporting purposes. Both forms contribute to a comprehensive system of tax identification and reporting.

Lastly, the IRS Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, is somewhat analogous to the Substitute W-9. Both forms allow individuals to certify certain tax-related information to avoid unnecessary withholding. The Form 8233 specifically applies to nonresident aliens claiming exemption from withholding on compensation, based on tax treaty benefits, showcasing the IRS's and Arizona state government's shared interest in correctly identifying tax obligations based on current tax status.

Dos and Don'ts

When you're tasked with filling out the Gao W 9 Arizona form, it's crucial to approach the task with an understanding of what the form is intended for. This form is essentially a request for your Taxpayer Identification Number (TIN) and certification, used by the State of Arizona to ensure accurate tax reporting and to avoid backup withholding. To help guide you through the process with ease, here's a list of dos and don'ts:

- Do carefully read all instructions provided with the form before beginning to fill it out. This ensures you understand each section and what is required.

- Do ensure the type of request is clearly marked, selecting at least one option that accurately describes the nature of your submission (e.g., New Request, Location Change).

- Do provide your Taxpayer Identification Number (TIN) accurately. Whether it's your Social Security Number (SSN) or Employer Identification Number (EIN), this is critical for proper identification and processing.

- Do enter your legal name or the name of your entity exactly as it appears on IRS EIN records, IRS Letter CP575, IRS Letter 147C, or your Social Security card to avoid discrepancies.

- Do select the correct entity type that applies to you or your organization, as this affects how your income is reported for tax purposes.

- Do provide accurate contact and address information, including a remittance address if it differs from the main address, to ensure you receive all correspondence and payments without delay.

- Do review the sections on Backup Withholding and FATCA exemptions, carefully entering any applicable codes if you are exempt.

- Do sign and date the form to certify the accuracy of the information provided and to attest to your compliance with the relevant tax laws.

- Don't leave any required fields blank. Incomplete forms can lead to processing delays or requests for additional information.

- Don't guess on any of the information. If you're uncertain about what to enter in any part of the form, seek guidance from a tax professional or the issuing agency.

Filling out the Gao W 9 Arizona form accurately and completely is crucial for conducting business with the State of Arizona. By following these dos and don'ts, you'll help ensure your information is processed smoothly and efficiently, facilitating a hassle-free business relationship with the state.

Misconceptions

Understanding the State of Arizona Substitute W-9 form (GAO-W-9) is crucial for entities and individuals conducting business with state agencies. However, there are common misconceptions that need clarification:

- Misconception 1: Any type of entity can omit selecting an entity type on the form. Reality: The form requires that an entity type be selected to properly identify the entity's tax classification.

- Misconception 2: It's optional to provide a Tax Identification Number (TIN) or Social Security Number (SSN). Reality: Providing a TIN or SSN is mandatory to avoid backup withholding and ensure accurate reporting to the IRS.

- Misconception 3: Only businesses need to fill out the GAO-W-9 form. Reality: Individuals, including sole proprietors or single-member LLCs, must also complete the form when engaging in activities that require tax reporting by the State.

- Misconception 4: The minority business indicator section is optional for all. Reality: While not all entities will qualify under this section, those that do should accurately indicate their minority business status as it may affect potential opportunities and reporting.

- Misconception 5: The form is used for reporting purposes outside of the State of Arizona. Reality: This form is specifically designed for entities doing business with the State of Arizona and its requirements may not align with other states or entities.

- Misconception 6: A new form must be completed for every transaction with the State. Reality: Generally, a single form is sufficient unless there’s a change in information such as entity name, address, or TIN.

- Misconception 7: Electronic signatures are not accepted. Reality: The State of Arizona typically accepts electronic signatures, aligning with modern document processing standards, but verify with the specific agency.

- Misconception 8: The Certification section is merely a formality. Reality: The certification under penalties of perjury confirms the accuracy of the information provided and its compliance with IRS regulations, thus it's critically important.

Ensuring the accurate completion of the GAO-W-9 form is vital for compliance and the efficient processing of transactions with the State of Arizona. Misunderstandings can lead to delays, the incorrect withholding of payments, or other compliance issues. It is always advised to review instructions carefully or seek clarification when uncertain about how to accurately complete the form.

Key takeaways

When completing the Gao W 9 Arizona form, it is essential to understand its purpose and the key sections that require careful attention. Here are six key takeaways to assist you in filling out and using the form effectively:

- Select the correct type of request from the options provided. This could be a new request, a location change, or a change in the taxpayer identification number (TIN) or legal name. Ensuring this is accurate is crucial for processing your form correctly.

- Provide your Taxpayer Identification Number (TIN) accurately. This is a nine-digit number that could either be your Social Security Number (SSN) or Employer Identification Number (EIN). Incorrect or missing TINs can lead to issues with your tax reporting and may result in backup withholding.

- Clearly state your entity name as registered with the IRS or Social Security Administration. If you operate under a different name (Doing Business As - DBA), ensure to include that information as well. This helps in verifying your identity and maintaining accurate records.

- Select your entity type carefully. Whether you are an individual/sole proprietor, a corporation, partnership, or any other entity type, this selection impacts how you are taxed and what information is required from you. Each entity type has different reporting and tax obligations.

- Indicate if your business qualifies as a minority or woman-owned business, a non-profit, or a veteran-owned business. The State of Arizona uses this information for demographic purposes and to potentially offer specific opportunities or benefits.

- Understand the importance of the certification section. By signing the certification, you are confirming that the information provided is correct and that you are compliant with IRS regulations concerning backup withholding and FATCA reporting. Incorrect certification can lead to penalties.

Ensuring the accuracy of the information provided on the Gao W 9 Arizona form is vital for legal compliance and to avoid potential issues with payment and tax reporting. Always review the details carefully before submission, and consult the detailed instructions provided with the form for any clarifications needed.

More PDF Forms

Paternity Test Arizona - By acknowledging paternity through this form, parents are taking a significant step towards securing their child's future and well-being.

Arizona Filing Requirements - Documentation supporting your request for abatement, such as medical reports or death certificates, should accompany your Form 290 submission.