Legal Arizona Deed in Lieu of Foreclosure Document

In Arizona, homeowners facing the daunting prospect of foreclosure have an alternative path that may offer a more graceful exit from their mortgage obligations: the Deed in Lieu of Foreclosure form. This legal document represents a mutual agreement between the lender and the borrower, where the borrower voluntarily transfers the title of their property back to the lender, effectively bypassing the traditional foreclosure process. This option not only helps homeowners avoid the lengthy and stressful foreclosure process but also potentially mitigates the impact on their credit scores. Understanding all the facets of this form is crucial, including eligibility criteria, potential tax implications, and the necessity for both parties to engage in comprehensive negotiations to ensure the agreement is fair and equitable. From the precise preparation to the formal execution, each step embodies a strategic maneuver to navigate away from financial turmoil while fostering a resolution conducive to both the lender and the homeowner's interests.

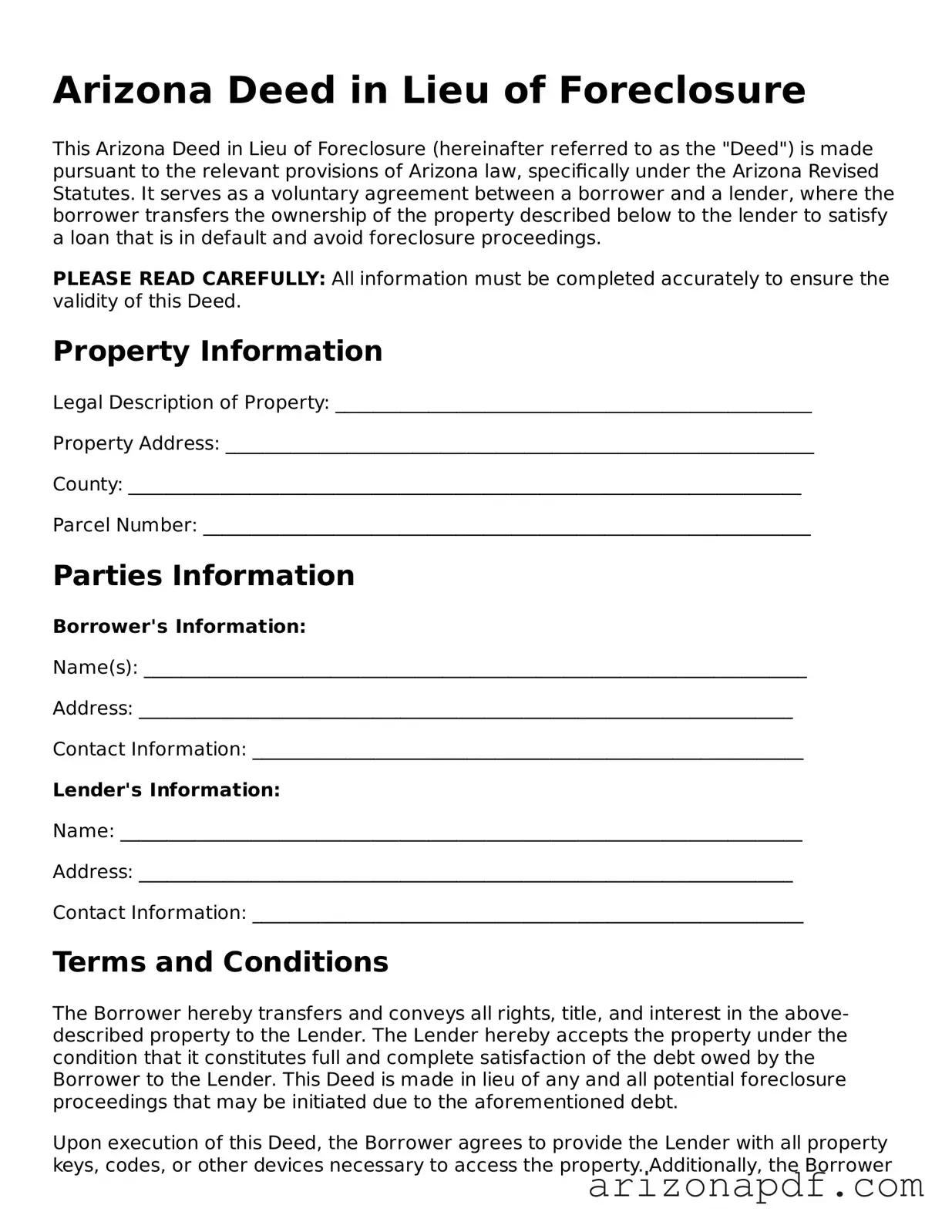

Arizona Deed in Lieu of Foreclosure Preview

Arizona Deed in Lieu of Foreclosure

This Arizona Deed in Lieu of Foreclosure (hereinafter referred to as the "Deed") is made pursuant to the relevant provisions of Arizona law, specifically under the Arizona Revised Statutes. It serves as a voluntary agreement between a borrower and a lender, where the borrower transfers the ownership of the property described below to the lender to satisfy a loan that is in default and avoid foreclosure proceedings.

PLEASE READ CAREFULLY: All information must be completed accurately to ensure the validity of this Deed.

Property Information

Legal Description of Property: ___________________________________________________

Property Address: _______________________________________________________________

County: ________________________________________________________________________

Parcel Number: _________________________________________________________________

Parties Information

Borrower's Information:

Name(s): _______________________________________________________________________

Address: ______________________________________________________________________

Contact Information: ___________________________________________________________

Lender's Information:

Name: _________________________________________________________________________

Address: ______________________________________________________________________

Contact Information: ___________________________________________________________

Terms and Conditions

The Borrower hereby transfers and conveys all rights, title, and interest in the above-described property to the Lender. The Lender hereby accepts the property under the condition that it constitutes full and complete satisfaction of the debt owed by the Borrower to the Lender. This Deed is made in lieu of any and all potential foreclosure proceedings that may be initiated due to the aforementioned debt.

Upon execution of this Deed, the Borrower agrees to provide the Lender with all property keys, codes, or other devices necessary to access the property. Additionally, the Borrower certifies that the property is free of all liens, claims, or encumbrances, except as specifically described herein.

Signatures

This Deed shall not be effective until signed by both the Borrower and the Lender. Upon signing, this Deed shall be recorded with the County Recorder's Office in the county where the property is located to ensure it becomes part of the public record.

IN WITNESS WHEREOF, the parties have set their hands and seals on this ______ day of _______________, 20____.

__________________________________

Borrower's Signature

__________________________________

Lender's Signature

Acknowledgment

This section requires notarization by a licensed notary public to verify the identities of both the Borrower and the Lender, ensuring that they signed this document willingly and under no duress.

State of Arizona

County of _______________________

Subscribed and sworn before me on this ______ day of _______________, 20____, by ____________________________ (Borrower) and ____________________________ (Lender).

__________________________________

Notary Public's Signature

My commission expires: _______________

Document Details

| Fact | Detail |

|---|---|

| Definition | A Deed in Lieu of Foreclosure form in Arizona allows a homeowner to transfer the ownership of their property to the lender voluntarily to avoid foreclosure proceedings. |

| Governing Law | Arizona Revised Statutes, Title 33 - Property, specifically governs the execution and processing of a Deed in Lieu of Foreclosure. |

| Benefits for Homeowner | This option provides a way for homeowners to avoid the negative impacts of a foreclosure on their credit report and may offer a faster resolution to financial distress. |

| Benefits for Lender | Lenders may prefer this option to avoid the lengthy and costly process of foreclosure, receiving the property directly and potentially mitigating their losses. |

| Considerations | Both parties should consider the potential tax implications and whether the lender will require the homeowner to pay the mortgage difference if the property's value is less than the mortgage balance. |

Instructions on Utilizing Arizona Deed in Lieu of Foreclosure

Once a homeowner decides that a Deed in Lieu of Foreclosure is the best path forward, careful attention to detail is necessary when filling out the form. This agreement allows the homeowner to transfer the property title directly to the lender, which can help avoid the foreclosure process. The form requires specific information about the property and the agreement terms between the lender and the borrower. Following the correct steps ensures that this legal document accurately reflects the understanding between both parties and is properly executed to prevent future disputes.

- Begin by entering the date at the top of the form. This should be the date on which the agreement is being made.

- Next, fill in the full legal names of the borrower(s) and the lender. Make sure to also include any co-borrowers' names.

- Enter the property address, including the city, state, and ZIP code, under the section titled "Property Information." Be sure to provide the full legal description of the property as well. This information can usually be found on your original deed or mortgage agreement.

- Describe the nature and the primary reason for the Deed in Lieu of Foreclosure in the provided space. Detail any important circumstances or agreements made between the borrower and the lender regarding the property transfer.

- In the section labeled "Agreement Terms," specify the terms agreed upon by both parties. This might include any conditions related to the property's condition, financial settlements, or timelines for vacating the property.

- Ensure both the borrower and the lender sign the form. The signatures must be notarized, so complete this step in the presence of a notary public. The notary will need to fill out, sign, and stamp the designated notary section of the form.

- Review the entire document carefully before signing. Look for any errors or omissions, and correct them. Both parties should be in full agreement with the content of the document before signing.

- Once the form is fully executed, file it with the county recorder's office where the property is located. There may be a filing fee, so check with the local office in advance to prepare the necessary payment.

After the form is completed and filed, the property officially changes hands, and the previous owner is relieved of their mortgage obligations under the agreed terms. It's crucial to keep a copy of the filed document for personal records. The lender will then take action to remove the borrower's name from the property title, marking the final step of this process. Legal advice is recommended to ensure all parties understand their rights and obligations fully.

Listed Questions and Answers

What is a Deed in Lieu of Foreclosure in Arizona?

A Deed in Lieu of Foreclosure is a legal document in Arizona where a borrower voluntarily transfers ownership of their property to the lender. This action is taken to avoid the foreclosure process. In essence, it allows the borrower to hand over the keys to their home to the lender, thereby avoiding the lengthy and often costly process of foreclosure. It's considered a last resort for borrowers facing financial hardship and unable to continue making mortgage payments.

How does a Deed in Lieu of Foreclosure affect my credit score?

Choosing a Deed in Lieu of Foreclosure will still negatively impact your credit score, though perhaps not as severely as a foreclosure might. The exact impact depends on several factors, including your credit history and the scoring model used by the credit bureau. Typically, the action will remain on your credit report for up to seven years, making it harder to obtain new loans or lines of credit during that time.

Can any property qualify for a Deed in Lieu of Foreclosure in Arizona?

Not all properties qualify for a Deed in Lieu of Foreclosure. Lenders often require the property to be free of any other liens or encumbrances. This means that other debts, like second mortgages, home equity lines of credit, or tax liens, may disqualify a property. Each lender may have its own set of requirements, so it's essential to communicate directly with your lender to understand its specific criteria.

Are there any tax implications for a Deed in Lieu of Foreclosure?

Yes, there can be significant tax implications. When a lender forgives debt through a Deed in Lieu of Foreclosure, the forgiven amount may be considered taxable income by the Internal Revenue Service (IRS) and the Arizona Department of Revenue. However, certain exemptions and exclusions might apply, especially if the property is your primary residence. Consulting with a tax professional is crucial to understand your individual circumstances.

What steps should I take to pursue a Deed in Lieu of Foreclosure in Arizona?

First, reach out to your lender to express your interest in a Deed in Lieu of Foreclosure and discuss your financial situation. It's important to gather all relevant financial documents and information regarding any additional liens on the property. Some lenders may require you to attempt to sell the property for its fair market value before agreeing to a Deed in Lieu of Foreclosure. Documentation and a formal request are typically needed to start the process, so follow your lender's guidance closely.

Can I stay in my home after completing a Deed in Lieu of Foreclosure?

After completing a Deed in Lieu of Foreclosure, you generally cannot remain in the home. The transfer of ownership to the lender means you relinquish all rights to the property, including residency. In some cases, lenders might offer a "Cash for Keys" agreement, providing you with a cash payment to assist with moving expenses in exchange for vacating the property promptly and leaving it in good condition.

Common mistakes

Filling out legal documents can be a daunting task. When it comes to the Arizona Deed in Lieu of Foreclosure form, making mistakes can lead to significant financial and legal consequences. To help individuals navigate this process more smoothly, here’s an overview of four common mistakes people often make:

Not Reviewing the Loan Agreement: Many individuals don’t check their original loan agreement before proceeding with a deed in lieu of foreclosure. This oversight can lead to a misunderstanding of the terms and conditions that might affect their eligibility or obligations under such an arrangement.

Incorrect Information: Providing inaccurate information about the property or the mortgage can cause delays and potentially void the agreement. It's crucial to double-check all entries for correctness and completeness.

Omitting Necessary Documentation: Failing to attach required documents, such as proof of financial hardship, property appraisals, or tax statements, can halt the process. These documents are vital to demonstrate the necessity and viability of a deed in lieu of foreclosure.

Ignoring Potential Tax Consequences: Many people don’t consider the tax implications of signing a deed in lieu of foreclosure. This oversight can lead to unexpected tax liabilities, as the cancellation of debt may be considered taxable income under certain circumstances.

Understanding and addressing these mistakes early can make a significant difference in navigating the complexities of a deed in lieu of foreclosure. It's always recommended to seek advice from a professional to ensure all legal and financial bases are covered.

Documents used along the form

Dealing with property issues can be complex, particularly when it involves avoiding foreclosure. Using an Arizona Deed in Lieu of Foreclosure is a useful method for homeowners to transfer their property back to the lender if they're unable to make mortgage payments. However, this process usually requires additional forms and documents to complete the transaction fully and securely.

- Hardship Letter: This document provides the homeowner's explanation of the financial difficulties they are facing. It's a personal statement that outlines why the homeowner is unable to continue making payments and requests consideration for a deed in lieu of foreclosure.

- Loan Modification Application: Before opting for a deed in lieu of foreclosure, homeowners are often required to attempt a loan modification. This application outlines the homeowner's financial situation and requests a change in loan terms to make payments more manageable.

- Financial Statement: A detailed account of the homeowner's financial situation, including income, debts, assets, and expenses. This document helps lenders assess the homeowner’s financial hardship and eligibility for a deed in lieu of foreclosure.

- Authorization to Release Information: A form that gives the lender permission to access the homeowner’s personal and financial information. This is necessary for the lender to verify the details provided in the homeowner's application and supporting documents.

- Mortgage Statement: The most recent statement of the mortgage account, showing the current balance, payment history, and any fees or penalties owed. It gives a snapshot of the loan status to both the homeowner and lender.

- Property Appraisal Report: An assessment of the property’s value conducted by a professional appraiser. Lenders require this to ensure the property value is sufficient to cover the outstanding mortgage balance in a deed in lieu transaction.

- IRS Form 1099-A: After completing a deed in lieu of foreclosure, the lender may issue this form, which reports the acquisition or abandonment of secured property. It is used for tax reporting purposes, signifying the homeowner may have cancellation of debt income.

- Deed in Lieu of Foreclosure Agreement: A formal agreement between the lender and homeowner that outlines the terms and conditions of the deed in lieu transaction. It includes details about any debt forgiveness, property condition requirements, and timelines for vacating the property.

Each of these documents plays a critical role in the process and ensures that both parties have a clear understanding of the terms and implications of a deed in lieu of foreclosure. Homeowners considering this option should gather these documents promptly and consult with a professional to guide them through the process smoothly and efficiently.

Similar forms

A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers the ownership of their property to the lender as an alternative to foreclosure. A document similar to this is a Mortgage Agreement, which outlines the borrower's obligation to repay a loan used to purchase the property and grants the lender a security interest in the property. Mortgage Agreements lay the groundwork for the borrower-lender relationship, specifying the loan terms, repayment schedule, and the lender’s rights in case of default, making them a precursor to situations where a Deed in Lieu of Foreclosure might be considered.

Another document that shares similarities is the Quitclaim Deed. This document is used to transfer property rights without any warranties on the title from one person to another. Like a Deed in Lieu of Foreclosure, a Quitclaim Deed can be used in situations where property is transferred quickly and without typical sale procedures, though it is often utilized between family members or to clear up title issues rather than as a foreclosure alternative.

The Loan Modification Agreement also resembles the Dean in Lieu of Foreclosure. This agreement is reached when a lender and borrower agree to alter the terms of the original mortgage. Changes can include the interest rate, payment schedule, or other terms to avoid foreclosure. Though its goal is to maintain the borrower's homeownership rather than transfer it, it serves a similar purpose of avoiding the traditional foreclosure process.

The Short Sale Approval Letter from a lender also shares commonalities. This letter grants a borrower permission to sell their home for less than the amount owed on the mortgage, which, similar to a Deed in Lieu, provides a way to avoid foreclosure. Both options are considered when the borrower is in financial distress, providing alternatives that can be less damaging to the borrower’s credit score than a foreclosure.

A Foreclosure Notice is yet another document akin to the Deed in Lieu of Foreclosure, albeit from a different standpoint. A Foreclosure Notice is a formal announcement from the lender to the borrower that foreclosure proceedings will begin due to default on the mortgage. While this document signals the initiation of a forced property transfer, a Deed in Lieu represents a voluntary agreement to avoid this scenario. Despite their differences, both documents are integral to the foreclosure process.

Lastly, the Promissory Note connected to mortgage transactions bears resemblance. This document represents the borrower’s promise to repay the borrowed amount. It details the loan’s terms, including repayment schedule, interest rate, and penalties for default. While a Promissory Note signifies the beginning of the borrowing process, a Deed in Lieu of Foreclosure can signify its conclusion under distressing circumstances, making them bookends in the life cycle of a loan.

Dos and Don'ts

Filling out the Arizona Deed in Lieu of Foreclosure form is a critical step for homeowners seeking to avoid foreclosure. To ensure the process is done correctly and efficiently, here are seven dos and don'ts to consider:

Do:- Review the form thoroughly before filling it out to ensure understanding of all the requirements and conditions.

- Collect all necessary documents related to the property and loan to ensure accuracy when completing the form.

- Use accurate and complete legal descriptions of the property as recorded in your original mortgage or deed of trust documents.

- Contact a legal advisor or a housing counselor to get guidance and to understand the implications of signing a deed in lieu of foreclosure.

- Ensure all parties on the mortgage loan are available to sign the form, as their consent is necessary for the process.

- Keep copies of all correspondence and documentation related to the deed in lieu of foreclosure for your records.

- Submit the form and any additional requested documentation to the lender as instructed, making sure to follow up for confirmation of receipt.

- Leave any sections of the form blank. If a section does not apply, write "N/A" (not applicable) to indicate this.

- Guess on details or provide inaccurate information, as this could delay the process or have legal consequences.

- Sign the deed in lieu of foreclosure agreement without fully understanding the terms and potential tax implications.

- Forget to inquire about whether the lender will waive the deficiency, which is the remaining balance owed after the property is sold.

- Ignore state laws and regulations that may impact the deed in lieu process in Arizona, as they can vary from those in other states.

- Rush through the process without considering other foreclosure alternatives that might be more beneficial in your situation.

- Fail to confirm that the lender has processed the form and that the legal transfer of the property has been completed.

Misconceptions

When navigating the complex terrain of foreclosure and alternatives available to homeowners in Arizona, the option of a Deed in Lieu of Foreclosure often surfaces. However, several misconceptions surround this legal document, leading to confusion and misinformed decisions. Let's clarify some of the most common misunderstandings.

- It completely absolves the borrower of any financial liability. Many believe that by opting for a Deed in Lieu of Foreclosure, they are freed from all financial obligations related to the mortgage. While this process does indeed prevent the lengthy proceedings of a traditional foreclosure, it doesn't always absolve the borrower of all financial liabilities. Lenders may still seek a deficiency judgment if the property's value doesn't cover the mortgage balance, depending on the agreement and state laws.

- It has no impact on credit scores. Another misconception is that a Deed in Lieu of Foreclosure is a get-out-of-jail-free card that leaves one's credit score untouched. Although a Deed in Lieu may have a less severe impact than a foreclosure, it still negatively affects credit scores. Lenders report it to credit bureaus as a settlement, which can significantly reduce the borrower's credit rating.

- The process is faster and simpler than foreclosure. While it's true that a Deed in Lieu of Foreclosure can be quicker than going through a foreclosure process, calling it simple is misleading. The process involves negotiation with the lender, who must agree to accept the deed in lieu. Homeowners may also be required to attempt to sell the home for its fair market value before the lender will consider this option. Document preparation and the negotiation process can be complicated and time-consuming.

- Any homeowner can opt for a Deed in Lieu of Foreclosure. Not all homeowners facing foreclosure qualify for a Deed in Lieu of Forevolution. Lenders typically require the homeowner to have attempted to sell the home for its fair market value without success. Additionally, the property must usually be the borrower's primary residence, and the homeowner should not have taken out a second mortgage or have other liens against the property, as these complicate the process and make the lender less likely to accept the deed in lieu.

Understanding these key points can guide homeowners through their options more clearly, enabling informed decisions during challenging financial times. While a Deed in Lieu of Foreclosure offers a potential way out for some, it's crucial to navigate this option with a full understanding of its implications and requirements.

Key takeaways

When dealing with the Arizona Deed in Lieu of Foreclosure form, there are several key takeaways that are crucial for a smooth and compliant process. This document plays a significant role for borrowers facing the prospect of foreclosure, offering an alternative resolution. Here are the essential points to remember:

- Familiarize Yourself with the Form: Before filling out the form, make sure to understand its sections and requirements. Accuracy is key in preventing potential legal issues.

- Accuracy Is Crucial: Provide complete and accurate information about the property and the parties involved. Any discrepancies can complicate the process or render the document invalid.

- Ensure Both Parties Agree: The deed in lieu of foreclosure is a voluntary agreement. Both the lender and the borrower must agree to the terms and conditions explicitly outlined in the document.

- Gather Necessary Documentation: Supporting documents, such as the original mortgage agreement and any loan modification records, should be compiled and reviewed. These provide a clear understanding of the debts being resolved.

- Understand the Financial Implications: Be aware of the potential tax consequences and credit implications of a deed in lieu of foreclosure. Consulting with a financial advisor or a tax professional is advisable.

- Legal Advice Is Recommended: Given the legal and financial complexities involved, seeking advice from a legal professional specializing in real estate or foreclosure can provide invaluable guidance.

- Record the Document: After the completion and signing of the deed in lieu of foreclosure form, it must be duly recorded with the local county recorder’s office. This public recording is essential for the agreement to be legally binding and effective.

- Keep Comprehensive Records: Retain copies of all correspondence and documents related to the agreement. Having a thorough record can protect both parties in case of future disputes or misunderstandings.

Understanding and properly executing the Arizona Deed in Lieu of Foreclosure form ensures a legal and potentially less damaging alternative to foreclosure. It offers a path forward for borrowers seeking to navigate financial difficulties while minimizing the impact on their credit and financial health.

Create Popular Templates for Arizona

Witness for Power of Attorney - A Power of Attorney for a Child is especially crucial in single-parent households where an alternate caregiver must be designated.

How Old Do You Have to Be to Get a Dnr - Crucial for preventing the initiation of lifesaving measures that a patient has declined ahead of time.

Lease Agreement Roommate - It provides a clear structure for the financial aspects of the rental, such as the rent amount, security deposit, and any late fees, protecting both parties’ interests.