Legal Arizona Articles of Incorporation Document

In the state of Arizona, individuals and entities looking to establish a corporation embark on a process that is both significant and foundational for their business's future. This journey commences with the completion and submission of the Arizona Articles of Incorporation form, a document that plays a pivotal role in giving legal birth to a corporation. It encompasses vital details such as the corporation's name, its purpose, the duration of its existence, the names and addresses of its initial directors, the incorporation’s principal office address, and the name and address of its statutory agent. Additionally, information regarding the shares of stock the corporation is authorized to issue is also specified, which is crucial for delineating the ownership structure. The form not only serves to fulfill state legal requirements but also lays down the primary structural elements of a corporation, making it a document of paramount importance for stakeholders involved. Understanding its contents, the precision required in filling it out, and its implications for the future of the corporation is essential for all prospective corporate entities.

Arizona Articles of Incorporation Preview

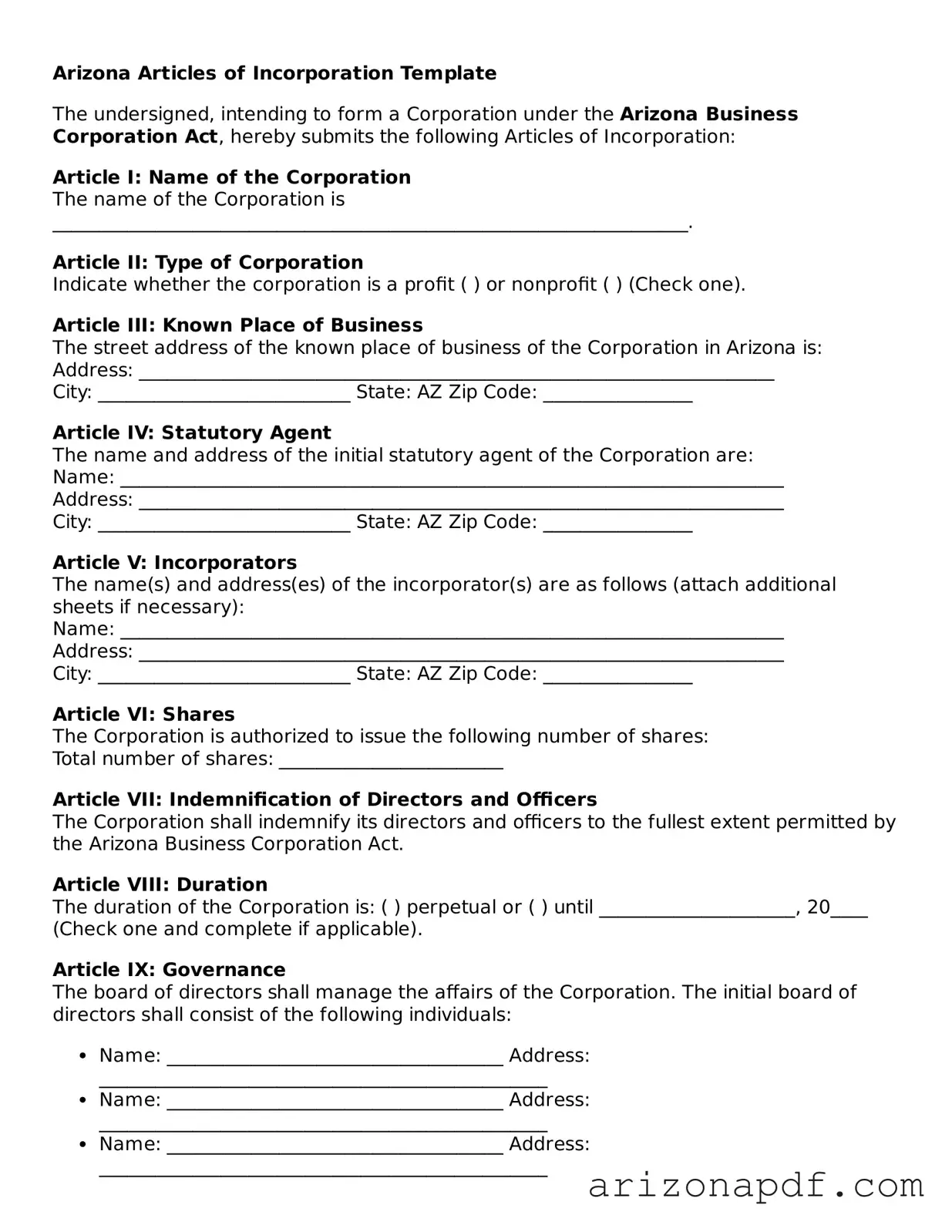

Arizona Articles of Incorporation Template

The undersigned, intending to form a Corporation under the Arizona Business Corporation Act, hereby submits the following Articles of Incorporation:

Article I: Name of the Corporation

The name of the Corporation is ____________________________________________________________________.

Article II: Type of Corporation

Indicate whether the corporation is a profit ( ) or nonprofit ( ) (Check one).

Article III: Known Place of Business

The street address of the known place of business of the Corporation in Arizona is:

Address: ____________________________________________________________________

City: ___________________________ State: AZ Zip Code: ________________

Article IV: Statutory Agent

The name and address of the initial statutory agent of the Corporation are:

Name: _______________________________________________________________________

Address: _____________________________________________________________________

City: ___________________________ State: AZ Zip Code: ________________

Article V: Incorporators

The name(s) and address(es) of the incorporator(s) are as follows (attach additional sheets if necessary):

Name: _______________________________________________________________________

Address: _____________________________________________________________________

City: ___________________________ State: AZ Zip Code: ________________

Article VI: Shares

The Corporation is authorized to issue the following number of shares:

Total number of shares: ________________________

Article VII: Indemnification of Directors and Officers

The Corporation shall indemnify its directors and officers to the fullest extent permitted by the Arizona Business Corporation Act.

Article VIII: Duration

The duration of the Corporation is: ( ) perpetual or ( ) until _____________________, 20____ (Check one and complete if applicable).

Article IX: Governance

The board of directors shall manage the affairs of the Corporation. The initial board of directors shall consist of the following individuals:

- Name: ____________________________________ Address: ________________________________________________

- Name: ____________________________________ Address: ________________________________________________

- Name: ____________________________________ Address: ________________________________________________

Article X: Additional Provisions

(Include any other provisions that are not inconsistent with the law. Attach additional sheets if necessary.)

Article XI: Incorporator’s Information

The incorporator must sign below, indicating their agreement to form the Corporation under the laws of Arizona.

Name: ____________________________________ Signature: ___________________________ Date: _____________

Article XII: Filing Contact Information

Please provide contact information for the person to whom correspondence regarding this filing should be sent:

Name: ____________________________________

Email: ____________________________________

Phone: ____________________________________

This document was prepared by (Name): ________________________________________________.

End of Document

Document Details

| Fact | Detail |

|---|---|

| 1. Purpose | Used to officially form a corporation in Arizona. |

| 2. Governing Law | Arizona Revised Statutes, Title 10 - Corporations and Associations. |

| 3. Filed With | Arizona Corporation Commission. |

| 4. Required Information | Includes the corporation’s name, its purpose, registered agent information, shares information, and incorporator(s) details. |

| 5. Filing Fee | Subject to change, but a standard fee is required, with an expedited service option available for an additional cost. |

| 6. Time to Process | Varies; expedited processing is faster but at an additional cost. |

| 7. Annual Requirements | Annual report and fees are required to maintain good standing. |

| 8. Online Filing Option | Yes, online filing is available through the Arizona Corporation Commission’s website. |

Instructions on Utilizing Arizona Articles of Incorporation

Filing the Articles of Incorporation is a crucial step in establishing a corporation in Arizona. This process officially registers the corporation with the state, allowing it to operate legally. The form can seem daunting at first, but by following these instructions, one can fill it out accurately and efficiently. Once the form is submitted and approved, the entity will be recognized as a legally incorporated business in the state of Arizona, opening the door to various benefits, including limited liability for its shareholders, tax advantages, and more.

- Gather all necessary information before you begin, including the corporation's name, business address, the nature of the business, the names and addresses of the incorporators and board of directors, and the number of shares the corporation is authorized to issue.

- Start by filling in the corporation's proposed name. Ensure it complies with Arizona state requirements and is distinguishable from the names of other businesses registered in the state.

- Enter the known place of business address, which may be inside or outside of Arizona. If the business does not have a physical address, provide the mailing address.

- State the general nature of the business. This does not need to be detailed but should give a clear idea of what the corporation will do.

- Specify the total number of shares the corporation is authorized to issue and the class of shares. If there are different classes of shares, provide the rights and preferences of each class.

- Provide the name and physical address in Arizona of the corporation's statutory agent. This agent will receive legal papers on behalf of the corporation.

- List the names, addresses, and signatures of the incorporators. Incorporators are the individuals responsible for completing the paperwork to form the corporation.

- If the corporation will have an initial board of directors, list their names and addresses. This step is optional and can be left blank if the incorporators prefer to elect the board of directors after incorporation.

- Indicate whether the corporation will be managed by its board of directors or by its shareholders directly. This will determine the governance structure of the corporation.

- Review the form to ensure all information is accurate and complete. Make sure that all necessary signatures are included.

- Submit the completed form, along with the required filing fee, to the Arizona Corporation Commission. The form can be submitted online, by mail, or in person, depending on preference.

After the form has been submitted, the Arizona Corporation Commission will review the Articles of Incorporation. If approved, the commission will issue a certificate of incorporation, officially recognizing the corporation as a legal entity. The corporation can now proceed with other necessary steps, such as obtaining business licenses and permits, opening a business bank account, and starting its operations. It's also essential to stay compliant with ongoing state reporting and tax obligations to maintain good standing.

Listed Questions and Answers

What is the purpose of the Arizona Articles of Incorporation form?

The Arizona Articles of Incorporation form is used to legally establish a corporation in Arizona. It records essential details about the corporation, such as the corporation's name, purpose, address, and information about its shares, incorporators, and statutory agent. This document must be filed with the Arizona Corporation Commission to officially create a corporation under state law.

Who needs to file the Arizona Articles of Incorporation?

Any group or individual seeking to form a corporation in Arizona must file the Articles of Incorporation. This applies to both for-profit and nonprofit entities that wish to be recognized as a corporate entity under Arizona law.

Where can I obtain the Arizona Articles of Incorporation form?

The form can be downloaded from the Arizona Corporation Commission's official website. It is also available in hard copy at their office. Make sure to use the most current form to ensure compliance with the latest state requirements.

How much does it cost to file the Arizona Articles of Incorporation?

The filing fee for the Articles of Incorporation varies depending on the type of corporation being formed. For the most accurate and up-to-date fee information, refer to the Arizona Corporation Commission's website or contact their office directly.

What information do I need to fill out the form?

When completing the Arizona Articles of Incorporation, you will need to provide the proposed name of the corporation, the principal place of business, the duration of the corporation (if not perpetual), the purpose for which the corporation is organized, the number of shares the corporation is authorized to issue, information about the incorporator(s), and the name and address of the statutory agent.

How do I file the Arizona Articles of Incorporation?

The completed form can be filed online through the Arizona Corporation Commission's e-filing system or by mailing a printed copy to their office. Ensure all information is accurate and complete before filing to avoid delays.

How long does it take for the Arizona Articles of Incorporation to be processed?

The processing time can vary depending on the current workload of the Arizona Corporation Commission and the filing method used. Online filings are typically processed faster than paper filings. For an estimated processing time, check with the Arizona Corporation Commission.

What happens after the Arizona Articles of Incorporation are filed?

Once the Articles of Incorporation are filed and approved by the Arizona Corporation Commission, your corporation will be officially registered in the state of Arizona. You will receive a confirmation and may then need to take additional steps, such as organizing an initial meeting of the board of directors, issuing stock, and applying for any necessary licenses or permits.

Common mistakes

Filling out the Arizona Articles of Incorporation is a crucial step in forming a corporation within the state. Unfortunately, many people make mistakes during this process. Here's an expanded list of common errors to avoid:

Not checking the availability of the corporation name: Before submitting the Articles of Incorporation, it's important to ensure that your chosen corporation name is available and complies with Arizona state regulations. Failure to do so can lead to the rejection of your application.

Forgetting to appoint a statutory agent: A statutory agent (also known as a registered agent) must be designated in your Articles of Incorporation. This agent is responsible for receiving important legal and tax documents on behalf of the corporation. Many people forget to appoint one, which is a mandatory requirement.

Incorrectly listing the shares of stock: Corporations need to specify the number of shares they are authorized to issue. Errors in listing the share structure or failing to mention it at all can complicate future business operations and investments.

Leaving out the duration of the corporation: Some people miss stating whether the corporation will exist perpetually or have a fixed duration. Although most opt for a perpetual duration, specifying this information is crucial.

Skip including the purpose of the corporation: Clearly stating the purpose of the corporation is not only vital for legal clarity but also for aligning with business licenses and permits. A vague or missing purpose statement may lead to processing delays.

Omitting the principal place of business: Not including the physical address of the corporation's principal place of business can lead to the misrouting of vital correspondence and affect the legitimacy of the business.

Errors in the incorporator's information: The incorporator is the individual preparing and filing the Articles of Incorporation. Simple mistakes in their name, address, or signature can invalidate the entire document.

Ignoring the need for additional attachments: Depending on the nature of the corporation, additional attachments or schedules may be required. Overlooking this requirement can cause substantial delays in the registration process.

Failure to comply with publication requirement: After filing the Articles of Incorporation, certain corporations are required to publish the articles in a newspaper for three consecutive publications. Not understanding or adhering to this requirement can lead to non-compliance issues.

Not securing or incorrectly completing the necessary attachments and schedules: Whether it's the statutory agent acceptance form or any additional schedules specific to your corporation type, overlooking or inaccurately completing these can hinder the approval of your Articles of Incorporation.

Being meticulous with the Arizona Articles of Incorporation is essential for a smooth business formation process. Avoiding these common mistakes can help expedite the approval of your corporation and ensure compliance with state regulations.

Documents used along the form

When establishing a corporation in Arizona, the Articles of Incorporation form is a fundamental requirement. However, to ensure a smooth and legally compliant startup process, several other forms and documents should be prepared and filed alongside it. These forms cover a range of legal, operational, and financial aspects critical for the proper establishment and functioning of the corporation. Below is a list of up to 10 other forms and documents often used in conjunction with the Arizona Articles of Incorporation, each described briefly to highlight their importance and usage.

- Corporate Bylaws - Detail the internal management structure, including the roles and responsibilities of directors and officers. It outlines the rules and procedures the corporation will follow for governance and operations.

- SS-4 Form - Used to apply for an Employer Identification Number (EIN) from the IRS. This number is essential for tax purposes and to open a business bank account.

- Form 2553 - Election by a Small Business Corporation. Used by corporations that choose to be taxed as an S-corporation, affecting their federal tax obligations.

- Initial Report Form - Some states require a new corporation to file an initial report after incorporation, which may include basic information about the corporation and its directors.

- Stock Certificate - A document that certifies ownership of a specific number of shares in the corporation. It's vital for tracking equity distribution among shareholders.

- Shareholder Agreement - Outlines the rights and obligations of the shareholders, including how shares can be bought, sold, or transferred, and what happens in the event of a shareholder's death or departure.

- Director and Officer Indemnification Agreement - Protects directors and officers from personal liability for actions taken in the best interest of the corporation, as long as they don't involve fraud or illegal activities.

- Operating Agreement - Although typically associated with LLCs, corporations, especially those opting for S-corp status, might use an operating agreement to define business operations and the responsibilities of the members.

- Bank Resolution - A formal document that authorizes specific individuals in the corporation to open a bank account and conduct financial transactions on behalf of the corporation.

- Business License Application - Depending on the nature of the business and its location, the corporation may need to apply for one or more business licenses to operate legally within a municipality or state.

Beyond the initial paperwork, it's crucial for corporations in Arizona to maintain compliance with state and federal law by regularly updating these forms and filing any required annual reports. Proper attention to these documents can aid in the protection of corporate and personal assets, facilitate financial activities, and ensure the smooth operation and growth of the business.

Similar forms

The Arizona Articles of Incorporation form shares similarities with the Certificate of Formation used in some states. Both documents are foundational for establishing a legal business entity, but while Articles of Incorporation are specifically for corporations, a Certificate of Formation can apply to limited liability companies (LLCs). Both documents require basic information about the business, such as the name, purpose, and registered agent, and are filed with the state government to officially recognize the entity.

Bylaws are another document closely related to the Articles of Incorporation. While the Articles establish the corporation’s existence and basic structure, bylaws detail the internal rules and procedures for managing the company. They cover topics such as the role of directors and officers, meeting logistics, and voting procedures. Think of the Articles of Incorporation as the birth certificate of a corporation, and the bylaws as its rulebook.

The Operating Agreement of an LLC bears resemblance to the Articles of Incorporation in that it outlines the organization’s structure and the rules for operation. However, it is used by LLCs instead of corporations and is more flexible in terms of content. The Operating Agreement is crucial for defining the financial and working relationships between co-owners in more detail than is typically included in the Articles of Incorporation.

Articles of Organization are to LLCs what Articles of Incorporation are to corporations. They are the documents filed with the state to legally form an LLC. Both types of documents mark the legal beginning of the business and include information such as the business name, principal address, and agent for service of process. However, the specifics and requirements can vary between the documents depending on the business structure.

The Statement of Information is periodically submitted to the state to update or confirm the recorded information about a business. Although it’s a separate requirement from the filing of Articles of Incorporation, both serve the purpose of keeping the state informed about key aspects of a business, like addresses and contact information for agents or officers.

DBA (Doing Business As) filings are similar to the Articles of Incorporation in the sense that they are both official documents filed with the state. However, a DBA filing is used when a business wants to operate under a name different from its legally registered name. While the Articles of Incorporation establish the legal identity of the corporation, a DBA filing allows it to publicly operate under a different name.

Shareholder Agreements, although not filed with the state, are significant documents for corporations that detail how the business is to be operated and the shareholders' rights and obligations. These agreements complement the information in the Articles of Incorporation by detailing ownership rights, share distribution, and how decisions are made, focusing more on the internal governance of the corporation.

The Employer Identification Number (EIN) application, while not a forming document, is closely related to the Articles of Incorporation process. After a corporation is formed through filing the Articles, it must obtain an EIN from the IRS for tax purposes. The EIN is necessary for opening bank accounts, hiring employees, and filing taxes, making it essential for the operation of the business.

Corporate Resolutions are written documents that record important decisions made by a corporation's board of directors or shareholders. While they operate differently from the Articles of Incorporation, which establish the company, Corporate Resolutions document the ongoing decisions affecting the company’s operation and governance, including major financial decisions and changes in policies.

Finally, the Business Plan, although not a legal document filed with the state, shares the goal of strategic planning for a new business with the Articles of Incorporation. The Business Plan outlines the company’s objectives, strategies for success, and financial forecasts, serving as a blueprint for the company’s future. While Articles of Incorporation give a company legal status, the Business Plan provides the detailed path for growth and operations.

Dos and Don'ts

When it comes to setting up a corporation in Arizona, the Articles of Incorporation form plays a pivotal role. This document serves as the foundation of your corporation, setting forth essential details that govern your business's legal and operational structure. To navigate this process with confidence, familiarize yourself with the following dos and don'ts:

- Do ensure all information is accurate before submission. Mistakes can delay processing and lead to unnecessary complications.

- Do check the Arizona Corporation Commission's (ACC) guidelines for naming your corporation, ensuring your proposed name is unique and adheres to state requirements.

- Do include the required number of copies and the appropriate fee when you submit your form, as outlined by ACC guidelines.

- Do specify the corporation's purpose, though it can be broadly defined unless specified otherwise by state law or regulations related to your business sector.

- Do appoint a statutory agent who has a physical address in Arizona, as they will handle official and legal correspondences on behalf of your corporation.

- Don't overlook the importance of detailing the share structure of your corporation. Clearly outline the number and type of shares the corporation is authorized to issue.

- Don't submit the Articles of Incorporation without reviewing them with all founders and, if possible, a legal professional who understands corporate law in Arizona.

- Don't forget to sign the form. An Articles of Incorporation form without the required signatures will not be processed.

- Don't neglect to keep a copy of the form and all documents submitted to the ACC for your records. This ensures you have a record of your submission and can refer back to it if necessary.

Navigating the process of incorporating your business in Arizona with attention to detail and adherence to the state's requirements can pave the way for a smooth launch and operation of your corporation. Taking these steps seriously can prevent potential setbacks, saving time and resources in the long run.

Misconceptions

Filing the Articles of Incorporation is a pivotal step for any new corporation in Arizona. However, there are common misconceptions about this process that can lead to confusion. Understanding these can make the process smoother and ensure that your corporation complies with state regulations.

- Misconception 1: The process is overly complicated.

Many individuals think filing the Articles of Incorporation is a daunting task. While it does require attention to detail, the Arizona Corporation Commission provides resources and a clear step-by-step guide to help applicants through the process. - Misconception 2: Any name can be registered for your corporation.

Not every name is available for use. The chosen name for the corporation must be distinguishable from other names already on file. It must also meet Arizona’s statutory requirements regarding corporation names. - Misconception 3: Incorporating in Arizona protects the name nationwide.

Filing your Articles of Incorporation in Arizona protects your corporation's name within the state. However, this does not guarantee your name's exclusivity outside of Arizona. - Misconception 4: The Articles of Incorporation are the only documents required to start a corporation.

While the Articles of Incorporation are crucial, they are not the only documents needed. Depending on your corporation's nature, other forms, such as an Employer Identification Number (EIN) application, may be necessary. - Misconception 5: Filing the Articles of Incorporation immediately allows you to start business operations.

While filing is a significant step towards legitimizing your business, you may also need to obtain various licenses and permits specific to your type of business and location before you can legally operate. - Misconception 6: Only an attorney can file the Articles of Incorporation.

It's a common belief that you need a lawyer to file your Articles of Incorporation. However, while legal advice can be beneficial, especially for complicated structures, the process is designed to be accessible to anyone comfortable with completing the required forms. - Misconception 7: The filing fee is the only cost associated with incorporating.

The initial filing fee is just one of several costs associated with incorporating. Depending on your corporation's activities, you may also need to budget for annual report fees, business licenses, and other regulatory requirements. - Misconception 8: Digital signatures are not accepted on the Arizona Articles of Incorporation.

In today's digital age, Arizona does accept digital signatures on Articles of Incorporation, making it easier for individuals to file documents efficiently and securely online. - Misconception 9: Once filed, the Articles of Incorporation cannot be amended.

Circumstances change and businesses evolve. The Articles of Incorporation can be amended. The state provides a process for submitting amendments, allowing corporations to update their records as needed.

Cutting through these misconceptions can clarify the incorporation process and help prospective business owners in Arizona set solid foundations for their ventures. It’s always recommended to review the latest resources provided by the Arizona Corporation Commission or consult with a professional to ensure that all legal requirements are met.

Key takeaways

Filing the Articles of Incorporation is a fundamental step for establishing a corporation in Arizona. This document, vital for your corporation’s formal recognition, must be filed with the Arizona Corporation Commission. Here are ten key takeaways to consider when filling out and using the Arizona Articles of Incorporation form:

- Know the type of corporation: Before filling out the form, it's essential to understand the different types of corporations (such as a non-profit, professional, or general for-profit) and choose the one that best fits your business model.

- Complete name and address information accurately: The name of your corporation must be unique and include a corporate designator such as "Inc.," "Corporation," or "Limited." Ensure the address information for your known place of business and statutory agent is accurate.

- Appoint a statutory agent: Your corporation must have a statutory agent in Arizona who agrees to accept legal papers on behalf of the corporation. This could be an individual or a business entity authorized to do business in Arizona.

- Share structure must be defined: Clearly outline the number of shares the corporation is authorized to issue, and if there are multiple classes of shares, each class must be described in detail in the Articles of Incorporation.

- Include necessary additional articles: Depending on your corporation's specifics, you might need to include additional articles. For example, if you have a professional corporation, you must state the professional service your corporation will provide.

- Director and incorporator information: Identify the initial directors and incorporators of your corporation, including names and addresses, ensuring that the incorporators sign the document.

- Filing fee and optional expedited service: The Arizona Corporation Commission requires a filing fee. There’s also an option for expedited processing for an additional fee.

- Submit the form: After completing the form, you can submit it through mail or in some cases, online, depending on the services offered by the Arizona Corporation Commission at the time of submission.

- Publication requirement: After filing, some corporations may need to publish their Articles of Incorporation in a local newspaper for three consecutive publications. This requirement depends on the county where your corporation's known place of business is located.

- Keep a copy for your records: Finally, ensure you keep a copy of the filed Articles of Incorporation for your records. This document is not only crucial for formalizing your corporation but also for future references and legal needs.

Approaching the filing with a detailed understanding of these elements will make the process smoother and help establish your corporation on a solid legal foundation in Arizona.

Create Popular Templates for Arizona

Printable Atv Bill of Sale Pdf - It provides peace of mind, knowing the details of your ATV’s sale are properly documented and agreed upon.

Arizona Prenup - A prenuptial agreement form is a legal document couples sign before marriage to outline the management of their financial matters in case of separation or divorce.