Fill in a Valid Arizona Tax Return Template

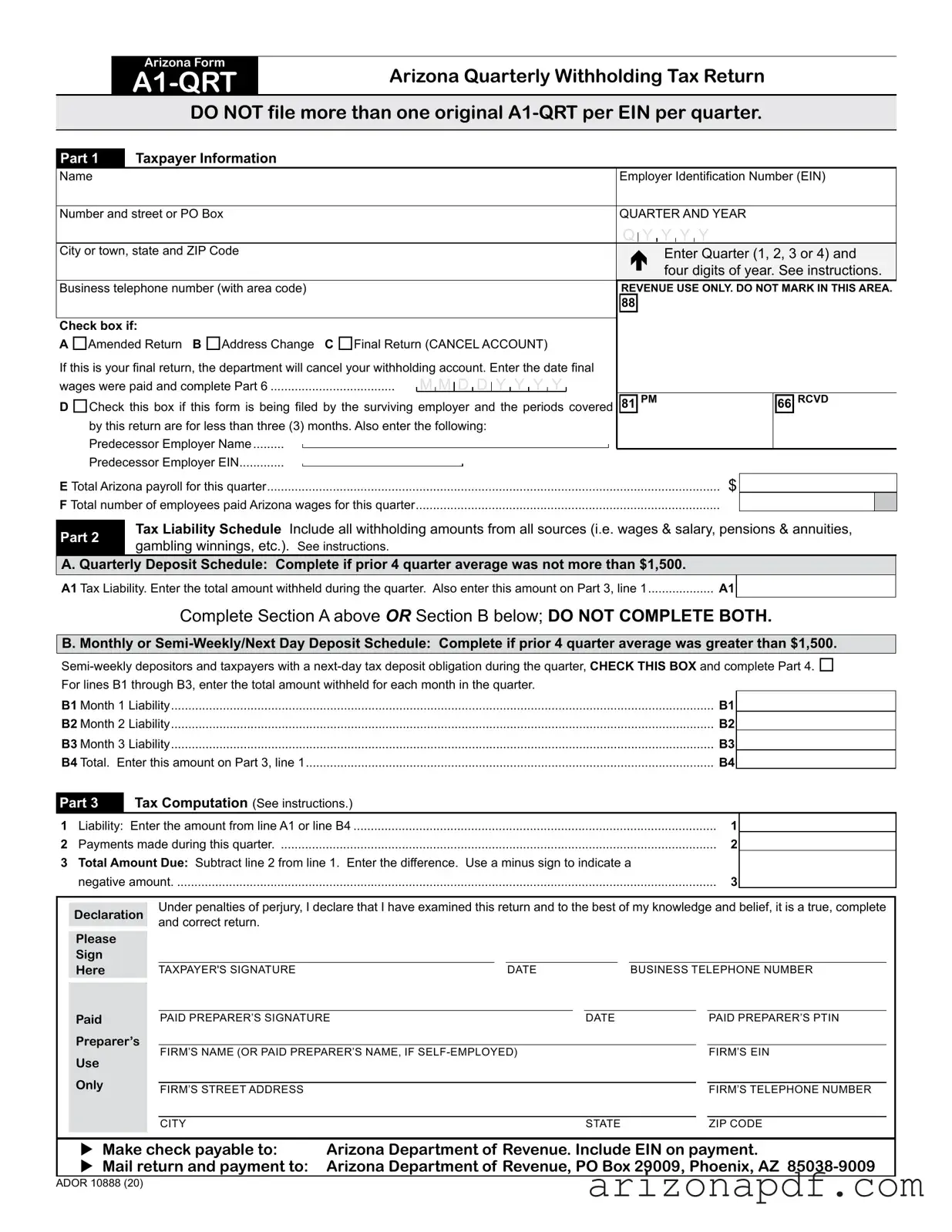

The complexity of managing taxes for businesses in Arizona requires close attention to various forms and deadlines, particularly the Arizona Quarterly Withholding Tax Return, known as Form A1-QRT. This form serves a critical role for employers, as it is used to reconcile and report the amounts withheld from employee wages for state income taxes on a quarterly basis. Employers must meticulously complete it to include taxpayer information such as name, Employer Identification Number (EIN), and contact details, along with specifying the quarter and year to which the return pertains. The form outlines two distinct sections for tax liability based on the employer's previous withholding amounts, thereby dictating their deposit schedule—either quarterly or more frequently, depending on the size of their payroll and the total tax withheld. Additionally, Form A1-QRT accommodates various scenarios such as amended returns, address changes, and designation of a final return signaling the cessation of business or payroll activities. The process for calculating tax liability, making payments during the quarter, and the declaration signed under penalty of perjury affirm the legality and correctness of the submitted information. Furthermore, the form includes provisions for businesses that change hands, cease operations, or experience significant changes affecting their withholding requirements. By accurately completing and timely filing Form A1-QRT, businesses not only comply with Arizona law but also ensure the correct amount of tax is withheld and remitted to the Arizona Department of Revenue, thereby avoiding potential penalties and interest for late or incorrect filings.

Arizona Tax Return Preview

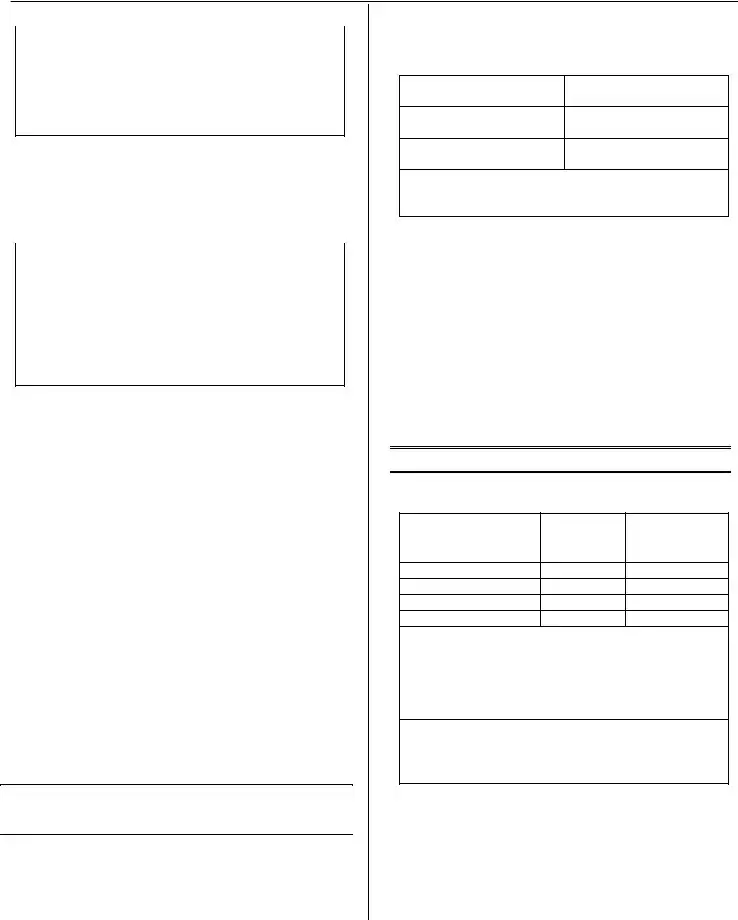

Arizona Form

Arizona Quarterly Withholding Tax Return

DO NOT file more than one original

Part 1

Taxpayer Information

Name |

|

|

|

|

|

|

|

|

|

Employer Identification Number (EIN) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and street or PO Box |

|

|

|

|

|

|

|

|

|

QUARTER AND YEAR |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Q |

|

Y Y Y Y |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

City or town, state and ZIP Code |

|

|

|

|

|

|

|

|

|

|

Enter Quarter (1, 2, 3 or 4) and |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

four digits of year. See instructions. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business telephone number (with area code) |

|

|

|

|

|

|

|

|

|

REVENUE USE ONLY. DO NOT MARK IN THIS AREA. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check box if: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A Amended Return B Address Change |

C Final Return (CANCEL ACCOUNT) |

|

|

|

|

|

|

|

|||||||||

If this is your final return, the department will cancel your withholding account. Enter the date final |

|

|

|

|

|

|

|

||||||||||

wages were paid and complete Part 6 |

|

M M |

|

D D |

|

Y Y Y Y |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||||

D Check this box if this form is being filed by the surviving employer and the periods covered |

81 PM |

|

|

66 RCVD |

|||||||||||||

by this return are for less than three (3) months. Also enter the following: |

|

|

|

|

|

||||||||||||

Predecessor Employer Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Predecessor Employer EIN |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

E Total Arizona payroll for this quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

........................................................................................F Total number of employees paid Arizona wages for this quarter |

|

|

|

||||||||||||||

Part 2

Tax Liability Schedule Include all withholding amounts from all sources (i.e. wages & salary, pensions & annuities, gambling winnings, etc.). See instructions.

A. Quarterly Deposit Schedule: Complete if prior 4 quarter average was not more than $1,500.

A1 Tax Liability. Enter the total amount withheld during the quarter. Also enter this amount on Part 3, line 1 |

A1 |

Complete Section A above OR Section B below; DO NOT COMPLETE BOTH.

B. Monthly or

B1 Month 1 Liability |

B1 |

|

B2 Month 2 Liability |

B2 |

|

B3 Month 3 Liability |

B3 |

|

......................................................................................................................B4 Total. Enter this amount on Part 3, line 1 |

B4 |

|

Part 3

Tax Computation (See instructions.)

1 |

Liability: Enter the amount from line A1 or line B4 |

1 |

2 |

Payments made during this quarter |

2 |

3Total Amount Due: Subtract line 2 from line 1. Enter the difference. Use a minus sign to indicate a

negative amount |

3 |

Declaration

Please

Sign

Here

Paid

Preparer’s

Use

Only

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, it is a true, complete and correct return.

TAXPAYER'S SIGNATURE |

DATE |

|

|

BUSINESS TELEPHONE NUMBER |

||

|

|

|

|

|

|

|

PAID PREPARER’S SIGNATURE |

|

|

DATE |

|

|

PAID PREPARER’S PTIN |

|

|

|

|

|

|

|

FIRM’S NAME (OR PAID PREPARER’S NAME, IF |

|

|

|

|

FIRM’S EIN |

|

|

|

|

|

|

|

|

FIRM’S STREET ADDRESS |

|

|

|

|

|

FIRM’S TELEPHONE NUMBER |

|

|

|

|

|

|

|

CITY |

|

|

STATE |

|

|

ZIP CODE |

Make check payable to:

Mail return and payment to:

Arizona Department of Revenue. Include EIN on payment.

Arizona Department of Revenue, PO Box 29009, Phoenix, AZ

ADOR 10888 (20)

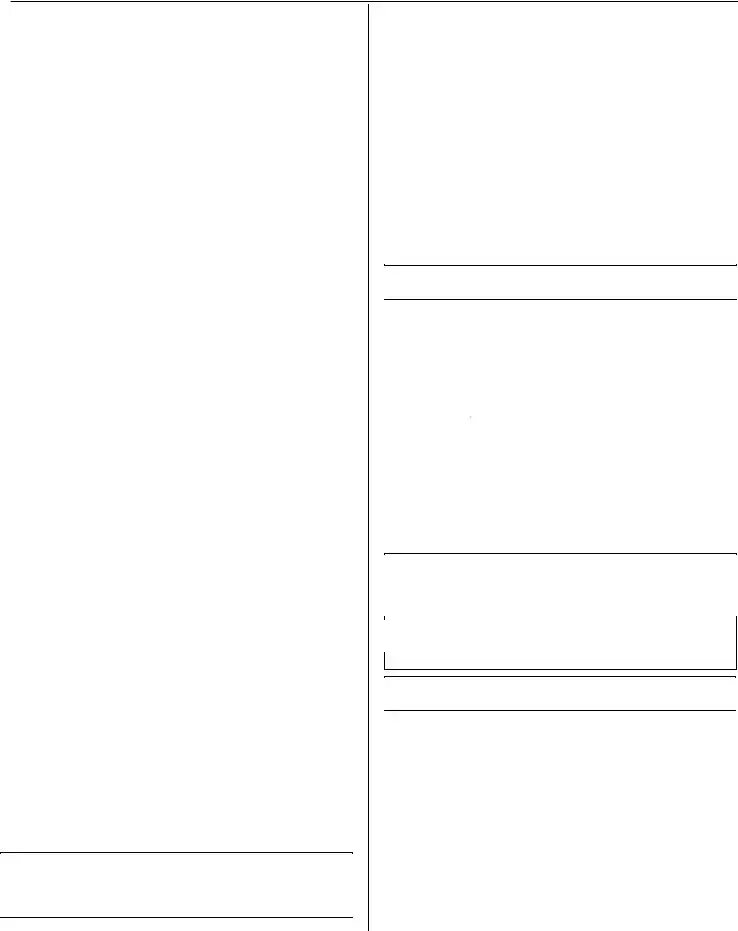

Name (as shown on page 1)

EIN

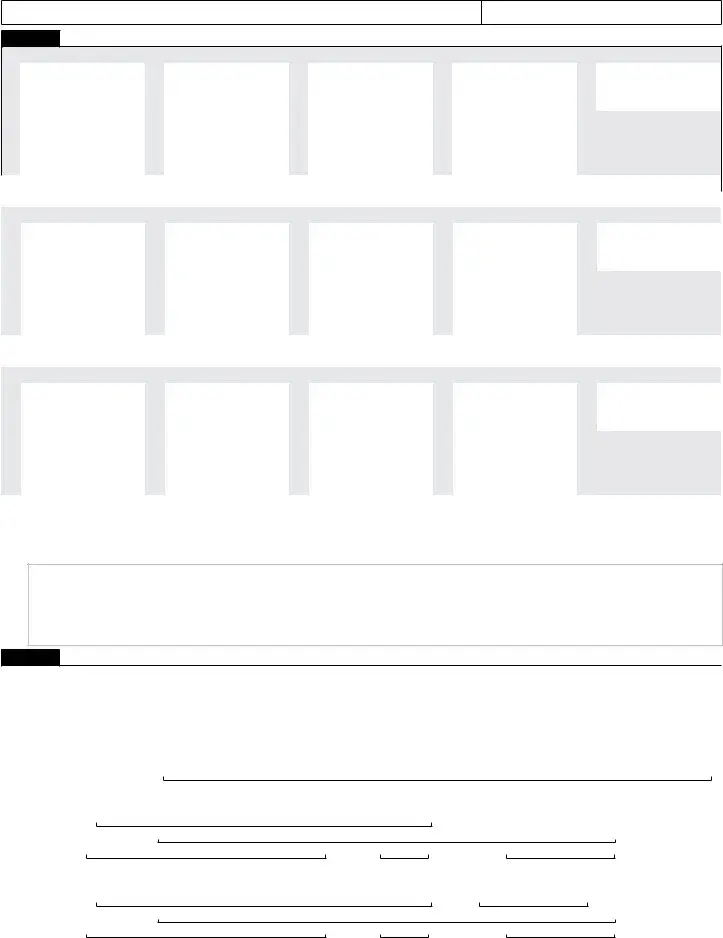

Part 4

A. First Month of Quarter (Days of the Month)

1 |

|

8 |

|

15 |

|

22 |

|

29 |

|

|

2 |

|

9 |

|

16 |

|

23 |

|

30 |

|

|

3 |

|

10 |

|

17 |

|

24 |

|

31 |

|

|

4 |

|

11 |

|

18 |

|

25 |

|

Check a box only if you |

||

5 |

|

12 |

|

19 |

|

26 |

|

had a |

||

6 |

|

13 |

|

20 |

|

27 |

|

|||

deposit obligation. |

||||||||||

7 |

|

14 |

|

21 |

|

28 |

|

|||

|

|

|||||||||

Month 1 Liability: Enter total here and on Part 2, line B1 |

|

|

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

B. Second Month of Quarter (Days of the Month) |

|

|

|

|

|

|

||||

1 |

|

8 |

|

15 |

|

22 |

|

29 |

|

|

2 |

|

9 |

|

16 |

|

23 |

|

30 |

|

|

3 |

|

10 |

|

17 |

|

24 |

|

31 |

|

|

4 |

|

11 |

|

18 |

|

25 |

|

Check a box only if you |

||

5 |

|

12 |

|

19 |

|

26 |

|

had a |

||

6 |

|

13 |

|

20 |

|

27 |

|

|||

deposit obligation. |

||||||||||

7 |

|

14 |

|

21 |

|

28 |

|

|||

|

|

|||||||||

Month 2 Liability: Enter total here and on Part 2, line B2 |

|

|

|

|

$ |

|

||||

|

|

|

|

|

|

|

||||

C. Third Month of Quarter (Days of the Month) |

|

|

|

|

|

|

||||

1 |

|

8 |

|

15 |

|

22 |

|

29 |

|

|

2 |

|

9 |

|

16 |

|

23 |

|

30 |

|

|

3 |

|

10 |

|

17 |

|

24 |

|

31 |

|

|

4 |

|

11 |

|

18 |

|

25 |

|

Check a box only if you |

||

5 |

|

12 |

|

19 |

|

26 |

|

had a |

||

6 |

|

13 |

|

20 |

|

27 |

|

|||

deposit obligation. |

||||||||||

7 |

|

14 |

|

21 |

|

28 |

|

|||

|

|

|||||||||

Month 3 Liability: Enter total here and on Part 2, line B3 |

|

|

|

|

$ |

|

||||

Part 5 |

Amended Form |

If you checked the box “Amended Return” in Part 1, explain why an amended Form

Part 6

Final Form

If you checked the box “Final Return” in Part 1, check the box that indicates why this is a final return:

1 Reorganization or change in business entity (example: from corporation to partnership).

2 Business sold.

3 Business stopped paying wages and will not have any employees in the future.

4 Business permanently closed.

5 Business has only leased or temporary agency employees.

6 Other (specify reason):

7 Check this box if records will be kept at a location different from the address shown in Part 1.

Name:

Number and Street:

City:State:

8 Check this box if there is a successor employer.

Name:

Number and Street:

City:State:

|

|

|

|

ADOR 10888 (20) |

AZ Form |

Page 2 of 2 |

|

|

|

Arizona Form |

Arizona Quarterly Withholding Tax Return |

||

|

|

|

For information or help, call one of these numbers:

Phoenix |

(602) |

From area codes 520 and 928, |

(800) |

Tax forms, instructions, and other tax information

If you need tax forms, instructions, and other tax information, go to the department’s website at www.azdor.gov.

Withholding Tax Procedures and Rulings

These instructions may refer to the department’s withholding tax procedures and rulings for more information. To view or print these, go to our website and click on Reports & Legal Research then click on Legal Research and select a Document Type and Category from the drop down menus.

Publications

To view or print the department’s publications, go to our website and click on Reports & Legal Research. Then click on Publications.

General Information

Arizona law requires employers to withhold Arizona income tax from:

•The payment of wages, salary, or bonus to any employee whose compensation is for services performed within Arizona, unless those wages are exempt from Arizona income tax withholding;

•The premature withdrawal of state and local retirement contributions; and,

•Payments of prize winnings subject to federal withholding under Internal Revenue Code (IRC) §§ 1441 or 3402(q) from:

O The Arizona state lottery commission, or, O Arizona sanctioned horse or dog racing.

At the request of the individual receiving the payment, Arizona income tax may be withheld from the following:

•Retired or retainer pay for service in the military or naval forces of the United States;

•Payments under the United States civil service retirement system from the United States government service retirement and disability fund;

•Pensions;

•Traditional Individual Retirement Accounts;

•Any other annuity;

•Unemployment compensation; and,

•

Each employer remits the tax withheld to the department using the deposit schedule that applies to that employer.

NOTE: For additional information on withholding

NOTE: For additional information on withholding

requirements, refer to the Employer’s Instructions for the

requirements, refer to the Employer’s Instructions for the

Employee’s Arizona Withholding Election (Form

Employee’s Arizona Withholding Election (Form

Instructions).

Instructions).

Why is Form

An employer must withhold Arizona income tax from wages paid for services performed in Arizona. Tax must be withheld, unless those wages are exempt from Arizona withholding tax.

In addition, Arizona income tax bay be withheld from pensions and gambling winnings.

The employer must remit the tax withheld to the department, based on the deposit schedule that applies to that employer.

Employers must reconcile the amounts withheld during the quarter to the amounts paid during the quarter. Form

Form

•The payment transmittal form for payments made on a quarterly basis when those payments are made by check or money order; and,

•The written notification to the department that the business is cancelling its withholding registration.

NOTE: For details about other returns and forms that may be

NOTE: For details about other returns and forms that may be

required, see Withholding Tax Procedure (WTP)

required, see Withholding Tax Procedure (WTP)

Withholding Tax Forms and Returns to File and When to File

Withholding Tax Forms and Returns to File and When to File

Them.

Them.

Who Must File Form

All employers, except employers who remit on an annual basis, must file Form

•Quarterly

•Monthly

•

•Next day

Form

•The payment transmittal form for payments made on a quarterly basis when those payments are made by check or money order, and as,

•The written notification to the department that the business is cancelling its withholding registration.

NOTE: An employer must file Form

NOTE: An employer must file Form

quarter. This includes quarters in which the employer has not

quarter. This includes quarters in which the employer has not

withheld any Arizona tax. For those quarters, the employer

withheld any Arizona tax. For those quarters, the employer

must file a Form

must file a Form

liability. These returns must be filed until the employer

liability. These returns must be filed until the employer

cancels its withholding registration by filing a final Form A1-

cancels its withholding registration by filing a final Form A1-

QRT. The only exception is for employers that qualify to file

QRT. The only exception is for employers that qualify to file

and pay on an annual basis (Form

and pay on an annual basis (Form

Exception for annual payment return (Form

Certain employers may make their withholding payments on an annual basis and file an annual withholding tax return on Form

An employer may make its Arizona withholding payments on an annual basis if all of the following conditions are met:

•The employer has established a history of withholding activity by filing the quarterly tax return (Form

•The employer's withholding liability was an amount greater than zero for at least one of the four preceding calendar quarters.

•The average amount of Arizona income taxes withheld by the employer in the four preceding calendar quarters does not exceed $200. The employer will meet this average withholding requirement if the total amount withheld in the four preceding calendar quarters is $800 or less.

•The employer has timely filed Form

•The employer has filed Form

•The employer has filed the annual reconciliation tax return (Form

An employer may continue to make its Arizona withholding payments on an annual basis for the succeeding calendar year if all of the following conditions are met:

•The average amount of Arizona income taxes withheld by the employer in the four preceding calendar quarters does not exceed $200; and,

•The employer has timely filed the annual tax return and has timely made its annual Arizona withholding payment for the preceding calendar year.

If an employer does not meet all of the qualifying conditions to continue making its Arizona withholding payments on an annual basis for the succeeding calendar year, or, if that employer has an average withholding of greater than $200 for the four preceding calendar quarters:

•The employer must determine its Arizona withholding payment schedule for succeeding calendar quarters according to the instructions in the Arizona Withholding Liability/Payment Schedule section; and,

•The employer shall file the quarterly tax return (Form

What withholding payments are reconciled using this form?

All Arizona withholding amounts averaging more than $200 per quarter are reconciled using this form. Arizona law requires all amounts withheld to be treated as if the withholding was from wages paid to an employee.

NOTE: Arizona law states that all amounts withheld are to be

NOTE: Arizona law states that all amounts withheld are to be

treated as if the withholding was from wages paid to an

treated as if the withholding was from wages paid to an

employee. If you file federal Form 941 to report federal

employee. If you file federal Form 941 to report federal

withholding on Arizona wages and federal Form 945 to report

withholding on Arizona wages and federal Form 945 to report

federal withholding on Arizona

federal withholding on Arizona

Employer Identification Number (EIN), file one

Employer Identification Number (EIN), file one

reconcile the total Arizona withholding for the quarter. Do not

reconcile the total Arizona withholding for the quarter. Do not

file more than one original

file more than one original

same quarter.

same quarter.

File Form

Form

2

Arizona Form

NOTE: Employers that qualify to file and pay on an annual

NOTE: Employers that qualify to file and pay on an annual

basis (Form

basis (Form

Payroll Service Companies

You may use a Payroll Service Company (PSC) to file your Form

Arizona Withholding Deposit Schedules

For Arizona withholding tax purposes, several deposit schedules may apply. The schedule that an employer must use depends on the amount of Arizona tax withheld. These schedules are based on the average amount withheld during the prior 4 quarter period. The employer must compute this average at the start of each new quarter. The deposit schedule that may apply for one quarter may not be the same schedule that applies to the next quarter. Refer to A.A.C.

NOTE: Employers whose Arizona withholding tax liability for

NOTE: Employers whose Arizona withholding tax liability for

the 2020 calendar year is $5,000 or more must make Arizona

the 2020 calendar year is $5,000 or more must make Arizona

withholding tax payments using EFT. See the section “Payment

withholding tax payments using EFT. See the section “Payment

by Electronic Funds Transfer” on page 5 for additional

by Electronic Funds Transfer” on page 5 for additional

information.

information.

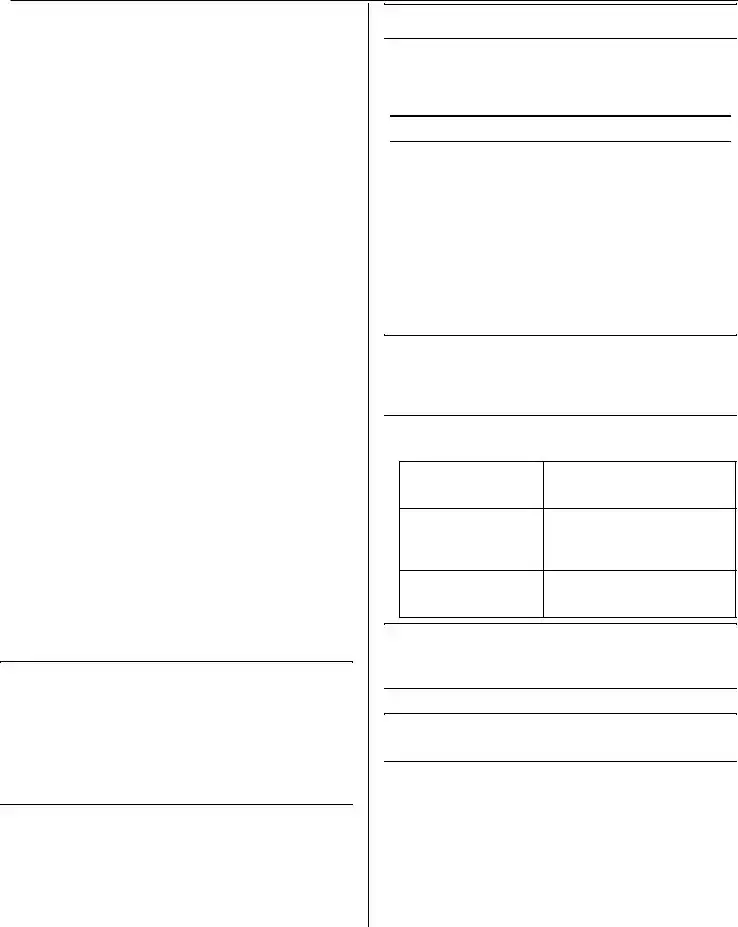

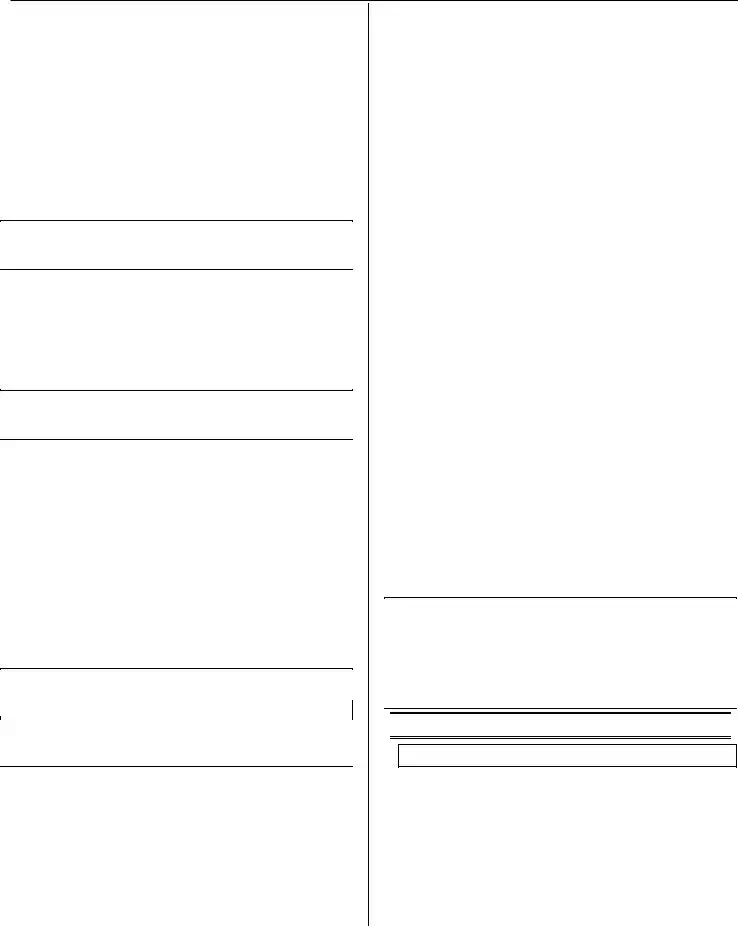

Explanation of Deposit Schedules

The Arizona deposit schedules are as follows:

Previous 4 Quarter |

Arizona Deposit Schedule |

Arizona Withholding |

|

Average |

|

$1,500 or less |

Quarterly |

|

(May deposit on an annual basis |

|

if 4 quarter average is $200 or |

|

less and other criteria met) |

More than $1,500 |

Same time as Federal |

|

(Monthly, |

|

Business Day) |

NOTE: For help in figuring out your quarterly averages and

NOTE: For help in figuring out your quarterly averages and

which deposit schedule to use, see WTP

which deposit schedule to use, see WTP

Withholding Tax Forms and Returns to File and When to File

Withholding Tax Forms and Returns to File and When to File

Them.

Them.

Annual Deposit Schedule

NOTE: An employer that uses the annual deposit schedule

NOTE: An employer that uses the annual deposit schedule

does not file Form

does not file Form

instead.

instead.

Some employers may qualify to make one annual Arizona withholding payment. The employer must have been in business for at least a year and must have established a specified filing and payment history. The employer must also have an average quarterly Arizona tax withholding of $200 or less for the 4 preceding calendar quarters. For complete details, see the instructions for the Annual Payment Withholding Tax Return, Arizona Form

The payment due date for the annual deposit schedule is:

Period in Which Wages |

Arizona Payment Due By |

Paid |

|

January – December |

January 31 of the following |

|

year |

If the due date falls on a Saturday, Sunday, or a legal holiday, the payment will be timely if made on the next banking day.

Quarterly Deposit Schedule

An employer that does not qualify to make one annual Arizona withholding payment and its income tax withheld during the prior 4 quarters was not greater than $1,500, must use the quarterly deposit schedule.

The payment due dates for the quarterly deposit schedule are:

Quarter in Which |

Arizona Payment Due By |

Wages Paid |

|

1st |

April 30 |

2nd |

July 31 |

3rd |

October 31 |

4th |

January 31 |

If the due date falls on a Saturday, Sunday, or a legal holiday, the payment will be considered timely if made on the next banking day.

Monthly or

When an employer’s prior 4 quarter average of Arizona income tax withheld is more than $1,500, the employer must pay its Arizona income tax withheld at the same time it pays its federal tax.

For federal purposes, there are two deposit schedules, monthly and

Federal Monthly Deposit Schedule

For federal purposes, this schedule applies when the total federal tax reported for the federal lookback period was $50,000 or less. Following the monthly deposit schedule, an employer must deposit its taxes for wages paid during the month by the 15th day of the following month. An Arizona employer whose prior 4 quarter average is more than $1,500, who uses this schedule for federal purposes must also deposit the Arizona tax withheld by the 15th day of the following month.

NOTE: If the due date falls on Saturday, Sunday, or a legal

NOTE: If the due date falls on Saturday, Sunday, or a legal

holiday, the payment is considered timely if made on the next

holiday, the payment is considered timely if made on the next

banking day.

banking day.

Federal

This schedule applies when the employer’s total federal tax reported for the federal lookback period was more than $50,000. An Arizona employer whose prior 4 quarter average is more than $1,500, who uses

3

Arizona Form

Day of the Week Wages |

Payment Due By |

Paid |

|

Wednesday, Thursday or |

The following Wednesday |

Friday |

|

Saturday, Sunday, Monday |

The following Friday |

or Tuesday |

|

If the due date falls on a Saturday, Sunday, or a legal holiday, the withholding payment is timely if made on the next banking day.

Federal Next Business Day Deposit

When the employer accumulates a federal tax liability of $100,000 or more on any day during a federal deposit period, the employer must deposit its tax by the close of the next business day. This applies whether the employer is a monthly or

An Arizona employer whose prior 4 quarter average is more than $1,500, that must deposit its federal tax by the close of the next business day, must also deposit its Arizona tax by the close of the next business day. If an employer is a monthly depositor, that employer will become a

General Instructions

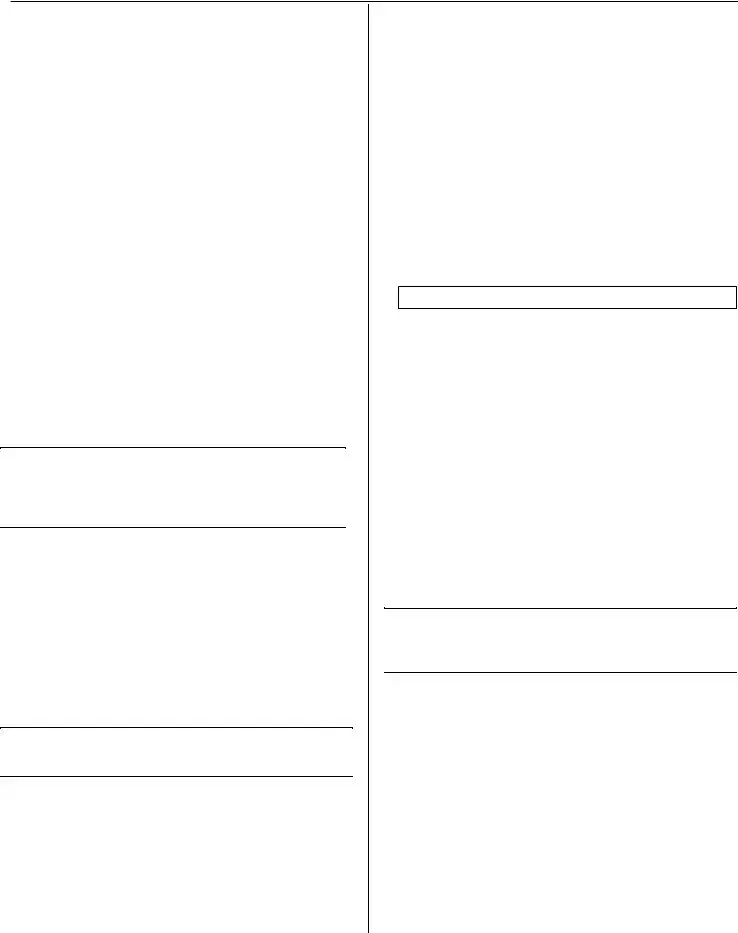

What are the due dates for filing Form

Form

|

Quarter |

Form |

*Form A1- |

|

|

QRT Extended |

|

|

|

Due Date |

Due Date |

1 |

(January - March) |

April 30 |

May 10 |

2 |

(April - June) |

July 31 |

August 10 |

3 |

(July - September) |

October 31 |

November 10 |

4 (October - December) |

January 31 |

February 10 |

|

If any due date falls on a Saturday, Sunday or legal holiday, the return will be considered timely if it is filed by the next business day. (See General Tax Ruling [GTR]

*Extended due dates for Form

Electronic Filing of Withholding Tax Returns

Withholding returns shall be filed electronically for taxable years beginning from and after December 31, 2019, or when the department establishes an electronic filing program.

For 2020, the department currently has three methods to file Form

• An employer may register at https://efile.aztaxes.gov/AZFSETPortal [AZ Web File (ASFSET)] to

• An employer may register at https://aztaxes.gov/Home/Page (AZTaxes) and use the data input method to submit its return.

•Registered transmitters of AZ Web File (AZFSET) can

Any employer who is required to file its withholding return electronically may apply to the director for an annual waiver from the electronic filing requirement. The waiver may be granted, which may be renewed for one subsequent year, if any of the following apply:

•The employer has no computer.

•The employer has no internet access.

•Any other circumstance considered to be worthy by the director.

To request a waiver, submit Form 292, Electronic Filing and Payment Waiver Application, to the department. Form 292 is available at:

A waiver is not required if the withholding return cannot be electronically filed for reasons beyond the employer’s control, including situations in which the employer was instructed by the Internal Revenue Service (IRS), or the Arizona Department of Revenue (department) to file by paper.

Please contact the department at azwebfilesupport@azdor.gov if you need assistance in electronically submitting your Arizona withholding return.

Filing an Original Return

File this form on a quarterly basis. File one Form

Submit Form

What to do if you close your business

When your business is sold, discontinued, converted to a new form, or all your employees are dismissed, you must notify the department by filing a final return and request the department close your withholding account. Until you request the department cancel your withholding account, your withholding return(s) will continue to be due.

To file your final Form

•Check box C “Final Return” to cancel your withholding account. Enter the date final wages were paid. Also complete Part 6.

•Check box D if this form is being filed by the surviving employer and the period(s) covered are for less than 3 months. Enter the Predecessor Employer Name and EIN in the spaces provided.

NOTE: To cancel your account, you must file a final Form A1-

NOTE: To cancel your account, you must file a final Form A1-

QRT and file a final Form

QRT and file a final Form

wages were paid. Refer to the instructions for Form

wages were paid. Refer to the instructions for Form

assistance in filing your final Form

assistance in filing your final Form

4

Arizona Form

Filing an Amended Return

If this is an amended Form

If you amend a return for a quarter in a prior calendar year, you must also file an amended Form

Unless the employer was granted a waiver to file its original return by paper, or was directed by the IRS or the department to file the original Form

NOTE: Amended Forms

NOTE: Amended Forms

AZTaxes.

AZTaxes.

Penalties and Interest

Late Filing Penalty

If you file late, a late filing penalty will be assessed. This penalty is 4½% (.045) of the tax required to be shown on the return for each month or fraction of a month the return is late. This penalty cannot exceed 25% (.25) of the tax found to be remaining due.

Late Payment Penalty

If the tax is paid late, a late payment penalty will be assessed. This penalty is ½ of 1% (.005) of the amount shown as tax for each month or fraction of a month for which the failure continues. The department charges this penalty from the original due date of the return until the date you pay the tax. This penalty cannot exceed a total of 10% (.10) of the unpaid tax.

NOTE: If you voluntarily file an amended return and pay the

NOTE: If you voluntarily file an amended return and pay the

additional tax due when you file your amended return, the

additional tax due when you file your amended return, the

department will not assess the late payment penalty.

department will not assess the late payment penalty.

Exceptions are:

Exceptions are:

• The taxpayer is under audit by the department.

• The taxpayer is under audit by the department.

• The amended return was filed on demand or request by the department.

• The amended return was filed on demand or request by the department.

NOTE: If the penalties in both A and B apply, the maximum

NOTE: If the penalties in both A and B apply, the maximum

combined penalty cannot be more than 25%.

combined penalty cannot be more than 25%.

Additional Failure to Pay Penalty

An additional penalty may be assessed if the amount of tax required to be withheld is not paid by the date set for its payment. This penalty is 25% (.25) of the amount of tax required to be withheld and paid to the department.

Payroll Service Company Penalty

A PSC must make withholding payments electronically. A PSC must also file Form

would be subject to four $25 penalties, totaling $100. If the PSC files a paper Form

Interest

The department charges interest on any tax not paid by the due date. The Arizona interest rate is the same as the federal rate imposed on individual taxpayers.

Payment of Tax

The entire amount of tax must be paid by the original due date of Form

NOTE: If the due date falls on a Saturday, Sunday, or a legal

NOTE: If the due date falls on a Saturday, Sunday, or a legal

holiday, the payment will be considered timely if made on the next

holiday, the payment will be considered timely if made on the next

business day.

business day.

Payment by Electronic Funds Transfer

Employers are required to pay their tax liability by electronic funds transfer (EFT) if the employer owes:

•$5,000 or more for any taxable year beginning from and after December 31, 2019, through December 31, 2020; or

•$500 or more for any taxable year beginning from and after December 31, 2020.

NOTE: If an employer was required to make its tax payments for

NOTE: If an employer was required to make its tax payments for

taxable year 2020 by EFT, it must also pay any additional tax due

taxable year 2020 by EFT, it must also pay any additional tax due

from an amended return by EFT,

from an amended return by EFT,

An employer may apply to the director for an annual waiver from the electronic payment requirement. The application must be received by December 31 of each year. The director may grant the waiver if any of the following applies:

•The employer has no computer.

•The employer has no internet access.

•Any other circumstance considered to be worthy by the director exists, including:

O Theemployerhasasustainedrecordoftimelypayments,and, O No delinquent tax account with the department.

To request a waiver, submit Form 292, Electronic Filing and Payment Waiver Application, to the department. Form 292 is available at:

NOTE: An employer who is required to pay by EFT but who fails

NOTE: An employer who is required to pay by EFT but who fails

to do so is subject to a penalty of 5% (.05) of the amount of the

to do so is subject to a penalty of 5% (.05) of the amount of the

payment not made by EFT. See A.R.S. §

payment not made by EFT. See A.R.S. §

For additional information on electronic funds transfer, refer to

For additional information on electronic funds transfer, refer to

A.R.S. §

A.R.S. §

(A.A.C.

(A.A.C.

How to Make EFT Payments

Employers making EFT payments must register with the department before their EFT payments may be accepted. An officer of the employer must complete the initial registration.

Employers may use AZTaxes.gov to make EFT payments:

•Payments can be made electronically from a checking or savings account. Login to your account on www.AZTaxes.gov and choose the

5

Arizona Form

•Payments can be made by American Express, Discover, MasterCard, or Visa credit cards. Login to your account on www.AZTaxes.gov and choose the credit card option. This will take you to the website of the credit card payment service provider. Follow the prompts to make your payment.

The service provider will charge a fee based on the amount of the tax payment. The service provider will disclose the amount of the fee during the transaction and you will be given the option to continue or cancel. If you accept the fee and complete the credit card transaction, a confirmation number will be generated. Please keep this confirmation number as proof of payment.

•EFT payments may also be made by ACH Credit. To register to make ACH Credit payments, go to the department’s website, www.azdor.gov. Click on “Forms”, then click “Other Forms.” Click on Form number 10366, Electronic Funds Transfer (EFT) Disclosure Agreement for ACH Credit filers. Click “Download.” Complete the form as instructed. Submit the completed application at least five business days before the first anticipated transaction as it may take that long to process the application.

Fax the completed form to the department at (602)

The payment will be electronically transferred into the department’s account, normally the next business day. The employers should consult with its bank for the timeframe required to make timely payments. NOTE: The employers may be charged a service fee.

NOTE: Employers using a foreign bank account to make EFT

NOTE: Employers using a foreign bank account to make EFT

payments cannot make EFT payments by ACH Debit. The

payments cannot make EFT payments by ACH Debit. The

department does not accept ACH Debit payments from a foreign

department does not accept ACH Debit payments from a foreign

bank account. If the employer wishes to make a payment from a

bank account. If the employer wishes to make a payment from a

foreign bank account by EFT, the payment MUST be made by

foreign bank account by EFT, the payment MUST be made by

ACH Credit. See the instructions for ACH Credit above to register

ACH Credit. See the instructions for ACH Credit above to register

and make ACH Credit payments.

and make ACH Credit payments.

Specific Instructions

Part 1 - Taxpayer Information

Name, Address, Phone Number and Address Change Box

Type or print the employer's name, address, and phone number in the spaces provided.

If the employer has a foreign address, enter the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Do not

abbreviate the country’s name.

Employer Identification Number (EIN)

Enter the employer’s EIN. If the employer does not have an EIN, it must get one from the Internal Revenue Service. All returns, statements, or other documents filed with the department must have the employer’s EIN indicated on them. Employers that fail to include their EIN may be subject to a penalty.

Quarter and Year

Enter the quarter and the year for which Form

Quarter |

Months in Quarter |

1st |

January through March |

2nd |

April through June |

3rd |

July through September |

4th |

October through December |

Check Boxes:

A. Amended Return

If this is an amended Form

If you amend a return for a quarter in a prior calendar year, you must also file an amended Form

NOTE: An amended Form

NOTE: An amended Form

filed through https://efile.aztaxes.gov/AZFSETPortal by a

filed through https://efile.aztaxes.gov/AZFSETPortal by a

PSC or by an employer filing through a registered transmitter.

PSC or by an employer filing through a registered transmitter.

All other employers required to file an amended Form A1-

All other employers required to file an amended Form A1-

QRT must file a paper return.

QRT must file a paper return.

B. Address Change

If you changed your address since you last filed Form

C. Final Return

If this is a final return, check Box C, “Final Return (CANCEL ACCOUNT)” to request that the department cancel your withholding account. Enter the date final wages were paid. Complete Part 6 to indicate the reason for the cancellation. Complete the remainder of your return to report your Arizona income tax withholding liability for the period(s) in which your account was closed.

NOTE: You must also file a final Form

NOTE: You must also file a final Form

instructions for Form

instructions for Form

Form

Form

D. Surviving Employer

If you file this return as the surviving employer and the period(s) covered by this return are for less than 3 months, check Box D. Also, enter the Predecessor Employer Name and EIN in the spaces provided.

Line E - Total Arizona Payroll for the Quarter

Enter the total gross Arizona payroll for this calendar quarter. Total gross Arizona payroll means the amounts considered wages for federal income tax withholding purposes.

6

Arizona Form

Line F – Total Number of Employees paid Arizona Wages for this Quarter

Enter the number of employees whose compensation for this calendar quarter was subject to Arizona withholding.

Include in this number:

•Employees who had Arizona withholding deducted from their compensation during this calendar quarter, and

•Employees whose compensation was for services performed in Arizona but the employee(s) filed an election to not have any Arizona withholding deducted from their compensation.

Do not include in this number:

•Annuity recipients,

•Independent contractors,

•Pension recipients, or,

•Employees whose Arizona compensation is excluded from withholding by Arizona law.

Part 2 - Tax Liability Schedule

Complete section A, Quarterly Deposit Schedule, or section B, Monthly or

Include all withholding amounts from all sources. Arizona law requires all amounts withheld from pensions and annuities, gambling winnings, unemployment compensation, etc., be treated as if the withholding was from wages paid to an employee. File one Form

Section A

Complete section A if the average amount of your Arizona tax withheld for the prior 4 quarters was greater than $200, but not more than $1,500.

Line A1

Enter the tax amount withheld for the quarter on line A1. Also, enter this amount in Part 3, line 1. Do not complete Section B. Continue to Part 3. Do not complete Part 4.

NOTE: If you are a monthly depositor and incur a

NOTE: If you are a monthly depositor and incur a

deposit requirement during the quarter, you become a semi-

deposit requirement during the quarter, you become a semi-

weekly depositor for the remainder of the quarter, and for the

weekly depositor for the remainder of the quarter, and for the

following calendar year.

following calendar year.

Section B

Complete section B if the average amount of your Arizona tax withheld for the prior 4 quarters was greater than $1,500.

Arizona employers whose prior 4 quarter average of Arizona income tax withheld is more than $1,500 must pay its Arizona income tax withheld to the department at the same time it pays its federal income tax withheld: monthly,

If you are a

Complete Part 4 only for the months in which you had a semi- weekly deposit or had a

Lines B1 through B3

Enter the tax amount withheld for each month of the quarter. If you are a

Line B4

Total the amounts on lines B1 through B3. Enter the total. This is the total amount withheld for the quarter.

Part 3 - Tax Computation

Line 1 - Liability (Arizona Tax Withheld or Amount Required to be Withheld During the Quarter)

•Quarterly Depositors

Enter the amount from Part 2, Section A, line A1.

•Monthly and

Line 2 - Payments Made during the Quarter

Enter the total amount of payments made for this quarter. If no payments were made prior to filing this return, enter “0”.

Do not include any payment that is made with this return (or for this return, if you are making a payment for an amount due for this return).

Line 3 - Total Amount Due

Subtract the amount on line 2 from the amount on line 1. Enter the difference.

If line 3 is a positive number, this is the amount of tax due. See the section, Payment of Tax, Penalties, and Interest, below for details on paying your tax due. If you owe any penalty or interest, the department will calculate these amounts and mail a billing notice after the return is processed. The entire amount of tax must be paid by the due date of Form

If you are filing an amended return and that return shows a balance due, enclose the amount due with the amended return, unless your payment must be made by EFT. The department will send you a bill for any interest or penalty due once the amended return is processed.

If line 3 is a negative number (an amount less than zero), this is the overpayment for the quarter. Use a minus sign to indicate a negative amount. After the return is processed and payments are confirmed, the overpayment will be applied to any outstanding liabilities, possibly in another tax type. If the overpayment exceeds the outstanding liabilities or the employer has no outstanding liabilities, a refund check will be issued and mailed to the employer. A refund will not be issued once the overpayment is applied to a liability.

Payment of Tax, Penalties, and Interest

The entire amount of tax, penalties, and interest is due by the original due date of the return.

If payment is due, and the employer is required to pay by EFT, see the Section, How to Make EFT Payments, for instructions on paying your tax liability by EFT.

If payment is due, and the employer is not required to pay by EFT, you may elect to pay by EFT. Or you may pay by check or money order. If paying by check or money order, make the check or money order payable to the Arizona Department of Revenue.

Arizona Form

NOTE: If this is an amended Form

NOTE: If this is an amended Form

required to make 2020 withholding payments by EFT, you must

required to make 2020 withholding payments by EFT, you must

also pay any additional withholding tax due from the amended

also pay any additional withholding tax due from the amended

return by EFT.

return by EFT.

Part 4 –

Schedule

If you checked the box in Part 2, Schedule B, complete Part 4 for each month you are required to make withholding deposits on a

Enter the amount of Arizona withholding tax liability on the day (of the month) the liability was incurred. Do not enter the amount of the withholding payment(s). Enter the total withholding liability for the month on the line labeled “Month 1, 2, or 3.”

EXAMPLE: Taxpayer R is a

EXAMPLE: Taxpayer R is a

incurred an Arizona tax withholding liability on the following

incurred an Arizona tax withholding liability on the following

dates in January 2020: January 3 - $1,500; January 17 -

dates in January 2020: January 3 - $1,500; January 17 -

$1,750; and January 31 - $1,600. In Schedule A, R enters

$1,750; and January 31 - $1,600. In Schedule A, R enters

$1,500 on line 3; R enters $1,750 on line 17; and R enters

$1,500 on line 3; R enters $1,750 on line 17; and R enters

$1,600 on line 31. On the line labeled “Month 1 Liability.” R

$1,600 on line 31. On the line labeled “Month 1 Liability.” R

enters the total tax liability for January 2020 - $4,850. R also

enters the total tax liability for January 2020 - $4,850. R also

enters this amount on Part 2, Schedule B, line B1.

enters this amount on Part 2, Schedule B, line B1.

Taxpayers with

EXAMPLE: Taxpayer R incurred an Arizona withholding tax

EXAMPLE: Taxpayer R incurred an Arizona withholding tax

liability on the following dates in February 2020: February 14

liability on the following dates in February 2020: February 14

- $2,350, and February 28 - $1,950. In addition, R incurred a

- $2,350, and February 28 - $1,950. In addition, R incurred a

federal

federal

enters $2,350 on line 14, and checks the box on line 14 to

enters $2,350 on line 14, and checks the box on line 14 to

indicate it incurred a

indicate it incurred a

28 liability on line 28 and does not check the box on line 28

28 liability on line 28 and does not check the box on line 28

because it did not incur a

because it did not incur a

liability for February 2020 - $4,300 on the line labeled “Month

liability for February 2020 - $4,300 on the line labeled “Month

2 Liability”. R also enters this amount on Part 2, Schedule B,

2 Liability”. R also enters this amount on Part 2, Schedule B,

line B2.

line B2.

Part 5 - Amended Return Information

If this is an amended return, explain why you are amending Form

Part 6 – Final Form

Lines 1 through 6 -

If you checked the Box C, “Final Return (CANCEL ACCOUNT)”, check the box that explains why this is your final return. If the reason is not provided, check “Other” and enter your own explanation.

Line 7 –

Check the box and provide name and location of your records if they will be kept at a different location from the address you provided in Part 1.

7

Line 8 –

Check the box and provide the name and address of the successor employer, if any.

Who Must Sign Form

The following persons are authorized to sign the return for each type of business entity.

•Sole proprietorship - The individual who owns the business.

•Corporation [including a limited liability company (LLC) treated as a corporation] - The president, vice president, or other principal officer duly authorized to sign.

•Partnership (including an LLC treated as a partnership) or unincorporated organization - A responsible and duly authorized member, partner, or officer having knowledge of its affairs.

•Single member LLC treated as a disregarded entity for federal income tax purposes - The owner of the LLC or a principal officer duly authorized to sign.

•Trust or estate - The fiduciary.

Form

8

Arizona Form

Paid Preparer Use Only

Paid preparers: Sign and date the return. Complete the firm name and address lines (the paid preparer’s name and address, if

Paid preparers must provide a Tax Identification Number (TIN). Paid preparers that fail to include their TIN may be subject to a penalty.

The TIN for a paid preparer may be one of the following:

•The preparer’s PTIN,

•The EIN for the business, or,

•The individual preparer’s social security number (SSN), if

File Properties

| Fact Number | Fact Detail |

|---|---|

| 1 | The Arizona Form A1-QRT is used for the Quarterly Withholding Tax Return. |

| 2 | Employers must not file more than one original A1-QRT per Employer Identification Number (EIN) per quarter. |

| 3 | Employers need to provide basic taxpayer information including the quarter and year, alongside their business contact information. |

| 4 | There are checkboxes for indicating if the return is an Amended Return, Address Change, Final Return (Cancel Account), or for lesser than three months due to change in employer status. |

| 5 | Employers can file this form to reconcile their withholding deposits for the calendar quarter, and it serves as the payment transmittal for quarterly payments made by check or money order. |

| 6 | Form A1-QRT also informs the Arizona Department of Revenue if a business is canceling its withholding registration. |

| 7 | For tax liability, the form distinguishes between Quarterly Deposit Schedule and Monthly/Semi-Weekly/Next Day Deposit Schedule based on the employer's previous four quarter average being not more than $1,500 or greater than $1,500, respectively. |

| 8 | Employers must calculate tax liability, report payments made during the quarter, and determine the total amount due or refundable. |

| 9 | The form must be signed under the penalties of perjury, attesting to its completeness and accuracy. |

| 10 | Governed by Arizona law, the use of the form is mandated for employers to comply with state withholding tax procedures and rulings, particularly as detailed in the Withholding Tax Procedure (WTP) 16-2 and relevant Arizona Administrative Code sections, including A.A.C. R15-2B-101(A). |

Instructions on Utilizing Arizona Tax Return

Filling out the Arizona Tax Return form, specifically the Arizona Form A1-QRT for Quarterly Withholding Tax Return, might seem daunting at first look. This task requires attention to detail and an understanding of the company's payroll within the specified quarter. The purpose of the form is to reconcile the taxes withheld from employees’ wages, ensuring the right amount is remitted to the Arizona Department of Revenue. Below are the steps to correctly complete the form, ensuring compliance with Arizona's tax laws.

- Begin by inputting the Taxpayer Information in Part 1. This includes the legal name of the business, Employer Identification Number (EIN), and the contact information such as the business address, telephone number, and the selected quarter and year you are reporting for. Ensure to enter the Quarter (1, 2, 3, or 4) followed by the year as YYYY.

- If applicable, check the appropriate box in Part 1 to indicate if the return is an Amended Return, there’s an Address Change, it’s a Final Return (indicating you wish to cancel your withholding account), or if this form is filed by a Surviving Employer.

- For businesses concluding operations, complete Part 6 regarding Final Form A1-QRT information.

- In Part 2, determine your Tax Liability Schedule. If your prior 4 quarter average was not more than $1,500, follow Section A. Enter the total amount withheld during the quarter in A1. Otherwise, complete Section B for Quarterly Deposit Schedule. Here, document monthly liabilities in B1, B2, and B3, then tally the total in B4.

- Transfer the total amount from Part 2, line A1 or B4, to Part 3, line 1 under Tax Computation. Subtract payments made during the quarter (line 2) from the liability (line 1) to find the total amount due (line 3).

- Complete the Declaration section by providing the taxpayer's and, if applicable, the paid preparer’s signatures along with the date. This section reaffirms that the information provided on the form is accurate to the best of your knowledge.

- If amending a return, offer an explanation in Part 5. This section allows you to provide reasons and any relevant adjustments.

- For those using semi-weekly/next-day deposit schedules, complete Part 4 by indicating the days within each month that had deposit obligations and noting the monthly liabilities.

- Lastly, ensure to make the check payable to the Arizona Department of Revenue and mail your completed form to the appropriate address provided in the instructions, along with any payments due.

By methodically following these steps, businesses can accurately fulfill their quarterly tax obligations. It is crucial to cross-verify all the information entered on the form to prevent possible errors or delays. Additionally, maintaining copies of the filed form and related documents is advisable for record-keeping and future reference.

Listed Questions and Answers

What is Form A1-QRT and why is it required?

Form A1-QRT, also known as the Arizona Quarterly Withholding Tax Return, is a form required by the state for all employers, except those who remit on an annual basis. It's used for reconciling amounts withheld from employees' wages for Arizona income tax during each quarter. Employers must withhold Arizona income tax from wages, bonuses, and certain other payments unless those wages are exempt from Arizona withholding tax. This form serves not only as the means to reconcile and report the total tax withheld during the quarter but also as a payment transmittal for those making payments via check or money order. Additionally, it notifies the department if a business is cancelling its withholding registration.

Who must file Form A1-QRT?

All employers, except those who qualify to remit withholding taxes on an annual basis, are required to file Form A1-QRT. This includes employers that withhold taxes on a quarterly, monthly, semi-weekly, or next-day basis. Even if an employer has not withheld any Arizona tax during a quarter, a Form A1-QRT showing zero withholding liability must still be filed. This requirement continues until the employer cancels its withholding registration.

What payments are reconciled using Form A1-QRT?

Form A1-QRT reconciles all Arizona withholding amounts that average more than $200 per quarter. This includes amounts withheld from wages, bonuses, and other compensations for services performed within Arizona. The law mandates that these withholdings be treated as if they were from wages paid to an employee. Employers who also file federal Forms 941 for reporting federal withholding on Arizona wages and Form 945 for reporting federal withholding on Arizona non-wage payments must reconcile the total Arizona withholding using one A1-QRT per quarter.

When are Form A1-QRT due?

Form A1-QRT must be filed by the following dates: for the first quarter (January - March), by April 30; for the second quarter (April - June), by July 31; for the third quarter (July - September), by October 31; and for the fourth quarter (October - December), by January 31. If a due date falls on a weekend or legal holiday, the form is considered timely if filed by the next business day. Employers who have made every payment on time during the prior quarter may enjoy an extended due date, granting them an additional 10 days to file.

Can I use a Payroll Service Company (PSC) to file Form A1-QRT?

Yes, employers may use a Payroll Service Company (PSC) to file Form A1-QRT. If this option is chosen, the PSC must file the A1-QRT electronically on behalf of the employer. This service ensures accuracy and timeliness in filing, catering to the needs of businesses that might not have the capacity to manage their payroll tax filings in-house.

What are the deposit schedules for withholding tax?

The Arizona Department of Revenue requires different deposit schedules based on an employer's average withholding amount during the prior four quarters. If the average is $1,500 or less, the quarterly deposit schedule applies. Employers may deposit on an annual basis if their average is $200 or less, meeting other criteria. For those with more than $1,500, Arizona withholding payments align with federal schedules, either monthly, semi-weekly, or the next business day, matching the federal tax payment schedule.

Are there electronic filing requirements for Withholding Tax Returns, including Form A1-QRT?

Starting from taxable years beginning after December 31, 2019, and once the Department of Revenue establishes an electronic filing program, withholding tax returns must be filed electronically. This includes Form A1-QRT. As of 2020, there are three available methods for electronically filing Form A1-QRT, accommodating the modern needs for efficiency and accessibility in tax filing.

Common mistakes

Filing more than one original A1-QRT form for the same Employer Identification Number (EIN) and quarter. This is a crucial mistake as it can lead to processing delays and unnecessary confusion. The system is designed to process only one original submission per EIN per quarter.

Not specifying the correct quarter and year in the designated "QUARTER AND YEAR" section. It is essential to enter the quarter (1, 2, 3, or 4) and the four digits of the year correctly to ensure that the return is applied to the correct period.

Choosing both the Quarterly and Monthly/Semi-Weekly deposit schedules on the form. This error arises when filers complete both Section A and Section B, which is not permitted. You should complete only the section that applies to your deposit schedule.

Incorrectly calculating the total amount due. Some filers subtract line 2 from line 1 on Part 3 and mistakenly record a positive amount when they have overpaid and should indicate a negative amount (using a minus sign).

Omitting crucial checkboxes like Amended Return, Address Change, Final Return, or indicating that the form was filed by a successor employer. These checkboxes provide critical information about the nature of the return and must not be overlooked.

Failing to include required attachments or explanations for amending a return or for checking the "Final Return" box in Part 1. If you amend a return or file a final return, you must provide a clear explanation for your action, including additional sheets if the space provided is insufficient.

Not signing the declaration section. The return is not valid without the taxpayer’s signature, date, and if applicable, the paid preparer’s information and signature. This oversight can result in the return being considered incomplete.

Preventing these errors can significantly smooth the filing process and ensure that your quarterly withholding tax returns are processed efficiently and accurately. Always take the time to review the form instructions and double-check your entries before submission.

Documents used along the form

When managing Arizona Taxes, the Arizona Quarterly Withholding Tax Return Form (A1-QRT) is crucial, but it's often just a starting point. Companies and individuals may need to manage and file various other forms and documents to fully comply with Arizona’s tax laws. Understanding these forms helps ensure accurate and timely filing. Below is a list of other critical documents used alongside the Arizona Tax Return form.

- Form A1-R: Arizona Annual Withholding Reconciliation Tax Return, used to reconcile the taxes withheld from employees' wages throughout the year.

- Form A1-APR: Annual Payment Withholding Tax Return, an option for employers who meet certain criteria to file and pay their withholding tax on an annual basis instead of quarterly.

- Form A-4: Employee’s Arizona Withholding Election, allows employees to choose their withholding rate for state taxes.

- Form 941: Employer’s Quarterly Federal Tax Return, used to report federal withholdings, Social Security, and Medicare taxes to the IRS, necessary for businesses that also operate within Arizona.

- Form 945: Annual Return of Withheld Federal Income Tax, for reporting non-wage income withheld for federal taxes, which may need to be considered alongside Arizona withholdings.

- Form W-2: Wage and Tax Statement, provided to employees to report annual wages and taxes withheld, which must be aligned with the information filed on state returns.

- Form W-3: Transmittal of Wage and Tax Statements, used to send Form W-2 to the Social Security Administration, ensuring federal and state tax records match.

- Form 1099: Information Returns, for reporting various forms of income other than wages, such as freelance or contract work, which may also require state reporting.

- Form W-9: Request for Taxpayer Identification Number and Certification, used to gather information from contractors or others who are paid outside of the traditional employee structure.

Each form serves a unique purpose and contributes to the comprehensive reporting and compliance process for Arizona taxes. It’s essential to understand the specific requirements and deadlines for each to maintain accurate records and avoid potential penalties. Staying informed and prepared with these documents can significantly streamline the tax filing process.

Similar forms

The Arizona Tax Return form, specifically the Arizona Form A1-QRT, shares similarities with several other documents commonly used in financial and tax reporting. One similar document is the Federal Form 941, the Employer's Quarterly Federal Tax Return. Similar to Arizona's A1-QRT, Form 941 is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks and to pay the employer's portion of Social Security or Medicare tax. Both forms require the employer's identification information, details about the tax liability, and a reconciliation of the taxes due versus what has been paid.

Another document akin to the Arizona A1-QRT is the Federal Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return. While the A1-QRT deals with withholding taxes quarterly, Form 940 covers the reporting of annual unemployment taxes at the federal level. Both require the employer to report the total payroll, though the taxes remitted serve different purposes—unemployment versus income withholding.

Form W-2, Wage and Tax Statement, also bears resemblance to the A1-QRT, in that both forms involve the reporting of employee wages and taxes withheld. The key difference is that Form W-2 is prepared for each employee to report their annual wages and taxes withheld, while the A1-QRT is a summary form filed by the employer on a quarterly basis to report the total amount withheld from all employees.

The State Unemployment Tax Act (SUTA) filings, specific to each state, are similar to the A1-QRT in that both involve reporting related to employee compensation and pay employer-specific taxes. SUTA filings focus on unemployment taxes at the state level, requiring detailed payroll reports, similar to how the A1-QRT collects information on total payroll and the corresponding Arizona state withholdings.

The Arizona Form A1-APR, Annual Payment Withholding Tax Return, is a directly related document used for employers who qualify to report and pay Arizona withholding tax on an annual basis, instead of quarterly. It serves a similar purpose to the A1-QRT but is assigned to a different reporting schedule. Both forms ensure compliance with Arizona’s withholding tax requirements, albeit on different timelines.

Form 945, Annual Return of Withheld Federal Income Tax, is the annual counterpart to the quarterly A1-QRT, with a focus on reporting non-payroll federal withholding. This similarity lies in the government's need to track and receive taxes withheld from various income sources throughout the year, requiring taxpayers to reconcile the total withheld amounts with their actual tax liabilities.

The Monthly, Semi-Weekly, and Next-Day Deposit Schedules referenced in the A1-QRT instructions are closely related to the IRS's tax deposit schedules for employment taxes. Employers must follow these schedules based on their tax liability size, similar to how federal tax deposit schedules dictate when an employer must submit withholdings to the IRS.

Finally, the Arizona Form A1-R, Arizona Withholding Reconciliation Tax Return, complements the A1-QRT by providing an annual overview of the withholding reported quarterly through A1-QRT forms. It requires employers to reconcile the total tax withheld during the year with the amounts reported and serves as a yearly summary akin to how the A1-QRT serves for quarter-to-quarter reporting.

Dos and Don'ts

When filling out the Arizona Tax Return form (Form A1-QRT), it is crucial to follow the correct procedures to avoid errors that could lead to penalties or delays. Below are essential dos and don'ts to keep in mind:

Do:

- Read the instructions carefully before you start filling out the form to ensure you understand the requirements.

- Double-check the Employer Identification Number (EIN) to make sure it matches the number registered with the Arizona Department of Revenue.

- Enter the quarter and year accurately in the designated field to avoid filing under the wrong period.

- Ensure all monetary amounts are correct and match your records, especially the total Arizona payroll for the quarter and the total number of employees paid.

- Sign and date the form. An unsigned form may be considered invalid and could lead to processing delays.

- File electronically if possible , as this can streamline the process and help prevent errors.

- Make your payment payable to the Arizona Department of Revenue and include the EIN on your payment for proper identification.

- Keep a copy of the completed form and any payment confirmation for your records.

Don't:

- File more than one original A1-QRT per EIN per quarter. Submitting duplicates can cause processing confusion.

- Leave mandatory fields blank . Incomplete forms may be returned or not processed, which could result in penalties.

- Guess on figures or information. Verify all data before submission to ensure accuracy.

- Ignore the deposit schedule that applies to your employer classification. Whether you fall into quarterly, monthly, or semi-weekly/next day deposit schedule affects your filing requirements.

- Forget to check the appropriate box if you are filing an amended return, changing your address, or if this is a final return.

- Mix up the quarterly and annual filing requirements . Ensure you follow the correct procedure based on your tax liability and withholding pattern.

- Overlook the declaration section . The taxpayer's signature and the paid preparer's information (if applicable) are crucial for the form's validity.

- Delay your filing beyond the due date. Late submissions can result in penalties and interest charges.

Misconceptions

When navigating the complexities of Arizona's Form A1-QRT, a Quarterly Withholding Tax Return, it's not uncommon to encounter a host of misconceptions that can lead to confusion and potential errors. Understanding these common misunderstandings is key to ensuring compliance and accuracy in filing. Here are eight notable misconceptions about the Arizona Tax Return form and the truths behind them:

Only businesses with employees need to file. Contrary to this belief, any entity that has withheld Arizona income tax must file Form A1-QRT – including those withholding on pensions and gambling winnings, not just employers with traditional employees.

If no tax was withheld during the quarter, filing is not necessary. This is incorrect. Even if no Arizona income tax was withheld in a quarter, the form must still be submitted, displaying a zero withholding liability. This clear reporting ensures the continuation of accurate records and compliance.

The form is only for calculating the amount of tax to be paid. While Form A1-QRT does involve reporting the amount of tax withheld and due, it also serves other purposes such as notifying the state about amendments to previously filed returns and indicating a business's cessation or change in registration details.

I can wait to file until I've paid all the withheld taxes. Filing deadlines are set regardless of payment status. Timely filing must happen by the due date, even if you've arranged with the Arizona Department of Revenue to pay the withheld taxes later.

Amendments to a return aren't allowed after filing. If mistakes were made on the original return, amendments can and should be made by checking the "Amended Return" box in Part 1 and providing a clear explanation in Part 5 for why the amendment is necessary.

Filing electronically is optional. Starting from the tax year 2020, the Arizona Department of Revenue requires electronic filing for withholding tax returns, making electronic submission not just an option but a requirement.

The form is the same for all types of filers. The form must be completed differently depending on the filer's situation, such as the business's deposit schedule or if the form is used for regular quarterly filing versus indicating the business is closing or changing ownership.

Only annual filers need to reconcile withholding at year's end. Reconciliation must occur every quarter, ensuring that the amount withheld matches the amount submitted to the state. This process is crucial for maintaining accurate tax records and ensuring compliance throughout the year.

Dispelling these misconceptions is vital for any employer or entity dealing with Arizona withholding tax. Accurate completion and timely submission of Form A1-QRT reflect adherence to state tax regulations, helping to avoid potential penalties for non-compliance.

Key takeaways

When navigating the intricacies of the Arizona Tax Return form, specifically Form A1-QRT for quarterly withholding tax, understanding the key elements can significantly streamline the process. Here are five essential takeaways to aid in filling out and utilizing the form effectively:

- Filing Frequency and Eligibility: Depending on the average amount withheld during the previous four quarters, employers are designated a specific deposit schedule—quarterly, monthly, or semi-weekly/next day. This classification dictates when and how often tax payments must be submitted to the Arizona Department of Revenue.

- Electronic Submission Requirements: Starting from taxable years after December 31, 2019, all withholding tax returns must be filed electronically. This move towards digital submissions aims to streamline the filing process, ensuring both efficiency and accuracy in tax handling.

- Correct Selection Between Part A and Part B: Form A1-QRT necessitates careful attention when declaring the withholding amounts; one must complete either Section A for quarterly deposit schedule filers or Section B for those on monthly or semi-weekly/next day deposit schedules, but never both. This distinction is crucial for the correct processing of the form.

- Understanding Amended and Final Returns: The form provides options to indicate if the submission is an amended return, involves a business address change, or represents a final return, which is essential for businesses concluding operations or undergoing significant changes. Each option has its requirements and implications on the business’s withholding account.

- Due Dates and Extended Filing Options: Form A1-QRT has specific quarterly due dates, but it’s important to note that employers who have made timely payments throughout the previous quarter may qualify for an extended due date, offering an additional 10 days to file. Keeping track of these dates ensures compliance and avoids potential penalties for late submission.

Adherence to these guidelines can assure systematic compliance with Arizona's withholding tax requirements, thereby minimizing errors and streamlining the submission process. Employers are encouraged to understand these key aspects thoroughly to facilitate accurate and timely tax reporting and payment.

More PDF Forms

Undesignated Felony - The stringent eligibility requirements ensure that only those with undesignated, less severe felonies without prior significant convictions can apply, maintaining the balance between justice and compassion.

Arizona State Ein Number - Solicits essential information for small, woman-owned, and minority-owned businesses.

Arizona Filing Requirements - Allows for the declaration of separate and community property, aiding in the smooth division process.