Fill in a Valid Arizona Repossession Affidavit Template

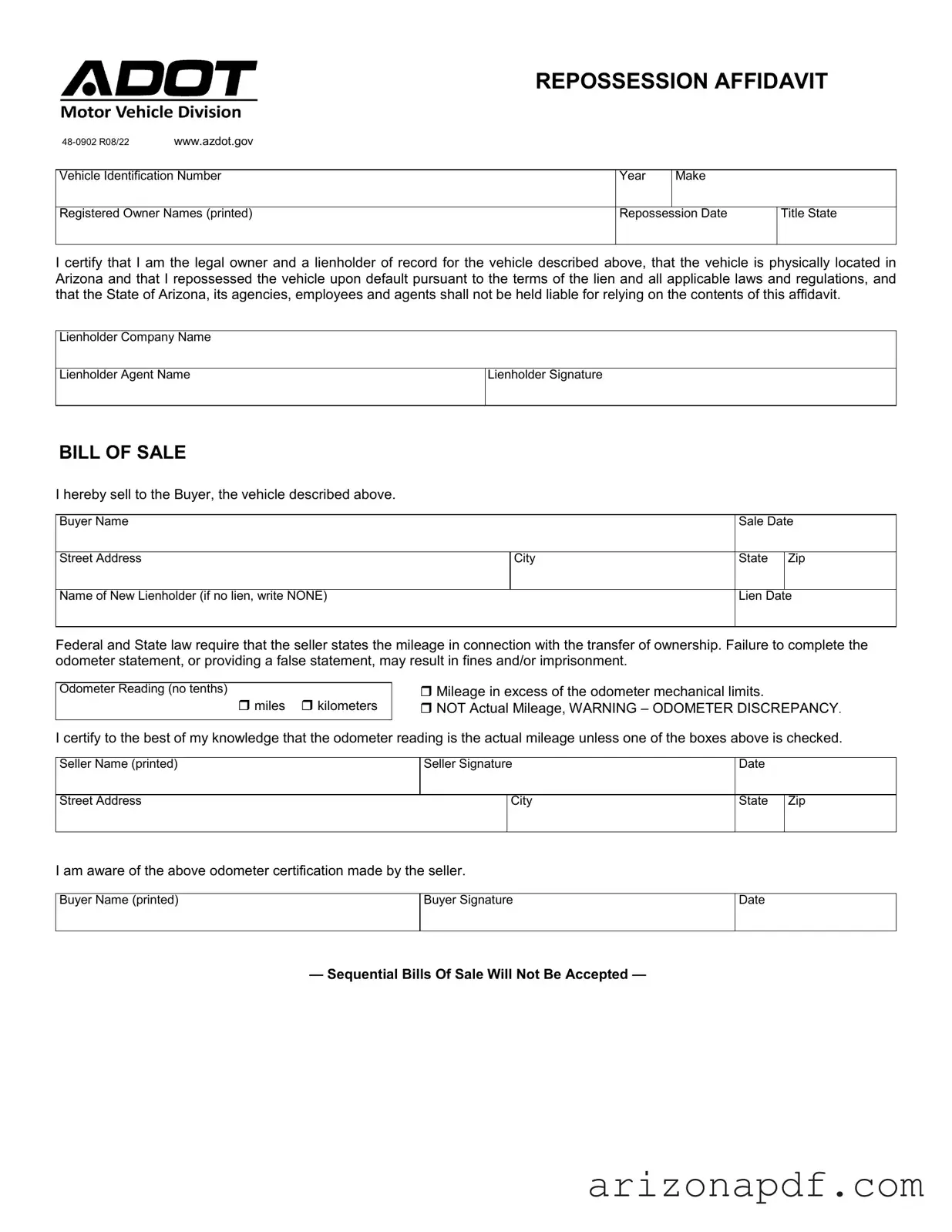

In the shifting sands of Arizona's legal landscape, the Repossession Affidavit form serves as a critical tool for lienholders navigating the complex process of reclaiming ownership of a vehicle. This document, officially designated as Vehicle Division 48-0902 R08/22 and accessible through the Arizona Department of Transportation's website, encapsulates key details including the Vehicle Identification Number, year, make, registered owner's name(s), and repossession date, alongside the title state. Its significance lies not only in formalizing the reposession based on the lienholder's legal rights upon a default but also in delineating the aftermath, including the potential sale of the repossessed vehicle. By asserting the lienholder's ownership and outlining the sale to the buyer, including odometer readings crucial for federal and state legal compliance, the form provides a transparent, procedural framework that safeguards both parties' interests. Furthermore, the explicit exemption of liability from the State of Arizona underlines the precision and care required in executing this affidavit, emphasizing its legal gravity in the repossession and subsequent transfer process.

Arizona Repossession Affidavit Preview

REPOSSESSION AFFIDAVIT

Vehicle Division

www.azdot.gov |

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

Year |

Make |

|

|

|

|

|

I |

|

Registered Owner Names (printed) |

Repossession Date |

Title State |

||

|

|

|

|

I |

I certify that I am the legal owner and a lienholder of record for the vehicle described above, that the vehicle is physically located in Arizona and that I repossessed the vehicle upon default pursuant to the terms of the lien and all applicable laws and regulations, and that the State of Arizona, its agencies, employees and agents shall not be held liable for relying on the contents of this affidavit.

Lienholder Company Name |

|

|

|

|

|

|

|

Lienholder Agent Name |

Lienholder Signature |

|

|

|

I |

|

|

BILL OF SALE |

|

|

|

I hereby sell to the Buyer, the vehicle described above. |

|

|

|

|

|

|

|

Buyer Name |

|

Sale Date |

|

|

|

|

|

Street Address |

City |

State |

Zip |

|

I |

|

I |

Name of New Lienholder (if no lien, write NONE) |

|

Lien Date |

|

|

|

|

|

Federal and State law require that the seller states the mileage in connection with the transfer of ownership. Failure to complete the odometer statement, or providing a false statement, may result in fines and/or imprisonment.

Odometer Reading (no tenths)

miles kilometers

Mileage in excess of the odometer mechanical limits.

NOT Actual Mileage, WARNING – ODOMETER DISCREPANCY.

I certify to the best of my knowledge that the odometer reading is the actual mileage unless one of the boxes above is checked.

Seller Name (printed)

Seller Signature

Date

Street Address

City

State Zip

I am aware of the above odometer certification made by the seller.

Buyer Name (printed)

Buyer Signature

Date

— Sequential Bills Of Sale Will Not Be Accepted —

File Properties

| Fact | Description |

|---|---|

| Form Identification | Arizona Repossession Affidavit, Vehicle Division 48-0902 R08/22 |

| Primary Purpose | To certify the legal repossession of a vehicle by the lienholder due to default, based on Arizona laws and regulations. |

| Governing Law | All applicable laws and regulations in the State of Arizona guide the execution of this affidavit. |

| Requirement for Use | The vehicle must be physically located in Arizona, and the affidavit confirms the lienholder's legal ownership and repossession rights. |

| Additional Function | Includes a Bill of Sale that facilitates the transfer of ownership from the lienholder to a new buyer post-repossession. |

| Odometer Statement Compliance | Federal and State law mandates the seller to declare the vehicle’s mileage accurately during ownership transfer to prevent legal penalties. |

Instructions on Utilizing Arizona Repossession Affidavit

After a lender repossesses a vehicle due to the borrower's failure to meet the agreed payment terms, the next step is to properly document the action and notify the appropriate state department. In Arizona, this documentation process involves filling out the Repossession Affidavit form. This form serves as a formal declaration of repossession and facilitates the transfer of the vehicle's title to the lender or a new owner. The process requires accurate and detailed information regarding the vehicle, the original owner, the lienholder, and the new owner, if applicable. Follow these steps meticulously to ensure compliance with Arizona state laws.

- Go to the Arizona Department of Transportation website (www.azdot.gov) to obtain the latest version of the Repossession Affidavit form.

- Start by entering the Vehicle Identification Number (VIN), the year of manufacture, and the make (brand) of the vehicle in the designated fields at the top of the form.

- Under "Registered Owner Names," print the names of the vehicle's registered owner(s) as recorded.

- Fill in the Repossession Date, ensuring it accurately reflects when the vehicle was repossessed.

- Specify the Title State, which is the state where the vehicle was originally titled.

- In the declaration section, provide the Lienholder Company Name.

- Under "Lienholder Agent Name," print the name of the individual completing the form.

- The form requires the Lienholder Signature to certify the accuracy of the information and compliance with repossession laws.

- For the "Bill of Sale" section (if applicable), enter the Buyer Name, Sale Date, and the buyer's address details, including Street Address, City, State, and Zip code.

- If there is a new lienholder, include their name in the "Name of New Lienholder" field, or write NONE if the vehicle will not have a lien against it.

- Fill in the Lien Date if a new lien is being recorded.

- Under the odometer certification, indicate the Odometer Reading and select the appropriate check box to describe the accuracy of the mileage or note any discrepancies.

- Print the Seller Name and secure the Seller Signature along with the Date.

- The buyer must also acknowledge the odometer certification by printing their Buyer Name and providing their Buyer Signature and the Date.

Once completed, this form should be submitted to the Arizona Department of Transportation or Motor Vehicle Division as directed. This is a crucial step in the repossession process, as it officially records the change in possession and, if applicable, ownership of the vehicle. Timely and accurate completion of this form is essential to ensure compliance with state regulations and to facilitate any necessary title transfers without legal complications.

Listed Questions and Answers

What is a Repossession Affidavit in Arizona?

A Repossession Affidavit in Arizona is a legal document that a lienholder (the legal owner of the vehicle) can use to assert that they have taken possession of a vehicle due to the borrower's default on the loan terms. This document confirms that the vehicle is located in Arizona and that the repossession complied with all applicable laws and regulations. It indemnifies the State of Arizona, its agencies, employees, and agents from liability associated with the repossession.

Who needs to fill out the Arizona Repossession Affidiffavit?

Lienholders who are legally repossessing a vehicle due to the registered owner's default on the loan agreement need to fill out this form. It is crucial for the lienholder to complete and submit this affidavit to repossess the vehicle legally and properly under Arizona law.

What information is required on the Arizona Repossession Affidavit form?

Required information includes the Vehicle Identification Number (VIN), year, make, registered owner's name(s), repossession date, and the title state of the vehicle. Additionally, the lienholder must provide their company name, agent name, and signature. If the vehicle is being sold after repossession, details such as the buyer's name, sale date, and new lienholder information (if applicable) must be filled out, alongside the odometer reading and acknowledgment of the odometer statement accuracy.

How does one complete the odometer statement section?

In the odometer statement section, the seller must indicate the correct mileage of the vehicle at the time of sale. They have the option to specify whether the mileage is in miles or kilometers, and whether the reading reflects the exact mileage, exceeds the mechanical limits of the odometer, or if there is an odometer discrepancy. It is imperative that the information provided is accurate to avoid penalties such as fines and/or imprisonment for odometer fraud.

What is the significance of the Bill of Sale in the Repossession Affidavit?

The Bill of Sale section of the Repossession Affidavit formalizes the sale of the repossessed vehicle to a new owner. It requires the seller (the previous lienholder or their agent) to document the transfer of ownership to the buyer, including the sale date and the vehicle’s price, if applicable. This section ensures that the transaction is recognized legally and that the chain of ownership is correctly documented for the state records.

Are sequential Bills of Sale allowed under the Arizona Repossession Affidavit procedure?

No, sequential Bills of Sale will not be accepted according to the stipulations outlined in the Arizona Repossession Affidavit. This measure ensures that each transaction is distinctively documented and tracked to prevent fraud and enhance the integrity of vehicle transaction records in Arizona.

Common mistakes

Filling out legal documents is a task that requires attention to detail and an understanding of the specific requirements of each form. The Arizona Repossession Affidavit form, utilized during the repossession of a vehicle, often witnesses common errors made by individuals completing it. These mistakes can lead to delays, legal complications, or the invalidation of the affidavit. Below are five common mistakes to avoid:

Incorrect Vehicle Information: One of the most frequent errors is the misrepresentation of the vehicle's details, such as the Vehicle Identification Number (VIN), year, make, or model. Ensuring accuracy in this section is crucial, as it legally identifies the vehicle in question.

Omitting Owner and Lienholder Names: Failure to properly print the registered owner's name(s) and the lienholder's information can lead to confusion or disputes regarding the vehicle's legal possession and ownership. This oversight may significantly hinder the repossession process.

Repossession Date Errors: Incorrectly stating the date of repossession may compromise the legal timeline required for repossession proceedings. The date should reflect when the vehicle was physically repossessed by the lienholder.

Odometer Disclosure Oversights: Neglecting to accurately complete the odometer section, including failing to indicate if the mileage is actual, exceeds mechanical limits, or if there's an odometer discrepancy, can invalidate the affidavit. Federal and state laws mandate accurate odometer disclosures to prevent fraud.

Signature Discrepancies: The affidavit requires signatures from the lienholder (or agent) and, in the bill of sale section, from the seller and buyer. Omissions, mismatched names to those printed, or illegible signatures can lead to questions regarding the document's authenticity.

To ensure the proper completion of the Arizona Repossession Affidavit form, individuals should meticulously review each section of the document, double-check details against the vehicle's official documents, and follow all instructions accurately. Adopting a careful approach minimizes the risk of errors, ensuring a smoother legal process in the repossession and sale of the vehicle.

Documents used along the form

When dealing with the repossession of a vehicle in Arizona, the Repossession Affidavit form plays a crucial role. However, this document rarely acts alone. Various other forms and documents are often required to ensure a comprehensive and legally abiding process. These documents complement the affidavit by providing detailed information, ensuring compliance with state laws, and facilitating the transfer of ownership following repossession. Here’s a closer look at some of these essential documents.

- Notice of Default and Right to Cure: This document informs the borrower of their failure to maintain regular payments and offers them a final opportunity to rectify the default to avoid repossession. It outlines the amount owed and the deadline for settling the debt.

- Notice of Repossession: After the vehicle is repossessed, this notice is sent to the borrower to inform them that the vehicle has been taken. It details the reasons for repossession, the location of the vehicle, and how to recover it or any personal items left inside.

- Condition Report: This report documents the condition of the vehicle at the time of repossession, detailing any damages or modifications. It serves as a record to determine if any damages occurred during the repossession process.

- Application for Title or Registration: Following a repossession, if the vehicle is to be sold or transferred to someone else, a new application for the title or registration must be filed with the state. This document establishes legal ownership and registration of the vehicle in the new owner’s name.

- Power of Attorney: This legal document may be used if the lienholder wishes to authorize another individual or entity to handle the transfer of the vehicle title and other necessary documentation on their behalf.

- Odometer Disclosure Statement: Required during the transfer of ownership, this document records the vehicle’s mileage at the time of sale and ensures accuracy in representing the vehicle's age and wear.

Together, these documents ensure that the repossession process is conducted fairly and in strict compliance with Arizona law. They not only protect the rights of the lienholder but also of the borrower, by ensuring transparency and legality in every step of the process. For anyone navigating the complexities of vehicle repossession, understanding and correctly utilizing these documents is essential for a smooth and effective resolution.

Similar forms

The Arizona Repossession Affidavit form shares similarities with the Notice of Default and Intent to Sell, which lenders often use in the vehicle financing sector. Both documents serve as a preliminary step in the repossession process, with a focus on alerting the borrower about the default and the subsequent steps the lender intends to take, including the sale of the repossessed asset. This formality helps ensure that the process is transparent and that the borrower is duly informed about the potential consequences of their default.

Comparable to the Repossession Affidavit is the Uniform Commercial Code (UCC) Financing Statement, a form filed to indicate a secured interest in an asset. Just like the affidavit attests to the legal owner's right to repossess the vehicle due to a default, the UCC Financing Statement serves as a public record that a lienholder has a security interest in the borrower's property or asset. It's a critical document for establishing priority in case of bankruptcy or disputes over assets.

The Vehicle Title Document is another closely related paper, especially after repossession has occurred. When a vehicle is repossessed, the title must be transferred from the previous owner to either the lienholder or a new owner if the vehicle is sold. The Repossession Affidavit often accompanies the application for a new title to prove that the repossession was lawful and to facilitate the transfer of ownership as outlined by state regulations.

The Mechanics Lien is also akin to the Repossession Affidavit in the sense that both serve as legal claims on property due to unpaid debts. While the Repossession Affidavit is specific to vehicle loans and defaults, a Mechanics Lien is used by contractors, subcontractors, and suppliers to secure debts for labor or materials provided to improve a property. Although different in application, both documents represent avenues through which creditors protect their financial interests.

Another analogous document is the Odometer Disclosure Statement, which is integral to vehicle sales and transfers, including repossession cases. The Arizona Repossession Affidavit requires an odometer statement to comply with federal and state regulations. This serves to ensure transparency in the transaction and protect the buyer from potential fraud, similar to how the disclosure operates in standard vehicle sales processes.

The Release of Lien document is closely related, primarily when a vehicle is repossessed and sold to a new owner. After the sale, any liens previously placed on the vehicle need to be officially released. While the Repossession Affidavit can act as a declaration of the lienholder's right to reclaim the vehicle, the Release of Lien certifies that the vehicle is free from previous financial encumbrances, enabling a clean title transfer to the new owner.

Similarly, the Security Agreement for a vehicle loan outlines the terms under which a lien is placed on the vehicle serving as collateral for the loan. This agreement provides the legal grounding for the Repossession Affidavit, as it details the circumstances under which the lienholder has the right to repossess the asset. It's a more detailed contract that encompasses the conditions agreed upon by the borrower and lender at the loan's inception.

Last but not least is the Power of Attorney (POA) document that, in the context of vehicle repossession and sale, may be necessary for the lienholder to act on behalf of the owner. Specifically, it allows the lienholder to sign documents related to the vehicle's sale or transfer following repossession. While the Repossession Affidavit signals the commencement of this process, a POA might be required to finalize transactions, particularly if the original owner is unavailable or uncooperative.

Dos and Don'ts

Filling out the Arizona Repossession Affidavit form is an important step in the repossession process. To ensure accuracy and compliance with Arizona state law, here’s a list of dos and don'ts that can guide you through this process.

Do:- Verify the vehicle information: Double-check the Vehicle Identification Number (VIN), year, and make of the vehicle to ensure they match the vehicle being repossessed.

- Print names clearly: The registered owner's name(s) should be printed legibly to avoid any confusion or issues with the affidavit’s acceptance.

- Fill in the repossession date accurately: Be precise with the date of repossession, as this date is critical for legal and record-keeping purposes.

- Provide complete lienholder information: Include the full name of the lienholder company and the agent, ensuring that all contact information is current and correct.

- Sign and date the document: The lienholder or their authorized agent must sign and date the affidavit to validate its contents.

- Correctly state the odometer reading: Be honest and accurate. If you're unsure, check the appropriate box indicating an odometer discrepancy or that the mileage exceeds mechanical limits.

- Acknowledge the buyer’s information: If selling the vehicle, ensure the buyer’s name, address, and signature are all correctly filled out to transfer ownership smoothly.

- Omit any vehicle details: Skipping or incorrectly filling out the vehicle identification number, year, or make can invalidate the affidavit.

- Guess on the repossession date: Estimating or inaccurately reporting the repossession date can lead to legal complications.

- Forge signatures: All signatures must be original and belong to the persons named on the affidavit. Forgery is illegal and carries serious penalties.

- Leave blanks in critical sections: Incomplete affidavits will likely be rejected. Ensure all fields are properly filled out.

- Overlook the bill of sale section: If transferring ownership, the bill of sale section is crucial. Neglecting to complete this part can hinder the sales process.

- Misrepresent the odometer reading: Falsifying the odometer reading is against federal and state law. Always provide an honest and accurate account.

- Ignore buyer or seller acknowledgment of odometer certification: Both parties’ acknowledgment is required. Skipping this can question the validity of the transaction.

By following these guidelines, you can ensure that your Arizona Repossession Affidavit is properly completed and accepted, paving the way for a smoother legal process.

Misconceptions

Understanding the ins and outs of the Arizona Repossession Affidavit form can be daunting. Reflecting on this, it's clear that a myriad of misconceptions clouds the actual process and requirements. Let's dispel some of these myths:

- Misconception #1: Any individual or entity can file the form without being the legal owner or lienholder. In reality, the form distinctly states that the person filing must be the legal owner and a lienholder of record for the vehicle. This legal nuance ensures protection against unauthorized repossessions.

- Misconception #2: The vehicle does not need to be in Arizona at the time of repossession. Contrarily, the affidavit specifies that the vehicle must physically be located in Arizona. This requirement is crucial for the jurisdictional validity of the document.

- Misconception #3: Repossessing a vehicle does not require adherence to any specific terms of the lien or laws. This misunderstanding overlooks a critical part of the affidavit which confirms that the repossession was conducted pursuant to the terms of the lien and all applicable laws and regulations. Legal compliance in this process cannot be overstated.

- Misconception #4: The State of Arizona can be held liable for mistakes in the repossession process. The affidavit clearly states that the State of Arizona, its agencies, employees, and agents shall not be held liable for relying on the contents of the affidavit, offering immunity under these circumstances.

- Misconception #5: The affidavit serves as a bill of sale. Although the document includes a section titled BILL OF SALE, it is integral to understand that this part is contingent upon the repossession and sale being legally executed. Thus, it forms part of the larger process of repossession and subsequent ownership transfer.

- Misconception #6: Odometer disclosure is optional when transferring vehicle ownership. The form clearly requires the seller to state the mileage as part of the transfer of ownership. Failing to complete this step, or providing a false statement, subjects the person to possible fines and/or imprisonment, highlighting the importance of accurate and honest disclosure.

- Misconception #7: The form accepts sequential bills of sale. The firm statement — Sequential Bills Of Sale Will Not Be Accepted — refutes this belief, ensuring that every transfer of ownership is documented as a standalone event, thereby maintaining the integrity of the vehicle’s ownership history.

- Misconception #8: Anyone can act as a lienholder agent. The affidavit requires the lienholder agent's name, implying that the individual must be officially associated with the lienholder (either as an employee or authorized agent) to act on their behalf in the repossession process. This restriction secures the process from potential abuse.

- Misconception #9: The affidavit does not require verification of odometer accuracy by the buyer. Conversely, the form makes it clear that the buyer must also be aware of the odometer certification made by the seller, ensuring transparency and mutual acknowledgment of the vehicle's condition.

Dispelling these misconceptions clarifies the affidavit's requirements, providing a smoother path for those needing to navigate the process of vehicle repossession and ownership transfer in Arizona.

Key takeaways

When dealing with the Arizona Repossession Affidavit form, understanding the key elements is crucial to ensure its proper completion and use. Below are vital takeaways that should guide anyone navigating through this process.

- Identify the vehicle clearly: The form requires detailed information about the vehicle, including the Vehicle Identification Number (VIN), the year of manufacture, and make. This precise identification prevents any confusion regarding the vehicle in question.

- Ownership and lienholder details are mandatory: The form necessitates the registered owner's name(s) to be printed and also requires comprehensive information regarding the lienholder, highlighting the legal ownership and rights to the vehicle.

- Repossession conditions: It's affirmed in the affidavit that the vehicle was repossessed upon the default of payment pursuant to the lien terms and in accordance with all applicable laws and regulations.

- Location of vehicle: The affidavit asserts that the repossessed vehicle is physically present in Arizona, ensuring jurisdictional clarity for the actions taken.

- Liability clause: By signing the affidavit, the lienholder agrees that the State of Arizona, including its agencies, employees, and agents, will not be held liable based on the document's contents.

- Bill of Sale inclusion: The form also acts as a bill of sale, allowing the lienholder to formally sell the repossessed vehicle, specifying the buyer’s details and the sale date.

- Odometer disclosure is required: Federal and State laws mandate the disclosure of the vehicle’s mileage at the time of sale. The form provides options to indicate if the odometer reading is actual, exceeds mechanical limits, or if there's a discrepancy.

- Sequential bills of sale are not accepted: This points to the need for the original document in the transaction, emphasizing authenticity and preventing fraudulent reproductions of the affidavit.

- Signatures are essential: The completion and validity of the form rely on the signatures of the lienholder and the buyer, acknowledging the terms of repossession and sale, including acknowledgment of the odometer certification by the seller and buyer.

Understanding these key points can significantly streamline the process of completing and using the Arizona Repossession Affidavit form, ensuring legal compliance and protecting the interests of all parties involved.

More PDF Forms

Child's Immunization Record - By completing this form, parents exercise their right to make health care decisions for their children based on religious beliefs.

Apply to the University of Arizona - Eliminate the financial barrier of application fees with a dedicated waiver form, opening doors to undergraduate programs at Arizona's leading universities.

Legal Name Change Arizona - Initiates a legal name change in Pima County, with specific requirements for personal information and reasons for the change.