Fill in a Valid Arizona New Hire Reporting Template

Welcome to the essential guide on the Arizona New Hire Reporting Form, a crucial document for employers in the state of Arizona. This form plays a vital role in ensuring that new employees are promptly reported to the Arizona New Hire Reporting Center, in alignment with the requirements stipulated by the Arizona Department of Economic Security. Employers are required to complete this form with comprehensive details about their organization, including the Federal Employer Identification Number (FEIN) under which employees' quarterly wages will be reported, as well as the employer's name, a designated contact person, and the company’s address. Additionally, detailed employee information must be provided for each new hire, including their Social Security Number, name, address, and other pertinent details such as date of birth, date of hire, and eligibility for medical insurance benefits. The form not only facilitates the efficient processing of income withholding orders but also supports the enforcement of child support obligations. It can be submitted via mail to the Arizona New Hire Reporting Center in Holbrook, MA, or through a toll-free fax number, ensuring multiple avenues for compliance. Employers seeking further information or assistance can access resources through the provided website or contact the center directly via a toll-free number, ensuring that the process is as smooth and straightforward as possible.

Arizona New Hire Reporting Preview

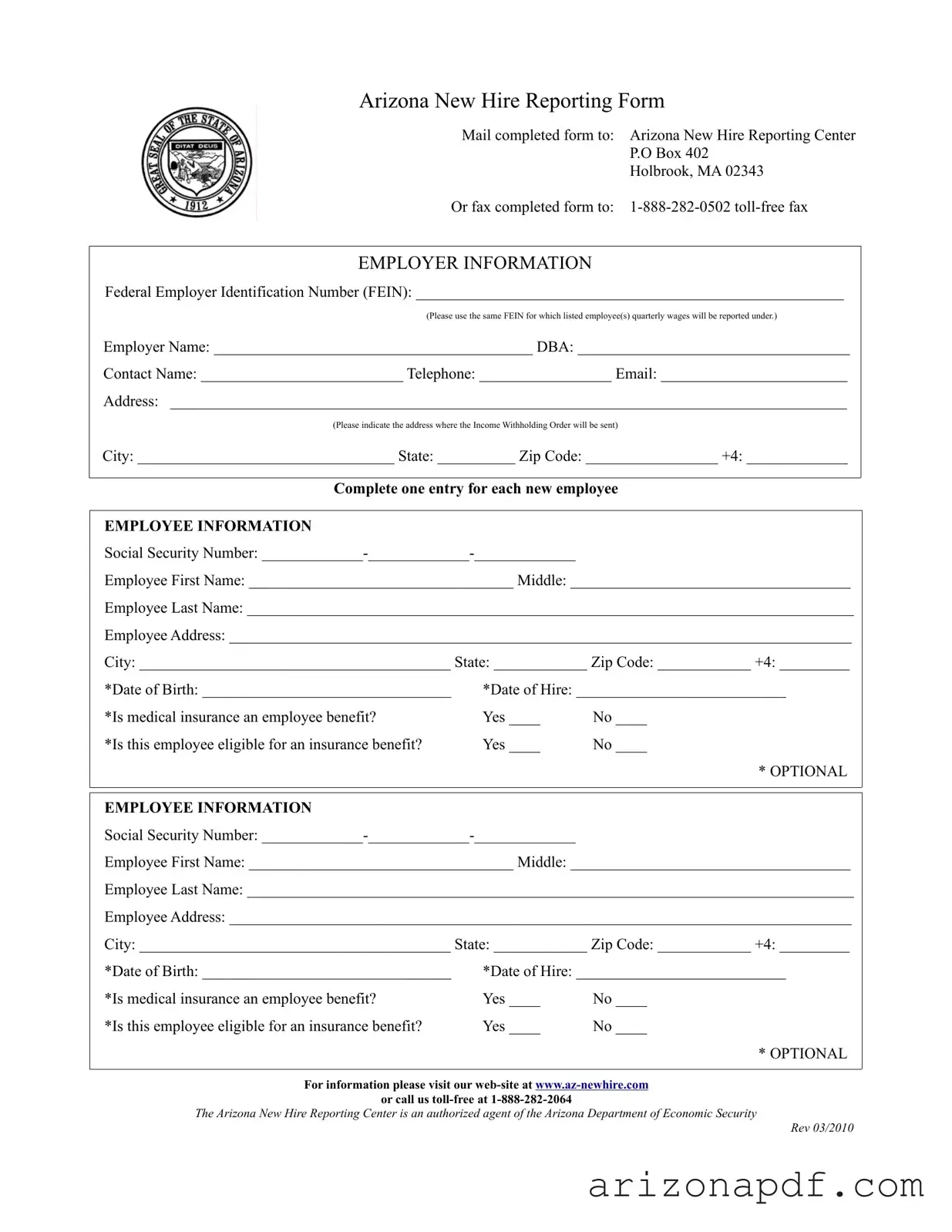

Arizona New Hire Reporting Form

Mail completed form to: Arizona New Hire Reporting Center

P.O Box 402

Holbrook, MA 02343

Or fax completed form to:

EMPLOYER INFORMATION

Federal Employer Identification Number (FEIN): _______________________________________________________

(Please use the same FEIN for which listed employee(s) quarterly wages will be reported under.)

Employer Name: _________________________________________ DBA: ___________________________________

Contact Name: __________________________ Telephone: _________________ Email: ________________________

Address: _______________________________________________________________________________________

(Please indicate the address where the Income Withholding Order will be sent)

City: _________________________________ State: __________ Zip Code: _________________ +4: _____________

Complete one entry for each new employee

EMPLOYEE INFORMATION

Social Security Number:

Employee First Name: __________________________________ Middle: ____________________________________

Employee Last Name: ______________________________________________________________________________

Employee Address: ________________________________________________________________________________

City: ________________________________________ State: ____________ Zip Code: ____________ +4: _________

*Date of Birth: ________________________________ |

*Date of Hire: ___________________________ |

|

*Is medical insurance an employee benefit? |

Yes ____ |

No ____ |

*Is this employee eligible for an insurance benefit? |

Yes ____ |

No ____ |

* OPTIONAL

EMPLOYEE INFORMATION

Social Security Number:

Employee First Name: __________________________________ Middle: ____________________________________

Employee Last Name: ______________________________________________________________________________

Employee Address: ________________________________________________________________________________

City: ________________________________________ State: ____________ Zip Code: ____________ +4: _________

*Date of Birth: ________________________________ |

*Date of Hire: ___________________________ |

|

*Is medical insurance an employee benefit? |

Yes ____ |

No ____ |

*Is this employee eligible for an insurance benefit? |

Yes ____ |

No ____ |

* OPTIONAL

For information please visit our

or call us

The Arizona New Hire Reporting Center is an authorized agent of the Arizona Department of Economic Security

Rev 03/2010

File Properties

| Fact | Detail |

|---|---|

| Purpose | The Arizona New Hire Reporting Form is used to report new hires to the Arizona New Hire Reporting Center, in compliance with state and federal laws. |

| Governing Law | This form is governed by the Arizona Department of Economic Security, under the legal framework that requires employers to report new or rehired employees. |

| Submission Methods | Employers can submit the completed form either by mail to the Arizona New Hire Reporting Center P.O Box in Holbrook, MA, or via a toll-free fax number. |

| Required Employer Information | Employers must provide their Federal Employer Identification Number (FEIN), name, Doing Business As (DBA) name if applicable, contact information, and address. |

| Employee Information | The form requires details about the employee, including Social Security Number, full name, address, date of birth, and date of hire, along with optional information on medical insurance benefit eligibility. |

Instructions on Utilizing Arizona New Hire Reporting

Upon hiring a new employee, it’s vital to ensure that all the necessary paperwork is filled out correctly and promptly. The Arizona New Hire Reporting Form plays a significant role in this process. By following the steps outlined below, you can accurately report your new hires to the Arizona New Hire Reporting Center. This step not only complies with the law but also aids in the enforcement of child support orders. Let’s walk through the procedure to ensure the information is submitted properly.

- Start by gathering the required information for the form, including your Federal Employer Identification Number (FEIN), your company’s name and doing business as (DBA) name, if applicable, and your contact details.

- Enter your Federal Employer Identification Number (FEIN) in the designated space. Ensure that this is the same FEIN under which the employee(s) quarterly wages will be reported.

- Write down the full legal name of your company in the space provided for the employer's name.

- Specify your DBA (Doing Business As) name if it is different from the legal name of your business.

- Include the contact name, telephone number, and email address of the person who can be contacted for further information.

- Provide the complete mailing address of your company, including city, state, zip code, and the +4 extension if known. This address will be used for sending Income Withholding Orders.

- Next, you will fill out the employee information section. Make sure to report each new hire on a separate form. Include the employee’s Social Security Number, first name, middle name (if applicable), and last name.

- Enter the employee’s address, including the city, state, zip code, and +4 extension.

- Fill in the employee’s date of birth and date of hire in the spaces provided. Although these fields are marked as optional, completing them can be beneficial for accurate record-keeping.

- Indicate whether medical insurance is a benefit of employment and if the new employee is eligible for this benefit.

- Review all the information you’ve entered for accuracy to ensure there are no errors in the submission.

- Once the form is completed, decide whether you will mail or fax it. If mailing, send the completed form to the Arizona New Hire Reporting Center at P.O Box 402, Holbrook, MA 02343. If faxing, use the toll-free fax number: 1-888-282-0502.

After the form is submitted, rest assured knowing that you have taken a necessary step towards compliance with Arizona’s employment laws. This action not only helps in maintaining your company's reputation but also supports the broader community by ensuring that child support obligations can be more effectively enforced. For any further information or assistance, the Arizona New Hire Reporting Center and its website are available resources designed to support employers through this process.

Listed Questions and Answers

What is the purpose of the Arizona New Hire Reporting Form?

The Arizona New Hire Reporting Form serves a critical role in helping the state's agency to effectively enforce child support obligations. By reporting new hires, employers assist in the quick detection of individuals who owe child support. The information can then be used to expedite the withholding of child support from an employee's wages, ensuring that children receive the support they need swiftly. Additionally, new hire reporting aids in preventing unemployment insurance fraud and ensures fair distribution of unemployment benefits.

Who is required to report new hires in Arizona?

All employers operating within the state of Arizona are required to report each newly hired or rehired employee. This includes any individual who resides or works in the state of Arizona and to whom the employer anticipates paying earnings. This requirement is designed to encompass a broad range of employment situations, ensuring comprehensive enforcement of child support and accurate distribution of benefits.

What information must be included on the Arizona New Hire Reporting Form?

Employers must provide detailed information about both the employer and the employee. For the employer, this includes the Federal Employer Identification Number (FEIN), the business name, contact information, and the address for sending Income Withholding Orders. Employee information required includes the Social Security Number, full name, address, date of birth, date of hire, and details relating to the availability of medical insurance as an employee benefit. Providing complete and accurate information is crucial for the form to serve its intended purpose effectively.

How can an employer submit the Arizona New Hire Reporting Form?

Employers have two primary methods for submitting the Arizona New Hire Reporting Form to ensure convenience and compliance. The form can be mailed to the Arizona New Hire Reporting Center at the provided P.O. Box address in Holbrook, MA. Alternatively, for a faster processing option, employers may choose to fax the completed form to the toll-free fax number listed. These methods are designed to accommodate different preferences and provide secure channels for the transmission of sensitive information.

What happens if an employer fails to report a new hire in Arizona?

Failure to report a new hire in Arizona can have serious consequences for employers. It compromises the state's ability to enforce child support orders, prevent fraud, and ensure the integrity of unemployment benefits. Employers who neglect this requisite might face penalties, including fines. These measures underscore the importance of the new hire reporting process in maintaining the state's social welfare systems and highlight the legal obligations of employers in supporting these initiatives.

Common mistakes

Filling out the Arizona New Hire Reporting Form accurately is crucial for compliance with state laws and ensures timely and accurate reporting to the Arizona Department of Economic Security. Unfortunately, people often make several common mistakes during this process. Recognizing and avoiding these mistakes can help streamline operations and avoid potential complications.

- Incorrect FEIN Usage: Employers sometimes mistakenly use different Federal Employer Identification Numbers (FEIN) for reporting new hires than the one under which employee quarterly wages are reported. Consistency is key to ensure accurate employee records.

- Incomplete Employer Information: Skipping details in the employer section, such as the DBA (Doing Business As) name, contact name, email, or the specific address where Income Withholding Orders should be sent, can lead to delays and miscommunication.

- Employee Social Security Number (SSN) Errors: Entering an incorrect SSN for an employee is a common mistake that can have significant repercussions, including issues with tax filings and employee record tracking.

- Leaving Mandatory Fields Blank: Missing information in any required fields, such as employee first name, last name, address, or date of hire, can result in an incomplete submission, necessitating additional follow-up and potential delays.

- Incorrect Employee Address: Not verifying or incorrectly entering an employee’s address can lead to problems with document delivery or communications meant for the employee.

- Neglecting Optional Fields When Relevant: While some employee information fields are marked as optional, including relevant details can be beneficial, especially regarding medical insurance benefits, to ensure comprehensive record-keeping.

- Failure to Double-check Information: Not reviewing the form for accuracy before submitting can result in errors related to typographical mistakes, incorrect dates (such as date of birth or date of hire), or other inaccuracies that could have been easily corrected.

- Using Outdated Forms: Employers sometimes use an outdated version of the form, which may not include recent changes or requirements, leading to incomplete or non-compliant submissions.

Avoiding these common mistakes ensures that the reporting process is efficient, compliant with state regulations, and beneficial for both employers and employees. For any questions or further clarification, employers are encouraged to visit the official website or contact the Arizona New Hire Reporting Center directly.

Documents used along the form

In the process of onboarding a new employee, businesses in Arizona are required to complete and submit the Arizona New Hire Reporting Form to the Arizona New Hire Reporting Center. This crucial document plays a significant role in assisting state agencies in collecting child support payments. However, the completion of this form is just one part of the documentation necessary during the hiring process. There are several other forms and documents employers should be aware of to ensure compliance with state and federal laws.

- I-9 Employment Eligibility Verification: The federal government mandates this form to verify an employee's identity and their eligibility to work in the United States. It requires the employer and employee to fill out parts of the document and for the employee to provide acceptable documents demonstrating their employment eligibility.

- W-4 Form (Employee's Withholding Certificate): This form is critical for determining the amount of federal income tax to withhold from an employee's paycheck. The employee fills out the form, and it includes questions about filing status, dependents, and any additional jobs or deductions.

- State Tax Withholding Form: Similar to the federal W-4, many states, including Arizona, have their tax withholding form. This document is essential for determining the correct amount of state income tax to withhold from the employee's wages.

- Employee Handbook Acknowledgment Receipt: While not a government-required form, many businesses provide an employee handbook that outlines important company policies and procedures. Having new employees sign an acknowledgment of receipt can protect the company by proving employees were informed about these policies.

Together with the Arizona New Hire Reporting Form, these documents form a basic suite that helps ensure both employers and employees start their working relationship on solid and compliant footing. Familiarity with these forms, understanding their purposes, and knowing how to accurately complete them are important steps in the hiring process. Such diligence not only helps in complying with legal requirements but also supports a transparent and efficient onboarding process.