Fill in a Valid Arizona Lsu Template

The Arizona Loan Status Update (LSU) form plays a crucial role in the real estate transaction process, ensuring transparency between the buyer, seller, and lender regarding the progress of the buyer's loan application. Updated in February 2013 by the Arizona Association of REALTORS®, this document outlines specific obligations, including the requirement for the buyer to provide an LSU to the seller within five days of contract acceptance, emphasizing the lender's duty to supply updated information upon request. This exhaustive document includes detailed sections ranging from the identification of the lender, loan officer, and the proposed loan details to comprehensive lists of initial and additional documentation required for the loan process. Furthermore, it addresses pre-qualification aspects, including discussions of the buyer's financial situation and creditworthiness. Its structured format is designed to track the progression of the loan from initial application, through underwriting and approval, ending with the closing phase where escrow is completed. Clearly, the Arizona LSU form serves as an essential tool in the realm of real estate, fostering a smoother transaction process by mandating regular updates and facilitating clear communication between all parties involved.

Arizona Lsu Preview

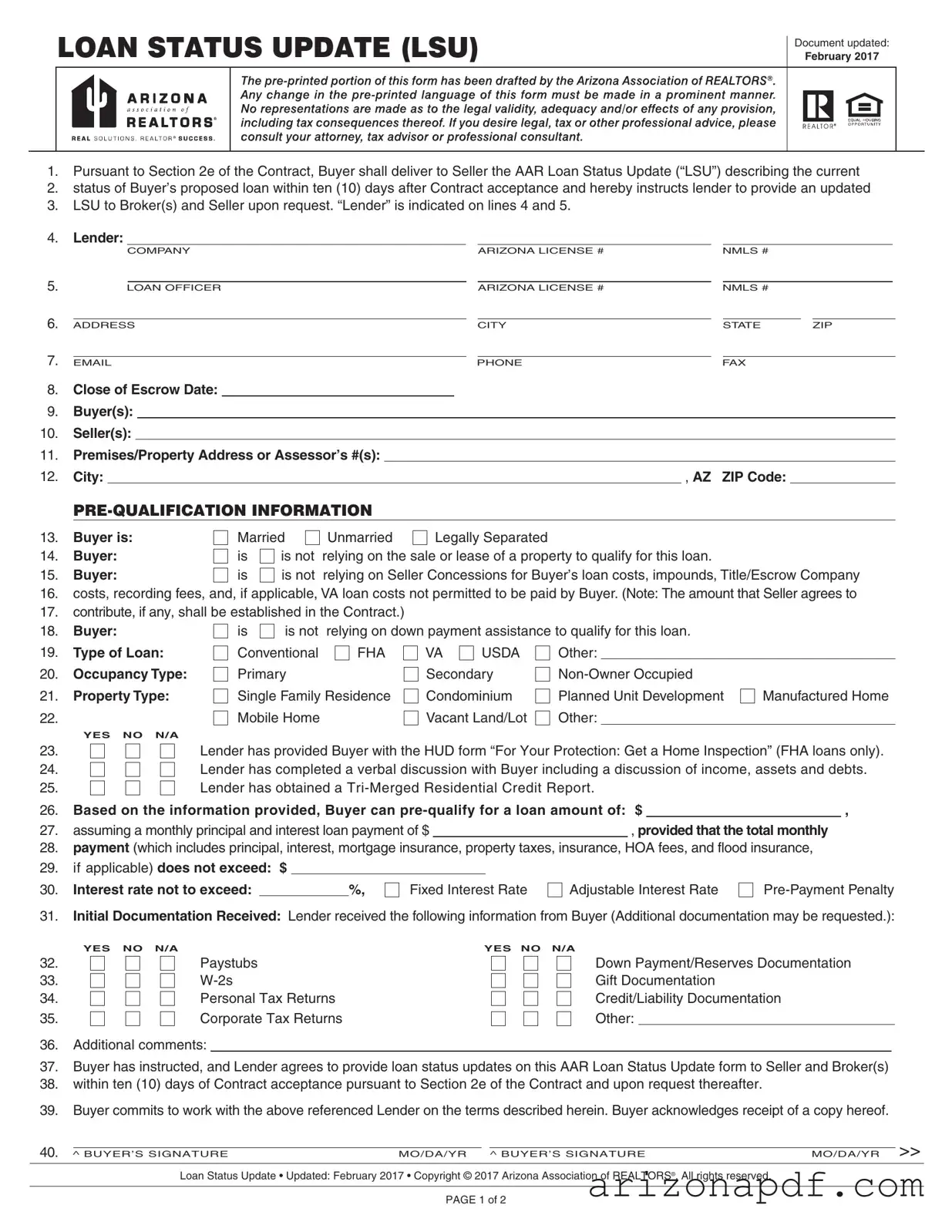

LOAN STATUS UPDATE (LSU)

Document updated:

February 2017

1.Pursuant to Section 2e of the Contract, Buyer shall deliver to Seller the AAR Loan Status Update (“LSU”) describing the current

2.status of Buyer’s proposed loan within ten (10) days after Contract acceptance and hereby instructs lender to provide an updated

3.LSU to Broker(s) and Seller upon request. “Lender” is indicated on lines 4 and 5.

4.Lender:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY |

|

ARIZONA LICENSE # |

NMLS # |

|

|

|

||||||||

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN OFFICER |

|

ARIZONA LICENSE # |

NMLS # |

|

|

|

||||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

CITY |

|

STATE |

|

ZIP |

|

|||||||||||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE |

FAX |

|

|

|

|||||||||||||

8. |

Close of Escrow Date: |

|

|

|

|

|

|

|

|

|

|

|

|||||

9. |

Buyer(s): |

|

|

|

|

|

|

|

|

|

|

||||||

10. |

Seller(s): |

|

|

|

|

|

|

|

|

|

|

||||||

11. |

Premises/Property Address or Assessor’s #(s): |

|

|

|

|

|

|

|

|

|

|

||||||

12. |

City: |

|

|

|

, AZ |

ZIP Code: |

|

|

|

|

|||||||

13. |

Buyer is: |

Married |

Unmarried |

Legally Separated |

|

14. |

Buyer: |

is |

is not |

relying on the sale or lease of a property to qualify for this loan. |

|

15. |

Buyer: |

is |

is not |

relying on Seller Concessions for Buyer’s loan costs, impounds, Title/Escrow Company |

|

16.costs, recording fees, and, if applicable, VA loan costs not permitted to be paid by Buyer. (Note: The amount that Seller agrees to

17.contribute, if any, shall be established in the Contract.)

18. |

Buyer: |

is |

is not |

relying on down payment assistance to qualify for this loan. |

|

||||

19. |

Type of Loan: |

Conventional |

FHA |

VA |

USDA |

Other: |

|

|

|

20. |

Occupancy Type: |

Primary |

|

Secondary |

|

||||

21. |

Property Type: |

Single Family Residence |

Condominium |

Planned Unit Development |

Manufactured Home |

||||

22. |

|

Mobile Home |

|

Vacant Land/Lot |

Other: |

|

|

||

|

YES NO N/A |

|

|

|

|

23. |

Lender has provided Buyer with the HUD form “For Your Protection: Get a Home Inspection” (FHA loans only). |

||||

24. |

Lender has completed a verbal discussion with Buyer including a discussion of income, assets and debts. |

||||

25. |

Lender has obtained a |

|

|

|

|

26. |

Based on the information provided, Buyer can |

|

, |

||

27. |

assuming a monthly principal and interest loan payment of $ |

|

, provided that the total monthly |

|

|

28.payment (which includes principal, interest, mortgage insurance, property taxes, insurance, HOA fees, and flood insurance,

29.if applicable) does not exceed: $

30. Interest rate not to exceed: |

|

%, |

Fixed Interest Rate |

Adjustable Interest Rate |

31.Initial Documentation Received: Lender received the following information from Buyer (Additional documentation may be requested.):

YES NO N/A |

YES NO N/A |

32.

33.

34.

35.

Paystubs

Personal Tax Returns

Corporate Tax Returns

Down Payment/Reserves Documentation

Gift Documentation

Credit/Liability Documentation

Other:

36.Additional comments:

37.Buyer has instructed, and Lender agrees to provide loan status updates on this AAR Loan Status Update form to Seller and Broker(s)

38.within ten (10) days of Contract acceptance pursuant to Section 2e of the Contract and upon request thereafter.

39.Buyer commits to work with the above referenced Lender on the terms described herein. Buyer acknowledges receipt of a copy hereof.

40. |

|

|

|

|

|

>> |

^ BUYER’S SIGNATURE |

MO/DA/YR ^ BUYER’S SIGNATURE |

MO/DA/YR |

||||

|

|

|

|

|

|

|

Loan Status Update • Updated: February 2017 • Copyright © 2017 Arizona Association of REALTORS®. All rights reserved.

PAGE 1 of 2

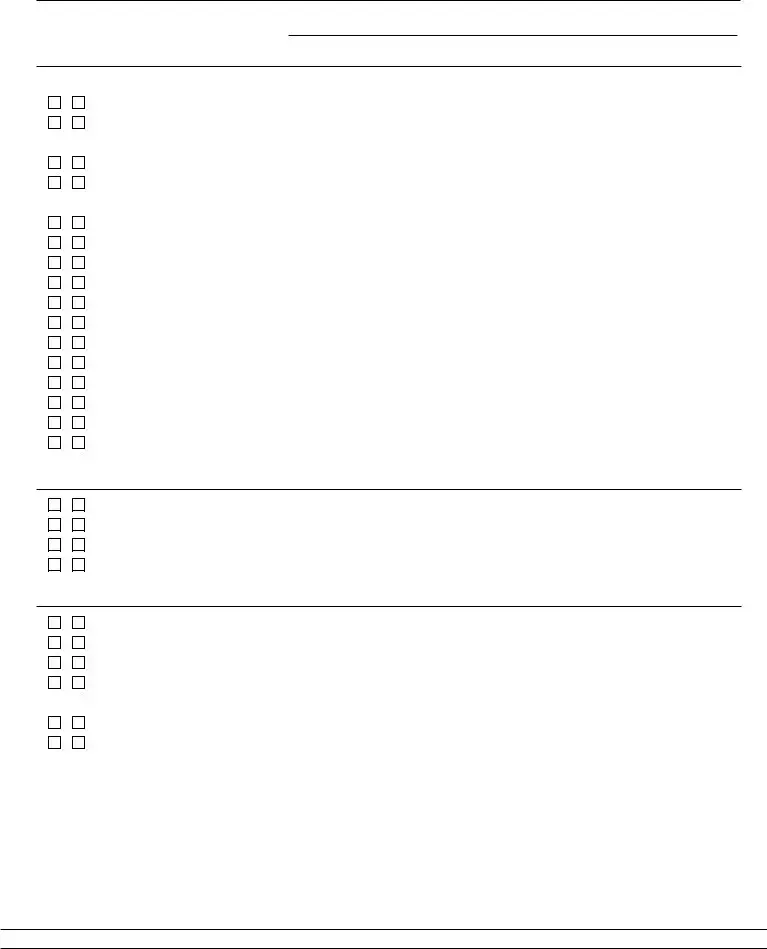

Page 2 of 2

Loan Status Update (LSU) >>

Premises/Property Address or Assessor’s #(s):

DOCUMENTATION

|

DATE |

LENDER |

YES NO |

COMPLETED |

INITIALS |

41.

42.

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

56.

57.

58.

Lender received the Contract and all Addenda |

/ |

/ |

||||||

Lender received Buyer’s name, income, social security number, Premises address, |

|

|

|

|

|

|

||

estimate of value of the Premises, and mortgage loan amount sought |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender sent Loan Estimate |

|

/ |

/ |

|||||

Buyer indicated to Lender an intent to proceed with the transaction after having |

|

|

|

|

|

|

||

received the Loan Estimate |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender received a signed Form 1003 and Lender disclosures |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Payment for the appraisal has been received |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender ordered the appraisal |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender identified down payment source |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Lender received and reviewed the Title Commitment |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

Buyer locked the loan program and financing terms, including interest rate and points |

|

/ |

/ |

|||||

Lock expiration date |

|

|

|

|

|

|

|

|

Lender received the Initial Documentation listed on lines |

|

/ |

/ |

|||||

|

|

|

|

|

|

|||

Appraisal received |

|

/ |

/ |

|||||

|

|

|

|

|

|

|||

Premises/Property appraised for at least the purchase price |

|

/ |

/ |

|||||

|

|

|

|

|

|

|||

Closing Disclosure provided to Buyer |

|

/ |

/ |

|||||

|

|

|

|

|

|

|||

Closing Disclosure received by Buyer |

|

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

UNDERWRITING AND APPROVAL

59.

60.

61.

62.

Lender submitted the loan package to the Underwriter |

|

/ |

/ |

||

|

|

|

|

|

|

Lender obtained loan approval with Prior to Document (“PTD”) Conditions |

|

/ |

/ |

||

|

|

|

|

|

|

Appraisal conditions have been met |

|

/ |

/ |

||

|

|

|

|

|

|

Buyer has loan approval without PTD Conditions |

|

/ |

/ |

||

|

|

|

|

|

|

CLOSING

63.

64.

65.

66.

67.

68.

69.

Lender ordered the Closing Loan Documents and Instructions |

|

/ |

/ |

|||

|

|

|

|

|

|

|

Lender received signed Closing Loan Documents from all parties |

|

/ |

/ |

|||

|

|

|

|

|

|

|

All Lender Quality Control Reviews have been completed |

|

/ |

/ |

|||

All Prior to Funding (“PTF”) Conditions have been met and Buyer has obtained |

|

|

|

|

|

|

loan approval without conditions |

|

/ |

/ |

|||

|

|

|

|

|

|

|

Funds have been ordered |

|

/ |

/ |

|||

|

|

|

|

|

|

|

All funds have been received by Escrow Company |

|

/ |

/ |

|||

|

|

|

|

|

|

|

70.Close of escrow occurs when the deed has been recorded at the appropriate county recorder’s office.

71. |

|

|

^ LOAN OFFICER’S SIGNATURE |

MO/DA/YR |

Loan Status Update • Updated: February 2017 • Copyright © 2017 Arizona Association of REALTORS®. All rights reserved.

PAGE 2 of 2

File Properties

| Fact | Detail |

|---|---|

| Governing Law | Arizona Association of REALTORS® (AAR) guidelines |

| Document Purpose | To update all parties on the current status of a buyer's loan application |

| Update Frequency | Within five (5) days after contract acceptance and upon request |

| Key Components | Lender information, loan type, property details, and current loan status |

| Relevant Sections | Loan application details, pre-qualification information, documentation, underwriting, and approval status |

| Special Instructions | Buyer instructs lender to provide updated LSU to seller and broker(s) |

Instructions on Utilizing Arizona Lsu

Filling out the Arizona Loan Status Update (LSU) form is a crucial step in the home buying process, particularly within the context of communicating financing statuses among involved parties. The LSU form provides a standardized manner for buyers and lenders to inform sellers about the progress of the buyer's loan application and approval. Here's a simple guide on how to accurately complete this form.

- Under the section titled "Loan Status Update," start by entering the name of the lending institution (the "Lender") and its Arizona license number in the spaces provided on lines 4 and 5.

- Fill in the loan officer's name and their NMLS number on line 5.

- Provide the complete address, including city, state, and zip code of the lending institution on line 6, followed by the loan officer's email, phone number, and fax on line 7.

- Record the anticipated dates for closing loan documents delivery and the close of escrow on line 8.

- Include the full names of the buyer(s) and seller(s) on lines 9 and 10, respectively.

- Write the address or assessor's number(s) of the premises/property, city, AZ, and ZIP code on lines 11 and 12.

- Under "PRE-QUALIFICATION INFORMATION," indicate the buyer's marital status (married, unmarried, or legally separated), reliance on the sale or lease of another property to qualify, and if seller concessions are expected for loan costs on lines 13 to 15.

- Select the appropriate loan type (conventional, FHA, VA, USDA, Other) and occupancy type (primary, secondary, non-owner occupied) on lines 18 and 19.

- Identify the property type by checking the appropriate box on line 20.

- For FHA loans, mark whether "Lender has provided Buyer with the HUD form" on line 22.

- Confirm verbal discussion of income, assets, and debts, and the completion of a tri-merged residential credit report on lines 23 and 24.

- Enter the pre-qualified loan amount and the total monthly payment not to exceed amount, along with the interest rate on lines 25 to 29.

- Check the appropriate boxes under "Initial Requested Documentation" for documents the lender has received from the buyer (lines 30 to 35).

- Add any additional comments or relevant information in the space provided on line 36.

- On page 2 of the form, mark whether various documentation and approvals have been received or completed, such as the contract and addenda, good faith estimate, and underwriting approval, following lines 41 to 65.

- The buyer and loan officer should sign and date the form at the designated areas at the bottom of pages 1 and 2.

Once filled out, this form acts as a concise communication tool that helps ensure transparency and efficiency in the loan process for all parties involved. The diligent completion and timely submission of the LSU form can facilitate smoother transitions through the various stages of loan approval and closing.

Listed Questions and Answers

What is the purpose of the Arizona Loan Status Update (LSU) form?

The Arizona Loan Status Update (LSU) form serves as a communication tool between the buyer, seller, lender, and broker(s) about the current status of the buyer's proposed loan. It ensures all parties are informed of the progress and any requirements or updates pertinent to the loan process within a real estate transaction.

When must the AAR Loan Status Update be delivered according to the form?

According to the LSU form, the AAR Loan Status Update must be delivered to the seller within five days after the acceptance of the contract. The lender is also instructed to provide an updated LSU to the broker(s) and seller upon request, maintaining transparency throughout the transaction process.

What information does the lender need to provide on the LSU form?

The lender is required to fill out comprehensive information including their company name, Arizona license number, loan officer's name, NMLS number, contact details, and various loan details such as the type of loan, occupancy type, property type, and details about the buyer’s pre-qualification status.

Does the LSU form include requirements for Buyer’s Financial Information?

Yes, the LSU form requests detailed information about the buyer’s financial situation, including a discussion of the buyer’s income, assets, and debts, completion of a tri-merged residential credit report, and initial requested documentation such as pay stubs, tax returns, and documentation on down payment/reserves. This information helps assess the buyer's capability to pre-qualify for a loan.

What actions are taken if the buyer is relying on the sale or lease of another property to qualify for this loan?

The LSU form allows the buyer to indicate if they are relying on seller concessions or the sale or lease of another property to qualify for the loan. Specific actions or considerations might be needed in such scenarios, including adjustments in the loan qualification process or additional documentation.

What does it mean when the form mentions HUD form “For Your Protection: Get a Home Inspection”?

This reference indicates that, for FHA loans, the lender must provide the buyer with the HUD form titled “For Your Protection: Get a Home Inspection.” This form advises buyers on the importance of home inspections and is part of the lender’s duty to inform and protect consumers.

How are updates to the LSU provided after the initial submission?

After the initial submission within five days of contract acceptance, the buyer has instructed, and the lender agrees, to provide loan status updates on the LSU form to the seller and broker(s) upon request. This ensures all parties remain informed of any changes or updates to the loan status throughout the purchasing process.

Common mistakes

Filling out the Arizona Loan Status Update (LSU) form is a crucial step in the home buying process, requiring precise attention to detail. However, mistakes can be common. Here are eight errors often made:

Not submitting the LSU within five days after contract acceptance as required. This can delay the overall transaction.

Failing to instruct the lender to provide updated LSUs to both the broker(s) and seller upon request, which is pivotal for keeping all parties informed.

Incorrectly identifying the lender by not providing the accurate company name and license number, potentially leading to confusion and verification issues.

Omitting or inaccurately filling in the loan officer’s contact information including NMLS number, which is essential for communication and verification purposes.

Not accurately reporting the buyer’s marital status, which can affect the loan qualification process due to differences in state law regarding property ownership.

Forgetting to indicate whether the buyer is relying on the sale or lease of another property to qualify for the loan. This is crucial information for the lender’s assessment of financial readiness.

Neglecting to specify the type of loan, occupancy type, and property type accurately. These details are necessary for determining loan eligibility and requirements.

Leaving the initial requested documentation section incomplete or unchecked, which can hinder the lender’s ability to proceed with the loan application.

To improve the accuracy and efficiency of the loan application process, participants should pay special attention to these common pitfalls. Careful review and completion of the LSU form can facilitate a smoother transaction for all parties involved.

Documents used along the form

When dealing with real estate transactions in Arizona, particularly those involving financing, the Loan Status Update (LSU) form is a pivotal document. However, this form rarely travels alone through the process. Each supporting document plays a crucial role in ensuring a smooth transaction from the initial offer to the final closing. Here's a closer look at some of these essential documents and their purposes.

- Pre-Qualification Letter: This letter from the lender provides an estimate of how much the buyer can borrow based on a preliminary review of their finances. It's often the first document that accompanies an LSU.

- Purchase Contract: This legal document outlines the terms and conditions of the sale between the buyer and seller, including the purchase price and any contingencies.

- Appraisal Report: An appraisal report assesses the home's market value to ensure it supports the loan amount. It is crucial for the lender’s underwriting process.

- Title Report: This report provides a detailed look at the property's legal status, including ownership details, liens, and any other encumbrances that may affect the sale.

- Credit Report: The lender uses this to evaluate the creditworthiness of the borrower, which affects loan approval and interest rates.

- Proof of Insurance: Lenders require proof of homeowner's insurance to protect the investment against damage or loss.

- Disclosure Statements: These documents, including property disclosures and Lead-Based Paint disclosures, inform buyers about the condition of the house and any known problems.

- Loan Estimate and Closing Disclosure: These documents outline the costs associated with the mortgage and the transaction, respectively. They are required by federal law to ensure transparency.

- Escrow Instructions: This document gives the escrow holder information about the transaction, including how to disburse funds and when certain conditions are met.

- Final Closing Statement: Also known as the HUD-1 Settlement Statement, this document itemizes all financial transactions and costs to both buyer and seller at closing.

Understanding each of these documents can be incredibly beneficial for both buyers and sellers as they navigate through the intricacies of real estate transactions. The LSU form is just the beginning, leading to a cascade of paperwork, each essential to the successful completion of a real estate transaction in Arizona. Navigating this process with awareness and preparation can make all the difference in achieving a smooth and timely closing.

Similar forms

The Residential Loan Application, universally known as Form 1003, shares significant similarities with the Arizona Loan Status Update (LSU) form. Both serve critical roles in the home buying process, providing lenders and other interested parties detailed information about the loan seeker's financial position and intentions. Like the LSU, Form 1003 collects comprehensive data about the applicant, including personal information, income, assets, and the specifics of the requested loan. The key difference, however, lies in their focus and timing within the lending process; while Form 1003 initiates the loan application, the LSU offers updates throughout.

Good Faith Estimate (GFE) documents, now integrated into the Loan Estimate under TRID (TILA-RESPA Integrated Disclosure) rules, also share certain features with the LSU form. The GFE was designed to offer borrowers an itemized list of expected closing costs. In both the GFE and the LSU, transparency for the buyer regarding loan terms and related expenses is a priority. Furthermore, both documents contribute to clear communication between the lending institution and the purchasers by outlining terms, though the LSU specifically updates parties on the progression toward these terms' fulfillment.

The Truth in Lending Act (TILA) disclosure closely aligns with the LSU form through its emphasis on clear communication of loan terms. This document, fundamental within the lending industry, provides borrowers detailed information on the cost of their loan, including the annual percentage rate (APR), finance charges, and payment schedule. While the TILA disclosure focuses on ensuring borrowers understand their financial obligations, the LSU complements this by updating all parties on the loan status and conditions, including any changes to what was initially disclosed.

Pre-qualification letters, often the first document indicating a lender's willingness to finance a potential borrower based on preliminary financial information, bear resemblance to the LSU as well. Both documents aim to assure sellers and their agents of a buyer’s financial capability. However, the LSU is more detailed and is used further along in the purchasing process, providing updates on the buyer's loan approval status and other pertinent milestones in the loan process.

The Appraisal Report, mandatorily acquired during the mortgage lending process, offers an objective valuation of the property a buyer intends to purchase and thereby parallels the LSU form's objective. Both play pivotal roles in determining the viability of the proposed loan amount versus the property's value and ensuring that the lending terms are met. While the appraisal focuses strictly on property valuation, the LSU form encompasses this aspect within the broader context of loan status updates.

Commitment letters from lenders, which formalize the bank's intention to lend the agreed amount under specified terms, also parallel the information in an LSU. Both documents signify progression toward closing, with the commitment letter often acting as a precursor to the LSU's detailed updates. They ensure that all involved parties are aware of the loan's status and any conditions that need to be met before final approval.

The Closing Disclosure, part of the TRID regulations alongside the Loan Estimate, shares the LSU's goal of transparency and comprehensive communication. This document offers a final review of loan terms, closing costs, and the details of the transaction before the closing meeting. Similarly, the LSU provides ongoing updates leading to this point, ensuring that any discrepancies can be addressed promptly to avoid delays or misunderstandings at closing.

The Title Commitment document, ensuring a property title is free of liens or legal defects prior to transfer, shares objectives with the LSU. While the Title Commitment safeguards the legal transfer of property ownership, the LSU updates on loan conditions related to such legal suitability for loan approval. Both documents are integral to the seamless progress of property purchasing, addressing different, yet equally crucial aspects of the approval and closing processes.

Dos and Don'ts

When completing the Arizona Loan Status Update (LSU) form, it's important to follow certain guidelines to ensure accuracy and compliance with the process. Here are some dos and don'ts to consider:

- Do submit the AAR LSU within five days after Contract acceptance as required by Section 2e of the Contract.

- Don't forget to instruct the lender to provide an updated LSU to both the Broker(s) and Seller upon request.

- Do ensure that the lender's information, including the company name, Arizona license number, loan officer, and contact details, are accurately filled in.

- Don't overlook the requirement to indicate whether the buyer is relying on the sale or lease of another property to qualify for this loan.

- Do accurately report on the buyer's proposed loan type, occupancy type, and property type.

- Don't leave out whether the buyer is married, unmarried, or legally separated if it's applicable to financial information or qualifications.

- Do provide clear and complete information regarding the initial requested documentation, checking off the appropriate boxes to indicate what has been received.

- Don't skip the sections that require information on whether particular procedures, like income and debt discussions or credit report checks, have been completed.

- Do confirm that all lender-related actions, such as receiving the contract, sending initial disclosures, appraisals, and underwriting and approval steps, are meticulously documented with dates and initials where required.

Following these guidelines can help ensure the efficient and accurate processing of the Arizona LSU form, facilitating smoother transactions for all parties involved.

Misconceptions

When navigating the complexities of the Arizona Loan Status Update (LSU) form, many misconceptions can lead to confusion for both buyers and sellers in a real estate transaction. Here are nine common misconceptions explained to help clarify the purpose and process of the LSU form:

- The LSU is optional during the home buying process. Contrary to what some may believe, the submission of the AAR Loan Status Update is mandatory within five days after contract acceptance, ensuring that both seller and broker(s) are informed of the loan's status.

- Any lender information is acceptable. The LSU specifically requires the lender's Arizona license number and NMLS number, ensuring accountability and that the lender is authorized to operate within Arizona.

- Loan details are not critical early on. The form mandates concise details about the proposed loan from the get-go, including the type of loan, occupancy type, and property type. This information is vital for the transparency and integrity of the transaction.

- Home inspection advisements are universal. Only for FHA loans does the lender need to provide the borrower with the HUD form “For Your Protection: Get a Home Inspection,” underscoring the loan type-specific requirements.

- Verbal financial discussions suffice. The LSU form clarifies that a lender must have a verbal discussion with the buyer about income, assets, and debts. This ensures a comprehensive understanding of the buyer's financial position early in the process.

- Pre-qualification equals guaranteed loan amount. Pre-qualification gives an estimate based on provided information, but it does not guarantee the final loan amount, which depends on further verification and underwriting processes.

- All financial documentation is required upfront. While the LSU lists initial requested documentation, it allows for the possibility that additional documentation may be required as the loan application progresses.

- Updates to the LSU are at the lender's discretion. The buyer instructs, and the lender agrees, to provide updated LSUs to the seller and broker(s) within five days of contract acceptance and upon request thereafter, ensuring ongoing transparency.

- Loan approval is indicated on the LSU. The form provides a comprehensive checklist through the underwriting and approval process, including appraisal and final loan documents, but final loan approval is subject to fulfilling all prior to funding (PTF) conditions.

Understanding these facets of the Arizona Loan Status Update form can demystify the process for both parties involved, leading to smoother transactions and better-prepared participants.

Key takeaways

Understanding the Arizona Loan Status Update (LSU) form is crucial for ensuring a smooth real estate transaction. Here are key takeaways to consider:

- The LSU must be delivered to the Seller within five days after the Contract acceptance, ensuring timely communication regarding the loan process.

- The form should be filled out with current loan status information, as it facilitates transparency between the Buyer, Seller, and Broker(s).

- The Lender, identified on the form, is tasked with providing updated LSUs upon request, making them a pivotal point of contact throughout the transaction.

- Accuracy in completing personal and loan-related information, such as contact details, loan types, and pre-qualification data, is essential for the validity of the LSU.

- The form includes sections for describing the type of loan, occupancy, and property type, helping in understanding the specifics of the Buyer’s financial arrangement.

- It addresses the Buyer's dependency on selling or leasing another property to qualify for the loan, which can significantly impact the transaction's progress.

- Details regarding the initial documentation received from the Buyer by the Lender are listed to confirm that foundational financial checks are conducted.

- Additional comments can be added for clarity or further explanation, offering a space for any pertinent information that doesn’t fit in the standardized fields.

- The LSU also tracks the progress of the loan approval process, including appraisal, underwriting, and closing steps, providing a timeline of completed tasks.

- Both the Buyer and the Loan Officer are required to acknowledge receipt and the accuracy of the information provided by signing the form.

Properly filled out and timely submitted, the Loan Status Update form is a key document in the Arizona real estate transaction process, designed to keep all parties informed and facilitate a smoother closing.

More PDF Forms

Undesignated Felony - Following the application submission, procedural instructions provided by the court guide applicants through post-submission steps, ensuring adherence to necessary legal proceedings for resolution.

Arizona Filing Requirements - To ensure a smooth processing of Form 290, taxpayers should verify that all required signatures and authorizations are in place.