Fill in a Valid Arizona Joint Tax Application Template

The Arizona Joint Tax Application form is a critical document for businesses operating within the state, serving multiple purposes across various tax-related requirements. It is a consolidated application that facilitates the process of registering new businesses, changing ownership, updating current business licenses, and adding additional business locations under the oversight of the Arizona Department of Revenue and the Department of Economic Security. The form requires comprehensive business information, including but not limited to, legal business names, types of ownership, business activities, employment information, and the identification of owners or corporate officers. Additionally, it outlines the need for licenses for transaction privilege tax (TPT), use tax, withholding, and unemployment tax, contingent upon the nature of the business operations. With the importance of accurate and timely submissions emphasized, the document also details the procedures for calculating and reporting state and city-level taxes, highlighting the significance of the TPT license for businesses engaged in taxable activities. Furthermore, it introduces a voluntary unemployment tax coverage option, underscoring the state's effort to facilitate a comprehensive tax compliance framework for its business community. This application, thus, plays a pivotal role in ensuring businesses meet their state tax obligations effectively and efficiently.

Arizona Joint Tax Application Preview

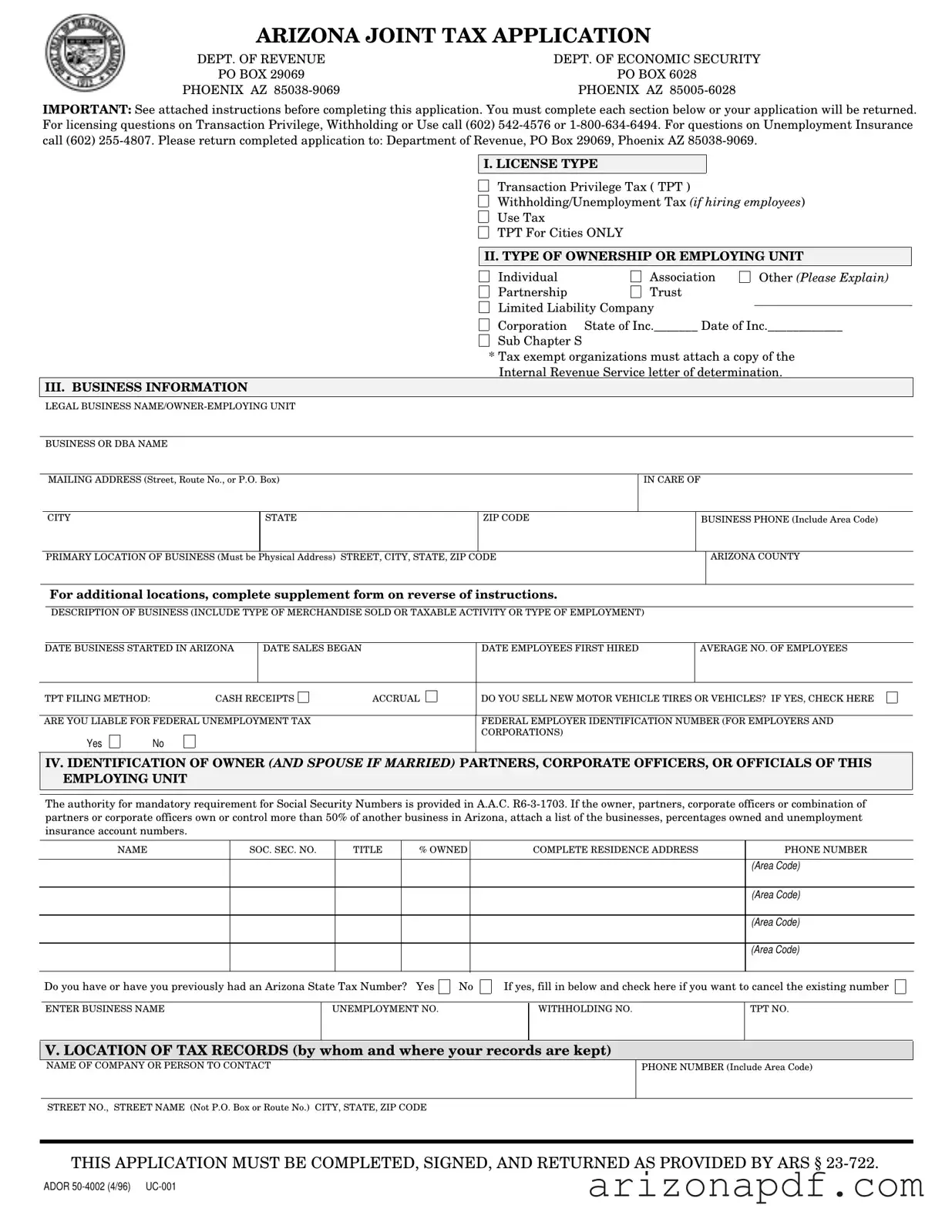

ARIZONA JOINT TAX APPLICATION

DEPT. OF REVENUE |

DEPT. OF ECONOMIC SECURITY |

|

PO BOX |

29069 |

PO BOX 6028 |

PHOENIX AZ |

PHOENIX AZ |

|

IMPORTANT: See attached instructions before completing this application. You must complete each section below or your application will be returned. For licensing questions on Transaction Privilege, Withholding or Use call (602)

I. LICENSE TYPE

Transaction Privilege Tax ( TPT )

Withholding/Unemployment Tax (if hiring employees)

Use Tax

TPT For Cities ONLY

II. TYPE OF OWNERSHIP OR EMPLOYING UNIT

Individual |

Association |

Partnership |

Trust |

Limited Liability Company

Other (Please Explain)

Corporation State of Inc._______ Date of Inc.____________

Sub Chapter S

* Tax exempt organizations must attach a copy of the Internal Revenue Service letter of determination.

III. BUSINESS INFORMATION

LEGAL BUSINESS

BUSINESS OR DBA NAME

MAILING ADDRESS (Street, Route No., or P.O. Box)

IN CARE OF

CITY

STATE

ZIP CODE

BUSINESS PHONE (Include Area Code)

PRIMARY LOCATION OF BUSINESS (Must be Physical Address) STREET, CITY, STATE, ZIP CODE

ARIZONA COUNTY

For additional locations, complete supplement form on reverse of instructions.

DESCRIPTION OF BUSINESS (INCLUDE TYPE OF MERCHANDISE SOLD OR TAXABLE ACTIVITY OR TYPE OF EMPLOYMENT)

|

|

|

|

|

|

|

DATE BUSINESS STARTED IN ARIZONA |

DATE SALES BEGAN |

|

DATE EMPLOYEES FIRST HIRED |

AVERAGE NO. OF EMPLOYEES |

||

|

|

|

|

|

|

|

TPT FILING METHOD: |

CASH RECEIPTS |

ACCRUAL |

DO YOU SELL NEW MOTOR VEHICLE TIRES OR VEHICLES? IF YES, CHECK HERE |

|||

|

|

|

|

|||

ARE YOU LIABLE FOR FEDERAL UNEMPLOYMENT TAX |

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FOR EMPLOYERS AND |

||||

|

|

|

|

|

CORPORATIONS) |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

IV. IDENTIFICATION OF OWNER (AND SPOUSE IF MARRIED) PARTNERS, CORPORATE OFFICERS, OR OFFICIALS OF THIS EMPLOYING UNIT

The authority for mandatory requirement for Social Security Numbers is provided in A.A.C.

NAME |

SOC. SEC. NO. |

TITLE |

% OWNED |

COMPLETE RESIDENCE ADDRESS |

PHONE NUMBER |

(Area Code)

(Area Code)

(Area Code)

(Area Code)

Do you have or have you previously had an Arizona State Tax Number? Yes

No

If yes, fill in below and check here if you want to cancel the existing number

ENTER BUSINESS NAME

UNEMPLOYMENT NO.

WITHHOLDING NO.

TPT NO.

V. LOCATION OF TAX RECORDS (by whom and where your records are kept)

NAME OF COMPANY OR PERSON TO CONTACT

PHONE NUMBER (Include Area Code)

STREET NO., STREET NAME (Not P.O. Box or Route No.) CITY, STATE, ZIP CODE

THIS APPLICATION MUST BE COMPLETED, SIGNED, AND RETURNED AS PROVIDED BY ARS §

ADOR

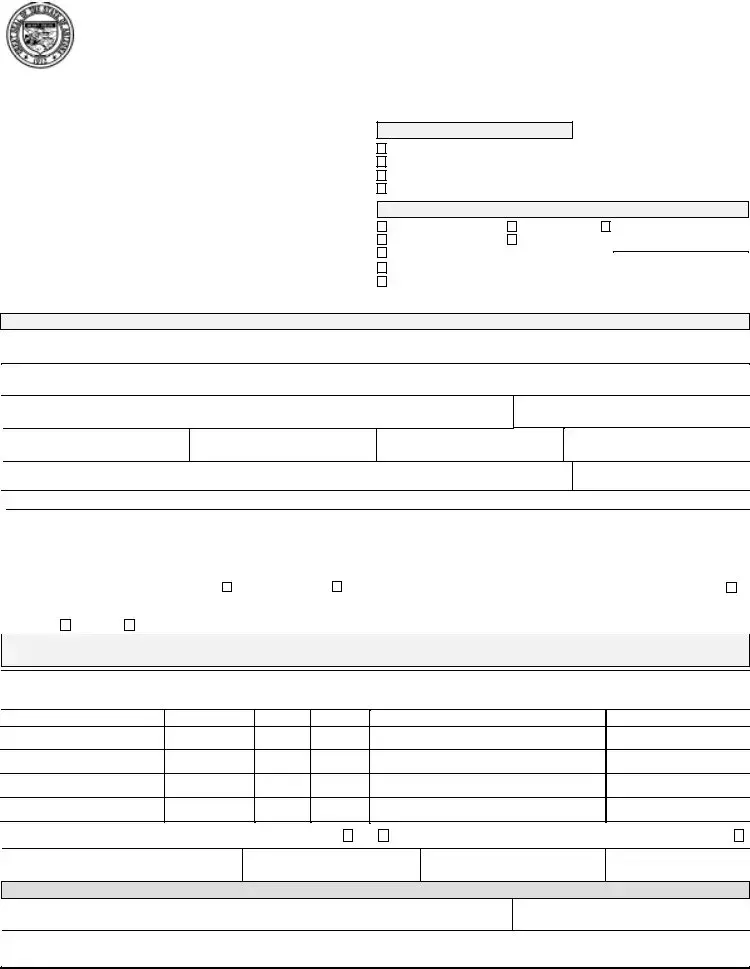

DES |

THIS BOX FOR AGENCY USE ONLY |

DOR |

|

|

|

NEW |

CHANGE |

REVISE |

REOPEN |

SIC __________ |

ACCT NO ______________ CTY CD __________ LIAB __________ TLAPSE________ |

||||

START ___________________________ LIAB EST _______________________________ |

||||

REPORTS |

|

S/E DATE |

KP |

|

TPT _______________________________________________________________

W H _______________________________________________________________

CITIES ____________ ___________ ___________ ___________ ___________

VI. PREVIOUS OWNERS (complete if you are acquiring an existing business)

Did you acquire all or part of an existing business? No |

Yes |

If yes, indicate date ________________________________ and whether you acquired: |

ALL business operations and locations in Arizona. |

You will receive the unemployment tax rate of the business you acquired. |

|

PART of the business.To apply for a portion of the prior owner's unemployment tax rate call to obtain form

NAME OF PREVIOUS OWNER

PREVIOUS OWNER'S PRESENT ADDRESS

PREVIOUS OWNER'S CURRENT PHONE NO.

UNEMPLOYMENT NO.

WITHHOLDING NO.

TPT NO.

VII. EMPLOYMENT INFORMATION (complete only if applying for withholding/unemployment tax license)

Record of Arizona wages paid by calendar quarters for current and preceding calendar years.

YEAR

19

19

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

Weekly record of number of persons performing services in Arizona for current & preceding calendar year.

YEAR |

JANUARY |

FEBRUARY |

MARCH |

APRIL |

MAY |

JUNE |

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

JULY |

AUGUST |

SEPTEMBER |

OCTOBER |

NOVEMBER |

DECEMBER |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

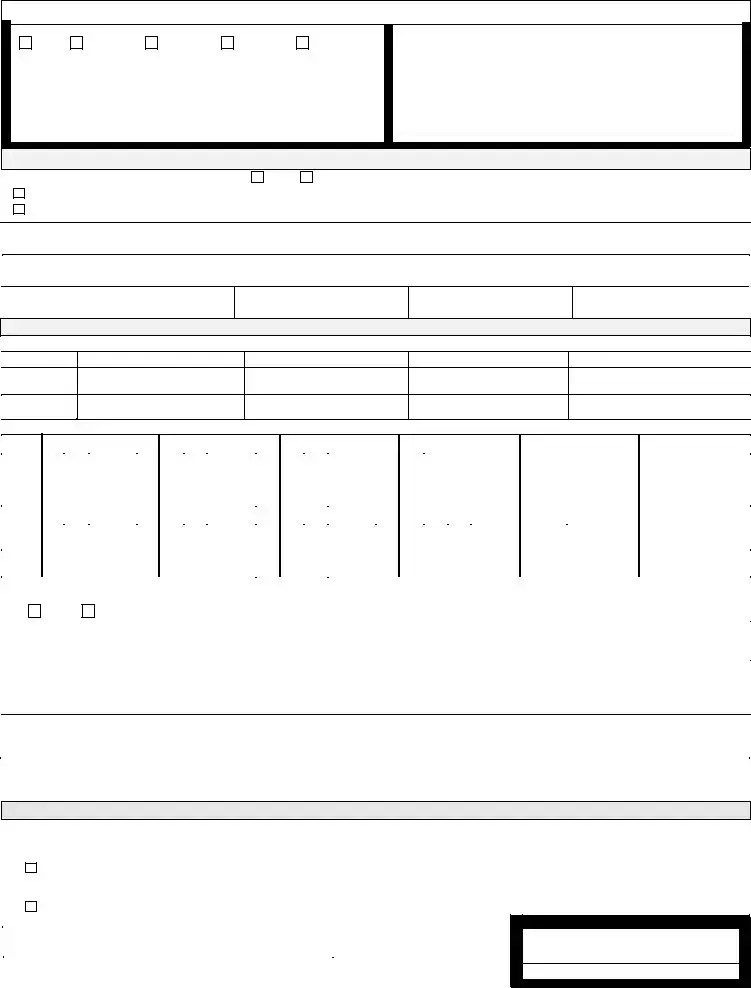

VIII. ARE INDIVIDUALS PERFORMING SERVICES THAT ARE EXCLUDED FROM WITHHOLDING OR UNEMPLOYMENT TAX? |

||||||||||||||||||||||||||

No |

Yes |

|

|

If yes, explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

IX. FEES FOR TRANSACTION PRIVILEGE TAX (no fee for withholding, use or unemployment) |

|

|

|

|

|

|

|

|

||||||||||||||||||

State Fees (# loc. x $12.00): |

City Fees (Total from Table): |

Total Fees: |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

X. SIGNATURE(S) required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This application must be signed by either a sole owner, two partners, two corporate officers, the trustee, receiver or personal representative of an estate.

UNDER PENALTY OF PERJURY I (WE) DECLARE THAT THE INFORMATION ON THIS DOCUMENT IS TRUE AND CORRECT.

TYPE OR PRINT NAME |

TITLE |

SIGNATURE |

DATE |

|

|

|

|

TYPE OR PRINT NAME |

TITLE |

SIGNATURE |

DATE |

XI. VOLUNTARY ELECTION OF UNEMPLOYMENT TAX COVERAGE

The undersigned, on behalf of the employing unit, voluntarily elects beginning January 1 of the current calendar year or the date employment started if later, and continuing for not less than two full calendar years to:

A. Become an employer subject to Title 23, Chapter 4, Arizona Revised Statutes, to the same extent as all other employers and extend unemployment tax coverage to my employees although not mandatory.

B. Extend coverage to all employees performing services excluded from coverage as shown in Section IX above.

SIGNATURE/TITLE |

DATE |

|

|

ADOR |

UC - 001 |

AGENCY USE ONLY

APPROVED/DATE

INSTRUCTIONS FOR JOINT TAX APPLICATION

IMPORTANT: You must complete each of the following sections or your application will be returned

USE THIS APPLICATION TO:

·License New Business: A new business with no previous owners.

·Change Ownership: If purchasing an existing business or changing business entity (sole owner to corporation, etc.).

If you need to update a license, add a business location, or make other

changes: Request an update card or provide a written notification of the change (a form is not necessary). Please include fees of $12 per location plus applicable city fee(s).

I.LICENSE TYPE

Transaction Privilege Tax (TPT): Anyone involved in an activity taxable under the TPT statutes must apply for a TPT License before engaging in business.

·For TPT, you are required to obtain a separate license for each business or rental location. This may be accomplished in one of the following ways:

·Each location may be licensed as a separate business with a separate license number for purpose of reporting sales and use taxes individually. Therefore a separate application is needed for each location.

Multiple locations may be licensed under a consolidated license number, provided the ownership is the same, to allow filing of a single tax return. If applying for a new license, list the various business locations as instructed below. If already licensed and you are adding locations, do not use this application to consolidate an existing license. Request on update form.

Please Note: Applicants in the construction contracting business may be required to submit bonds for TPT tax before a transaction privilege license is issued. The amount of bond required is based on the type of construction performed. Please see the Department of Revenue Taxpayer Bonds brochure for more information.

In addition, bonds are required for new license holders for construction contracts over $50,000, before building permits can be issued. TPT license holders who are delinquent in payment of tax or returns are also subject to bonding.

Withholding & Unemployment Taxes: Employers paying wages or salaries to employees for services performed in the State must apply for a Withholding number & Unemployment number.

Use Tax:

TPT for cities only: This type of license is needed if your business activity is subject to city TPT that is collected by the state, but the activity is not taxed at the state level.

Many of the larger cities in Arizona administer and collect their own privilege taxes. Please contact those cities directly to

obtain information about licensing requirements.

II.TYPE OF OWNERSHIP OR EMPLOYMENT UNIT

Check as applicable. Corporation must provide the state and date of incorporation.

III.BUSINESS INFORMATION

·Enter the Legal Business Name of the Owner or Employing Unit (Name of corporation as listed in its articles of incorporation, or individual & spouse, or partners, or organization owning or controlling the business).

·Enter the name of the Business/DBA (doing business as) name, if same as above, enter "same."

·Enter mailing address where all correspondence is to be sent. You may use

your home address, corporate headquarters, or accounting firm's address, etc. If mailing addresses differ for licenses (for instance withholding and unemployment insurance), please use cover letter to explain.

·If you wish correspondence to be sent to a name other than the owner, enter the name of the department or accountancy firm in the "In care of" box to ensure delivery by the postal service.

·Enter the street address for the primary location(s) of the business. For additional

business location(s) complete the supplemental form on the reverse side of the instructions.

·Describe the major business activity:

principal product you manufacture, commodity sold, or services performed. Your description of the business is very important because it determines your transaction privilege tax rate and provides a basis for state economic forecasting.

·Enter the date the business started in Arizona.

·Enter the date sales began in Arizona.

·Enter the date employees were first hired in Arizona and the average number of employees.

·Cash/Accrual Methods: Cash method requires the payment of tax based on sales receipts actually received during the period covered on the tax return. When filing under the accrual method, the tax is calculated on the sales billed rather than receipts.

·Sellers of new motor vehicles and motor vehicle tires in the state, for

·Indicate whether you are liable for FUTA

and enter your Federal Employer Identification number.

·Taxpayers are required to provide their taxpayer identification number (TIN) on all returns and documents. A TIN is defined as the federal employer identification number (EIN), or social security number (SSN) depending upon how income tax is reported. Employers must provide their federal EIN. A penalty of $5 will be assessed for each document filed without a TIN.

IV. IDENTIFICATION OF OWNER(S)

Enter as many as applicable; attach a separate sheet if additional space is needed.

V.LOCATION OF TAX RECORDS

Complete as indicated.

VI. PREVIOUS OWNERS

Complete this section if you acquired an existing business.

VII. EMPLOYMENT INFORMATION

Enter total gross wages paid for each quarter the business has operated. Enter the number of persons performing services each week the business operated.

VIII. COMPLETE AS APPLICABLE

IX. FEES

There are no fees for Withholding, Unemployment, or Use Tax registrations. To calculate the fees for TPT ($12) licenses, calculate the State fees by multiplying the number of locations in the state by $12. To calculate the city(ies) fee, use the table on the reverse of instructions. First, indicate the number of businesses or physical locations for each of the cities for which the Department of Revenue licenses and collects. Then multiply by the city fee for each city in which you will do business. Add the columns to determine the total city fees. Fill in the totals for state fees and city fees on the application form and total to determine the amount due. Make checks payable to the Arizona Department of

Revenue. Be sure to return the instruction/fees sheet with your application.

To obtain licensing for cities not listed on the form, please contact the city directly.

X.SIGNATURES

The application must be signed only by individuals legally responsible for the business, not agents or representatives.

XI. VOLUNTARY ELECTION OF UN- EMPLOYMENT TAX COVERAGE

Complete and sign this portion of the application ONLY if you wish to provide unemployment coverage to your employees, and you believe you are not REQUIRED to provide coverage. Refer to "A Guide to Arizona Employment Tax Requirements" or "Employers' Handbook" for requirements.

ADOR

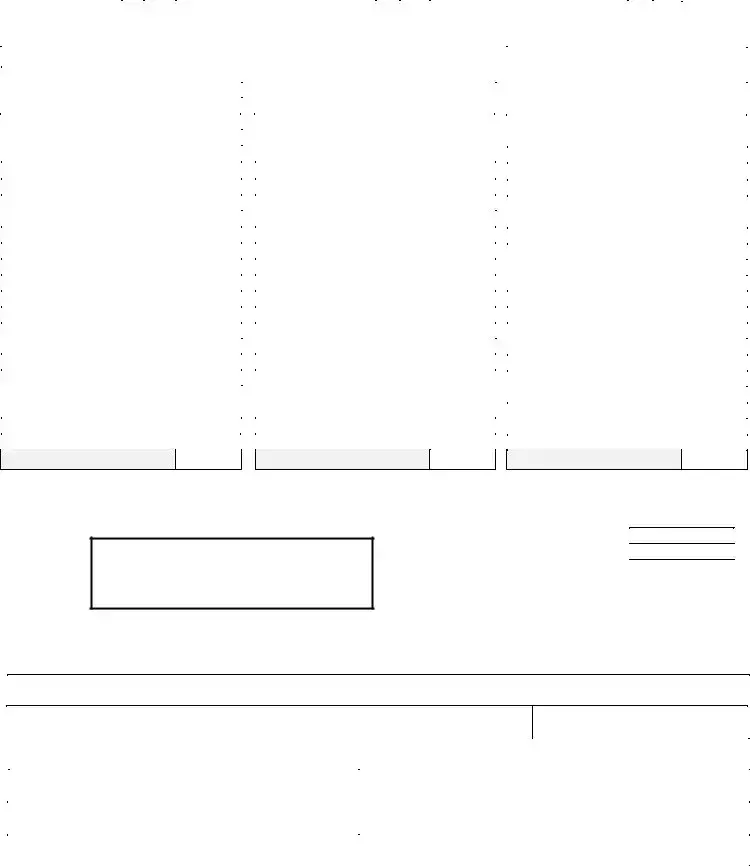

CITIES OR TOWNS LICENSED BY THE STATE

|

C |

F |

TOTAL |

|

|

C |

F |

TOTAL |

|

|

C |

F |

TOTAL |

|

O |

|

|

O |

|

|

O |

||||||

CITY/TOWN |

E |

FEES |

|

CITY/TOWN |

E |

FEES |

|

CITY/TOWN |

E |

||||

D |

|

D |

|

D |

FEES |

||||||||

|

E |

|

|

|

E |

|

|

|

E |

||||

|

E |

|

|

|

E |

|

|

|

E |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

APACHE JUNCTION |

AJ |

2.00 |

|

|

GLOBE |

GL |

2.00 |

|

|

SAFFORD |

SF |

2.00 |

|

BENSON |

BS |

5.00 |

|

|

GOODYEAR |

GY |

5.00 |

|

|

SAHUARITA |

SA |

5.00 |

|

BISBEE |

BB |

1.00 |

|

|

GUADALUPE |

GU |

2.00 |

|

|

SAN LUIS |

SU |

2.00 |

|

BUCKEYE |

BE |

2.00 |

|

|

HAYDEN |

HY |

5.00 |

|

|

SEDONA |

SE |

2.00 |

|

BULLHEAD CITY |

BH |

2.00 |

|

|

HOLBROOK |

HB |

1.00 |

|

|

SHOW LOW |

SL |

2.00 |

|

CAMP VERDE |

CE |

2.00 |

|

|

HUACHUCA CITY |

HC |

2.00 |

|

|

SIERRA VISTA |

SR |

1.00 |

|

CAREFREE |

CA |

10.00 |

|

|

JEROME |

JO |

2.00 |

|

|

SNOWFLAKE |

SN |

2.00 |

|

CASA GRANDE |

CG |

2.00 |

|

|

KEARNY |

KN |

2.00 |

|

|

SOMERTON |

SO |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAVE CREEK |

CK |

20.00 |

|

|

KINGMAN |

KM |

2.00 |

|

|

SOUTH TUCSON |

ST |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHINO VALLEY |

CV |

2.00 |

|

|

LAKE HAVASU |

LH |

5.00 |

|

|

SPRINGERVILLE |

SV |

5.00 |

|

CLARKDALE |

CD |

2.00 |

|

|

LITCHFIELD PARK |

LP |

2.00 |

|

|

ST. JOHNS |

SJ |

2.00 |

|

CLIFTON |

CF |

2.00 |

|

|

MAMMOTH |

MH |

2.00 |

|

|

SUPERIOR |

SI |

2.00 |

|

COLORADO CITY |

CC |

2.00 |

|

|

MARANA |

MA |

5.00 |

|

|

SURPRISE |

SP |

10.00 |

|

COOLIDGE |

CL |

2.00 |

|

|

MIAMI |

MM |

2.00 |

|

|

TAYLOR |

TL |

2.00 |

|

COTTONWOOD |

CW |

2.00 |

|

|

ORO VALLEY |

OR |

12.00 |

|

|

THATCHER |

TC |

2.00 |

|

DOUGLAS |

DL |

5.00 |

|

|

PAGE |

PG |

2.00 |

|

|

TOLLESON |

TN |

2.00 |

|

DUNCAN |

DC |

2.00 |

|

|

PARADISE VALLEY |

PV |

2.00 |

|

|

TOMBSTONE |

TS |

1.00 |

|

EAGAR |

EG |

10.00 |

|

|

PARKER |

PK |

2.00 |

|

|

WELLTON |

WT |

2.00 |

|

EL MIRAGE |

EM |

2.00 |

|

|

PAYSON |

PS |

2.00 |

|

|

WICKENBURG |

WB |

2.00 |

|

ELOY |

EL |

10.00 |

|

|

PIMA |

PM |

2.00 |

|

|

WILLCOX |

WC |

1.00 |

|

FLORENCE |

FL |

2.00 |

|

|

PINETOP/LAKESIDE |

PP |

2.00 |

|

|

WILLIAMS |

WL |

2.00 |

|

FOUNTAIN HILLS |

FH |

2.00 |

|

|

PRESCOTT VALLEY |

PL |

2.00 |

|

|

WINKELMAN |

WM |

2.00 |

|

FREDONIA |

FD |

10.00 |

|

|

QUARTZSITE |

QZ |

2.00 |

|

|

WINSLOW |

WS |

10.00 |

|

GILA BEND |

GI |

2.00 |

|

|

QUEEN CREEK |

QC |

2.00 |

|

|

YOUNGTOWN |

YT |

10.00 |

|

GILBERT |

GB |

2.00 |

|

|

|

|

|

|

|

YUMA |

YM |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

TOTAL

TOTAL

FOR CITIES NOT LISTED, PLEASE CONTACT THE CITY DIRECTLY

PLEASE NOTE:

City fees are subject to change occasionally.

You will be billed for the difference.

Total of City Fees: State Fees $12.00 x No. Loc.:

TOTAL FEES:

FOR ADDITIONAL LOCATIONS, COMPLETE THE FOLLOWING:

Name Doing Business As at this Location

Physical Location (not P.O. Box or Rte. No.)

Telephone No.

|

City |

County |

State |

ZIP Code |

|

Avg. No. of Employees |

|

|

|

|

|

|

|

|

|

|

Name Doing Business As at this Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical Location (not P.O. Box or Rte. No.) |

|

|

|

Telephone No. |

|

||

|

|

|

|

|

|

|

|

|

City |

County |

State |

ZIP Code |

|

Avg. No. of Employees |

|

|

|

|

|

|

|

|

|

If more space is needed, please attach additional sheet.

ADOR

File Properties

| Fact | Detail |

|---|---|

| Application Purpose | Used to license new businesses, change ownership, or update business information in Arizona. |

| Administering Agencies | Department of Revenue and Department of Economic Security. |

| Return Address for Application | Department of Revenue, PO Box 29069, Phoenix AZ 85038-9069. |

| License Types Included | Transaction Privilege Tax, Withholding/Unemployment Tax, Use Tax, and TPT for Cities ONLY. |

| Types of Ownership Recognized | Individual, Association, Partnership, Corporation, Trust, Limited Liability Company, and more. |

| Business Information Required | Legal business name, business or DBA name, mailing address, business phone, primary location, description of business, dates related to business operations, and average number of employees. |

| Mandatory Identification Information | Includes owner(s), corporate officers, or officials' names, Social Security Numbers, titles, percentage of ownership, and contact information. Based on A.A.C. R6-3-1703. |

| Record Location of Tax Records | Applicants must specify where business records are kept, including contact details. |

| Unemployment Information Section | Requires details on Arizona wages paid, the record of the number of persons performing services, and if there are individuals performing services that are excluded from withholding or unemployment tax. |

| Signatory Requirements | The application must be signed by authorized individuals, such as a sole owner, partners, or corporate officers. |

| Governing Law | Arizona Revised Statutes (ARS) § 23-722 provides the legal foundation for the mandatory completion and submission of the application. |

Instructions on Utilizing Arizona Joint Tax Application

Before diving into completing the Arizona Joint Tax Application form, it's essential to gather all necessary information about your business. This application is crucial for business owners in Arizona to comply with tax obligations correctly. Ensure accuracy and completeness as missing or incorrect information can delay the process. Here's a guided step to ensure you fill out the form properly.

- Begin with selecting the License Type that applies to your business. Options include Transaction Privilege Tax, Withholding/Unemployment Tax, Use Tax, and TPT for Cities ONLY.

- Under Type of Ownership or Employing Unit, mark the appropriate category that represents the structure of your business and provide the state and date of incorporation if you're registering a Corporation.

- In section III. Business Information, fill in your Legal Business Name, DBA (Doing Business As) name if applicable, and complete mailing address including the city, state, and ZIP code. Don't forget to include your Business Phone number and the primary location of your business.

- Describe your business in detail, noting the type of merchandise sold or taxable activity or type of employment. Fill in the dates relevant to when your business started in Arizona, when sales began, and when employees were first hired along with the average number of employees. Choose your TPT Filing Method by marking either Cash Receipts or Accrual.

- Indicate if you sell new motor vehicle tires or vehicles and if you are liable for Federal Unemployment Tax, alongside providing your Federal Employer Identification Number.

- In section IV. Identification of Owner(s), list the names, Social Security Numbers, titles, percentage owned, and complete residence addresses along with phone numbers for each owner, partner, or corporate officer.

- For Location of Tax Records, provide the name of the company or person to be contacted, their phone number, and the address where your records are kept.

- If acquiring an existing business, fill in the Previous Owners section with relevant details.

- In the Employment Information section, provide a record of Arizona wages paid by calendar quarters for current and preceding calendar years and a weekly record of the number of persons performing services in Arizona for the same period.

- Respond to the question about individuals performing services that are excluded from withholding or unemployment tax if applicable.

- Calculate and list the fees for Transaction Privilege Tax in section IX. Fees by multiplying the number of business locations by $12.00 and then adding any city fees as applicable.

- Ensure the application is signed by an authorized individual such as a sole owner, two partners, or corporate officials in the Signatures section, affirming the accuracy and truth of the information provided.

- If you wish to voluntarily elect unemployment tax coverage, complete section XI. Voluntary Election of Unemployment Tax Coverage by marking the applicable options and signing the document.

After completing the form, review all the information for accuracy and completeness. Once satisfied, mail the completed form to the provided address of the Department of Revenue. This step is critical to ensure your business is compliant with Arizona's tax regulations and to avoid any processing delays. Remember, accurate and timely submission of this application forms part of your business's foundational compliance with state tax obligations.

Listed Questions and Answers

What is the purpose of the Arizona Joint Tax Application?

The Arizona Joint Tax Application serves to streamline the process for businesses to register with the state for various taxes and licenses. Its primary functions include registering new businesses that have no previous owners, changing ownership details for existing businesses, or updating business entity types (for instance, transitioning from a sole proprietorship to a corporation). Through this application, businesses can apply for licenses related to Transaction Privilege Tax (TPT), Use Tax, and register for Withholding and Unemployment taxes. Essentially, this form facilitates compliance with state tax obligations and the operational requirements for businesses in Arizona.

Who needs to complete the Arizona Joint Tax Application?

Any business operating in Arizona that engages in activities subject to the Transaction Privilege Tax (such as selling physical goods or certain services), pays wages to employees (requiring registration for Withholding and Unemployment Taxes), or purchases goods for use from out-of-state vendors (necessitating a Use Tax Registration Certificate) needs to complete the Arizona Joint Tax Application. Additionally, businesses changing ownership or entity type must use this form to update their records with the state.

What is Transaction Privilege Tax (TPT), and how is it different from sales tax?

Transaction Privilege Tax (TPT) is commonly referred to as a sales tax; however, it is a tax on the privilege of doing business in Arizona. Unlike a conventional sales tax that is levied on the end consumer of goods or services, TPT is imposed on businesses and can vary depending on the type of business or services offered. Businesses are responsible for collecting the appropriate tax from their customers and remitting it to the state. The Arizona Joint Tax Application is required for businesses to apply for a TPT license before engaging in taxable business activities.

How do businesses calculate the fees required with the application?

To calculate the fees associated with the application, businesses must first determine the number of locations they operate within Arizona that require a TPT license. Each location incurs a state fee of $12. Additionally, if the business operates in cities that impose their own TPT and are collected by the state, the applicable city fees (which vary by city) also need to be included. Total fees are the aggregate of state fees plus any applicable city fees, calculated according to the instructions provided with the form. There are no fees required for registering for Withholding, Use, or Unemployment taxes through this application.

What happens if a section of the application is not completed?

If any section of the application is not fully completed, the application will be returned to the business. It's crucial for businesses to provide all requested information, including detailed business activities, tax filing methods, and identification details of owners or corporate officers, among other requirements. Proper completion ensures the application can be processed without delay, allowing businesses to comply with state tax laws and operate legally within Arizona.

Common mistakes

Filling out the Arizona Joint Tax Application form is a critical step for businesses to ensure compliance with state tax regulations. However, several common mistakes can lead to delays or issues with the application process, ultimately affecting the operation of the business.

Not Providing Complete Ownership Information: Applicants sometimes neglect to fill out all required fields in the Type of Ownership or Employing Unit section. The state of incorporation, date of incorporation for corporations, and the specific ownership percentages for owners, partners, or corporate officers must be accurately and completely documented. Failing to do so can lead to unnecessary complications or delays in processing the application.

Omitting Business Activity Details: The Business Information section requires a clear description of the business's primary activity, including the type of merchandise sold or taxable activity engaged in. Generic or incomplete descriptions can hinder the Department of Revenue's ability to correctly classify and apply relevant tax rates, potentially resulting in incorrect tax assessments.

Incorrectly Calculating Fees: The application includes a section for calculating state and city fees for the Transaction Privilege Tax (TPT) licenses. A common mistake involves miscalculating these fees by not accurately accounting for the number of business locations or misunderstanding the fees table. This results in either underpayment or overpayment, each of which can lead to processing delays or administrative headaches.

Failure to Identify Responsible Persons: The Identification of Owner(s) section must list individuals with significant control or ownership of the business, along with their Social Security Numbers or Employer Identification Numbers. Incompletely identifying responsible parties, or failing to provide these identification numbers, can result in the rejection of the application, as these details are crucial for tax administration and enforcement purposes.

Neglect in Specifying the Filing Method: Businesses need to declare their preferred TPT filing method – either on a cash receipts or accrual basis. Overlooking this selection can complicate tax filings and lead to inaccuracies in tax reporting, potentially incurring penalties. Furthermore, selector misuse of this designation might bring about inconsistencies in financial reporting, reflecting poorly on the business’s fiscal responsibility.

Ensuring that each of these potential pitfalls is carefully avoided can greatly smooth the process of obtaining the necessary tax licenses and registrations in Arizona. These details underscore the importance of thoroughness and accuracy in completing the Arizona Joint Tax Application form.

Documents used along the form

Submitting an Arizona Joint Tax Application is an important step for businesses operating within the state, addressing various taxation and employment requirements. However, this form is often just one piece in a larger compilation of documents necessary for compliance with state and local regulations. Below are seven commonly used forms and documents that frequently accompany the Arizona Joint Tax Application, offering a comprehensive approach to fulfilling state obligations.

- Transaction Privilege Tax (TPT) License: Required for businesses engaged in taxable activities in Arizona, indicating their legal authorization to collect and remit state and, if applicable, city transaction privilege taxes.

- Employer Identification Number (EIN) Application (Form SS-4): Filed with the IRS, this document is necessary for identifying a business entity for tax purposes and is required for hiring employees, opening business bank accounts, and more.

- Unemployment Tax Registration: Needed for employers to register for an unemployment tax account with the Arizona Department of Economic Security, ensuring compliance with state unemployment insurance laws.

- Business License Application(s) for Local Jurisdictions: Many Arizona cities and counties require businesses to obtain local business licenses, separate from any state-issued licenses or registrations.

- Arizona Department of Revenue (ADOR) Bond Form: Required for certain businesses, such as those in construction, to ensure the payment of due taxes. The bond amount varies based on the business activity and tax liability.

- Use Tax Registration: For businesses purchasing goods for use rather than resale, ensuring compliance with state use tax obligations. This registration is essential for businesses that buy from out-of-state vendors not collecting Arizona sales tax.

- Workers' Compensation Insurance Proof: Documentation proving a business has secured workers' compensation insurance, as mandated by Arizona law for businesses with employees, to cover job-related injuries or illnesses.

Each of these documents plays a pivotal role in establishing and maintaining a business’s legal and operational framework within Arizona. They ensure that a business complies with tax, employment, and local government requirements, facilitating smooth operations and contributing to the state’s economic ecosystem. For businesses aiming to ensure full compliance, understanding the purpose of each form and maintaining accurate and current records are fundamental practices.

Similar forms

The Arizona Joint Tax Application Form shares similarities with the Federal Employer Identification Number (EIN) Application (Form SS-4). Both forms are essential for new businesses to officially register with the respective tax authorities—state for Arizona Joint Tax and federal for EIN. While the Arizona form is concerned with state taxes, such as Transaction Privilege Tax and Withholding/Unemployment Tax, the SS-4 form is for obtaining an EIN, vital for federal tax identification purposes. Each form must be completed by businesses to ensure compliance with tax obligations, though they target different levels of government.

Similar to the Arizona Joint Tax Application is the Business License Application form used by many states. These forms are necessary for obtaining the proper licenses to legally operate a business within a municipality or state. Both forms collect detailed information about the business, including type, ownership, and primary location. However, while the Arizona form is specifically for tax purposes, general business license applications may also address various regulatory compliance issues at the local or state level.

The Unemployment Insurance Tax Registration form is another document that bears similarity to the Arizona Joint Tax Application, particularly regarding the section on unemployment tax. Each form is used by businesses to register for unemployment insurance, a mandatory state-run program providing temporary financial assistance to unemployed workers. The details requested on both forms include business information and employment details, but the Arizona Joint Tax Application consolidates this registration with other tax liabilities.

Another related document is the Sales Tax Permit Application form found in states with sales tax. This parallels the Arizona joint form's section on Transaction Privilege Tax, as both are concerned with the authorization to collect sales tax from customers. Each form necessitates details about the business and its activities but serves the same primary function of granting permission to collect and remit sales tax to the state.

The Workers' Compensation Insurance Registration shares a functional similarity with the Arizona Joint Tax Application, particularly in the concern for employee welfare. While the former registers a business with the state's workers' compensation program to provide benefits to workers who get injured on the job, Arizona's form includes registration for Unemployment Insurance, another form of worker protection. Each form safeguards employees but from different aspects of employment-related risks.

The Use Tax Registration Certificate, necessary for businesses engaged in selling goods or services in states where they do not have a physical presence, is akin to the Use Tax section of the Arizona form. While both documents serve to ensure tax compliance for out-of-state sales, the Use Tax Registration typically applies to businesses not physically located in the taxing state, unlike the broader scope of the Arizona Joint Tax Application.

DBA (Doing Business As) Registration forms also share similarities with the Arizona Joint Tax Application. Businesses may use a DBA registration to operate under a trade name different from their legal business name. The Arizona form captures information about the business's legal and DBA names, highlighting the regulatory need for clear identification of business entities for taxation and legal purposes.

The Local Business Tax Receipt Application, required by some localities for businesses operating within their jurisdictions, has similarities with the city-specific part of the Arizona Joint Tax Application. Both forms are geared towards ensuring businesses pay the appropriate taxes directly benefiting the local or city government. However, the Arizona form combines state and possibly local tax responsibilities in one application.

Finally, the Home Occupation Permit Application, required by some cities for businesses operating out of a home, parallels the Arizona form in its provision for identifying the primary location of the business. While the focus of a Home Occupation Permit is on zoning and land use compliance, the identification of business location is crucial for both documents to ensure proper tax assessment and regulatory adherence.

Dos and Don'ts

When preparing to fill out the Arizona Joint Tax Application form, certain practices should be embraced, while others are best avoided to ensure the application process is both smooth and compliant. Below are key recommendations:

- Do: Carefully read the attached instructions before filling out the application. Understanding the guidelines in advance simplifies the process and helps avoid common mistakes.

- Don't: Leave any sections incomplete. The application stipulates that every section must be filled, or it will be returned. This could delay the licensing process unnecessarily.

- Do: Ensure accurate and up-to-date information is provided, especially concerning the business's legal name, DBA (Doing Business As) name, and mailing address. Accuracy in these areas is crucial for official communications and legal identification.

- Don't: Use a P.O. Box when a physical address is required, specifically for the primary location of the business. The difference between mailing and physical addresses is pivotal for state records and possibly, tax considerations.

- Do: Contact cities directly for city-specific Transaction Privilege Tax (TPT) licensing requirements if your business activity is subject to city TPT collected by the state but not taxed at the state level.

- Don't: Ignore city fees when calculating your total fees for TPT licenses. Each city may impose its own fee structure in addition to the state fees.

- Do: Check the corresponding boxes accurately regarding your liability for Federal Unemployment Tax (FUTA) and whether you sell new motor vehicle tires or vehicles, as these entail additional responsibilities and forms.

- Don't: Forget to sign the application. It must be signed by individuals legally responsible for the business, verifying the truthfulness and correctness of the information provided under penalty of perjury.

In summary, attention to detail, comprehensive review, and adherence to the specific requirements are indispensable when completing the Arizona Joint Tax Application form. Both inclusions and omissions carry significant weight in the processing and ultimate approval of your application, setting the groundwork for your business operations in Arizona.

Misconceptions

There are several misconceptions surrounding the Arizona Joint Tax Application form that can lead to confusion for new and established business owners. Understanding these misconceptions can help ensure that businesses comply with state requirements and avoid unnecessary complications. Below are five common misconceptions clarified:

- One License Covers All Business Activities: Many business owners mistakenly believe that a single Transaction Privilege Tax (TPT) license covers all types of business activities across Arizona. However, certain activities may require additional licenses or permits specific to the nature of the business, the location, or the goods and services provided. It’s crucial to research and understand specific licensing requirements.

- Fees Are Required for All Tax Registrations: While there are fees associated with TPT licenses, the application mentions that there are no fees for applying for Withholding, Use, or Unemployment tax registrations. This distinction is essential for budgeting the initial costs of starting a business in Arizona.

- Physical Location Is Optional: The application requires the physical address of the primary location of the business; a P.O. Box address will not suffice. This requirement ensures that all businesses operating within the state have a verifiable operating location, which is critical for various regulatory and tax purposes.

- Personal Information Is Optional: Section IV requires detailed information about the owner(s), including social security numbers. This section emphasizes the importance of personal accountability and traceability in business operations. The provision of a social security number is mandatory and serves several legal and tax purposes.

- Instant Approval Is Guaranteed: Completing and submitting the Joint Tax Application does not mean instant approval. The review process involves verification of information and compliance with Arizona’s business regulations. Approval times can vary, and businesses should allow for this process when planning their launch or expansion activities.

Understanding these aspects of the Arizona Joint Tax Application can help businesses navigate the initial setup process more smoothly and ensure compliance with state regulations. It is always advisable to consult the Department of Revenue or a legal advisor for any clarifications or specific concerns.

Key takeaways

When you're ready to start a new business in Arizona or need to update your existing one due to changes like a new owner or business model, the Arizona Joint Tax Application is a crucial step in the process. Here are six key takeaways to keep in mind:

- First and foremost, it’s essential to read the attached instructions carefully before you start filling out the form. Every section must be completed; otherwise, the application will be returned to you.

- Determine the type of license your business requires. Whether it's a Transaction Privilege Tax, Withholding/Unemployment Tax, Use Tax, or TPT for Cities ONLY, selecting the right license type is crucial for your business to operate legally in Arizona.

- Your business’s ownership type needs to be clearly defined. Whether you’re operating as an individual, a partnership, a corporation, or another structure, this choice affects how your business will be taxed and what liabilities you may face.

- Accurately detail your business information, including the legal business name, DBA (doing business as) name, mailing address, and the primary location of your business. This information is not only vital for tax purposes but also for your business’s legality and correspondence with the state.

- If you've bought an existing business, you must provide information about the previous owners and whether you’re taking over all or part of the business operations. This can affect your unemployment tax rate and other tax responsibilities.

- Fees are required for the Transaction Privilege Tax (TPT) license, based on the number of business locations and applicable city fees. However, there are no fees for registering for Withholding, Use, or Unemployment Taxes.

Completing and submitting the Arizona Joint Tax Application accurately and comprehensively is your first legal step toward running your business. If you have any questions or need clarification, don't hesitate to contact the appropriate agencies listed on the form. Remember, the choices you make on this form can significantly impact your business operations, taxes, and legal responsibilities in Arizona.

More PDF Forms

Arizona State Tax Forms - A current home address, along with daytime and home phone numbers, must be provided.

Can I Be My Own Statutory Agent - The form serves as a formal acceptance of the statutory agent's role for the specified entity.