Fill in a Valid Arizona Financial Template

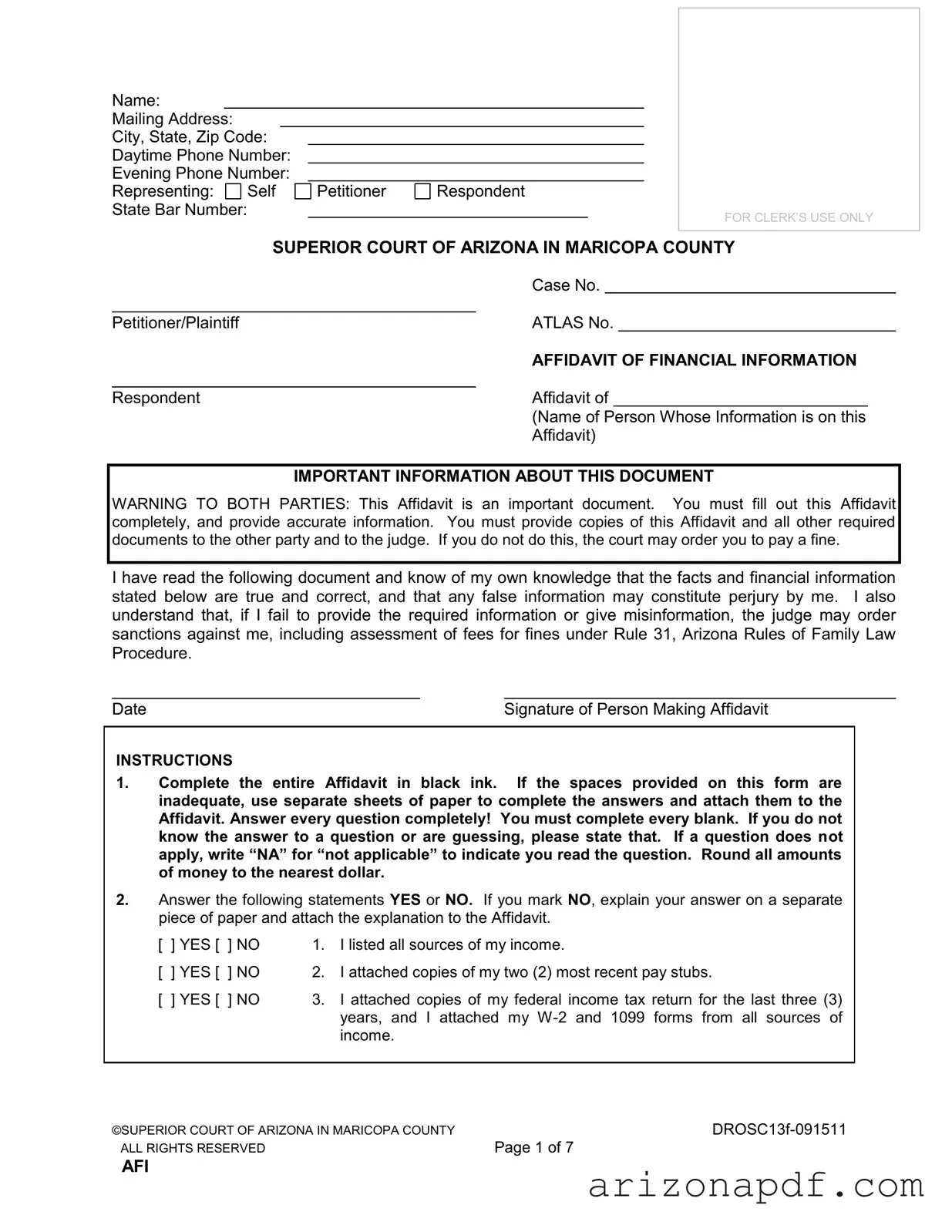

Navigating the complexities of legal documentation in family law cases can often seem an insurmountable task for individuals without a background in law. Among the myriad of forms one might encounter is the Arizona Financial Information Form, a critical document used in the Superior Court of Arizona, particularly in Maricopa County. This comprehensive affidavit demands meticulous attention to detail as it serves multiple purposes, including providing a detailed overview of an individual's financial standing. The form covers a broad range of financial data, from general information, employment details, income sources, educational background, monthly expenses, to specifics regarding children's expenses. Given its significance, the form carries a stern warning about the accuracy and completeness of the provided information. Failure to comply, as the document cautions, may result in fines or other sanctions. This implies the judicial system’s effort to maintain transparency and fairness in proceedings such as divorce, child support, and spousal maintenance cases. It’s imperative for the parties involved to carefully document and verify each section to avoid perjury charges or other legal ramifications, highlighting how critical this document is in the broader context of family law procedures.

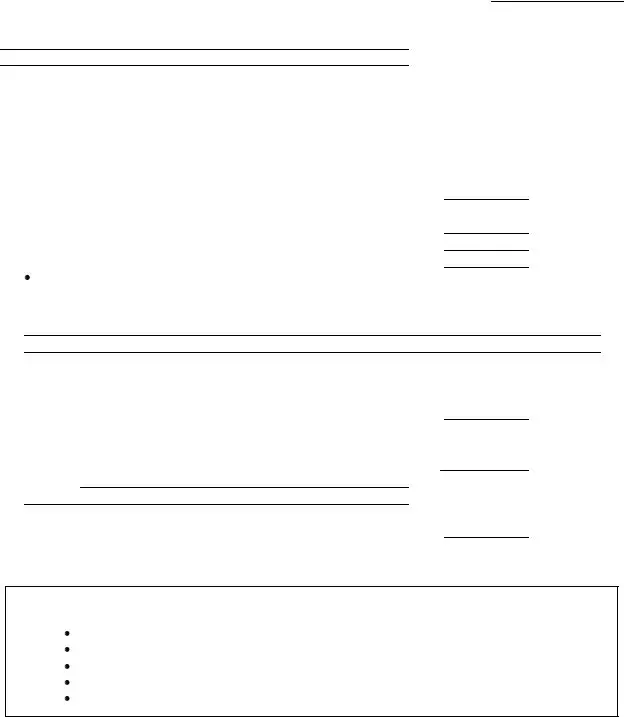

Arizona Financial Preview

Name:

Mailing Address:

City, State, Zip Code:

Daytime Phone Number:

Evening Phone Number:

Representing:

Self

Self

State Bar Number:

Petitioner

Respondent

FOR CLERK’S USE ONLY

|

SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|||||

|

|

Case No. |

|

|||

|

|

|

|

|

|

|

Petitioner/Plaintiff |

|

ATLAS No. |

|

|||

|

|

AFFIDAVIT OF FINANCIAL INFORMATION |

||||

|

|

|

|

|

||

Respondent |

|

Affidavit of |

|

|

||

|

|

(Name of Person Whose Information is on this |

||||

|

|

Affidavit) |

||||

IMPORTANT INFORMATION ABOUT THIS DOCUMENT

WARNING TO BOTH PARTIES: This Affidavit is an important document. You must fill out this Affidavit completely, and provide accurate information. You must provide copies of this Affidavit and all other required documents to the other party and to the judge. If you do not do this, the court may order you to pay a fine.

I have read the following document and know of my own knowledge that the facts and financial information stated below are true and correct, and that any false information may constitute perjury by me. I also understand that, if I fail to provide the required information or give misinformation, the judge may order sanctions against me, including assessment of fees for fines under Rule 31, Arizona Rules of Family Law Procedure.

Date |

Signature of Person Making Affidavit |

INSTRUCTIONS

1.Complete the entire Affidavit in black ink. If the spaces provided on this form are inadequate, use separate sheets of paper to complete the answers and attach them to the Affidavit. Answer every question completely! You must complete every blank. If you do not

know the answer to a question or are guessing, please state that. If a question does not apply, write “NA” for “not applicable” to indicate you read the question. Round all amounts of money to the nearest dollar.

2.Answer the following statements YES or NO. If you mark NO, explain your answer on a separate piece of paper and attach the explanation to the Affidavit.

[ |

] YES [ |

] NO |

1. |

I listed all sources of my income. |

[ |

] YES [ |

] NO |

2. |

I attached copies of my two (2) most recent pay stubs. |

[ |

] YES [ |

] NO |

3. |

I attached copies of my federal income tax return for the last three (3) |

|

|

|

|

years, and I attached my |

|

|

|

|

income. |

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 1 of 7 |

AFI

Case No.

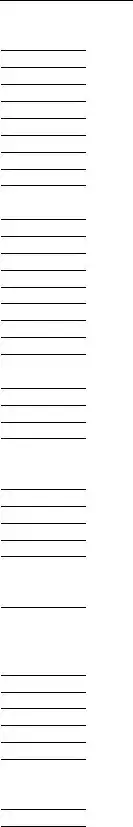

1. GENERAL INFORMATION: |

|

|

|

|

|

|||

A. Name: |

|

|

Date of Birth: |

|

||||

B. Current Address: |

|

|

|

|

|

|

||

C. Date of Marriage: |

|

Date of Divorce: |

|

|

||||

D.Last date when you and the other party lived together:

E.Full names of child(ren) common to the parties (in this case), their dates of birth:

Name |

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

F.The name, date of birth, relationship to you, and gross monthly income for each individual who lives in your household:

Name |

|

Date of Birth |

|

Relationship to you |

|

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G. Any other person for whom you contribute support: |

|

|

|

Name |

Age Relationship |

Reside With |

Court Order to |

|

to You |

You (Y/N) |

Support (Y/N) |

|

|

|

|

|

|

|

|

H. Attorney’s Fees paid in this matter $ |

|

. Source of funds |

2.EMPLOYMENT INFORMATION:

A.Your job/occupation/profession/title: Name and address of current employer:

Date employment began:

How often are you paid: [ ] Weekly [ ] Every other week [ ] Monthly [ ] Twice a month

[] Other

B.If you are not working, why not?

C.Previous employer name and address: Previous job/occupation/profession/title:

Date previous job began: |

|

Date previous job ended: |

|

|

Reason you left job: |

|

|

|

|

Gross monthly pay at previous job: $ |

|

|

||

D.Total gross income from last three (3) years’ tax returns (attach copies of pages 1 and 2 of your federal income tax returns for the last three (3) years):

Year |

|

$ |

|

Year |

|

$ |

Year |

$ |

||

|

|

|

|

|

|

|

|

|

|

|

E.Your total gross income from January 1 of this year to the date of this Affidavit

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 2 of 7 |

AFI

Case No.

3.YOUR EDUCATION/TRAINING: List name of school, length of time there, year of last attendance, and degree earned:

A.High School:

B.College:

C.

D.Occupational Training:

4.YOUR GROSS MONTHLY INCOME:

|

List all income you receive from any source, whether private or governmental, taxable or not. |

|||||||||

|

List all income payable to you individually or payable jointly to you and your spouse. |

|||||||||

|

Use a monthly average for items that vary from month to month. |

|

|

|

||||||

|

Multiply weekly income and deductions by 4.33. Multiply biweekly income by 2.165 to arrive at |

|||||||||

|

the total amount for the month. |

|

|

|

||||||

A. Gross salary/wages per month |

$ |

|

|

|||||||

|

|

Attach copies of your two most recent pay stubs. |

|

|

|

|||||

|

Rate of Pay $ |

|

per [ ] hour [ ] week [ ] month [ ] year |

|

|

|

||||

B. Expenses paid for by your employer: |

|

|

|

|||||||

|

1. |

Automobile |

|

|

$ |

|

|

|||

|

2. |

Auto expenses, such as gas, repairs, insurance |

$ |

|

|

|||||

|

3. |

Lodging |

|

|

$ |

|

|

|||

|

4. |

Other (Explain) |

|

|

|

$ |

|

|

||

C. Commissions/Bonuses |

$ |

|

|

|||||||

D. Tips |

|

|

$ |

|

|

|||||

E. |

$ |

|

|

|||||||

F. |

Social Security benefits |

$ |

|

|

||||||

G. |

Worker's compensation and/or disability income |

$ |

|

|

||||||

H. |

Unemployment compensation |

$ |

|

|

||||||

I. |

Gifts/Prizes |

|

|

$ |

|

|

||||

J. |

Payments from prior spouse |

$ |

|

|

||||||

K. |

Rental income (net after expenses) |

$ |

|

|

||||||

L. |

Contributions to household living expense by others |

$ |

|

|

||||||

M. Other (Explain:) |

|

|

|

$ |

|

|

||||

|

(Include dividends, pensions, interest, trust income, annuities |

|

|

|

||||||

|

or royalties.) |

|

|

|

|

|

||||

|

|

|

|

|

|

TOTAL: |

$ |

|

|

|

5.

If you are

If self employed, provide the following information: Name, address and telephone no. of business:

Type of business entity:

State and Date of incorporation: Nature of your interest:

Nature of business: Percent ownership: Number of shares of stock:

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 3 of 7 |

AFI

Case No.

Total issued and outstanding shares:

Gross sales/revenue last 12 months:

INSTRUCTIONS

Both parties must answer item 6 if either party asks for child support. These expenses include only those expenses for children who are common to the parties, which means one party is the birth/adoptive mother and

the other is the birth/adoptive father of the children.

6.SCHEDULE OF ALL MONTHLY EXPENSES FOR CHILDREN:

DO NOT LIST any expenses for the other party, or child(ren) who live(s) with the other party, unless you are paying those expenses.

DO NOT LIST any expenses for the other party, or child(ren) who live(s) with the other party, unless you are paying those expenses.

Use a monthly average for items that vary from month to month.

Use a monthly average for items that vary from month to month.

If you are listing anticipated expenses, indicate this by putting an asterisk (*) next to the estimated amount.

If you are listing anticipated expenses, indicate this by putting an asterisk (*) next to the estimated amount.

A.HEALTH INSURANCE:

Do you have health insurance available? Yes

No

Are you enrolled?

1. |

Total monthly cost |

$ |

2. |

Premium cost to insure you alone |

$ |

3. |

Premium cost to insure child(ren) common to the parties |

$ |

4.List all people covered by your insurance coverage:

5.Name of insurance company and Policy/Group Number:

B. DENTAL/VISION INSURANCE:

1. |

Total monthly cost |

$ |

2. |

Premium cost to insure you alone |

$ |

3. |

Premium cost to insure child(ren) common to the parties |

$ |

4.List all people covered by your insurance coverage:

5.Name of insurance company and Policy/Group Number:

C.UNREIMBURSED MEDICAL AND DENTAL EXPENSES:

(Cost to you after, or in addition to, any insurance reimbursement)

1. |

Drugs and medical supplies |

|

$ |

|

|

||

2. |

Other |

|

$ |

|

|

||

|

|

|

|

TOTAL: |

$ |

|

|

D. CHILD CARE COSTS: |

|

|

|

|

|||

1. |

Total monthly child care costs |

|

$ |

|

|

||

|

(Do not include amounts paid by D.E.S.) |

|

|

|

|

||

2. |

Name(s) of child(ren) cared for and amount per child: |

|

|

|

|||

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

|

|||||

ALL RIGHTS RESERVED |

Page 4 of 7 |

|

|

|

|||

AFI

Case No.

3. Name(s) and address(es) of child care provider(s):

E.EMPLOYER PRETAX PROGRAM:

Do you participate in an employer program for pretax payment of child care expenses? (Cafeteria Plan)? [ ] YES [ ] NO

F.COURT ORDERED CHILD SUPPORT:

1. |

Court ordered current child support for child(ren) |

|

|

not common to the parties |

$ |

2. |

Court ordered cash medical support for child(ren) |

|

|

not common to the parties |

$ |

3. |

Amount of any arrears payment |

$ |

4. |

Amount per month actually paid in last 12 mos. |

$ |

Attach proof that you are paying

5.Name(s) and relationship of minor child(ren) who you support or who live with you, but are not common to the parties.

G. COURT ORDERED SPOUSAL MAINTENANCE/SUPPORT (Alimony):

1.Court ordered spousal maintenance/support you actually

pay to previous spouse: |

$ |

H. EXTRAORDINARY EXPENSES :

1. For Children (Educational Expense/Special Needs/Other): $ Explain:

2. For Self: |

$ |

||

|

Explain: |

|

|

|

|

|

|

INSTRUCTIONS

Both parties must answer items 7 and 8 if either party is requesting:

Spousal maintenance

Division of expenses

Attorneys’ fees and costs

Adjustment or deviation from the child support amount

Enforcement

7.SCHEDULE OF ALL MONTHLY EXPENSES:

Do NOT list any expenses for the other party, or children who live with the other party unless you are paying those expenses.

Do NOT list any expenses for the other party, or children who live with the other party unless you are paying those expenses.

Use a monthly average for items that vary from month to month.

Use a monthly average for items that vary from month to month.

If you are listing anticipated expenses, indicate this by putting an asterisk (*) next to the estimated amount.

If you are listing anticipated expenses, indicate this by putting an asterisk (*) next to the estimated amount.

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 5 of 7 |

AFI

|

|

|

|

|

Case No. |

||||

A. HOUSING EXPENSES: |

|

||||||||

1. |

House payment: |

|

|||||||

|

a. |

First Mortgage |

$ |

||||||

|

b. |

Second Mortgage |

$ |

||||||

|

c. |

Homeowners Association Fee |

$ |

||||||

|

d. |

Rent |

$ |

||||||

2. |

Repair & upkeep |

$ |

|||||||

3. |

Yard work/Pool/Pest Control |

$ |

|||||||

4. |

Insurance & taxes not included in house payment |

$ |

|||||||

5. |

Other (Explain) |

$ |

|||||||

|

|

|

|

|

TOTAL: |

$ |

|||

B. UTILITIES: |

|

||||||||

1. |

Water, sewer, and garbage |

$ |

|||||||

2. |

Electricity |

$ |

|||||||

3. |

Gas |

$ |

|||||||

4. |

Telephone |

$ |

|||||||

5. |

Mobile phone/pager |

$ |

|||||||

6. |

Internet Provider |

$ |

|||||||

7. |

Cable/Satellite television |

$ |

|||||||

8. |

Other (Explain:) |

|

|

$ |

|||||

|

|

|

|

|

TOTAL: |

$ |

|||

C. FOOD: |

|

|

|

|

|

|

|

|

|

1. |

Food, milk, and household supplies |

$ |

|||||||

2. |

School lunches |

$ |

|||||||

3. |

Meals outside home |

$ |

|||||||

|

|

|

|

|

TOTAL: |

$ |

|||

D. CLOTHING: |

|

||||||||

1. |

Clothing for you |

$ |

|||||||

2. |

Uniforms or special work clothes |

$ |

|||||||

3. |

Clothing for children living with you |

$ |

|||||||

4. |

Laundry and cleaning |

$ |

|||||||

|

|

|

|

|

TOTAL: |

$ |

|||

E. TRANSPORTATION OR AUTOMOBILE EXPENSES: |

|

||||||||

1. |

Car insurance |

$ |

|||||||

2. |

List all cars and individuals covered: |

|

|||||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

3. |

Car payment, if any |

$ |

|||||||

4. |

Car repair and maintenance |

$ |

|||||||

5. |

Gas and oil |

$ |

|||||||

6. |

Bus fare/parking fees |

$ |

|||||||

7. |

Other (explain): |

|

|

$ |

|||||

|

|

|

|

|

TOTAL: |

$ |

|||

F. MISCELLANEOUS: |

|

||||||||

1. |

School and school supplies |

$ |

|||||||

2. |

School activities or fees |

$ |

|||||||

3. Extracurricular activities of child(ren) |

$ |

|

|

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

||

ALL RIGHTS RESERVED |

Page 6 of 7 |

||

AFI

|

|

|

|

|

|

Case No. |

|

||

4. |

Church/contributions |

|

|

$ |

|

|

|

||

5. |

Newspapers, magazines and books |

|

|

$ |

|

|

|

||

6. |

Barber and beauty shop |

|

|

$ |

|

|

|

||

7. |

Life insurance (beneficiary: |

|

|

) |

$ |

|

|

|

|

8. |

Disability insurance |

|

|

$ |

|

|

|

||

9. |

Recreation/entertainment |

|

|

$ |

|

|

|

||

10. |

Child(ren)'s allowance(s) |

|

|

$ |

|

|

|

||

11. |

Union/Professional dues |

|

|

$ |

|

|

|

||

12. |

Voluntary retirement contributions and savings deductions |

$ |

|

|

|

||||

13. |

Family gifts |

|

|

$ |

|

|

|

||

14. Pet Expenses |

|

|

$ |

|

|

|

|||

15. |

Cigarettes |

|

|

$ |

|

|

|

||

16. |

Alcohol |

|

|

$ |

|

|

|

||

17. |

Other (explain): |

|

|

$ |

|

|

|

||

|

|

|

|

TOTAL: |

$ |

|

|

|

|

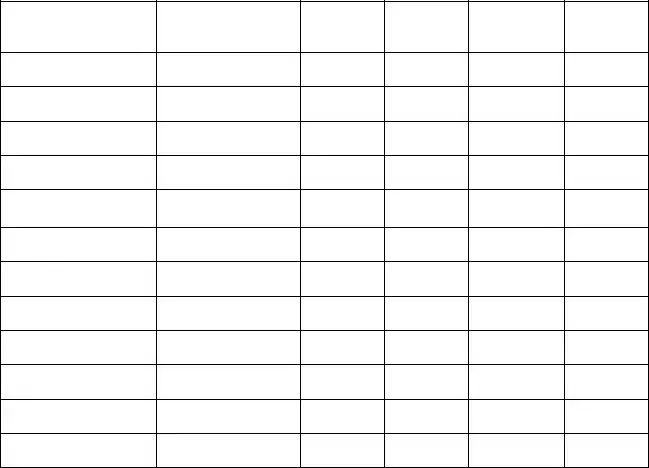

8.OUTSTANDING DEBTS AND ACCOUNTS: List all debts and installment payments you currently owe, but do not include items listed in Item 7 “Monthly Schedule of Expenses”. Follow the format below. Use additional paper if necessary.

Creditor Name

Purpose of Debt

Unpaid

Balance

Min.

Monthly

Payment

Date of

Your Last

Payment

Amount of

Your

Payment

©SUPERIOR COURT OF ARIZONA IN MARICOPA COUNTY |

|

ALL RIGHTS RESERVED |

Page 7 of 7 |

AFI

File Properties

| Fact | Details |

|---|---|

| Affidavit Purpose | Provides detailed financial information in family law cases. |

| Governing Law | Arizona Rules of Family Law Procedure, specifically Rule 31 for sanctions. |

| Comprehensive Detail Requirement | Requires complete and accurate financial information, rounding money amounts to the nearest dollar. |

| Documentation Requirements | Recent pay stubs, federal income tax returns for the last three years, W-2 and 1099 forms. |

| Penalty for Non-compliance | Failure to provide accurate information may result in perjury charges or court sanctions. |

| Employment Information | Details about current and previous employment, including reasons for leaving and gross monthly pay. |

| Income Sources | Includes all possible income sources, both taxable and non-taxable. |

| Child and Spousal Support | Specific sections for detailing child support and spousal maintenance obligations. |

Instructions on Utilizing Arizona Financial

Completing the Arizona Financial Information Form is a necessary step in certain legal proceedings to ensure that all financial details are accurately shared and considered. This document plays a crucial role in various legal situations, such as divorce or child support cases, where an individual's income and expenses need to be thoroughly documented and transparent. The form requires detailed information about your income, expenses, assets, and liabilities. Failure to provide complete and accurate information may result in legal penalties. Hence, it's essential to approach this task with care and diligence, ensuring that all details are recorded as accurately as possible.

Steps to Fill Out the Arizona Financial Information Form:

- Start by reading the entire form carefully to understand the required information and gather all necessary documents before beginning to fill it out.

- Write your General Information including your full name, date of birth, current mailing address, daytime and evening phone numbers, and legal representation status. If applicable, include your State Bar Number and indicate whether you are the Petitioner or Respondent.

- Under Case Information, fill in the Superior Court of Arizona county name, case number, petitioner/plaintiff and respondent's names, and ATLAS number if known.

- For Affidavit Information, enter the name of the person the affidavit is about.

- In the section marked IMPORTANT INFORMATION, acknowledge the warning by reviewing the statement regarding the seriousness of providing false information and the associated penalties.

- Complete every question in black ink. For questions that do not apply, write "NA" to indicate they are not applicable.

- Respond to statements about income verification by indicating YES or NO, and attach separate explanation sheets if necessary.

- Provide your employment information, including job title, employer's name and address, employment dates, and your income details. Attach additional sheets if the space provided is insufficient.

- Detail your educational background and training, including institutions attended and degrees obtained.

- List all your sources of income, including salary, bonuses, self-employment income, and any other forms of income. Attach your most recent pay stubs and the relevant sections from your federal income tax returns as instructed.

- For those who are self-employed, provide detailed information about your business, including the type, nature, and financial details.

- Fill out the section regarding expenses for children common to both parties if applicable, including health and daycare costs. Remember, this information should only include expenses related to mutual children. Complete the schedule of all monthly expenses for personal and household needs. This should encompass all areas of expenditure, from housing costs to medical, educational, and other expenses.

- Finally, sign and date the form at the end, indicating that you have provided true and accurate information to the best of your knowledge.

Rigorously check your form for completeness and accuracy. Once completed, make sure to provide copies to the other party involved in the case as well as to the court, as failing to do so can result in fines or other sanctions. The meticulous completion of this form is vital for ensuring a fair evaluation of financial matters in legal proceedings.

Listed Questions and Answers

What is the purpose of the Affidavit of Financial Information in Arizona?

The Affidavit of Financial Information is a critical legal document used within the state of Arizona, predominantly in family court proceedings. Its primary function is to provide a comprehensive overview of an individual's financial status. This includes details about income, expenses, assets, and liabilities. It's essential for cases involving spousal maintenance (alimony), child support, and the division of property. This affidavit ensures that the court has accurate financial details to make informed decisions.

Who needs to complete the Affidavit of Financial Information?

Any individual involved in a legal case within Maricopa County, Arizona, that requires a review of one's financial situation must complete the affidavit. This typically includes cases related to divorce, legal separation, child support, and spousal maintenance. Both parties involved in the case are often required to submit this detailed financial snapshot to the court.

What information must be provided in the Affidavit?

The Affidavit mandates a wide array of financial information. This includes personal data like name and contact information, detailed employment information, a comprehensive listing of all income sources, monthly expenses, assets, and liabilities. Also required are details about dependents, child care expenses, and any extraordinary expenses. Completeness and accuracy are imperative when filling out this form to avoid potential legal consequences.

Are there any attachments required with the Affidavit?

Yes, certain attachments are needed along with the affidavit. These attachments typically include recent pay stubs, the last three years of federal income tax returns along with W-2s and 1099s, and any relevant documentation related to self-employment. These documents help verify the financial information provided in the affidavit.

What happens if information is mistakenly omitted or falsely reported on the Affidavit?

Mistakenly omitting or falsely reporting financial information in the Affidavit can lead to severe repercussions, including perjury charges. The court depends on this information to make fair and informed decisions. Therefore, any inaccuracies can result in the court imposing sanctions, fines, or other legal consequences against the individual responsible for the affidavit.

Can the Affidavit be amended once it is submitted?

If after submitting the affidavit, it is discovered that information was inaccurate or incomplete, it's possible to amend the document. The process involves submitting a corrected version of the affidavit to the court and providing an explanation for the discrepancies. It's essential to take action quickly to avoid potential legal issues.

How often does the Affidavit need to be updated?

Typically, the Affidavit of Financial Information needs updating only when there are significant changes to one's financial status, or as requested by the court. This may include changes in employment, income, or family circumstances affecting expenses or financial obligations.

Where is the completed Affidavit submitted?

The completed Affidavit, along with all required attachments, must be submitted to the Superior Court of Arizona in Maricopa County. Specific procedures, such as whether the submission should be made directly to the court or provided to the other party first, can vary based on case particulars. It's crucial to follow the detailed submission guidelines provided by the court to ensure proper procedure.

Common mistakes

Filling out the Arizona Financial Affidavit form is a crucial step in many legal processes, including family law cases. However, it's common for individuals to make mistakes while completing this form, which can lead to penalties, delays, or complications in their case. Below are eight common errors to avoid:

- Not using black ink for handwriting the form, as specifically required, can lead to processing issues.

- Leaving blanks instead of indicating "NA" (not applicable) where questions do not apply to your situation shows a lack of attention to instructions.

- Failing to round all amounts of money to the nearest dollar can lead to inaccuracies in financial reporting.

- Omitting attachments such as the two most recent pay stubs, the last three years' federal income tax returns, and associated W-2 and 1099 forms can result in an incomplete submission.

- Incorrectly listing all sources of income, or forgetting to include some, can change the outcome of financial determinations like child support or spousal maintenance.

- Underestimating or omitting expenses for children common to the parties in item 6, thereby not providing a true picture of financial needs.

- Not providing detailed explanations when marking "NO" to statements that require further information, thus leaving out critical context for decision-makers.

- Skipping over the instructions at the beginning of the document, leading to a misunderstanding of the form's requirements and importance.

Every detail in the Arizona Financial Affidavit form contributes to the accurate representation of an individual's financial situation. It's crucial that people take the time to carefully review and correctly complete each section to avoid these common mistakes.

Documents used along the form

When navigating legal matters in Arizona, especially those related to family law, the Arizona Financial Information Form (AFI) plays a crucial role in providing a comprehensive view of an individual's financial situation. Besides the AFI, several other documents are commonly used to ensure thorough and accurate representation of one's financial affairs. Understanding these documents can help parties involved to prepare effectively for their legal proceedings.

- Proof of Income Documents: These include recent pay stubs, employment contracts, and documentation of any other sources of income (e.g., rental income, dividends). They support the income details provided in the AFI.

- Tax Returns: Copies of recent federal and state income tax returns, along with W-2 and 1099 forms, validate yearly earnings and tax liabilities. This information can be pivotal in cases involving spousal maintenance or child support.

- Bank Statements: Personal and business bank statements from the last several months can demonstrate financial stability, average monthly expenditures, and any significant transactions that may impact one's financial status.

- Debt and Liability Statements: Documentation of current debts, including mortgage statements, car loan statements, and credit card bills, helps provide a clear picture of liabilities. It is crucial for equitable division of debts in divorce proceedings.

- Asset Documentation: Titles or deeds for properties, recent statements for all investment accounts (stocks, bonds, retirement accounts), and appraisals for valuable personal property (e.g., artwork, jewelry) are necessary to ascertain the full scope of an individual's assets.

- Insurance Policies: Life, health, auto, and property insurance policies, including those covering any minor children, offer insights into monthly premiums and coverage limits that may affect financial obligations and needs.

- Childcare and Education Expenses: Receipts and contracts showing ongoing or expected expenses for childcare, private schooling, or special educational needs of children can impact support calculations and financial allocations in family law cases.

In conclusion, while the Arizona Financial Information Form provides a foundation, these additional documents play indispensable roles in painting a full financial portrait. Together, they enable accurate assessments and equitable decisions in family law matters, from divorce and child support to spousal maintenance and property division. Thus, ensuring these documents are complete and accurate is essential for anyone involved in such legal proceedings in Arizona.

Similar forms

The Arizona Financial form shares similarities with the Uniform Financial Affidavit, a document used in many states for divorce proceedings. Like the Arizona form, the Uniform Financial Affidavit collects detailed financial information from a party in a divorce, including income, expenses, assets, and debts. This comprehensive snapshot ensures equitable decisions regarding alimony, child support, and the division of assets. Both forms require thorough documentation of financial status and an attestation to the accuracy of the provided information, highlighting their importance in the family law process.

Another document similar to the Arizona Financial form is the Child Support Worksheet, commonly used to calculate child support obligations. Both documents require detailed income information, including salary, self-employment income, and other sources. The key aim is to establish a financial baseline for determining appropriate child support payments. Additionally, expenses related to childcare and the needs of the children involved are detailed, ensuring that support amounts reflect the children's needs accurately.

The Loan Application Form is also akin to the Arizona Financial form in several aspects. Both types of documents collect detailed personal and financial information from the individual completing the form, such as income, employment details, and personal assets. This information helps in assessing the individual's financial stability and ability to fulfill financial commitments, whether it's managing a loan or fulfilling court-ordered financial obligations in a divorce or child support scenario.

The Bankruptcy Schedules form is another document with similarities to the Arizona Financial form. Both require individuals to disclose exhaustive details about their financial situation, including assets, liabilities, income, and expenses. These disclosures are vital in bankruptcy proceedings to ensure that all creditors are treated fairly and that the individual's ability to pay is accurately represented. The emphasis on detailed and accurate financial disclosure in both documents underscores the serious legal implications of the information provided.

Tax Returns provide a yearly snapshot of an individual's financial status, much like the Arizona Financial form does for legal proceedings. Both require detailed income information and documentation, such as W-2s and 1099 forms. While tax returns are used to determine tax liabilities or refunds, the Arizona Financial form helps assess financial responsibilities in legal contexts, demonstrating the pivotal role of accurate financial information in various legal and administrative processes.

The Financial Statement for a mortgage refinance application shares similarities with the Arizona Financial form through the detailed collection of financial information, including income, assets, and liabilities. Both documents are crucial in assessing the individual's financial health and ability to meet financial obligations, whether it be successfully managing a mortgage refinance or ensuring the equitable resolution of family law matters. The need for precision and truthfulness in completing both forms highlights the significant impact of financial declarations on decision-making processes.

The FAFSA (Free Application for Federal Student Aid) form, while primarily for educational funding, resembles the Arizona Financial form in its collection of detailed personal and financial information to assess eligibility for financial aid. Both require disclosure of income, assets, and dependent information to make informed determinations about financial assistance, whether for educational purposes or resolving family law issues. The emphasis on detailed financial disclosure in both underscores their role in accessing necessary funds, whether for education or ensuring fair legal outcomes.

Dos and Don'ts

Filling out financial forms, such as the Arizona Affidavit of Financial Information, demands attention to detail and accuracy. Providing clear and honest responses is crucial in legal proceedings to ensure fairness and transparency. Here are some recommendations on what to do and what not to do when completing this affidavit:

- Do read all instructions carefully before you begin filling out the form. This ensures you understand what is required and helps avoid mistakes.

- Do use black ink to complete the entire affidavit, as requested in the instructions, to ensure that the document is legible and formally presented.

- Do answer every question completely. If a question does not apply to your situation, write “NA” for “not applicable” to indicate you read the question. This approach demonstrates thoroughness and prevents accidental omission of information.

- Do attach additional sheets of paper if the space provided on the form is inadequate for your answers. Make sure these are clearly labeled and securely attached to the affidavit.

- Don’t leave any blanks. If you do not know the answer or are unsure, state that you are guessing. Honesty is vital for the integrity of the affidavit.

- Don’t provide false information. The instructions warn that any false information may be considered perjury, which is a serious offense with legal consequences.

- Don’t forget to attach copies of all required documents, such as your most recent pay stubs, federal income tax returns for the last three years, and W-2 and 1099 forms. This documentation is crucial for verifying the financial information you provide.

- Don’t underestimate the importance of rounding all amounts of money to the nearest dollar. This might seem trivial, but it ensures consistency and accuracy in your financial reporting.

In legal and financial matters, precision and honesty are paramount. By adhering to these guidelines, you can complete the Arizona Affidavit of Financial Information accurately and responsibly, thereby contributing to a fair and efficient legal process.

Misconceptions

When it comes to filling out legal forms, misunderstandings are common, and the Arizona Financial Information form is no exception. Here are nine misconceptions that need clarification:

- It's only necessary to complete parts that apply to you: All questions on the form must be answered. If a question is not applicable, "NA" should be written to indicate this.

- Estimates are adequate for financial figures: The form requires actual numbers rounded to the nearest dollar. Guesswork can lead to inaccuracies and potential legal issues.

- Disclosure of income sources is optional: Every source of income must be listed. Failure to disclose can result in sanctions, including fines under Rule 31, Arizona Rules of Family Law Procedure.

- Personal assets are irrelevant: While the form focuses on income, understanding an individual’s financial status, including assets, may be necessary for a complete analysis in certain situations.

- Signing the document is sufficient: The affidavit must not only be signed but also filled out accurately and completely. Mere signature does not validate the information provided if it's incomplete or false.

- The document only concerns current financial status: The form requires historical data as well, including employment history and income over the last three years, to provide a comprehensive financial picture.

- Child support details are only needed if currently paying: The form asks for information regarding child support for any child, not just those common to the parties involved in the case, ensuring a full view of financial responsibilities.

- Legal representation isn't important when submitting this form: Missteps in filling out the form can have serious consequences. Professional guidance can prevent errors and omissions that might affect the outcome of the case.

- The form is final: Circumstances change, and the form can be updated to reflect significant changes to financial situations. Keeping the court informed is essential to maintaining fairness in any ongoing proceedings.

Correcting these misconceptions is crucial for anyone involved in a legal process requiring the completion of the Arizona Financial Information form. Every section of the document provides crucial information that affects the outcome of legal proceedings, stressing the importance of accuracy, completeness, and honesty.

Key takeaways

Filling out the Arizona Financial Affidavit form requires careful attention to detail to ensure accuracy and compliance with court expectations. Here are key takeaways to remember:

- Completing the Affidavit: Fill out the Affidavit in black ink, answering every question fully. If additional space is needed, attach separate sheets of paper. For questions that do not apply, mark them as “NA” (not applicable).

- Income Documentation: Accurately list all sources of income. Attach copies of your two most recent pay stubs, your federal income tax returns for the past three years, and all W-2 and 1099 forms.

- Accuracy: The information provided must be true and complete. Any false information can be considered perjury, leading to possible sanctions including fines.

- Disclosure: Copies of the completed affidavit and all relevant documents must be shared with the other party and the judge. Failure to do so can result in a fine.

- Employment Details: Include comprehensive employment information, whether currently employed or not. If unemployed, explain why.

- Self-Employment: For self-employed individuals, attach a copy of Schedule C from your last tax return and a recent income/expense statement for your business.

- Education and Training: Detail your education background and any training programs, including the name of the institution, dates of attendance, and degrees or certificates earned.

- Child-Related Expenses: If applicable, outline all monthly expenses for children common to both parties. Do not include expenses for children not shared.

Monthly Expenses: List all monthly personal and household expenses. If some expenses are anticipated rather than current, note them accordingly with an asterisk (*).

By closely following these guidelines, individuals can ensure they provide the complete financial picture required for their case, aiding in the fair and just resolution of their legal matter.

More PDF Forms

Arizona Income Tax Forms - There are no fees for withholding, unemployment, or use tax registrations, but there are specific fees for transaction privilege tax licenses.

Arizona State Tax Forms - Instructions for voluntary political gifts and special penalties like the MSA withdrawal penalty are addressed.