Fill in a Valid Arizona Estate Template

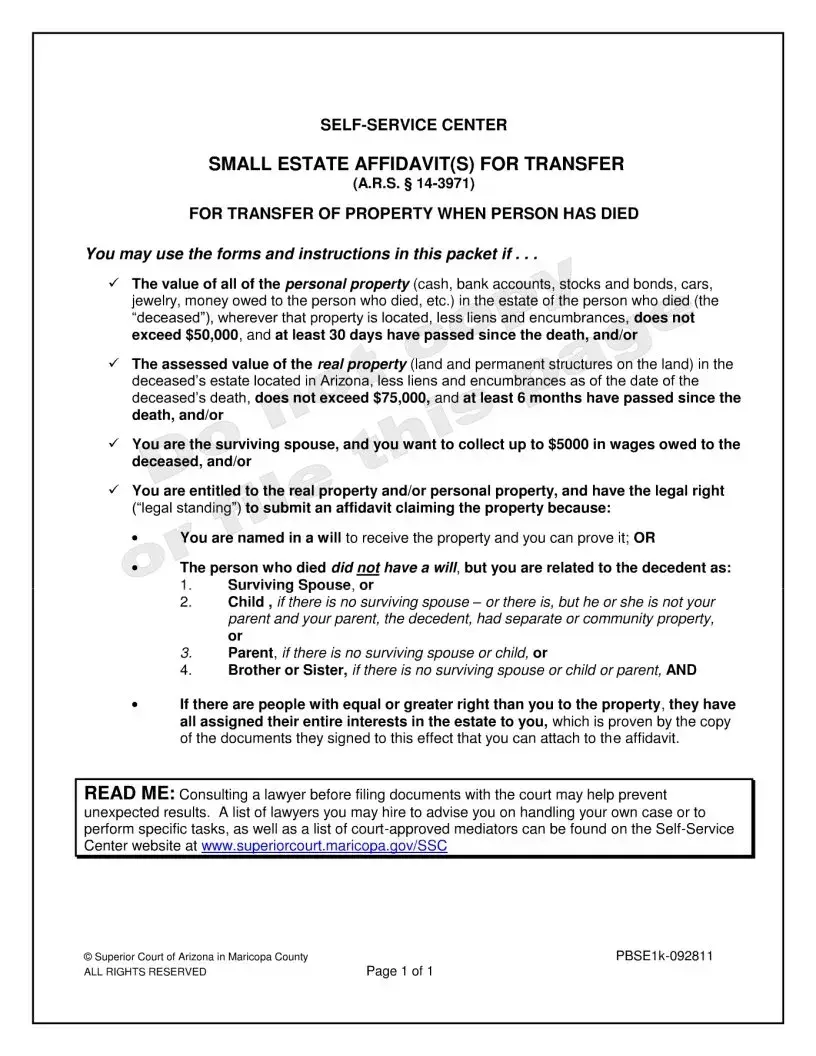

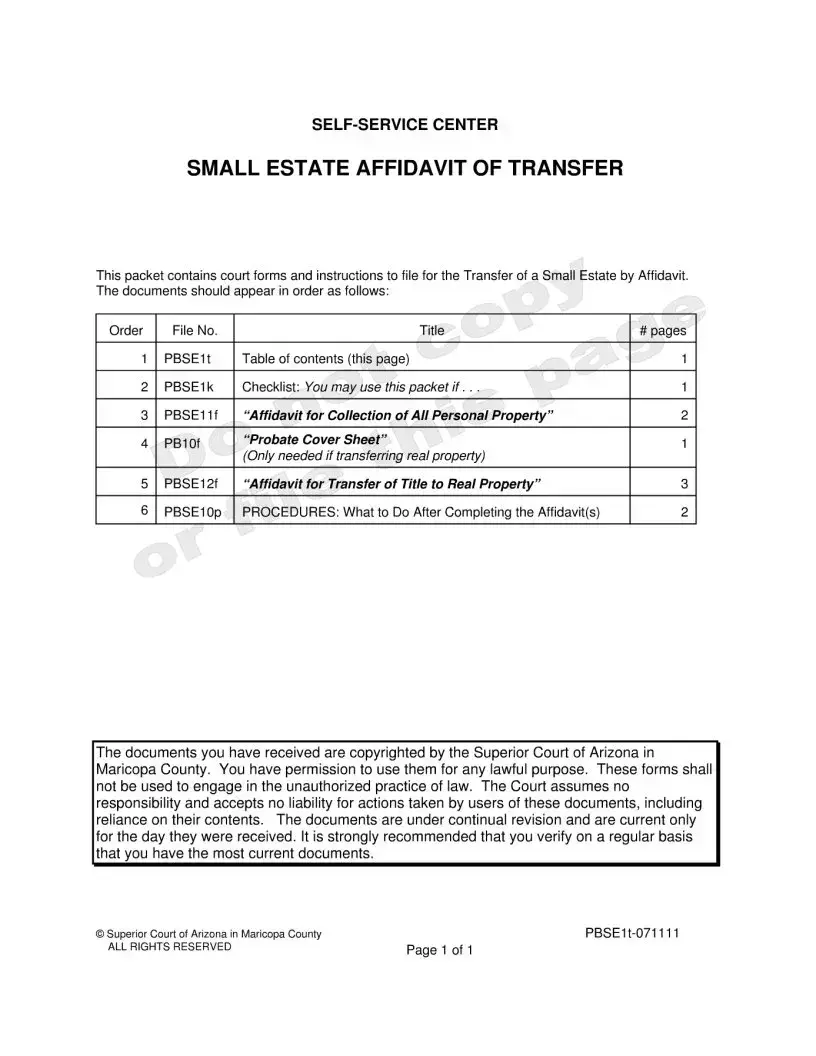

When considering the management and distribution of an individual's assets and responsibilities after their passing, the Arizona Estate form serves as a vital document that encompasses a wide array of considerations central to this process. From designating beneficiaries to outlining specific wishes regarding the distribution of personal and real property, this form acts as a comprehensive guide to ensure that one's final wishes are executed with respect and diligence. Additionally, it involves the appointment of an executor, the person entrusted with the task of overseeing the estate's settlement according to the stipulated instructions. Other significant aspects covered by the form include provisions for the care of minor children, instructions for digital assets, and directives for personal care and funeral arrangements, all of which contribute to a detailed approach in estate planning. Thoughtfully prepared, the Arizona Estate form not only safeguards an individual’s legacy but also serves to alleviate the emotional and administrative burden on loved ones during a time of grief.

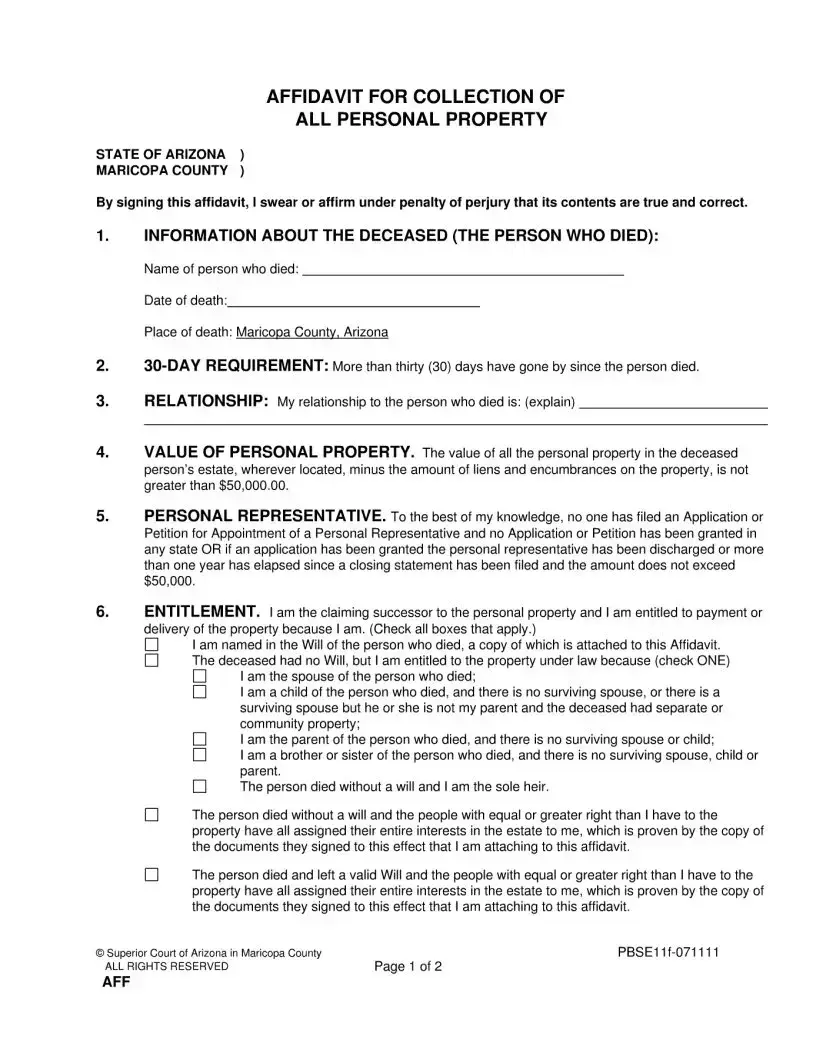

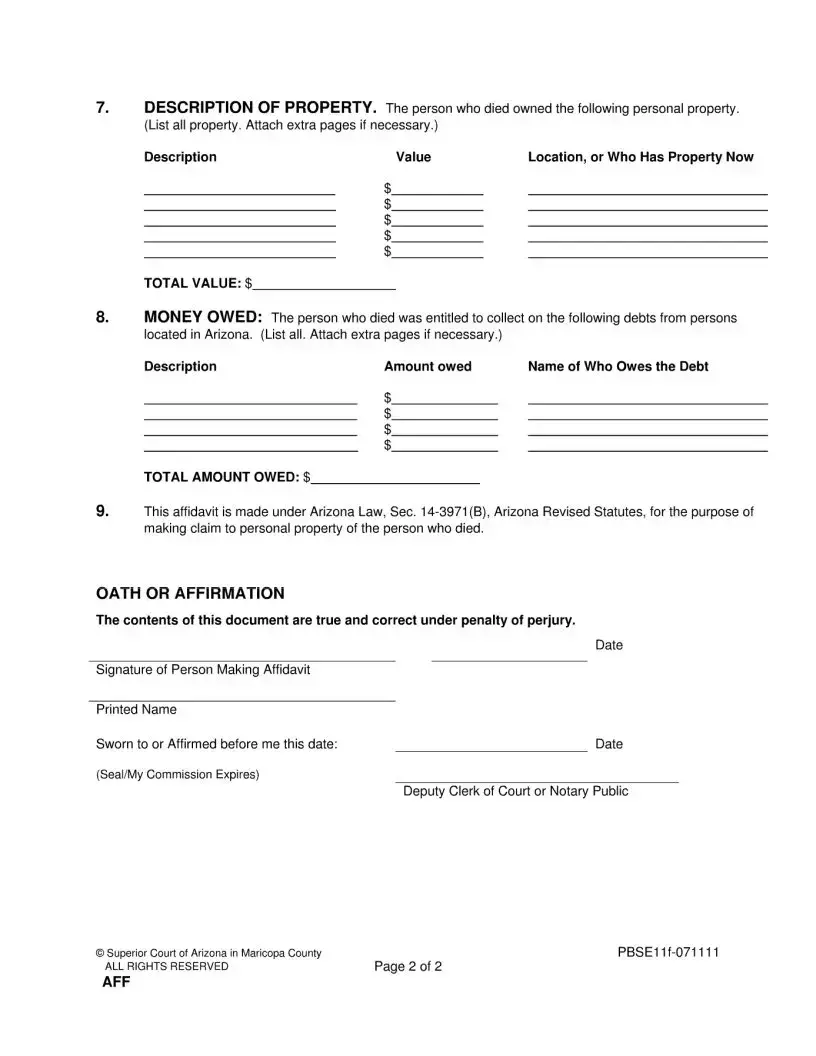

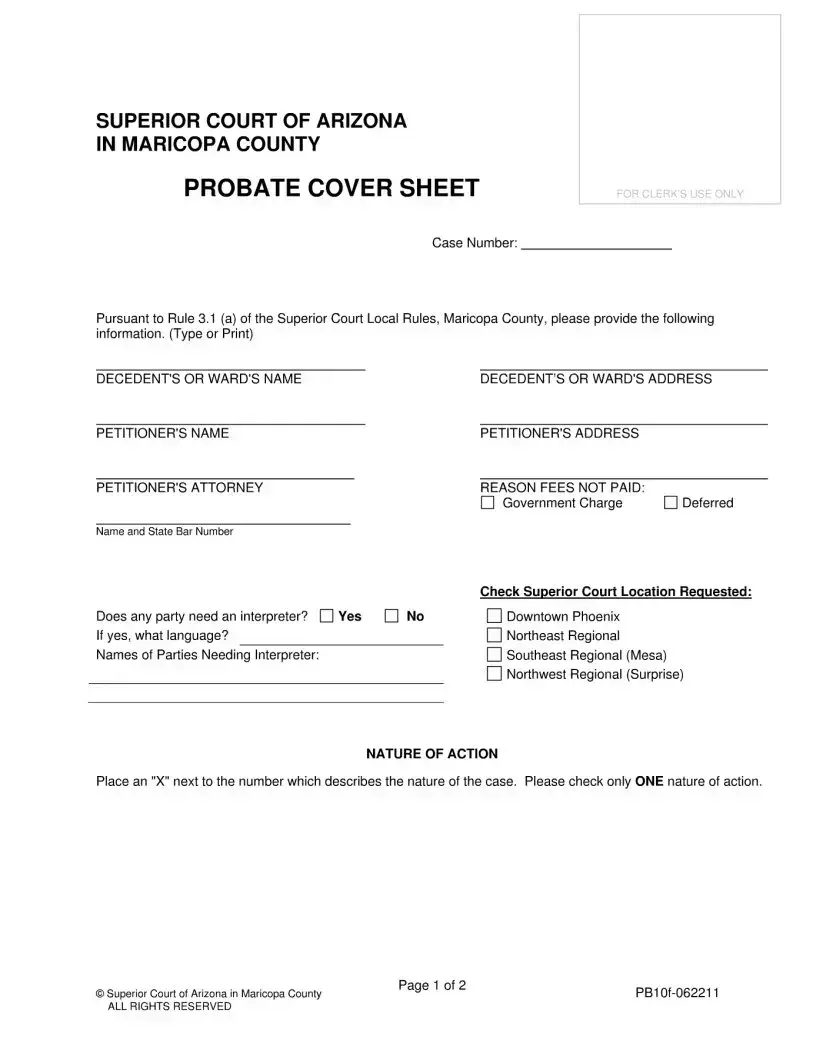

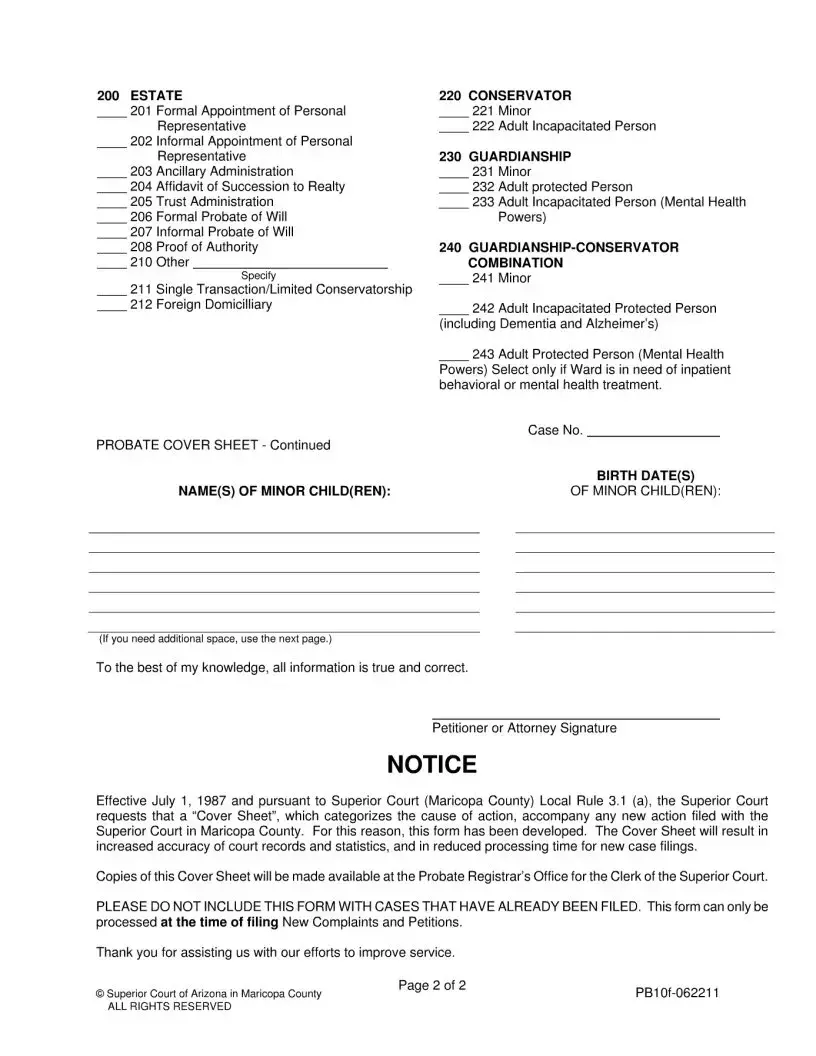

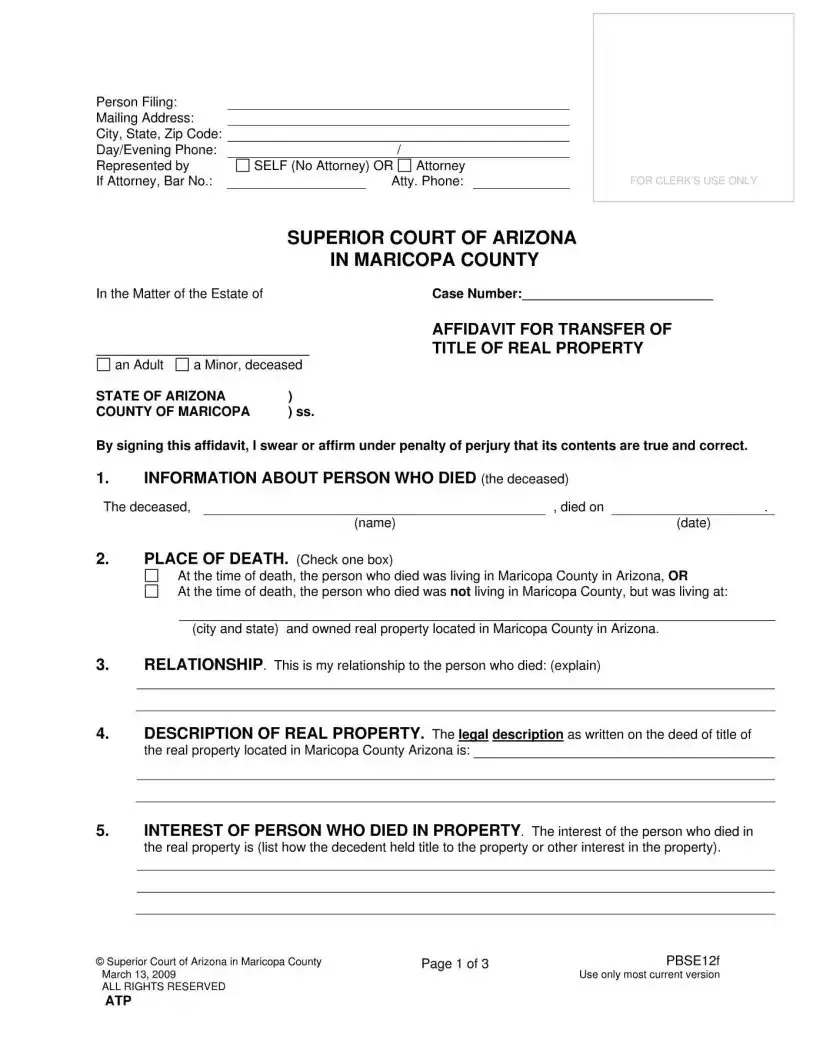

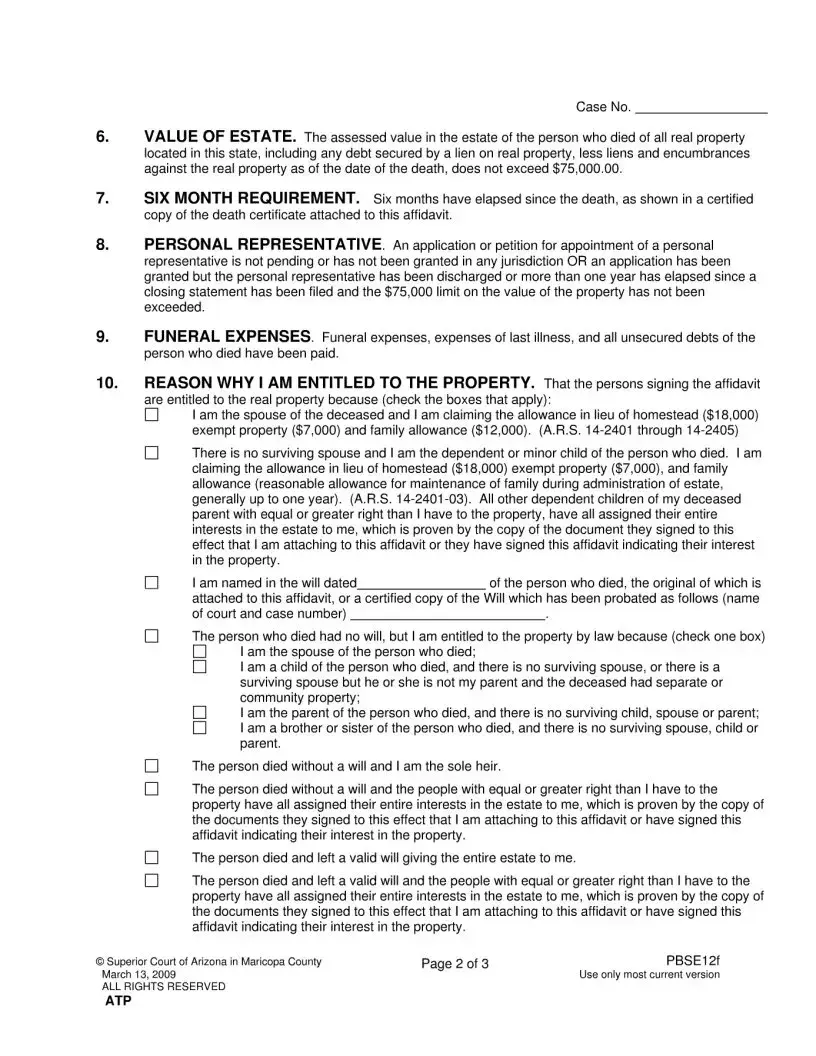

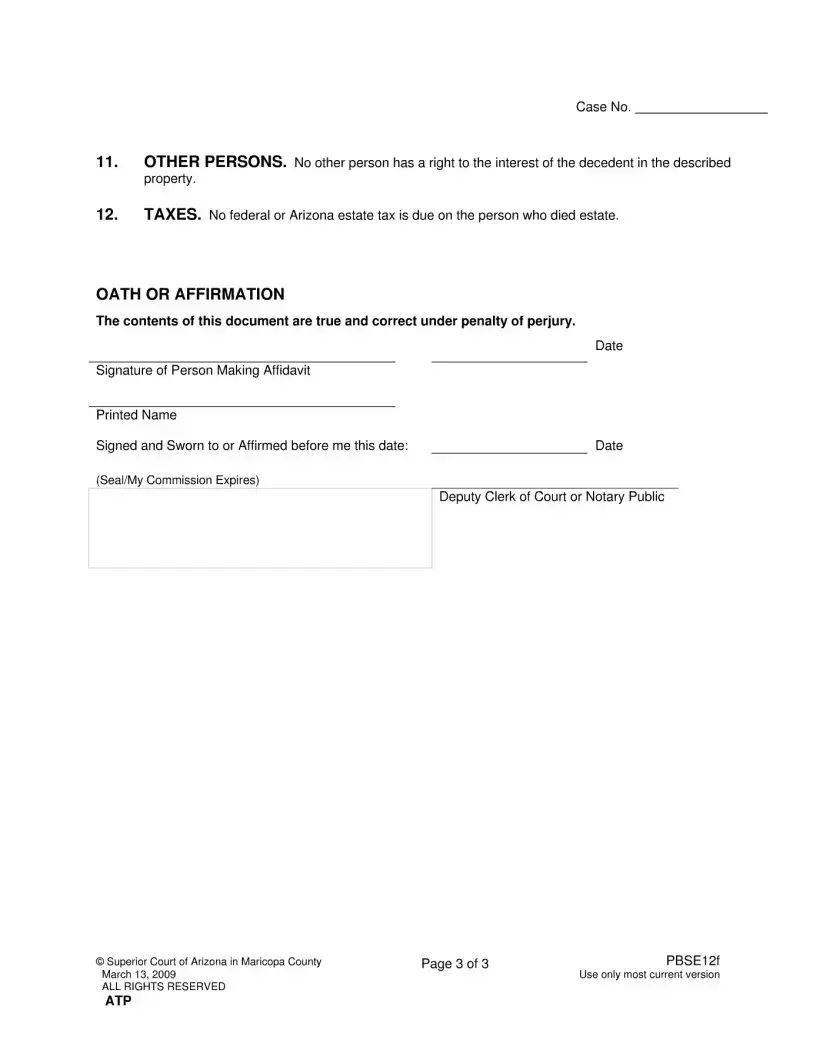

Arizona Estate Preview

File Properties

| # | Fact | Governing Law(s) |

|---|---|---|

| 1 | The form must be used to legally manage and distribute a deceased person's estate within Arizona. | Arizona Revised Statutes, Title 14 |

| 2 | It allows for the appointment of an executor or personal representative. | Arizona Revised Statutes, Title 14 |

| 3 | The form is essential for probate proceedings in Arizona. | Arizona Revised Statutes, Title 14 |

| 4 | Must be filed in the Superior Court in the county where the deceased resided. | Arizona Rules of Probate Procedure |

| 5 | Used to identify and inventory the deceased's assets. | Arizona Revised Statutes, Title 14 |

| 6 | Helps in determining debts and taxes that the estate owes. | Arizona Revised Statutes, Title 14 |

| 7 | Ensures the proper distribution of assets to heirs and beneficiaries. | Arizona Revised Statutes, Title 14 |

| 8 | The form can be used to waive the right to a formal probate process in certain circumstances. | Arizona Revised Statutes, Title 14 |

| 9 | Accuracy in completing the form is crucial to avoid delays in the probate process. | Arizona Revised Statutes, Title 14 |

| 10 | May require the filing of additional documents depending on the specific needs of the estate. | Arizona Revised Statutes, Title 14; Arizona Rules of Probate Procedure |

Instructions on Utilizing Arizona Estate

Filling out an Arizona Estate Form is an important step in managing estate matters in the state of Arizona. This process ensures that all necessary information is accurately recorded and submitted as required by state law. The form itself captures details about the estate, the deceased, and how the estate should be managed or distributed. While the task may seem daunting at first, breaking it down into steps can simplify the process. The following guidelines are designed to assist individuals in completing the Arizona Estate Form correctly and efficiently.

- Begin by collecting all necessary documents related to the estate. This includes titles, deeds, financial statements, and any other records that will provide a complete overview of the estate's assets.

- Read through the entire form before writing to familiarize yourself with the type of information requested.

- Fill in the basic information section at the top of the form, including the full legal name of the deceased, their date of birth, date of death, and the county in which the estate will be processed.

- Itemize the assets of the estate. Be specific and provide detailed descriptions, including the value of each item or account at the time of the deceased's passing.

- List all known debts and liabilities of the estate, including outstanding bills, loans, and any other financial obligations.

- Specify the legal heirs or beneficiaries of the estate. Include their full names, addresses, and relationship to the deceased.

- If applicable, attach any additional documents that support the information provided on the form, such as copies of wills, trust documents, or death certificates.

- Review the entire form to ensure all information is accurate and complete. Make any necessary corrections.

- Sign and date the form in the designated area at the bottom. If the form requires notarization, make sure to sign it in front of a notary public.

- Submit the completed form to the appropriate Arizona county probate court along with any filing fees that may be required.

After the form is submitted, it will be reviewed by the court, and additional steps may be necessary depending on the specifics of the estate and the contents of the form. It is advisable to consult with a legal professional if there are any questions or concerns during this process. Filling out the Arizona Estate Form accurately is critical to ensuring that the estate matters are handled according to the deceased's wishes and in compliance with Arizona law.

Listed Questions and Answers

What is the Arizona Estate Form?

The Arizona Estate Form is a legal document used by individuals to outline how their assets should be managed and distributed upon their death. This comprehensive document can include specifications regarding personal property, real estate, investments, and instructions for guardianship of minors, among others. It's a crucial step in estate planning to ensure that your wishes are honored and to potentially simplify the legal process for your heirs.

Who needs to fill out an Arizona Estate Form?

Any resident of Arizona who wishes to have control over the distribution of their assets after death should consider filling out an Arizona Estate Form. It is especially important for individuals who have significant property, minor children, or specific wishes about how their estate should be managed. However, it's a practical step for anyone who wants to provide clear instructions and ease the burden on their loved family members during a challenging time.

How can one get started with completing the Arizona Estate Form?

To begin completing the Arizona Estate Form, one should first gather all necessary information about their assets, including details on real estate, personal property, bank accounts, and investments. It's also important to consider who will be named as the executor of the estate, who the beneficiaries will be, and any specific instructions regarding the care of minors or distribution of personal items. Consulting with a legal expert specializing in estate planning is highly recommended to ensure that the form is filled out correctly and all legal requirements are met.

What happens if someone dies without having filled out an Arizona Estate Form?

If a person dies without having filled out an Arizona Estate Form, or any will, their estate will be distributed according to Arizona's intestate succession laws. This means the state dictates how the estate is divided among surviving relatives, which may not align with the deceased's wishes. This can lead to potential conflicts among heirs and a more prolonged, complicated probate process. Therefore, filling out an Arizona Estate Form is a vital step in safeguarding one's wishes and providing for loved ones after death.

Common mistakes

Filling out an Arizona Estate form requires careful attention to detail. Common mistakes can lead to delays and complications in the estate process. To ensure your form is completed accurately, avoid these pitfalls:

Not double-checking the form version. The latest form version is often required, and using an outdated one can invalidate your submission.

Overlooking the need for accurate personal information. Every detail, from full legal names to dates of birth, must match official documents.

Forgetting to list all assets. It’s crucial to include every asset, no matter how small, to ensure a comprehensive estate evaluation.

Missing signatures and dates. The form isn’t valid unless it’s signed and dated by all required parties.

Ignoring state-specific requirements. Arizona may have unique demands that differ from other states, and failing to comply can cause the form to be rejected.

Failing to provide detailed descriptions for property and assets. Vague descriptions can lead to disputes or confusion during the estate process.

Not seeking legal advice when needed. Professionals can help navigate complex situations, ensuring the form is filled out correctly.

Avoiding these mistakes can smooth the path for your estate process, leading to faster resolution and less stress for all involved. Proper attention and diligence are your best tools.

Documents used along the form

When managing an estate in Arizona, the main form is often just the beginning of the necessary documentation process to effectively handle all aspects of estate planning and execution. Alongside the primary Arizona Estate form, several other forms and documents are commonly utilized to ensure a comprehensive approach to estate management. The documents listed and described below cover a variety of functions, from designating power of attorney to distributing assets according to the deceased's wishes.

- Will: A legal document that outlines how a person's assets will be distributed after their death. It also may specify guardianship preferences for minor children.

- Durable Power of Attorney: This document grants authority to another person (the agent) to make decisions on behalf of the person who created the power of attorney (the principal), concerning financial matters and/or healthcare decisions, effective even if the principal becomes incapacitated.

- Living Trust: A living trust is created during a person's lifetime to hold assets for the benefit of the person or others, with instructions for management and distribution. It can help avoid probate.

- Medical Power of Attorney: Also known as a healthcare proxy, this form designates a person who is authorized to make healthcare decisions on behalf of someone else, should they become unable to do so themselves.

- Living Will: A document that outlines a person’s wishes regarding medical treatment in situations where they are unable to express consent, often including directives about life support and other life-sustaining measures.

- Beneficiary Designations: Forms that specify who will receive benefits from insurance policies, retirement accounts, and other financial assets, bypassing the probate process.

- Property Titles: Legal documents that show ownership of assets such as real estate, vehicles, and more. Correct titling is crucial for the appropriate transfer of assets.

- Letter of Intent: A document expressing the deceased’s personal wishes regarding various aspects of their estate administration, which might include funeral arrangements or specific bequests not covered in the will.

Each of these documents plays a key role in the overall estate planning and management process, providing clarity and legal authority for various actions needed before and after an individual's passing. Individuals should consider preparing these documents as part of their estate planning to ensure their wishes are honored and loved ones are taken care of in their absence. It's recommended to consult with a legal professional when preparing these documents to ensure accuracy and compliance with Arizona law.

Similar forms

The Arizona Estate form often bears resemblance to a Last Will and Testament. Both are legal documents that specify how a person's assets should be distributed after their demise. The core similarity lies in their fundamental purpose: to provide clear instructions for the handling of personal property. However, while the Arizona Estate form might encompass directives for health care decisions or guardianship alongside property distribution, a Last Will specifically focuses on asset allocation and executor appointments.

Similarly, the Arizona Estate form shares traits with a Living Trust. A Living Trust is created during a person's lifetime and can be used to manage assets before and after death. Like the Arizona Estate form, it helps avoid probate, maintaining privacy and simplifying the transfer of assets. However, the Living Trust offers more control over when and how assets are distributed, a distinction that sets it apart from the broad directives potentially included in an Arizona Estate form.

Another document closely related to the Arizona Estate form is the Power of Attorney. This document grants someone else the authority to make decisions on one's behalf, which can include financial, legal, or health-related decisions. The overlap with the Arizona Estate form arises when considering durable powers of attorney, which remain in effect if the individual becomes incapacitated. Both documents ensure an individual's affairs can be managed according to their wishes, even when they are no longer able to communicate those wishes themselves.

Lastly, the Advance Healthcare Directive, or living will, echoes aspects of the Arizona Estate form, especially when the latter includes instructions regarding medical care. Both documents dictate preferences for treatment in situations where the individual cannot make decisions due to illness or incapacity. While the Advance Healthcare Directive focuses exclusively on medical decisions and the conditions under which life-sustaining treatment should be offered or withheld, the Arizona Estate form might incorporate these directives within a broader estate planning context.

Dos and Don'ts

When filling out an Arizona Estate form, it is essential to:

- Review the form in its entirety before beginning to understand the scope of information required.

- Consult with a legal expert knowledgeable in Arizona estate laws to ensure compliance and accuracy.

- Use black ink or type your responses to ensure legibility, as this is a formal legal document.

- Gather all necessary documents, such as titles, deeds, and account statements, to accurately report assets and liabilities.

- Double-check the spelling of names and accuracy of dates, particularly those of beneficiaries and decedents.

- Clearly identify any debts or liabilities associated with the estate to prevent future legal issues.

- Be thorough in describing each asset, including location, value, and any identifying numbers or characteristics.

- Consider the tax implications of estate distribution and how they may affect the estate and its beneficiaries.

- Sign and date the form in the presence of a notary public to validate its authenticity.

- Keep a copy of the completed form for your records and provide copies to relevant parties, such as the executor or beneficiaries.

Conversely, here are things to avoid when completing an Arizona Estate form:

- Do not leave any sections blank; if a section does not apply, clearly mark it as "N/A" to indicate this.

- Avoid guessing on values or information; if unsure, seek out an appraisal or expert advice.

- Do not use pencil or erasable ink, as alterations could raise questions about the document's integrity.

- Avoid naming as beneficiaries any persons you do not wish to inherit your estate, even as alternates, without careful consideration.

- Do not overlook digital assets, such as online accounts and digital files, which may hold financial or sentimental value.

- Refrain from neglecting to update the form after major life events, such as marriages, divorces, births, or deaths.

- Avoid making assumptions about state laws; estate laws can vary significantly and have nuanced requirements.

- Do not eschew professional legal advice, particularly for complex estates or unique family situations.

- Refrain from submitting the form without reviewing it for accuracy and completeness.

- Avoid keeping the completion and location of the form a secret from all relevant parties, such as executors or attorneys.

Misconceptions

When discussing estate planning, many individuals have misconceptions about the process and forms required, especially within specific states like Arizona. It's crucial to clarify these misunderstandings to ensure proper estate management and peace of mind. Here are six common misconceptions about the Arizona estate form:

- All assets are covered by the Arizona estate form. Many people assume that filling out an estate form in Arizona automatically covers all of their assets. However, this isn't the case. Certain assets, such as those held in joint tenancy, retirement accounts, and life insurance proceeds with designated beneficiaries, are not covered by this form and pass outside of the estate process.

- The form eliminates the need for a will or trust. Another common misconception is that completing an estate form negates the need for a will or trust. While the form is an important part of estate planning, it does not replace the comprehensive planning that a will or trust can provide. Both play crucial roles in managing different aspects of your estate.

- There's only one type of estate form in Arizona. People often think there's a one-size-fits-all estate form for Arizona residents. The truth is, there are several types of forms, each serving different purposes, such as the Last Will and Testament, the Health Care Power of Attorney, and the Living Will. Selecting the right form depends on your specific needs and goals.

- You must be wealthy to need an estate form. There's a widespread belief that estate planning is only for the rich. This is not true. No matter the size of the estate, having the proper forms in place is essential for all individuals to ensure their wishes are honored and their loved ones are protected.

- The process is too complicated and expensive. Many Arizonans avoid estate planning, thinking it's too complex or costly. While it's true that estate planning can be detailed, the consequences of not having these forms when needed far outweigh the perceived inconvenience. Furthermore, the cost and complexity can vary, but there are resources available to help simplify the process.

- Once completed, the Arizona estate form never needs updating. Finally, a significant misconception is that once an estate form is filled out and filed, it never needs to be revisited. In reality, life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets necessitate updates to your estate forms to reflect your current circumstances and wishes accurately.

Understanding and demystifying these misconceptions are the first steps toward effective estate planning. Proper planning ensures that your assets are distributed according to your wishes and provides peace of mind for you and your loved ones.

Key takeaways

Filling out the Arizona Estate form is a crucial step for those handling the assets of a deceased individual in Arizona. This process ensures that assets are distributed according to the will of the deceased or, in the absence of a will, according to state law. To navigate this process efficiently and correctly, there are key points to keep in mind.

- Understanding the Purpose: The Arizona Estate form is primarily used to either appoint a personal representative or to request the local court's permission to distribute the estate's assets. Knowing its purpose aids in filling it out accurately.

- Accuracy is Key: Filling out the form requires attention to detail. Every piece of information needs to be accurate, as errors can delay the process or lead to legal complications.

- Legal Terminology Understanding: The form includes specific legal terms such as "executor," "administrator," and "probate." Familiarizing yourself with these terms can help demystify the process and ensure you fill out the form correctly.

- Documentation is Crucial: Supporting documents, such as the death certificate and the will (if available), need to be submitted alongside the form. It is important to gather all necessary documents before starting the process.

- Review State Laws: Estate and probate laws vary by state. Arizona has unique requirements and exemptions, especially regarding the value of the estate and how it may be distributed without formal probate. Reviewing these laws can help determine the correct way to fill out the form.

- Seek Professional Advice: Considering the complexities involved, consulting with a legal professional familiar with Arizona estate law can provide guidance and ensure that you navigate the process correctly. This is especially important in complicated estates or when disputes among heirs are present.

Filling out the Arizona Estate form is a significant responsibility that shouldn't be taken lightly. By understanding its purpose, ensuring accuracy, being familiar with legal terminology, gathering necessary documents, reviewing state laws, and possibly seeking professional advice, individuals can navigate this process more effectively. This careful approach helps in fulfilling legal obligations and honoring the deceased’s wishes with respect to the distribution of their assets.

More PDF Forms

Consent Guardianship Arizona - Details the process for applying for guardianship without giving notice to parents in urgent situations.

Arizona State Ein Number - Must be completed by vendors or payees to ensure proper tax reporting and payment processing.

Arizona Corporation Commision - Features checkboxes for companies to indicate their compliance with payments towards regulatory assessments and funds, highlighting their adherence to state regulations.