Fill in a Valid Arizona Commercial Real Contract Template

In the realm of commercial real estate in Arizona, transactions are underpinned by a critical document: the Arizona Commercial Real Estate Contract form. This comprehensive form serves as the backbone for negotiations, agreements, and the legal documentation of the sale and purchase of commercial properties. It meticulously outlines the terms, conditions, and obligations of all parties involved, ensuring clarity and protecting the interests of both buyers and sellers. With specific sections dedicated to the description of the property, purchase price, financing conditions, due diligence periods, and closing details, it acts as a roadmap through the complex process of commercial real estate transactions. Moreover, the form incorporates provisions for contingencies, representations and warranties, risk allocation, and remedies, making it an indispensable tool for navigating the intricacies of commercial real estate dealings in Arizona. Its significance cannot be overstated, as it not only facilitates smooth transactions but also helps to prevent potential disputes by clearly defining the rights and responsibilities of each party.

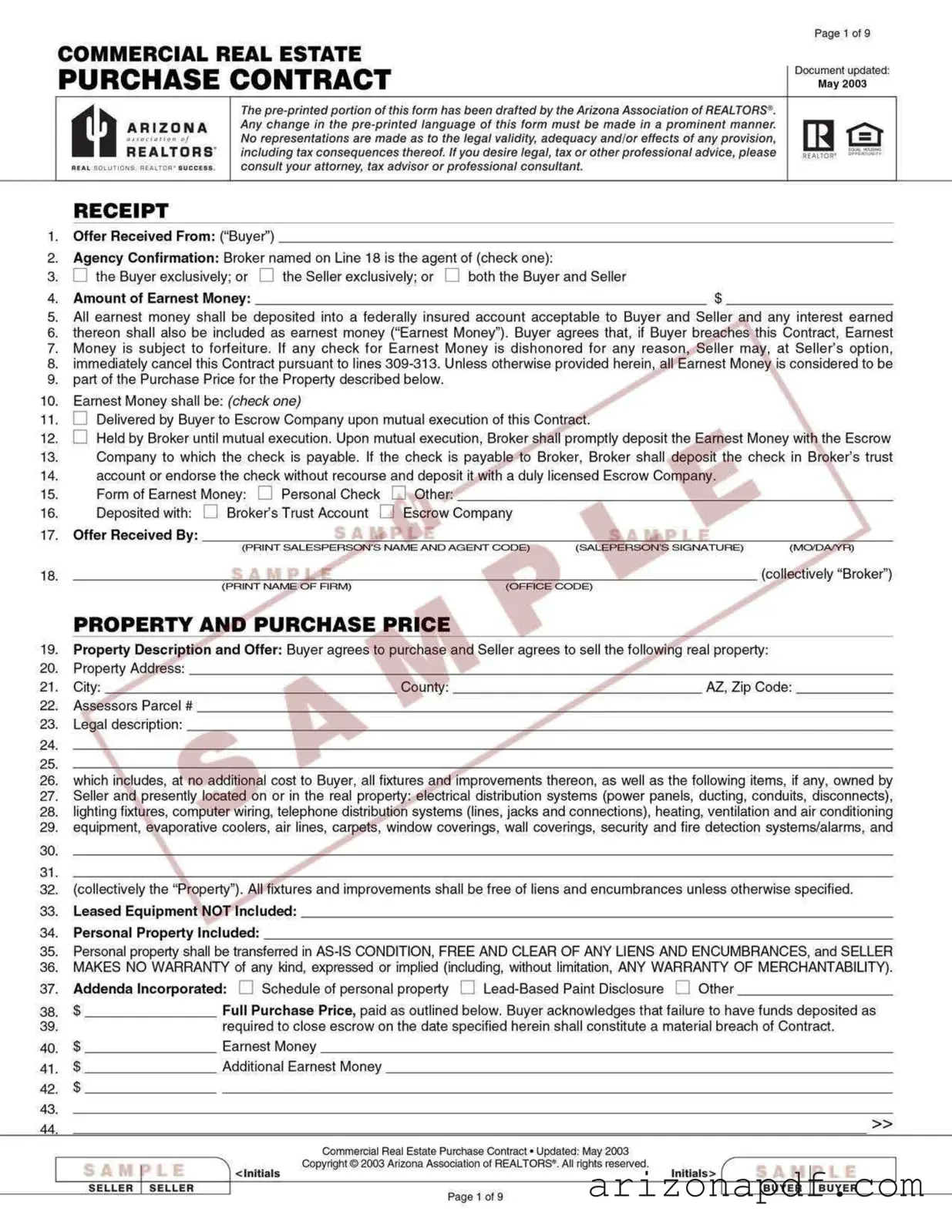

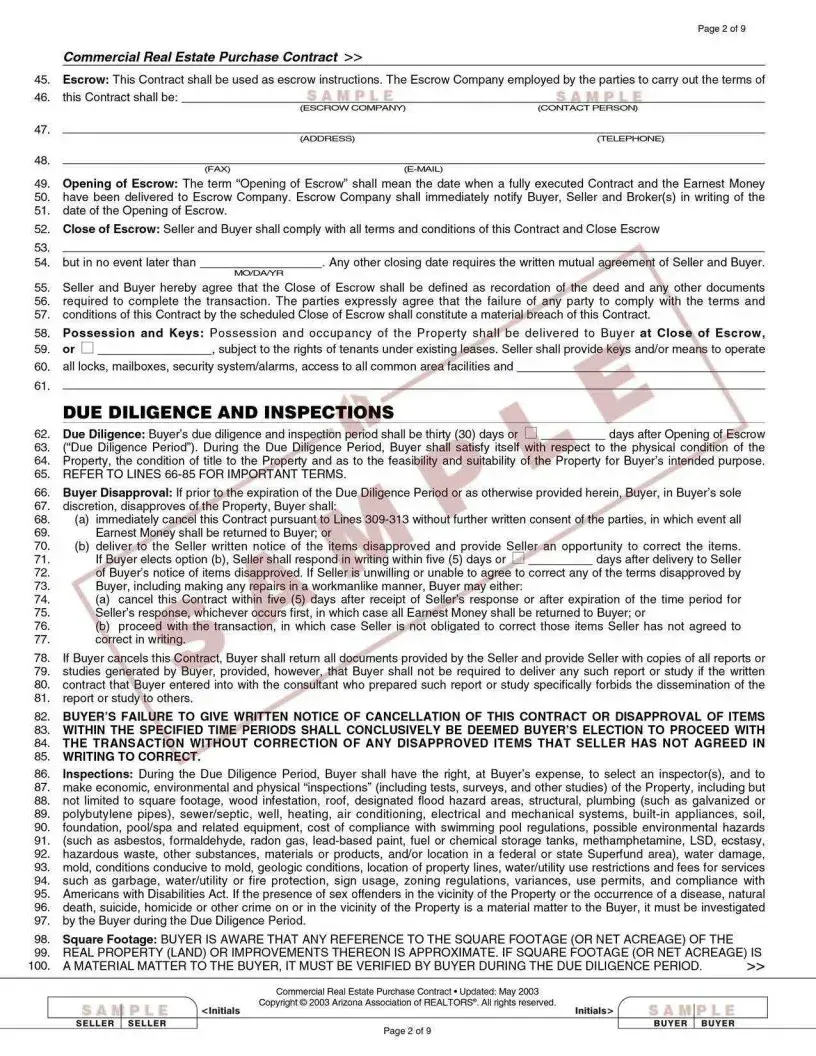

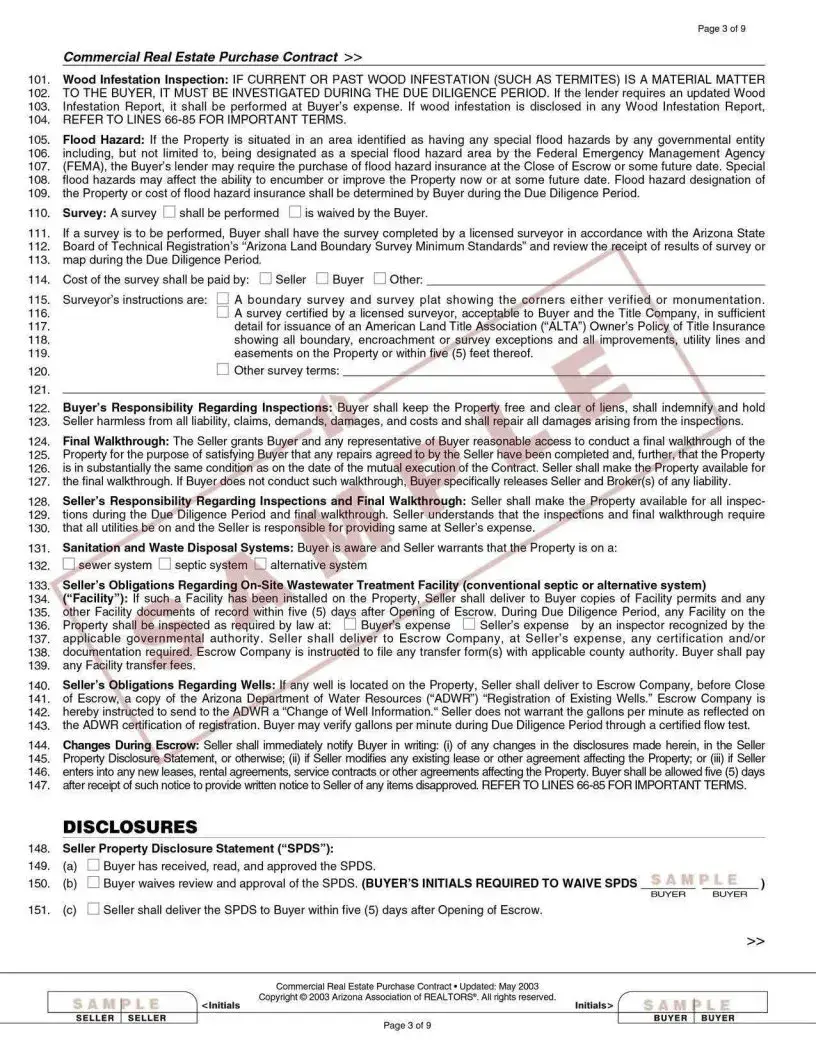

Arizona Commercial Real Contract Preview

File Properties

| Fact | Detail |

|---|---|

| 1. Purpose | Used for the sale, purchase, or lease of commercial properties in Arizona. |

| 2. Governing Law | Arizona Revised Statutes and applicable federal laws. |

| 3. Parties Involved | Typically involves a seller (or lessor) and a buyer (or lessee). |

| 4. Property Types | Includes office buildings, retail spaces, warehouses, industrial buildings, and other types of commercial real estate. |

| 5. Key Elements | Identifies the property, purchase price or lease terms, closing date, and any conditions or contingencies. |

| 6. Due Diligence | Buyers are often allowed a period to conduct due diligence to verify the condition and legal status of the property. |

| 7. Financing | The contract may include terms related to financing, specifying whether the purchase is contingent upon obtaining financing. |

| 8. Disclosures | Sellers may be required to disclose certain conditions of the property, depending on local laws and regulations. |

| 9. Dispute Resolution | Specifies how disputes related to the contract will be resolved, often through arbitration or litigation. |

Instructions on Utilizing Arizona Commercial Real Contract

Filling out the Arizona Commercial Real Estate Contract form is a crucial step for parties engaged in buying or selling commercial property within the state. This document helps ensure that all terms of the transaction are clearly outlined and agreed upon, protecting the interests of both buyers and sellers. By following the steps below, individuals can complete the form accurately and efficiently, facilitating a smoother real estate transaction. Whether you are a seasoned investor or navigating your first commercial purchase, understanding how to properly complete this form is essential.

- Begin by entering the date on which the contract is being filled out at the top of the form.

- Next, fill in the full legal names of both the buyer and the seller in their respective fields.

- Enter the legally described address and/or legal description of the property being sold, including county and parcel number.

- Specify the purchase price agreed upon by both the buyer and the seller.

- Detail the terms of payment, including any deposit amounts, financing details, and deadlines for payment.

- Outline any contingencies that must be met before the sale can be finalized, such as property inspections, appraisals, or financing approval.

- Include any items or fixtures that are being sold with the property, ensuring clarity on what is included in the sale.

- Detail the closing and possession dates, specifying when the buyer will officially take possession of the property.

- Specify who will be responsible for closing costs and any other fees associated with the sale.

- List any additional terms or conditions that have been agreed upon by both parties, which are not already covered in the standard sections of the contract.

- Both the buyer and the seller must sign and date the form at the bottom to signify their agreement to the terms outlined in the contract.

- Lastly, ensure that all necessary disclosures and addenda that are required by Arizona law or agreed upon by the parties are attached and properly completed.

Once the Arizona Commercial Real Estate Contract form is fully completed and signed, the next steps typically involve carrying out the provisions outlined in the contract, such as performing due diligence, securing financing, and preparing for the closing process. It is important for both parties to closely adhere to the terms of the contract and remain in communication to address any issues that may arise leading up to the transfer of ownership. Consulting with real estate professionals and legal advisors throughout the process can help ensure a successful transaction.

Listed Questions and Answers

What is the purpose of the Arizona Commercial Real Estate Contract form?

The form serves as a legally binding agreement between a seller and a buyer concerning the purchase of commercial real estate in Arizona. It outlines the sale's terms and conditions, including the purchase price, financing, inspections, closing conditions, and other essential details relevant to the transaction. This document ensures that both parties understand their rights and obligations, and it helps to prevent misunderstandings and disputes during the process.

Who needs to use the Arizona Commercial Real Estate Contract form?

Anyone involved in buying or selling commercial property in the state of Arizona should use this form. This includes individual investors, companies, real estate brokers, and legal representatives acting on behalf of their clients. By utilizing this form, parties ensure that their commercial real estate transactions comply with Arizona state laws, thereby providing a clear and enforceable framework for the sale.

How does one obtain the Arizona Commercial Real Estate Contract form?

The form can be obtained through several channels. Real estate professionals often have access to these forms through their associations or brokerages. Additionally, legal professionals specializing in real estate can provide the form, often customizing it to fit the specific needs of the transaction. It is also available for purchase or download from various online sources, including websites that specialize in legal documents for real estate transactions.

Can the Arizona Commercial Real Estate Contract form be customized?

Yes, the form can be customized to address the specific needs and agreements of the parties involved in the transaction. However, it is crucial to ensure that any modifications or additions comply with Arizona law and do not undermine the legal integrity of the contract. It's advisable to consult a legal professional specialized in real estate law to make any changes, ensuring the contract remains enforceable and protective of both parties' interests.

What happens if a dispute arises after signing the Arizona Commercial Real Estate Contract form?

If a dispute arises after the contract has been signed, the parties should first refer to the dispute resolution provisions outlined in the contract itself. These provisions typically include negotiation, mediation, or arbitration as steps to resolve conflicts. If these methods fail, legal action may be necessary. It's crucial to seek legal advice from professionals experienced in commercial real estate law to navigate disputes effectively and minimize potential losses.

Common mistakes

When filling out the Arizona Commercial Real Estate Contract form, people often make mistakes due to oversight or misunderstanding. To ensure accuracy and avoid legal complications, it's crucial to pay attention to every detail. Here are seven common mistakes:

Not checking the zoning laws: Many people forget to verify zoning restrictions for the property in question. This mistake can lead to legal issues or prevent the purchaser from using the property as intended.

Skipping the inspection period: Some either ignore or are unaware of the importance of the inspection period. This step is critical to evaluate the property's condition and identify any potential problems.

Incorrectly identifying the property: Failing to accurately describe the property in the contract can cause significant issues. It's essential to use the property's legal description, not just its address.

Misunderstanding the closing costs: Often, individuals underestimate or miscalculate the closing costs involved in the transaction. It is important to review these expenses carefully to avoid surprises at closing.

Neglecting to specify the earnest money deposit details: The terms regarding the earnest money deposit, including amount and conditions for its return, must be clearly outlined to protect both parties.

Forgetting to include contingencies: Contingencies such as financing, inspection results, or the sale of another property are crucial. Omitting them can lock a buyer into a contract without a clear path out if conditions aren't met.

Not getting legal advice: Lastly, many choose not to consult a legal professional. This decision can lead to misunderstandings of the contract's terms and obligations. Professional advice can prevent costly mistakes and provide peace of mind.

Avoiding these mistakes requires diligence, attention to detail, and, quite often, professional guidance. When in doubt, seeking the assistance of a real estate lawyer or professional experienced with Arizona commercial real estate transactions can be invaluable.

Documents used along the form

In the process of executing a commercial real estate transaction in Arizona, several additional forms and documents are often used alongside the Arizona Commercial Lease Contract. These documents play a vital role in ensuring the transaction is conducted thoroughly and with attention to detail, catering to both legal requirements and the parties' mutual interests. Descriptions of such forms and documents are provided below, representing a structured approach to managing commercial real estate agreements effectively.

- Letter of Intent (LOI): This document typically precedes the actual contract, outlining the preliminary agreement terms between the parties involved. It serves as a foundation for negotiating the final lease or purchase agreement.

- Property Inspection Report: This report provides detailed information on the property's condition. It's crucial for identifying any issues that might need addressing before finalizing the transaction.

- Title Report: A title report helps ensure that the property title is clear of any liens, encumbrances, or legal disputes, securing the buyer's investment.

- Environmental Assessment: An environmental assessment evaluates the property for potential contamination or environmental hazards, which is essential for compliance and due diligence purposes.

- Zoning Compliance Documentation: This important document confirms that the property's use complies with local zoning ordinances, crucial for businesses with specific operational requirements.

- Estoppel Certificate: Often requested by lenders, this certificate verifies the status of the lease and the absence of conflicts between the landlord and tenants, providing reassurance to potential investors or buyers.

- Lease Agreement: If the contract involves leasing, a detailed lease agreement will be necessary. This document outlines all the terms, conditions, and obligations of both the landlord and the tenant involved in the leasing arrangement.

The integration of these documents with the Arizona Commercial Real Estate Contract ensures a comprehensive approach to commercial real estate transactions, safeguarding the interests of all parties involved. Accuracy, clarity, and thoroughness in completing and reviewing these documents can significantly impact the success and legality of the transaction. Engaging with a professional to navigate these documents can also provide valuable insight and assurance throughout the process.

Similar forms

The Arizona Commercial Lease Agreement is closely related to a Residential Lease Agreement. Both documents serve as a binding contract between a landlord and tenant, outlining terms for renting property. However, the Arizona Commercial Lease Agreement is specifically tailored for business purposes, allowing companies to rent commercial spaces like offices, retail units, or warehouses. In contrast, a Residential Lease Agreement is used for living spaces such as apartments or houses. Despite these differences, both agreements cover similar areas such as lease duration, payment terms, and conditions for termination.

Similar to the Arizona Commercial Lease Agreement, the Bill of Sale is another significant document that serves as proof of a transaction, but this time for personal property, rather than real estate. While the Commercial Lease Agreement deals with the rights to use property over a specified period, the Bill of Sale transfers ownership of goods or assets from one party to another. Both documents ensure a legal record of the transaction but differ in the nature of the assets involved.

The Sublease Agreement shares similarities with the Arizona Commercial Lease Agreement, as it also concerns the renting of property. A Sublease Agreement comes into play when an existing tenant wishes to rent out their leased premises to a third party. This agreement is bound by the terms of the original lease. While the Commercial Lease Agreement is a direct deal between the property owner and the initial tenant, a Sublease Agreement introduces another layer, making the original tenant a sublessor to the new tenant.

A Triple Net Lease (NNN) Agreement is a particular form of the Arizona Commercial Lease Agreement where, in addition to the rent, the tenant agrees to pay for property taxes, insurance, and maintenance. This document places more financial responsibilities on the tenant compared to a standard commercial lease, which might have these expenses covered by the landlord. Both agreements facilitate commercial property rentals but diverge in terms of the tenant's financial obligations beyond just the rental fee.

Comparable to the Arizona Commercial Lease Agreement, the Real Estate Purchase Agreement is a legally binding document that outlines the terms under which real estate is sold. Instead of detailing the conditions for leasing commercial property, this agreement specifically deals with the sale and purchase dynamics, including the offer, acceptance, purchase price, and closing details. Although one centers on leasing and the other on selling, both documents provide a structure and legal framework for real estate transactions.

An Employment Contract bears resemblance to the Arizona Commercial Lease Agreement in that both establish terms between two parties. With an Employment Contract, the agreement is between an employer and employee, detailing job responsibilities, compensation, and terms of employment. While distinctly different in context—one dealing with employment and the other with leasing—both documents serve to outline the expectations and obligations of each party involved in the agreement.

Finally, the Option to Purchase Agreement is another document that relates to the Arizona Commercial Lease Agreement. This document typically gives a tenant the right to purchase the leased property during or at the end of the lease term. While the Commercial Lease Agreement facilitates a business's use of commercial space for a set period, the Option to Purchase Agreement adds a potential pathway to ownership of the property. Although their primary functions vary—one for renting and the other for potential buying—they both play pivotal roles in the negotiation of commercial real estate.

Dos and Don'ts

Filling out the Arizona Commercial Real Estate Contract form is a critical step in securing a commercial property transaction in the state of Arizona. It requires attention to detail and a clear understanding of the terms and conditions involved. Here is a list of dos and don’ts to help guide you through the process, ensuring that the contract reflects your intentions accurately and is legally binding.

- Do read the entire contract carefully before you start filling it out. Understanding every clause is key to your protection and success in the transaction.

- Do confirm accuracy in all details, such as property descriptions, names of parties involved, and financial figures. Errors in these areas can lead to disputes or legal issues down the line.

- Do use clear and concise language to fill in any blanks or add any clauses. This helps avoid ambiguity that could complicate the transaction.

- Do consult with a professional, such as a real estate agent or attorney, to clarify any terms or conditions you do not fully understand. Expertise in real estate law and contracts can be invaluable.

- Do ensure that both parties have their identification verified and are legally authorized to engage in the transaction. This includes verifying the authority of individuals acting on behalf of corporations or other entities.

- Don’t leave any sections blank. If a section does not apply, mark it as “N/A” (not applicable) to confirm that it was reviewed but found to be not relevant to the current transaction.

- Don’t sign the contract without ensuring all parties understand and agree with its contents. Signing the contract legally binds each party to the stated terms.

- Don’t hesitate to negotiate terms that do not meet your needs or expectations. The contract negotiation phase is the time to address and amend any aspects of the agreement before signing.

- Don’t forget to retain a signed copy of the contract for your records. Having a physical or digital copy is essential for reference in case of any disputes or for future transactions.

By following these guidelines, you will be better prepared to navigate the complexities of the Arizona Commercial Real Estate Contract, making the process smoother and more efficient for all parties involved.

Misconceptions

When it comes to dealing with commercial real estate transactions in Arizona, it's essential to have a good understanding of the Arizona Commercial Real Estate Contract form. There are quite a few misunderstandings surrounding this type of contract. To ensure you're well-informed, here's a list of common misconceptions and the truths behind them:

- One-size-fits-all: Many people believe that the Arizona Commercial Real Estate Contract form is a one-size-fits-all solution. However, every commercial transaction is unique, and the contract should be tailored to fit the specific needs and agreements between the parties involved.

- Only for buying and selling: Another misconception is that this form is exclusively for buying or selling property. In reality, it can also be adjusted for leasing agreements, making it a versatile tool in commercial real estate transactions.

- Doesn't require a lawyer: Some think they don't need a lawyer if they use the standard Arizona Commercial Real Estate Contract form. Though the form is designed to simplify transactions, consulting with a lawyer ensures your interests are adequately protected and all legal requirements are met.

- Static and outdated: There's a belief that once you've seen one Arizona Commercial Real Estate Contract, you've seen them all. This is false. The form is regularly updated to reflect changes in law and industry practices. Always check you're using the latest version.

- Easy to fill out without mistakes: Filling out this contract without any mistakes is harder than many believe. Overlooking or inaccurately entering details can lead to significant problems. Attention to detail is crucial.

- Exclusive to real estate agents: Although real estate agents commonly use it, the form is not exclusive to them. Investors, legal professionals, and even private buyers and sellers might use the contract during their deals.

- No need for negotiation: A common misunderstanding is that the terms provided in the form are set in stone. In reality, almost all aspects of the contract can be negotiated to better suit the needs of both parties involved in the transaction.

- Financial details are straightforward: Some people think that filling out the financial sections of the contract is straightforward. Given the complexities of financing commercial real estate deals, thoroughly understanding these sections is vital to ensuring the agreement's success.

- Immediate effect: Lastly, there is a misconception that the contract takes effect as soon as it is signed. It's essential to understand that specific contingencies and conditions must often be met before the contract becomes enforceable.

Armed with the correct information, parties involved in commercial real estate transactions can navigate the process more effectively and avoid common pitfalls associated with the Arizona Commercial Real Estate Contract form.

Key takeaways

Understanding how to properly fill out and use the Arizona Commercial Real Estate Contract form is crucial for all parties involved in commercial real estate transactions in Arizona. Here are seven key takeaways to ensure that these contracts are correctly handled:

- Legal Descriptions Are Essential: The contract must include a complete legal description of the property. This is more detailed than just an address and may require input from a surveyor.

- Specify Payment Terms Clearly: All payment terms, including the purchase price, deposit amounts, and any financing arrangements, should be clearly stated to avoid misunderstandings.

- Diligence is Required for Disclosures: Sellers must disclose all known material defects and environmental hazards. Accuracy in these disclosures protects sellers from future liability and helps buyers make informed decisions.

- Contingencies Must Be Specified: Clearly outline any conditions that must be met for the transaction to proceed, such as financing approvals and satisfactory inspections.

- Zoning and Use Restrictions: The buyer should verify that the property's zoning allows for their intended use, as the contract should address how such matters will be handled if discrepancies arise.

- Timeframes and Deadlines: Each phase of the contract, from inspections to closing dates, has associated deadlines. Strict adherence to these timelines ensures a smoother transaction process.

- Closing Costs and Procedures: The contract should detail which parties are responsible for specific closing costs and outline the procedures for the final transfer of property ownership.

By addressing these key areas in the Arizona Commercial Real Estate Contract form, parties can make sure that their real estate transactions are legally sound, fair, and clear to all involved, reducing the potential for conflicts and misunderstandings.

More PDF Forms

Arizona Filing Requirements - Promotes detailed disclosure of each party's living situation, assets, and financial obligations for fair resolution.

How Much to Withhold for Az Taxes - The Arizona A1-WP form is not suitable for employers who make quarterly withholding payments.

Az State Income Tax Form - A fundamental application for those desiring to perform weight certification services in Arizona, emphasizing legal compliance and scale specifications.