Fill in a Valid Arizona A4 Template

The Arizona A4 form is a critical document for employees working within the state, serving as the primary tool for determining how much state income tax should be withheld from their paychecks. This form, officially titled "Employee’s Arizona Withholding Election", requires individuals to provide personal information, including their full name, social security number, address, and to make a crucial decision regarding their tax withholding rate. Options range from electing a specific percentage of gross taxable wages—from as low as 0.8% to as high as 5.1%—to choosing not to have any taxes withheld at all, under the condition that the employee expects to have no Arizona tax liability for the year. Furthermore, the form allows for the addition of an extra amount to be withheld, giving employees greater control over their tax obligations. The instructions included with the form emphasize the importance of making these elections promptly, within the first five days of employment, to avoid a default withholding rate of 2.7%. This document also includes provisions for changes by current employees and highlights considerations for nonresident workers in Arizona. Failure to update this form as necessary can lead to unexpected tax liabilities, underscoring the form's role in the financial planning of Arizona's workforce. Additionally, even those electing zero withholding must remain vigilant of their tax responsibilities, as this choice does not exempt them from owing taxes come filing season. In essence, the Arizona A4 form encapsulates a critical element of employment in Arizona, blending compliance with personal financial management.

Arizona A4 Preview

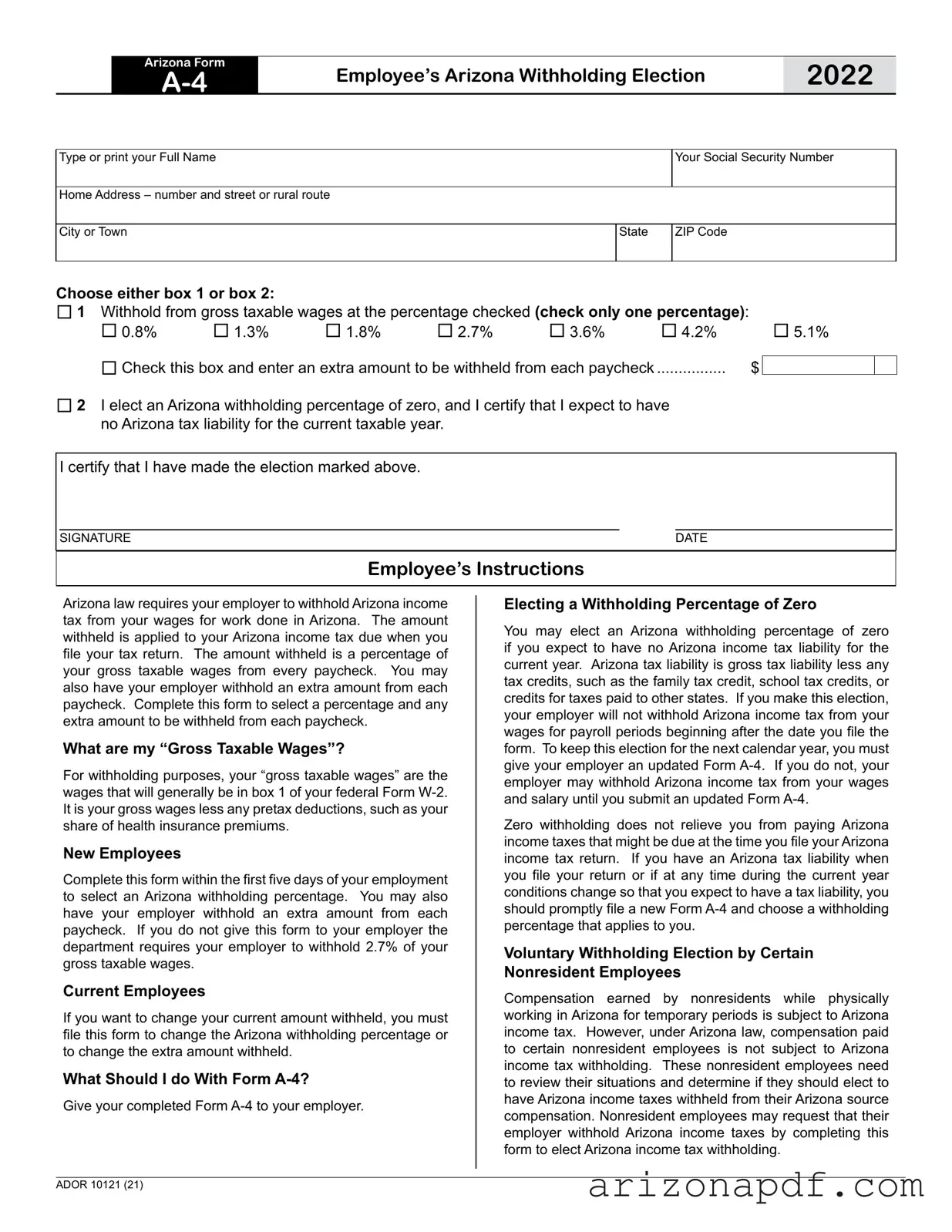

Arizona Form

Employee’s Arizona Withholding Election

2022

Type or print your Full Name |

|

Your Social Security Number |

|

|

|

Home Address – number and street or rural route |

|

|

|

|

|

City or Town |

State |

ZIP Code |

|

|

|

Choose either box 1 or box 2:

1 Withhold from gross taxable wages at the percentage checked (check only one percentage):

0.8% |

1.3% |

1.8% |

2.7% |

3.6% |

4.2% |

|

5.1% |

|

Check this box and enter an extra amount to be withheld from each paycheck |

|

$ |

|

|

||||

................ |

|

|

||||||

2 I elect an Arizona withholding percentage of zero, and I certify that I expect to have no Arizona tax liability for the current taxable year.

I certify that I have made the election marked above.

SIGNATURE |

DATE |

Employee’s Instructions

Arizona law requires your employer to withhold Arizona income tax from your wages for work done in Arizona. The amount withheld is applied to your Arizona income tax due when you file your tax return. The amount withheld is a percentage of your gross taxable wages from every paycheck. You may also have your employer withhold an extra amount from each paycheck. Complete this form to select a percentage and any extra amount to be withheld from each paycheck.

What are my “Gross Taxable Wages”?

For withholding purposes, your “gross taxable wages” are the wages that will generally be in box 1 of your federal Form

New Employees

Complete this form within the first five days of your employment to select an Arizona withholding percentage. You may also have your employer withhold an extra amount from each paycheck. If you do not give this form to your employer the department requires your employer to withhold 2.7% of your gross taxable wages.

Current Employees

If you want to change your current amount withheld, you must file this form to change the Arizona withholding percentage or to change the extra amount withheld.

What Should I do With Form

Give your completed Form

Electing a Withholding Percentage of Zero

You may elect an Arizona withholding percentage of zero if you expect to have no Arizona income tax liability for the current year. Arizona tax liability is gross tax liability less any tax credits, such as the family tax credit, school tax credits, or credits for taxes paid to other states. If you make this election, your employer will not withhold Arizona income tax from your wages for payroll periods beginning after the date you file the form. To keep this election for the next calendar year, you must give your employer an updated Form

Zero withholding does not relieve you from paying Arizona income taxes that might be due at the time you file your Arizona income tax return. If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form

Voluntary Withholding Election by Certain Nonresident Employees

Compensation earned by nonresidents while physically working in Arizona for temporary periods is subject to Arizona income tax. However, under Arizona law, compensation paid to certain nonresident employees is not subject to Arizona income tax withholding. These nonresident employees need to review their situations and determine if they should elect to have Arizona income taxes withheld from their Arizona source compensation. Nonresident employees may request that their employer withhold Arizona income taxes by completing this form to elect Arizona income tax withholding.

ADOR 10121 (21)

File Properties

| Fact | Detail |

|---|---|

| Form Name | Arizona Form A-4 Employee’s Arizona Withholding Election |

| Year | 2021 |

| Primary Purpose | To elect the percentage of gross taxable wages that an employer will withhold for Arizona income tax. |

| Options for Withholding | Employees can choose withholding percentages from 0.8% up to 5.1% or elect to withhold an additional specific amount from each paycheck. |

| Zero Withholding Election | Employees can elect a 0% withholding if they expect to have no Arizona tax liability for the current year. |

| Requirement for New Employees | New employees must complete the form within five days of employment to select their Arizona withholding percentage. |

| Default Withholding Rate | If an employee does not submit this form, employers are required to withhold at a default rate of 2.7%. |

| Nonresident Employee Provision | Nonresident employees working temporarily in Arizona can elect to have Arizona income tax withheld from their wages through this form. |

| Governing Law(s) | Arizona income tax withholding requirements are governed by state tax laws and regulations. |

Instructions on Utilizing Arizona A4

Once you've gathered your employment details and made a decision on your Arizona income tax withholding preferences, it's time to fill out the Arizona Form A-4. This step is essential for ensuring that the right amount of tax is withheld from your paycheck, aligning with your financial and tax situation. Carefully follow the instructions below to accurately complete the form. After filling it out, you must submit this form to your employer, who will adjust your withholding amounts according to your election.

- Type or print your Full Name, Social Security Number, Home Address (number and street or rural route), City or Town, State, and ZIP Code in the designated spaces at the top of the form.

- Decide if you want a specific percentage of your gross taxable wages withheld and check the appropriate box (options range from 0.8% to 5.1%). Remember, you can select only one percentage. If you want to withhold at a percentage that reflects your anticipated tax obligation, choose accordingly.

- If you prefer to have an additional amount withheld from each paycheck in addition to the percentage selected, check the corresponding box and specify the extra amount in the space provided.

- Select the second option if you anticipate having no Arizona income tax liability for the current year and wish to have no withholding. By doing so, you indicate understanding this election remains valid only for the current year, and conditions changing might necessitate a future adjustment.

- Sign and date the form at the bottom to certify your election.

- Finally, submit the completed Form A-4 to your employer for processing.

After your employer has received the Form A-4, they will adjust your withholding based on your selected percentage and/or additional amount. It's important to review your pay stubs after submitting the form to ensure the correct amounts are being withheld. If your financial situation changes or if you simply wish to adjust your withholding amount, you will need to submit a new Form A-4 to your employer.

Listed Questions and Answers

What is the Arizona Form A-4?

The Arizona Form A-4, also known as the Employee’s Arizona Withholding Election, is a document that employees in Arizona use to indicate their preferred percentage of gross taxable wages to be withheld for state income tax. Employees can choose from various percentages or elect not to have any state income tax withheld if they anticipate no tax liability for the year.

Why do I need to complete the Arizona Form A-4?

Arizona law requires employers to withhold state income tax from employees' wages for work done in Arizona. The amount withheld is based on the percentage indicated on the completed Form A-4. This form allows employees to have control over the amount of tax withheld from their paychecks.

What are "Gross Taxable Wages"?

Gross taxable wages are the wages that will typically appear in box 1 of your federal Form W-2. They represent your total gross wages minus any pre-tax deductions, such as health insurance premiums. This is the amount used to calculate the Arizona state tax withholding.

When should a new employee complete Form A-4?

New employees should complete the Arizona Form A-4 within the first five days of employment to select their desired Arizona withholding percentage or to choose an additional amount to be withheld from each paycheck. Without this form, employers are required to withhold at a standard rate of 2.7%.

Can current employees change their withholding amount?

Yes, current employees can change their withholding amount or percentage anytime by submitting a new Arizona Form A-4 to their employer. This allows adjustments to withholding based on changes in financial or personal circumstances.

How do I elect a withholding percentage of zero?

To elect a withholding percentage of zero, you must certify on the Arizona Form A-4 that you expect to have no Arizona income tax liability for the current year. However, if your financial situation changes, making you liable for state income tax, it is your responsibility to submit a new form with an updated withholding percentage.

What if I’m a nonresident working temporarily in Arizona?

Nonresident employees working in Arizona for temporary periods are still subject to Arizona income tax and can choose to have Arizona income tax withheld from their wages. By completing the Arizona Form A-4, nonresidents can request their employers to withhold state income tax from their Arizona-source compensation.

Does electing not to withhold Arizona income tax relieve me from tax liabilities?

No, electing a zero withholding percentage does not exempt you from owing state income tax. You are still responsible for reporting your income and paying any Arizona income tax due when filing your annual tax return. If you anticipate owing state income tax, it’s advisable to adjust your withholding preferences.

What happens if I do not submit an updated Form A-4 for the next calendar year?

If you do not submit an updated Form A-4 for the following calendar year, your employer may default to withholding Arizona income tax from your wages at the previously determined rate. It's important to review and update your withholding preferences annually or whenever your financial situation changes.

Where should I submit the completed Arizona Form A-4?

Once completed, you should submit the Arizona Form A-4 to your employer. Your employer will use the information provided to adjust your state income tax withholding accordingly.

Common mistakes

- Not selecting only one withholding percentage from the options provided. The form requires you to check only one percentage option for withholding from your gross taxable wages. Checking multiple options or none at all is a common error.

- Failing to enter an exact amount for additional withholding if choosing the option to have an extra amount withheld from each paycheck. It’s important to write down the specific dollar amount you desire in the space provided.

- Electing a zero withholding percentage without understanding that it does not exempt you from owing Arizona income tax. This mistake can lead to an unexpected tax liability when filing your Arizona income tax return.

- Skipping the essential step of signing and dating the form. Your signature and the date validate that the election made and the information provided are accurate and to your knowledge.

- Omitting personal information, including your full name, Social Security Number, or address. This information is critical for your employer to accurately record and apply your withholding preferences.

- Incorrectly assuming the form has been updated for the current year without checking. It’s vital to ensure the form is for the correct tax year to reflect accurate withholding rates and legislations.

- Not filing a new Form A-4 when anticipated Arizona tax liability changes. Conditions changing that affect your tax liability require a prompt update to your withholding preferences.

- Forgetting to update the Arizona A-4 form with your employer if you continue to elect a zero withholding for the next calendar year. Without an updated form, employers may default to withholding Arizona income tax.

- Nonresident employees overlooking the voluntary withholding election option. Nonresidents working temporarily in Arizona should evaluate their situation to decide if they should have Arizona income taxes withheld.

Documents used along the form

When completing the Arizona Form A-4 for your withholding election, you may need to gather additional forms to ensure your payroll and tax information is accurate and comprehensive. These forms play distinct roles in managing your financial and employment records. Understanding these documents can help streamline the process of starting a new job, updating your personal information, or adjusting your withholding settings for a smoother financial management experience.

- Form W-4: This is the Employee's Withholding Certificate used at the federal level to determine the amount of federal income tax to withhold from your paycheck. It's similar to the Arizona Form A-4 but applies to your federal tax obligations.

- Form W-2: The Wage and Tax Statement is an annual form that reports an employee's total gross earnings, Social Security earnings, Medicare earnings, and federal and state taxes withheld from the employee's paycheck. This form is crucial for filing your yearly tax returns.

- Form I-9: Employment Eligibility Verification is required by the U.S. Citizenship and Immigration Services to verify an employee's identity and eligibility to work in the United States. It's a mandatory form for all employees in the U.S.

- Form A-4V: Arizona Form A-4V is a Voluntary Withholding Request form for unemployment compensation. If you're receiving unemployment compensation, you can use this form to request Arizona income tax withholding from your benefits.

- Direct Deposit Authorization Form: Many employers offer direct deposit of wages into a bank account. This optional form provides the employer with the necessary information to deposit your paycheck directly into your designated bank account, streamlining the payment process.

Each of these documents plays a vital role in ensuring your employment records and tax information are in order. While the Arizona Form A-4 allows you to specify your state withholding preferences, accompanying forms like the W-4, W-2, and I-9 facilitate proper documentation and processing of your employment and tax obligations at both federal and state levels. Hence, understanding and accurately completing these forms can significantly impact your financial wellbeing and compliance with various regulations.

Similar forms

The W-4 Form, officially titled "Employee's Withholding Certificate," closely mirrors the Arizona Form A-4 in its core purpose: to dictate the amount of federal income tax to be withheld from an employee’s paycheck. Just as the A-4 allows employees to select their desired withholding rate or opt for an additional amount to be withheld specifically for Arizona state taxes, the W-4 accomplishes the same at the federal level. Employees provide information such as marital status and dependents, which the W-4 uses to determine the appropriate amount of federal tax to withhold from each paycheck, making it a crucial document for ensuring employees are not over or underpaying their federal income tax obligations throughout the year.

The State of California DE 4 Form, or the "Employee's Withholding Allowance Certificate," serves a similar function to the Arizona A-4 form but is specific to California state taxes. This document allows employees to specify the amount of state income tax to be withheld from their paychecks based on factors like marital status, number of allowances claimed, and additional amounts if one chooses to withhold extra. The emphasis on personal financial circumstance and the objective to tailor tax withholding to the individual’s needs align closely with the intentions behind the Arizona Form A-4, making the DE 4 an essential tool for California employees managing their state tax liabilities.

The New York State IT-2104 Form, also known as the "Employee's Withholding Allowance Certificate," is akin to Arizona's A-4 in its foundational goal: to inform the employer about how much state income tax to withhold from an employee’s wages. Similar to the A-4, the IT-2104 is filled out by employees who wish to adjust the amount of state tax withheld, considering their personal allowances and expected tax credits. This adjustment ensures that the amount withheld more accurately reflects the employee’s anticipated state income tax liability, reducing the likelihood of a significant tax due or refund at year’s end.

Georgia’s Form G-4, "State of Georgia Employee’s Withholding Allowance Certificate," operates under a similar premise to the Arizona A-4, providing Georgia employees the means to customize their state tax withholdings. By specifying allowances and any additional withholding amounts, employees use the G-4 to communicate to employers how much state income tax to deduct from their paychecks. This process, paralleling the A-4’s purpose, aids employees in managing their tax responsibilities in an effort to avoid unexpected tax liabilities and promotes financial planning throughout the fiscal year.

The Colorado Form DR 0004, entitled "Employee Withholding Certificate," parallels the Arizona Form A-4 by offering Colorado employees a method to determine their state withholding levels. Employees detail their personal and financial situations through allowances and preference for additional withholdings, directing employers on the appropriate amount of state income tax to subtract from each paycheck. This ensures that employees can influence their tax withholding to better match their expected annual tax liability, a crucial aspect of personal financial management that emphasizes the importance of tailored withholding amounts for employee tax planning.

Dos and Don'ts

When filling out the Arizona A4 form, it's important that you follow specific guidelines to ensure your Arizona withholding election is accurate and meets state requirements. Here's a list of things you should and shouldn't do when completing this crucial document.

What You Should Do:

Read the instructions carefully before you begin. The form provides essential information on determining your gross taxable wages and electing your withholding percentage.

Choose only one withholding percentage or elect to have an additional amount withheld. It is critical to only check one box in the percentage options to avoid confusion or incorrect withholding.

Type or print your information legibly to prevent any errors in processing your form. Ensure your full name, Social Security Number, and address are clearly written.

Sign and date the form. An unsigned form might not be considered valid, which could lead to being defaulted to a standard withholding rate.

Submit the completed form to your employer within the first five days of employment or whenever you wish to update your withholding amount or percentage.

What You Shouldn't Do:

Do not check more than one percentage box. Selecting multiple percentages can cause processing errors and may result in incorrect tax withholdings.

Avoid leaving fields blank. If a section does not apply to you, consider filling it with "N/A" or "0" if it's numerical, especially in the additional amount section if you do not wish to withhold an extra amount.

Do not disregard updating your Form A-4 if your financial situation changes during the year. If you anticipate a tax liability or no longer qualify for zero withholding, promptly submit a new form to your employer.

Remember, filling out the Arizona A4 form accurately ensures that the correct amount of Arizona state tax is withheld from your paycheck, preventing any surprises during tax season. It's always advisable to consult with a tax professional if you're unsure how to proceed.

Misconceptions

Many people have misconceptions about the Arizona Form A-4, which can lead to confusion and mistakes in tax withholding choices. Let's clear up some of the most common misunderstandings:

- Thinking the only options are the preset percentages. Some employees believe they must choose one of the preset percentages for withholding. However, they also have the option to specify an additional dollar amount to be withheld from each paycheck.

- Assuming that selecting zero withholding means no filing of Arizona tax return is required. Choosing a zero withholding percentage does not exempt an individual from filing their state tax return. This election solely means that the employer will not withhold Arizona income tax from the employee's paycheck. Taxpayers are still responsible for filing an Arizona income tax return and paying any taxes due.

- Believing that the A-4 form is only for new employees. While new employees are expected to complete the A-4 form within the first five days of employment, current employees also need to submit a new form whenever they wish to change their withholding amount or percentage.

- Misunderstanding the definition of "gross taxable wages." Gross taxable wages are often confused with gross wages. For Arizona withholding purposes, "gross taxable wages" are the wages that will be reported in box 1 of the federal Form W-2, which are the gross wages minus any pretax deductions, like health insurance premiums.

- Assuming changes in withholding preferences take effect immediately. Changes to withholding preferences don't take effect instantly. They apply from the beginning of the payroll period after the form is filed. Hence, if the form is submitted late in a payroll period, the changes will not apply until the next payroll period begins.

- Confusing non-resident withholding rules. Some believe that if they are non-residents working temporarily in Arizona, Arizona income tax should never be withheld. In fact, non-residents can choose to have Arizona income tax withheld by submitting the A-4 form. This option can help manage their tax liabilities and should be considered based on individual circumstances.

Understanding these key points about the Arizona Form A-4 can help employees make informed choices about their state income tax withholding, ensuring they are neither over- or under-withheld at the year's end.

Key takeaways

Filling out the Arizona A4 form is an important task that every employee in Arizona must complete to ensure the correct amount of state income tax is withheld from their paycheck. Here are five key takeaways about the Arizona A4 form:

- Understanding Gross Taxable Wages: Gross taxable wages are what your employer uses to determine the amount of state income tax to withhold from your paycheck. This amount is generally your gross wages minus any pretax deductions, such as health insurance premiums.

- Choosing Your Withholding Percentage: The Arizona A4 form allows you to select a specific percentage of your gross taxable wages to be withheld for state income taxes. The percentages you can choose from range from 0.8% to 5.1%, or you can elect to withhold an additional specific dollar amount.

- New Employees' Responsibility: If you are new to an organization, it's your responsibility to fill out the Arizona A4 form within the first five days of starting your job. If you do not submit this form, your employer is required to withhold at a default rate of 2.7% of your gross taxable wages.

- Annual Update Requirement: If you wish to elect a zero withholding percentage because you expect to have no Arizona income tax liability for the current year, you must submit an updated Arizona A4 form each year to your employer. Failure to update the form may result in the withholding of state income taxes from your wages.

- Voluntary Withholding for Nonresident Employees: Nonresidents working in Arizona may not be subjected to automatic state income tax withholding. However, if these nonresident employees wish to have taxes withheld from their wages, they can choose to complete the Arizona A4 form to elect Arizona income tax withholding voluntarily.

Correctly filling out and updating the Arizona A4 form is crucial for managing your state income taxes efficiently. It ensures that the right amount of tax is withheld from your paycheck, helping to avoid surprises during tax season. Whether you're a new employee or just need to update your current withholding rate, paying attention to the details on this form can help you stay on top of your Arizona state tax obligations.

More PDF Forms

Prior Authorization Forms - Requests detailed job or business information for income verification purposes, including payment frequency and hours worked.

Az Lsu Form - Reduces the risk of transaction fallout by keeping the seller informed about the buyer's financial standing.