Fill in a Valid Arizona A1 Wp Template

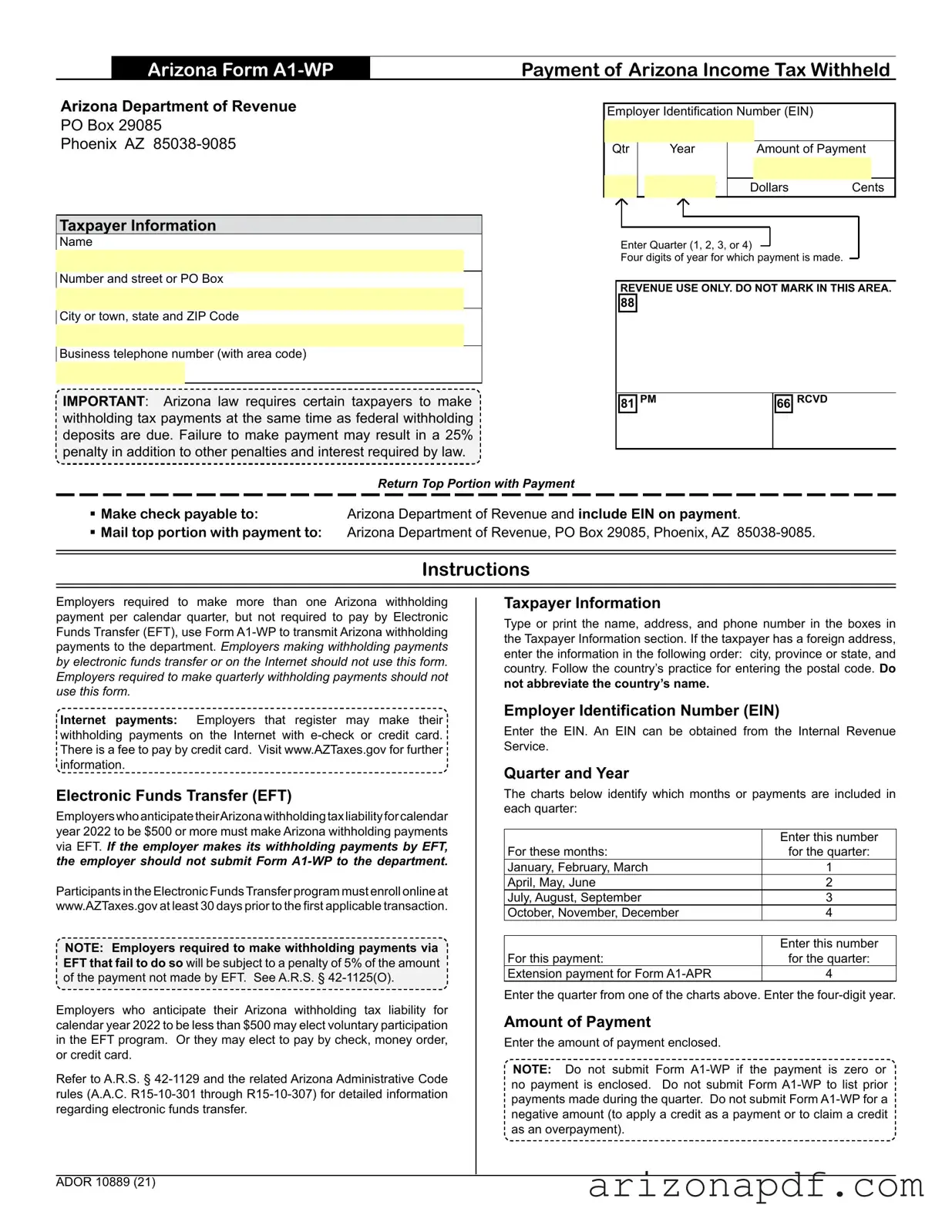

The Arizona Form A1-WP, designed for the payment of Arizona income tax withheld, represents an essential document for employers managing their tax withholding responsibilities. Administered by the Arizona Department of Revenue, this form facilitates the process for employers to transmit withholding tax payments. It is pivotal for businesses to understand the specificity of the form, which requires the employer's identification number, the specific quarter and year for which the payment applies, and the exact amount of payment. Notably, the law mandates that payments align with the respective due dates of federal withholding deposits, and any discrepancies or delays could incur a hefty 25% penalty, alongside other fines and accrued interest. This form is particularly relevant for those who are obligated to make multiple Arizona withholding payments within a calendar quarter, differing from those required to make quarterly payments or who opt for electronic mediums such as electronic funds transfer (EFT) or internet payments. The state's shift towards electronic payments is underscored by guidelines that urge employers, expecting to owe $5,000 or more in withholding taxes for the year, to utilize the EFT method; a failure to comply results in additional penalties. However, for those with expected liabilities under this threshold, participation in EFT is voluntary, promoting a streamlined, efficient process for tax payment and record keeping. The Arizona A1-WP form, therefore, stands as a crucial element in ensuring compliance and facilitating the accurate and timely payment of withheld income taxes, cementing its role in the broader framework of state tax administration.

Arizona A1 Wp Preview

Arizona Form

Payment of Arizona Income Tax Withheld

Arizona Department of Revenue

PO Box 29085

Phoenix AZ

Employer Identification Number (EIN) |

|

||

Qtr |

Year |

Amount of Payment |

|

Q Y Y Y Y |

Dollars |

Cents |

|

Taxpayer Information

Name

Number and street or PO Box

City or town, state and ZIP Code

Business telephone number (with area code)

IMPORTANT: Arizona law requires certain taxpayers to make withholding tax payments at the same time as federal withholding deposits are due. Failure to make payment may result in a 25% penalty in addition to other penalties and interest required by law.

Return Top Portion with Payment

Enter Quarter (1, 2, 3, or 4)

Four digits of year for which payment is made.

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

81 PM |

66 RCVD |

|

|

Make check payable to:Arizona Department of Revenue and include EIN on payment.

Mail top portion with payment to: Arizona Department of Revenue, PO Box 29085, Phoenix, AZ

Instructions

Employers required to make more than one Arizona withholding payment per calendar quarter, but not required to pay by Electronic Funds Transfer (EFT), use Form

Internet payments: Employers that register may make their withholding payments on the Internet with

Electronic Funds Transfer (EFT)

EmployerswhoanticipatetheirArizonawithholdingtaxliabilityforcalendar year 2022 to be $500 or more must make Arizona withholding payments via EFT. If the employer makes its withholding payments by EFT, the employer should not submit Form

Participants in the Electronic FundsTransfer program must enroll online at www.AZTaxes.gov at least 30 days prior to the first applicable transaction.

NOTE: Employers required to make withholding payments via EFT that fail to do so will be subject to a penalty of 5% of the amount of the payment not made by EFT. See A.R.S. §

Employers who anticipate their Arizona withholding tax liability for calendar year 2022 to be less than $500 may elect voluntary participation in the EFT program. Or they may elect to pay by check, money order, or credit card.

Refer to A.R.S. §

Taxpayer Information

Type or print the name, address, and phone number in the boxes in the Taxpayer Information section. If the taxpayer has a foreign address, enter the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Do

not abbreviate the country’s name.

Employer Identification Number (EIN)

Enter the EIN. An EIN can be obtained from the Internal Revenue Service.

Quarter and Year

The charts below identify which months or payments are included in each quarter:

|

Enter this number |

For these months: |

for the quarter: |

January, February, March |

1 |

April, May, June |

2 |

July, August, September |

3 |

October, November, December |

4 |

|

|

|

Enter this number |

For this payment: |

for the quarter: |

Extension payment for Form |

4 |

Enter the quarter from one of the charts above. Enter the

Amount of Payment

Enter the amount of payment enclosed.

NOTE: Do not submit Form

ADOR 10889 (21)

File Properties

| Fact | Detail |

|---|---|

| Governing Laws | Arizona Revised Statutes § 42-1129 and Administrative Code rules A.A.C. R15-10-301 through R15-10-307 |

| Purpose | Form A1-WP is used by employers to transmit Arizona withholding payments to the Department of Revenue. |

| Electronic Payments | Employers with an Arizona withholding tax liability of $5,000 or more must make payments via electronic funds transfer. |

| Penalties for Non-Compliance | Failure to make electronic payments when required results in a 5% penalty of the payment amount not made by EFT, in addition to a 25% penalty for late payment of withholding tax. |

Instructions on Utilizing Arizona A1 Wp

When needing to make a payment for Arizona income tax withheld, the Arizona A1-WP form is used to ensure that your payment is processed correctly and efficiently. This form serves as a critical piece of documentation for employers who are required to make more than one withholding payment per calendar quarter. Below are the steps to fill out this form correctly. It’s important to follow each step to avoid any issues or delays with your payment.

- Type or print the taxpayer information including the name, address, and business telephone number in the designated "Taxpayer Information" section. If dealing with a foreign address, remember to list the city, province or state, and country according to the country's format for postal codes, ensuring not to abbreviate the country name.

- Enter the Employer Identification Number (EIN) in the space provided. If you do not have an EIN, you can obtain one from the Internal Revenue Service.

- Refer to the charts provided on the form to determine the correct number for the quarter of your payment. The charts outline which months fall into each quarter. After identifying the correct quarter, enter its number (1, 2, 3, or 4).

- Insert the four-digit year for the payment next to the quarter.

- In the "Amount of Payment" section, write the total amount of your payment, including both dollars and cents.

- Confirm that the payment made matches the required Arizona withholding tax. Remember, if your withholding tax liability was anticipated to be $5,000 or more for the calendar year, you must use electronic funds transfer (EFT) and should not fill out this form.

- Ensure that you make your check payable to the Arizona Department of Revenue and include your EIN on the payment for proper identification.

- Separate the top portion of the form and mail it along with your payment to the address provided: Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

After completing these steps, your part in the process is done. The Arizona Department of Revenue will process your payment accordingly. Always double-check your entries and ensure that your payment is made before the deadline to avoid penalties or interest charges. If at any point you are required to make payments electronically or if your withholding tax liability changes significantly, adjust your payment method accordingly to stay compliant with Arizona law.

Listed Questions and Answers

What is the Arizona Form A1-WP used for?

The Arizona Form A1-WP is used by employers to transmit Arizona withholding tax payments to the Department of Revenue. It's specifically for those required to make more than one withholding payment per calendar quarter. However, it's not for use by those only needing to make quarterly payments, nor by those making payments electronically.

When should the Arizona Form A1-WP be used?

Employers who must make multiple withholding tax payments within a single calendar quarter should use the Form A1-WP. This form should not be used by those making quarterly payments or by those opting to pay through electronic funds transfer (EFT) or online methods.

Can I make withholding tax payments online instead of using Form A1-WP?

Yes, employers can register to make their withholding tax payments online using e-check or credit card through the Arizona Department of Revenue's website. However, be aware that credit card payments may incur a fee.

What are the penalties for not making withholding tax payments on time?

Failure to make timely withholding tax payments can result in a penalty of 25% of the unpaid tax, in addition to other penalties and interest as required by law.

What is the importance of including the Employer Identification Number (EIN) on the payment?

Including the Employer Identification Number (EIN) is crucial as it helps the Arizona Department of Revenue identify the taxpayer making the payment. Employers should ensure this number is included on their payment to avoid processing delays.

How are the quarter numbers determined for the Form A1-WP?

Each quarter of the calendar year corresponds to a number: 1 for January-March, 2 for April-June, 3 for July-September, and 4 for October-December. Employers should enter the correct number for the quarter during which the payment is made.

Is it possible to make a withholding tax payment by electronic funds transfer (EFT)?

Yes, employers whose Arizona withholding tax liability is anticipated to be $5,000 or more for the calendar year must make their payments via electronic funds transfer (EFT). Employers opting for EFT should not submit Form A1-WP.

What should I do if my payment amount is zero or if I want to claim a credit?

Do not submit Form A1-WP if your payment amount is zero or if you're seeking to apply a credit. This form is solely for transmitting withholding payments, not for indicating no payment or claiming credits.

Where should I mail the completed Arizona Form A1-WP?

The top portion of Form A1-WP, along with your payment, should be mailed to the Arizona Department of Revenue at the specific PO box address provided: PO Box 29085, Phoenix, AZ 85038-9085.

Can I participate in the Electronic Funds Transfer program voluntarily if my tax liability is less than $5,000?

Yes, employers with an Arizona withholding tax liability of less than $5,000 for the previous calendar year can choose to participate in the EFT program voluntarily. However, they must enroll online at the Arizona Department of Revenue's website at least 30 days before the first transaction.

Common mistakes

Completing the Arizona A1-WP form, which is used for the payment of Arizona Income Tax Withheld, can sometimes be challenging. Here are some common mistakes people make:

Not including the Employer Identification Number (EIN): The EIN is crucial for identification and must be included with your payment.

Incorrectly filling in the Quarter and Year: It's important to use the right numbers for the quarter and to write the four-digit year clearly.

Filling in the Amount of Payment inaccurately: Make sure the dollars and cents are correctly calculated and entered.

Omitting Taxpayer Information such as the name, address, and phone number: This information is essential for the processing of your payment.

Failure to mail the top portion with payment: Only the top part of the form should be mailed with your payment to the address provided.

Using the form when payments are made electronically: Employers who pay via electronic funds transfer should not submit this form.

Forgetting to make the check payable to the Arizona Department of Revenue: Additionally, always include the EIN on your payment.

Ignoring the requirement for certain taxpayers to make withholding tax payments when federal deposits are due, which can lead to penalties.

Avoiding these mistakes can help ensure your withholding tax payments are processed efficiently and without delay. Always double-check your form for accuracy before submission.

Documents used along the form

When dealing with Arizona Form A1-WP for Payment of Arizona Income Tax Withheld, several additional forms and documents often come into play, especially for employers managing withholding tax responsibilities. Understanding these documents is crucial for maintaining compliance and ensuring accurate tax administration.

- Form A1-QRT: This is the Quarterly Withholding Tax Return form. Employers use it to report the total income taxes withheld from their employees' wages each quarter. It's essential for reconciling the amounts reported on Form A1-WP.

- Form A1-APR: The Annual Payment Recap Form is used at the end of the year to summarize all the withholding tax payments made during the year. It helps in ensuring that the total amount paid matches the quarterly amounts reported.

- Form UC-018: The Arizona Department of Economic Security requires this Unemployment Tax and Wage Report. It details the wages paid to employees, which is necessary for calculating unemployment insurance tax.

- Form W-2: Wage and Tax Statements are crucial for employees at year-end, as these forms report an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form W-3: The Transmittal of Wage and Tax Statements complements Form W-2 by summarizing the total wages and taxes reported by the employer to the Social Security Administration.

- Form 1099-MISC: This form reports payments made to independent contractors and other payments such as rents and royalties. It's used by businesses that pay individuals not treated as employees.

- Form WR: The Withholding Tax Reconciliation Form is used annually to reconcile Arizona income tax withheld as reported on Forms W-2, W-3, and 1099. It ensures that the total withholding reported to the state matches the employer's payroll records.

- EFT Authorization Form: For employers required or choosing to make payments via Electronic Funds Transfer, the EFT Authorization Form initiates the process, allowing the Arizona Department of Revenue to debit the necessary tax payments directly from the employer’s bank account.

Being well-versed with these forms and documents is indispensable for employers to seamlessly manage their tax and reporting obligations to both the state and their employees. Staying informed about the purpose and requirements of each document ensures compliance, minimizes errors, and helps streamline the payroll and tax reporting processes.

Similar forms

The Arizona Form A1-APR, Payment of Annual Arizona Income Tax Withheld, shares similarities with the Arizona A1-WP form in terms of purpose and use. Both forms are designed for employers to report and pay withheld income tax to the Arizona Department of Revenue, but they differ in their frequency and context of submission. The A1-WP is used for periodic payments within a quarter, while the A1-APR is specifically for annual reporting and payment, consolidating the withheld taxes over the entire fiscal year. This distinction highlights their complementary roles in ensuring employers meet their tax withholding and remittance obligations on different schedules.

Form 941, Employer's Quarterly Federal Tax Return, is a document used at the federal level that bears resemblance to Arizona's A1-WP form in its function and frequency. This form is required by the Internal Revenue Service (IRS) for reporting income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and both serve the purpose of reconciling taxes withheld from employees with the actual remittances. The key similarity lies in their quarterly submission requirement, though they cater to different tax authorities and cover different scopes of tax liabilities.

The Form W-2, Wage and Tax Statement, while primarily an annual wage and tax report provided to employees, indirectly aligns with the Arizona A1-WP form in the ecosystem of tax documentation. The A1-WP facilitates the actual payment of withheld taxes throughout the year, which are then reported cumulatively on the W-2 forms. Both are crucial for the accurate accounting of income and taxes withheld from employees, ensuring that the withholdings reported on the W-2 are backed by actual remittance of these funds to the state treasury.

Form W-3, Transmittal of Wage and Tax Statements, works in tandem with Form W-2 but is geared toward summarizing the total earnings, social security wages, Medicare wages, and withholding for all employees of a company. It complements the Arizona A1-WP in that both are summary forms that provide a holistic view of the tax withheld and remitted. The A1-WP's focus on the payment aspect for the state contrasts with the W-3's role in consolidating this information at the federal level, highlighting the interconnectedness of payroll tax reporting requirements across jurisdictional boundaries.

Form W-4, Employee’s Withholding Certificate, though not a payment form, is integral to the process that culminates in the use of forms like the Arizona A1-WP. The W-4 allows employees to determine the amount of federal income tax withheld from their pay, which directly influences the amount that employers will later remit using the A1-WP. Therefore, while the W-4 and A1-WP serve different stages of the withholding and payment cycle, they are linked by the flow of tax withholding decisions from employee instructions to employer action.

The Electronic Federal Tax Payment System (EFTPS) instructions document serves as a federal counterpart to the A1-WP's sections regarding electronic payments. Both set forth the procedures for remitting withheld taxes electronically, emphasizing the shift towards more efficient, secure, and timely tax payments. By specifying the need for electronic funds transfer (EFT) for certain thresholds of tax liability, they highlight parallel efforts at the state and federal levels to streamline tax administration and compliance.

Form 1040, U.S. Individual Income Tax Return, while primarily for individual taxpayers, connects with the Arizona A1-WP through the concept of withheld taxes. The taxes paid via Form A1-WP impact individual employees’ tax liabilities and potential refunds when they file their Form 1040. The link is found in how withheld amounts are credited against the annual tax liability individuals report, demonstrating a direct relationship between employer remittances of withheld taxes and individual income tax filings.

The State of Arizona's Unemployment Tax Return (not a specific form name given) is similar to the Arizona A1-WP in that both involve periodic reporting and payment obligations by employers to a state agency. While the A1-WP deals with income tax withholding, the unemployment tax return addresses unemployment insurance taxes, showcasing the variety of employer contributions to state funds. Each form plays a distinct role in the broader spectrum of employment-related fiscal responsibilities, underlining the multifaceted nature of employer tax liabilities.

Dos and Don'ts

When completing the Arizona Form A1-WP for Payment of Arizona Income Tax Withheld, it's essential to adhere to specific dos and don'ts for a seamless process. Below are crucial points to remember:

- Do ensure you have the correct Employer Identification Number (EIN) before filling out the form. This number is assigned by the Internal Revenue Service and is crucial for identity purposes on the form.

- Do fill in the taxpayer information section with clear and accurate details. Type or print the name, address, and phone number in the designated boxes to avoid any misunderstanding or miscommunication.

- Do accurately enter the payment amount, specifying dollars and cents. Ensuring the correct amount is filled will prevent any discrepancies or processing delays.

- Do not use Form A1-WP if you are making more than one withholding payment per quarter and are required to pay electronically. Check if electronic funds transfer (EFT) or internet payment methods apply to you, and use the appropriate channels.

- Do not send in the form with no payment enclosed, a zero amount, or for the purpose of listing prior payments made during the quarter. Form A1-WP should only be submitted with an actual payment for the current period.

- Do not forget to choose the correct quarter and year for which the payment is being made. Using the charts provided on the form will help you identify the corresponding number for the months or payments included in each quarter.

Following these guidelines will help ensure that your payment of Arizona Income Tax Withheld is processed efficiently and accurately, minimizing the risk of errors or penalties.

Misconceptions

Understanding tax forms can sometimes be a labyrinthine task, especially when dealing with specific documents such as the Arizona Form A1-WP, which deals with the payment of Arizona income tax withheld. There are a number of pitfalls and misconceptions that can trip up even the most diligent of taxpayers. Below are seven common misconceptions about the Arizona A1-WP form:

- It's the only form for withholding tax payments: Some believe that the A1-WP is the universal form for all withholding tax payments in Arizona. However, it's specifically used by employers who are required to make more than one Arizona withholding payment per calendar quarter. Other forms and payment methods are also available and appropriate in different scenarios.

- It's suitable for quarterly payments: Despite assumptions, employers required to make quarterly withholding payments should not use this form. The A1-WP is designed for those making multiple payments within a quarter, not for quarterly payments themselves.

- Electronic payments require this form: In reality, employers making withholding payments by electronic funds transfer (EFT) or on the Internet should not use this form. Electronic payments are processed differently, and using this form in conjunction with such payments is unnecessary.

- Any business can choose to pay by EFT: While it's true that any employer can opt into the electronic funds transfer program voluntarily, there's a misconception about the requirements. Employers who anticipate their withholding tax liability to be $5,000 or more for the calendar year must make payments via EFT, making it not just an option but a requirement for some.

- Credit card payments are fee-free: Another common misconception is that payments made by credit card over the Internet come without an additional cost. However, there is a fee associated with credit card payments, a detail that businesses should take into account when planning their payment strategies.

- It's necessary to submit the form with zero payment: There's no need to submit Form A1-WP if no payment is enclosed or if the payment amount is zero. This misunderstanding could lead to unnecessary paperwork being filed with the Arizona Department of Revenue.

- Form A1-WP can be used to apply for or claim credits: Lastly, some might think this form can be used to apply a credit as a payment or to claim a credit as an overpayment. This isn't the case; Form A1-WP is strictly for the transmission of withholding payments, not for managing credits.

A clearer understanding of the Arizona A1-WP form will help employers navigate their tax obligations more effectively, ensuring that they remain compliant while optimizing their tax payment processes. Knowing what the form is — and isn't — used for is crucial in managing business finances and meeting state tax requirements.

Key takeaways

Filling out and using the Arizona A1-WP form, which is essential for the payment of Arizona income tax withheld, requires attention to detail and adherence to specific guidelines. Here are seven key takeaways to ensure the process is handled accurately:

- Timeliness is crucial: Arizona law mandates that certain taxpayers must make withholding tax payments concurrently with federal withholding deposits. Not adhering to the schedule can lead to a 25% penalty, alongside other penalties and interest mandated by law.

- Correct payment method: Payments should be made via a check payable to the Arizona Department of Revenue, with the employer's Identification Number (EIN) included on the payment. It's important to send the top portion of the Form A1-WP with the payment to the specified address.

- Electronic payments: Employers who are required to make more than one withholding payment per calendar quarter should consider electronic payment options. These include payments via e-check or credit card on the Internet, although a fee is charged for credit card payments. Employers anticipated to have a withholding tax liability of $5,000 or more must use the Electronic Funds Transfer (EFT) program.

- Employers not using EFT or internet payments should properly complete the Taxpayer Information section of the form, providing clear and accurate details, including name, address, and business telephone number.

- To participate in the EFT program, employers must enroll online at least 30 days prior to their first transaction. Note that a 5% penalty is applied to required EFT payments that are not made electronically.

- When filling out the form, it is important to correctly enter the Employer Identification Number (EIN), quarter, and year relevant to the payment. Mistakes in these entries can lead to processing errors or delays.

- Only use Form A1-WP if a payment is due. The form should not be submitted for zero payments, to list prior payments, or to apply or claim credits.

Employers should refer to the Arizona Department of Revenue's website for the most current information and guidelines on withholding tax payments and electronic payment options to ensure compliance and avoid penalties.

More PDF Forms

Arizona Filing Requirements - Enables clear communication to the court regarding the division of all types of property and debts between spouses.

Apply to the University of Arizona - Ensure your application to Arizona's top universities is complete by using the fee waiver form if paying the application fee poses a financial challenge.