Fill in a Valid Arizona A 4P Template

When individuals receive pension or annuity payments, navigating the tax implications of these distributions becomes a crucial aspect of managing their finances. In Arizona, the Form A-4P plays a significant role for annuitants who wish to have state income tax voluntarily withheld from their distributions. This form, which denotes the annuitant's request for voluntary Arizona income tax withholding, offers various withholding percentage options, ensuring that taxpayers can tailor their deductions according to their individual financial needs. Recipients of annuities or pension payments utilize this form to select their preferred withholding rate from the available choices, or to terminate a previous withholding election, ensuring that their tax obligations are met in a manner that aligns with their personal fiscal preferences. It's important to note that this election pertains only to the taxable portion of distributions, as outlined by Arizona Revised Statutes §43-404, and does not apply to non-periodic payments, lump-sum distributions, or distributions from individual retirement accounts that do not constitute an annuity. Additionally, the form cannot be used for withholding from Social Security pensions, Veterans' Administration annuities, or Railroad Retirement pensions. Once the election is made, it will remain in effect until the annuitant directly instructs the payor to stop withholding Arizona income tax, offering a measure of control over one's taxable income throughout the year. This voluntary withholding can simplify tax season for retirees, ensuring that they are not faced with unexpected tax liabilities. Furthermore, annuitants are advised to submit Form A-4P directly to the payer of their pension or annuity, not to the Arizona Department of Revenue, underscoring the personal nature of this financial decision.

Arizona A 4P Preview

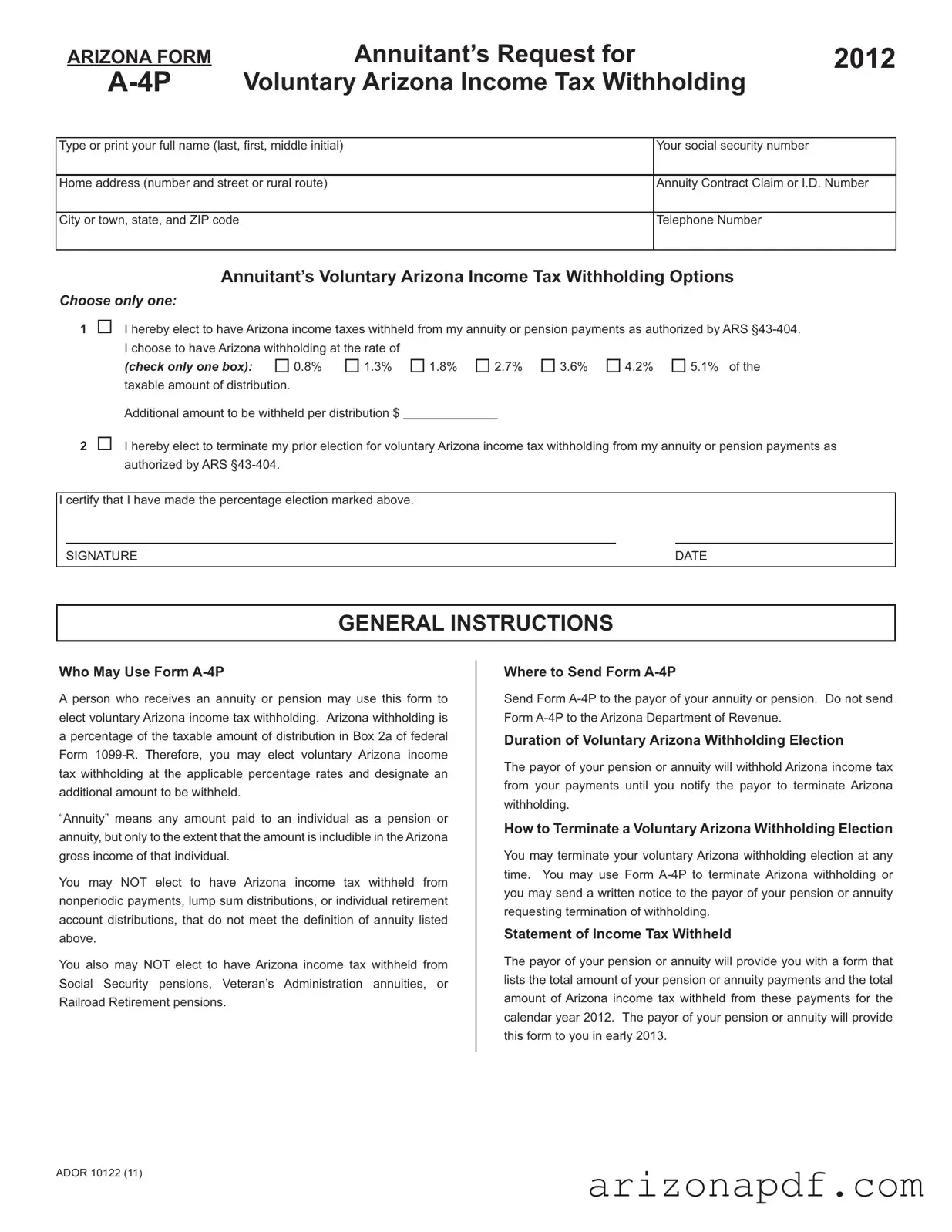

ARIZONA FORM |

Annuitant’s Request for |

2012 |

Voluntary Arizona Income Tax Withholding |

|

Type or print your full name (last, fi rst, middle initial)

Your social security number

Home address (number and street or rural route)

Annuity Contract Claim or I.D. Number

City or town, state, and ZIP code

Telephone Number

Annuitant’s Voluntary Arizona Income Tax Withholding Options

Choose only one:

1! I hereby elect to have Arizona income taxes withheld from my annuity or pension payments as authorized by ARS

(check only one box): ! 0.8% ! 1.3% ! 1.8% ! 2.7% ! 3.6% ! 4.2% ! 5.1% of the taxable amount of distribution.

Additional amount to be withheld per distribution $

2! I hereby elect to terminate my prior election for voluntary Arizona income tax withholding from my annuity or pension payments as authorized by ARS

I certify that I have made the percentage election marked above.

SIGNATURE |

DATE |

GENERAL INSTRUCTIONS

Who May Use Form

A person who receives an annuity or pension may use this form to elect voluntary Arizona income tax withholding. Arizona withholding is a percentage of the taxable amount of distribution in Box 2a of federal Form

“Annuity” means any amount paid to an individual as a pension or annuity, but only to the extent that the amount is includible in the Arizona gross income of that individual.

You may NOT elect to have Arizona income tax withheld from nonperiodic payments, lump sum distributions, or individual retirement account distributions, that do not meet the defi nition of annuity listed above.

You also may NOT elect to have Arizona income tax withheld from Social Security pensions, Veteran’s Administration annuities, or Railroad Retirement pensions.

Where to Send Form

Send Form

Duration of Voluntary Arizona Withholding Election

The payor of your pension or annuity will withhold Arizona income tax from your payments until you notify the payor to terminate Arizona withholding.

How to Terminate a Voluntary Arizona Withholding Election

You may terminate your voluntary Arizona withholding election at any time. You may use Form

Statement of Income Tax Withheld

The payor of your pension or annuity will provide you with a form that lists the total amount of your pension or annuity payments and the total amount of Arizona income tax withheld from these payments for the calendar year 2012. The payor of your pension or annuity will provide this form to you in early 2013.

ADOR 10122 (11)

File Properties

| Fact | Detail |

|---|---|

| Form Purpose | Arizona Form A-4P is used by annuitants to request voluntary Arizona income tax withholding from their annuity or pension payments. |

| Governing Law | Arizona Revised Statutes §43-404 authorizes the withholding of Arizona income taxes from annuity or pension payments. |

| Who May Use | Individuals receiving annuity or pension payments includible in Arizona gross income can use this form to elect voluntary withholding. |

| Withholding Options | Annuitants can choose to have Arizona income tax withheld at rates of 0.8%, 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1% of the taxable distribution amount, with an option to designate an additional amount for withholding. |

| Non-Eligible Payments | Arizona income tax cannot be withheld from nonperiodic payments, lump-sum distributions, individual retirement account distributions not meeting the definition of an annuity, Social Security pensions, Veteran’s Administration annuities, or Railroad Retirement pensions. |

| Terminating Election | Annuitants can terminate their voluntary Arizona income tax withholding election at any time using Form A-4P or by sending a written notice to the payor. |

| Where to Send | The completed Form A-4P should be sent to the payor of the annuity or pension, not the Arizona Department of Revenue. |

Instructions on Utilizing Arizona A 4P

Filling out the Arizona A-4P form is a straightforward process for annuitants wishing to adjust their state income tax withholding preferences. This form is your tool to communicate with the payor of your annuity or pension about how much state income tax you want withheld from your payments. Whether you're initiating, changing, or stopping your withholding, the steps below will guide you through completing the form accurately. Remember, this is about your financial wellness, ensuring you have control over your tax withholdings throughout the year.

- Type or print your full name, including last, first, and middle initial, in the designated space.

- Enter your social security number next to your name.

- Provide your home address, including number and street or rural route. Do not forget to include your city or town, state, and ZIP code.

- Fill in your annuity contract claim or I.D. Number.

- Add your telephone number where indicated.

- From the provided options, select your desired Arizona income tax withholding rate by checking only one box. Choose from 0.8%, 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1% of the taxable amount of distribution.

- If you wish to have an additional amount withheld per distribution, specify this amount in the allocated space.

- For those electing to terminate prior voluntary Arizona income tax withholding from annuity or pension payments, check the second box under "Annuitant’s Voluntary Arizona Income Tax Withholding Options" and confirm your choice is intentional.

- Sign and date the form at the bottom to certify your withholding election.

After filling out the form, send it directly to the payor of your annuity or pension. It's crucial to understand that the completion of this form affects how much state income tax is withheld from your annuity or pension payments. The withholding choice made with the Arizona A-4P remains in effect until you decide to update it by submitting a new form or cancelling the withholding instructions. Early the following year, you'll receive a statement from the payor listing both the total amount of your annuity or pension payments and the total Arizona income tax withheld, helping you reconcile your tax obligations.

Listed Questions and Answers

What is the Arizona Form A-4P?

Form A-4P, known as the Annuitant’s Request for Voluntary Arizona Income Tax Withholding, is a form that individuals receiving annuities or pension payments use to elect voluntary income tax withholding in Arizona. It allows recipients to choose a specific percentage of their distribution to be withheld for Arizona state income taxes.

Who is eligible to use Form A-4P?

Individuals who receive annuity or pension payments and wish to have Arizona income tax voluntarily withheld from their payments can use Form A-4P. However, it is not applicable for nonperiodic payments, lump sums, individual retirement account distributions that do not qualify as an annuity, Social Security pensions, Veteran’s Administration annuities, or Railroad Retirement pensions.

How does one elect to have taxes withheld using Form A-4P?

To elect for voluntary Arizona income tax withholding, an individual needs to complete Form A-4P, selecting one of the specified percentage rates for withholding. They can also designate an additional amount to be withheld per distribution. This completed form should then be sent to the payor of the annuity or pension, not to the Arizona Department of Revenue.

Can one choose not to have Arizona income taxes withheld from their annuity or pension payments?

Yes, if one previously elected to have Arizona income taxes withheld and decides to terminate this election, they can indicate this preference on Form A-4P. Alternatively, sending a written notice to the payor requesting the termination of withholding is also an option.

What are the withholding rate options available on Form A-4P?

Form A-4P provides multiple withholding rate options for the taxable amount of distribution from an annuity or pension. These rates include 0.8%, 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, and 5.1%. Annuitants can also specify an additional amount to be withheld per distribution.

How long will the voluntary Arizona withholding election remain in effect?

The election for voluntary Arizona income tax withholding will remain in effect until the annuitant notifies the payor of their pension or annuity to terminate the withholding.

Will I receive a statement of the income tax withheld?

Yes, the payor of your pension or annuity is required to provide you with a statement that lists the total amount of your pension or annuity payments alongside the total amount of Arizona income tax withheld. This statement is usually provided in the early part of the following year.

Common mistakes

When filling out the Arizona A-4P form, which is used by annuitants to request Voluntary Arizona Income Tax Withholding, there are several common errors to watch out for. Avoiding these mistakes can help ensure the process goes smoothly and your tax withholdings are accurately applied. Here are six of the most frequent missteps:

- Incorrectly Choosing Withholding Percentage: Only one box for the Arizona withholding rate should be checked. Choosing more than one or none at all can lead to incorrect withholding amounts.

- Failure to Provide Complete Identification Information: Not filling in your full name (last, first, middle initial), social security number, or annuity contract, claim, or I.D. number can result in processing delays or form rejection.

- Omitting Contact Information: Your home address, city or town, state, ZIP code, and telephone number are crucial for any necessary correspondence regarding your withholding. Leaving these fields blank may lead to communication issues.

- Not Specifying an Additional Withholding Amount: If you wish to have an additional amount withheld per distribution, forgetting to specify this amount can affect your year-end tax liability.

- Incorrect Declaration on Withholding Election: Not marking the correct option to either elect to have tax withheld or to terminate a previous election can lead to unintended withholding actions.

- Signature and Date Omissions: The form requires your signature and the date to act as a certification of your withholding choices. Skipping these can invalidate the request.

Additionally, it's worth noting some important aspects regarding the eligibility and process:

- The A-4P form is specifically for annuity or pension recipients, and not applicable to lump-sum distributions, nonperiodic payments, individual retirement account distributions not defined as annuities, Social Security pensions, Veteran’s Administration annuities, or Railroad Retirement pensions.

- Donees should send the completed A-4P form directly to the payor of the annuity or pension, not to the Arizona Department of Revenue.

- An election to withhold Arizona income tax remains effective until the payor is notified to terminate the withholding.

- A statement of income tax withheld will be provided by the payor, usually early in the year following the tax year in question.

Ensuring each of these points is addressed can streamline the withholding process, making it easier for both the annuitant and the payor to comply with Arizona state tax laws.

Documents used along the form

When dealing with the Arizona A-4P form, an annuitant's request for voluntary Arizona income tax withholding, it's important to consider other documents and forms that often accompany it or are similarly essential in managing an individual's financial and tax obligations. These forms play a role in ensuring that the financial affairs of an individual, particularly someone receiving pension or annuity payments, are in order.

- Form 1099-R: This document reports the distribution of retirement benefits, including pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. It is crucial because the Arizona A-4P form's withholding is a percentage of the taxable distribution in Box 2a of the 1099-R form.

- Form W-4P: While the A-4P is for Arizona state tax withholdings, Form W-4P is used for federal income tax withholdings from pension or annuity payments. Individuals use this form to determine the amount of federal income tax to be withheld.

- Form AZ-140: This is the Arizona Resident Personal Income Tax Return form. It is used to file individual state income tax returns with Arizona. The tax withheld by utilizing the A-4P form would be accounted for in this annual tax return.

- Form 1040: The U.S. Individual Income Tax Return is where all income, deductions, and credits are reported for federal tax purposes, which includes information from Form 1099-R related to pensions and annuities.

- Form 1099-INT: This form is used to report interest income. While not directly related to the A-4P form, individuals receiving pension or annuity payments may also have investments generating interest that needs to be reported.

Together, these documents support a comprehensive approach to tax and income management for retirees or individuals receiving annuities, ensuring compliance with both federal and state tax obligations. Understanding and correctly using these forms can help streamline financial management and avoid complications with tax filings.

Similar forms

The Federal W-4P form, titled "Withholding Certificate for Pension or Annuity Payments," bears a close resemblance to the Arizona A-4P form. The Federal W-4P form is utilized by annuitants and pension receivers to determine the amount of federal income tax to be withheld from their pension or annuity payments. Similar to the Arizona A-4P, individuals can select their withholding preferences based on their tax situation. The similarity lies in their shared purpose to manage tax withholdings directly from periodic retirement income, providing a pre-emptive approach to annual tax obligations.

Another document akin to the Arizona A-4P form is the Form 1099-R, "Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc." While the Form 1099-R reports the amount distributed and the tax withheld over the year to both the IRS and the payee, the Arizona A-4P form is an election form allowing individuals to specify how much Arizona state tax they wish to have withheld from their annuity or pension. The connection between these forms lies in their roles in managing and reporting taxable income from retirement distributions, with the A-4P enabling proactive withholding adjustments.

Arizona's Form A-4, "Employee's Arizona Withholding Election," serves a similar purpose to the A-4P but is designed for current employees rather than retirees. While Form A-4 allows employees to indicate their desired Arizona state tax withholding rate from their wages, the A-4P provides retirees the same ability with their annuity or pension payments. Both forms empower individuals to customize their state tax withholdings to fit their needs, reflecting their income sources' different nature but echoing the mechanism of taxation preference.

The Social Security Administration (SSA) provides a similar capability through its form for taxpayers to decide on the federal tax withholding rate from Social Security benefits. This parallels the A-4P's function for Arizona state tax on annuity or pension payments. Though focused on Social Security payments, the SSA's withholding election process offers retirees control over their tax liabilities, much like the A-4P form aims for state tax obligations on different retirement income. The core similarity rests in providing individuals with the option to manage tax withholdings to prevent owing significant amounts during tax season.

Dos and Don'ts

When filling out the Arizona A-4P form, it's important to pay attention to detail and understand the requirements to complete it accurately. Here are five things you should do:

- Review your annuity or pension information thoroughly before you start filling out the form to ensure you have all the necessary details at hand, such as the annuity contract claim or I.D. number.

- Choose only one withholding rate option from the list provided to avoid confusion or processing delays.

- Clearly mark your chosen tax withholding percentage or specify the additional amount to be withheld per distribution to accurately communicate your withholding preferences.

- Sign and date the form to validate it. An unsigned form is considered incomplete and will not be processed.

- Send the completed form directly to the payor of your annuity or pension, as the Arizona Department of Revenue does not process this form.

Conversely, here are five things you shouldn't do:

- Do not select more than one withholding percentage, as this can lead to processing errors and potential delays.

- Avoid leaving the signature and date fields blank, as these are crucial for verifying and processing your withholding election.

- Do not use the form to request withholding from nonperiodic payments, lump sum distributions, or distributions that do not qualify as an annuity, as specified in the general instructions.

- Do not send the form to the Arizona Department of Revenue. It should be sent to the entity that pays your annuity or pension.

- Avoid making assumptions about your withholding needs without consulting the appropriate documentation or a tax professional if you're unsure about how much to withhold.

Misconceptions

Understanding the nuances of tax forms can be challenging. As it pertains to the Arizona Form A-4P—an important document for annuitants and pension receivers in Arizona—there are several common misconceptions that ought to be clarified to ensure individuals are well-informed about their tax withholding options.

Misconception 1: The A-4P form is only for Arizona residents. This form is indeed geared towards those receiving an annuity or pension and have an Arizona income tax liability, regardless of their residency status.

Misconception 2: Form A-4P limits withholding to fixed amounts. In truth, the form allows annuitants to choose from a range of percentage rates for withholding, offering flexibility based on their tax situations. Additionally, they can specify an extra amount to be withheld from each distribution.

Misconception 3: Submitting an A-4P form will cover all tax liabilities. While the form does allow for voluntary income tax withholding which can help manage tax liabilities, individuals should consult with a tax professional to ensure all state and federal tax obligations are met.

Misconception 4: It’s mandatory to choose a withholding option. Choosing a withholding rate is completely voluntary. Annuitants have the option to not have Arizona income tax withheld from their annuity or pension payments by not submitting the form or choosing to terminate a previous election.

Misconception 5: Once submitted, the withholding choice is permanent. Annuitants can change their withholding choice at any time by submitting a new A-4P form or by providing written notice to their pension or annuity payor.

Misconception 6: The form is complex and difficult to fill out. The Arizona A-4P form is straightforward, requesting basic personal information, your choice of withholding rate, and if desired, an additional amount to withhold.

Misconception 7: All annuities and pensions qualify for withholding. The form specifies that nonperiodic payments, lump sum distributions, or distributions from individual retirement accounts that do not fit the definition of an annuity are not eligible for withholding. Furthermore, Social Security pensions, Veteran’s Administration annuities, and Railroad Retirement pensions are also exempt.

Misconception 8: The form should be submitted to the Arizona Department of Revenue. Form A-4P must be sent to the payor of the annuity or pension, not to any state department or agency.

Misconception 9: The form does not affect how individuals receive their tax statements. Annuitants will receive a statement from their payor outlining the total amount of the annuity or pension payments and the Arizona income tax withheld, which is important for tax filing purposes.

Understanding these aspects of the Arizona A-4P form is crucial for anyone receiving annuity or pension payments and residing in or paying taxes to Arizona. It ensures that they can make informed decisions about their tax withholding choices.

Key takeaways

Filling out and using the Arizona Form A-4P is essential for annuitants and pension receivers who wish to have Arizona income tax voluntarily withheld from their payments. Understanding the key aspects of this form can significantly simplify this process. Here are some key takeaways:

- Form A-4P allows individuals receiving an annuity or pension to elect for voluntary Arizona income tax withholding directly from their payments, as per ARS §43-404.

- Withholding rates can be chosen from a predefined set, including 0.8%, 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, and 5.1% of the taxable amount of distribution, with an option to designate an additional amount to be withheld per distribution.

- This form caters specifically to periodic payments such as pensions or annuities and is not applicable for nonperiodic payments, lump sum distributions, individual retirement account distributions not classified as annuities, Social Security pensions, Veteran’s Administration annuities, or Railroad Retirement pensions.

- To enact voluntary Arizona income tax withholding, the completed Form A-4P should be submitted to the payor of the annuity or pension, not the Arizona Department of Revenue.

- Once an election for voluntary Arizona withholding is made using Form A-4P, it remains in effect until the annuitant notifies the payor to terminate the withholding.

- Annuitants can terminate their voluntary Arizona withholding election at any time by either using Form A-4P for this purpose or by sending a written notice to the payor.

- At the beginning of the following tax year, the payor will provide a statement that details the total amounts of pension or annuity payments made and the total Arizona income tax withheld during the calendar year.

Understanding these points ensures annuitants and pension receivers approach the voluntary Arizona income tax withholding process informed and prepared, making financial planning more straightforward.

More PDF Forms

Does Arizona Have State Income Tax - Designed for both new hires and current employees in Arizona, facilitating their state tax withholding preferences.

Arizona State Tax Forms - Adjustments for U.S. Social Security or Railroad Retirement Act benefits are accounted for in the form.