Fill in a Valid Arizona A 4 Template

In the realm of employment in Arizona, navigating tax obligations is a critical aspect that both employers and employees must address diligently. The Arizona Form A-4, officially titled "Employee’s Arizona Withholding Percentage Election," stands as a key document in this process. It enables employees to specify the percentage of their gross taxable wages they wish withheld for state income taxes, providing options ranging from 0.8% to 5.1%, or to elect for zero withholding if they anticipate no tax liability for the year. Required by law, this election ensures that the appropriate amount of Arizona income tax is withheld from wages earned for work performed within the state, thereby streamlining the process of meeting tax obligations. New employees must complete this form within the first five days of employment to set their withholding percentage, while current employees may file a new form at any time to adjust their withholding rate or elect additional amounts to be withheld. Notably, the form also offers guidance for nonresident employees working in Arizona temporarily, allowing them to make informed decisions about their withholding needs. Understanding and effectively utilizing the Arizona A-4 form is essential for managing one’s income tax responsibilities in the state, with implications for both timely tax payments and year-end tax liabilities.

Arizona A 4 Preview

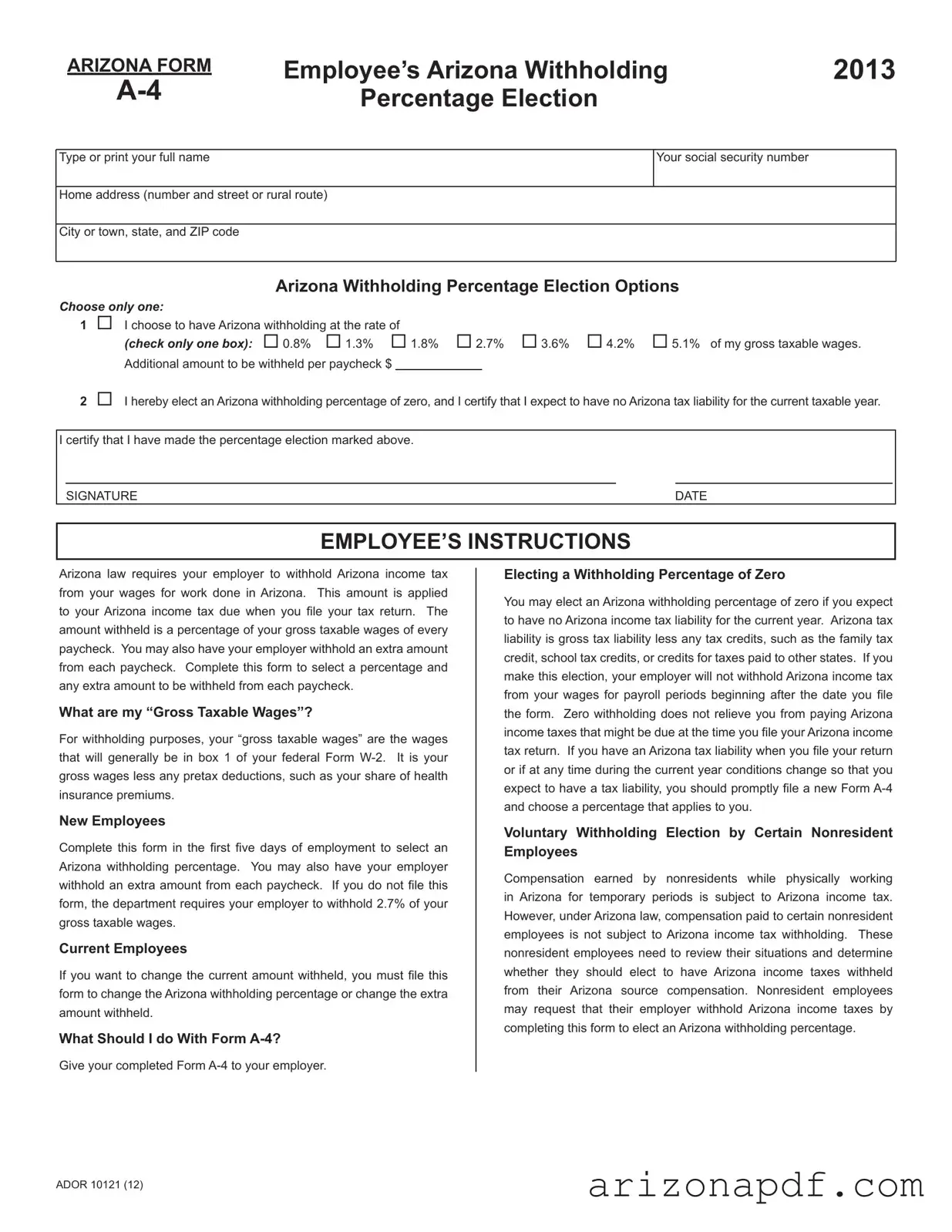

ARIZONA FORM |

Employee’s Arizona Withholding |

2013 |

|

Percentage Election |

|

||

|

|

Type or print your full name

Your social security number

Home address (number and street or rural route)

City or town, state, and ZIP code

Arizona Withholding Percentage Election Options

Choose only one:

1I choose to have Arizona withholding at the rate of

(check only one box): |

0.8% |

1.3% |

1.8% |

2.7% |

3.6% |

4.2% |

5.1% of my gross taxable wages. |

|

Additional amount to be withheld per paycheck $ |

|

|

|

|

|

|

||

2I hereby elect an Arizona withholding percentage of zero, and I certify that I expect to have no Arizona tax liability for the current taxable year.

I certify that I have made the percentage election marked above.

SIGNATURE |

DATE |

EMPLOYEE’S INSTRUCTIONS

Arizona law requires your employer to withhold Arizona income tax from your wages for work done in Arizona. This amount is applied to your Arizona income tax due when you file your tax return. The amount withheld is a percentage of your gross taxable wages of every paycheck. You may also have your employer withhold an extra amount from each paycheck. Complete this form to select a percentage and any extra amount to be withheld from each paycheck.

What are my “Gross Taxable Wages”?

For withholding purposes, your “gross taxable wages” are the wages that will generally be in box 1 of your federal Form

New Employees

Complete this form in the first five days of employment to select an Arizona withholding percentage. You may also have your employer withhold an extra amount from each paycheck. If you do not file this form, the department requires your employer to withhold 2.7% of your gross taxable wages.

Current Employees

If you want to change the current amount withheld, you must file this form to change the Arizona withholding percentage or change the extra amount withheld.

What Should I do With Form

Give your completed Form

Electing a Withholding Percentage of Zero

You may elect an Arizona withholding percentage of zero if you expect to have no Arizona income tax liability for the current year. Arizona tax liability is gross tax liability less any tax credits, such as the family tax credit, school tax credits, or credits for taxes paid to other states. If you make this election, your employer will not withhold Arizona income tax from your wages for payroll periods beginning after the date you file the form. Zero withholding does not relieve you from paying Arizona income taxes that might be due at the time you file your Arizona income tax return. If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form

Voluntary Withholding Election by Certain Nonresident Employees

Compensation earned by nonresidents while physically working in Arizona for temporary periods is subject to Arizona income tax. However, under Arizona law, compensation paid to certain nonresident employees is not subject to Arizona income tax withholding. These nonresident employees need to review their situations and determine whether they should elect to have Arizona income taxes withheld from their Arizona source compensation. Nonresident employees may request that their employer withhold Arizona income taxes by completing this form to elect an Arizona withholding percentage.

ADOR 10121 (12)

File Properties

| Fact Number | Description |

|---|---|

| 1 | The Arizona Form A-4 is used for the purpose of state income tax withholding. |

| 2 | Employees must elect their withholding rate within the first five days of employment. |

| 3 | Withholding options range from 0.8% to 5.1% of gross taxable wages. |

| 4 | An employee can elect a 0% withholding if they expect to have no Arizona tax liability for the year. |

| 5 | If the form is not submitted, employers are required to withhold at a default rate of 2.7%. |

| 6 | 'Gross Taxable Wages' are defined as wages in box 1 of the federal Form W-2 minus any pre-tax deductions. |

| 7 | Additional amounts can be elected to be withheld from each paycheck above the chosen percentage. |

| 8 | Arizona law allows compensation paid to certain nonresident employees for temporary work to be exempt from withholding. |

| 9 | Choosing zero withholding does not exempt an employee from owing Arizona income taxes at year-end. |

| 10 | The withholding percentages or additional amounts can be updated by submitting a new Form A-4. |

Instructions on Utilizing Arizona A 4

Completing the Arizona A-4 form is an important step for employees to ensure the right amount of state income tax is withheld from their wages. This form allows employees to choose a specific percentage of their gross taxable wages to be deducted each pay period, potentially averting issues when it comes time to file their Arizona state tax return. Whether you're a new hire or a current employee wishing to adjust your withholdings, the process is straightforward and crucial for managing your tax liability effectively.

- Type or print your full legal name in the designated space provided.

- Enter your social security number accurately to ensure your earnings and withholdings are correctly recorded.

- Provide your home address, including the number and street or rural route. Do not forget the city or town, state, and ZIP code.

- From the Arizona Withholding Percentage Election Options, select only one percentage for withholding. Make sure to check the box next to your desired rate. Options range from 0.8% to 5.1% of your gross taxable wages.

- If you wish to have an additional amount withheld from each paycheck on top of the percentage chosen, write that amount in the space provided.

- If applicable, elect a zero withholding percentage by choosing the second option and certifying that you expect to have no Arizona tax liability for the current year. It's important to understand that this choice means your employer will not withhold Arizona income tax from your wages. However, this does not exempt you from owing state taxes if they become due upon filing your return.

- Sign and date the form in the designated areas to validate your election. Your signature confirms the accuracy of the information provided and the withholding election made.

- Submit the completed Form A-4 to your employer. It's crucial that this step is not delayed, especially for new employees who must complete this form within the first five days of employment.

By carefully selecting your withholding rate and any additional amounts, you can better manage your tax obligations and possibly avoid owing a significant amount come tax season. Remember, conditions can change, and it's your responsibility to update this form if your expected tax liability alters during the year. Submitting the Arizona A-4 form is not just a compliance requirement but a proactive step in personal financial management.

Listed Questions and Answers

What is the purpose of the Arizona Form A-4?

The Arizona Form A-4, officially known as the Employee's Arizona Withholding Percentage Election, serves a critical role in managing an employee's income tax withholding in the state of Arizona. Required by Arizona law, this form allows employees to dictate the percentage of their gross taxable wages that must be withheld by their employer for state income taxes. The primary purpose is to aid employees in aligning their withholding with their anticipated Arizona income tax liability, thereby avoiding underpayment or overpayment of taxes.

How do I determine which Arizona withholding percentage to choose?

Choosing the correct Arizona withholding percentage requires an understanding of your gross taxable wages and your expected tax liability. Your "gross taxable wages" refer to the wages reported in box 1 of your federal Form W-2, which accounts for gross wages less any pre-tax deductions, like health insurance premiums. Review the different percentage options provided on the form, ranging from 0.8% to 5.1%, and elect the rate that best estimates your expected state tax liability for the year. Consider factors such as your income level, tax credits, and deductions when making this choice.

Can I elect to have no Arizona income tax withheld?

Yes, employees can elect to have zero Arizona income tax withheld by selecting the appropriate option on the Form A-4. This election is suitable for employees who expect to have no Arizona tax liability for the current year, considering gross tax liability and applicable credits. However, it's important to remember that choosing not to have taxes withheld does not exempt you from owing taxes that may be due when filing your Arizona income tax return. If your financial situation changes and you anticipate owing taxes, you must promptly complete a new Form A- 4 to adjust your withholding.

What should I do with the completed Form A-4?

After filling out the Form A-4, you should submit the completed document to your employer. It's essential for both new and current employees wishing to adjust their Arizona income tax withholding. New employees should complete this form within the first five days of employment, while current employees need to submit a new form whenever they want to change their withholding percentage or the additional amount withheld from their paychecks. Your employer will then adjust your withholding according to your selected rate for future payrolls.

Are nonresident employees required to fill out the Arizona Form A-4?

Nonresident employees who earn compensation while working in Arizona for temporary periods are subject to Arizona income tax and may need to fill out the Form A-4 to elect Arizona income tax withholding. However, certain nonresident employees might not be subject to automatic Arizona income tax withholding due to specific criteria outlined by Arizona law. These employees should evaluate their situation to decide if electing to have Arizona income tax withheld from their wages is necessary. Completing the Form A-4 allows them to request voluntary withholding to cover their potential Arizona income tax liabilities.

Common mistakes

When filling out the Arizona A-4 form, which is vital for determining the correct amount of Arizona income tax to withhold from an employee's wages, people often make mistakes. Being aware of these common errors can help ensure the process is done accurately, enabling both employees and employers to comply with Arizona tax laws efficiently. Below are six mistakes frequently encountered with the Arizona A-4 form:

Failing to select only one withholding percentage: The form allows for the selection of a specific withholding percentage of gross taxable wages. Choosing more than one option or failing to make a selection at all can lead to incorrect withholding amounts.

Omitting the additional amount for withholding: Employees have the option to specify an additional amount to be withheld from each paycheck on top of the selected percentage. Skipping this step, especially for those who may anticipate needing to withhold more, can result in underpayment of taxes.

Incorrectly completing personal information: The form requires precise entry of the employee's name, social security number, and address. Mistakes in this section can lead to processing delays or the form being returned for correction.

Overlooking the signature and date: An unsigned form or one lacking a date is considered incomplete. This oversight can nullify the election, defaulting the withholding rate to the state-specified percentage.

Choosing a zero withholding without qualifying: Electing a zero withholding percentage is only permissible if the employee expects to have no Arizona tax liability for the year. Misinterpreting eligibility for this option can result in underwithholding.

Not updating the form for changed circumstances: Employees must file a new A-4 form when their anticipated tax situation changes, such as expecting to owe Arizona taxes after previously electing zero withholding. Neglecting to update the form can lead to incorrect withholding.

In sum, careful attention to detail and a clear understanding of eligibility and requirements can help avoid these common mistakes on the Arizona A-4 form. Ensuring accuracy in the completion of this form is crucial not just for compliance with Arizona laws but also for accurate tax withholding, ultimately benefiting both employees and employers.

Documents used along the form

When dealing with employment and tax documentation in Arizona, particularly the Arizona Form A-4, it's important to understand that there are several other forms and documents that often accompany or are closely related to this form. These documents are vital for both employers and employees in managing tax liabilities and ensuring compliance with Arizona tax laws. Below are descriptions of up to seven forms and documents that are frequently used alongside Arizona Form A-4.

- Form W-4: The Employee's Withholding Certificate is a federal document used by employers to determine the correct amount of federal income tax to withhold from an employee's paycheck. While the A-4 specifically addresses Arizona state taxes, the W-4 is its counterpart for federal taxation.

- Form W-2: The Wage and Tax Statement is issued by employers to employees and the IRS at the end of the year. It reports an employee's annual wages and the amount of taxes withheld from their paycheck, both for federal and state taxes including those specified on the A-4 form.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. For individuals working as independent contractors or freelancers in Arizona, this form is crucial for reporting their State income when the A-4 is not applicable.

- Form I-9: The Employment Eligibility Verification form is required by the U.S. government to verify an employee's identity and eligibility to work in the United States. This form indirectly impacts withholding taxes by confirming employment status, but it does not deal directly with tax withholding.

- Form A-1: The Employer's Quarterly Withholding Tax Return is used by employers to report the total wages paid to employees and the amount of Arizona income tax withheld from those wages, aligned with the choices employees make on their A-4 forms.

- Form A-4V: This is the Voluntary Withholding Request form which allows individuals, such as those receiving pension or annuity payments, to request Arizona income tax withholding, thus extending the concept of elective withholding beyond just wages and salaries.

- Form UC-018: The Arizona Joint Tax Application for a Unemployment Tax Account Number. While not directly related to withholding tax, it's important for employers as it registers them with the state for unemployment insurance tax purposes.

In summary, while the Arizona Form A-4 is a crucial document for managing state tax withholdings, it's just one part of a broader ecosystem of employment and tax forms. These documents work in concert to ensure both compliance with tax laws and the smooth operation of payroll processes. By understanding these related documents, employers and employees can better navigate the complexities of tax withholdings and reporting in Arizona.

Similar forms

The Arizona A-4 form, a pivotal document for defining income tax withholding preferences for employees in Arizona, shares similarities with a variety of other tax and employment-related documents across the United States. Each of these documents plays a unique role in the financial affairs of employees and employers, particularly in managing taxes and payroll deductions.

The W-4 Form, or Employee's Withholding Certificate, used at the federal level, is quite similar to the Arizona A-4 form. It allows employees to determine the amount of federal income tax to be withheld from their paychecks. Like the A-4, employees fill out the W-4 to adjust their tax withholdings based on personal and financial situations, ensuring the right amount of federal tax is withheld to meet their tax liability.

The California DE 4 Form serves a similar purpose for the residents of California, allowing employees to specify their state income tax withholding preferences. Just like the A-4 form, the DE 4 is used by employees to indicate to employers how much state tax to withhold from their paychecks, based on their estimated annual tax liability, exemptions, and credits.

New York's IT-2104 form is another state-specific equivalent, enabling employees within New York to tailor their state tax withholdings. Comparable to Arizona's A-4 form, the IT-2104 allows for adjustments based on personal allowances and additional amounts to be withheld, ensuring employees can manage their state tax liabilities effectively throughout the year.

In Texas, which does not collect state income tax, there is no direct equivalent to the A-4 form, showcasing the variability in state tax laws across the United States. However, residents may still encounter similar documentation for other purposes, such as the Texas Franchise Tax form for businesses, highlighting the diversity in tax-related documentation needs based on geographical and occupational differences.

For individuals working in multiple states or moving between states, the Certificate of Non-Residence or Allocation of Withholding Tax (often seen with different names and form numbers across states) serves a similar purpose. It allows them to claim exemptions or adjustments in withholding based on the states' reciprocity agreements or their residency status, reminiscent of the nonresident considerations in the Arizona A-4 form.

On a more specialized note, the W-4P Form is utilized by recipients of pensions, annuities, and certain other deferred compensation plans to determine the amount of federal income tax withholding. Similar to the A-4 form's function for wage earners, the W-4P enables retirees and others to adjust their tax withholdings according to their expected tax liability.

The W-4V, or Voluntary Withholding Request, allows Social Security and other federal benefit recipients to request withholding for federal taxes, an option that mirrors the elective nature of withholding adjustments found in the A-4 form. It provides a means for individuals receiving government payments to manage their tax responsibilities proactively.

Lastly, the 1099-MISC and 1099-NEC forms, while primarily for reporting purposes, indirectly relate to the topic of withholding, as they may trigger the need for individuals to adjust their withholding amounts on wage earnings forms like the A-4, if they have additional income not subject to withholding.

Each of these documents, while catering to different facets of tax and employment law, collectively ensure that individuals can navigate their tax obligations with a degree of personalization and foresight, echoing the objectives of Arizona's A-4 form.

Dos and Don'ts

When filling out the Arizona A-4 form, it's important to consider a list of dos and don'ts to ensure the process is completed correctly and effectively. Below are guidelines to help you navigate through this process with confidence.

Things You Should Do

- Ensure that you type or print your full name, social security number, and home address clearly to prevent any misunderstandings or processing delays.

- Review the Arizona Withholding Percentage Election Options thoroughly and select only one option that best suits your expected tax liability for the year.

- If you anticipate a need for additional withholding beyond the chosen percentage, specify the exact amount in the space provided for an additional amount to be withheld per paycheck.

- Complete this form within the first five days of your employment to meet state requirements and avoid default withholding rate.

- Sign and date the form to certify your election and validate the document.

- If expecting to have no Arizona tax liability for the current year, elect a withholding percentage of zero by marking the appropriate option and certifying your expectation.

- Keep a copy of this form for your records after submission to your employer for future reference or in case of discrepancies.

Things You Should Not Do

- Do not choose more than one withholding percentage option, as this can cause processing issues and potentially delay your form’s acceptance.

- Avoid leaving the form incomplete; ensure all required fields are filled out to avoid unnecessary complications with your withholding taxes.

- Do not forget to sign and date the form, as an unsigned form is considered invalid and will not be processed.

- Refrain from ignoring the instructions provided in the Employee’s Instructions section to ensure you're filling out the form correctly.

- Avoid delaying the submission of this form if you are a new employee or wish to make changes to your current withholding amount.

- Do not elect a zero withholding percentage without being certain that you expect to have no Arizona tax liability, as this might result in underpayment penalties.

- Do not neglect to inform your employer promptly by submitting a new Form A-4 if your situation changes and you now expect to have Arizona tax liability.

Misconceptions

Understanding the Arizona Form A-4, also known as the Employee’s Arizona Withholding Percentage Election, is crucial for accurate tax filing and compliance with state laws. However, there are several misconceptions associated with this form. Here are nine common misunderstandings and their clarifications:

- Misconception 1: The percentage rates on the form are arbitrary.

Each percentage rate option provided on the form corresponds to a specific withholding rate that impacts the amount of state income tax withheld from an employee's paycheck, carefully determined to allow for accurate tax withholding.

- Misconception 2: You must choose a withholding percentage other than zero.

An employee can elect a withholding percentage of zero if they confidently expect to have no Arizona tax liability for the current year, debunking the idea that a non-zero rate must always be selected.

- Misconception 3: If you select a withholding percentage of zero, you will not owe any state taxes.

Selecting zero does not absolve an employee from potential tax liability; it simply means no tax is withheld from paychecks. Employees could still owe taxes when filing their annual return.

- Misconception 4: Only Arizona residents can elect to have taxes withheld.

Nonresident employees working in Arizona for temporary periods can also opt to have state income taxes withheld by electing a withholding percentage, extending tax compliance responsibilities beyond just residents.

- Misconception 5: Changes to withholding cannot be made after the initial election.

Employees can file a new Form A-4 at any time to adjust their withholding percentage or additional amount withheld, allowing for flexibility in response to changes in tax liability expectations.

- Misconception 6: The form is only for new employees.

While new employees are required to complete the form within the first five days of employment, current employees are also encouraged to submit a new form if they wish to adjust their withholding settings.

- Misconception 7: Filing this form is optional.

Arizona law mandates that employers withhold state income tax from employee wages, necessitating the completion of Form A-4 to specify withholding preferences.

- Misconception 8: Gross taxable wages are the same as gross pay.

For the purposes of withholding, "gross taxable wages" are defined as gross wages minus any pretax deductions, such as health insurance premiums, not simply the total amount earned before taxes.

- Misconception 9: Additional withholding is not allowed.

Employees can choose to have an additional amount withheld from each paycheck beyond the standard percentage elected, providing an additional layer of customization to their tax withholding plan.

Carefully understanding the options and requirements of the Arizona Form A-4 is essential for both compliance and personal financial planning. Correcting these misconceptions ensures employees make informed decisions about their state income tax withholding preferences.

Key takeaways

Understanding how to properly complete and use the Arizona Form A-4 can significantly impact an individual's tax responsibilities and compliance with state law. Arizona requires employees to declare their preferred rate of income tax withholding through this form, which serves as a crucial document for managing state income tax obligations.

When first employed or when intending to change the withholding rate, employees must fill out the Arizona Form A-4 to indicate their chosen rate of state income tax withholding. This rate ranges from 0.8% to 5.1% of their gross taxable wages, or they may elect for 0% withholding if they expect to have no Arizona tax liability for the year. It is important for the employee to accurately anticipate their tax obligation to avoid under-withholding, which could result in owing taxes at the end of the year, or over-withholding, which reduces their take-home pay but could result in a tax refund.

The "Gross Taxable Wages" for the purposes of the A-4 form are defined as an employee's before-tax earnings minus any pre-tax deductions, like health insurance premiums. These gross taxable wages are what the selected withholding percentage will be applied to. This definition ensures that the withholding is based on the employee's actual taxable income, rather than the total gross pay before deductions.

Completing the form promptly is critical. New employees have five days from the start of their employment to submit the form with their withholding preference. Failing to submit this form within the specified timeframe will result in the employer withholding at a default rate of 2.7% of gross taxable wages. This rule ensures that withholding begins immediately with employment but affords a brief period for the employee to consider their tax situation and make an informed decision.

Zero withholding election entails a certification by the employee that they expect no Arizona tax liability for the current year. However, it's essential for employees to reconsider their withholding rates if their financial situation changes during the year that may result in an Arizona tax liability. Submitting a new Form A-4 allows adjustments to withholdings to reflect these changes, helping avoid unexpected tax bills or penalties at the year's end.

Nonresident employees working in Arizona for temporary periods are subject to state income tax and must decide whether to elect having Arizona income tax withheld from their wages. This decision requires a nuanced understanding of one's tax liability and may necessitate consulting with a tax professional, especially if their residency status or duration of work in Arizona complicates their tax situation.

By carefully considering these key takeaways, employees can better manage their Arizona state income tax liability, ensuring compliance with state regulations while optimizing their financial outcomes throughout the year.

More PDF Forms

Undesignated Felony - This legal provision aims to support rehabilitation by opening pathways for individuals with undesignated class 6 felonies to amend their records, provided they haven't committed serious or weapon-involved crimes.

Do I Need a Business License to Sell Online in Arizona - The JT-1 form serves as a joint tax application for state and unemployment insurance tax registrations.

Making a Contract for Small Business - Details any contingencies that must be met before the sale can be finalized, such as financing or zoning approvals.