Fill in a Valid Arizona 74 Template

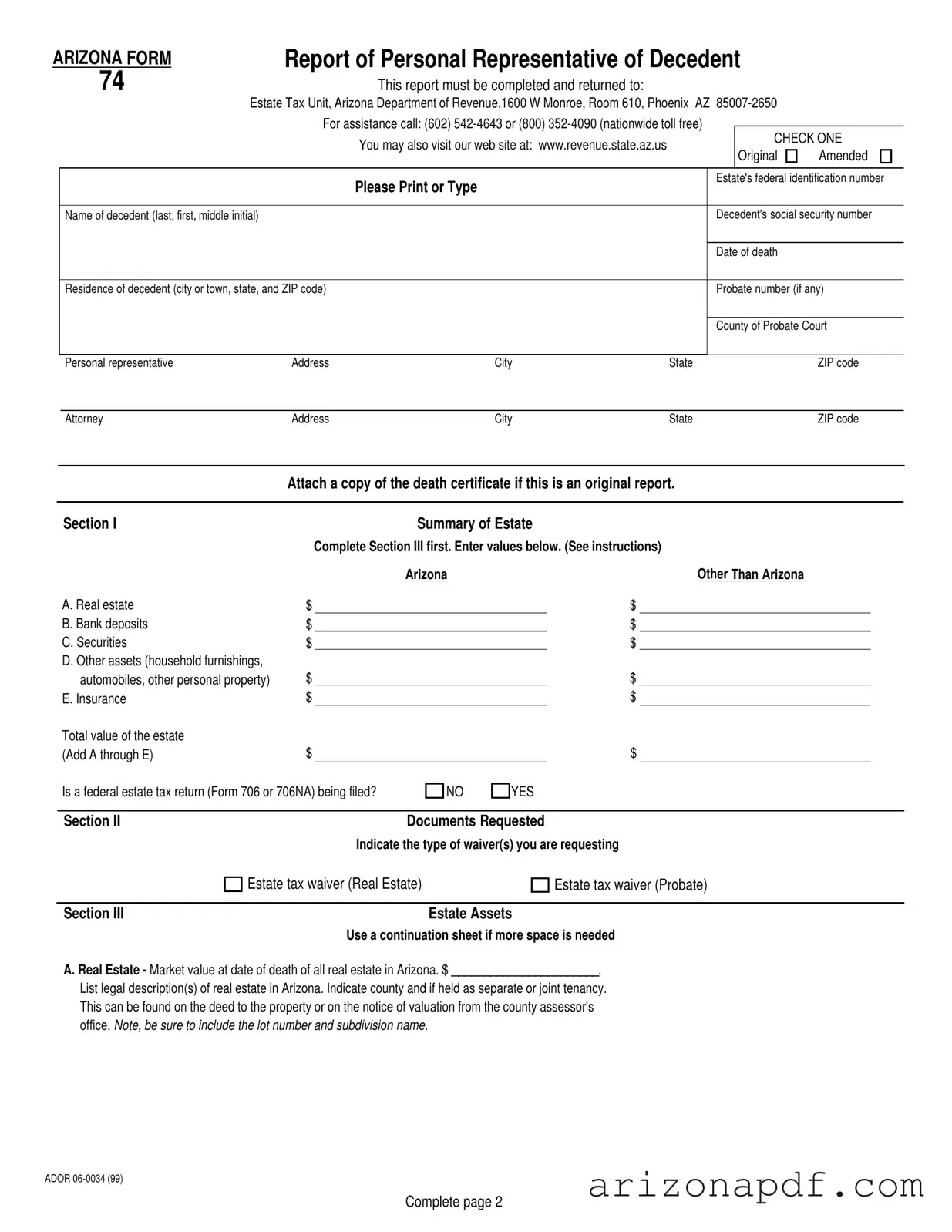

When a loved one passes away, managing their estate can become an essential but challenging task for their personal representative or executor. This is where the Arizona 74 form plays a crucial role. Also known as the Report of Personal Representative of Decedent, this form is a comprehensive document designed to streamline the reporting process to the Estate Tax Unit of the Arizona Department of Revenue. It helps ensure that all assets, including real estate, bank deposits, securities, other personal assets, and even insurance, are accurately accounted for. The form requires detailed information about the decedent, such as their name, social security number, date of death, and residency details, along with the federal identification number of the estate. Whether it's an original report or an amendment, the personal representative must also decide if a federal estate tax return needs to be filed, based on the total value of the estate. Additionally, specific waivers related to estate tax can be requested through this form. It serves as both a methodical guide for personal representatives to follow and a legal requirement to ensure proper handling and reporting of the decedent’s assets, making the already difficult time a bit more manageable.

Arizona 74 Preview

ARIZONA FORM |

Report of Personal Representative of Decedent |

|

|

||||||||

74 |

|

|

This report must be completed and returned to: |

|

|

|

|

|

|||

|

Estate Tax Unit, Arizona Department of Revenue,1600 W Monroe, Room 610, Phoenix AZ |

|

|

||||||||

|

|

|

For assistance call: (602) |

|

|

|

|||||

|

|

|

|

You may also visit our web site at: www.revenue.state.az.us |

|

|

CHECK ONE |

||||

|

|

|

|

|

|

Original |

Amended |

||||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print or Type |

|

|

|

Estate's federal identification number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of decedent (last, first, middle initial) |

|

|

|

|

|

|

Decedent's social security number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Residence of decedent (city or town, state, and ZIP code) |

|

|

|

|

Probate number (if any) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County of Probate Court |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal representative |

Address |

City |

|

State |

|

|

|

ZIP code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Attorney |

Address |

City |

|

State |

|

|

|

ZIP code |

||

|

|

|

|

|

|

|

|

|

|

||

|

|

Attach a copy of the death certificate if this is an original report. |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Section I |

|

|

Summary of Estate |

|

|

|

|

|

|

|

|

|

Complete Section III first. Enter values below. (See instructions) |

|

|

|

|

|

||||

|

|

|

|

Arizona |

|

|

Other Than Arizona |

|

|

||

|

A. Real estate |

$ |

|

|

$ |

|

|

|

|

|

|

|

B. Bank deposits |

$ |

|

|

$ |

|

|

|

|

|

|

|

C. Securities |

$ |

|

|

$ |

|

|

|

|

|

|

|

D. Other assets (household furnishings, |

|

|

|

|

|

|

|

|

|

|

|

automobiles, other personal property) |

$ |

|

|

$ |

|

|

|

|

|

|

|

E. Insurance |

$ |

|

|

$ |

|

|

|

|

|

|

|

Total value of the estate |

|

|

|

|

|

|

|

|

|

|

|

(Add A through E) |

$ |

|

|

$ |

|

|

|

|

|

|

Is a federal estate tax return (Form 706 or 706NA) being filed?

NO

YES

Section II |

Documents Requested |

Indicate the type of waiver(s) you are requesting

Estate tax waiver (Real Estate)

Estate tax waiver (Probate)

Section III |

Estate Assets |

|

Use a continuation sheet if more space is needed |

A. Real Estate - Market value at date of death of all real estate in Arizona. $ _______________________.

List legal description(s) of real estate in Arizona. Indicate county and if held as separate or joint tenancy. This can be found on the deed to the property or on the notice of valuation from the county assessor's

office. NOTE, BE SURE TO INCLUDE THE LOT NUMBER AND SUBDIVISION NAME.

ADOR

Complete page 2

Form 74 Page 2

B. Bank Deposits - List accounts in financial institutions.

Name of bank or other institution |

Type of account |

Balance at date of death |

|

|

|

Total Value |

$ __________________ |

|

|

|

|

|

C. Securities - List all stocks, bonds, and other securities that were owned by the decedent. |

|

|

||

Name of company |

Number of shares |

Value at date of death |

||

Total Value |

$ __________________ |

D. Other Assets - List other assets (household furnishings, motor vehicles, and other personal property).

Total Value |

$ __________________ |

E. Insurance - Insurance on decedent's life (owned by the decedent).

Total Value $ __________________

Under penalty of perjury, I declare that I have examined this report, including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Personal Representative / Surviving Joint Tenant / Attorney

Name (typed or printed) |

|

Social security number or federal employer identification number |

|

|

|

Address |

|

|

|

|

|

City |

State |

ZIP code |

|

|

|

Signature of representative |

Date |

Phone number |

ADOR

File Properties

| Fact | Detail |

|---|---|

| Form Name and Number | Arizona Form 74: Report of Personal Representative of Decedent |

| Required Submission | This report must be submitted to the Estate Tax Unit of the Arizona Department of Revenue. |

| Purpose | To summarize the estate of a deceased individual, including real estate, bank deposits, securities, and other assets within and outside of Arizona. |

| Governing Law | Guided by Arizona state laws regarding the estate of deceased persons and may involve federal estate tax regulations if applicable. |

Instructions on Utilizing Arizona 74

Filling out Arizona Form 74, the Report of Personal Representative of Decedent, is a crucial step in managing the estate of a loved one who has passed away. This form allows the state to assess the assets within the estate, ensuring that all tax obligations are met. Before diving into the form, it's important to gather all necessary documents such as death certificates, property deeds, bank statements, and stock certificates. This preparation streamlines the process, making it less daunting. Now, let's break down the steps to fill out the form accurately and efficiently.

- At the top of the form, select between "Original" or "Amended" to indicate the type of report you're filing.

- Enter the estate's federal identification number, the name of the decedent (including last, first, and middle initial), and the decedent's social security number.

- Fill in the date of death and the residence of the decedent, including city or town, state, and ZIP code.

- If available, enter the probate number and the county of the Probate Court.

- Type in the personal representative’s full address including city, state, and ZIP code. Repeat this step for the attorney's address if applicable.

- Attach a copy of the death certificate if this is an original report submission.

- Before completing Section I, jump to Section III as suggested by the form instructions. List all assets including real estate, bank deposits, securities, other assets such as household furnishings or automobiles, and insurance benefits.

- In Section I, summarize the estate's assets. Enter the total values for real estate, bank deposits, securities, other assets, and insurance under both Arizona and other locations columns.

- Answer whether a federal estate tax return (Form 706 or 706NA) is being filed by selecting "YES" or "NO".

- In Section II, indicate the type of waiver(s) you're requesting: 'Estate tax waiver (Real Estate)' and/or 'Estate tax waiver (Probate)'.

- Provide detailed information on estate assets in Section III according to the headings: real estate, bank deposits, securities, other assets, and insurance. Use a continuation sheet if more space is needed.

- Print or type the personal representative/surviving joint tenant/attorney's name. Enter their social security number or federal employer identification number, full address, including city, state, ZIP code, and finally, sign and date the form. Provide a contact phone number.

After filling out the form, it's imperative to review all sections carefully to ensure accuracy and completeness. Double-check numbers, dates, and spellings. Inaccurate or incomplete forms can delay processing and might require resubmission. Once the form is completed and checked, submit it to the Arizona Department of Revenue, Estate Tax Unit, as directed on the form. Timely and accurate completion of Form 74 facilitates a smoother process in managing the decedent's estate, ensuring compliance with state requirements.

Listed Questions and Answers

What is Arizona Form 74 and when do I need to use it?

Arizona Form 74, known as the Report of Personal Representative of Decedent, is a document required by the Arizona Department of Revenue, specifically by its Estate Tax Unit. This form is pivotal for personal representatives of a deceased individual's estate. It's used to report the value of the estate's assets, including real estate, bank deposits, securities, and other assets like household furnishings and automobiles. If you are managing the estate of someone who recently passed away, you'll need to complete and return this form if the estate has assets in Arizona. It's also necessary to attach a death certificate if this is the original report being filed.

How do I determine if I need to file a federal estate tax return alongside Form 74?

Within the Form 74, there's a specific query about whether a federal estate tax return, Form 706 or 706NA, is being filed. This hinges on the total value of the estate and the applicable federal estate tax thresholds at the time of death. Generally, you're required to file a federal estate tax return if the gross value of the decedent's estate exceeds the federal exemption amount in the year of the decedent's death. It's advisable to check the current exemption threshold since it can change due to inflation adjustments or legislative changes. If the estate's value surpasses this limit, a federal estate tax return should be filed alongside Form 74.

What types of waivers can I request through Form 74, and how do they work?

In the section labeled "Documents Requested," Form 74 allows personal representatives to request two specific types of waivers: an estate tax waiver for real estate and an estate tax waiver for probate. Requesting these waivers is a crucial step in the estate administration process. An estate tax waiver for real estate allows for the transfer of the property title without tax implications. Similarly, an estate tax waiver for probate is essential for the estate settlement process, ensuring that assets can be distributed to heirs or beneficiaries without being held up due to tax claims by the state. Essentially, these waivers signal to the state that all or a portion of the estate's tax liabilities have been satisfied, or that the estate is exempt, facilitating a smoother transfer of assets.

How should I go about completing Section III of the form, concerning estate assets?

When approaching Section III of Form 74, it's crucial to provide detailed information about each asset within the estate. Begin by listing all real estate in Arizona, including its market value at the date of death and legal descriptions. For bank deposits and securities, you should include the names of institutions or companies, types of accounts or securities, and their values at the date of death. Other assets, such as household furnishings, motor vehicles, and personal property, must also be documented with their total value. Finally, insurance on the decedent's life, if owned by the decedent, should be listed with its total value. Be thorough and accurate, as this information is vital for properly assessing the estate's value and any taxes or waivers that may apply. If additional space is needed, use a continuation sheet, making sure to provide as complete a picture of the estate's assets as possible.

Common mistakes

Completing the Arizona Form 74, known as the Report of Personal Representative of Decedent, is crucial in the process of managing and settling a decedent's estate within the state of Arizona. It is essential to approach this form with care to avoid common mistakes that could delay or complicate the administration of the estate. Here are six common mistakes made when filling out the Arizona Form 74:

- Not attaching a copy of the death certificate when filing an original report. This document is essential for verifying the decedent's death and is a mandatory attachment.

- Incorrectly reporting the estate's federal identification number, or the decedent's social security number. Accuracy in these numbers is critical for identification and processing purposes.

- Omitting details about the decedent's residence at the time of death. Providing the complete city or town, state, and ZIP code is necessary for legal and tax purposes.

- Failing to complete Section III before Section I as instructed. Section III provides a detailed listing of estate assets which is summarized in Section I.

- Inaccurate valuation of estate assets, including real estate, bank deposits, securities, and other personal property. It's crucial to provide market values as of the date of death to ensure the accurate assessment of the estate.

- Forgetting to request the necessary waivers in Section II for the estate. Understanding whether an estate tax waiver for real estate or probate is needed is important for compliance with Arizona laws.

Addressing these mistakes can significantly streamline the process, ensuring that the estate is managed efficiently and in compliance with Arizona Department of Revenue requirements. Proper attention to detail and thoroughness in completing the Arizona Form 74 helps avoid delays and potential legal complications during a time that is often stressful for those managing the affairs of a loved one.

Documents used along the form

In the process of estate management and closure in Arizona, filing the Arizona Form 74, known as the Report of Personal Representative of Decedent, is a crucial step. This form ensures that the estate of the deceased is properly reported to the Arizona Department of Revenue. However, to comprehensively address all the legal and financial aspects of closing an estate, several additional documents often come into play alongside Form 74. Understanding these documents can help in navigating the complexities of estate settlement more effectively.

- Death Certificate: A certified copy of the death certificate is a prerequisite for nearly all transactions and filings related to the decedent’s estate. It serves as a legal proof of death, and it is crucial for validating the Arizona Form 74 among other legal processes.

- Will and Testament: The decedent’s will provides a roadmap for the distribution of their assets in accordance with their wishes. It outlines beneficiaries, executors, and can provide specific instructions for the dispersal of the estate.

- Appointment of Personal Representative (Letters Testamentary or Letters of Administration): This document issued by the probate court formally authorizes an individual to act as the executor or personal representative of the estate. It is necessary for conducting business on behalf of the estate.

- Inventory and Appraisal Form: This is a detailed list of the decedent’s assets at the time of death, including real estate, personal property, securities, and other assets. The appraisal values serve as a basis for tax calculations and equitable distribution among heirs.

- Notice to Creditors: A notice to creditors is published in a local newspaper and may also be sent directly to known creditors. This action is essential to notify potential claimants of the estate settlement process and to settle the decedent’s outstanding debts in a timely manner.

Each of these documents plays a vital role in the estate settlement process, working alongside the Arizona Form 74 to ensure a smooth, orderly, and law-compliant transition of the decedent's assets. Handling these documents with care and within legal timeframes ensures the personal representative fulfills their duties effectively, laying a solid foundation for the resolution of the deceased person’s final affairs.

Similar forms

The Internal Revenue Service (IRS) Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, shares several core characteristics with Arizona's Form 74. Both documents are essential for reporting the financial aspects of an estate following someone's death. Form 706 is utilized to report the value of the decedent's estate to the federal government, determining any owed estate taxes, mirroring Arizona Form 74's function at the state level. They each require detailed listings of assets, including real estate, bank deposits, securities, and other personal property, to accurately assess the estate's total value. Furthermore, decisions regarding the filing of these forms hinge on whether the value of the estate surpasses specific thresholds, with Form 706 focusing on federal thresholds, while Form 74 applies state-specific criteria.

Another document bearing resemblance to Arizona Form 74 is the IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Form 1041 is vital for reporting income accumulated by the estate or trust after the decedent's death. Similar to Form 74, which tallies the total asset value within the estate for state-level estate tax considerations, Form 1041 ensures that any income generated by the estate's assets is appropriately taxed at the federal level. Both forms serve to ensure the decedent's estate complies with respective tax obligations, although focusing on different aspects of tax law—estate valuation for Form 74 and income taxation for Form 1041.

Comparable in purpose, the state-specific Real Estate Transfer Tax forms, which many states require upon the transfer of property following a death, also share attributes with Arizona Form 74. While Form 74 encompasses a broader estate overview, both sets of forms are crucial for legal and tax processing after someone passes away. Real Estate Transfer Tax forms specifically focus on the valuation and taxation of real estate transactions. They require similar detailed information about property included within an estate, such as market value and legal descriptions, akin to the real estate section in Arizona's Form 74.

The Affidavit for Collection of Personal Property, another document filed in many states, parallels Arizona Form 74 by facilitating the transfer of assets without formal probate. This affidavit allows for a simpler asset collection process for estates under a certain value, sharing Form 74's goal of asset distribution but differing in procedural complexity and applicability based on the estate's total value. Both documents necessitate an inventory and valuation of assets, ensuring heirs receive their rightful inheritance while complying with state laws.

Lastly, the Demand for Notice form in probate proceedings, while not a tax document, aligns with Arizona Form 74's role in the estate administration process. Individuals file this form to receive notifications about probate court proceedings related to an estate, ensuring transparency and allowing for potential objections to be raised. Similarly, Arizona Form 74 provides a structured report of the estate's assets and liabilities, integral to the probate process, ensuring all interested parties are informed of the estate's valuation and tax obligations under state law.

Dos and Don'ts

When completing the Arizona 74 form, also known as the Report of Personal Representative of Decedent, it's crucial to approach the process thoroughly and accurately to ensure compliance with the Arizona Department of Revenue. Here are some guidelines to help you navigate the form correctly:

- Do start by gathering all necessary documents and information regarding the decedent's estate, including bank statements, property deeds, and insurance policies. This will make the completion process smoother.

- Do carefully read all instructions provided on the form to ensure that you understand each section's requirements.

- Do complete Section III first, as instructed on the form. This section asks for a detailed list of the estate's assets, which is essential for accurately filling out other parts of the form.

- Do attach a copy of the death certificate if you are submitting an original report. This is an essential document for the Arizona Department of Revenue to process the form.

- Do make sure to check the appropriate box indicating whether the submission is an original or amended report. This helps the department process your form efficiently.

- Don't forget to provide the estate's federal identification number and the decedent's social security number. These identifiers are critical for tax purposes.

- Don't leave any sections blank. If a section does not apply, it's better to indicate this with a "N/A" or "None" to confirm that the section was not overlooked.

- Don't hesitate to seek assistance if you have questions or encounter difficulties while filling out the form. Utilizing the contact information provided on the form for support can prevent errors and ensure the report is completed correctly.

Attention to detail and careful adherence to these dos and don'ts can significantly streamline the process of completing the Arizona 74 form, ensuring that the report is accurate and compliant with state requirements.

Misconceptions

Understanding the Arizona Form 74 can be confusing, leading to misconceptions that may complicate the process for the personal representatives of decedents. Here are eight common misunderstandings and their clarifications:

- All estates must file Form 74. This is not necessarily the case. The requirement to file Form 74 is specifically for those estates that need to report their assets to the Arizona Department of Revenue. It's important to check the current requirements, as they can change and may not apply to every estate.

- Form 74 is only for Arizona residents. While Form 74 is an Arizona-specific document, it must be completed by the personal representative of any decedent who owned real estate or other taxable assets in Arizona, regardless of the decedent’s state of residence.

- The form is complicated and can only be completed by an attorney. Although having an attorney can help navigate the complexities of estate administration, personal representatives can fill out and submit Form 74 themselves. The instructions provided are designed to guide individuals without legal expertise.

- There’s no deadline for filing Form 74. Like most tax-related documents, there are deadlines for submitting Form 74. Failing to file on time can result in penalties. Always check the most recent guidelines from the Arizona Department of Revenue for current deadlines.

- Real estate values should be estimated by the personal representative. The market value of real estate at the date of death should be accurately reported on Form 74. This typically requires an appraisal by a qualified professional, rather than an estimate by the personal representative.

- Bank accounts in joint tenancy do not need to be reported. Even if the decedent held bank accounts in joint tenancy, these accounts might still need to be reported on Form 74, depending on the total value of the estate and other factors.

- All assets need an appraisal. While significant assets like real estate usually require an appraisal, not all assets reported on Form 74 will need one. For items like household furnishings or vehicles, a fair market value estimate may suffice.

- Filing Form 74 means a federal estate tax return isn’t necessary. Filing Form 74 with the Arizona Department of Revenue and filing a federal estate tax return are separate obligations. Whether a federal estate tax return (Form 706 or 706NA) needs to be filed depends on the total value of the estate and federal tax laws.

Dispelling these misconceptions about Arizona Form 74 ensures that personal representatives can fulfill their duties more effectively, adhering to Arizona laws and regulations regarding estate reporting. When in doubt, seeking advice from a professional experienced in estate planning and tax law in Arizona can provide clarity and direction.

Key takeaways

Filing the Arizona 74 form, also known as the "Report of Personal Representative of Decedent," requires careful attention to detail and accuracy. Here are five key takeaways to ensure the form is filled out correctly and its use is maximized:

- Complete Section III before others: The form specifically instructs to fill out Section III first. This part deals with the estate assets, requiring a detailed breakdown of items such as real estate, bank deposits, stocks, and personal property. This approach helps in providing a structured summary of the estate which is necessary for other sections of the form.

- Accuracy is crucial: When reporting values of assets such as real estate, securities, bank deposits, and other assets, make sure all figures are correct and up to date. Inaccuracies can lead to issues with the estate's valuation and potentially result in legal complications or delays.

- Attach a death certificate for original reports: If you are filing an original report, it's mandatory to attach a copy of the death certificate. This serves as a formal verification of the decedent's death and is essential for the report to be processed.

- Estate tax waivers may be necessary: The form allows personal representatives to request estate tax waivers for real estate or probate assets. Understanding when and why to apply for these waivers is important, as they are significant in the management of the estate’s obligations and rights.

- Know when to file a federal estate tax return: One section asks whether a federal estate tax return (Form 706 or 706NA) is being filed. This is dependent on the total value of the estate and other factors under federal law. Knowing these requirements ensures compliance with both state and federal tax obligations.

The Arizona 74 form is a vital document for personal representatives handling decedent's estates in Arizona. Proper completion and submission of this form are fundamental steps in fulfilling one's duties and ensuring the estate is managed correctly. Always consider seeking professional advice to navigate the complexities involved.

More PDF Forms

Arizona 676 - Supports maritime safety and legal compliance by ensuring all watercraft are properly registered and accounted for.

How to Apply Wic Arizona - Integrates a systematic approach to address dietary restrictions and preferences, with a focus on promoting healthy growth and development.