Fill in a Valid Arizona 650A Template

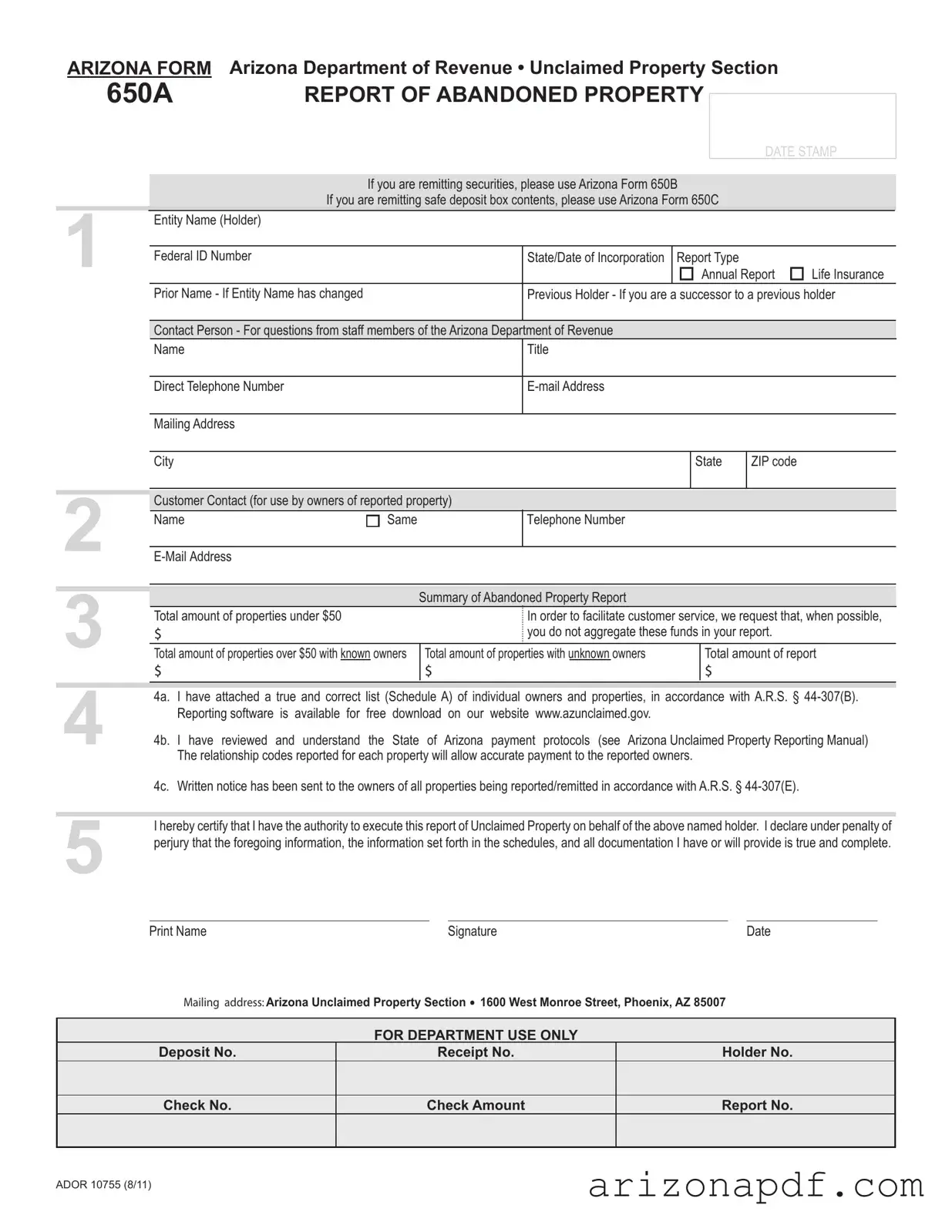

In the state of Arizona, managing unclaimed property and ensuring it finds its way back to the rightful owner or their heirs is a role taken seriously by the Arizona Department of Revenue. At the heart of this endeavor is the Arizona Form 650A, a crucial document designed for entities to report abandoned property. This form is tailored for a wide array of property types, excluding securities and safe deposit box contents, which are covered by other specific forms. Entities, often referred to as holders, include a comprehensive report detailing the personal and contact information of the holder, information about the abandoned property, and the efforts made to contact the property's rightful owners. Key sections of the form outline the total amount of remittable property, distinguishing between amounts below and above $50, and whether the owners are known or unknown. The form also emphasizes the importance of attaching a detailed list of the individual owners and properties (Schedule A), understanding the state's payment protocols for rightful property return, and the legal requirement to notify owners prior to reporting their property as abandoned. Each submission underlines the need for accuracy and honesty, as the signatory attests to the truthfulness of the information under penalty of perjury. Designed to facilitate the connection between abandoned properties and their owners, the Arizona Form 650A stands as a testament to the state's commitment to protecting individual property rights.

Arizona 650A Preview

ARIZONA FORM Arizona Department of Revenue • Unclaimed Property Section |

|

|||||||

|

650A |

REPORT OF ABANDONED PROPERTY |

|

|

||||

|

DATE STAMP |

|||||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

If you are remitting securities, please use Arizona Form 650B |

|

|||

|

|

|

If you are remitting safe deposit box contents, please use Arizona Form 650C |

|

||||

1 |

|

Entity Name (Holder) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal ID Number |

|

|

State/Date of Incorporation |

Report Type |

|

||

|

|

|

|

|

Annual Report |

Life Insurance |

||

|

|

Prior Name - If Entity Name has changed |

|

Previous Holder - If you are a successor to a previous holder |

||||

|

|

|

|

|

|

|

|

|

Contact Person - For questions from staff members of the Arizona Department of Revenue

Name

Title

Direct Telephone Number

Mailing Address

City

State

ZIP code

2 |

Customer Contact (for use by owners of reported property) |

|

|||

Name |

Same |

|

Telephone Number |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

Summary of Abandoned Property Report |

|

|

Total amount of properties under $50 |

|

|

In order to facilitate customer service, we request that, when possible, |

||

$ |

|

|

you do not aggregate these funds in your report. |

||

|

|

|

|||

Total amount of properties over $50 with known owners |

Total amount of properties with unknown owners |

Total amount of report |

|||

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

44a. I have attached a true and correct list (Schedule A) of individual owners and properties, in accordance with A.R.S. §

The relationship codes reported for each property will allow accurate payment to the reported owners.

4c. Written notice has been sent to the owners of all properties being reported/remitted in accordance with A.R.S. §

5I hereby certify that I have the authority to execute this report of Unclaimed Property on behalf of the above named holder. I declare under penalty of perjury that the foregoing information, the information set forth in the schedules, and all documentation I have or will provide is true and complete.

Print Name |

Signature |

Date |

Mailing address: Arizona Unclaimed Property Section  1600 West Monroe Street, Phoenix, AZ 85007

1600 West Monroe Street, Phoenix, AZ 85007

FOR DEPARTMENT USE ONLY

Deposit No. |

Receipt No. |

Holder No. |

Check No.

Check Amount

Report No.

ADOR 10755 (8/11)

File Properties

| Fact | Detail |

|---|---|

| Form Type | Arizona Form 650A |

| Issuing Body | Arizona Department of Revenue, Unclaimed Property Section |

| Primary Use | Reporting Abandoned Property |

| Related Forms | Securities: Form 650B, Safe Deposit Box Contents: Form 650C |

| Governing Law | A.R.S. § 44-307(B) for attaching a list of properties, A.R.S. § 44-307(E) for sending notice to property owners |

| Reporting Requirement | Entities holding unclaimed property must report items under $50 individually and not aggregate these funds. |

| Notification Requirement | Written notice must be sent to owners of all properties being reported, in accordance with specific state statutes. |

| Submission Certification | The form must be signed under penalty of perjury, certifying the information provided is true and complete. |

Instructions on Utilizing Arizona 650A

Filling out the Arizona Form 650A is a crucial step in ensuring that unclaimed property is reported accurately to the Arizona Department of Revenue. This responsibility, while straightforward, needs attention to detail to ensure that the report is completed correctly. The process involves providing detailed information about the entity reporting the property, a summary of the property being reported, and a certification that the submitted information is true and correct. After completing this form, the entity takes an important step towards compliance with Arizona's unclaimed property laws, contributing to the efficient return of property to rightful owners.

- Under the section titled ENTITY NAME (HOLDER), enter the legal name of the entity reporting the unclaimed property.

- Provide the entity's Federal ID Number and State/Date of Incorporation.

- Select the Report Type from the options provided: Annual Report or Life Insurance.

- If there has been a change in the entity's name, fill in the Prior Name field. If you are reporting on behalf of a successor entity, enter the previous holder's details in the Previous Holder field.

- For internal communications, provide the contact information of a person within your entity in the Contact Person section: Name, Title, Direct Telephone Number, and E-mail Address.

- Include the Mailing Address where the Arizona Department of Revenue can send correspondence, making sure to fill in the City, State, and ZIP code.

- In the Customer Contact section, provide the contact details intended for use by owners attempting to reclaim their property: Name, same Telephone Number, and E-Mail Address.

- Under the Summary of Abandoned Property Report section, specify the total amounts: enter the total amount of properties under $50, the total amount of properties over $50 with known owners, and the total amount of properties with unknown owners. Make sure not to aggregate these funds in your report as requested.

- Attach a true and correct list (Schedule A) of individual owners and properties as required by A.R.S. § 44-307(B).

- Confirm that you have reviewed and understood the State of Arizona payment protocols as mentioned in the Arizona Unclaimed Property Reporting Manual.

- Ensure that written notice has been sent to the owners of all properties being reported/remitted as per A.R.S. § 44-307(E).

- Finally, certify the report by printing the name of the individual authorized to report on behalf of the entity, signing the report, and dating it in the designated spaces.

Once you have completed the Arizona Form 650A, mail it to the specified address of the Arizona Unclaimed Property Section. This completes your responsibility for this reporting period, contributing to a system that aims to return properties to their rightful owners. Remember, accuracy and diligence in completing this form ensure a smoother process for both the entity reporting the unclaimed property and the individuals seeking to reclaim it.

Listed Questions and Answers

What is the Arizona 650A form used for?

The Arizona 650A form is used to report abandoned property to the Arizona Department of Revenue. This includes any financial assets or items that have gone unclaimed by their rightful owners for a period of time as defined by state law. Entities holding such property must complete this form to ensure compliance with state regulations on unclaimed property.

Who needs to file the Arizona 650A form?

Any business or entity that is in possession of property deemed abandoned under Arizona law is required to file the Arizona 650A form. This includes banks, insurance companies, corporations, and other entities that have unclaimed assets on their records. The form helps the state to reunite lost or forgotten assets with their rightful owners.

Are there different forms for different types of unclaimed property?

Yes, there are different forms depending on the type of unclaimed property you are reporting. For securities, you should use Arizona Form 650B, and for the contents of safe deposit boxes, Arizona Form 650C is required. The 650A form is for general use for all other types of unclaimed property not specified by the other forms.

What should be included with the Arizona 650A form when it is filed?

When filing the Arizona 650A form, you must include a complete and accurate list of individual owners and properties, referred to as Schedule A, in accordance with A.R.S. § 44-307(B). Additionally, you should ensure you have reviewed and understand the State of Arizona payment protocols and have sent written notice to the owners of all properties being reported/remitted as required by A.R.S. § 44-307(E).

Can reporting software assist in completing the Arizona 650A form?

Yes, reporting software designed to assist in completing the Arizona 650A form can be downloaded for free from the official website, www.azunclaimed.gov. This software helps ensure that the information submitted is accurate and meets the state's requirements for reporting unclaimed property.

What happens after the Arizona 650A form is filed?

After the Arizona 650A form is filed, the Arizona Department of Revenue will process the information to help reunite the reported unclaimed property with its rightful owners. The department may reach out to the entity that submitted the form if additional information or clarification is required during the process.

Where should the Arizona 650A form be mailed?

The completed Arizona 650A form, along with any required attachments, should be mailed to the Arizona Unclaimed Property Section at 1600 West Monroe Street, Phoenix, AZ 85007. This ensures that your report is properly received and processed by the Unclaimed Property Section of the Arizona Department of Revenue.

Common mistakes

Filling out the Arizona Form 650A, which is crucial for reporting abandoned property, requires precision and attention to detail. However, common mistakes can undermine the process, affecting both the reporting entity and the rightful owners of the property. Here are six errors to avoid:

- Incorrect Entity Information: Failing to accurately provide the entity name, federal ID number, and state/date of incorporation can lead to processing delays. It's essential these details mirror official records.

- Not Updating Previous Holder Information: If reporting on behalf of an entity that's succeeded another holder, overlooking to update the previous holder's information can cause confusion and misdirect the follow-up process.

- Miscommunication Details: Often, contact information for both entity and customer contacts is inaccurately filled out or outdated. Ensuring that these details are current and correct improves communication.

- Aggregating Funds Improperly: Bundling funds under $50 with those over $50 can obscure the total value of abandoned properties. This practice contradicts the request for itemization to enhance clarity and service.

- Ignoring Attachment of Schedule A: Schedule A, a detailed list of individual owners and properties, is sometimes omitted. This oversight can invalidate the report since it is a legal requirement for completion.

- Omitting Owner Notification: Failure to send written notice to the owners of the reported properties, as mandated by law, not only is a legal misstep but also prevents potential reunification of the property with its owner.

Avoiding these mistakes ensures that the report of abandoned property fulfills legal obligations and aids in the efficient return of property to rightful owners. Given the potential complexities, diligent review and adherence to the State of Arizona's guidelines can prevent the complications that arise from these common errors.

Documents used along the form

When managing or submitting the Arizona 650A form, which is essential for reporting abandoned property in the state of Arizona, it's common to use additional forms and documents to ensure compliance with state regulations and to thoroughly complete the submission process. Understanding these additional forms can simplify and streamline the reporting process.

- Arizona Form 650B: This form is specifically designed for entities remitting securities as unclaimed property. It is crucial for businesses or financial institutions that hold stocks, bonds, or other securities that have gone unclaimed by their rightful owners. The form helps in detailing the specifics of each security being reported.

- Arizona Form 650C: Used when remitting contents from safe deposit boxes, Form 650C is necessary for banks or other institutions reporting items left unclaimed in safe deposit boxes. It ensures that all items are properly documented and reported to the state.

- Schedule A: This is not a separate form but a required attachment to the 650A form. Schedule A lists individual property owners and their properties, providing detailed information necessary for processing each case of unclaimed property. It is crucial for accuracy in reporting.

- Arizona Unclaimed Property Reporting Manual: While not a form, this manual is a critical document for anyone reporting unclaimed property to Arizona. It provides comprehensive instructions, guidelines, and protocols for proper reporting and remitting of unclaimed property, ensuring adherence to state laws.

Together with the Arizona 650A form, these forms and documents play a vital role in the process of reporting unclaimed property. Utilizing them appropriately ensures that businesses and institutions can fulfill their legal obligations efficiently and effectively, minimizing errors and ensuring that property can be returned to its rightful owners or adequately held by the state.

Similar forms

The Arizona 650A form, focusing on the report of abandoned property, bears similarities with various other documents required by different entities, both within and outside of Arizona. These documents share common goals such as reporting, compliance, and record-keeping, albeit in different contexts. Let's explore eight such documents and how they relate to the Arizona 650A form.

The California Unclaimed Property Report is a document that serves a similar purpose to the Arizona 650A form. Like its Arizona counterpart, it is used by holders to report unclaimed property to the state. Both documents require information on the entity reporting the unclaimed property, details about the property, and the presumed owners. They are integral to the respective states' efforts to reunite lost or forgotten property with its rightful owners.

The IRS Form 990, while primarily a tax document for nonprofit organizations, shares the reporting and compliance nature of the Arizona 650A form. Both documents require detailed record-keeping and accuracy in reporting financial information. Where the 650A form focuses on unclaimed property, Form 990 provides the IRS with a comprehensive overview of a nonprofit's operations, including its income, expenditures, and charitable activities.

The Uniform Commercial Code (UCC) Financing Statement, often filed with a state's secretary of state, has similarities to the 650A in that it deals with the declaration of certain types of property. While the UCC form is used to announce a security interest in personal property to alert potential creditors, the 650A reports unclaimed property to the state. Both forms play crucial roles in the management and awareness of property rights.

A security deposit return letter, which landlords provide to tenants, can draw a parallel with the 650A form in terms of dealing with property (in this case, money) that may be owed to another party. Both documents involve the process of identifying, documenting, and taking action to return property to its rightful owner, though in very different legal contexts.

The FDIC's Unclaimed Funds form, used to report unclaimed funds from failed financial institutions, serves a purpose analogous to the Arizona 650A form, focusing on a specific type of property: money in accounts of closed banks. Each document aids in the process of ensuring that unclaimed funds are reported and eventually returned to the rightful owners, reflecting a shared interest in financial propriety and consumer protection.

The Missing Participant Form from the Pension Benefit Guaranty Corporation (PBGC) is tasked with the reporting of unclaimed pension benefits, paralleling the intent behind the Arizona 650A form. Both documents address the necessity of reporting property that is no longer within the active control of its owner but has not yet been reunited with them, whether it be pension benefits or other types of property.

The Securities and Exchange Commission (SEC) Lost Securityholder Search Report, another comparative document, requires reporting on securities and shareholders that are unaccounted for. Much like the Arizona 650A form, it involves the identification, reporting, and eventual reuniting of property (in this case, securities) with the rightful owners, focusing on maintaining integrity and trust in the financial markets.

Lastly, the Bank Secrecy Act (BSA) Currency Transaction Report (CTR) shares the broader theme of reporting financial information to authorities, similar to the 650A form's objective with unclaimed property. While the CTR focuses on large transactions that might signal illegal activity, both forms are essential tools in the framework of regulatory compliance and monitoring financial transactions within their respective spheres.

Dos and Don'ts

When it comes to filling out the Arizona 650A form for reporting abandoned property, it’s important to follow specific guidelines to ensure accuracy and compliance with the state requirements. Here’s a list of dos and don'ts to help guide you through the process:

- Do thoroughly read the instructions provided by the Arizona Department of Revenue before you start filling out the form.

- Do ensure that all the information about the entity (holder) is current and accurate, including the Federal ID Number and the State/Date of Incorporation.

- Do list any previous names of the entity or previous holders if applicable, to avoid confusion and ensure proper tracking of unclaimed property.

- Do provide direct contact information, including a direct telephone number and an email address, for someone who can answer questions regarding the report.

- Do attach a detailed and true list (Schedule A) of individual owners and properties, adhering to the guidelines set forth in A.R.S. § 44-307(B).

- Do not aggregate amounts smaller than $50 into one sum; they must be reported individually to facilitate customer service.

- Do review the State of Arizona payment protocols stated in the Unclaimed Property Reporting Manual to ensure correct payment to reported owners.

- Do send written notice to owners of all properties you're reporting, following the requirements stated in A.R.S. § 44-307(E).

- Do verify that you have the authority to execute this report on behalf of the named holder and confirm that all provided information is true, complete, and signed under penalty of perjury.

- Do not submit the form without double-checking all entered information for accuracy and completeness to prevent potential issues or delays with the report processing.

Following these guidelines will help ensure that your reporting process is smooth and compliant with Arizona state laws. It’s crucial to take your time and provide as much detail as possible to accurately report unclaimed property and facilitate its return to the rightful owners.

Misconceptions

Understanding the Arizona 650A form for reporting abandoned property can sometimes be confusing due to a mixture of factual and mistaken beliefs. Let's clear up some common misconceptions about this document.

It's only for reporting large amounts of property: Actually, the Arizona 650A form is for reporting any abandoned property, whether the value is above or below $50. It is crucial for accurate reporting, regardless of the property's value.

It can be used for any type of abandoned property: This is not entirely accurate. While the 650A form is versatile, specific types of property, such as securities or safe deposit box contents, require different forms, namely Arizona Forms 650B and 650C, respectively.

Only Arizona-based companies need to file it: Any entity holding abandoned property belonging to someone whose last known address is in Arizona is required to file the 650A form, regardless of the company's location.

Annual reports are the only reports accepted: While the form is commonly used for annual reporting, it also accommodates reporting for life insurance and changes in business entity names or ownership through the "Report Type" section.

Email addresses and phone numbers are optional: The form asks for direct contact information, including email addresses and telephone numbers, for both the entity reporting the property and the customer contact. This is required to ensure both the Arizona Department of Revenue and potential property owners can make inquiries.

The total amount of report doesn't need to be precise: Precision is key when filling out the form. The total amount reported must accurately reflect the value of the abandoned property, broken down by whether the owner is known, unknown, and if the property value is under or over $50.

Notification to owners is optional before filing: Contrary to this belief, written notice to the owners of unclaimed property is a required step before submitting the form, as mandated by A.R.S. § 44-307(E). This ensures owners have a chance to claim their property before it's reported as abandoned.

Any company employee can sign off on the form: The form requires certification by an individual who has the authority to execute the report on behalf of the entity, confirming the accuracy and completeness of the information under penalty of perjury.

Once submitted, no further action is required: Submission is just one part of the process. Entities must be prepared to provide additional documentation or clarification if contacted by the Arizona Department of Revenue or the property owners.

Correct understanding and adherence to the guidelines set by the Arizona Department of Revenue when completing the 650A form ensure the proper reporting of abandoned properties, maintaining compliance and facilitating the possible return of properties to their rightful owners.

Key takeaways

Filling out and using the Arizona 650A form correctly is crucial for entities reporting abandoned property to the Arizona Department of Revenue. Here are six key takeaways to ensure compliance and accuracy in the process:

- Identify the Type of Property: Use the Arizona 650A form specifically for reporting abandoned property other than securities or safe deposit box contents. For those, forms 650B and 650C are respectively required.

- Provide Complete Entity Information: Clearly fill out the entity name, federal ID number, state/date of incorporation, and specify the report type. If the entity's name has changed or if you're a successor to a previous holder, this information must also be included.

- Contact Details are Essential: Accurately provide the contact information for both the entity reporting the abandoned property and a separate contact for owners of the reported property. This facilitates communication and ensures any questions can be addressed efficiently.

- Detailed Property Summary is Required: The form requires a summary of abandoned property, including totals for properties under $50, over $50 with known owners, and those with unknown owners. Aggregating funds is discouraged to aid in customer service.

- Attachments and Review: Attach a true and correct list (Schedule A) of individual owners and properties. It's also mandatory to review and understand the State of Arizona payment protocols, ensuring the relationship codes reported for each property allow for accurate payments to reported owners.

- Certification: The form necessitates certification by an authorized individual declaring the information provided, including attached schedules and documentation, is true and complete under penalty of perjury. Ensure the printed name, signature, and date are clearly provided.

Remember: The Arizona 650A form is a legal document, and accuracy, completeness, and compliance with the specified guidelines and the Arizona Revised Statutes are vital. Careful attention to these key takeaways can help avoid common mistakes and ensure the reporting process is conducted smoothly and efficiently.

More PDF Forms

Can I Be My Own Statutory Agent - It's a foundational document ensuring that entities have a responsible party for statutory communications.

Az State Income Tax Form - Arizona's official avenue for professionals to become recognized Public Weighmasters, ensuring integrity in weighing practices.

How to Apply Wic Arizona - Addresses the needs of children requiring special formula or medical food due to severe medical conditions like prematurity or severe food allergies.