Fill in a Valid Arizona 600A Template

Reuniting individuals with their forgotten or misplaced assets is a process managed with care by the Arizona Department of Revenue, made approachable through the Arizona Form 600A. Aimed at original property owners, this form serves as a pivotal tool for claiming unclaimed property, including but not limited to money orders, checks from financial institutions, or IRA funds from former employers. With a requirement for a physical signature, the form underscores the importance of authenticity and the need for claimants to provide accurate, thorough information regarding their identity, the property in question, and their relationship to it. Completing the form involves a detailed provision of personal information and an agreement to indemnify the State of Arizona against further claims once the property is returned. Moreover, the process is nuanced, necessitating the submission of evidence to prove identity, ownership, and, in cases of joint ownership, the current status of all parties. The form, while seemingly straightforward, is underpinned by a commitment to ensure that unclaimed property is returned to its rightful owner, safeguard both the claimant and the state, and navigate the complexities inherent in reuniting individuals with their assets.

Arizona 600A Preview

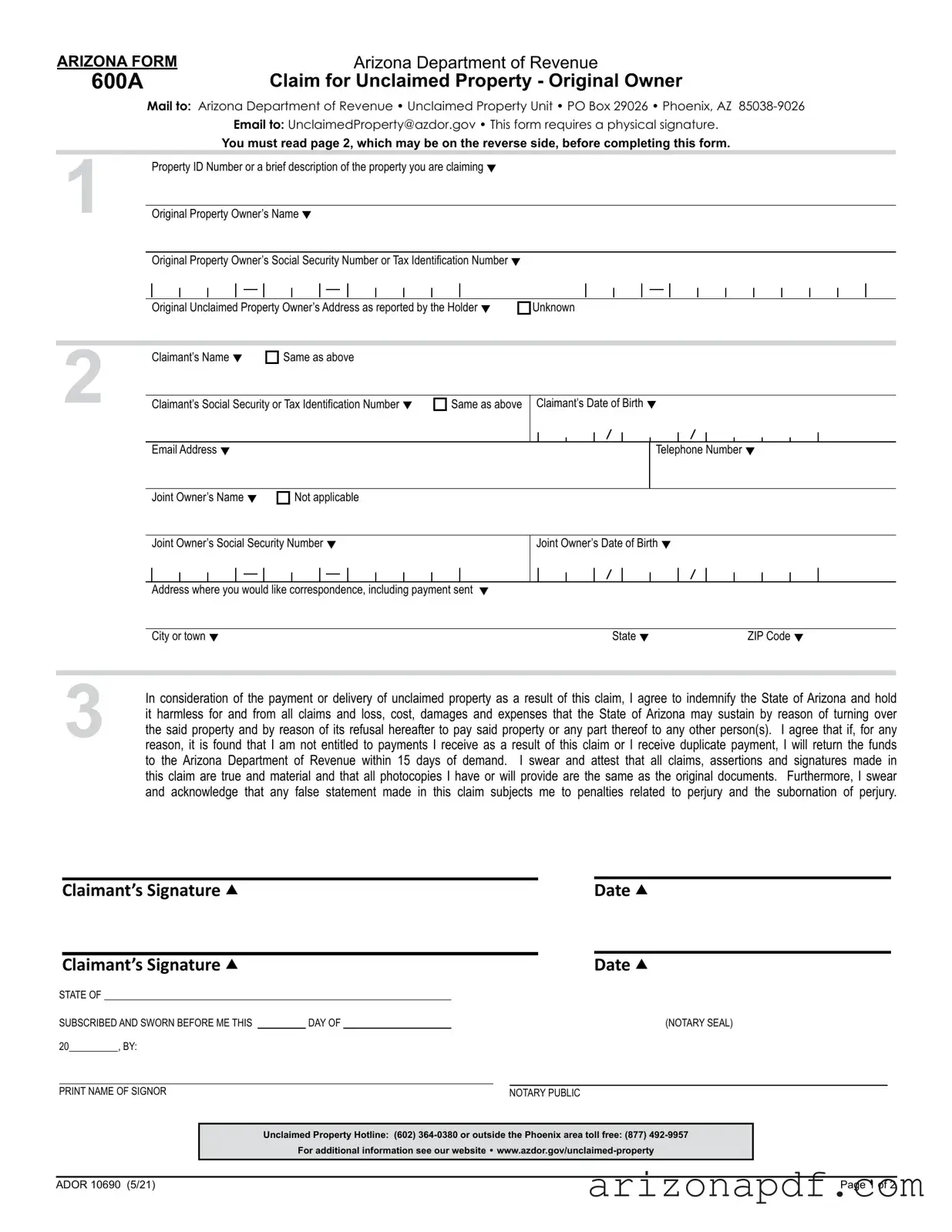

ARIZONA FORM |

Arizona Department of Revenue |

600A |

Claim for Unclaimed Property - Original Owner |

Mail to: Arizona Department of Revenue • Unclaimed Property Unit • PO Box 29026 • Phoenix, AZ

Email to: UnclaimedProperty@azdor.gov • This form requires a physical signature.

You must read page 2, which may be on the reverse side, before completing this form.

1 |

|

Property ID Number or a brief description of the property you are claiming |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Original Property Owner’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

Original Property Owner’s Social Security Number or Tax Identification Number |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Unclaimed Property Owner’s Address as reported by the Holder |

Unknown |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

2 |

|

Claimant’s Name |

Same as above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

Claimant’s Social Security or Tax Identification Number |

Same as above |

Claimant’s Date of Birth |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Joint Owner’s Name |

Not applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Joint Owner’s Social Security Number

Joint Owner’s Date of Birth

Address where you would like correspondence, including payment sent

City or town |

State |

ZIP Code |

3In consideration of the payment or delivery of unclaimed property as a result of this claim, I agree to indemnify the State of Arizona and hold it harmless for and from all claims and loss, cost, damages and expenses that the State of Arizona may sustain by reason of turning over the said property and by reason of its refusal hereafter to pay said property or any part thereof to any other person(s). I agree that if, for any reason, it is found that I am not entitled to payments I receive as a result of this claim or I receive duplicate payment, I will return the funds to the Arizona Department of Revenue within 15 days of demand. I swear and attest that all claims, assertions and signatures made in this claim are true and material and that all photocopies I have or will provide are the same as the original documents. Furthermore, I swear and acknowledge that any false statement made in this claim subjects me to penalties related to perjury and the subornation of perjury.

Claimant’s Signature

Claimant’s Signature

STATE OF |

|

|

|

|

|

|

SUBSCRIBED AND SWORN BEFORE ME THIS |

|

DAY OF |

||||

20 |

|

|

, BY: |

|

|

|

Date

Date

(NOTARY SEAL)

PRINT NAME OF SIGNOR |

|

NOTARY PUBLIC |

Unclaimed Property Hotline: (602)

For additional information see our website •

ADOR 10690 (5/21) |

Page 1 of 2 |

ARIZONA FORM |

Arizona Department of Revenue |

600A |

Claim for Unclaimed Property - Original Owner |

This form should only be used to claim property of which you are the original owner.

If you are claiming property as the heir or beneficiary of a deceased owner (Form 600B), the agent of an entity (Form 600C) or the agent of a living owner (Form 600D), you must complete the appropriate form.

FORM INSTRUCTIONS

Section 1 of page 1

Regardless of how you answer this Section, we will do a complete search of our database to identify and work to return all unclaimed property belonging to the pertinent owner.

•In this section, we ask that you please provide the property ID or a brief description of the property you are claiming. It is not required to complete this section but we ask, if known, that you provide the property ID, if not known it is not required nor helpful to collect this number. If you do not know the property ID number, but are looking for a specific lost asset, it is helpful to give us a brief description, such as, “Southwest Cactus Wren Federal Credit Union Money Order Check #1008 321 6587” or “IRA funds from employer Jackson and Lynch Welding”. Lastly, if you simply wish to collect all miscellaneous unclaimed property you may leave the section blank.

•In the remaining questions in this section, you are required to provide the name of the individual you believe to be the owner, this may be your name, and if known, the address, and tax ID number reported by the business or entity that remitted the property to the State of Arizona. If unknown you may leave this Section blank.

Section 2 of page 1

It is very important that you complete this Section fully and accurately. You are required to provide us with your current or correct name and your current/correct contact information. If you provide an email address, we will provide you with a receipt of your claim with 15 to 20 business days of receipt; this information is no longer provided in hard copy. Providing an email address also expedites communication and helps us more efficiently serve you. The address that you record in this Section will be the address that payment will be sent to should your claim be approved.

Section 3 of page 1

You must sign and date the form, we require a physical signature. In this section, please read the declarations carefully. There is a notary section under the signature, you may choose to have the form notarized or provide a legible photocopy of valid government issued photo identification; such as a driver’s license or passport. If there are joint owners, they must also sign the claim form (see evidence requirements below for all joint owner exceptions).

YOU ARE REQUIRED TO SUBMIT THE FOLLOWING EVIDENCE WITH THIS FORM:

You must provide proof of your identity as the claimant. Please provide a clear copy of official photo identification or have your signature on the claim form notarized. If your name has changed since the property was reported to the State of Arizona, you must provide verification of your name change, such as, a court order, marriage license or divorce decree.

You must provide proof of ownership. The Arizona Unclaimed Property Section does not release funds based on name similarity alone, must provide a match to another reported factor, most commonly social security number or match to the reported (not current) address.

•Provide proof that you lived at or received mail at the address reported to the State of Arizona as the last known address of the original owner. If you do not know what address was reported to the State of Arizona, you can complete an inquiry at www. missingmoney.com. Acceptable proof includes; the original financial instrument, a statement from the entity that originally held the asset, a canceled envelope addressed to you, a credit report, lease/mortgage, property/income tax documentation, school/military records, past government issued identification or utility bills/statements. Please see our website:

•Provide proof of your social security number. Providing your Social Security number (SSN) is optional. However, if you choose not to provide your SSN, there may be insufficient information available to determine whether you are the owner of the unclaimed property held by the Section and in some cases may result in your claim being denied. If you provide your SSN, the Section will only disclose it to employees involved in paying your claim and to the federal government as required by law.

Joint owners must file together unless:

•One of the owners is deceased. In this case, a copy of the joint owner’s death certificate is required.

•The owners are now divorced. In this case, a certified copy of the divorce decree and complete property settlement are required.

•The owners have lost contact. In this case, a notarized statement that confirms that the owners had no marital relationship, and have lost all contact is required.

Please be aware that each claim is unique and that once your claim is received, the Section may need to request additional information and will allow you an opportunity to provide the additional evidence rather than denying your claim. If you have any questions or

cannot provide the evidence requested we recommend that you complete the claim form and submit the evidence, you can provide, along with a note explaining your circumstances. A claims specialist may be able to clarify and assist you with the evidence requirement.

Mail to: Arizona Department of Revenue • Unclaimed Property Unit • PO Box 29026 • Phoenix, AZ

Email to: UnclaimedProperty@azdor.gov • This form requires a physical signature.

For additional information see our website •

ADOR 10690 (5/21) |

Page 2 of 2 |

File Properties

| Fact | Detail |

|---|---|

| Governing Law | The Arizona Department of Revenue governs the Arizona Form 600A under the state's unclaimed property laws. |

| Form Purpose | Form 600A is used by an original owner to claim unclaimed property held by the Arizona Department of Revenue. |

| Key Requirements | Claimants must provide a physical signature, proof of identity, proof of ownership of the property, and, if applicable, proof of joint ownership status or evidence regarding changes to name or ownership. |

| Submission Method | The completed form can be submitted by mail to the Arizona Department of Revenue Unclaimed Property Unit or by email to UnclaimedProperty@azdor.gov. |

| Additional Provisions | Claimants must agree to indemnify and hold the State of Arizona harmless for any claims, losses, costs, damages, and expenses resulting from the property claim. They must also return any payments received in error. |

Instructions on Utilizing Arizona 600A

Filling out the Arizona Form 600A is the first step towards reclaiming what's rightfully yours. It's a straightforward process designed to restore unclaimed property to its original owner. We understand that navigating through any form can be daunting, but following these steps will ensure your claim is submitted correctly and efficiently. Remember, this form is only for the original owners. If you're claiming on behalf of someone else, there are other forms specified for those situations. Once you submit your form, accompanied by the necessary documentation, it will undergo a verification process. The Arizona Department of Revenue's Unclaimed Property Unit meticulously reviews claims to ensure rightful ownership before any property is released. Let's get started on the steps to complete the Arizona Form 600A.

- Start by reading the instructions and page two of the form carefully to understand the information and documents you need to provide.

- Provide the Property ID Number or a brief description of the property you're claiming in the designated section. If you don't know the Property ID, offering descriptions like "Southwest Cactus Wren Federal Credit Union Money Order Check #1008 321 6587" or "IRA funds from employer Jackson and Lynch Welding" can be helpful.

- Fill in the Original Property Owner’s Name, Social Security Number or Tax Identification Number, and Address as reported by the Holder. If any of this information is unknown, you may leave it blank.

- Under the Claimant’s section, enter your name, Social Security or Tax Identification Number, Date of Birth, Email Address, and Telephone Number. If you're the original owner, select "Same as above" where applicable.

- If there was a Joint Owner, provide their Name, Social Security Number, and Date of Birth. Check "Not applicable" if this does not apply to your situation.

- Specify the address where you would like correspondence and payment sent, including the city or town, state, and ZIP Code.

- Read the declaration in Section 3 carefully. By signing this form, you agree to indemnify the State of Arizona from any claims arising from the property's release to you and to return any payments received in error.

- Sign and date the claim form. Remember, a physical signature is required. If there are joint owners, ensure they sign the form as well.

- You must also decide whether to have your signature notarized or to provide a copy of a valid photo ID. If opting for notarization, ensure the notary section is completed.

- Gather the required evidence to submit with your form, including proof of your identity, proof of ownership, and proof of the original owner’s address or your connection to it. Joint owners must comply with additional requirements detailed in the form based on their specific circumstances.

- Finally, mail your completed form and all accompanying evidence to the Arizona Department of Revenue Unclaimed Property Unit at PO Box 29026, Phoenix, AZ 85038-9026, or email to UnclaimedProperty@azdor.gov.

After submitting the form and necessary documentation, the Arizona Department of Revenue will undertake a thorough review to verify your claim. This process may include additional requests for information to ensure the property is rightfully returned. While waiting, you can check the status of your claim by contacting the Unclaimed Property Unit. Patience and thoroughness in gathering your documentation will aid in a smoother process, bringing you one step closer to reclaiming what's yours.

Listed Questions and Answers

What is Arizona Form 600A?

Arizona Form 600A is a document used to claim unclaimed property in the state of Arizona if you are the original owner of the property. The form is processed by the Arizona Department of Revenue's Unclaimed Property Unit. It's designed to help individuals recover property that has been reported as unclaimed by various entities.

Who needs to fill out this form?

If you believe you have unclaimed property being held by the State of Arizona, and you are the original owner of that property, you need to fill out and submit this form. This includes forgotten bank accounts, uncashed checks, or other assets that the holder has lost contact with the owner over time.

What information do I need to provide on the form?

You need to provide detailed information about yourself, including your name, Social Security or Tax Identification Number, date of birth, email address, telephone number, and mailing address. Additionally, if applicable, information regarding a joint owner must also be provided. You will also need to agree to certain declarations about the claim and provide a physical signature.

Is a notary required for this form?

A notarized signature is not mandatory if you provide a legible photocopy of a valid government-issued photo identification, such as a driver's license or passport. However, if you prefer not to provide a photocopy of your identification, then the claim form’s signature will need to be notarized.

How do I submit evidence with my form?

You are required to submit evidence of your identity, evidence of your ownership of the claimed property, and, if needed, evidence of a name change. Acceptable documents may include photo identification, financial statements related to the unclaimed property, documentation proving residence at the address reported by the entity that remitted the property to the state, or legal documents verifying a name change.

What if I am a joint owner of the property?

Joint owners must file the claim together unless specific circumstances apply, such as the death of one owner, divorce, or loss of contact. Documentation supporting these claims, like a death certificate or a divorce decree, must be provided.

What happens after submitting the form?

After submitting the form and the required evidence, the Unclaimed Property Unit will review your claim. They may contact you for additional information or documentation. If your claim is approved, the unclaimed property or payment will be sent to the address you provided on the form.

Can I submit the form electronically?

While the form and supporting documents can be emailed to UnclaimedProperty@azdor.gov, the form requires a physical signature. Therefore, you may need to print out and sign the form before scanning and emailing it, along with the other required documents.

Where can I find additional information or assistance?

Additional information and assistance with the Arizona Form 600A can be found on the Arizona Department of Revenue's website under the Unclaimed Property section. You can also contact the Unclaimed Property Hotline at (602) 364-0380 or toll free outside the Phoenix area at (877) 492-9957.

Common mistakes

Failing to provide a Property ID Number or a detailed description of the property being claimed is a common oversight. While it's not mandatory to know the Property ID, offering a detailed description, such as "IRA funds from employer Jackson and Lynch Welding," can significantly aid in the identification and processing of your claim.

Incorrect information regarding the original owner's details, including name, Social Security Number, or Tax Identification Number, and address, can lead to delays. It's crucial to ensure that the information matches exactly with what was reported by the entity holding the unclaimed property.

Omitting current contact details, including the claimant’s name, current address, email, and phone number, can hinder communication. Providing an email address is not only beneficial for receiving a receipt of your claim but also expedites the overall communication process.

Not signing the form or misunderstanding the indemnity agreement and declaration section can invalidate your claim. A physical signature is required, and if the form is not properly signed and dated, the claim cannot be processed. Additionally, misunderstanding the indemnity clause could lead to complications if a claim is found to be false.

Lack of required evidence, or submitting incomplete documentation, frequently results in delays or denials. Proof of identity, ownership, and, if applicable, changes in relationship status or contact loss between joint owners, is imperative. If you cannot provide all the necessary documentation, it's recommended to submit what you can with a note explaining your situation for potential assistance from a claims specialist.

Here are some suggested documents for ensuring your claim is processed smoothly:

- Valid government-issued photo identification, such as a driver's license or passport, to establish your identity.

- Documents proving ownership, like financial statements or utility bills, that connect you to the address reported by the entity that held the unclaimed property.

- For name changes, supporting legal documents such as marriage licenses or court orders are essential.

- If claiming jointly with another owner, relevant documents based on your current relationship status with the joint owner are required.

Remember, the Arizona Department of Revenue is here to help return unclaimed property to its rightful owners. Carefully reviewing the instructions on the form and providing as much information as possible can streamline the process, ensuring a smoother claim experience.

Documents used along the form

When dealing with the Arizona 600A form for claiming unclaimed property, it's quite common to need additional forms and documents. These aren't just busywork; each plays a critical role in ensuring that your claim is legitimate and that the process runs smoothly. Below is a list of other forms and documents often used in conjunction with the Arizona 600A form, including a brief description of each.

- Death Certificate: Required when the original owner of the property is deceased. This document proves the death and helps establish the claimant's right to the property.

- Marriage Certificate: Necessary when changing a name due to marriage. This certifies the name change that may link the claimant to the property.

- Divorce Decree: Similar to the marriage certificate, this is required in scenarios involving name changes due to divorce. Additionally, it may be needed to establish entitlement to the property post-divorce.

- Power of Attorney (POA) Documentation: Required if someone is claiming on behalf of the original owner. This legally authorizes the claimant to act on the original owner's behalf.

- Notarized Affidavit of Lost Contact: Necessary if joint owners have lost contact, supporting claims that communication between parties has ceased.

- Court Order for Name Change: Required for individuals who have legally changed their name outside of marriage or divorce. This document proves the legal change of name.

- Proof of Residency or Ownership: May include previous utility bills, mortgage or lease agreements, or similar documents that place the claimant or the original owner at the address linked to the unclaimed property.

Understanding these documents and knowing which ones you need can cut down on confusion and streamline the claiming process. Each document serves to verify your identity, your relationship to the original owner (if applicable), or your legal right to the property in question. Gathering these documents before starting your claim can save time and effort, ensuring that your claim is processed as quickly as possible.

Similar forms

The Arizona 600A form for claiming unclaimed property shares similarities with the Internal Revenue Service (IRS) Form 1040, which is used for filing individual income tax returns. Both forms require the claimant or taxpayer to provide detailed personal information, such as social security numbers, addresses, and full names. Furthermore, they necessitate a signature to attest to the accuracy of the information provided, acknowledging that providing false information could lead to penalties. While the 600A form specifically deals with reclaiming property presumed lost or unclaimed, the IRS Form 1040 focuses on the reconciliation of annual income and taxes owed or refunded, both inherently aimed at resolving matters of personal finance and asset declaration.

Another document that resembles the Arizona 600A form is the Change of Address form (USPS Form 3575) used by the United States Postal Service. Though the primary purpose of the USPS form is to notify the postal service of a residential address change, both forms require claimants to provide previous and current addresses to ensure proper delivery of mail or property. In addition, they share a common procedural requirement in that they assist in updating personal records and ensuring assets, whether material or correspondences, are delivered to the correct recipient. This comparison highlights their shared focus on maintaining accurate and current personal information to prevent losses.

The Unclaimed Property Claim Form is also similar to the Social Security Administration’s Application for a Social Security Card (Form SS-5). Both documents demand detailed personal information, including names, social security numbers, and addresses. They both serve to establish or confirm the identity of an individual in the pursuit of claiming what is rightfully theirs, be it unclaimed property or a social security card. While their end goals differ—one aims at retrieving property and the other, identity verification for government benefits and services—each plays a crucial role in safeguarding individuals’ rights and assets.

Last but not least, the Arizona form parallels many aspects of a bank's Account Opening Form. Such forms typically require similar pieces of information like name, social security number, address, and often a signature to verify the account holder's identity and to protect against fraud. Both sets of documents are integral in establishing a formal claim over assets, with the primary difference being that the 600A form is for reclaiming what has been lost or forgotten, whereas bank forms are for initiating new relationships or accounts. Nonetheless, both forms emphasize the importance of accurate personal documentation and the legal acknowledgment of ownership over assets.

Dos and Don'ts

When filling out the Arizona 600A form for claiming unclaimed property, it's important to follow specific guidelines to ensure your claim is processed smoothly. Below are the things you should and shouldn't do.

Do:

- Read the instructions on both pages of the form carefully before beginning to fill it out. Understanding each section's requirements is crucial for a valid claim.

- Provide accurate and complete information for all requested details, including your current contact information, to avoid any delays in the processing of your claim.

- Include a Property ID Number or a brief description of the property you're claiming if available, as this can expedite the identification and processing of your claim.

- Submit proof of identity, such as a clear copy of official photo identification or a notarized signature if you do not opt for photo identification. This is essential for verifying your claim.

- Provide documentation proving your ownership of the unclaimed property, such as financial records or proof of address, linked to the original owner's reported address.

- Ensure that all joint owners sign the form if the unclaimed property has more than one owner, unless exceptions apply (e.g., death, divorce).

- Sign and date the form personally, as a physical signature is required for the form to be processed.

Don't:

- Leave mandatory sections blank unless specified that it’s acceptable. Incomplete forms may lead to processing delays or claim denial.

- Forget to provide essential evidence supporting your claim, such as proof of identity, proof of ownership, and any applicable legal documents for joint ownership situations.

- Submit the form without reviewing it for accuracy and completeness. Ensuring all information is correct before submission is crucial.

- Use the form to claim property if you are not the original owner. Other forms are available for heirs, beneficiaries, or agents.

- Ignore the requirement for a physical signature. Electronic signatures or copies of signatures are not accepted.

- Overlook the need to update your details if your name has changed since the property was reported. Supporting documents for name changes are required.

- Rely solely on name similarity for proof of ownership. The Arizona Unclaimed Property Section requires a match to another reported factor, such as the social security number or the address reported.

Misconceptions

Many people have misconceptions about the Arizona Form 600A, which is designed for claiming unclaimed property as the original owner. Let's address some common misunderstandings:

- Only paper submissions are accepted. While the form emphasizes the need for a physical signature, it is a common misconception that it must be submitted strictly via traditional mail. In reality, the form and accompanying documents can also be sent through email, as clearly indicated in the instructions.

- You must know the Property ID Number to claim. It's often misunderstood that a Property ID Number is required to make a claim. However, the form instructions state that providing the ID is helpful but not mandatory. Descriptions of the property or simply expressing the wish to claim any unclaimed property under your name are also acceptable approaches.

- Email addresses are optional for communication. Many assume that providing an email address is just a suggestion. On the contrary, supplying an email not only facilitates the receipt of a claim confirmation but also speeds up the communication process, making it a highly recommended piece of information to provide.

- You must physically sign in the presence of a notary. While the form does require a physical signature, there's a misconception that it must be done in the presence of a notary. In reality, notarization is an option. Claimants can also opt to provide a legible photocopy of a valid government-issued photo identification as an alternative to having their signature notarized.

- Joint owners always have to file together. A common misunderstanding is that if the property was owned jointly, both parties must always file together. However, exceptions are made in cases where a joint owner has passed away, the owners are divorced, or contact has been lost. In such situations, additional documents such as death certificates or divorce decrees can enable a single claimant to proceed.

- Claims are denied if exact proof is missing. There's a misconception that a claim will be immediately denied if all recommended evidence is not provided. Although the form lists specific documents for proving identity and ownership, the Arizona Department of Revenue encourages claimants to submit any available evidence and a written explanation if certain documents are missing. This allows for flexibility, and claims specialists may work with claimants to fulfill the evidence requirement.

Addressing these misconceptions helps clarify the process for claiming unclaimed property in Arizona, ensuring that potential claimants understand their rights and the steps involved.

Key takeaways

Completing the Arizona Form 600A, designed for original owners to claim unclaimed property, is a straightforward process that ensures rightful owners can recover their assets efficiently. Here are key takeaways to ensure the process goes smoothly:

- The form must be filled out meticulously, requiring details such as the Property ID Number or a general description of the property, alongside personal information including the original owner’s name, Social Security or Tax Identification Number, and contact details.

- Physical signatures are mandatory for the claim to be processed, underscoring the formality and security of the claims process.

- Reading the form's second page is crucial as it contains important instructions and conditions related to the claim process.

- Claimants are encouraged to provide an email address to expedite the communication process, acknowledging the shift towards digital correspondence for efficiency.

- The necessity of providing a physical signature, with the option of including a notarized signature or a legible photocopy of a valid government-issued photo identification, emphasizes the form’s legal significance.

- Provision of proof is mandatory, with requirements including proof of identity, proof of ownership, and, when applicable, verification of a name change or the specific circumstances of joint owners.

- The form outlines the need for potential indemnification by the claimant, protecting the state from any claims, loss, or expenses arising from inaccurately awarded property.

- Claimants are advised that making a false statement on the form could subject them to penalties related to perjury, illustrating the legal importance of honesty in the claims process.

- Completing and submitting this form could involve providing additional evidence as requested by the Arizona Department of Revenue, indicating a collaborative process aimed at ensuring rightful ownership.

Submitting the Arizona Form 600A is a necessary step for original owners to reclaim property that is rightfully theirs. It is advised that claimants approach this process with the seriousness it demands, given the legal and financial implications involved.

More PDF Forms

Arizona Dmv Forms - Arizona Motor Vehicle Division's procedural packet for drivers seeking to overturn revocation through a thorough investigation process.

Arizona Filing Requirements - Ensure that your request for penalty abatement, through Form 290, is supported by as much relevant documentation as possible for a strong case.

Arizona Divorce Petition - Email and call options for the Self-Service Center and the Clerk of Court offer convenient resources for seeking further assistance.