Fill in a Valid Arizona 5000 Template

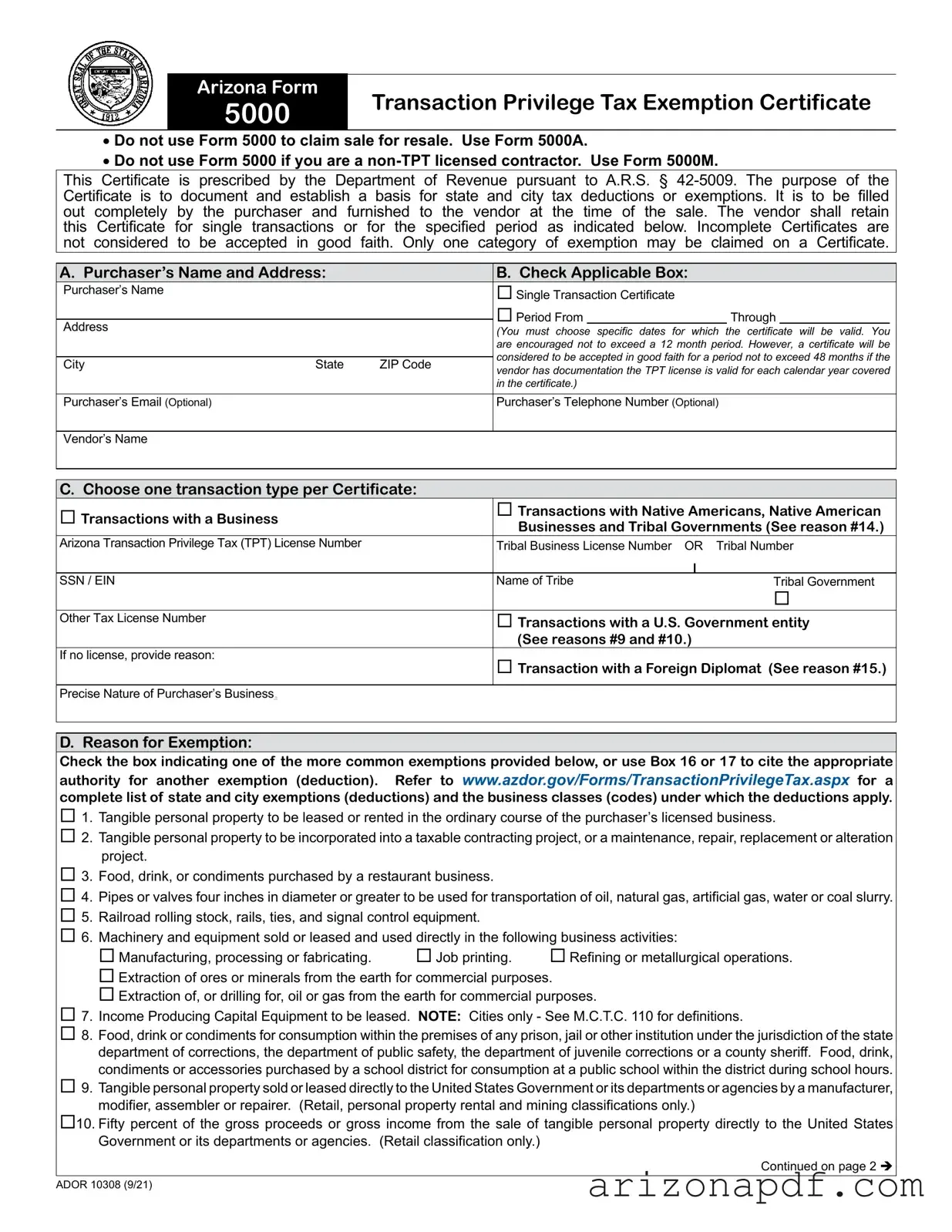

Navigating the complexities of tax exemptions in Arizona requires familiarity with various forms, among which the Arizona Form 5000, or the Transaction Privilege Tax Exemption Certificate, holds significant importance. Designed by the Department of Revenue under the authority of A.R.S. § 42-5009, this form serves as a crucial document for businesses and individuals seeking exemptions from the state and city transaction privilege tax. The guidelines clearly state its application—excluding its use for sale for resale purposes, which requires Form 5000A, and its inapplicability to non-TPT licensed contractors who must use Form 5000M instead. With a well-defined purpose to document and substantiate claims for tax exemptions, the Arizona Form 5000 requires meticulous completion at the time of sale, mandating purchasers to accurately furnish their details and specify the exemption category from a list that covers a diverse array of transactions including dealings with businesses, Native American entities, U.S. government entities, and foreign diplomats, to mention a few. The form’s adherence to good faith acceptance for a period not exceeding 48 months, provided the vendor has proof of the purchaser’s valid TPT license for each calendar year, underscores the state’s approach to regulated tax relief mechanisms. Moreover, the exhaustive list of exemption reasons, ranging from tangible personal property leases to specific transactions authorized for state or federally recognized entities, reflects the nuanced understanding of different business operations and their respective tax liabilities. Through the detailed specification processes and the critical role it plays in tax exemption, Arizona Form 5000 stands as a testament to the state’s effort in streamlining tax-related procedures while ensuring compliance and accountability among its users.

Arizona 5000 Preview

Arizona Form |

Transaction Privilege Tax Exemption Certificate |

|

5000 |

||

|

•Do not use Form 5000 to claim sale for resale. Use Form 5000A.

•Do not use Form 5000 if you are a

This Certificate is prescribed by the Department of Revenue pursuant to A.R.S. § |

||||||||||

Certificate is to document and establish a basis for |

state and city tax deductions or exemptions. It is to be filled |

|||||||||

out completely by the purchaser and furnished to |

the vendor at the time of |

the sale. The vendor shall retain |

||||||||

this Certificate for single transactions or |

for the specified period as indicated |

below. Incomplete Certificates are |

||||||||

not considered to be accepted in good faith. Only |

one category of exemption may be claimed on a Certificate. |

|||||||||

|

|

|

|

|

|

|

|

|

||

A. Purchaser’s Name and Address: |

|

|

B. Check Applicable Box: |

|||||||

Purchaser’s Name |

|

|

|

Single Transaction Certificate |

||||||

|

|

|

|

Period From |

|

|

|

Through |

|

|

Address |

|

|

|

|||||||

|

|

|

(You must choose specific |

dates for which the certificate will be valid. You |

||||||

|

|

|

|

are encouraged not to exceed a 12 month period. However, a certificate will be |

||||||

|

|

|

|

considered to be accepted in good faith for a period not to exceed 48 months if the |

||||||

City |

State |

ZIP Code |

|

|||||||

|

vendor has documentation the TPT license is valid for each calendar year covered |

|||||||||

|

|

|

|

|||||||

|

|

|

|

in the certificate.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Purchaser’s Email (Optional) |

|

|

|

Purchaser’s Telephone Number (Optional) |

||||||

|

|

|

|

|

|

|

|

|

|

|

Vendor’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

C. Choose one transaction type per Certificate: |

|

|

|

|

|

|

|

|

||

Transactions with a Business |

|

|

|

Transactions with Native Americans, Native American |

||||||

|

|

|

Businesses and Tribal Governments (See reason #14.) |

|||||||

|

|

|

|

|||||||

Arizona Transaction Privilege Tax (TPT) License Number |

|

|

Tribal Business License Number OR Tribal Number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN / EIN |

|

|

|

Name of Tribe |

|

|

Tribal Government |

|||

|

|

|

|

|

|

|

|

|

||

Other Tax License Number |

|

|

|

Transactions with a U.S. Government entity |

||||||

|

|

|

|

(See reasons #9 and #10.) |

||||||

If no license, provide reason: |

|

|

|

Transaction with a Foreign Diplomat (See reason #15.) |

||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Precise Nature of Purchaser’s Business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Reason for Exemption:

Check the box indicating one of the more common exemptions provided below, or use Box 16 or 17 to cite the appropriate authority for another exemption (deduction). Refer to www.azdor.gov/Forms/TransactionPrivilegeTax.aspx for a complete list of state and city exemptions (deductions) and the business classes (codes) under which the deductions apply.

1. Tangible personal property to be leased or rented in the ordinary course of the purchaser’s licensed business.

2. Tangible personal property to be incorporated into a taxable contracting project, or a maintenance, repair, replacement or alteration project.

3. Food, drink, or condiments purchased by a restaurant business.

4. Pipes or valves four inches in diameter or greater to be used for transportation of oil, natural gas, artificial gas, water or coal slurry.

5. Railroad rolling stock, rails, ties, and signal control equipment.

6. Machinery and equipment sold or leased and used directly in the following business activities:

Manufacturing, processing or fabricating. |

Job printing. |

Refining or metallurgical operations. |

Extraction of ores or minerals from the earth for commercial purposes.

Extraction of, or drilling for, oil or gas from the earth for commercial purposes.

7. Income Producing Capital Equipment to be leased. NOTE: Cities only - See M.C.T.C. 110 for definitions.

8. Food, drink or condiments for consumption within the premises of any prison, jail or other institution under the jurisdiction of the state department of corrections, the department of public safety, the department of juvenile corrections or a county sheriff. Food, drink, condiments or accessories purchased by a school district for consumption at a public school within the district during school hours.

9. Tangible personal property sold or leased directly to the United States Government or its departments or agencies by a manufacturer, modifier, assembler or repairer. (Retail, personal property rental and mining classifications only.)

10. Fifty percent of the gross proceeds or gross income from the sale of tangible personal property directly to the United States Government or its departments or agencies. (Retail classification only.)

Continued on page 2

ADOR 10308 (9/21)

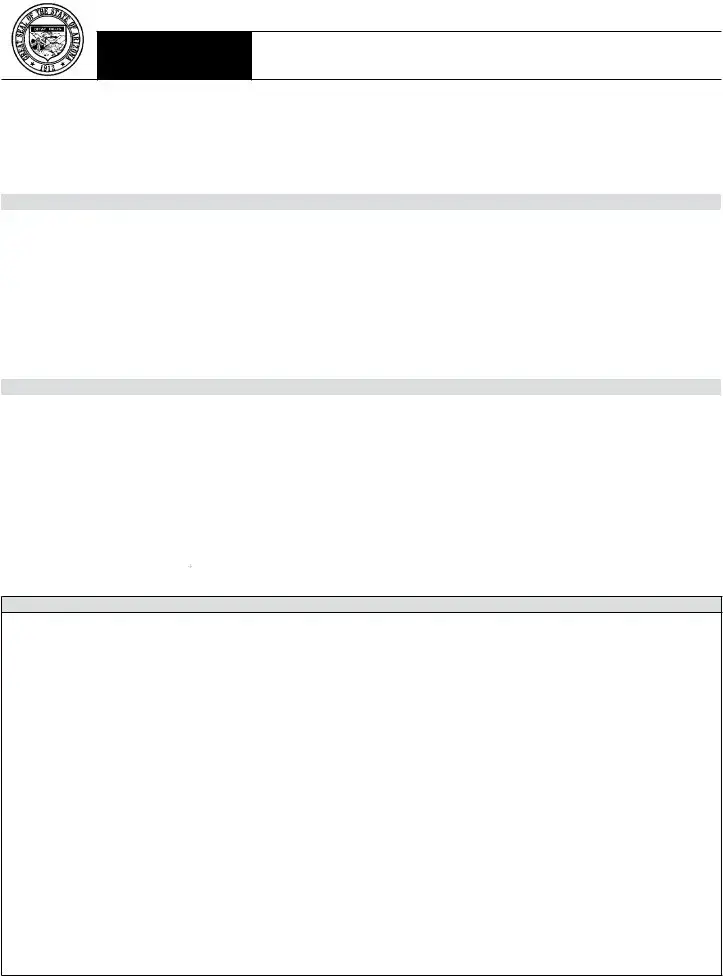

Your Name (as shown on page 1)

Arizona Transaction Privilege Tax License Number

11. Electricity, natural gas or liquefied petroleum gas sold to a qualified manufacturing or smelting business. A manufacturing or smelting business that claims this exemption authorizes the release by the vendor of the information required to be provided to the Department of Revenue pursuant to A.R.S. §

12. Electricity or natural gas to a business that operates an international operations center in this state and that is certified by the Arizona Commerce Authority. NOTE: Certification must be attached. (Utilities classification only.) (Not available for all Cities.)

13. Computer data center equipment sold to the owner, operator or qualified colocation tenant of a computer data center that is certified by the Arizona Commerce Authority pursuant to A.R.S. §

14. Sale or lease of tangible personal property to affiliated Native Americans if the order is placed from and delivered to the reservation. NOTE: The vendor shall retain adequate documentation to substantiate the transaction.

15. Foreign diplomat. NOTE: Limited to authorization on the U.S. Department of State Diplomatic Tax Exemption Card. The vendor shall retain a copy of the U.S. Department of State Diplomatic Tax Exemption Card and any other documentation issued by the U.S. Department of State. Motor vehicle purchases or leases must be

16.*Other Deduction: Cite the Arizona Revised Statutes authority for the deduction. A.R.S. §

Description:

17.*Other Cities Deduction: Cite the Model City Tax Code authority for the deduction. M.C.T.C. § Description:

*Refer to www.azdor.gov/TransactionPrivilegeTax(TPT)/RatesandDeductionCodes.aspx for a complete list of state and city exemptions (deductions) and the business classes (codes) under which the deductions apply.

E.Describe the tangible personal property or service purchased or leased and its use below. (Use additional pages if needed.)

F. Certification

A vendor that has reason to believe that this Certificate is not accurate or complete will not be relieved of the burden of proving entitlement to the exemption. A vendor that accepts a Certificate in good faith will be relieved of the burden of proof and the purchaser may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish the accuracy and completeness of the information provided in the Certificate, the purchaser is liable for an amount equal to the transaction privilege tax, penalty and interest which the vendor would have been required to pay if the vendor had not accepted the Certificate. Misuse of this Certificate will subject the purchaser to payment of the A.R.S. §

I, (print full name) |

, hereby certify that these transactions are |

exempt from Arizona transaction privilege tax and that the information on this Certificate is

on this Certificate is true, accurate and complete. Further, if

true, accurate and complete. Further, if purchasing or leasing as an agent or officer, I

purchasing or leasing as an agent or officer, I certify that I

certify that I am authorized to execute this Certificate on behalf of the purchaser named above.

am authorized to execute this Certificate on behalf of the purchaser named above.

SIGNATURE OF PURCHASER |

|

DATE |

|

TITLE |

ADOR 10308 (9/21)

Page 2 of 2

Print Form

Reset Form

File Properties

| Fact | Detail |

|---|---|

| Governing Law | Arizona Revised Statutes (A.R.S.) § 42-5009 |

| Purpose | To document and establish a basis for state and city tax deductions or exemptions. |

| Usage Restriction | Form 5000 should not be used for sale for resale (use Form 5000A) or by non-TPT licensed contractors (use Form 5000M). |

| Completion Requirement | The form must be completely filled out by the purchaser and furnished to the vendor at the time of sale. |

| Vendor Responsibility | The vendor must retain the Certificate for single transactions or for the specified period, not to exceed 48 months, with valid TPT license documentation for each year. |

| Exemption Categories | Only one category of exemption may be claimed on a Certificate, with specific common exemptions listed and others requiring citation of appropriate authority. |

| Misuse Implications | Misuse of the Certificate can result in the purchaser being liable for tax, penalty and interest, with willful misuse subjecting the purchaser to criminal penalties of a felony. |

| Validity Period Suggestion | The certificate can be valid for a specific period, with a suggestion not to exceed a 12-month period for good faith acceptance. |

Instructions on Utilizing Arizona 5000

Filling out the Arizona Form 5000, the Transaction Privilege Tax Exemption Certificate, is a critical step for businesses aiming to claim applicable state and city tax deductions or exemptions on their transactions. This form ensures that transactions are properly documented, providing a basis for exemptions under the law. It is essential for purchasers to provide complete and accurate information to the vendor at the time of sale, with the vendor responsible for retaining this certificate. An understanding of the specific requirements and steps to accurately complete this form is vital for both compliance and the benefit of applicable tax exemptions.

- Begin by entering the full Purchaser’s Name and Address in the designated section (Section A).

- Decide whether the certificate is for a Single Transaction or for a specific period. If choosing a period, remember to specify the start and end dates, keeping in mind the certificate’s validity up to 48 months with proof of an active TPT license for each calendar year covered.

- Provide optional contact information, such as the Purchaser’s Email and Telephone Number.

- Enter the Vendor’s Name to whom you're furnishing this certificate.

- Select the transaction type (Section C) relevant to this exemption certificate by checking the appropriate box. Choose only one option per certificate.

- In the Reason for Exemption section (Section D), mark the box that corresponds to the exemption reason for your purchase. If your specific exemption reason is not listed, use boxes 16 or 17 to cite the appropriate authority from either the Arizona Revised Statutes or the Model City Tax Code for your exemption.

- Describe in detail the tangible personal property or service being purchased or leased and its intended use in the space provided. Attach additional pages if necessary.

- Review the Certification section (Section F), which highlights the responsibilities of both the purchaser and the vendor regarding the accuracy and completeness of the certificate. Misuse of this certificate can result in severe penalties including the payment of taxes, interest, and penalties, and in some cases, felony charges.

- Print your full name to certify the accuracy of the information and sanction the exemption claim. Sign and date the certificate. If signing on behalf of a business, include your title to showcase your authorization to execute this certificate for the purchaser.

After completing and signing the form, hand it over to the vendor for their records. Remember, this form does not serve as a blanket exemption for all transactions. Each transaction type may require a separate form, and it's the purchaser's responsibility to ensure that each form is appropriately used and accurately completed. Failure to provide a fully completed form may result in the inability to claim the intended tax exemptions. Therefore, it’s essential to pay close attention to each step and provide detailed, accurate information throughout the form.

Listed Questions and Answers

What is the Arizona Form 5000 used for?

The Arizona Form 5000, also known as the Transaction Privilege Tax Exemption Certificate, is used to document and establish a basis for state and city tax deductions or exemptions on transactions. This certificate must be fully completed by the purchaser and provided to the vendor at the time of sale. It helps delineate transactions eligible for specific exemptions from the Arizona transaction privilege tax.

Can Form 5000 be used for all types of sales?

No, Form 5000 cannot be used for all sales. Specifically, it should not be used to claim a sale for resale, which requires Form 5000A. Additionally, non-TPT licensed contractors looking to claim exemptions must use Form 5000M instead. Form 5000 is tailored for transactions that qualify for certain exemptions under the guidelines set by the Arizona Department of Revenue.

What happens if the Form 5000 is incomplete?

An incomplete Form 5000 is not considered to be accepted in good faith. This means that for an exemption to be valid, the form must be filled out completely and accurately. An incomplete form may result in the vendor being liable for the transaction privilege tax, penalty, and interest that could have been exempted if the form had been properly completed.

How long is the Form 5000 valid?

The validity period of Form 5000 can vary. Although purchasers are encouraged not to exceed a 12-month period, a certificate will be considered to be accepted in good faith for a period not to exceed 48 months, assuming the vendor has documentation that the purchaser's TPT license is valid for each calendar year covered by the certificate. Specific dates for the certificate's validity must be chosen at the time of completion.

Can multiple categories of exemption be claimed on a single Form 5000?

No, only one category of exemption can be claimed on a single Form 5000. If a purchaser is eligible for exemptions under multiple categories, they must fill out separate forms for each exemption category. This requirement helps ensure the clarity and accuracy of tax exemption claims made under different provisions.

What are the consequences of misusing Form 5000?

Misuse of Form 5000 will subject the purchaser to the payment of the amount equal to any transaction privilege tax, penalty, or interest that would have been due had the exemption not been claimed incorrectly. Willful misuse of this certificate is considered a felony under A.R.S. § 42-1127(B) and can lead to criminal penalties. Vendors accepting the form in good faith are relieved from the burden of proof, but the purchaser may need to establish the accuracy of the claimed exemption if questioned.

Common mistakes

Filling out the Arizona 5000 form, also known as the Transaction Privilege Tax Exemption Certificate, accurately is crucial for qualifying for state and city tax deductions or exemptions. However, several common mistakes can lead to problems or even disqualification of the exemption. Below are ten mistakes frequently made when completing this form:

- Utilizing Form 5000 for incorrect purposes: Individuals often use Form 5000 to claim a sale for resale, which is incorrect. Form 5000A is specifically designated for this purpose.

- Filling out the form as a non-licensed contractor: Non-TPT licensed contractors sometimes mistakenly use Form 5000 instead of the correct Form 5000M intended for their uses.

- Incomplete certificates: Not fully completing the certificate makes it non-acceptable in establishing good faith for tax exemption claims.

- Claiming multiple categories of exemption on a single certificate: The form stipulates that only one exemption category can be claimed per certificate. Overlooking this instruction is a common error.

- Choosing incorrect dates: Proper dates for the period during which the certificate is valid must be specified, and exceeding the 12-month period is discouraged. Certificates will, however, be accepted for periods not exceeding 48 months, provided documentation supports the TPT license validity for each year covered.

- Failure to specify the transaction type: Each certificate requires the selection of one specific transaction type. Omitting this crucial step or selecting multiple types can invalidate the form.

- Incorrect exemption reason: The reason for the exemption must match one of the provided common exemptions or properly cite the relevant authority for another exemption. Misidentifying this reason can lead to the rejection of the certificate.

- Not attaching required documentation: Some exemptions, such as those for manufacturing, smelting businesses, or computer data centers, require attached documentation for verification. Failing to attach these documents can negate the exemption claim.

- Incorrect description of tangible personal property or service: The description of the purchased or leased property or service must be clear and accurate, including its use. Ambiguity or inaccuracies in this section can lead to misunderstandings regarding the exemption's applicability.

- Misuse of the certification: The signatory must certify the accuracy and completeness of the information. Misuse of the certificate, intentional or otherwise, can result in penalties, including criminal charges for willful misuse.

By avoiding these common errors, applicants can ensure their Arizona 5000 form is correctly completed, supporting their qualification for the intended tax deductions or exemptions.

Documents used along the form

Understanding the intricacies of Arizona's tax exemptions involves more than just filling out the Arizona Form 5000, Transaction Privilege Tax Exemption Certificate. Often, businesses and individuals find themselves navigating through additional documents and forms to ensure full compliance and optimal benefits under the law. Let's explore some of the documents frequently associated with Form 5000 to provide a clearer picture of the process.

- Form 5000A: This form is specifically designed for transactions that are sales for resale. Unlike the more general Form 5000, Form 5000A caters to situations where purchased goods are intended to be resold, allowing businesses to claim the proper tax exemptions.

- Form 5000M: Tailored for non-TPT (Transaction Privilege Tax) licensed contractors, this document is vital for those seeking exemptions specific to their contractual work. It's a critical distinction for contractors operating within Arizona's regulatory framework.

- Form 5005: Serving as a Certificate of Exemption for Government Purchase Orders, this document is essential for transactions made directly with the U.S. Government, its departments, or agencies. It's particularly relevant when purchasing or leasing tangible personal property.

- ADOR 10308: While technically part of the Form 5000 documentation, this supporting document details the requirements and criteria for exemption claims, guiding users through the specifics of the exemption process.

- TPP 18-1 Worksheet: Recommended for purchasers claiming an exemption on utilities for a qualifying manufacturing or smelting business, this worksheet helps in documenting the exemption under certain criteria outlined in the Arizona Transaction Privilege Tax Procedure.

- Computer Data Center (CDC) Exemption Certificate: For transactions involving computer data center equipment, this certification is mandatory. It qualifies the owner, operator, or tenant of a CDC for tax exemptions on related equipment, provided the center is certified by the Arizona Commerce Authority.

Navigating these forms can be a complex process, but understanding their purpose and how they interconnect with the Arizona Form 5000 is crucial for correctly claiming tax exemptions. Whether it's selling goods for resale, contracting without a TPT license, making government purchases, or operating a certified computer data center, the correct forms play an essential role in ensuring compliance and maximizing tax benefits. Being informed and prepared with the right documents is the first step toward navigating Arizona's tax regulations successfully.

Similar forms

The Arizona 5000 form, known as the Transaction Privilege Tax Exemption Certificate, shares similarities with various other tax documents seeking to establish a taxpayer's right to specific exemptions or deductions. One such document is the "Sales Tax Exemption Certificate" utilized by retailers and wholesalers across different states. Both certificates serve the purpose of documenting exemptions from state tax liabilities; however, while the Arizona 5000 is specific to transaction privilege tax in Arizona, the Sales Tax Exemption Certificate applies to sales tax and may vary by state. The primary similarity lies in their function to exempt purchasers from tax obligations under certain conditions, necessitating complete and accurate information for validity.

Another similar document is the "Resale Certificate," which is used by businesses to purchase goods tax-free that will later be resold. The Arizona 5000 form and Resale Certificates share the notion of tax exemption on purchases, although the Resale Certificate specifically addresses items for resale, avoiding double taxation once the items are sold to the end consumer. The distinction between the two lies in their applicability; the Arizona 5000 encompasses a broader range of exemptions, while the Resale Certificate focuses solely on resale purposes.

The "Use Tax Certificate" also mirrors aspects of the Arizona 5000 form, as both are involved in tax exemption processes. A Use Tax Certificate is for items purchased tax-free for use, storage, or other consumption within a state where the purchase did not include sales tax. Both documents aim to regulate tax responsibilities, ensuring that exemptions are properly documented and justified. However, the Arizona 5000 is more closely related to transaction privilege tax and sales within Arizona, whereas Use Tax Certificates apply to the use tax obligation arising from out-of-state purchases.

The "Farm Exemption Certificate" is another document with similarities, particularly used by individuals or entities in the agricultural sector to exempt certain purchases from sales tax. Like the Arizona 5000 form, it specifies conditions under which purchasers qualify for tax exemptions. The main difference lies in the specificity of the exemptions; the Farm Exemption Certificate is strictly for agricultural uses, demonstrating the specialized nature of tax exemption certificates and their application to diverse fields and transactions.

Finally, the "Manufacturer's Exemption Certificate" closely relates to the Arizona 5000 form in its provision for tax exemptions to manufacturers on purchases of machinery, equipment, or supplies used directly in production. Both documents alleviate tax burdens under specific circumstances, supporting economic activities by reducing operational costs. While the Manufacturer's Exemption Certificate is specific to manufacturing activities, the Arizona 5000 form covers a broader range of exemptions, including but not limited to manufacturing, indicating the varied applications of exemption certificates in tax law.

Dos and Don'ts

When filling out the Arizona Form 5000, the Transaction Privilege Tax Exemption Certificate, it’s crucial to follow proper guidelines to ensure compliance and avoid any legal or financial repercussions. Below is a list of things you should and shouldn't do that can help streamline the process:

- Do read the instructions carefully before you start. Understanding the purpose and requirements of the form is essential for accurate completion.

- Do not use Form 5000 to claim a sale for resale. For such transactions, Form 5000A is the correct document to use.

- Do not use Form 5000 if you are a non-TPT licensed contractor. Instead, use Form 5000M, which is designed for contractors without a Transaction Privilege Tax license.

- Do ensure to fill out the form completely. Incomplete forms are not considered to be filled out in good faith, which can lead to the rejection of your exemption claim.

- Do choose only one category of exemption per Certificate. Attempting to claim multiple exemptions on a single form can invalidate your submission.

- Do provide specific dates for the period the certificate will be valid if you’re opting for a Period Certificate. Remember, the period should not exceed 12 months, though exceptions are noted in the form’s instructions.

- Do include your Transaction Privilege Tax License Number if applicable, as this can be vital for the form’s acceptance and your eligibility for exemptions.

- Do not misuse the certificate. Misuse can result in the purchaser being liable for any applicable taxes, penalty, and interest, and willful misuse could lead to criminal penalties.

Adherence to these guidelines not only facilitates the intended exemption claims but also minimizes potential issues with tax compliance. Should questions or uncertainties arise, consulting with tax professionals or the Arizona Department of Revenue may provide additional clarity and ensure that all criteria are met in the completion and submission of Form 5000.

Misconceptions

When it comes to the Arizona Form 5000, commonly known as the Transaction Privilege Tax Exemption Certificate, there are several misconceptions that need to be cleared up. Understanding this form is crucial for businesses and individuals aiming to navigate tax exemptions accurately.

Misconception 1: Form 5000 can be used for all resale transactions. This is incorrect because for sale for resale transactions, you should use Form 5000A instead. Form 5000 is not designed for this purpose.

Misconception 2: Non-TPT licensed contractors can use Form 5000. In fact, non-TPT licensed contractors must use Form 5000M, as Form 5000 is not applicable to them.

Misconception 3: A Certificate can be used to claim multiple exemption categories. Only one category of exemption may be claimed on a Certificate, ensuring that each transaction is clearly categorized and appropriately exempt.

Misconception 4: Certificates do not need to be complete or accurate. On the contrary, incomplete Certificates are not accepted in good faith. Both the purchaser and the vendor must ensure the Certificate is fully and accurately completed.

Misconception 5: Certificates can be valid indefinitely. The truth is that while purchasers are encouraged not to exceed a 12-month period for a Certificate's validity, it may be considered in good faith for a period not to exceed 48 months, provided the vendor has documentation of the TPT license's validity for each covered year.

Misconception 6: The Certificate is optional for tax exemption claims. Actually, this Certificate is prescribed by the Department of Revenue pursuant to A.R.S. § 42-5009 for documenting and establishing a basis for state and city tax deductions or exemptions, making it a necessary document for these claims.

Misconception 7: Any exemption can be claimed without providing the appropriate authority or documentation. Specific exemptions require citing the Arizona Revised Statutes (A.R.S.) or the Model City Tax Code (M.C.T.C.) authority. Additionally, certain exemptions like transactions with foreign diplomats or Native Americans require specific documentation or authorization to substantiate the exemption claim.

Clearing up these misconceptions helps ensure that the Transaction Privilege Tax Exemption Certificate is used correctly, enabling businesses and individuals to accurately claim their entitled deductions and exemptions.

Key takeaways

Understanding the Arizona Form 5000 is crucial for correct tax exemption claims within the state. Here are key takeaways to ensure its proper use and compliance:

- Form Selection: It's essential to use the correct form based on the transaction type. Form 5000 is not suitable for sale for resale transactions (use Form 5000A instead) nor for non-TPT licensed contractors (use Form 5000M).

- Completeness: Fill out the certificate completely to document and establish a basis for tax deductions or exemptions. Incomplete certificates are not accepted in good faith.

- Duration Validity: You can specify the validity period of the certificate, encouraged not to exceed 12 months. However, a certificate may be considered in good faith for up to 48 months, provided the vendor has documentation of a valid TPT license for each year.

- Single Use: Only one category of exemption can be claimed per Certificate, making it imperative to choose the exemption category carefully based on the precise nature of the transaction.

- Vendor Responsibility: The vendor must retain this Certificate either for single transactions or the specified period. By accepting a Certificate in good faith, the vendor is relieved of the burden of proof should any question arise regarding the exemption's validity.

- Purchaser Accountability: Misuse of this Certificate can lead to the purchaser being liable for any unclaimed transaction privilege tax, penalty, and interest. In cases of willful misuse, criminal penalties, including felony charges, may apply.

Additionally, it's recommended for purchasers to attach necessary documentation or certifications, especially in cases involving specific exemptions like manufacturing or smelting operations, to avoid any disputes about the exemption claim's validity.

More PDF Forms

How to Apply Wic Arizona - Provides a clear and organized method for documenting a child’s nutritional requirements and the medical rationale behind them.

Apply to the University of Arizona - This waiver form enables a hassle-free application process to Arizona's top universities for financially challenged residents, clearing the path to higher education.