Fill in a Valid Arizona 285Up Template

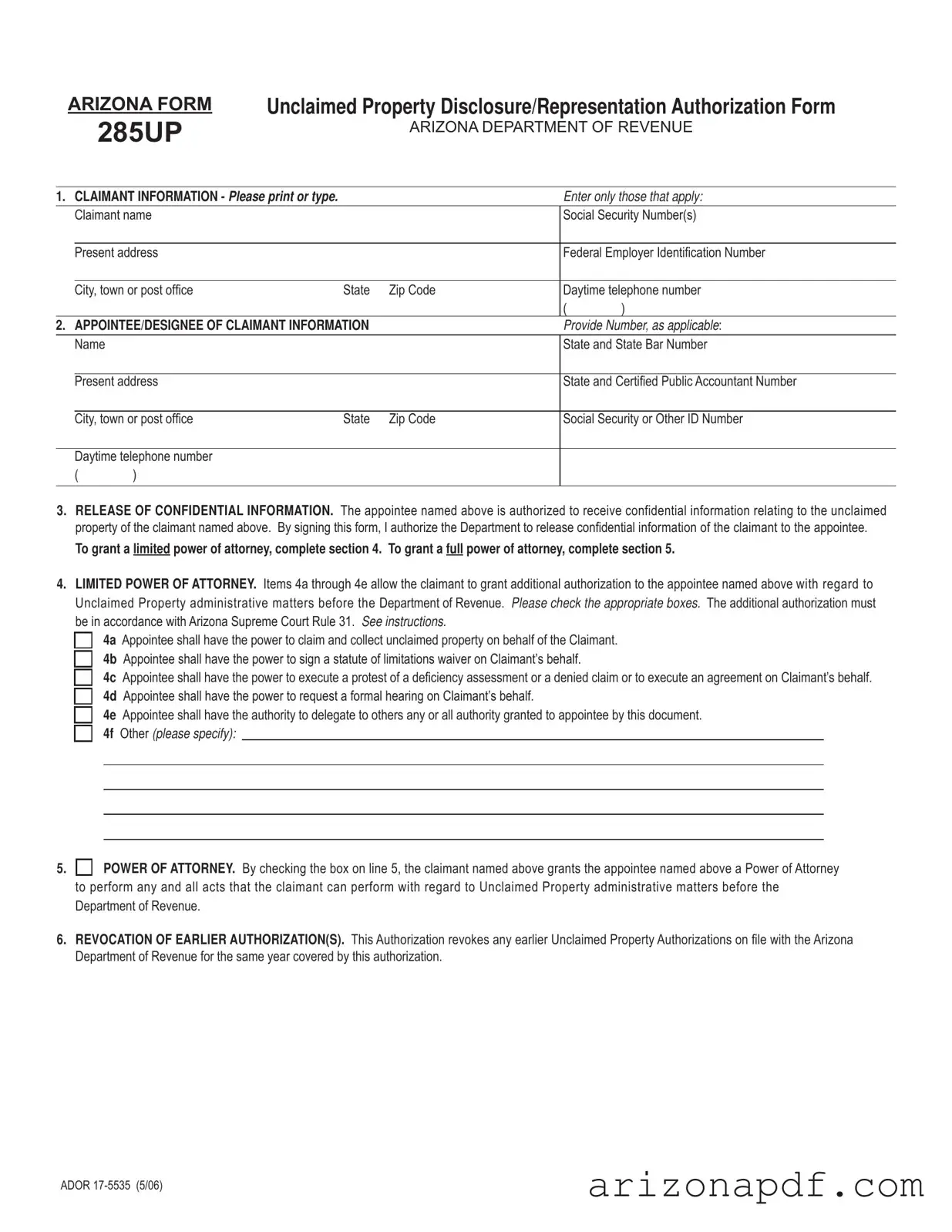

In the landscape of the Arizona legal framework, the Unclaimed Property Disclosure/Representation Authorization Form 285UP stands as a crucial document for individuals and entities navigating the process of claiming unclaimed property. Issated by the Arizona Department of Revenue, this document facilitates the appointment of a representative to act on behalf of the claimant in matters related to unclaimed property. The form requires detailed claimant information including their name, contact details, and identification numbers, ensuring that the claimant is accurately identified in the process. Additionally, it sets out provisions for appointing a designee, including lawyers and certified public accountants, who are granted varying levels of authority to access confidential information, claim and collect unclaimed property, execute legal documents, and possibly request formal hearings on behalf of the claimant. The form not only underscores the importance of explicit consent and authority in these affairs but also outlines the penalties for the provision of fraudulent information. Furthermore, it addresses the specific needs of corporate taxpayers with controlled subsidiaries, allowing for a streamlined authorization process in complex organizational structures. By completing and submitting this form, claimants initiate the procedure to claim what is rightfully theirs, all the while ensuring their representation is adequately empowered to act efficiently and in their best interests. The signature sections for both the claimant and appointee seal the authorization, emphasizing the form's role in bridging the gap between unclaimed assets and their rightful owners.

Arizona 285Up Preview

ARIZONA FORM |

Unclaimed Property Disclosure/Representation Authorization Form |

||||

|

285UP |

|

ARIZONA DEPARTMENT OF REVENUE |

||

|

|

|

|

|

|

|

|

|

|

||

1. CLAIMANT INFORMATION - Please print or type. |

|

Enter only those that apply: |

|||

|

Claimant name |

|

|

Social Security Number(s) |

|

|

|

|

|

|

|

|

Present address |

|

|

Federal Employer Identification Number |

|

|

|

|

|

|

|

|

City, town or post office |

State |

Zip Code |

Daytime telephone number |

|

|

|

|

|

( |

) |

2. APPOINTEE/DESIGNEE OF CLAIMANT INFORMATION |

|

Provide Number, as applicable: |

|||

|

Name |

|

|

State and State Bar Number |

|

|

|

|

|

|

|

|

Present address |

|

|

State and Certified Public Accountant Number |

|

|

|

|

|

|

|

|

City, town or post office |

State |

Zip Code |

Social Security or Other ID Number |

|

Daytime telephone number

()

3.RELEASE OF CONFIDENTIAL INFORMATION. The appointee named above is authorized to receive confidential information relating to the unclaimed property of the claimant named above. By signing this form, I authorize the Department to release confidential information of the claimant to the appointee.

To grant a limited power of attorney, complete section 4. To grant a full power of attorney, complete section 5.

4.LIMITED POWER OF ATTORNEY. Items 4a through 4e allow the claimant to grant additional authorization to the appointee named above with regard to Unclaimed Property administrative matters before the Department of Revenue. Please check the appropriate boxes. The additional authorization must be in accordance with Arizona Supreme Court Rule 31. See instructions.

4a Appointee shall have the power to claim and collect unclaimed property on behalf of the Claimant.

4b Appointee shall have the power to sign a statute of limitations waiver on Claimant’s behalf.

4c Appointee shall have the power to execute a protest of a deficiency assessment or a denied claim or to execute an agreement on Claimant’s behalf. 4d Appointee shall have the power to request a formal hearing on Claimant’s behalf.

4e Appointee shall have the authority to delegate to others any or all authority granted to appointee by this document.

4f Other (please specify):

5.

POWER OF ATTORNEY. By checking the box on line 5, the claimant named above grants the appointee named above a Power of Attorney to perform any and all acts that the claimant can perform with regard to Unclaimed Property administrative matters before the Department of Revenue.

POWER OF ATTORNEY. By checking the box on line 5, the claimant named above grants the appointee named above a Power of Attorney to perform any and all acts that the claimant can perform with regard to Unclaimed Property administrative matters before the Department of Revenue.

6.REVOCATION OF EARLIER AUTHORIZATION(S). This Authorization revokes any earlier Unclaimed Property Authorizations on file with the Arizona Department of Revenue for the same year covered by this authorization.

ADOR

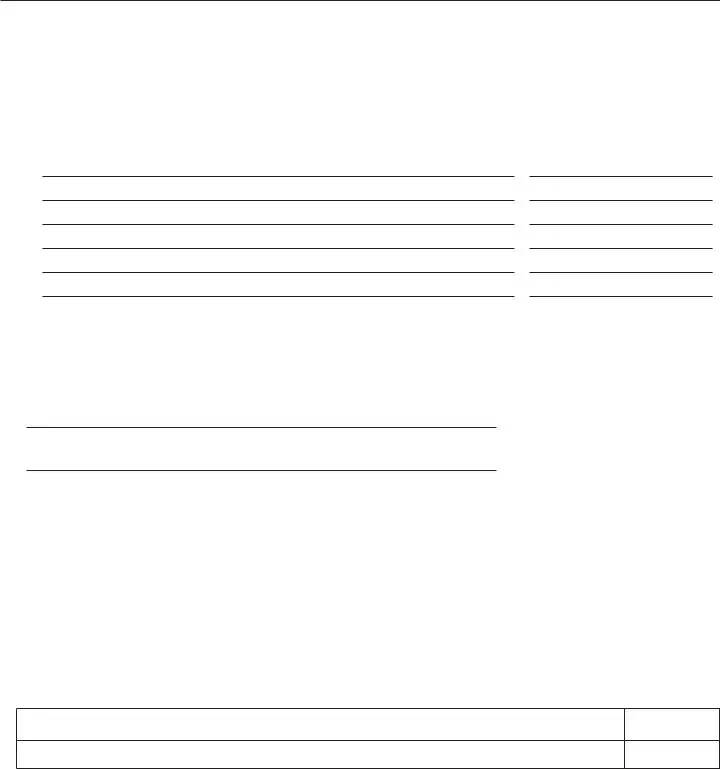

AZ FORM 285UP (2006) PAGE 2

7.CORPORATIONS HAVING CONTROLLED SUBSIDIARIES. A.R.S.

Include the following controlled subsidiaries. A controlled subsidiary, for purposes of A.R.S.

NAME |

FEDERAL I.D. NO. |

7a

7b

7c

7d

7e

7f

8.SIGNATURE OF CLAIMANT. I hereby certify that I have the authority, within the meaning of A.R.S.

►

SIGNATURE |

DATE |

PRINT NAME

TITLE

9.DECLARATION OF APPOINTEE. Complete if Appointee has been given authority under Section 4 or Section 5 or is otherwise authorized to pratice law as defined in Rule 31 of the Arizona Rules of the Supreme Court.

Under penalties of perjury, I, the above named appointee, declare that I am one of the following:

a A

b Attorney - an active member of the State Bar of Arizona.

c Certified Public Accountant - duly qualified to practice as a Certified Public Accountant in Arizona.

d Federally Authorized Tax Practitioner within the meaning of A.R.S. §

_______________________________________________________ |

___________________________ |

PRACTITIONER’S NAME |

CAF NUMBER |

eOther - This may be any individual, providing the total amount in dispute, including tax, penalties, and interest is less than $5,000.00.

DESIGNATION |

JURISDICTION |

|

Enter a letter (a, b, c d or e). |

(State) |

SIGNATURE |

|

|

|

If this Declaration of Appointee is not signed and dated, the representation authorization will be returned.

Mail completed form to:

Arizona Department of Revenue Unclaimed Property Unit

1600 W. Monroe Street Phoenix, AZ 85007

DATE

ADOR

File Properties

| Fact | Detail |

|---|---|

| Form Purpose | The Arizona Form 285UP is used for disclosing and authorizing representation concerning unclaimed property. |

| Execution for Power of Attorney | Claimants can grant limited or full power of attorney to an appointee for Unclaimed Property administrative matters before the Department of Revenue. |

| Governing Law for Disclosure | A.R.S. §42-2003(A)(1) allows confidential information of a corporate taxpayer to be disclosed to a designated authorized individual. |

| Revocation Clause | This form revokes any previously filed Unclaimed Property Authorizations for the same year with the Arizona Department of Revenue. |

| Penalty for False Statements | Knowingly preparing or presenting a document that is fraudulent or false is considered a Class 5 felony under A.R.S. §42-1127(B)(2). |

Instructions on Utilizing Arizona 285Up

When handling unclaimed property in Arizona, the Arizona Form 285UP is a critical document that grants authorization to a designee to act on behalf of the claimant. This includes receiving confidential information and taking specific actions regarding the unclaimed property. Filling out this form accurately is essential for ensuring that the designated party can effectively manage or claim the property on behalf of the original owner.

Steps to Fill Out the Arizona 285UP Form:- Start by providing the claimant's information in section 1. Fill in the claimant's name, Social Security Number(s) or Federal Employer Identification Number, present address, city, state, zip code, and daytime telephone number.

- In section 2, input the appointee or designee's information. Include their name, present address, city, state, zip code, daytime telephone number, and the relevant certification numbers (State Bar Number and/or Certified Public Accountant Number), along with their Social Security or other ID number.

- Under section 3, by signing the form, the claimant authorizes the release of confidential unclaimed property information to the appointee. No additional action is required in this step other than to ensure understanding of this authorization.

- Section 4 involves granting limited powers of attorney to the appointee. Check the appropriate boxes (4a through 4e) to specify the types of authorization given, such as the power to claim and collect unclaimed property, sign waivers, protest assessments, request hearings, or delegate authority. If there are other specific authorizations, specify these in item 4f.

- In section 5, grant a full power of attorney if the claimant wishes to give the appointee complete authority to handle all matters related to the unclaimed property before the Department of Revenue. Check the box if this applies.

- Section 6 revokes any previous unclaimed property authorizations that might have been filed with the Arizona Department of Revenue for the same property. Acknowledge this by understanding no further action is needed other than completing this form.

- For corporations with controlled subsidiaries (section 7), include all necessary information about each subsidiary for which you are granting authorization. This might require attaching a separate list or a federal Form 851.

- Sign the form in section 8 as the claimant, certifying authority to execute this form and understanding the legal implications of a fraudulent document.

- The appointee must complete section 9, declaring their qualifications, and sign and date the form. This validates their authorization to act on behalf of the claimant.

- Mail the completed form to the address provided: Arizona Department of Revenue Unclaimed Property Unit, 1600 W. Monroe Street, Phoenix, AZ 85007.

Properly filled out and submitted, the Arizona Form 285UP facilitates the process of managing or claiming unclaimed property, ensuring that all necessary authorizations are in place. It is a straightforward yet vital step in safeguarding one's rights or effectively acting on behalf of another in matters of unclaimed property in the state of Arizona.

Listed Questions and Answers

What is the Arizona 285UP form used for?

The Arizona 285UP form, also known as the Unclaimed Property Disclosure/Representation Authorization Form, is used by individuals or entities to authorize another person or entity, such as a lawyer or accountant, to represent them in matters related to unclaimed property with the Arizona Department of Revenue. This includes authorizing an appointee to receive confidential information, make claims, sign waivers, protest assessments, and request hearings related to the claimant’s unclaimed property.

Who needs to complete the Arizona 285UP form?

This form needs to be completed by individuals or entities who have unclaimed property being held by the Arizona Department of Revenue and wish to appoint someone else to handle their unclaimed property matters. This could include individuals, corporations, or legal representatives of estates that expect to engage in activities such as claiming property, signing waivers, or other administrative actions on behalf of the owner of the unclaimed property.

What information is required on the Arizona 285UP form?

To complete the Arizona 285UP form, you will need to provide detailed information for both the claimant and the appointee/designee. For the claimant, this includes name, Social Security Number or Federal Employer Identification Number, contact information, and authorization signature. For the appointee/designee, the form requires name, jurisdictional numbers (like State Bar Number or Certified Public Accountant Number), contact information, and a declaration with signature to confirm their eligibility and authority to act on behalf of the claimant.

Can a claimant revoke the authorization given on an Arizona 285UP form?

Yes, a claimant can revoke the authorization at any time. Section 6 of the Arizona 285UP form explicitly states that this authorization revokes any earlier Unclaimed Property Authorizations on file with the Arizona Department of Revenue for the same year covered by this authorization. To revoke the authorization, a new form must be submitted indicating the change in representation or to nullify previous authorizations.

How does one submit the completed Arizona 285UP form?

Once filled out, the Arizona 285UP form should be mailed to the Unclaimed Property Unit at the Arizona Department of Revenue, located at 1600 W. Monroe Street, Phoenix, AZ 85007. It is important to ensure that all required sections are completed, and necessary signatures are provided. Incomplete forms or forms lacking the necessary declaration and signatures will be returned, possibly delaying the process of claiming the unclaimed property.

Common mistakes

Completing the Arizona Form 285UP, the Unclaimed Property Disclosure/Representation Authorization Form, requires attention to detail. Common mistakes can hinder the process of claiming unclaimed property. Recognizing and avoiding these mistakes is crucial for a successful claim.

- Not providing complete Claimant Information, including all relevant identification numbers and current contact information. This misstep can lead to delays or correspondence issues.

- Filling out the Appointee/Designee of Claimant Information section incorrectly or incompletely, particularly in providing the correct State Bar or Certified Public Accountant number. Accurate information here is crucial for the authorization of the appointee.

- Omitting the Release of Confidential Information signature. Without this, the Department cannot legally share the necessary details with the appointee, stalling the process.

- In the Limited Power of Attorney section, failing to check the appropriate boxes according to the specific authorities being granted can result in an incomplete grant of powers.

- Not specifying other powers in section 4f when "other" is checked, leaving ambiguous the exact scope of authority granted to the appointee.

- Assuming the Power of Attorney section grants more authority than it does without checking the appropriate box or misunderstanding its impact on claimant's rights.

- Revocation of earlier authorization(s) oversight. Neglecting to revoke previous authorizations can create conflicting commands, especially without specifying the year of authorization being revoked.

- For corporations with controlled subsidiaries, not listing all entities for which information disclosure is authorized can lead to partial disclosure, not covering all intended subsidiaries.

- Failing to provide a signature and date on the Signature of Claimant section, which is essential to validate the form. Without these, the form is considered incomplete.

- Incorrectly completing the Declaration of Appointee section or not providing the required signatures and designations can invalidate the entire authorization.

Avoiding these common mistakes can streamline the process, ensuring that the Arizona Department of Revenue has all necessary information to process the unclaimed property claim efficiently and correctly.

Documents used along the form

The Arizona Form 285UP, an Unclaimed Property Disclosure/Representation Authorization Form, is essential for managing and authorizing the representation of claims related to unclaimed property in Arizona. This form plays a pivotal role in facilitating the recovery of unclaimed assets by authorizing designated appointees to act on behalf of the claimant in matters concerning unclaimed property held by the Arizona Department of Revenue. However, to effectively address all aspects of unclaimed property recovery and ensure compliance with state requirements, several additional forms and documents may be required to support or accompany the Arizona 285UP form. Here is a breakdown of these essential documents:

- Form A-4: Employee’s Arizona Withholding Election – This form allows employees to determine the amount of state income tax withheld from their paychecks, potentially relevant to the unclaimed property if the property in question originates from past employment.

- Form 140: Arizona Individual Income Tax Return – Necessary for claimants who need to report any income derived from the reclaimed property or to adjust prior returns based on the claimed property.

- Form W-9: Request for Taxpayer Identification Number and Certification – Often required to verify the claimant's tax identification number for tax reporting purposes related to the recovered unclaimed property.

- Form 821: Power of Attorney – While the 285UP includes a limited power of attorney section, a comprehensive Form 821 may be needed for broader representation in all tax matters.

- Bank Statements or Financial Records: To support the claim of ownership over the unclaimed property, especially if it relates to bank accounts or financial instruments.

- Death Certificate: If the unclaimed property is being claimed by the heir or executor of an estate, a death certificate of the deceased will be required to establish the claimant’s right to the property.

- Probate Court Documents: Including wills, estate documents, or letters of administration, to further support claims made by heirs or executors of estates.

Together with the Arizona 285UP form, these documents form a comprehensive toolkit that addresses the legal and procedural requirements for claiming unclaimed property in Arizona. Properly completing and submitting these documents is crucial for a smooth and successful unclaimed property recovery process. By ensuring all relevant documents are accurate and fully in order, claimants can effectively navigate the complexities of unclaimed property claims and expedite the resolution of their cases.

Similar forms

The Arizona Form 285UP shares similarities with the IRS Form 2848, Power of Attorney and Declaration of Representative. Both forms serve the purpose of authorizing an individual to represent the claimant or taxpayer before the respective department, allowing access to confidential information and the ability to perform actions on the claimant's or taxpayer's behalf. The key similarity lies in the stipulation that the appointee can execute claims, sign waivers, and engage in actions typically reserved for the claimant or taxpayer, showcasing the forms' roles in delegating authority for financial and legal matters.

Similar to the Arizona Form 285UP, the IRS Form 8821, Tax Information Authorization, allows individuals or designated appointees to receive and inspect confidential tax information. While Form 8821 does not grant the authority to act on behalf of the taxpayer in terms of representation, it does share the feature of permitting the disclosure of tax information to a third party, aligning with Form 285UP’s release of confidential information to the appointee.

The Securities and Exchange Commission's Form ADV is designed for investment advisors to register with both the SEC and state securities authorities, sharing a connection with the Arizona Form 285UP in terms of disclosure requirements. Both forms necessitate detailed personal and professional information, aiming to provide transparency and protect stakeholder interests, although they serve different regulatory purposes and audiences.

Form SS-4, Application for Employer Identification Number (EIN), issued by the IRS, parallels the Arizona Form 285UP in the aspect of requiring identification details like social security numbers or federal employer identification numbers. Although serving distinct functions—with Form SS-4 used for obtaining an EIN and Form 285UP for unclaimed property matters—both forms collect critical identification information for processing and verification purposes.

The Uniform Power of Attorney Act's standardized form, adopted by several states, has resemblances to the Arizona Form 285UP’s sections dealing with powers of attorney. Both documents allow the principal to confer broad or specific financial powers to an agent or appointee, detailing the scope of actions they are authorized to perform on behalf of the principal, underscoring the importance of delineating authority in financial affairs.

Another similar document is the U.S. General Services Administration's (GSA) Form SF-3881, ACH Vendor/Miscellaneous Payment Enrollment Form. This form collects banking information to facilitate electronic payments, akin to how the Arizona Form 285UP gathers claimant information for unclaimed property purposes. Both forms streamline financial transactions, albeit for different ends—the former for vendor payments and the latter for unclaimed property claims.

The Health Insurance Portability and Accountability Act (HIPAA) Authorization Form also shares a degree of similarity with the Arizona Form 285UP in that it authorizes the release of confidential information. While the HIPAA form specifically pertains to medical records, and Form 285UP to unclaimed property data, both enable individuals to designate representatives to access sensitive information, emphasizing the importance of controlled information sharing in personal and financial matters.

Finally, state-level unclaimed property search and claim forms, akin to those offered by various states' Departments of Treasury or Revenue, resemble the Arizona Form 285UP. These forms function to identify and reunite individuals with their unclaimed property, requiring similar types of personal identification to verify the claimant's identity and rightful ownership, reflecting the core purpose of Form 285UP within unclaimed property administration.

Dos and Don'ts

Understanding how to correctly fill out the Arizona Form 285UP is crucial for anyone looking to handle unclaimed property matters with the Arizona Department of Revenue efficiently. Here is a list of dos and don'ts that will help ensure the form is completed accurately and your process is smooth.

- Do ensure that all claimant information is filled out legibly, whether printed or typed, to avoid any misunderstandings or processing delays.

- Do not leave out any crucial details such as the Claimant's Social Security Number or Federal Employer Identification Number, as incomplete forms may lead to delays.

- Do accurately provide all required appointee/designee information, including the necessary identification numbers, ensuring they are eligible to act on the claimant's behalf.

- Do not forget to check the appropriate boxes under the Limited Power of Attorney and Power of Attorney sections to clearly indicate the appointee’s authority level.

- Do carefully consider who is appointed, as this person will have access to confidential information and possibly the ability to make significant decisions regarding the unclaimed property.

- Do not overlook the need to list all controlled subsidiaries if the form is being filed on behalf of a corporation, ensuring all are included for transparency and completeness.

- Do make sure the signature of the claimant is placed at the designated section to certify the authority and accuracy of the information provided in the form.

- Do not send the form without checking for accuracy and completeness to prevent it from being returned or delayed, which can hinder the process of claiming unclaimed property.

Following these guidelines when completing the Arizona Form 285UP will help streamline the process of claiming unclaimed property, ensuring a positive outcome for all parties involved.

Misconceptions

When it comes to navigating legal documents, the Arizona 285UP form – a key form for handling unclaimed property in Arizona – is often misunderstood. These misconceptions can lead to mistakes in the process, potentially affecting the outcome of claims. Let's clarify the most common misunderstandings.

Only individuals can file: A common belief is that the Arizona 285UP form is solely for individual use. However, corporations, especially those with controlled subsidiaries, can also utilize this form to claim unclaimed property or give another entity the power to do so on their behalf, provided the appropriate sections are completed and additional documentation, such as a list of subsidiaries, is attached if necessary.

Attorneys or CPAs are the only appointees: While the form does provide spaces for appointing attorneys or certified public accountants, it actually allows for a broader range of appointees. These can include full-time officers, partners, members, managers of a limited liability company, employees qualifying under specific rules, or even any individual if the total amount in dispute is less than $5,000. This flexibility ensures that claimants can choose representatives best suited to their needs.

Granting full power of attorney is irreversible: Some think that once you grant full power of attorney through this form, it cannot be revoked. However, section 6 explicitly allows for the revocation of earlier authorizations, ensuring that claimants maintain control over who has the authority to act on their behalf regarding their unclaimed property.

Confidential information release is unlimited: There's a misconception that by signing the form, the claimant allows for an unlimited release of confidential information. In reality, the release is very specific, limited to the unclaimed property matters of the claimant, and to the appointee named in the form. The document was designed with privacy in mind, strictly regulating the flow of sensitive information.

The form only serves to claim property: It's often thought that the Arizona 285UP form's sole purpose is to claim unclaimed property. However, it also enables the appointee to undertake various actions on behalf of the claimant, such as signing statute of limitations waivers, protesting denied claims, and even requesting formal hearings. This range of actions underscores the form's role in providing comprehensive assistance in unclaimed property matters.

Any mistake renders the form invalid: The fear that a single error on the form will invalidate it entirely is another common misconception. While accuracy is crucial, minor mistakes do not necessarily result in the form being rejected. The Arizona Department of Revenue prioritizes helping claimants and appointees rectify errors to ensure that the process of claiming unclaimed property proceeds smoothly.

Understanding the Arizona 285UP form thoroughly can dispel fears and ensure that the process of claiming unclaimed property is conducted correctly and efficiently. By clarifying these misconceptions, individuals and corporations alike can navigate their claims with greater confidence.

Key takeaways

Here are some key takeaways about filling out and using the Arizona 285Up form for Unclaimed Property Disclosure/Representation Authorization.

- Claimant information: The form requires detailed information about the claimant, including their name, Social Security Number or Federal Employer Identification Number, present address, and daytime telephone number.

- Appointee/Designee information: If the claimant wishes to authorize someone (like a lawyer or CPA) to act on their behalf, this section must be filled out with the appointee’s name, professional identification numbers, address, and contact information.

- Release of confidential information: By signing the form, the claimant grants the Arizona Department of Revenue permission to share confidential information about their unclaimed property with the designated appointee.

- Limited Power of Attorney: This part of the form allows the claimant to specify certain powers authorized to the appointee related to unclaimed property matters, such as claiming property, signing waivers, requesting hearings, or executing agreements.

- Full Power of Attorney: Checking the box in this section grants the appointee complete authority to act on all administrative matters of unclaimed property on behalf of the claimant, just as the claimant could do themselves.

- Revocation of earlier authorizations: Submitting this form revokes any previous unclaimed property authorizations filed with the Arizona Department of Revenue for the same claim year.

- Corporations and subsidiaries: A corporate officer can authorize the release of confidential information to a designee for controlled subsidiaries by either attaching a list of these entities or including them directly on the form.

- Execution and declaration: The form requires signatures from both the claimant and the appointee, certifying their authority and acknowledging the legal implications of submitting fraudulent information.

- Where to send: Completed forms should be mailed to the Arizona Department of Revenue’s Unclaimed Property Unit in Phoenix, AZ, ensuring proper handling and processing of the claimant’s unclaimed property case.

By understanding and carefully completing the Arizona 285Up form, claimants and their designated appointees can navigate the process of claiming unclaimed property effectively, ensuring compliance with state regulations and procedures.

More PDF Forms

Arizona New Hire Forms - The mailing address provided for the submission of the Arizona New Hire Reporting Form is specific to ensure secure and directed delivery of sensitive information.

Arizona State Ein Number - Integral for maintaining updated and correct records in the State of Arizona’s payee/vendor system.