Fill in a Valid Arizona 285 Template

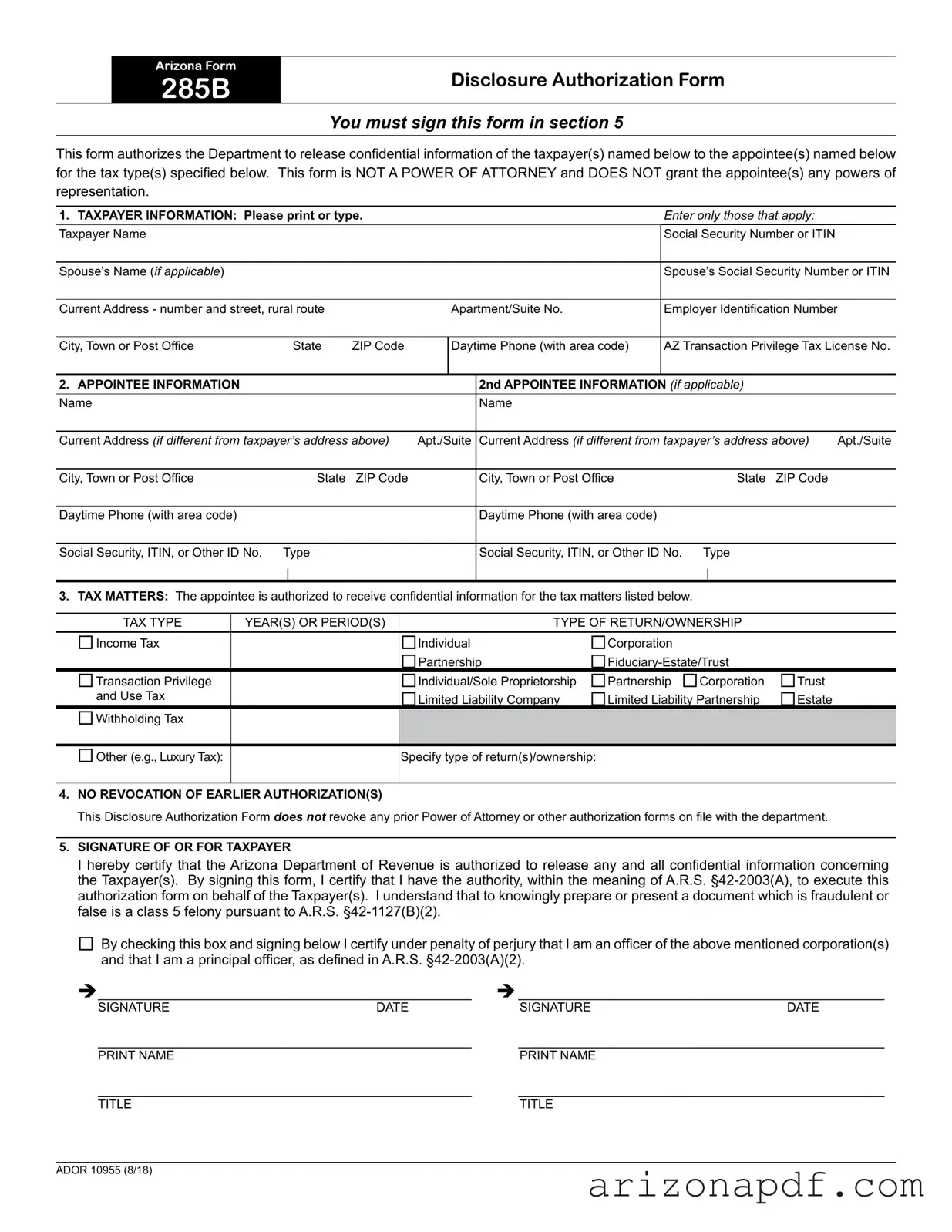

Handling sensitive tax information requires a degree of trust and compliance with legal standards, which is exactly what the Arizona Form 285B aims to facilitate. This Disclosure Authorization Form is a critical document for taxpayers in Arizona who wish to authorize the release of their confidential information to appointed individuals or entities, yet it explicitly states that it is not a power of attorney, nor does it confer any representational powers to the appointee. The form meticulously outlines the necessary information for both the taxpayer and the appointee, which includes names, addresses, social security numbers or ITINs, and specific tax matters for which the disclosure is authorized. Notably, it covers a broad range of tax types and stipulates that signing the form does not negate any previously granted authorizations. The importance of accuracy and truthfulness when completing this document cannot be overstated, as any attempt to furnish the department with fraudulent information constitutes a severe offense. By requiring a signature from the taxpayer or a principal officer of a corporation, the form ensures that the authorization is given with full knowledge and consent, thereby safeguarding the integrity of the tax information management process.

Arizona 285 Preview

ARIZONA FORM

285B

DISCLOSURE AUTHORIZATION FORM

You must sign this form in section 5

This form authorizes the Department to release confidential information of the taxpayer(s) named below to the appointee(s) named below for the tax type(s) specified below. This form is NOT A POWER OF ATTORNEY and DOES NOT grant the appointee(s) any powers of representation.

1. TAXPAYER INFORMATION: Please print or type. |

|

|

|

Enter only those that apply: |

|

||

Taxpayer Name |

|

|

|

|

|

Social Security Number or ITIN |

|

|

|

|

|

|

|

|

|

Spouse’s Name (if applicable) |

|

|

|

|

|

Spouse’s Social Security Number or ITIN |

|

|

|

|

|

|

|

|

|

Current Address - number and street, rural route |

|

|

Apartment/Suite No. |

Employer Identification Number |

|

||

|

|

|

|

|

|

|

|

City, Town or Post Office |

State |

ZIP Code |

|

Daytime Phone (with area code) |

AZ Transaction Privilege Tax License No. |

||

|

|

|

|

|

|

|

|

2. APPOINTEE INFORMATION |

|

|

|

|

2nd APPOINTEE INFORMATION (if applicable) |

|

|

Name |

|

|

|

|

Name |

|

|

|

|

|

|

||||

Current Address (if different from taxpayer’s address above) |

Apt./Suite |

Current Address (if different from taxpayer’s address above) |

Apt./Suite |

||||

|

|

|

|

|

|

|

|

City, Town or Post Office |

State |

ZIP Code |

|

|

City, Town or Post Office |

State ZIP Code |

|

|

|

|

|

|

|

|

|

Daytime Phone (with area code) |

|

|

|

|

Daytime Phone (with area code) |

|

|

|

|

|

|

|

|

|

|

Social Security, ITIN, or Other ID No. |

Type |

|

|

|

Social Security, ITIN, or Other ID No. Type |

|

|

|

| |

|

|

|

|

| |

|

3.TAX MATTERS: The appointee is authorized to receive confidential information for the tax matters listed below.

|

TAX TYPE |

YEAR(S) OR PERIOD(S) |

TYPE OF RETURN/OWNERSHIP |

|

||

|

Income Tax |

|

|

|

Corporation |

|

|

|

Individual |

|

|

||

|

|

|

Partnership |

|

||

Transaction Privilege |

|

Individual/Sole Proprietorship |

Partnership Corporation |

Trust |

||

|

and Use Tax |

|

Limited Liability Company |

Limited Liability Partnership |

Estate |

|

Withholding Tax |

|

|

|

|

|

|

|

|

|

|

|

||

Other (e.g., Luxury Tax): |

|

Specify type of return(s)/ownership: |

|

|

||

|

|

|

|

|

|

|

4.NO REVOCATION OF EARLIER AUTHORIZATION(S)

This Disclosure Authorization Form does not revoke any prior Power of Attorney or other authorization forms on file with the department.

5.SIGNATURE OF OR FOR TAXPAYER

I hereby certify that the Arizona Department of Revenue is authorized to release any and all confidential information concerning the Taxpayer(s). By signing this form, I certify that I have the authority, within the meaning of A.R.S.

By checking this box and signing below I certify under penalty of perjury that I am an officer of the above mentioned corporation(s) and that I am a principal officer, as defined in A.R.S.

________________________________________________ |

_______________________________________________ |

||

SIGNATURE |

DATE |

SIGNATURE |

DATE |

________________________________________________ |

_______________________________________________ |

||

PRINT NAME |

|

PRINT NAME |

|

________________________________________________ |

_______________________________________________ |

||

TITLE |

|

TITLE |

|

ADOR 10955 (8/18)

File Properties

| Fact | Detail |

|---|---|

| Document Type | Arizona Form 285B Disclosure Authorization Form |

| Purpose | Authorizes the Arizona Department of Revenue to release confidential tax information to specified appointee(s). |

| Not a Power of Attorney | The form does NOT grant appointee(s) any powers of representation or decision-making on behalf of the taxpayer. |

| Required Signatory | The taxpayer must sign the form in Section 5 to validate the authorization. |

| Governing Law | Governed by Arizona Revised Statutes (A.R.S.) §42-2003 for authorization and A.R.S. §42-1127(B)(2) regarding penalties for fraudulence. |

| Information Required | Taxpayer and appointee information, including names, addresses, identification numbers, and the specific tax matters and types of returns for disclosure. |

Instructions on Utilizing Arizona 285

After filling out the Arizona Form 285B, you are taking the necessary steps to allow the Department to share confidential information with the person or people you choose. This document is crucial for granting access to your tax information without giving away any representational powers. Carefully following the instructions to complete this form ensures your information is shared accurately and securely.

- Start with the Taxpayer Information section:

- Print or type the taxpayer's full name.

- Enter the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- If applicable, fill in the spouse’s name and their SSN or ITIN.

- Provide the current address, including the apartment or suite number if relevant.

- Include the city, state, and ZIP code.

- List the daytime phone number, including the area code.

- For businesses, enter the Employer Identification Number (EIN).

- If applicable, provide the Arizona Transaction Privilege Tax License Number.

- Fill out the Appointee Information:

- Enter the name of the first appointee. If a second appointee is applicable, also fill in their name.

- For each appointee, if the address is different from the taxpayer's, provide it along with the city, state, and ZIP code.

- Include the daytime phone number for each appointee.

- Fill in the Social Security, ITIN, or other identification numbers and specify the type.

- Tax Matters:

- Check the box(es) for the type(s) of tax matters the appointee is authorized to receive confidential information for.

- Specify the year(s) or period(s), and the type of return/ownership for each authorization.

- For "Other" taxes, such as Luxury Tax, be sure to specify the type of return(s)/ownership.

- Understand that this form does not revoke any prior authorizations.

- Signature:

- Review the form carefully.

- If applicable, check the box to certify your status under penalty of perjury as an officer of the corporation.

- Sign and date the form to certify that the Department of Revenue is authorized to release confidential information as specified.

- Print the name(s) and title(s) of the signer(s). If there are two taxpayers, both must sign.

After completing these steps, check your form for any errors or missing information. When you are satisfied that all information is accurate and complete, you may submit the form as directed by the Arizona Department of Revenue. Keep a copy for your records. Your appointee(s) will then be able to access the specified tax information, according to the permissions you have granted on this form.

Listed Questions and Answers

What is the Arizona 285 form used for?

The Arizona 285 form, officially known as the Disclosure Authorization Form, is used to authorize the Arizona Department of Revenue to release confidential taxpayer information to specified appointees. This form enables the named appointee(s) to receive detailed tax information for the type(s) of taxes and tax periods listed in the form. However, it's important to note that this form is not a power of attorney and does not grant the appointee(s) any powers of representation.

Who needs to sign the Arizona 285 form?

The taxpayer(s) must sign the Arizona 285 form in section 5. By signing, the taxpayer certifies that the Arizona Department of Revenue is authorized to release confidential information as specified on the form. They must also certify that they have the legal authority to grant this authorization.

Can the Arizona 285 form be used to grant power of attorney?

No, the Arizona 285 form does not grant power of attorney. While this form authorizes the release of confidential tax information to appointed individuals, it does not confer any legal powers of representation or decision-making on behalf of the taxpayer.

What types of taxes can information be authorized for release on this form?

The form allows for the authorization of information release for various tax matters including Income Tax, Transaction Privilege and Use Tax, and Withholding Tax among others. Specific types of returns or ownership structures such as Corporation, Individual, Partnership, Fiduciary-Estate/Trust, and more can be specified.

Can I revoke a previous authorization using the Arizona 285 form?

No, completing and submitting the Arizona 285 form does not revoke any prior authorizations, including Powers of Attorney, on file with the Arizona Department of Revenue. This form solely provides authorization as outlined within the document itself and does not impact any previously granted authorizations.

What happens if the taxpayer information provided is incorrect?

Providing incorrect information on the Arizona 285 form could delay or prevent the intended release of confidential tax information. It's crucial to carefully review all sections for accuracy before submission, ensuring that all taxpayer and appointee information is correct and up-to-date.

Is it a criminal offense to submit fraudulent information on this form?

Yes, knowingly preparing or presenting a document that is fraudulent or false, including the Arizona 285 form, is considered a class 5 felony under A.R.S. §42-1127(B)(2). It's imperative to provide only true and accurate information.

How do I know if I have the authority to sign this form?

The individual signing the form on behalf of the taxpayer(s) must have the authority within the meaning of A.R.S. §42-2003(A) to execute the authorization. This includes being the taxpayer themselves or having a legally recognized position or authorization to act on the taxpayer's behalf, such as a principal officer of a corporation.

Can more than one appointee be named on the Arizona 285 form?

Yes, the form provides space for information about a second appointee if applicable. This allows taxpayers to authorize the release of confidential information to more than one individual, provided that all required sections of the form are completed for each appointee.

Common mistakes

When individuals are completing the Arizona Form 285B, commonly known as the Disclosure Authorization Form, several common mistakes can significantly impact the processing and effectiveness of the form. Paying close attention to the details and avoiding these errors can ensure a smoother process for both the taxpayer and the authorizing department.

-

Not signing in Section 5: This form requires a signature in section 5 to be considered valid. A frequent mistake is overlooking this requirement. The form explicitly states that it "must be signed" in this section. Without the signature, the authorization to release confidential information cannot be processed.

-

Incorrect Taxpayer Information: Entering inaccurate or incomplete information in the Taxpayer Information section can lead to delays or the form being returned. It is crucial to ensure that details such as the Taxpayer Name, Social Security Number or ITIN, and current address are correctly filled out. The form is designed to capture specific taxpayer identifiers, and any discrepancies can complicate the authorization process.

-

Failure to Specify Tax Matters: The section titled "TAX MATTERS" is essential for defining the scope of the authorization. Not specifying the tax types, years, or periods—or the type of return/ownership—can render the form ineffective. An appointee's ability to receive confidential information is contingent on clear instructions provided in this portion of the form.

-

Assuming Revocation of Earlier Authorizations: There is often a misconception that submitting a new Arizona Form 285B automatically revokes previous authorizations. However, the form clearly states that it "does not revoke any prior Power of Attorney or other authorization forms on file with the department." This misunderstanding can lead to unintended persons retaining access to confidential information, which might not be the taxpayer's intention.

By carefully avoiding these mistakes, individuals can ensure their forms are accurately processed and that the right people are authorized to receive confidential tax information. It's always a good practice to review all sections of the form before submission, ensuring all applicable areas are complete and accurate.

Documents used along the form

When handling tax matters in Arizona, especially with the use of the Arizona Form 285B for Disclosure Authorization, it's common to pair this form with additional documents to ensure comprehensive coverage of one's tax situation. Understanding these supplemental forms can provide a clearer picture of the whole process and assist in achieving a smoother transaction with the Arizona Department of Revenue. Below, we explore some of the other forms and documents frequently used alongside Form 285B.

- Form 821 - Power of Attorney (POA): This form grants an individual or entity the authority to represent a taxpayer before the Arizona Department of Revenue. Unlike the 285B, which only authorizes disclosure, a Power of Attorney can enable the appointee to take actions on behalf of the taxpayer.

- Form 140 - Individual Income Tax Return: For individuals managing their income tax matters alongside disclosure authorization, Form 140 is the standard document for filing an annual income tax return in Arizona.

- Form 120 - Corporate Income Tax Return: Companies that need to disclose confidential information often also need to file their corporate income taxes using Form 120, making it a commonly paired document with Form 285B.

- Form 202 - Application for Extension of Time to File: Taxpayers who are authorizing disclosure of their information close to filing deadlines may also submit Form 202. This form is used to request additional time to file a tax return.

- Form 5000 - Transaction Privilege Tax Exemption Certificate: For those dealing with Transaction Privilege Tax matters as indicated in Form 285B, the Form 5000 is crucial for claiming exemptions when applicable.

Understanding and utilizing the proper forms in conjunction with Arizona Form 285B plays a significant role in effectively managing one's tax affairs. Whether seeking to authorize disclosure, file tax returns, extend filing deadlines, or claim exemptions, each document serves a unique purpose in the broader context of tax administration. Handling these documents correctly can lead to more efficient processing and facilitate better outcomes in tax matters.

Similar forms

The IRS Form 8821, Tax Information Authorization, is quite similar to the Arizona Form 285B because it allows individuals to authorize a third party to access their tax information. Like the Arizona form, the IRS form does not grant the appointee any powers of representation, but rather it simply enables them to receive confidential tax information from the IRS on behalf of the taxpayer.

The IRS Form 2848, Power of Attorney and Declaration of Representative, shares some similarities with the Arizona 285B form in the context of dealing with tax matters. However, unlike the Arizona form, the IRS Form 2848 not only allows the appointee to receive confidential tax information but also grants them the authority to act on behalf of the taxpayer in representing them before the IRS, making it a more powerful instrument.

The California Form 3520, Power of Attorney, resembles the Arizona 285B form because it is used to authorize someone else to receive confidential tax information. Although both forms share the objective of authorizing disclosure of tax information, the California form can also grant broader powers, including representation rights before the California Franchise Tax Board, which the Arizona 285B does not provide.

The New York State Form POA-1, Power of Attorney, is another document similar to the Arizona 285B. It serves to authorize a representative to obtain confidential tax information. While both forms facilitate the sharing of tax information with designated individuals, the New York POA-1 also allows appointees to represent taxpayers in matters before the New York State Department of Taxation and Finance, a feature not offered by the Arizona 285B.

The Texas Form 86-113, Limited Power of Attorney to Transfer Motor Vehicle, although specific to motor vehicle matters, parallels the Arizona 285B form in its function as a limited authorization tool. Both forms enable designated individuals to receive specific types of information without conferring broader legal powers of representation, although they apply to different areas of information and authorization.

Form SSA-3288, Social Security Administration Consent for Release of Information, is akin to the Arizona 285B form in the manner it permits the sharing of confidential information upon the taxpayer's authorization. Both forms are designed to protect personal information while allowing the taxpayer to specify individuals who can receive this information, focusing on a single type of information disclosure without granting decision-making rights.

The Health Insurance Portability and Accountability Act (HIPAA) Authorization Form is similar to the Arizona 285B concerning the concept of information sharing with specified individuals. While the HIPAA form is specific to health information, it parallels the Arizona 285B in its purpose to authorize the release of private information to appointed entities, without extending the scope to representation or decision-making powers.

The Florida DR-835, Power of Attorney and Declaration of Representative, has similarities with the Arizona 285B in that it is used for authorizing the release of confidential tax information to third parties. However, like some other forms mentioned, the Florida DR-835 can also allow the representative to act on the taxpayer’s behalf in tax matters before the Florida Department of Revenue, making it broader in scope compared to the Arizona 285B.

The General Authorization to Disclose Personal Information to a Third Party, a generic form that can be adapted for various uses, relates closely to the Arizona 285B. It's designed to authorize a third party to receive sensitive personal information, much like the Arizona form permits for tax information. The main similarity lies in their functionality of allowing information sharing while limiting the powers granted to the third party.

Dos and Don'ts

When filling out the Arizona Form 285B Disclosure Authorization Form, understanding what to do and not to do is crucial for the process to be completed accurately and effectively. This form is essential for authorizing the release of confidential tax information to appointed individuals without granting them powers of representation. Here are the key do's and don'ts:

- Do: Ensure all the information provided is accurate and up-to-date. Incorrect information can lead to unauthorized disclosure or non-disclosure of tax information.

- Do: Clearly print or type the taxpayer's information in Section 1, including full names, Social Security Number or ITIN, and complete address to avoid any misunderstanding or processing delays.

- Do: Fill out the appointee information section completely. If appointing more than one individual, make sure to provide details for each appointee to ensure they have authorized access to your confidential tax information.

- Do: Specify the tax matters the appointee is authorized to receive information about, including the type of tax, year(s), or period(s), and the type of return/ownership. This specificity helps safeguard sensitive information from unauthorized access.

- Don't: Leave any required fields blank. Incompleteness can result in the form being rejected or delays in processing.

- Don't: Forget to sign and date Section 5 of the form. This section is imperative as it indicates your agreement and authorization for the release of information. Without your signature, the form is invalid.

- Don't: Assume this form revokes any prior authorization(s). If you wish to change or revoke previous authorizations, additional steps must be taken outside of this form.

- Don't: Overlook the legal certification and the implications of providing false information. Knowingly submitting false or fraudulent information on this form is a serious offense, classified as a class 5 felony.

By following these guidelines, taxpayers can ensure the Arizona Form 285B is filled out correctly and efficiently, facilitating the smooth release of confidential tax information to the rightful appointees.

Misconceptions

When it comes to understanding the Arizona Form 285B, also known as the Disclosure Authorization Form, a number of misconceptions can lead people astray. Clearing up these misunderstandings is crucial for taxpayers and their appointees to navigate the process effectively.

It grants the same powers as a Power of Attorney: One common misconception is that Form 285B acts as a Power of Attorney (POA). However, unlike a POA, which grants broad powers to act on behalf of the taxpayer, Form 285B strictly authorizes the release of confidential tax information to the named appointee(s) and does not allow them to make decisions or act on behalf of the taxpayer.

Mandatory for all tax matters: Another mistake is thinking that this form is a one-size-fits-all requirement for dealing with tax matters. In reality, the need to use Form 285B depends on the specific needs for information disclosure. Not every tax matter requires the authorization provided by this form.

Revokes previous authorizations: Some people mistakenly believe that submitting a new Form 285B will automatically revoke earlier authorizations. However, Form 285B explicitly states that it does not cancel or revoke any prior authorizations on file with the Arizona Department of Revenue.

One form per appointee: Taxpayers often think they need to file separate forms for each appointee. In fact, Form 285B allows for the inclusion of a second appointee, enabling the taxpayer to grant disclosure authorization to two individuals on a single form.

Unlimited duration of authorization: Some assume that once submitted, the form provides indefinite authorization. Unlike some other forms, the duration of the authorization granted by Form 285B should be understood as limited and subject to the specifics of the request or until explicitly revoked by the taxpayer.

Authorization extends to all tax types: It's a common misconception that authorization through this form applies to all types of taxes. However, the taxpayer must specify the tax type(s) and year(s) or period(s) for which the authorization applies, limiting the scope of the disclosure.

Applies to tax matters in all states: Sometimes, there's confusion that this form would apply to tax matters beyond Arizona. Form 285B is specific to the Arizona Department of Revenue and does not extend authorization to other states' tax departments.

Signature guarantees authority: Signing the form is sometimes mistaken as a guarantee of the individual’s authority to request information. While signing the form, the individual asserts they have the necessary authority to do so, but it does not serve as proof of such authority. Integrity and compliance with state laws are presumed and expected in these declarations.

Understanding these nuances of the Arizona Form 285B ensures taxpayers and their appointees navigate the process with clarity, avoiding potential pitfalls and legal misunderstandings. Awareness and precision in handling such forms play a significant role in maintaining compliance and ensuring smooth interactions with the Arizona Department of Revenue.

Key takeaways

Filling out and using the Arizona 285 form, formally known as the Disclosure Authorization Form, plays a crucial role in authorizing the release of confidential taxpayer information. Its proper completion is vital for ensuring that appointed individuals can access specific tax-related details. Here are key takeaways to understand when dealing with this form:

- The Arizona Form 285B is solely for authorizing the release of confidential tax information to named appointees, it does not bestow any representative powers to those individuals. This distinction is critical for understanding the form's limitations.

- Every section marked in the form, especially section 5 for signatures, must be completed to validate the authorization. Without the taxpayer's signature, the authorization to disclose information cannot be processed.

- Designated appointees can only access information for the tax types and periods explicitly listed on the form. This specification ensures that access is limited to what is directly granted by the taxpayer.

- This form does not override previous authorizations, including existing Powers of Attorney. Taxpayers should be aware that prior grants of access remain effective unless individually revoked or expired.

- Section 5 demands the taxpayer certify their authority to release information under penalty of perjury, emphasizing the legal significance of the form's completion and the severe consequences for falsification.

Understanding these key aspects ensures that taxpayers can effectively grant access to their confidential information with confidence and legal clarity. The Arizona 285 form serves as a crucial tool for managing tax information disclosure while emphasizing both the limits and responsibilities it entails.

More PDF Forms

How Much Does It Cost to File for Custody - Offers a step-by-step guide for completing, filing, and serving the subpoena, including where to obtain and file the necessary documents.

Arizona New Hire Forms - By contributing to the state's ability to enforce child support orders, employers play a crucial role in ensuring the financial welfare of children across Arizona.