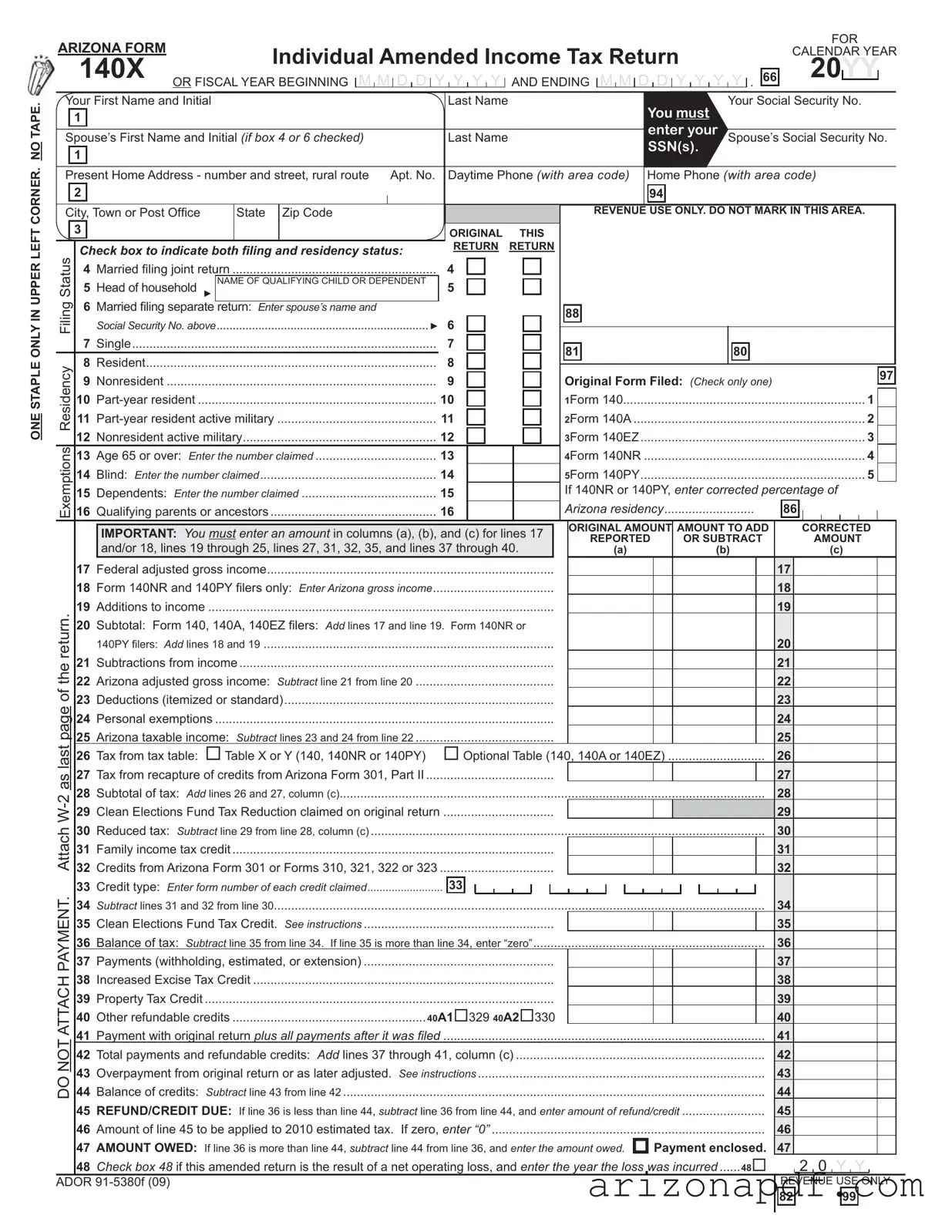

Fill in a Valid Arizona 140X Template

The Arizona 140X form is a critical document for individuals looking to amend their state income tax returns. This form applies to those who have realized errors or overlooked details in their initial Arizona state tax filings, whether under the category of a calendar year taxpayer or those operating on a fiscal year basis. The comprehensive design of this form caters to various adjustments, allowing amendments in income, deductions, tax credits, and overall tax liability. It obliges taxpayers to detail personal information, including names, social security numbers, and addresses. Additionally, filers must specify their filing status—such as single, married filing jointly, or head of household—and residency status, distinguishing between full-year residents, part-year residents, and non-residents. It encompasses a range of tax situations, from adjustments in federal adjusted gross income to specific state credits such as the Family Income Tax Credit or Property Tax Credit. This form serves not only to correct inaccuracies but also to ensure taxpayers can claim any overlooked benefits or correct overstated obligations, thereby adjusting their tax contributions to the state accurately. Furthermore, the Arizona 140X form includes sections for those affected by IRS audits or those who need to report changes following the filing of an amended federal return. For payments accompanying the return or for those expecting a refund, detailed instructions on mailing addresses are provided, ensuring proper processing and timely resolution of the amended return.

Arizona 140X Preview

ONE STAPLE ONLY IN UPPER LEFT CORNER. NO TAPE.

ARIZONA FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR |

|||||||||||||

|

|

Individual Amended Income Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALENDAR YEAR |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

140X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

YY |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

OR FISCAL YEAR BEGINNING |

|

M |

|

M |

|

D |

|

D |

|

Y |

Y |

Y |

|

Y |

|

AND ENDING |

|

M |

|

M |

|

D |

D |

|

Y |

|

Y |

|

Y |

Y |

|

. 66 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Your First Name and Initial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Social Security No. |

|||||||||||||||||||||||||||||||||||

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You must |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Spouse’s First Name and Initial (if box 4 or 6 checked) |

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Social Security No. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN(s). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present Home Address - number and street, rural route Apt. No. |

Daytime Phone (with area code) |

|

Home Phone (with area code) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, Town or Post Office |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE USE ONLY. DO NOT MARK IN THIS AREA. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORIGINAL |

THIS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Check box to indicate both fi ling and residency status: |

|

|

|

|

RETURN RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

Status |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

4 |

|

Married fi ling joint return |

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

5 |

Head of household. ► |

NAME OF QUALIFYING CHILD OR DEPENDENT |

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Filing |

6 |

|

Married filing separate return: Enter spouse’s name and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

.................................................................. |

|

|

|

|

|

|

|

|

|

|

|

► 6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

Social Security No. above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

7 |

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Residency |

8 |

|

Resident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

97 |

|

|||||||||||||||||||||||||||

9 |

|

Nonresident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

Original Form Filed: (Check only one) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

10 |

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

1Form 140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

||||||||||||||||||||||||||||||||

11 |

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

2Form 140A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

12 |

|

Nonresident active military |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

3Form 140EZ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

Exemptions |

13 |

|

Age 65 or over: Enter the number claimed |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

4Form 140NR |

................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

14 |

|

Blind: Enter the number claimed |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

5Form 140PY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

15 |

|

Dependents: Enter the number claimed |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

If 140NR or 140PY, enter corrected percentage of |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

16 |

|

Qualifying parents or ancestors |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

..........................Arizona residency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

86 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

IMPORTANT: You must enter an amount in columns (a), (b), and (c) for lines 17 |

|

|

ORIGINAL AMOUNT |

AMOUNT TO ADD |

|

|

CORRECTED |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

REPORTED |

OR SUBTRACT |

|

|

|

|

AMOUNT |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

and/or 18, lines 19 through 25, lines 27, 31, 32, 35, and lines 37 through 40. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

(b) |

|

|

|

|

|

|

(c) |

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

17 |

|

Federal adjusted gross income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

18 |

|

Form 140NR and 140PY fi lers only: Enter Arizona gross income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

return. |

19 |

|

Additions to income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20 |

|

Subtotal: Form 140, 140A, 140EZ filers: Add lines 17 and line 19. |

Form 140NR or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

140PY filers: Add lines 18 and 19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

21 |

|

Subtractions from income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

22 |

|

Arizona adjusted gross income: Subtract line 21 from line 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

23 |

|

Deductions (itemized or standard) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

24 |

|

Personal exemptions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

25 |

|

Arizona taxable income: Subtract lines 23 and 24 from line 22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

26 |

|

Tax from tax table: |

Table X or Y (140, 140NR or 140PY) |

|

|

|

|

Optional Table (140, 140A or 140EZ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

27 |

|

Tax from recapture of credits from Arizona Form 301, Part II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

as |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

28 |

|

Subtotal of tax: Add lines 26 and 27, column (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

W- |

29 |

|

Clean Elections Fund Tax Reduction claimed on original return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Attach |

30 |

|

Reduced tax: Subtract line 29 from line 28, column (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

31 |

|

Family income tax credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

32 |

|

Credits from Arizona Form 301 or Forms 310, 321, 322 or 323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

PAYMENT. |

33 |

|

Credit type: Enter form number of each credit claimed |

|

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

34 |

|

..............................................................................................................................................Subtract lines 31 and 32 from line 30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

35 |

|

Clean Elections Fund Tax Credit. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

36 |

|

Balance of tax: Subtract line 35 from line 34. If line 35 is more than line 34, enter “zero” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

37 |

|

Payments (withholding, estimated, or extension) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ATTACH |

38 |

|

Increased Excise Tax Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

39 |

|

Property Tax Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

40 |

|

Other refundable credits |

40A1 329 40A2 |

330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

41 |

|

Payment with original return plus all payments after it was filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

NOT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

42 |

|

Total payments and refundable credits: Add lines 37 through 41, column (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

43 |

|

Overpayment from original return or as later adjusted. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

DO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

44 |

|

Balance of credits: Subtract line 43 from line 42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

45 |

|

REFUND/CREDIT DUE: If line 36 is less than line 44, subtract line 36 from line 44, and enter amount of refund/credit |

........................ |

|

|

|

|

|

|

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

46 |

|

Amount of line 45 to be applied to 2010 estimated tax. If zero, enter “0” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

47 |

|

AMOUNT OWED: If line 36 is more than line 44, subtract line 44 from line 36, and enter the amount owed. |

|

|

Payment enclosed. |

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

48 |

|

Check box 48 if this amended return is the result of a net operating loss, and enter the year the loss was incurred |

48 |

|

|

|

2 0 Y Y |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ADOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE USE ONLY |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

82 |

|

99 |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Name (as shown on page 1)

Your Social Security No.

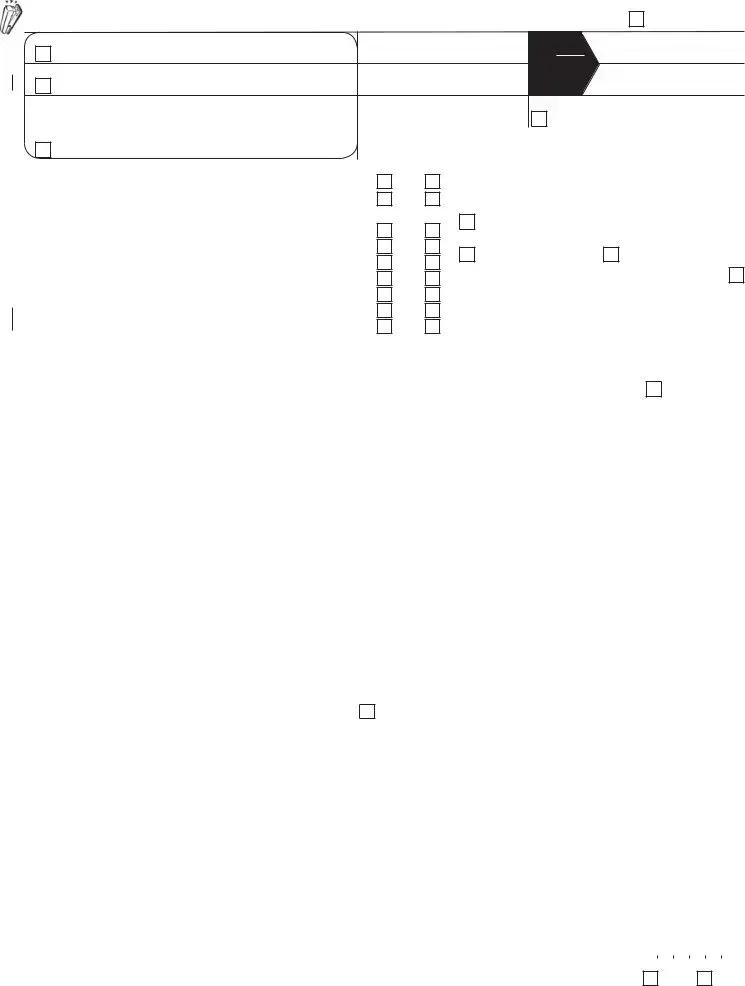

PART I: Dependent Exemptions - do not list yourself or spouse as dependents

List children and other dependents. If more space is needed, attach a separate sheet.

FIRST AND LAST NAME: |

SOCIAL SECURITY NO. |

RELATIONSHIP |

|

|

|

NO. OF MONTHS LIVED IN YOUR HOME DURING THE TAXABLE YEAR

Enter the names of the dependents listed above who do not qualify as your dependent on your federal return:

Enter dependents listed above who were not claimed on your federal return due to education credits:

PART II: Qualifying Parents and Ancestors of Your Parents Exemptions (Arizona residents only)

List below qualifying parents and ancestors of your parents for which you are claiming an exemption. If more space is needed, attach a separate sheet. Do not list the same person here that you listed in Part I, above, as a dependent. For information on who is a qualifying parent or ancestor of your parents, see the instructions for the original return that you filed.

FIRST AND LAST NAME:

SOCIAL SECURITY NO.

RELATIONSHIP

NO. OF MONTHS LIVED IN YOUR HOME DURING THE TAXABLE YEAR

PART III: Income, Deductions, and Credits

List the line reference from page 1 for which you are reporting a change then give the reason for each change. Attach any supporting documents required. If the change(s) pertain(s) to an IRS audit, please attach a copy of the agent’s report. If you filed an amended federal return with the IRS (Form 1040X), please attach a copy and all supporting schedules.

Part IV: Name and Address on Original Return

If your name and address is the same on this amended return as it was on your original return, write “same” on the line below.

Name |

Number and Street, R.R. |

Apt. No. |

City, Town or Post Office State Zip Code |

|

|

|

|

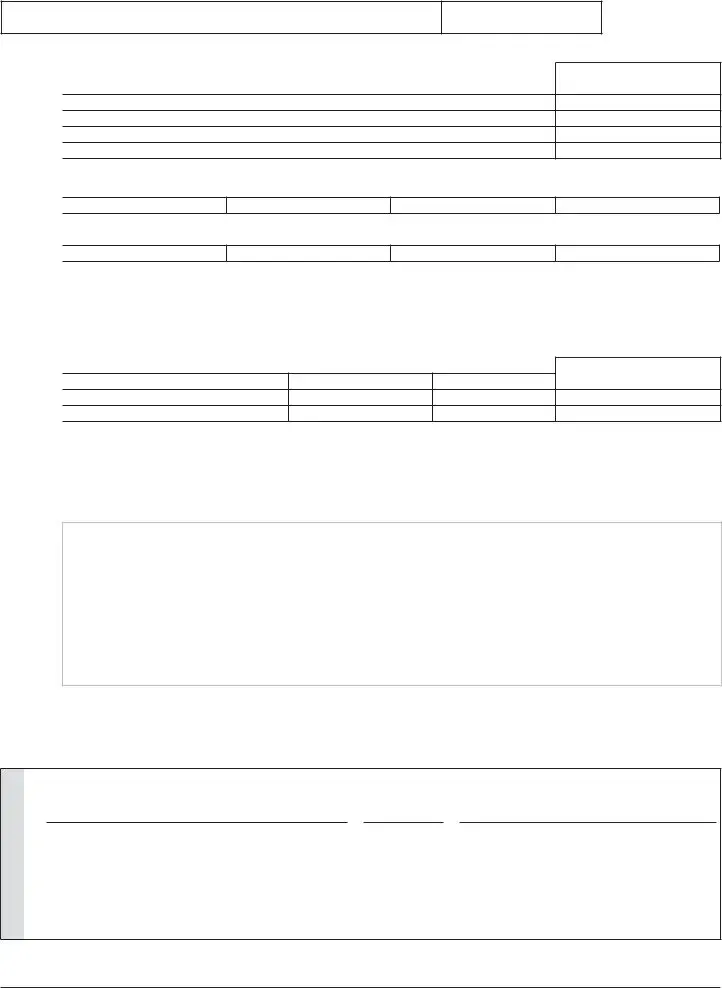

PLEASE SIGN HERE

I have read this return and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

YOUR SIGNATURE |

|

|

|

|

DATE |

|

|

OCCUPATION |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S SIGNATURE |

|

|

|

|

DATE |

|

|

SPOUSE’S OCCUPATION |

||||

|

|

|

|

|

|

|

|

|

|

|

||

PAID PREPARER’S SIGNATURE |

|

|

DATE |

|

|

|

FIRM’S NAME (PREPARER’S IF |

|||||

|

|

|

|

|

|

|

|

|

|

|

||

PAID PREPARER’S TIN |

PAID PREPARER’S ADDRESS |

|

|

|

|

|

|

|

PAID PREPARER’S PHONE NO. |

|||

If you are sending a payment with this return, mail to Arizona Department of Revenue, PO Box 52016, Phoenix, AZ,

If you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to Arizona Department of Revenue, PO Box 52138, Phoenix, AZ,

ADOR |

Form 140X (2009) |

Page 2 of 2 |

File Properties

| Fact | Detail |

|---|---|

| Purpose | Used for filing an amended individual income tax return |

| Year or Fiscal Period | Applicable for a specific calendar year or fiscal year beginning and ending dates |

| Form Type | Arizona Form 140X |

| Required Information | Personal details, original and corrected income, deductions, exemptions, and tax credits |

| Filing Status Options | Includes options such as single, married filing jointly, married filing separately, head of household |

| Residency Status | Options include resident, nonresident, part-year resident |

| Governing Laws | Arizona Revised Statutes - Governs the state tax filings and requirements |

Instructions on Utilizing Arizona 140X

Filing an amended tax return with the Arizona Department of Revenue requires careful attention to detail. The 140X form is designed for individuals who need to correct or update their previously filed state income tax returns. Whether you discovered a mistake on your original return or your financial situation has changed, submitting a Form 140X ensures your state tax obligations reflect your true financial picture. Steps for completing this form must be followed exactly to avoid processing delays or possible errors in amendment processing.

- Gather your documents: Before you start, make sure you have your original tax return and any supporting documents related to the changes you are reporting. This includes W-2 forms, 1099s, receipts, or documents from the IRS if your amendment is due to changes in your federal return.

- Enter personal information: At the top of the form, write your name, social security number, and contact information. If you're amending a joint return, include your spouse's name and SSN.

- Mark your filing and residency status: Check the appropriate box to indicate your filing status (such as single or married filing jointly) and whether you are a resident, nonresident, or part-year resident of Arizona for the tax year being amended.

- Indicate the original form filed: Check the box corresponding to the original Arizona tax form you submitted (Form 140, 140A, 140EZ, 140NR, or 140PY).

- Enter exemption information: For individuals over the age of 65 or who are blind, specify the number of exemptions being claimed. Also, include details about dependents and any qualifying parents or ancestors not listed as dependents.

- Report income adjustments: In the income section, enter the original amounts from your original return and the changes, whether increases or decreases, to calculate the corrected amounts.

- Adjust deductions and credits: Amend deductions (itemized or standard) and personal exemptions as necessary. If claiming new credits or need to adjust those previously claimed, include these amounts in the designated sections.

- Calculate tax: Use your revised Arizona taxable income to determine the tax owed according to the correct tax table. Include any adjustments to tax credits or recapture of credits.

- Report payments and credits: Enter details about payments made with the original return, withholding, estimated payments, and any refundable or nonrefundable credits to calculate your payment or refund due.

- Sign and date the form: Review the return for accuracy, then sign and date it. If you’re filing jointly, your spouse must also sign.

- Mail the form: If including a payment, send the return to the Arizona Department of Revenue at the address provided for payments. Otherwise, use the provided address for returns not accompanied by payment.

By following these steps diligently, you ensure that your amended Arizona state tax return is accurately completed and submitted. This process can correct any errors or omissions, ensuring compliance with state tax laws and potentially adjusting your tax liability favorably.

Listed Questions and Answers

What is the Arizona Form 140X used for?

The Arizona Form 140X is a document specifically designed for individuals who need to amend their previously filed income tax return. This might be necessary if you have to correct your income, deductions, credits, or taxes paid after the original submission. The form applies to various filing statuses, including individuals filing singly, married couples filing jointly or separately, and head of household filers.

Who needs to file the Arizona Form 140X?

Any Arizona taxpayer who has identified mistakes or needs to make corrections to an income tax return filed for a previous year should file the Form 140X. This includes updates to personal information, adjustments in income, deductions, credits, or any other change that would alter the tax liability or refund amount on the originally filed return.

What sections are critical in the Arizona Form 140X?

Several sections of the Form 140X are crucial and must be carefully filled out. These include the section for personal information, where you must enter your current address and Social Security number; the section detailing the original and corrected amounts for income, deductions, and credits; and the tax calculation section, where you figure out the corrected tax owed or refund due. Additionally, if you are claiming dependents, exemptions for qualifying parents or ancestors, or if there are any changes pertaining to an IRS audit or amended federal return, those sections are also significant.

How do I submit the Arizona Form 140X?

After carefully completing the Arizona Form 140X, you should submit it to the Arizona Department of Revenue. If you are expecting a refund, owe no tax, or owe tax but are not enclosing a payment, send it to the PO Box for refunds listed at the end of the form instructions. If you are sending a payment with your return, use the PO Box designated for payments. Remember, only one staple is allowed in the upper left corner of the form—no tape.

What should I do if I need to correct my filing status or the number of dependents?

If you need to correct your filing status or the number of dependents, you should do so directly on the Arizona Form 140X. Check the appropriate box for your correct filing status under the "Filing Status" section, and adjust the number of dependents and exemptions as necessary in the designated areas. Be sure to include any required documentation or explanations for the changes, especially if it pertains to dependents not previously claimed or corrected amounts of income and taxes.

Common mistakes

Filling out the Arizona 140X form for amending an Individual Income Tax Return can be tricky. People sometimes make mistakes that can lead to delays in processing their amendments. Here are eight common errors to watch out for:

- Not using ONE STAPLE ONLY in the upper-left corner of the form and additional documents. Using tape or multiple staples can cause issues with processing.

- Incorrectly reporting the Social Security Number(s) for yourself or your spouse. This is crucial for your identity and must match the numbers provided on your original tax return.

- Failing to accurately check the correct box to indicate filing and residency status, such as married filing jointly or head of household. This affects how the tax is calculated and processed.

- Omitting or incorrectly entering the name and Social Security Number of a spouse when filing a separate return or amend accordingly if your marital status has changed.

- Leaving the exemptions section incomplete, including age, blindness, and the number of dependents. Each category affects your tax liability and potential refunds.

- Miscalculating the corrected amounts in the section for income, deductions, and tax calculations. Errors here impact your tax owed or refund due.

- Forgetting to attach necessary documentation for any reported changes, such as supporting schedules or a copy of the IRS audit report if applicable. This documentation is crucial for verifying the amendments made.

- Not updating or incorrectly filling out the PART IV: Name and Address on Original Return section if there have been changes since the original submission or failing to note it's the same when there are no changes. Accurate records help ensure all correspondence and refunds reach you without delay.

Being attentive to these details can streamline the process of amending your Arizona income tax return and help you avoid common pitfalls.

Documents used along the form

When dealing with the complexities of filing an amended income tax return in Arizona using Form 140X, it's not uncommon to need additional documentation to ensure the amendments are accurately processed. These documents often serve to clarify changes in income, deductions, credits, or personal information from the original tax return. Understanding these documents can simplify the amendment process and ensure that individuals meet state requirements accurately and completely.

1. Original Tax Return (Form 140, 140A, 140EZ, 140NR, or 140PY): Essential for comparing the original figures with the amended ones, helping to identify the specific changes being made.

2. Federal Amended Return (Form 1040X): If changes also affect federal tax filings, this form is required to show what alterations were made at the federal level, which could impact state taxes.

3. W-2 Forms: These provide proof of income and tax withholdings from employers. If the amendment involves changes to income or withholding amounts, new or corrected W-2s must be attached.

4. 1099 Forms: Similar to W-2s but for independent contractors, freelancers, or others who received various forms of income not reported on a W-2, like dividends or interest.

5. Schedule A (Itemized Deductions): If amendments change itemized deductions, a revised Schedule A may need to be included, detailing expenses like medical costs, taxes paid, and charitable donations.

6. Schedule C (Profit or Loss from Business): Relevant for individuals who need to amend income or expenses related to business operations.

7. Arizona Form 301 (Nonrefundable Individual Tax Credits): Required if changes involve Arizona-specific tax credits previously claimed or to be claimed on the amended return.

8. Arizona Form 322 (Credit for Contributions to Charities): Needed if amendments adjust contributions to qualifying charitable organizations that affect tax credits.

Working through the process of amending a tax return can initially seem daunting. However, by understanding and gathering the necessary supplementary documents, individuals can navigate the process more smoothly and ensure their tax obligations are correct and up-to-date. It's always advisable to consult with a tax professional if there are any uncertainties about which forms or documents are needed, as they can provide guidance tailored to specific situations.

Similar forms

The Arizona 140X form, designed for individual amended income tax returns, closely mirrors the IRS Form 1040X used at the federal level. Just like the 140X allows Arizona taxpayers to correct or update their state tax return, Form 1040X serves the same purpose for federal income tax filings. Both documents require the taxpayer to list the original amounts reported, the changes being made, and the corrected sums for income, deductions, credits, and taxes owed or refunded. This parallel structure ensures taxpayers can amend inaccuracies or report additional information that affects their tax liabilities and refunds comprehensively.

Another document similar to the Arizona 140X is the California Form 540X, which is used for amending individual state tax returns in California. Like the 140X, the California 540X requires detailed reporting of the original and corrected values for income, deductions, credits, and other pertinent tax information. Each form serves the same function within its respective state, providing a rigorous process for taxpayers to correct or update their state income tax filings, ensuring that state tax obligations reflect accurate and up-to-date taxpayer information.

The New York Form IT-201-X, used for amending individual state income tax returns in New York, also shares similarities with the Arizona 140X. These forms both require filers to indicate their filing status, original income reported, and any subsequent changes that affect their tax liability. By comparing the initially reported amounts with the updated figures, both forms facilitate the correction of errors or the inclusion of previously unreported information. Their structured approach to amending returns helps ensure both accuracy and compliance with state tax law.

Last but not least, the Arizona 140X form can be compared to the IRS Schedule A (Form 1040), which pertains to itemized deductions at the federal level. While Schedule A is not used for amendments, it parallels the 140X in its attention to detail concerning deductions. Both forms require the taxpayer to closely examine aspects of their financial activities that reduce taxable income. As such, while they serve different functions—one for amending returns and the other for detailing deductions—both are integral to ensuring taxpayers pay the correct amount of tax by accounting for all eligible financial considerations.

Dos and Don'ts

Filling out the Arizona 140X form can be straightforward if you follow these guidelines. Making sure you adhere to these do's and don'ts will help ensure your amended income tax return is processed smoothly and accurately.

- Do use one staple only in the upper left corner of your form as instructed. This helps keep your documents organized and manageable for processing.

- Don’t use tape on your form or attachments. Tape can make documents difficult to handle and may cause issues during the processing of your return.

- Do fill out your name, social security number, and the same information for your spouse if you're filing jointly. This information is essential for identifying your tax records.

- Don’t forget to check the appropriate box for your filing and residency status. This information helps determine the correct tax calculations and requirements for your return.

- Do include all required schedules and supporting documents if you’re reporting changes to income, deductions, or credits. This documentation is pivotal for verifying the amendments you are making.

- Don’t list yourself or your spouse as dependents when filling out the portion of the form dedicated to exemptions. The form specifically instructs not to do so.

- Do thoroughly review the form before submission to ensure all necessary sections are completed and that the information provided is accurate and comprehensive.

- Don’t forget to sign and date the form. A signature is required to validate the information and to swear it is true and correct under penalty of perjury.

- Do pay attention to the mailing instructions based on whether you’re expecting a refund, owe no tax, or are sending a payment. Using the correct address ensures your form reaches the correct department without delay.

By adhering to these simple guidelines, you can streamline the process of amending your Arizona income tax return. Taking these steps helps prevent common errors and can lead to a quicker processing time for your form 140X.

Misconceptions

There are several common misconceptions about the Arizona Form 140X, which is the form used for filing an amended individual income tax return in Arizona. Understanding these misconceptions can help ensure that taxpayers file their amended returns accurately.

- Misconception 1: The Form 140X is only for correcting mistakes on your original return. While the Form 140X is commonly used for corrections, it is also used to report additional income, claim new deductions or tax credits not claimed on the original return, or to adjust your filing status. Therefore, it serves broader purposes than just correcting errors.

- Misconception 2: You must file a separate Form 140X for each tax year you wish to amend. It's important to understand that each Form 140X amends only one tax year. If you need to amend returns for multiple years, you must complete a separate form for each year. The form does not allow for the consolidation of amendments across different years.

- Misconception 3: Filing a Form 140X automatically triggers an audit. Filing an amended return does not automatically trigger an audit from the Arizona Department of Revenue. While it is true that the department reviews amended returns, this review does not necessarily mean you will be audited. Amended returns are a normal part of tax administration, allowing taxpayers to correct or update their tax filings.

- Misconception 4: If you expect a refund due to the amendment, you needn’t file Form 140X until you receive a notice from the Arizona Department of Revenue. If you discover that you made mistakes or omitted something on your original return that could result in a refund, you should file Form 140X promptly. Do not wait for a notice from the department to make the correction. Waiting for a department notice could delay your refund or potentially cause you to forfeit it if not claimed within the prescribed timeframe.

Understanding these aspects of the Arizona 140X form can help taxpayers navigate the process of amending their state tax returns more effectively, ensuring they remain compliant while taking advantage of any tax benefits to which they are entitled.

Key takeaways

When dealing with the Arizona 140X form, intended for amending an individual income tax return, it's essential to grasp a few fundamental points. This knowledge ensures the process is both smooth and accurate, facilitating a stress-free correction of your previously filed tax return.

- Single Staple Rule: It’s important to note that the form specifies a “ONE STAPLE ONLY IN UPPER LEFT CORNER.” This might seem minor, but adhering to these small details can aid in preventing processing delays. Avoid using tape or other binding methods that are not specified.

- Dual Purpose Field: The form requires the listing of both original and corrected amounts. You must enter amounts in three columns: the original amount reported, the amount to add or subtract, and the corrected amount. This layout is crucial for clearly communicating the intended amendments to your tax return.

- Supporting Documentation: If your amendments are due to an IRS audit or you've filed an amended federal return (Form 1040X), attaching the audit report or a copy of the 1040X form, respectively, is necessary. Including all relevant schedules and supporting documents ensures that your amended state return reflects the changes made on the federal level accurately.