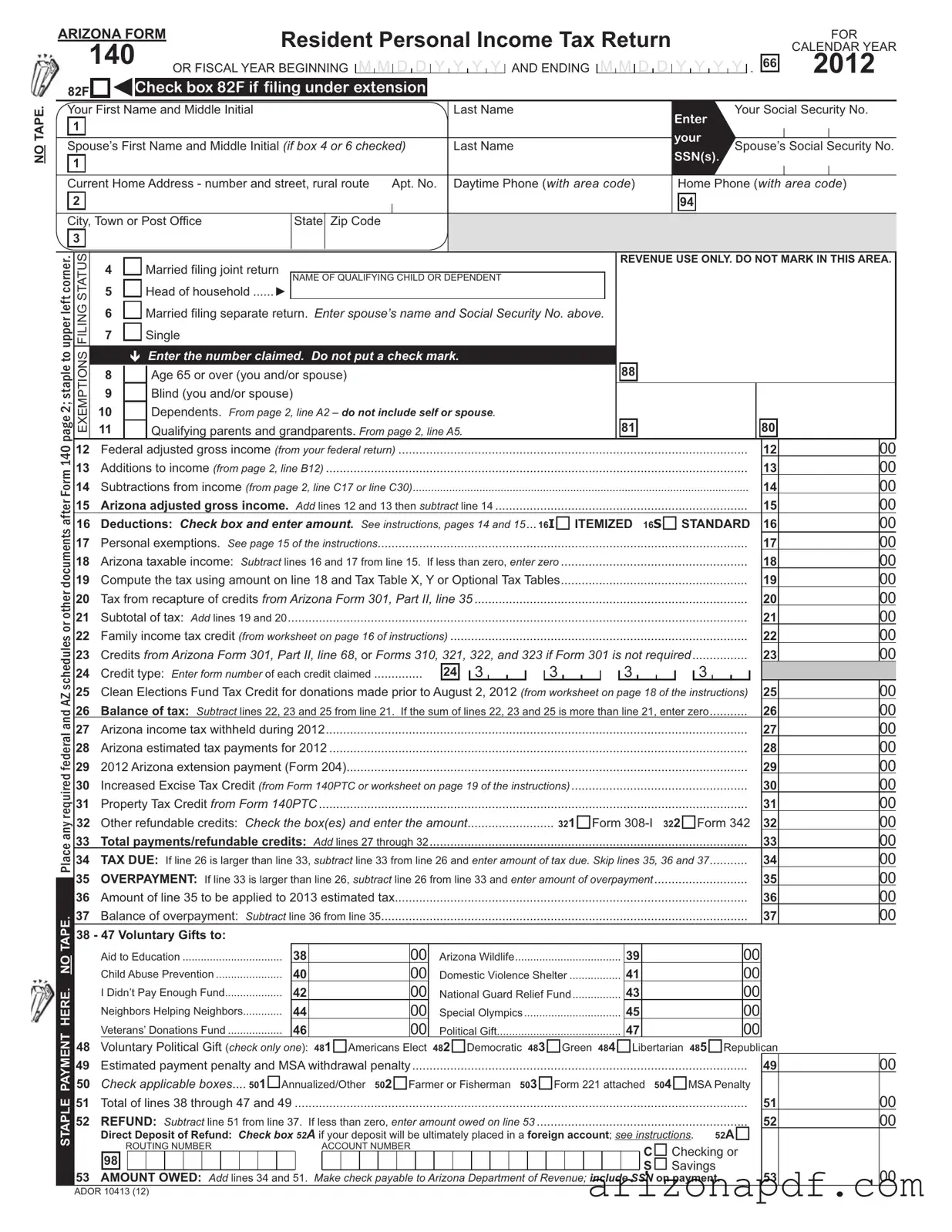

Fill in a Valid Arizona 140 Template

For residents of Arizona, navigating tax season involves a critical step: completing the Arizona Form 140. As the designated method for filing a Resident Personal Income Tax Return, this document applies to those reporting earnings for either the calendar year or a specific fiscal period. The form captures essential taxpayer information, from personal details to income specifics, and outlines the process for calculating Arizona's state tax liability. It requires taxpayers to detail their income, adjustments, deductions, and applicable credits, ensuring a comprehensive accounting of their financial obligations to the state. The structure of Form 140 facilitates various filing statuses, including joint or separate filings for married couples, head of household, and single filers, accommodating the diverse living situations of Arizona's residents. It also provides spaces for reporting exemptions due to age or blindness and for listing dependents and qualifying relatives, impacting the calculation of taxable income. Moreover, this form allows for direct engagement with community support through contributions to the Arizona Clean Elections Fund, among others, illustrating the state's encouragement of citizen participation in broader societal support. With options for including tax from credits recapture, detailing payments and withholding, and accounting for overpayments, Arizona Form 100 is designed to address the complete tax situation of individuals, ensuring accuracy and compliance in the state's fiscal landscape.

Arizona 140 Preview

NO TAPE.

ARIZONA FORM |

Resident Personal Income Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALENDAR YEAR |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

OR FISCAL YEAR BEGINNING |

|

M |

|

M |

|

D |

|

D |

|

|

Y |

Y |

|

|

|

Y |

|

|

Y |

|

|

AND ENDING |

|

M |

M |

|

|

D |

|

D |

Y |

|

|

|

Y |

|

|

Y |

|

|

Y |

|

. |

66 |

2012 |

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

82F |

|

|

|

|

|

|

Check box 82F if filing under extension |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your First Name and Middle Initial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter |

|

|

|

|

Your Social Security No. |

||||||||||||||||||||||||||||||||||||||||||||

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Spouse’s First Name and Middle Initial (if box 4 or 6 checked) |

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your |

|

|

|

|

Spouse’s Social Security No. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN(s) |

. |

|

|

|

|||||||||||||||

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Current Home Address - number and street, rural route |

|

|

Apt. No. Daytime Phone (with area code) |

Home Phone (with area code) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

City, Town or Post Office |

|

State Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corner.leftupper |

|

STATUSFILING |

4 |

|

|

|

|

|

Married filing joint return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE USE ONLY. DO NOT MARK IN THIS AREA. |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

5 |

|

|

|

|

|

Head of household |

|

NAME OF QUALIFYING CHILD OR DEPENDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Married filing separate return. Enter spouse’s name and Social Security No. above. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

7 |

|

|

|

|

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

staple2;pageto |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXEMPTIONS |

|

|

|

|

|

|

|

|

Enter the number claimed. Do not put a check mark. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

8 |

|

|

|

|

|

Age 65 or over (you and/or spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

9 |

|

|

|

|

|

Blind (you and/or spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

10 |

|

|

|

|

|

Dependents. From page 2, line A2 – do not include self or spouse. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

11 |

|

|

|

|

|

Qualifying parents and grandparents. From page 2, line A5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

140 |

|

12 |

|

Federal adjusted gross income (from your federal return) |

..................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

00 |

|||||||||||||||||||||||||||||||

|

13 |

|

Additions to income (from page 2, line B12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

00 |

|||||||||||||||||||||||

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

14 |

|

Subtractions from income (from page 2, line C17 or line C30) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

00 |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

after |

|

15 |

|

Arizona adjusted gross income. Add lines 12 and 13 then subtract line 14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

documents |

|

16 |

|

Deductions: Check box and enter amount. See instructions, pages 14 and 15... |

16I ITEMIZED 16S |

|

STANDARD |

16 |

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

19 |

|

......................................................Compute the tax using amount on line 18 and Tax Table X, Y or Optional Tax Tables |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

17 |

|

Personal exemptions. See page 15 of the instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

00 |

||||||||||||||||||||||||||||||

|

|

|

18 |

|

Arizona taxable income: Subtract lines 16 and 17 from line 15. If less than zero, enter zero |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

Tax from recapture of credits from Arizona Form 301, Part II, line 35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

or |

|

21 |

|

Subtotal of tax: Add lines 19 and 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

00 |

|||||||||||||||||||

|

22 |

|

Family income tax credit (from worksheet on page 16 of instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||

schedules |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

23 |

|

Credits from Arizona Form 301, Part II, line 68, or Forms 310, 321, 322, and 323 if Form 301 is not required |

|

|

|

|

|

|

|

|

|

23 |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

24 |

|

Credit type: Enter form number of each credit claimed |

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

3 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

.............. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

00 |

|||||||||||||||||||||||||||||

AZ |

|

|

Clean Elections Fund Tax Credit for donations made prior to August 2, 2012 (from worksheet on page 18 of the instructions) |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

26 |

|

Balance of tax: Subtract lines 22, 23 and 25 from line 21. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

00 |

||||||||||||||||||||||||||||||||

and |

|

|

If the sum of lines 22, 23 and 25 is more than line 21, enter zero |

........... |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

27 |

|

Arizona income tax withheld during 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

00 |

|||||||||||||||||||||||

federal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

28 |

|

Arizona estimated tax payments for 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

00 |

|||||||||||||||||||||||

required |

|

29 |

|

2012 Arizona extension payment (Form 204) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

00 |

|||||||||||||||||||||||

|

30 |

|

Increased Excise Tax Credit (from Form 140PTC or worksheet on page 19 of the instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

31 |

|

Property Tax Credit from Form 140PTC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

00 |

||||||||||||||||||||||

any |

|

32 |

|

Other refundable credits: Check the box(es) and enter the amount |

|

321 Form |

|

|

|

|

Form 342 |

32 |

|

00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

33 |

|

Total payments/refundable credits: Add lines 27 through 32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

00 |

|||||||||||||||||||||||||||||||||||||

Place |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

34 |

|

TAX DUE: If line 26 is larger than line 33, subtract line 33 from line 26 and enter amount of tax due. Skip lines 35, 36 and 37 |

|

|

|

|

|

|

|

|

|

34 |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

........... |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

35 |

|

OVERPAYMENT: If line 33 is larger than line 26, subtract line 26 from line 33 and enter amount of overpayment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

36 |

|

Amount of line 35 to be applied to 2013 estimated tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

00 |

|||||||||||||||||||||||||||||||

TAPE. |

37 |

|

Balance of overpayment: Subtract line 36 from line 35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

00 |

||||||||||||||||||||||||||||||||

|

38 - 47 Voluntary Gifts to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

NO |

|

|

|

|

Aid to Education |

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

Arizona Wildlife |

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Child Abuse Prevention |

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

Domestic Violence Shelter |

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

HERE. |

|

|

|

|

I Didn’t Pay Enough Fund |

|

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

National Guard Relief Fund |

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Neighbors Helping Neighbors |

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

Special Olympics |

|

|

|

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||

PAYMENT |

|

|

|

|

Veterans’ Donations Fund |

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

Political Gift |

|

|

|

|

|

|

|

|

|

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

|||||||||||||||||||||||||||||||||||||

50 |

|

Check applicable boxes 501.... |

Annualized/Other |

502 |

|

|

Farmer or Fisherman 503 |

Form 221 attached 504 |

|

|

MSA Penalty |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

48 |

|

Voluntary Political Gift (check only one): |

481 |

|

Americans Elect |

482 |

|

|

Democratic |

483 |

Green |

484 |

Libertarian |

485 |

|

|

Republican |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

49 |

|

.................................................................................................Estimated payment penalty and MSA withdrawal penalty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49 |

00 |

||||||||||||||||||||||||||||||||||||||

STAPLE |

51 |

|

Total of lines 38 through 47 and 49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51 |

00 |

|||||||||||||||||||||

52 |

|

REFUND: Subtract line 51 from line 37. |

If less than zero, enter amount owed on line 53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52 |

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Direct Deposit of Refund: Check box 52A if your deposit will be ultimately placed in a foreign account; see instructions. |

|

52A |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

ROUTING NUMBER |

|

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

Checking or |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

Savings |

|

|

|

|||||||||||||||||||||

|

|

53 |

|

AMOUNT OWED: Add lines 34 and 51. |

Make check payable to Arizona Department of Revenue; include SSN on payment. |

53 |

00 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ADOR 10413 (12)

Your Name (as shown on page 1)

Your Social Security No.

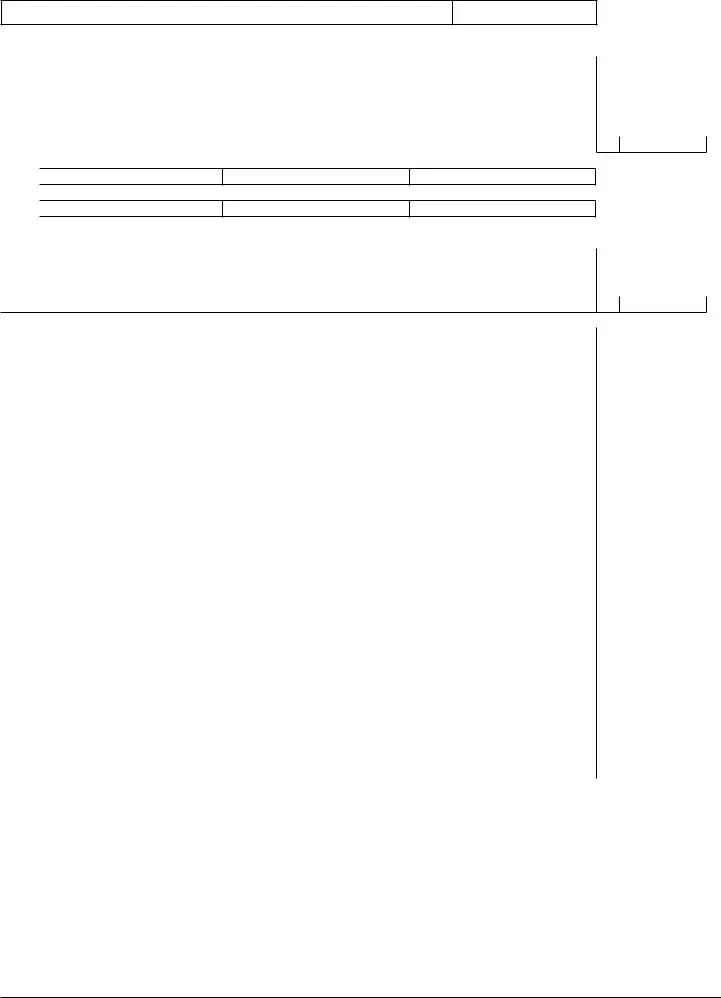

PART A: Dependents, Qualifying Parents and Grandparents - do not list yourself or spouse

If completing Part A, also complete Part C, lines C15 and/or C16 and C17. |

|

|

|

||||

A1 List children and other dependents. If more space is needed, attach a separate sheet. |

NO. OF MONTHS LIVED |

|

|||||

|

FIRST AND LAST NAME |

SOCIAL SECURITY NO. |

RELATIONSHIP |

IN YOUR HOME IN 2012 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A2 Enter total number of persons listed in A1 here and on the front of this form, box 10; also complete Part C below... TOTAL

A3 a Enter the names of the dependents listed above who do not qualify as your dependent on your federal return:

A2

b Enter dependents listed above who were not claimed on your federal return due to education credits:

A4 List qualifying parents and grandparents. If more space is needed, attach a separate sheet. |

|

|

|||||

|

You cannot list the same person here and also on line A1. For information on who is a |

|

|

||||

|

qualifying parent or grandparent, see page 6 of the instructions. |

|

NO. OF MONTHS LIVED |

|

|||

|

FIRST AND LAST NAME |

SOCIAL SECURITY NO. |

RELATIONSHIP |

IN YOUR HOME IN 2012 |

|

||

|

|

|

|

|

|

|

|

A5 Enter total number of persons listed in A4 here and on the front of this form, box 11 |

TOTAL |

A5

PART B: Additions to Income

B6 |

|

B6 |

|

00 |

|

B7 |

Ordinary income portion of |

|

B7 |

|

00 |

B8 |

Total federal depreciation. Also see the instructions for line C22 |

|

B8 |

|

00 |

B9 |

Medical savings account (MSA) distributions. See page 7 of the instructions |

|

B9 |

|

00 |

B10 |

I.R.C. §179 expense in excess of allowable amount. Also see the instructions for line C26 |

B10 |

|

00 |

|

B11 |

Other additions to income. See instructions and attach your own schedule |

B11 |

|

00 |

|

B12 |

Total: Add lines B6 through B11. Enter here and on the front of this form, line 13 |

B12 |

|

00 |

|

PART C: Subtractions From Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

C13 |

|

Exemption: Age 65 or over. Multiply the number in box 8, page 1, by $2,100 |

|

C13 |

|

|

|

00 |

|

|

|

|

|||||||||

C14 |

|

Exemption: Blind. Multiply the number in box 9, page 1, by $1,500 |

|

C14 |

|

|

|

00 |

|

|

|

|

|||||||||

C15 |

|

Exemption: Dependents. Multiply the number in box 10, page 1, by $2,300 |

|

C15 |

|

|

|

00 |

|

|

|

|

|||||||||

C16 |

|

Exemption: Qualifying parents and grandparents. Multiply the number in |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

box 11, page 1, by $10,000 |

|

|

|

|

|

|

C16 |

|

|

|

00 |

|

|

|

|

||||

C17 |

|

Total exemptions: Add lines C13 through C16. |

If you have no other subtractions from |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

income, skip lines C18 through C30 and enter the amount on line C17 on Form 140, Page 1, line 14 |

|

|

|

C17 |

|

00 |

|||||||||||||

C18 |

|

Interest on U.S. obligations such as U.S. savings bonds and treasury bills |

|

|

|

|

|

|

|

C18 |

|

00 |

|||||||||

C19 |

|

Exclusion for federal, Arizona state or local government pensions (up to $2,500 per taxpayer) |

|

|

|

|

|

|

|

C19 |

|

00 |

|||||||||

C20 |

|

Arizona state lottery winnings included as income on your federal return (up to $5,000 only) |

|

|

|

|

|

|

|

C20 |

|

00 |

|||||||||

C21 |

|

U.S. Social Security or Railroad Retirement Act benefits included as income on your federal return (the taxable amount) . |

C21 |

|

00 |

||||||||||||||||

C22 |

Recalculated Arizona depreciation |

|

|

|

|

|

|

|

|

|

|

|

C22 |

|

00 |

||||||

C23 |

|

Certain wages of American Indians |

|

|

|

|

|

|

|

|

|

|

|

C23 |

|

00 |

|||||

C24 |

|

Income tax refund from other states. See instructions |

|

|

|

|

|

|

|

|

C24 |

|

00 |

||||||||

C25 |

|

Deposits and employer contributions into MSAs. See page 11 of the instructions |

|

|

|

|

|

|

|

C25 |

|

00 |

|||||||||

C26 |

|

Adjustment for I.R.C. §179 expense not allowed |

.............................................................................................................. |

|

|

|

|

|

|

|

|

|

|

C26 |

|

00 |

|||||

C27 |

|

Pay received for active service as a member of the reserves, national guard or the U.S. armed forces |

|

|

|

C27 |

|

00 |

|||||||||||||

C28 |

|

Net operating loss adjustment. See instructions before you enter any amount here |

|

|

|

|

|

|

|

C28 |

|

00 |

|||||||||

C29 |

|

Other subtractions from income. See instructions and attach your own schedule |

|

|

|

|

|

|

|

C29 |

|

00 |

|||||||||

C30 |

Total: Add lines C17 through C29. Enter here and on the front of this form, line 14 |

|

|

|

|

|

|

|

C30 |

|

00 |

||||||||||

Part D: Last Name(s) Used in Prior Years – if different from name(s) used in current year |

|

|

|

|

|

|

|

|

|||||||||||||

D31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HERE |

! |

I have read this return and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are |

|||||||||||||||||||

true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|

|

|||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

SIGN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR SIGNATURE |

|

|

|

|

|

|

DATE |

|

OCCUPATION |

|

|

|

|

|

|

|

|

||

! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PLEASE |

|

|

SPOUSE’S SIGNATURE |

|

|

|

|

|

|

DATE |

|

SPOUSE’S OCCUPATION |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAID PREPARER’S SIGNATURE |

|

|

DATE |

|

FIRM’S NAME (PREPARER’S IF |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

PAID PREPARER’S TIN |

|

PAID PREPARER’S ADDRESS |

|

|

|

|

|

|

PAID PREPARER’S PHONE NO. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you are sending a payment with this return, mail to Arizona Department of Revenue, PO Box 52016, Phoenix, AZ,

If you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to Arizona Department of Revenue, PO Box 52138, Phoenix, AZ,

ADOR 10413 (12) |

AZ Form 140 (2012) |

Page 2 of 2 |

File Properties

| Fact | Detail |

|---|---|

| Form Title | Arizona Form 140 |

| Purpose | For filing Resident Personal Income Tax Return |

| Applicability | Used by residents of Arizona to file their state income tax |

| Governing Law | Arizona Revised Statutes, Title 43 |

Instructions on Utilizing Arizona 140

Filling out the Arizona Form 140, the Resident Personal Income Tax Return, requires a focused approach to ensure accuracy and compliance with state tax laws. After gathering all necessary documentation, including W-2s, 1099 forms, and any relevant federal income tax return information, you can begin the process. Pay close attention to each section to accurately report income, deductions, and credits that relate to your tax situation.

- Start by entering the calendar year or fiscal year dates at the top of the form.

- If you're filing under an extension, check box 82F.

- Enter Your First Name and Middle Initial, Last Name, and Social Security No. in the designated fields.

- If applicable, fill in your Spouse’s First Name and Middle Initial, Last Name, and Social Security No. in the provided spaces.

- For your Current Home Address, include the number and street, rural route, and Apartment No. if applicable.

- Add your Daytime Phone and Home Phone numbers with the area code.

- Enter the City, Town or Post Office, State, and Zip Code for your address.

- Check the appropriate box for your filing status: Married filing joint return, Head of household, Married filing separate return, or Single.

- In the exemptions section, enter the number claimed for age 65 or over, blindness, dependents, and qualifying parents and grandparents as per the form’s instructions.

- Input your Federal adjusted gross income from your federal return.

- Add any Additions to income and Subtractions from income, following instructions from the additional pages if necessary.

- Choose deductions: Itemized or Standard, checking the corresponding box and entering the amount.

- Complete the sections on tax calculations, including personal exemptions, Arizona taxable income, and compute the tax using the indicated tax table or optional tax tables.

- Address any applicable credits, such as the Clean Elections Fund Tax Credit, and calculate the Balance of tax.

- Detail Arizona income tax withheld, estimated tax payments for 2012, 2012 extension payment, and any other refundable credits as instructed.

- Calculate Total payments/refundable credits, and determine the TAX DUE or OVERPAYMENT accordingly.

- Optionally, you can allocate part of your overpayment to 2013 estimated tax and decide on contributions to various charitable causes listed on the form.

- Review the section on voluntary political gifts and estimate payment penalty, if applicable.

- Sign and date the form, ensuring both you and your spouse (if filing jointly) complete this section. A paid preparer must also sign and provide their information if they prepared the form.

- If including a payment, use the payment address. Otherwise, use the refund or no-tax-due address to mail your completed Form 140.

By methodically completing each step, you ensure that your Arizona Form 140 accurately reflects your income tax situation, potentially leading to a swift processing of your return by the Arizona Department of Revenue.

Listed Questions and Answers

What is the Arizona Form 140?

The Arizona Form 140 is the Resident Personal Income Tax Return used by individuals who are residents of Arizona to file their state income tax. It's designed for reporting income, calculating taxes owed, and claiming any deductions or credits for a specific tax year. This form is tailored for individuals, including those filing single, married filing jointly, married filing separately, or as head of household.

Who needs to file the Arizona Form 140?

Any resident of Arizona who has earned income during the tax year is required to file the Arizona Form 140 if their income exceeds the state's filing threshold. This includes individuals who are employed, self-employed, or receiving income from other sources such as investments. Even if you don't owe any tax, you might still need to file a return if your income is above the threshold to ensure compliance with state tax laws.

Can I file Arizona Form 140 electronically?

Yes, Arizona Form 140 can be filed electronically, which is often faster and more secure than paper filing. Electronic filing (e-filing) also ensures quicker processing of your return and any due refunds. The state of Arizona encourages taxpayers to use e-filing for its efficiency and convenience. Taxpayers can use approved software to prepare their returns and submit them directly to the Arizona Department of Revenue.

What are the key sections in Arizona Form 140?

Form 140 is divided into various sections, each designed to capture specific information about the taxpayer's income, deductions, and tax credits. Key sections include: - Personal information: Where you provide names, Social Security Numbers, and addresses. - Filing status: Such as single, married filing jointly, or head of household. - Exemptions: Including dependents, age, or blindness. - Income: Where you report federal adjusted gross income and specific additions or subtractions as per Arizona law. - Deductions: Either itemized or standard, alongside personal exemptions. - Tax calculation: Where the amount of tax owed is calculated using state tax tables. - Credits and payments: Including withholding and estimated payments, as well as any qualifying state tax credits.

Where can I find help for filling out the Arizona Form 140?

Help for completing the Arizona Form 140 is widely available. The Arizona Department of Revenue's website is a valuable resource, offering instructions, guidelines, and contact information for taxpayer assistance. Additionally, tax preparation software can guide individuals through the process step by step. For those seeking personal assistance, tax professionals, including accountants and tax preparers, can provide services to ensure the form is completed accurately and efficiently.

Common mistakes

Filling out the Arizona 140 form, a key tax document for residents, requires attention to detail to avoid common mistakes that can lead to processing delays, incorrect tax calculations, or even penalties. Here are five common mistakes to watch out for:

Incorrect Social Security Numbers (SSNs): Entering an incorrect SSN for yourself, your spouse, or dependents can lead to significant delays. The Arizona Department of Revenue uses SSNs to verify taxpayers' identities and process returns efficiently.

Choosing the Wrong Filing Status: Your filing status affects tax calculations and eligibility for certain deductions and credits. Ensure you choose the correct status (e.g., Single, Married Filing Jointly, Head of Household) that applies to your situation for the tax year.

Miscalculating Deductions and Credits: Overlooking or inaccurately calculating deductions and credits can impact your taxable income and the total amount of tax owed. This includes errors with itemized deductions (Form 140, Line 16I) or the standard deduction (Line 16S), as well as not fully understanding eligibility for credits listed under lines 22 through 25.

Overlooking Income Additions or Subtractions: Failing to properly report additional income (line 13) or not claiming legitimate income subtractions (line 14) can result in incorrect tax calculations. Taxpayers often overlook non-Arizona municipal interest income or improperly calculate their Arizona adjusted gross income.

Forgetting to Sign and Date: The Arizona 140 form is not valid without the taxpayer’s and, if applicable, the spouse’s signatures and the date signed. Unsigned forms will be returned, leading to delays in processing and potential late filing penalties.

When completing the Arizona Form 140, taking the time to double-check these areas can help ensure the accuracy of your tax return, aiding in a smoother processing experience with the Arizona Department of Revenue.

Documents used along the form

When residents of Arizona tackle the task of filing their state taxes, especially through the Arizona 140 form, a resident personal income tax return, they often find themselves needing to navigate additional documents for a complete and compliant submission. This doesn't just involve numbers and calculations but a well-rounded compilation of life's financial events over the calendar year. To ensure accuracy and maximize potential tax benefits, certain forms and schedules commonly accompany the main filing document, likened to a chorus supporting the lead singer at a concert.

- Form 321: This form is instrumental for taxpayers who have made charitable donations to qualifying organizations throughout the year. It allows them to claim those donations as tax credits, directly reducing their tax liability dollar for dollar.

- Form 322: Education is a cornerstone of community development and personal growth. This form is dedicated to taxpayers who have supported public and/or private schools in Arizona, providing them tax credits for fees paid for extracurricular activities or character education programs.

- Form 301: Often a companion to various charitable credit forms, Form 301 serves as a summary that consolidates all tax credits from donations. It helps taxpayers and the state alike by providing a clear record of all credits claimed, ensuring that no benefit is left unclaimed or duplicated.

- Form 204: Life can be unpredictable, and sometimes taxpayers need more time to file their taxes accurately. Form 204 requests an extension for filing beyond the original deadline, giving taxpayers up to six additional months to gather their documents and complete their tax returns without penalty for late filing.

These forms represent common documents that accompany the Arizona 140 form. Each has its unique purpose, yet all share the common goal of ensuring taxpayers can accurately report their financial activities and receive any owed benefits or credits. Navigating tax documents requires a meticulous approach, but understanding each document’s role within the broader tax landscape helps taxpayers ensure their filings are both comprehensive and compliant. Thus, while the Arizona 140 form is the vessel through which taxpayers communicate their financial year to the state, these additional forms and schedules are indispensable in painting the full picture of one's financial narrative.

Similar forms

The Arizona Form 140 is quite similar to the 1040 Form used for federal tax returns in the United States. Both forms are utilized by individuals to report their yearly income and calculate the taxes owed to the government. They cover various types of income, deductions, and credits available to the taxpayer, making them comprehensive tools for income tax reporting. The 1040 Federal Form, like the Arizona Form 140, allows for itemized or standard deductions, personal exemptions, and includes sections for tax credits and payments throughout the year.

Arizona Form 140PTC, Property Tax Refund (Credit) Claim, shares similarities with Form 140 in the context of offering specific tax credits. While Form 140 covers a broad range of income, deductions, and credits, Form 140PTC focuses on providing a credit for individuals who pay property taxes or rent on their primary residence in Arizona. Both forms aim to reduce the taxpayer's financial burden through credits, but Form 140PTC specifically targets property tax relief.

The Arizona Form 321, Credit for Contributions to Qualifying Charitable Organizations, is another document that parallels the Arizona 140 form in its provision for tax credits. While Form 140 includes various credits, including those for donations to certain funds, Form 300 provides a structured way to claim credits for donations made to certified charitable organizations. Both forms work to incentivize and acknowledge taxpayers' contributions to eligible entities, thereby reducing their taxable income through specific credit sections.