Legal Arizona Affidavit of Death Document

When someone passes away, those left behind are faced with numerous tasks, one of which may involve dealing with the deceased's property and legal matters. In Arizona, an Affidavit of Death form plays a crucial role in this process, serving as a formal declaration that confirms the death of an individual. This document is typically required by entities such as banks, title companies, and courts to officially recognize the death and proceed with the transfer of assets or the execution of the deceased's will. The Affidavit of Death is instrumental in ensuring that property and assets are correctly distributed to the rightful heirs or designated beneficiaries. It simplifies the process by avoiding lengthy probate proceedings, providing a streamlined way to handle the legal aspects of a person's passing. Emphasizing the importance of accuracy and completeness, this form must be signed in the presence of a notary public to validate its authenticity. Understanding its purpose, requirements, and implications can significantly ease the burden on those tasked with settling the deceased's affairs, making it a vital document in the aftermath of a loss.

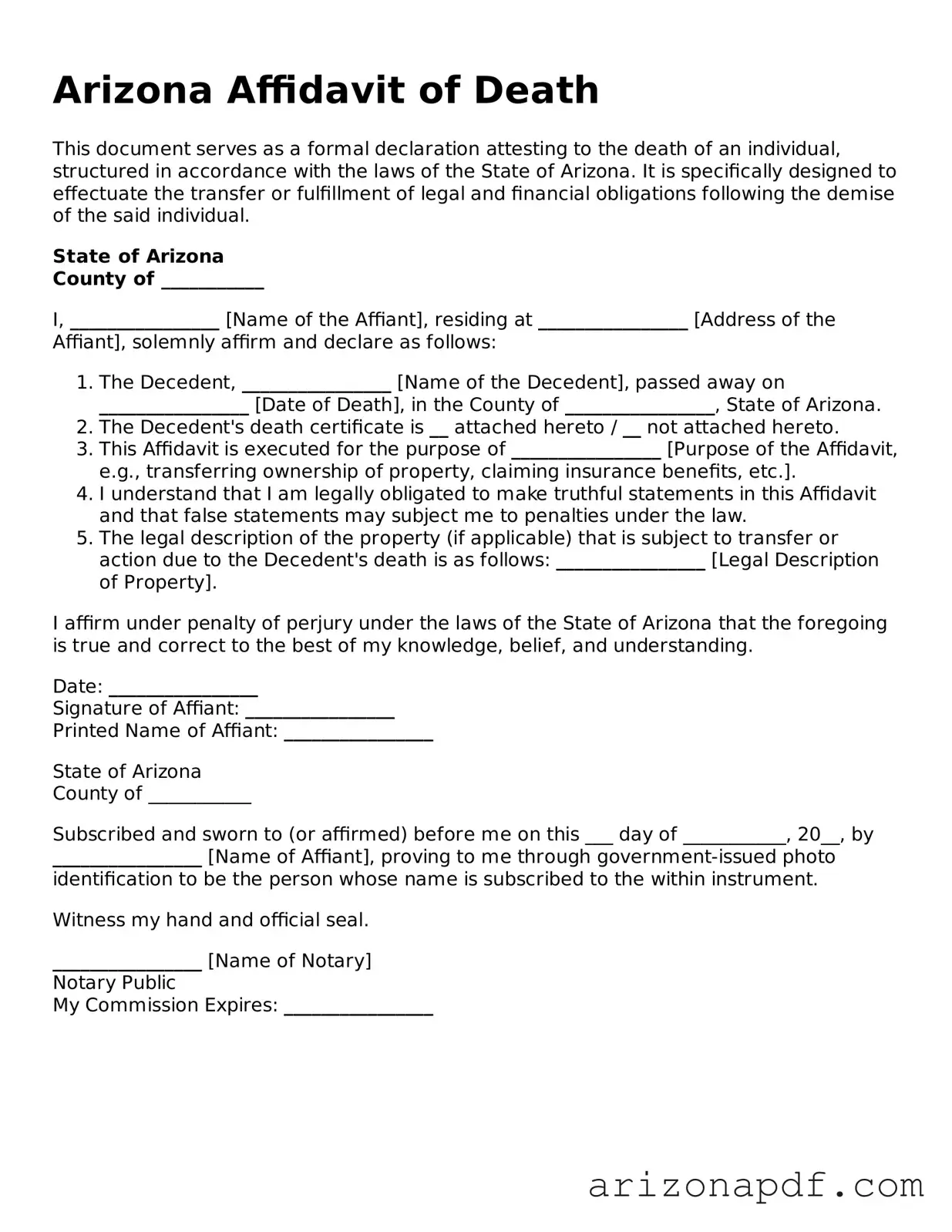

Arizona Affidavit of Death Preview

Arizona Affidavit of Death

This document serves as a formal declaration attesting to the death of an individual, structured in accordance with the laws of the State of Arizona. It is specifically designed to effectuate the transfer or fulfillment of legal and financial obligations following the demise of the said individual.

State of Arizona

County of ___________

I, ________________ [Name of the Affiant], residing at ________________ [Address of the Affiant], solemnly affirm and declare as follows:

- The Decedent, ________________ [Name of the Decedent], passed away on ________________ [Date of Death], in the County of ________________, State of Arizona.

- The Decedent's death certificate is __ attached hereto / __ not attached hereto.

- This Affidavit is executed for the purpose of ________________ [Purpose of the Affidavit, e.g., transferring ownership of property, claiming insurance benefits, etc.].

- I understand that I am legally obligated to make truthful statements in this Affidavit and that false statements may subject me to penalties under the law.

- The legal description of the property (if applicable) that is subject to transfer or action due to the Decedent's death is as follows: ________________ [Legal Description of Property].

I affirm under penalty of perjury under the laws of the State of Arizona that the foregoing is true and correct to the best of my knowledge, belief, and understanding.

Date: ________________

Signature of Affiant: ________________

Printed Name of Affiant: ________________

State of Arizona

County of ___________

Subscribed and sworn to (or affirmed) before me on this ___ day of ___________, 20__, by ________________ [Name of Affiant], proving to me through government-issued photo identification to be the person whose name is subscribed to the within instrument.

Witness my hand and official seal.

________________ [Name of Notary]

Notary Public

My Commission Expires: ________________

Document Details

| Fact | Detail |

|---|---|

| 1. Purpose | Used to notify relevant parties and government offices about the death of a property owner in Arizona. |

| 2. Primary Use | Commonly utilized to transfer or clarify title on real property after the owner's death. |

| 3. Required Information | Includes details of the deceased, the legal description of the property, and a certified copy of the death certificate. |

| 4. Filing Location | Must be filed with the county recorder's office in the county where the property is located. |

| 5. Governing Laws | Governed by Arizona Revised Statutes, specifically sections related to estate and property laws. |

| 6. Processing Time | Varies by county but is essential for updating property records and title. |

| 7. Associated Fees | There may be recording fees which vary by county. Additional charges could apply for certifications or expedited processing. |

| 8. Importance for Estate Planning | Crucial for the executor or administrator of an estate to ensure smooth transition of property ownership and settling of the estate. |

Instructions on Utilizing Arizona Affidavit of Death

The Arizona Affidavit of Death form is a legal document that plays a crucial role after a loved one has passed away. It is often used to make changes to property records and to ensure that assets are properly transferred according to the deceased’s wishes or the law. Filling out this form accurately is vital to avoid any delay or complications in settling the deceased's estate. The process is straightforward, but it requires attention to detail to complete it correctly. Here are the step-by-step instructions to help you navigate through filling out the Arizona Affidavit of Death form.

- Begin by gathering all necessary documents, including the death certificate of the deceased and any property deeds or titles that need to be updated.

- Locate the proper form. Ensure you have the current version of the Arizona Affidavit of Death form. This can often be found online through county or state websites.

- Read through the entire form before filling out any information. This will give you an understanding of what information is required.

- Enter the full legal name of the deceased in the section provided. Ensure the name matches exactly as it appears on the death certificate.

- Fill in the date of death exactly as it appears on the death certificate.

- Include a legal description of the property. This may require copying the description from the property deed or title documents to ensure accuracy.

- Provide your information as the Affiant. This means you will need to include your full legal name, address, and relationship to the deceased.

- Attach a certified copy of the death certificate to the affidavit. Most institutions require a certified copy to process the document properly.

- Review the affidavit in its entirety to ensure all the information provided is accurate and complete.

- Sign the affidavit in front of a notary public. This step is crucial as the notarization legitimizes the document.

- Finally, file the affidavit along with the death certificate (if required by the institution) with the appropriate county recorder’s office or other institutions as needed to update the property records.

Following these steps will help ensure the Affidavit of Death is filled out accurately and completely. Remember, this document is a critical part of managing the deceased's affairs and property, so taking the time to complete it properly is important. If at any point the process feels overwhelming, don't hesitate to seek assistance from a legal professional who can guide you through the specifics and ensure everything is in order.

Listed Questions and Answers

What is an Arizona Affidavit of Death form?

An Arizona Affidavit of Death form is a legal document used to officially report the death of an individual. It's typically utilized in the process of transferring property or assets to the beneficiaries or heirs of the deceased, especially when the property is held in joint tenancy or when the deceased has designated beneficiaries for certain assets.

Who can file an Arizona Affidavit of Death?

Generally, the executor of the deceased's estate or a surviving spouse, adult child, or other close relative can file an Arizona Affidavit of Death. The eligibility to file may depend on the specific requirements of the institution or entity requesting the affidavit, such as a bank or the bureau of land management.

What information is required to complete the form?

To complete the Arizona Affidavit of Death form, the following information is usually required: the deceased’s full name and date of death, the legal description and address of the property involved if applicable, the relationship of the person filing the affidavit to the deceased, and evidence of the deceased's death, typically involving a certified copy of the death certificate.

Where should the Arizona Affidavit of Death be filed?

The Arizona Affidavit of Death should be filed with the county recorder’s office in the county where the property or asset is located. This step is crucial for the legal transfer of the property's title or for the execution of the deceased's asset distribution wishes.

Is there a fee to file an Arizona Affidavit of Death?

Yes, there is usually a filing fee required to record the Arizona Affidavit of Death with the county recorder's office. The amount of this fee can vary by county, so it’s advisable to contact the specific county recorder’s office to inquire about the current fees.

How soon after a death should the Arizona Affidavit of Death be filed?

While there is no strict deadline for filing an Arizona Affidavit of Death, it’s generally advisable to file it as soon as is practical after obtaining the official death certificate. Timely filing can prevent complications in the transfer of assets and property, helping to ensure the deceased's wishes are honored without unnecessary delay.

Common mistakes

-

Omitting necessary personal details can significantly slow down the process. This document requires precise information about the deceased, including full legal name, date of death, and the property in question. Missing information can lead to delays or even the rejection of the affidavit.

-

Not attaching the death certificate is a common oversight. The Arizona Affidavit of Death form must be accompanied by an official death certificate to verify the death. Failure to include this essential document can invalidate the affidavit.

-

Incorrectly identifying the property involved can create legal complications. It's vital to provide a clear and legal description of the property, ensuring it matches the records. This includes not only the address but also any legal description used in property records.

-

Forgetting to sign the affidavit in front of a notary public is a critical misstep. The affidavit is a legal document and, as such, requires notarization to be considered valid and binding. Skipping this step can render the document ineffective.

-

Failure to file the affidavit with the appropriate county recorder's office can lead to its non-recognition. Once completed and notarized, the document must be recorded in the county where the property is located. This formalizes the transfer or acknowledgement of death in relation to the property.

-

Using outdated or incorrect forms is another common mistake. It's crucial to use the latest version of the Arizona Affidavit of Death form, as laws and requirements may change. An outdated form may not be accepted.

-

Misunderstanding the purpose of the affidavit can lead to incorrect use. This affidavit is specifically for the purpose of ensuring that property is transferred or to make official note of a death in relation to particular properties. Using it for other purposes can mislead legal processes.

-

Not consulting with a legal professional can cause numerous issues down the line. While the form may seem straightforward, understanding its implications and ensuring it's filled out correctly can benefit greatly from professional advice, particularly in complex cases involving significant property or potential disputes.

Documents used along the form

When managing a loved one’s estate in Arizona, the Affidavit of Death form plays a crucial role in the process. However, it's seldom the only document needed. Various other forms and documents are often required to ensure a smooth transfer of assets, compliance with state laws, and adherence to the deceased's wishes. Below is a list of up to ten additional crucial documents that are frequently used alongside the Arizona Affidavit of Death form. Each has a unique purpose and is critical in different aspects of estate management.

- Death Certificate: An official record of death. This document is fundamental for validating the death with various institutions and is required for many transactions after a person has passed away.

- Will: A legal document outlining the deceased person's wishes regarding the distribution of their assets and care for any minor children.

- Trust Documents: If the deceased person had a trust, these documents outline the terms and beneficiaries of the trust, which can bypass the probate process.

- Letters of Administration or Letters Testamentary: These are issued by the court granting authority to the executor or administrator to manage and distribute the deceased's estate.

- Probate Petition: A document filed with the court to initiate the probate process, which is the legal process for distributing the deceased's assets.

- Notice to Creditors: A notice published in a local newspaper and sent to known creditors to inform them of the decedent's death so they can make claims against the estate.

- Inventory of Assets: A comprehensive list of the deceased's assets at the time of death, including real estate, bank accounts, securities, and personal property.

- Final Income Tax Return: This form must be filed to settle any income taxes owed by the deceased up to the date of death.

- Estate Tax Return: If the estate exceeds certain thresholds, an estate tax return may be required by federal and possibly state tax authorities.

- Beneficiary Designation Forms: Documents that list beneficiaries for specific assets, such as retirement accounts and life insurance policies, which can transfer outside of the will or trust.

Together, these documents provide a comprehensive framework for managing the legal and financial affairs of someone who has passed away. Navigating through them can be complex, and it’s often beneficial to seek legal guidance to ensure compliance with Arizona laws and that the deceased’s wishes are honored accurately and efficiently.

Similar forms

The Arizona Affidavit of Death form shares similarities with the Death Certificate in that both serve as legal confirmation of an individual's death. While a Death Certificate is a formal government-issued document that officially records the date, location, and cause of death, the Affidavit of Death is a sworn statement used primarily for transferring assets or property of the deceased to their heirs or designated beneficiaries. Despite their different applications, both documents play crucial roles in settling the affairs of someone who has passed away.

Like the Arizona Affidavit of Death form, a Last Will and Testament is integral in managing the affairs of the deceased. The Last Will outlines the decedent's wishes regarding the distribution of their estate and the care of any dependents. In contrast, the Affidavit of Death is used to assert the fact of death in the legal process, often initiating the execution of the will. Both are essential in the probate process, with the Affidavit of Death sometimes acting as a supportive document to the Last Will and Testament.

The Transfer on Death Deed (TODD) bears resemblance to the Arizona Affidavit of Death form in that both involve the transfer of property upon the death of an individual. A TODD allows homeowners to name a beneficiary to whom the property will transfer when they die, bypassing the lengthy probate process. The Affidavit of Death, meanwhile, can be used to demonstrate the decedent's death, thereby facilitating the transfer process outlined in a TODD.

Joint Tenancy with Right of Survivorship Deeds are similar to the Arizona Affidavit of Death form in terms of property transfer upon an owner's death. These deeds allow property to pass automatically to the surviving owner(s) without the need for probate. The Affidavit of Death helps by providing legal proof of one owner’s demise, thereby enabling the property's transfer under the terms of the joint tenancy agreement.

Comparable to the Arizona Affidavit of Death form, a Life Insurance Claim form is used in the aftermath of an individual's passing to initiate a process, in this case, the payout of a life insurance policy. The Life Insurance Claim form requires proof of death and beneficiaries’ information to release funds. While serving different purposes—one for asset transfer and the other for claim processing—both documents rely on official acknowledgment of death as a starting point.

The Beneficiary Designation Form, often used in conjunction with retirement accounts or life insurance policies, shares a common purpose with the Arizona Affidavit of Death form, in that it designates who will receive assets upon the policyholder's or account holder's death. The Affidavit of Death, when presented, can activate these designations, ensuring the seamless transfer of assets to named beneficiaries according to the previously expressed wishes of the deceased.

A Durable Power of Attorney for Healthcare becomes important in the context of documents similar to the Arizona Affidavit of Death form. This legal document allows an individual to appoint another person to make healthcare decisions on their behalf if they become incapacitated. While not directly related to asset transfer or proving death, both documents address circumstances surrounding an individual’s end-of-life care and the subsequent administrative processes.

The Trust Certification is akin to the Arizona Affidavit of Death form in estate planning and execution purposes. This document certifies the existence of a trust, outlines its terms, and identifies the trustees. Upon the death of the trustor, the Affidavit of Death may be required to confirm the event, thereby enabling the trust's administration according to its terms. Both documents work hand-in-hand within the broader scope of managing and distributing the deceased's assets.

Dos and Don'ts

When the time comes to fill out an Arizona Affidavit of Death form, it's crucial to proceed with care and attention to detail. This document is used to notify entities of a person's death, often relating to the transfer of property or to claim assets. Here are essential do's and don'ts to ensure the process is handled smoothly and accurately.

Do:

- Ensure you have the legal right to file the affidavit. This typically means you're an heir or executor of the deceased's estate.

- Gather all necessary documents beforehand, such as the death certificate and any relevant property deeds or account information.

- Read the form thoroughly before you start filling it out. Understanding every section can prevent mistakes.

- Use blue or black ink if filling out the form by hand, to ensure the information is legible and photocopy-friendly.

- Be precise with the details of the deceased, including their full legal name, date of birth, and date of death, as these need to match official records exactly.

- Double-check the legal description of any property involved, if applicable. This information must be accurate for the transfer of property to be valid.

- Sign the affidavit in front of a notary public. This step is crucial for the document to have legal standing.

- Submit the form to the appropriate county recorder’s office, as this is where official records are kept and updated.

- Keep a copy of the notarized affidavit for your records. Having your own copy can be helpful for future reference.

- Contact a legal advisor if you're unsure about any part of the process. Professional guidance can prevent errors and legal complications.

Don't:

- Attempt to use the affidavit for purposes other than what it's legally intended for. Misuse of the document can result in legal penalties.

- Fill in the form with incomplete or inaccurate information. Errors can delay the process and might require you to start over.

- Sign the document without a notary present. A notarized signature is typically required for the affidavit to be accepted.

- Overlook details regarding the deceased’s assets. Correct information is critical for a smooth transfer of assets.

- Forget to notify all relevant parties about the death. Depending on the case, this could include banks, governmental agencies, or other entities.

- Assume that the affidavit is the only document you'll need. Sometimes additional paperwork is required by certain institutions or agencies.

- Underestimate the importance of the legal description in property matters. Mistakes here can invalidate the transfer.

- Rush through filling out the form. Taking your time can help ensure accuracy.

- Neglect to check whether the county recorder’s office requires a filing fee. Being prepared can save you a return trip.

- Forget that laws and procedures can vary by jurisdiction. Always verify that you're following the latest guidelines specific to Arizona.

Navigating the legal requirements after a loved one's passing can be challenging. By following these do's and don'ts, you can ensure the Arizona Affidavit of Death form is filled out correctly, helping to ease the process during a difficult time.

Misconceptions

When navigating the process of dealing with the death of a property owner in Arizona, the Affidavit of Death form becomes crucial. However, misunderstandings about its use and requirements are common. Let's clarify some of these misconceptions to ensure you're fully informed:

-

It's the same as a death certificate: A common misconception is that the Affidavit of Death and a death certificate are the same. In reality, the Affidavit of Death form is used by successors to notify the county recorder and other institutions of the owner’s death and to assert their interest in the property, while a death certificate is an official document issued by the government confirming the date, location, and cause of death.

-

Only family members can file it: It's often thought that only direct family members can file an Affidavit of Death. However, in Arizona, any successor in interest, including family members or those named in a will or trust as beneficiaries, may file this affidavit, provided they meet certain legal criteria and requirements.

-

It transfers property automatically: Another misunderstanding is the belief that filing an Affidavit of Death by itself automatically transfers property to the survivors or heirs. The truth is this form serves as a notification of death and a claim of interest. Additional legal steps are necessary to transfer property ownership properly.

-

Legal representation is required to file it: Many believe that you must have legal representation to file an Affidavit of Death. While consulting with an attorney is advisable for any legal process, particularly in complex estates, filing this affidavit does not require legal representation. Successors can file it themselves once they accurately complete the required information and comply with Arizona's legal requirements.

-

There is a universal form for all states: Some people might think there is a one-size-fits-all Affidavit of Death form for every state. However, each state, including Arizona, has its own specific form and requirements. It’s important to use the correct state-specific form and follow state guidelines closely.

-

It solely pertains to real estate: While commonly used in the context of real estate to clear the title or assert a claim, the concept of an Affidavit of Death can also pertain to other assets, like vehicles or bank accounts, depending on state laws and the institution's policies. The specific application and requirements can vary, making it important to verify how and when to use this affidavit for different types of assets in Arizona.

Clearing up these misconceptions ensures that individuals dealing with an estate in Arizona are better prepared and informed. Handling property and legal matters after a loved one's death can be challenging, but understanding the correct use and limitations of the Affidavit of Death form can make the process smoother.

Key takeaways

Filling out and using the Arizona Affidavit of Death form is a critical step in the legal process following a person's death, especially for the transfer of ownership or to make claims against the deceased's property. Understanding the key aspects of this document can help ensure that the process is handled correctly and efficiently. Here are six key takeaways:

- Accuracy is crucial: When completing the Arizona Affidavit of Death form, every detail needs to be accurate. This includes the deceased's full name, date of death, and any property or asset descriptions. Mistakes in the document can lead to delays or challenges in the transfer process.

- Supporting documents are required: Alongside the affidavit, you'll need to provide a certified copy of the death certificate. This serves as official proof of death and is necessary for the document to be legally recognized.

- Notarization is mandatory: For the affidavit to be valid, it must be signed in the presence of a notary public. This step authenticates your identity and your signature, giving the document legal weight.

- Know the limits: The Arizona Affidavit of Death form can be used to transfer ownership of certain assets without going through probate, but it's not all-encompassing. It typically applies to personal property, vehicles, and small estates. Real estate or larger assets may require a more complex process.

- Timeliness matters: There is often a waiting period after the death before the affidavit can be filed. This period allows for the clarification of the deceased's debts and claims. Understanding and adhering to these timelines ensures that the process moves forward without unnecessary delays.

- Consult with a professional: While the form may seem straightforward, navigating the legal landscape can be challenging, especially during a time of loss. Consulting with a professional, such as a lawyer or an estate planning expert, can provide guidance, help avoid potential pitfalls, and ensure that the process honors the deceased's wishes and legal requirements.

Create Popular Templates for Arizona

How to Get Power of Attorney in Arizona - This document remains effective even if you become mentally or physically incapacitated, differing from a standard Power of Attorney.

Arizona Corporation Commission Certificate of Good Standing - After filing, the corporation must maintain compliance with state laws, including annual reporting and tax obligations.