Fill in a Valid Ador 10759 Arizona Template

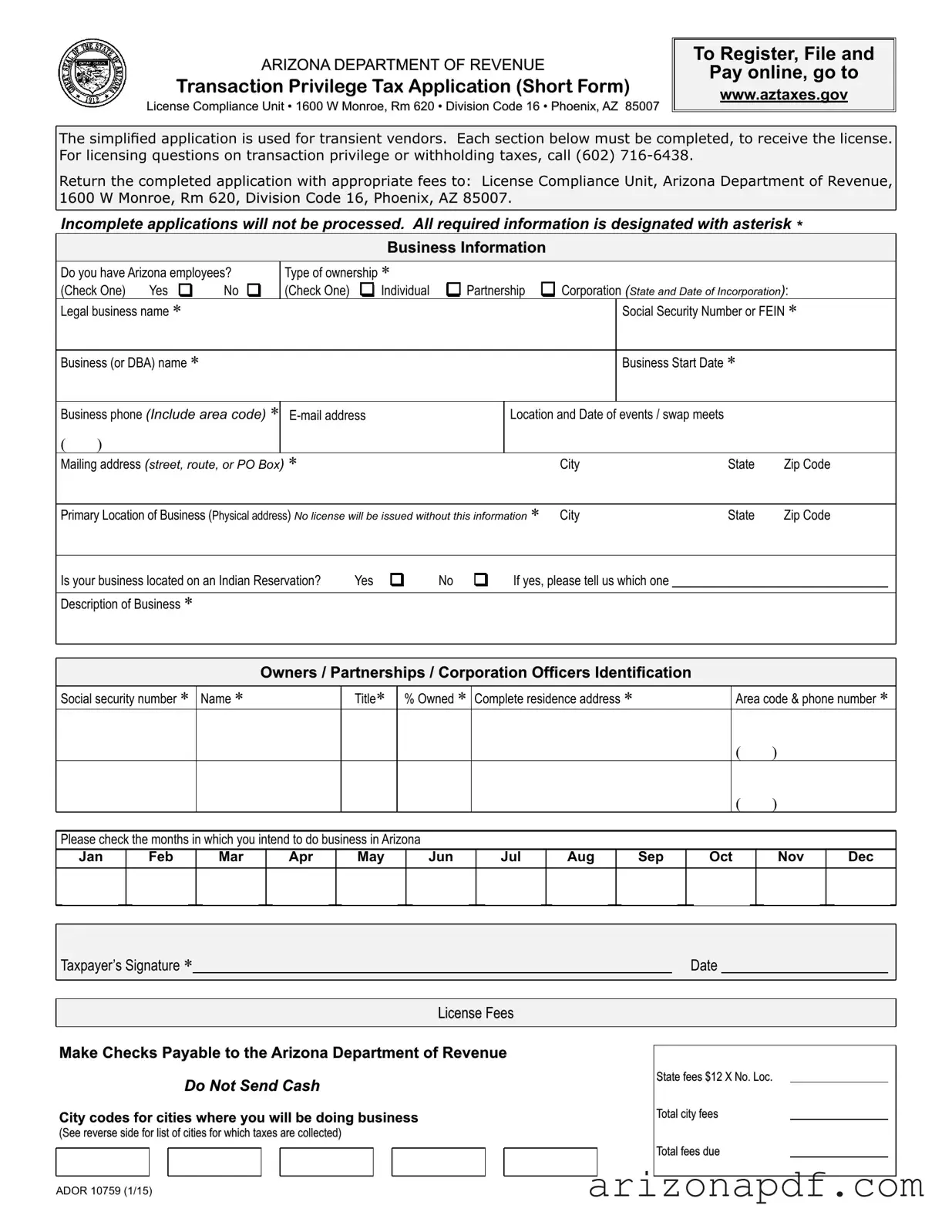

In the bustling business landscape of Arizona, the ADOR 10759 form emerges as a gateway for transient vendors aiming to delve into the state's vibrant market of fairs, special events, shows, and swap meets. Crafted by the Arizona Department of Revenue and nestled within the avenues of Phoenix, this simplified yet compulsory application form is a cornerstone for initiating legal sales activities. It meticulously outlines the essential steps towards acquiring a Transaction Privilege Tax license, encompassing a broad spectrum of pertinent business information such as ownership type, legal and DBA names, business start dates, and crucial contact information. Additionally, it delves into the specifics of event dates and locations, underscoring the requirement for a physical address regardless of business nature. The form stands as a testament to regulatory compliance, guiding vendors through the process of listing their business description and owner/partnership details, all while reinforcing the importance of city licenses and fees compatible with statewide mandates. The nuanced inclusion of Indian Reservation codes further exemplifies its thoroughness in addressing diverse vendor needs. Prompting for taxpayer's signature, this form encapsulates the quintessence of state tax obligations and serves as a comprehensive tool for ensuring that vendors meet all legal prerequisites before embarking on their entrepreneurial journey in Arizona.

Ador 10759 Arizona Preview

ARIZONA DEPARTMENT OF REVENUE

Transaction Privilege Tax Application (Short Form)

License Compliance Unit • 1600 W Monroe, Rm 620 • Division Code 16 • Phoenix, AZ 85007

Compliance Unit • 1600 W Monroe, Rm 620 • Division Code 16 • Phoenix, AZ 85007

To Register, File and

Pay online, go to

www.aztaxes.gov

The simpliied application is used for transient vendors. Each section below must be completed, to receive the license. For licensing questions on transaction privilege or withholding taxes, call (602)

Return the completed application with appropriate fees to: License Compliance Unit, Arizona Department of Revenue, 1600 W Monroe, Rm 620, Division Code 16, Phoenix, AZ 85007.

Incomplete applications will not be processed. All required information is designated with asterisk *

|

|

|

Business Information |

Do you have Arizona employees? |

Type of ownership * |

||

(Check One) |

Yes q |

No q |

(Check One) q Individual q Partnership q Corporation (State and Date of Incorporation): |

Legal business name * |

|

Social Security Number or FEIN * |

|

Business (or DBA) name *

Business Start Date *

Business phone (Include area code) *

()

Location and Date of events / swap meets

Mailing address (street, route, or PO Box) * |

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

||||

Primary Location of Business (Physical address) No license will be issued without this information * |

City |

State |

Zip Code |

|||||

|

|

|

|

|

|

|

|

|

Is your business located on an Indian Reservation? |

Yes q |

No |

q |

If yes, please tell us which one |

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Business * |

|

|

|

|

|

|

|

|

Owners / Partnerships / Corporation Oficers Identiication

Social security number *

Name *

Title*

% Owned *

Complete residence address *

Area code & phone number *

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please check the months in which you intend to do business in Arizona |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Jan |

|

Feb |

|

Mar |

|

Apr |

|

May |

|

|

Jun |

|

Jul |

|

Aug |

|

Sep |

|

Oct |

|

Nov |

|

Dec |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer’s Signature * |

|

Date |

|

|

|

|

|

|

|

License Fees

Make Checks Payable to the Arizona Department of Revenue

Do Not Send Cash

City codes for cities where you will be doing business

(See reverse side for list of cities for which taxes are collected)

State fees $12 X No. Loc.

Total city fees

Total fees due

ADOR 10759 (1/15)

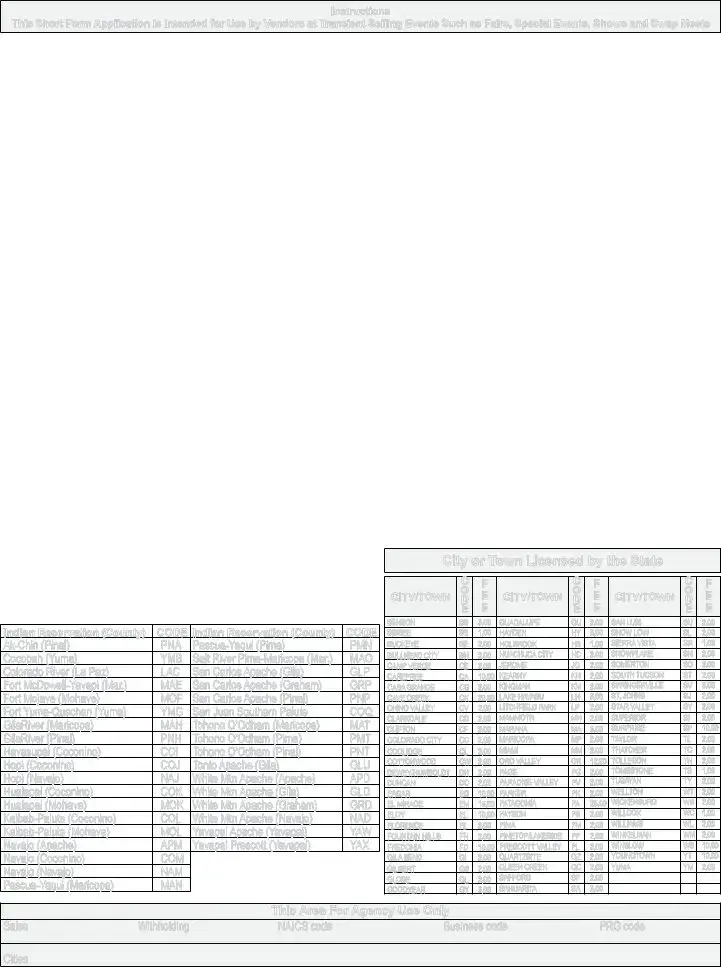

Instructions

This Short Form Application is Intended for Use by Vendors at Transient Selling Events Such as Fairs, Special Events, Shows and Swap Meets

Do you have employees? |

Check yes if you employ individuals in the state of Arizona. If you do not have employees or only have immediate family members |

|

who assist you during a special event or at a swap meet, check no. |

Type of ownership |

Check as applicable. Corporations and partnerships must provide the federal employer identiication number. |

Legal business name or |

Enter the individual’s and spouse’s name if Individual was selected for ownership type. |

owner name |

Enter all partner’s names if Partnership was selected for ownership type. Additional owners may be listed on a separate sheet |

and |

attached. |

|

Enter the organization name owning or controlling the business if Corporation was selected for ownership type. |

Business (or DBA) name |

Enter the name of the business/DBA (doing business as) name, if the same as legal business name, enter same. Commonly, the |

|

business name is the name by which the public knows your business/company/shop. If you wish correspondence to be sent to a name |

|

other than the owner, enter the name of the department or accountancy irm as “In Care Of” to ensure delivery by the postal service. |

Location and Date of event/ swap meet

Enter the address and date of the special event or swap meet. If you do not know the actual address of the event, enter the city/town name in which the event will be held. The location is very important in determining whether an additional city/town license must be obtained for those licensed by the state. Use the City or Town Licensed By The State chart below to determine if you must be licensed through the state for the location in which your event occurs. For cities not listed, please contact the city directly. Also add the city fee amount to the license fee which appears in the lower right corner of the front page.

Mailing address |

Enter mailing address where all correspondence is to be sent. You may elect to use your home address, corporate headquarters, or |

|

accounting irm’s address. |

Primary location of business |

Enter the street address for the primary location of the business. If you conduct most of your business at various special events or swap |

|

meets throughout the state, you may wish to enter your resident location. Even if your mailing address is a PO Box, you must provide a |

|

physical location. For example if you live in a rural community, your physical location may be the intersection of two roads, interstates, or |

|

milepost marker. |

Description of business |

Describe the major activity and principal product you manufacture or commodity sold or service performed. Your description of your business |

|

is very important because it determines your sales tax rate and provides a basis for state economic forecasting. |

Owners identiication |

Enter as many as applicable, attach a separate sheet if additional space is needed. The authority for mandatory requirement for social |

|

security numbers of owners is provided in ARS § |

Signature |

The application must be signed by either the individual owner or, for partnerships or corporation, two partners or two corporate oficers. |

Fees |

The state fee is $12 no matter how many special events you attend. |

|

However, a separate city license fee is required for each city unless |

|

you are currently licensed for the city in which an event will be held. |

|

List the cities in which you will be doing business on the front of the |

|

application form and total to determine the amount due. |

Indian Reservation (County) |

CODE |

Indian Reservation (County) |

CODE |

PNA |

PMN |

||

Cocopah (Yuma) |

YMB |

Salt River |

MAO |

Colorado River (La Paz) |

LAC |

San Carlos Apache (Gila) |

GLP |

Fort |

MAE |

San Carlos Apache (Graham) |

GRP |

Fort Mojave (Mohave) |

MOF |

San Carlos Apache (Pinal) |

PNP |

Fort |

YMG |

San Juan Southern Paiute |

COQ |

GilaRiver (Maricopa) |

MAH |

Tohono O’Odham (Maricopa) |

MAT |

GilaRiver (Pinal) |

PNH |

Tohono O’Odham (Pima) |

PMT |

Havasupai (Coconino) |

COI |

Tohono O’Odham (Pinal) |

PNT |

Hopi (Coconino) |

COJ |

Tonto Apache (Gila) |

GLU |

Hopi (Navajo) |

NAJ |

White Mtn Apache (Apache) |

APD |

Hualapai (Coconino) |

COK |

White Mtn Apache (Gila) |

GLD |

Hualapai (Mohave) |

MOK |

White Mtn Apache (Graham) |

GRD |

COL |

White Mtn Apache (Navajo) |

NAD |

|

MOL |

Yavapai Apache (Yavapai) |

YAW |

|

Navajo (Apache) |

APM |

Yavapai Prescott (Yavapai) |

YAX |

Navajo (Coconino) |

COM |

|

|

Navajo (Navajo) |

NAM |

|

|

MAN |

|

|

City or Town Licensed by the State

|

C |

F |

|

C |

F |

|

C |

F |

CITY/TOWN |

O |

E |

CITY/TOWN |

O |

E |

CITY/TOWN |

O |

E |

D |

D |

D |

||||||

|

E |

E |

|

E |

E |

|

E |

E |

BENSON |

BS |

5.00 |

GUADALUPE |

GU |

2.00 |

SAN LUIS |

SU |

2.00 |

BISBEE |

BB |

1.00 |

HAYDEN |

HY |

5.00 |

SHOW LOW |

SL |

2.00 |

BUCKEYE |

BE |

2.00 |

HOLBROOK |

HB |

1.00 |

SIERRA VISTA |

SR |

1.00 |

BULLHEAD CITY |

BH |

2.00 |

HUACHUCA CITY |

HC |

2.00 |

SNOWFLAKE |

SN |

2.00 |

CAMP VERDE |

CE |

2.00 |

JEROME |

JO |

2.00 |

SOMERTON |

SO |

2.00 |

CAREFREE |

CA |

10.00 |

KEARNY |

KN |

2.00 |

SOUTH TUCSON |

ST |

2.00 |

CASA GRANDE |

CG |

2.00 |

KINGMAN |

KM |

2.00 |

SPRINGERVILLE |

SV |

5.00 |

CAVE CREEK |

CK |

20.00 |

LAKE HAVASU |

LH |

5.00 |

ST. JOHNS |

SJ |

2.00 |

CHINO VALLEY |

CV |

2.00 |

LITCHFIELD PARK |

LP |

2.00 |

STAR VALLEY |

SY |

2.00 |

CLARKDALE |

CD |

2.00 |

MAMMOTH |

MH |

2.00 |

SUPERIOR |

SI |

2.00 |

CLIFTON |

CF |

2.00 |

MARANA |

MA |

5.00 |

SURPRISE |

SP |

10.00 |

COLORADO CITY |

CC |

2.00 |

MARICOPA |

MP |

2.00 |

TAYLOR |

TL |

2.00 |

COOLIDGE |

CL |

2.00 |

MIAMI |

MM |

2.00 |

THATCHER |

TC |

2.00 |

COTTONWOOD |

CW |

2.00 |

ORO VALLEY |

OR |

12.00 |

TOLLESON |

TN |

2.00 |

DEWEY/HUMBOLDT |

DH |

2.00 |

PAGE |

PG |

2.00 |

TOMBSTONE |

TS |

1.00 |

DUNCAN |

DC |

2.00 |

PARADISE VALLEY |

PV |

2.00 |

TUSAYAN |

TY |

2.00 |

EAGAR |

EG |

10.00 |

PARKER |

PK |

2.00 |

WELLTON |

WT |

2.00 |

EL MIRAGE |

EM |

15.00 |

PATAGONIA |

PA |

25.00 |

WICKENBURG |

WB |

2.00 |

ELOY |

EL |

10.00 |

PAYSON |

PS |

2.00 |

WILLCOX |

WC |

1.00 |

FLORENCE |

FL |

2.00 |

PIMA |

PM |

2.00 |

WILLIAMS |

WL |

2.00 |

FOUNTAIN HILLS |

FH |

2.00 |

PINETOP/LAKESIDE |

PP |

2.00 |

WINKELMAN |

WM |

2.00 |

FREDONIA |

FD |

10.00 |

PRESCOTT VALLEY |

PL |

2.00 |

WINSLOW |

WS |

10.00 |

GILA BEND |

GI |

2.00 |

QUARTZSITE |

QZ |

2.00 |

YOUNGTOWN |

YT |

10.00 |

GILBERT |

GB |

2.00 |

QUEEN CREEK |

QC |

2.00 |

YUMA |

YM |

2.00 |

GLOBE |

GL |

2.00 |

SAFFORD |

SF |

2.00 |

|

|

|

GOODYEAR |

GY |

5.00 |

SAHUARITA |

SA |

5.00 |

|

|

|

This Area For Agency Use Only

Sales |

Withholding |

NAICS code |

Business code |

PRG code |

Cities

ADOR 10759 (1/15)

File Properties

| Fact | Detail |

|---|---|

| Form Number | ADOR 10759 |

| Department | Arizona Department of Revenue |

| Application Type | Transaction Privilege Tax Application (Short Form) |

| Intended Users | Transient vendors attending fairs, special events, shows, and swap meets |

| Governing Law(s) | Arizona Revised Statutes § 42-1105 |

| Online Submission Portal | www.aztaxes.gov |

| License Fee | $12, additional city fees may apply |

| Contact Number | (602) 716-6438 |

| Required Information Indicators | All required information is designated with an asterisk * |

Instructions on Utilizing Ador 10759 Arizona

Once the ADOR 10759 Arizona form is diligently filled out and submitted, it initiates the process of registering for a Transaction Privilege Tax. It is essential for vendors at transient selling events, ensuring compliance with Arizona's tax requirements. Upon receiving this form, the Arizona Department of Revenue will review the provided information for completeness and accuracy. Should there be any discrepancies or missing information, the applicant will be contacted for clarification. This step is crucial for vendors to legally conduct sales at events such as fairs and swap meets in Arizona. The following instructions guide through the process of completing the form accurately.

- Check the appropriate box to indicate whether you have Arizona employees.

- Under the "Type of ownership" section, select the option that corresponds to your business structure.

- If your business is a Corporation, provide the State and Date of Incorporation.

- Enter the Legal business name, ensuring it matches the official records.

- Provide your Social Security Number or FEIN (Federal Employer Identification Number).

- For the Business (or DBA) name, input the name under which your business operates.

- Record the Business Start Date as accurately as possible.

- Add the Business phone number, including the area code.

- Provide an E-mail address for electronic communication.

- For Location and Date of events/swap meets, detail where and when you will be vending.

- Enter your Mailing address completely, covering street, route, or PO Box along with the city, state, and Zip Code.

- For the Primary Location of Business, provide a physical address. This cannot be a PO Box.

- Check the appropriate box to indicate if your business is located on an Indian Reservation and specify which one if applicable.

- Briefly describe the nature of your business under the Description of Business section.

- For each Owner/Partner/Corporation Officer, input their Social security number, Name, Title, Percentage Owned, Complete residence address, and Contact phone number.

- Indicate the months you plan to do business in Arizona by checking the corresponding boxes.

- Sign and date the application in the Taxpayer’s Signature section.

- Calculate and enter your license fees, including both State and City fees, based on your business locations.

- Review the form for accuracy and completeness before submitting it with the appropriate fees to the License Compliance Unit at the specified address.

Completing the ADOR 10759 form is a critical step towards ensuring your business's compliance with state tax laws for vendors participating in transient selling activities. This form serves as a formal request for authorization to conduct business at events throughout Arizona. Prompt and careful completion aids in avoiding delays, ensuring you receive your Transaction Privilege Tax License in due time. Remember, licensing is just the beginning; maintaining good standing involves regular filing and tax payments according to the schedule determined by the Arizona Department of Revenue.

Listed Questions and Answers

What is the purpose of the ADOR 10759 form?

The ADOR 10759 form, issued by the Arizona Department of Revenue, serves as a Transaction Privilege Tax Application. This streamlined form is specifically designed for transient vendors who sell goods at events such as fairs, special events, and swap meets. It facilitates the legal registration process, ensuring vendors comply with state tax obligations.

How can I register using the ADOR 10759 form?

To register, complete each section of the form accurately and submit it along with the appropriate fees to the License Compliance Unit at the provided address. Online registration options are also available, enabling a more convenient submission process through www.aztaxes.gov.

Are there specific business types that need to use this form?

Yes, the form is intended for use by transient vendors operating in Arizona. This includes individuals, partnerships, and corporations participating in temporary selling events. The type of ownership should be clearly indicated on the form to ensure accurate processing.

What fees are associated with the ADOR 10759 form?

A state fee of $12 is required, regardless of the number of events you attend. Additionally, separate city license fees may be applicable depending on the locations where you plan to conduct business. These fees should be calculated and included with your application.

How do I determine if my business is located on an Indian Reservation?

If your business operates on an Indian Reservation, you should indicate which one on the form. The form includes codes for various reservations, facilitating accurate identification and processing of your application based on your business location.

What happens if I don't know the exact address of the event or swap meet?

If the exact address is unknown, you should provide the city or town name where the event will be held. This information is crucial for determining whether you need an additional city or town license, beyond the state license, for your selling location.

What should I do if my application is incomplete?

Incomplete applications cannot be processed. To avoid delays, ensure that all sections of the form are filled out accurately and that any required documentation is included before submission. Double-check for completeness and accuracy to facilitate a smooth registration process.

Common mistakes

When filling out the ADOR 10759 Arizona form, a crucial step for transient vendors seeking to comply with the state's Transaction Privilege Tax requirements, individuals often make mistakes that can lead to delays or issues with their application. Noting these common errors can help ensure a smoother process.

Omitting Required Information: Every section marked with an asterisk (*) is mandatory. Missing out on any of these sections, such as not providing the Social Security Number or Federal Employer Identification Number (FEIN), legal business name, or the primary location of the business, can result in the application not being processed.

Incorrect Business Information: Correctly entering the type of ownership and the accurate legal business or DBA (Doing Business As) name is crucial. Errors in these sections can not only lead to processing delays but also potentially result in legal issues regarding business identity and tax obligations.

Failure to Specify Business Location Details: The form requires detailed information regarding both the mailing address and the primary physical location of the business. Providing just a P.O. Box for the latter, without a specific physical address, or failing to accurately describe the location of events or swap meets, can invalidate the application.

Inaccurate Description of Business: The description of the business activity, principal products, commodities sold, or services performed, influences the determination of the sales tax rate. Vague or inaccurate descriptions can lead to incorrect tax assessments and complications with state economic forecasting.

It is advisable for vendors to exercise great care in reviewing their application for completeness and accuracy before submission, ensuring all sections are duly filled as per the instructions. This diligence helps in swift processing and avoids unnecessary complications with Arizona's Department of Revenue.

Documents used along the form

When you're dealing with the ADOR 10759 form—Arizona's Transaction Privilege Tax Application—it's important to have a clear understanding of the other documents that might be needed to ensure your business is properly documented and compliant with state regulations. Whether you're just starting out or you're a transient vendor preparing for events, the following list of documents can play a crucial role in your business's administrative tasks, tax responsibilities, and legal obligations.

- Form TPT-1: This is Arizona's Transaction Privilege Tax Return form. It's used by businesses to report and pay tax on the revenue earned from business activities in Arizona. You must file this form regularly, usually monthly, after your business is registered.

- Arizona Joint Tax Application (JT-1): For new businesses, this form is required for registering with the Department of Revenue and the Arizona Department of Economic Security. It covers registration for transaction privilege tax, use tax, and unemployment insurance.

- Business License Application: Depending on your location and the nature of your business, you might also need to apply for a municipal business license. This isn't a state-level form, but many cities and towns in Arizona require local licensing in addition to state tax registration.

- Employer Identification Number (EIN): This isn't a form you file with the state of Arizona, but rather with the Internal Revenue Service (IRS). Most businesses will need an EIN for tax purposes, and it's commonly required on state tax forms.

- Employer's Quarterly Wage Report (Form UC-018): If you have employees in Arizona, you'll need to file this form quarterly with the Arizona Department of Economic Security to report wages paid and unemployment tax owed.

- Application for Extension of Time to File: If for some reason you are unable to file your Transaction Privilege Tax Return by the due date, you may need to submit an application for an extension to avoid penalties.

- Power of Attorney (Form 285): This form authorizes another person or entity to act on your behalf in matters related to your Arizona taxes, including the transaction privilege tax. It can be crucial for business owners who need a tax professional to manage their state tax affairs.

Each of these documents serves a specific purpose in the life cycle of a business, from starting up and registering with state and federal entities, to hiring employees, and fulfilling ongoing tax reporting obligations. Careful attention to the requirements and timely filing of these forms can help ensure your business operates smoothly and remains in good standing with all regulatory bodies. Remember, the ADOR 10759 form is just the beginning for transient vendors. Staying informed and prepared is key to managing the complexities of business taxation and licensing in Arizona.

Similar forms

The "Form SS-4: Application for Employer Identification Number (EIN)" provided by the Internal Revenue Service (IRS) closely resembles the Ador 10759 Arizona form in its structure and purpose. Similar to the Arizona form, which requires a business's legal name and Federal Employer Identification Number (FEIN), the Form SS-4 is used for businesses to apply for an EIN, necessary for tax reporting purposes. Both forms serve as a means for businesses to register with the respective tax authority, ensuring compliance with tax obligations related to employment and business operations.

The "Business License Application" offered by many municipalities across the United States shares similarities with the Ador 10759 Arizona form, specifically in the way it collects information about the business, its location, and its operations for the purpose of issuing a license. While the Arizona form focuses on transient vendors and transaction privilege tax, municipal business license applications serve a broader purpose but similarly require details about the business type, ownership, location, and nature of business activities to ensure compliance with local regulations and tax laws.

The "Uniform Business License Application" used in various states aims to streamline the process of applying for business permits, licenses, and tax registrations across different jurisdictions. This application parallels the Ador 10759 Arizona form in its intent to simplify the registration process for businesses. It collects detailed information about the business, ownership structure, and operational details, much like the Arizona form, which is designed specifically for transient vendors participating in events like fairs and swap meets.

The "Sales and Use Tax Permit Application" used by state departments of revenue, including Texas and California, mirrors the purpose of the Ador 10759 Arizona form by requiring businesses to register for the collection and remittance of sales and use taxes. Both types of applications gather comprehensive details about the business, including but not limited to the legal name, FEIN, business location, and description of business activities, to ensure accurate tax collection and compliance with state tax laws.

The "Special Event Vendor Permit Application" commonly used by cities and counties for vendors participating in temporary events, such as festivals or markets, has a targeted audience similar to that of the Ador 10759 Arizona form. These applications collect information on the vendor's business, including dates and locations of events, which is crucial for tax purposes and regulatory compliance. Both forms facilitate the legal operation of vendors at temporary locations, albeit within different jurisdictional scopes.

The "Home Occupation Permit Application" required by many local governments for businesses operating out of a residence aligns with the Ador 10759 form in its collection of detailed business information. Although focusing on home-based businesses, this permit application shares the goal of ensuring businesses comply with local zoning laws, safety regulations, and tax requirements, similar to how the Ador 10759 form regulates transient vendors for tax compliance purposes.

Dos and Don'ts

When engaging with the Arizona Department of Revenue Transaction Privilege Tax Application, commonly referred to as the ADOR 10759 form, there are several do's and don'ts one should adhere to for an efficient and error-free submission process. Ensuring you follow these guidelines can help in avoiding common mistakes and in facilitating a smoother processing of your application.

Do's:- Read instructions carefully: Before you start filling out the form, take time to read through the instructions provided to understand each section thoroughly.

- Complete all required sections: Ensure every section designated with an asterisk (*) is completed, as missing information can result in the non-processing of your application.

- Provide accurate business information: Double-check your entries for your business's legal name, type of ownership, Social Security Number (SSN), or Federal Employer Identification Number (FEIN) to prevent any discrepancies.

- Describe your business clearly: Give a concise yet comprehensive description of your business activities, principal products, or services to ensure correct tax categorization and rate application.

- List event locations and dates: Accurately list the locations and dates of events or swap meets where you intend to conduct business, as it affects licensing requirements.

- Include correct license fees: Calculate and include the correct state and, if applicable, city license fees, ensuring you check for any city-specific requirements.

- Sign the application: Remember that the application needs to be signed by the individual owner, partners, or corporate officers, as applicable, to be deemed complete.

- Attach additional documentation if needed: If you need more space for any section, such as listing additional owners, attach a separate sheet clearly labeled and referenced in the application.

- Don't leave sections blank: Avoid skipping sections or leaving them blank. If a section does not apply to your situation, clearly mark it as "N/A" (not applicable).

- Don't guess information: If you're unsure about specific details, such as NAICS codes or exact event locations, take the time to research or confirm the information before submitting.

- Don't use outdated forms: Ensure you're filling out the most current version of the form to avoid processing delays due to outdated information or format.

- Don't send cash: When submitting license fees, avoid sending cash. Instead, use checks or money orders payable to the Arizona Department of Revenue, as advised.

- Don't underestimate license fees: Carefully calculate your total dues, including both state and city fees, where applicable, to avoid short payments that could delay license issuance.

- Don't forget about city licenses: If your events are in cities that require additional licensing, make sure you're aware of and comply with these requirements.

- Don't overlook the signature date: Ensure the application is signed with the current date to confirm the timeliness and accuracy of the information provided.

- Don't ignore Indian Reservation codes: If your business is located on an Indian Reservation, make sure to use the correct reservation code listed in the form for accurate processing.

Misconceptions

There are several common misconceptions about the Arizona Department of Revenue's ADOR 10759 form, especially for vendors and small business owners preparing to navigate state taxes and licensing. Understanding these misconceptions is crucial for anyone looking to conduct business activities within the state. Here are four key misconceptions and their clarifications:

- Only Permanent Businesses Need to File: A major misconception is that the ADOR 10759 form is only for businesses with a fixed, permanent location in Arizona. In reality, this form is specifically designed for transient vendors that participate in temporary events such as fairs, special events, shows, and swap meets. Whether you have a permanent foothold in the state or are temporarily doing business, compliance is required.

- State Fees Cover All Necessary Licenses: While the form does mention a state fee of $12, many vendors mistakenly believe this single fee covers all their licensing needs. The truth is, additional city license fees may be required depending on the location of the event or swap meet. Each participating city might have its licensing requirements, and it's the vendor's responsibility to secure these.

- Indian Reservation Events Are Automatically Exempt: Another common misunderstanding is that events held on Indian reservations are exempt from state and city licensing requirements. Although doing business on an Indian reservation involves different considerations, vendors must still indicate which reservation their event will be on, suggesting that various rules and fees could apply.

- Personal Information is Optional: The requirement for owners' identification, including social security numbers, is sometimes thought to be optional. This form makes it clear that providing this information is mandatory. The form's thoroughness in collecting personal data underscores its role in ensuring tax compliance and accountability within the state.

Understanding these misconceptions is vital for every vendor and business owner planning to engage in commercial activities in Arizona, ensuring they remain compliant with local tax laws and licensing requirements.

Key takeaways

Filling out and using the ADOR 10759 Arizona form is an essential step for transient vendors participating in events such as fairs, swap meets, or other special events within the state of Arizona. Here are some key takeaways to ensure compliance and proper registration:

- Online Registration Available: Vendors can register, file, and pay online through the Arizona Department of Revenue's official website, providing a streamlined process for obtaining the necessary licenses.

- Mandatory Information: The form requires specific mandatory information, including business information, type of ownership, and a description of the business activity. Failure to complete these sections can result in non-processing of the application.

- Type of Ownership: Clearly indicating the type of ownership (individual, partnership, or corporation) is crucial and affects the required information on the form. For corporations and partnerships, providing a federal employer identification number (FEIN) is compulsory.

- Business Location Details: Applicants must provide both a mailing address and the primary location of the business. The physical location address is mandatory, even for vendors operating across various locations.

- Description of Business: A concise description of the main business activity, products manufactured, commodities sold, or services performed is required to determine the appropriate sales tax rate and for state economic analysis purposes.

- License Fees: A state fee of $12 is imposed regardless of the number of events a vendor participates in. However, separate city license fees may be required for each city in which the vendor operates, unless already holding a city license.

- Indian Reservation Codes: For businesses located on Indian reservations, specific codes corresponding to the reservation's county must be used, indicating the location's jurisdiction for tax purposes.

- Owner Identification: Information about the owners, partners, or corporate officers, including social security numbers (as mandated by ARS § 42-1105), is necessary to complete the application process.

- City Licenses: Vendors must check whether an additional city or town license is needed for the location of their event. This information helps determine if licensing through the state suffices or if additional permissions are required.

Thoroughly reviewing and adhering to the instructions and requirements of the ADOR 10759 form ensures vendors remain compliant with the Arizona Department of Revenue's regulations. This compliance facilitates smooth operations at special events and contributes to the overall success of a vendor's participation in these events throughout Arizona.

More PDF Forms

Child's Immunization Record - The form provides a space for parents to list the vaccines they are refusing for their child based on their religious convictions.

What Is Arizona Sales Tax - Special exemptions are delineated for utilities sold to qualified manufacturing or smelting operations, adhering to specific regulatory requirements.