Fill in a Valid 290 Arizona Template

Dealing with penalties from the Arizona Department of Revenue can be daunting, but for taxpayers seeking relief, the Arizona Form 290 offers a pathway to request penalty abatement—a chance to have penalties reduced or eliminated if they meet certain criteria. This form allows individuals or entities to explain the circumstances that led to the penalty, emphasizing that it was due to reasonable cause rather than willful neglect. Whether it's for individual income tax, transaction privilege, use tax, corporate income tax, withholding tax, or other entity-specific tax obligations, the form requires detailed information including the taxpayer's identification number, the specific tax period in question, and the amount for which abatement is requested. Moreover, Arizona Form 290 mandates an explanation supported by documentation for a thorough review. Besides the abatement request, those filing must be authorized to act on behalf of the taxpayer—whether as individuals, partnerships, corporations, or other entities—undersigned with the acknowledgment that submitting false documents is a serious offense. The comprehensive yet straightforward approach of Arizona Form 290, accompanied by the potential inclusion of Form 285 for representative authorization, illustrates Arizona's structured yet accessible means for addressing and possibly rectifying tax penalty situations.

290 Arizona Preview

Arizona Form 290 |

Request for Penalty Abatement |

UseTHE PURPOSEForm 290OFtoTHISrequestFORMan abatement of

The account for which the abatement request is being submitted must be in compliance. Compliance means there are no delinquent tax returns and all

The request will not be considered for processing if the form is incomplete or if the account is not in compliance. The abatement request form and documentation will be returned for correction. The form and documentation will then need to be resubmitted for consideration.

IMPORTANT: If the penalty being addressed is the result of an audit, do not use Form 290. Contact the Audit Unit at the phone number shown on the assessment. The Penalty Review Unit does not process audit assessed penalties.

INFORMATION

AllPARTrequests1 - GENERALfor abatementINFORMATIONof penalties must include the name, address, email address and telephone number of the taxpayer for which the request is being made.

If you want the Arizona Department of Revenue to work with your representative or third party, complete and include Arizona Form 285, General Disclosure/ Representation Authorization Form. Ensure boxes 4b and 4c or box 5 are indicated.

PART 2 - SPECIFIC DETAILS FOR ABATEMENT

ProvideCONSIDERATIONspecific details regarding the account and periods to be considered for abatement.

•TAXIfTYPEyour request is for an individual income tax return, use the Individual Taxpayer Identification Number (ITIN) number or social security number from the return.

• If your request is for a business account, use the Transaction Privilege Tax (TPT) or Marijuana Excise Tax (MET) license number.

• If your request is for a corporate or withholding account, use an Employer Identification Number (EIN).

EnterPERIOD(S)the specificOR YEAR(S)tax period(s) in date format, based on the filing frequency, that you want considered for the abatement.

For example:

• Annual filers:

• Quarterly filers:

• Monthly filers:

EnterPENALTYthe AMOUNTdollar amount for which you are requesting penalty abatement. There is no statutory provision that permits abatement of interest based on reasonable cause.

ExplainPART 3 - inEXPLANATIONdetail your&reason(s)DOCUMENTATIONfor requesting the abatement. You must provide specific details or reasons that directly contributed to the failure to file or pay timely for the period(s) you are requesting penalty abatement. Include in the explanation as to why there is reasonable cause for the returns and/or payments being late. Clear and concise information will allow for a prompt reply. Include additional pages if you need more space.

IMPORTANT: You must include Documentation that supports the basis of your request. Requests without

supporting documentation may be denied. Examples include:

• Proof of timely payment; including front and back of canceled checks.

• Medical reports and/or Death Certificate(s).

• Other pertinent documents that support your request for this abatement.

• Proof an extension has been filed.

BelowSituationsare someWh resituationsReasonablewhereCausereasonableMay Exist:cause may exist. There may be other situations where reasonable cause may exist. Accordingly, it’s important for you to provide specific details or reasons that directly contributed to the failure to. file or pay timely for the Circumstancesperiods you arebeyondrequestingthe control of the taxpayer while using reasonable and prudent business practices. A1.mathematicalMathematicalerroronrsa timely filed tax return.

2.Unexpected illness or unavoidable absence

A. aIndividual. Delay causedreturnsby serious illness of the taxpayer, or

member of the taxpayer’s immediate family. b. Delay caused by unavoidable absence of the

taxpayer. Vacation time is not acceptable as an unavoidable absence.

ADOR 11237 (05/23) |

Instructions |

Arizona Form 290 |

|

|

|

|

Request for Penalty Abatement |

||||||||||

|

|

B. Entity r turns |

|

|

|

|

|

|

If you want the Arizona Department of Revenue to work with |

||||||

|

|

|

In the caseof corporate, estate, trust or other business |

your representative or third party, complete and include |

|||||||||||

|

|

|

|

|

|

or |

|||||||||

|

|

|

returns, delay caused by unexpected serious illness of |

Arizona Form 285, General Disclosure/Representation |

|||||||||||

|

|

|

Authorization Form. Ensure boxes 4b and 4c box 5 are |

||||||||||||

|

|

|

the individual with sole authority to execute the return |

indicated. |

|

|

|

||||||||

|

|

|

or member of such individual’s immediate family. |

Handwritten signature, date, print the signer’s name and |

|||||||||||

|

|

|

Delay caused by unavoidable absence of the individual |

||||||||||||

If |

|

|

with sole authority to execute return. |

|

|

title. An electronic signature with a digital certificate is |

|||||||||

|

|

|

|

|

is the basis of the request for penalty |

accepted. |

|

|

|

||||||

abatement, the Department shall require proof of the date |

Type of Entity |

|

Who must sign |

|

|||||||||||

|

unexpected illness |

|

|

|

|

|

|

|

|

|

|

||||

of illness. This proof includes, but is not limited to, doctor |

|

|

|

|

|||||||||||

statements. |

|

|

|

|

|

|

|

Individuals, Joint |

The individual/joint filers/sole proprietor |

||||||

|

A. |

In the case of individual returns, delay caused by the |

Filers and Sole |

must sign. |

|

|

|||||||||

|

|

|

Proprietorships |

|

|

|

|||||||||

3. Death |

|

|

|

|

|

|

|

|

meaning of A.R.S. § |

||||||

death of a taxpayer or member of the taxpayer’s immediate |

|

||||||||||||||

family. |

|

|

|

|

|

|

|

Corporations |

A principal corporate officer within the |

||||||

|

|

|

|

|

|

|

|

person designated by a principal corporate |

|||||||

|

|

|

In the case of corporate, estate, trust or other business |

|

officer or any person designated in a resolution |

||||||||||

returns, the delay must have been caused by the death of an |

|

similar governing body, must sign. |

|||||||||||||

B. |

|

|

|

|

|

|

|

|

|

by the corporate board of directors or other |

|||||

individual with the sole authority to execute the return, or a |

|

|

|

|

|||||||||||

Limited Partnerships |

of the partnership must sign. |

|

|||||||||||||

member of such individual’s immediate family. |

|

|

|

||||||||||||

For both individual and business returns, a reasonable time |

Partnerships & |

A partner having authority to act in the name |

|||||||||||||

Trusts/Estates |

A trustee, executor/executrix or the personal |

||||||||||||||

frame should apply for filing the return and payment of tax. |

|

representative of the estate must sign. See |

|||||||||||||

A copy of the death certificate must be provided. |

|

|

|

Fiduciary Capacity. |

|

||||||||||

4. Absence of records |

|

|

|

|

|

Form 210, Notice of Assumption of Duties in a |

|||||||||

|

|

|

|

Limited Liability |

A member having authority to act in the name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

The taxpayer is unable to obtain records necessary to |

|||||||||||||||

Companies |

of the company must sign. |

|

|||||||||||||

determine the amount of tax due for reasons beyond the |

Governmental |

An officer having authority to act on behalf of |

|||||||||||||

taxpayer’s control. An example would be a fire which |

MAIL,AgenciesFAX OR EMAILtheFORMgovernmental290 TO:agency must sign. |

||||||||||||||

destroys the taxpayer’s records. |

|

|

|

|

|

|

|

||||||||

|

|

|

ARIZONA DEPARTMENT OF REVENUE |

||||||||||||

1. Ignorance of the law or lack of awareness of filing and |

|||||||||||||||

|

paying requirements. |

|

|

|

|

PENALTY REVIEW UNIT |

|

|

|||||||

Situations Where Reason ble C use May NOT Exist: |

|

1600 W MONROE ST |

|

|

|||||||||||

2. Delegation of duties. |

|

|

|

|

|

|

|||||||||

3. Financial difficulties have no effect on the taxpayer’s |

|

PHOENIX AZ |

|

||||||||||||

|

ability to file returns in a timely fashion. |

|

|

Fax No. (602) |

|

|

|||||||||

1. Interest |

|

|

|

|

|

|

|

Email: PenaltyReview@azdor.gov |

|

||||||

Penalti and/or fees not considered for Abatement: |

Allow up to six (6) weeks for processing. |

|

|||||||||||||

2. TPT licensing fees |

|

|

|

|

|

|

|

||||||||

3. Audit assessed penalties |

|

|

|

|

|

|

|

||||||||

4. Any disallowed accounting credit(s) for TPT |

|

|

|

|

|

|

|||||||||

For additional information regarding reasonable cause, |

|

|

|

|

|||||||||||

please refer to the following: |

|

|

|

|

|

|

|

||||||||

• Arizona Revised Statutes § |

|

|

|

|

|||||||||||

• |

|

|

www.azleg.gov. |

|

|

of Revenue |

|

Ruling |

|

|

|

|

|||

|

|

(GTR) |

|

|

|

General Tax |

|

and |

|

|

|

|

|||

|

|

|

Arizona Department |

of Revenue |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Publication 700 |

|

|

|

|

|

|||

|

|

|

|

available at www.azdor.gov. |

|

|

|

|

|

|

|||||

PART 4 - SIGNATURE OF TAXPAYER OR AUTHORIZED TheREPRESENTATIVEform should be signed by one of those listed below or otherwise authorized by A.R.S. §

ADOR 11237 (05/23)

Print Form

Instructions

Arizona Form

290

Request for Penalty Abatement

PLEASE READ THE INSTRUCTIONS CAREFULLY. Ensure all applicable sections of the form are completed, all returns are filed, and taxes paid prior to submitting. The request will not be considered for processing if incomplete or the account is not in compliance. The abatement request form and

ThedocumentationArizona Departmentwill be returnedof Revenue,for correcon writtenion applicationnd must bebyresubmittedthe taxpayer,forshallconsiderationabate the penalty. if it determines that the conduct, or lack of conduct, that caused the penalty to be imposed was due to reasonable cause and not due to willful neglect.

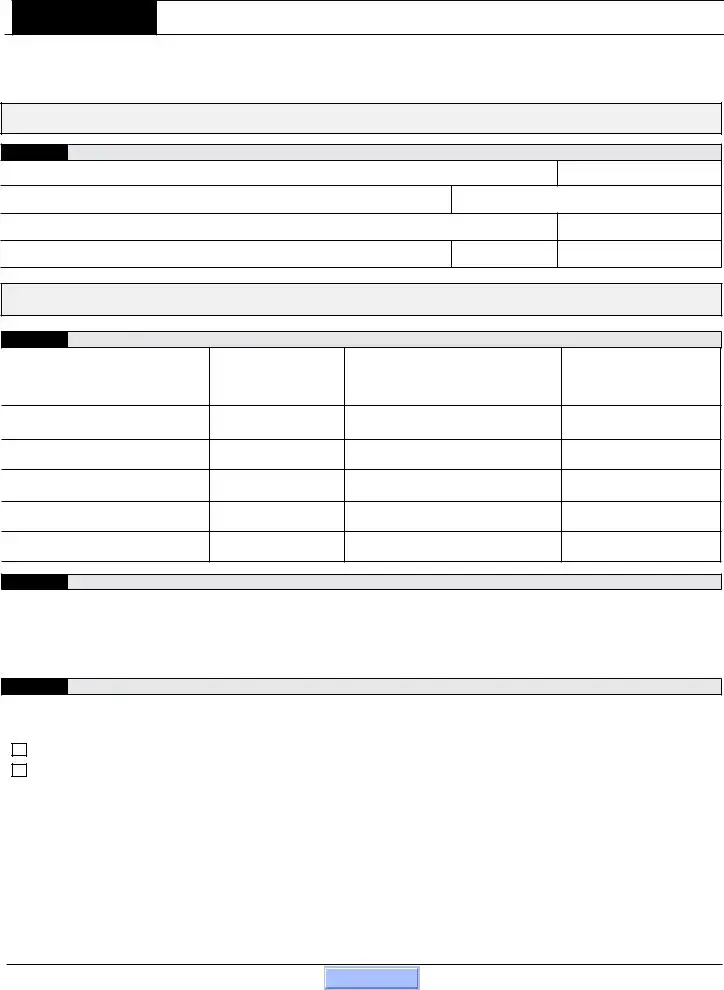

PART 1 |

GENERAL INFORMATION (REQUIRED) |

|

|

|

|

|

|||||

Taxpayer Name |

|

|

|

|

|

|

|

Daytime Phone (with area code) |

|||

Spouse’s Name (if joint return was filed) |

|

|

|

|

|

Email address: |

|

|

|

||

Present Address - number and street, rural route |

|

|

|

Apartment/Suite No. |

|

||||||

City, Town or Post Office |

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

or |

|

|

|

|

|

|

|

|

If you want the Arizona Department of Revenue to work with your representative, complete and include Arizona Form 285, General Disclosure/Representation |

|||||||||||

Authorization Form. Ensure boxes 4b and 4c |

|

box 5 are marked. |

|

|

|

|

|

||||

PART 2 |

SPECIFIC DETAILS FOR ABATEMENT CONSIDERATION (REQUIRED) |

|

|

|

|||||||

|

TAX TYPE |

|

TAXPAYER ID |

|

Provide the |

SPECIFIC PERIOD(S) |

AMOUNT |

|

PENALTY |

||

Indicate the |

for the account |

|

Provide the associated |

|

Provide the total |

|

|||||

|

|

|

|

number for |

for the account requesting abatement |

|

for the account |

||||

requesting abatement |

|

the account requesting |

|

|

requesting abatement. |

||||||

Individual Income Tax |

|

|

ITIN or SSN |

|

|

(Do not include interest) |

|||||

|

abatement |

|

|

||||||||

|

|

|

|

|

|

|

|

|

$ |

|

|

License Number

$

EIN

$

EIN

$

EIN/License Number

$

PART 3 EXPLANATION & DOCUMENTATION (REQUIRED)

Provide specific details or reasons that directly contributed to the failure to file or pay timely for the periods you are requesting penalty abatement. Include additional pages if more space is needed and documentation to support the claim of reasonable cause.

_______________________________________________________________________________________________________________________________

PART 4 SIGNATURE OF TAXPAYER OR AUTHORIZED REPRESENTATIVE (Did you print and sign the form?)

Who can sign this form? The taxpayer (individual, principal corporate officer, LLC Member/Manager, Trustee, Partner) or other authorized by A.R.S. §

Check here if you are attaching a completed Arizona Form 285 with boxes 4b and 4c or box 5 indicated.

I certify that I have the authority, within the meaning of A.R.S. §

A.R.S. §

|

|

|

|

|

|

|

|

|

|

TAXPAYER’S SIGNATURE |

DATE |

SIGNATURE |

DATE |

|

|||

|

|

|

|

|

|

|

|

|

|

|

PRINT OR TYPE NAME |

|

|

|

PRINT OR TYPE NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

TITLE |

|

|

|

TITLE |

|

|

SEND THE COMPLETED FORM TO: ARIZONA DEPARTMENT OF REVENUE ● PENALTY REVIEW UNIT

●1600 W MONROE ST ● PHOENIX AZ

ADOR 11237 (05/23)

Print Form

File Properties

| Fact | Detail |

|---|---|

| Purpose of Form 290 | Used to request an abatement of non-audit penalties. |

| Exclusion | Not applicable for penalties resulting from audits; in such cases, contact the Audit Unit. |

| Key Requirement | Taxpayer's name, address, and phone number must be included in all requests. |

| Additional Forms | Form 285 (General Disclosure/Representation Authorization Form) if representation by another party is desired. |

| Governing Law | Abatement determined under Arizona Revised Statutes §42-2003(A). |

| Penalty for False Documents | Presenting false documents is a Class 5 felony under A.R.S. § 42-1127(B)(2). |

| Submission Method | Requests can be mailed or faxed to the Penalty Review Unit, Arizona Department of Revenue. |

| Processing Time | Processing can take up to six weeks. |

| Supporting Documentation | Required as part of the request, including but not limited to, copies of checks, returns, medical reports, and death certificates. |

Instructions on Utilizing 290 Arizona

Filling out the Arizona Form 290 for a request for penalty abatement requires attention to detail and a thorough understanding of the circumstances that led to the penalty. If an error or unavoidable circumstance resulted in a penalty from the Arizona Department of Revenue, submitting a well-documented Form 290 might lead to an abatement, depending on the agency's determination of reasonable cause versus willful neglect. Before initiating this process, gathering all pertinent information and any supporting documentation that can substantiate the claim will make the completion of this form smoother and more effective.

- Gather all necessary information including taxpayer identification number (ITIN), social security number (SSN), or employer identification number (EIN) and the specific details of the penalty incurred.

- Complete Part 1 - General Information: Provide the taxpayer’s name, daytime and alternate phone numbers, spouse’s name if applicable, and current address including city, state, and ZIP code. If representation by another party is desired, remember to include the completed Arizona Form 285.

- Check the appropriate box under Part 2 - Tax Type: Indicate the type of tax for which the penalty was assessed (e.g., Individual Income Tax, Corporate Income Tax) by checking the relevant box. Then, fill in the taxpayer ID number (ITIN, SSN, or EIN), the specific tax period(s) or year(s) involved, and the amount of penalty being disputed.

- Explain the circumstances in Part 3 - Explanation & Documentation: Write a clear and concise explanation detailing the reasons behind the request for abatement. Specify why the penalty was due to reasonable cause and not a result of willful neglect. Attach additional pages if more space is required and include any supporting documentation such as medical reports, death certificates, copies of canceled checks, or pertinent tax returns that could strengthen the case.

- Complete Part 4 - Signature: Sign and date the form, verifying the authority to request an abatement on behalf of the entity or individual mentioned. Print or type the name and title of the signatory. Note that joint filers, corporations, partnerships, and other entities may have specific signing requirements outlined in the Instructions section.

- Review the entire form: Before mailing, double-check all filled sections for accuracy and completeness to ensure that all necessary information has been provided.

- Mail the completed form to the Penalty Review Unit, Division 9, Arizona Department of Revenue, 1600 W Monroe St, Phoenix, AZ 85007-2612. Alternatively, if preferred, the form can be faxed to 602-771-9912. Remember, processing can take up to six weeks, so allow sufficient time for a response.

By following these steps diligently and providing a thorough explanation supported by relevant documentation, taxpayers can effectively request a penalty abatement from the Arizona Department of Revenue. This could potentially lead to a reduction or removal of penalties, assuming the department finds the reasons presented to align with their criteria for reasonable cause. Patience is key, as the review process is meticulous and can take several weeks.

Listed Questions and Answers

What is Arizona Form 290?

Arizona Form 290, titled "Request for Penalty Abatement," is a document used to request the Arizona Department of Revenue to abate or forgive penalties associated with tax payments or filings. This form allows taxpayers to explain circumstances that led to delays or mistakes in their tax obligations, provided these were due to reasonable cause and not willful neglect.

Who can file Arizona Form 290?

Individuals, corporations, partnerships, estates, trusts, limited liability companies, and even governmental agencies can file Form 290, given they have penalties they wish to have abated and they meet the criteria set forth by the Arizona Department of Revenue. The key requirement is proving that the penalties were the result of reasonable cause.

What types of penalties can be abated using Form 290?

Form 290 can be used to request abatement for various non-audit tax penalties. This includes penalties from individual income tax, corporate income tax, transaction privilege and use tax, withholding tax, and other specified tax types. However, it is important to note that penalties resulting from audit assessments are not eligible to be addressed using Form 290 and require direct contact with the Audit Unit.

What information is required to complete Form 290?

When completing Form 290, taxpayers need to provide general information such as taxpayer names, contact numbers, addresses, and taxpayer identification numbers (SSN, ITIN, or EIN depending on the tax type). The specific tax period and penalty amount being contested must also be detailed. Moreover, a comprehensive explanation and documentation supporting the reason for abatement request are mandatory, along with the taxpayer’s signature validating the information provided.

How should one submit the completed Form 290?

Once filled, Form 290 along with any supporting documentation should be mailed or faxed to the Penalty Review Unit, Division 9, at the Arizona Department of Revenue. The mailing address is 1600 W Monroe St, Phoenix, AZ 85007-2612, and the fax number is 602-771-9912. Ensure that all parts of the form are completed accurately to avoid delays in processing.

What is the processing time for a Form 290 request?

The Arizona Department of Revenue typically requires up to six weeks to process a Form 290 request. This timeframe can vary based on the complexity of the request and the volume of applications being processed. It’s important for applicants to provide clear and concise information and any relevant documentation to facilitate a prompt review.

Can Form 290 be filed by a representative on behalf of a taxpayer?

Yes, a representative can file Form 290 on behalf of a taxpayer. However, for the Arizona Department of Revenue to work with a representative, the taxpayer must complete and include with Form 290 the Arizona Form 285, General Disclosure/Representation Authorization Form. This grants the representative the authority to act on behalf of the taxpayer regarding the penalty abatement request.

Common mistakes

When filling out the Arizona Form 290 for Request for Penalty Abatement, people often make mistakes that can lead to delays or even denials of their requests. It's important to avoid these common errors:

Not reading the instructions carefully before beginning. This form requires specific information and documentation to support your request for abatement. Overlooking this step can lead to incomplete submissions.

Failing to include all required personal information, such as a taxpayer ID number or Social Security number, depending on the type of tax issue you're addressing. This can make it difficult for the Arizona Department of Revenue to properly identify and process your request.

Omitting the specific tax period(s) for which you are requesting abatement. This detail is crucial for the review process, as it helps identify exactly which penalties you are contesting.

Not providing a detailed explanation for the request or the reason(s) justifying a reasonable cause. A vague or brief explanation may not be sufficient to have the penalty abated.

Forgetting to include supporting documentation such as front and back copies of canceled checks, medical reports, death certificates, or other pertinent records. Lack of evidence can result in your request being denied.

Incorrectly signing the form. Depending on your status (individual, joint filers, corporations, etc.), the correct individual(s) must sign the form. Failing to do so could invalidate your request.

Remember: Ensuring your request is complete, with clear explanations and necessary documentation, will increase the likelihood of having your penalty abated. Take the time to review your form carefully before submission to avoid these common errors.

Documents used along the form

When dealing with tax matters, especially when it comes to seeking penalty abatement as outlined by Arizona Form 290, it is essential to be thorough and well-prepared. To support a Request for Penalty Abatement, several documents and forms may be pivotal in substantiating the claim for abatement. The array of documents serves not only to validate the reasons behind a penalty but also to provide a comprehensive understanding of the taxpayer's situation. Below is a list of other forms and documents that are often used in conjunction with Arizona Form 290:

- Arizona Form 285, General Disclosure/Representation Authorization Form: This form is crucial because it authorizes a representative, such as a tax attorney or accountant, to receive confidential information and communicate on behalf of the taxpayer with the Arizona Department of Revenue.

- Income Tax Returns: Both individual and business income tax returns may be necessary to provide context regarding the financial year in question, contributing to the understanding of the circumstances that led to the penalty.

- Canceled Checks: Front and back copies of canceled checks can serve as evidence of payment attempts or financial transactions relevant to the tax period under dispute.

- Medical Reports: These can provide proof of serious illness or incapacitation that might have prevented timely compliance with tax obligations, therefore supporting claims of reasonable cause.

- Death Certificates: In cases where the penalty is linked to a decedent’s tax affairs or the taxpayer suffered a bereavement that impacted their ability to comply with tax laws, death certificates are crucial documents.

- Power of Attorney (POA) Forms: Arizona Form 285B, specifically for tax matters, grants authorization to an individual chosen by the taxpayer to perform actions on their behalf.

- Business Licenses and Registrations: For business tax-related penalties, documentation relating to the legal operation of the business, including licenses and registrations, may be requested to verify claims related to the business activity and its financial obligations.

- Correspondence from the Arizona Department of Revenue: Any previous communications, including notices of assessment, demand notices, or previous correspondence trying to resolve the issue, are important to include.

- Financial Statements: Profit and loss statements, as well as other financial records, may be necessary to demonstrate the taxpayer’s financial situation during the period in question.

- Documentation of Natural Disasters or Catastrophic Events: This can include insurance claims, reports from governmental agencies, or news articles validating the occurrence of events that could have significantly interfered with the taxpayer’s ability to comply with tax obligations.

Compiling these documents in support of a Request for Penalty Abatement, such as the one facilitated by Arizona Form 290, is a meticulous process that requires attention to detail. Each piece of evidence plays a role in providing a clear and comprehensive picture of the circumstances leading to the request. It is also worth noting that while the relevance and necessity of each document may vary depending on individual circumstances, a thorough compilation of supportive documents significantly enhances the likelihood of a favorable outcome. Proper documentation ensures that the Arizona Department of Revenue can make a well-informed decision regarding the abatement request.

Similar forms

The Internal Revenue Service (IRS) Form 843, "Claim for Refund and Request for Abatement," shares similarities with the Arizona Form 290. Both forms are designed to request the abatement of penalties imposed due to various tax compliance issues. Taxpayers fill out these forms to explain and provide evidence as to why penalties should not apply to them, often citing reasonable cause and not willful neglect. Both forms also require thorough documentation to support the claims made by the taxpayer.

The IRS Form 656, "Offer in Compromise," while primarily used for negotiating tax debts, bears resemblance to the Arizona Form 290 in that it also includes a provision for penalty abatement as part of the compromise offer. Taxpayers may propose to have their penalties abated in exchange for a lump sum or periodic payments towards their tax debt, arguing similar grounds of reasonable cause for their inability to fully comply with tax laws.

California's Form 290, "Request for Penalty Abatement," is directly analogous to Arizona's in both purpose and content. This form allows California taxpayers to request penalty relief for state taxes, mirroring the Arizona form’s objective of providing taxpayers a formal avenue to seek relief from penalties due to reasonable cause. Both forms underscore the importance of providing a detailed explanation and supporting documentation for the abatement request.

IRS Form 940, "Employer's Annual Federal Unemployment (FUTA) Tax Return," is somewhat related to Arizona Form 290 in terms of penalty considerations. Form 940 includes sections where employers can calculate and report any penalties due for late filings or payments. While it's primarily a tax return form, the mechanism for calculating and reporting penalties touches on similar procedural aspects of tax compliance and potential for penalty abatement found in Form 290.

The IRS Form 1120, "U.S. Corporation Income Tax Return," includes sections for penalties related to underpayment and late payments of estimated tax, bearing resemblance to the penalty abatement request process in Form 290. Corporations may find themselves seeking relief from such penalties and would need to provide explanations for reasonable cause, akin to the justification required on Arizona's penalty abatement form.

New York State's Form IT-201, "Resident Income Tax Return," and its accompanying documentation, include provisions for addressing penalties for late payments and filings, similar to the Arizona Form 290. Taxpayers in New York can attach a statement to their return to explain any reasonable cause for late actions, seeking abatement or adjustment of penalties, aligning with the nature of requesting penalty relief on the basis of non-willful neglect.

Form 941, "Employer’s Quarterly Federal Tax Return," used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, also deals with penalties for late filing or payment. Employers can request abatement of these penalties by providing a reasonable cause, which is a process mirrored in the Arizona Form 290 where detailed explanations are necessary for considering penalty relief.

The Offer in Compromise Pre-Qualifier tool provided by the IRS, although not a physical form, serves a similar purpose to Arizona Form 290 by evaluating a taxpayer's eligibility for relief from federal tax debts, including the potential abatement of penalties. This digital assessment tool guides taxpayers through a series of questions to determine if they could qualify for an offer in compromise, indirectly addressing penalty issues in the process, much like requesting penalty abatement requires a thorough explanation of circumstances.

Dos and Don'ts

Filling out the Arizona Form 290 is crucial for those requesting penalty abatement. It's important to pay attention to detail to ensure your request is processed smoothly. Here are some tips to help guide you through this process:

- Do:

- Read the instructions carefully before beginning to fill out the form to avoid any mistakes that could delay the processing of your request.

- Ensure that all the information you provide, including your name, address, and taxpayer ID number, is accurate and matches the details on your tax return.

- Provide a clear and detailed explanation in Part 3 for requesting the abatement, including any reasonable cause for the penalties.

- Include all necessary supporting documentation, such as canceled checks, medical reports, or any other pertinent documents that justify your request for abatement.

- Don't:

- Use this form if your penalty resulted from an audit. In such cases, you should contact the Audit Unit directly.

- Forget to sign and date the form in Part 4. Your request cannot be processed without your signature.

- Leave out any relevant tax period(s) or the dollar amount for which you are requesting abatement. This information is crucial for your request to be evaluated accurately.

- Submit the form without double-checking that all required parts are completed and that it includes the necessary documentation to support your case.

Following these guidelines can help ensure that your Form 290 is filled out correctly and that your request for penalty abatement is processed without unnecessary delays.

Misconceptions

Misconceptions about the Arizona Form 290 can lead to confusion and mistakes when requesting penalty abatements. Understanding these myths is crucial for correct form submission.

It's only for individual taxpayers: Form 290 serves a broader audience, including businesses, corporations, trusts, estates, partnerships, and limited liability companies.

Audited penalties can be abated using this form: This form is not applicable for penalties resulting from audits. In such cases, you should contact the Audit Unit directly.

Reason for request doesn’t need to be detailed: A detailed explanation, including supporting documentation, is necessary to clarify the reasonable cause behind the request for penalty abatement.

Any type of penalty can be abated: The form is specifically for non-audit related penalties. Understanding the nature of your penalty is key before submission.

Supporting documents aren’t important: Supporting documentation is critical and must accompany your request to substantiate the reasons for abatement.

Electronic submission is an option: Currently, the form and accompanying documents must be mailed or faxed, not submitted electronically.

Immediate action on requests: Processing can take up to six weeks, so patience is required after submitting a request for penalty abatement.

Signing authority is flexible: The person signing the form must have the authority within the specific guidelines set out for each type of entity, to ensure the request is considered valid.

One form fits all tax penalties: You must specify the type of tax and the period or year for which you are requesting abatement, as one form does not cover multiple types or periods.

Form 285 is not related: If you want the Arizona Department of Revenue to work with a representative on your behalf, including Arizona Form 285 with your submission is necessary.

Clarifying these misconceptions ensures that taxpayers approach the abatement process informed and prepared, leading to a more streamlined and effective resolution.

Key takeaways

Understanding the Arizona Form 290, designed for Request for Penalty Abatement, is crucial for handling penalties associated with Arizona taxes. This form allows taxpayers to apply for the abatement of penalties due to reasonable cause rather than willful neglect. Here are key takeaways to note when filling out and using this form:

- Eligibility: Use Form 290 only if your penalty does not stem from an audit. For penalties resulting from audits, you should contact the Audit Unit directly.

- General Information: The form requires detailed general information, including taxpayer's name, phone numbers, address, and if filing jointly, the spouse's name.

- Authorization to Represent: If you want the Arizona Department of Revenue to communicate with your representative about your case, you must complete and include Arizona Form 285 alongside Form 290.

- Tax Type: It's important to specify the type of tax your request relates to, such as individual income tax, corporate income tax, or others, and provide the appropriate identification numbers and periods or years for which penalty abatement is requested.

- Explanation and Documentation: You must clearly explain the reason for the penalty abatement request and provide documentation supporting your case. This might include canceled checks, medical reports, death certificates, or other relevant documents.

- Signature Requirement: The form requires the signature of the taxpayer or, depending on the entity type (corporation, partnership, trust, etc.), the authorized individual who has the authority to act on behalf of the entity.

- Processing Time: Be prepared to allow up to six weeks for the processing of your Form 290. This timeline is essential for planning and expectations.

- Additional References: For more detailed information, refer to Arizona Revised Statutes §106 and Arizona Department of Revenue Publication 700, which can provide further clarification on penalty abatement requests.

Correctly completing and submitting the Arizona Form 290 is a step towards resolving tax penalties by demonstrating reasonable cause. Always ensure the accuracy of the information provided and attach all necessary documentation to support your request for abatement.

More PDF Forms

Does Arizona Have State Income Tax - Mandates new employees to submit this form within the first five days of employment to establish their withholding rate.

Consent Guardianship Arizona - Explains the procedure for filing for both temporary and permanent guardianship together or separately.